Methodology for reflecting the receipt of services at various VAT rates

Courses Stimul › Reference book › Useful materials › 1C:Enterprise 7.7 › Complex configuration › Complex configuration

1C:Enterprise 7.7 / Complex configuration / Complex configuration

Table of contents

Services are provided on an advance payment basis.

Receipt of services is carried out on the terms of subsequent payment.

Due to the fact that recently the operation of reflecting payment for mobile communication services, which in addition to VAT is also subject to the pension fund, has become very popular, we will consider the method of reflecting this operation in the standard configuration “Accounting + Trade + Warehouse + Salary + Cards for Ukraine”.

It should be noted that in the configuration the flag is set to allocate advances and VAT postings are made according to the “Tax invoice”.

Receipt of services is carried out on an advance payment basis

- At the first step, you should draw up an “Agreement” and an “Incoming Invoice” for the services provided, it is necessary to indicate in separate lines both the received cellular communication services (subject to VAT, we indicate the VAT rate - 20%), and the amount of contributions to the Pension Fund (which is not subject to VAT , indicate the VAT rate – Without VAT).

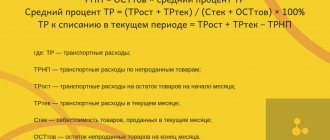

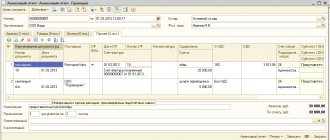

These documents will subsequently act as analytical sections when registering mutual settlements. The completed form of the “Incoming Invoice” document is shown in Figure 1 – “Incoming Invoice” document. Figure 1 – Document “Invoice” - In the second step, it is necessary to reflect the prepayment for the services received. To do this, you should create and fill out the “Bank Statement” document. The document should reflect in one line the transfer of the advance for the service received - “20%”, select “Counterparty”, “Agreement”, “Incoming Invoice”, indicate the amount that should be transferred as an advance for the service received. The second line should indicate the deduction to the pension fund, indicate the “VAT rate” – “Without VAT”, select “Counterparty”, “Agreement”, “Incoming account”, and you should also indicate the amount transferred to the Pension Fund. The completed form of the document is shown in Figure 2 - Document “Bank Statement”.

Figure 2 – Document “Bank Statement”After the “Bank Statement” is completed, transactions will be generated that will reflect Gross expenses in tax accounting, the amount of the advance, as well as a tax credit for the service received (Figure 3).

Figure 3 – Postings of the “Bank Statement” document

- In the third step, it is necessary to reflect the receipt of the services themselves. To do this, based on the “Incoming Invoice” document, you must enter the “Third Party Services” document. The document header will automatically contain the counterparty and the documents for the receipt of services. In the tabular part of the document, two lines will be filled in - one for receipt of services (VAT rate - 20%), and the second for transfer to the Pension Fund (VAT rate - Without VAT). The completed form of the document “Third Party Services” is shown in Figure 4. Figure 4 – Document “Third Party Services”

After completing the document “Services of third-party organizations”, entries will be generated that will reflect the repayment of the advance, tax credit, and the cost of services will also be included in the administrative costs (Figure 5).Figure 5 – Postings of the document “Third Party Services”

- In the last, fourth step, it is necessary to reflect the closure of the VAT tax credit. To do this, based on the “Bank Statement” document for which the first event occurred, you must enter two “Acquisition Ledger Entry” documents. One document (VAT rate – “20%”) for communication services and a second document (VAT rate – “Without VAT”) for transfer to the Pension Fund. When you try to enter the document “Acquisition book entry” based on the “Bank statement,” the program will prompt you to enter two documents with different rates. You must enter two documents in turn. The details in the documents will be filled in automatically based on the data specified in the “Incoming Invoice”. The documents are shown in Figure 6 and 7, respectively. Figure 6 – Document “Acquisition Book Entry” payment for services Figure 7 – Document “Acquisition Book Entry” transfer to the Pension Fund

After posting the document “Acquisition Book Entry”, a posting will be generated for only one document – payment for services. Wiring shown in Figure 8.Figure 8 – Postings of the document “Acquisition book entry” payment for services

Receipt of services is carried out on the terms of subsequent payment

- At the first step, as in the first case (receipt of services on an advance payment basis), you should draw up an “Agreement”.

- The second step is to reflect the receipt of services. To do this, based on the “Agreement” document, you must enter the “Third Party Services” document. The document header will automatically contain the counterparty and the documents for the receipt of services.

In the tabular part of the document, two lines will be filled in - one for receipt of services (VAT rate - 20%), and the second for transfer to the Pension Fund (which is not subject to VAT, indicate the VAT rate - Without VAT). The completed form of the “Third Party Services” document is shown in Figure 9.Figure 9 – Document “Third Party Services”

After posting the document “Services of third-party organizations”, entries will be generated that will reflect Gross expenses in tax accounting, a tax credit, and the cost of services will also be included in the composition of administrative costs (Figure 10).

Figure 10 – Postings of the document “Third Party Services”

- In the third step, it is necessary to reflect the transfer of payment for services received. To do this, you should create and fill out a “Bank Statement” document. The document should reflect in one line the transfer of payment for the received - “20%”, select “Counterparty”, “Agreement”, indicate the amount that should be transferred for the service received. The second line should indicate the contribution to the pension fund, indicate the “VAT rate” – “Without VAT”, select “Counterparty”, “Agreement”, and also indicate the amount transferred to the Pension Fund. The completed form of the document is shown in Figure 11 - Document “Bank Statement”. Figure 11 – Document “Bank Statement”

After the “Bank Statement” is completed, a posting will be generated that will reflect the transfer of payment to the counterparty for the service received (Figure 12).Figure 12 – Postings of the “Bank Statement” document

- In the last, fourth step, it is necessary to reflect the closure of the VAT tax credit. To do this, based on the “Third Party Services” document, for which the first event occurred, you must enter two “Acquisition Ledger Entry” documents. One document (VAT rate – “20%”) for communication services and a second document (VAT rate – “Without VAT”) for transfer to the Pension Fund. If you try to enter on the basis of “Third Party Services” in the “Acquisition Ledger Entry” document, the details will be filled in automatically based on the data that was specified in the “Third Party Services” document. Please note that it is not correct to show the amount transferred to the Pension Fund in the VAT database, because this amount is included in the declaration. Therefore, you should correct the “Amount without VAT” for payment of services in one document, and in the second document indicate the “VAT rate” - “Without VAT” and manually fill in the “Amount without VAT” for transfers to the Pension Fund. The documents are shown in Figure 13 and 14 respectively. Figure 13 – Document “Acquisition Book Entry” payment for services Figure 14 – Document “Acquisition Book Entry” transfer to the Pension Fund

After posting the document “Acquisition Book Entry”, a posting will be generated for only one document – payment for services. Wiring shown in Figure 15.Figure 15 – Postings of the document “Acquisition book entry”

Other

Provision of services: wiring

Current as of: February 28, 2021

Services are the same object of civil rights as things, and they can be freely alienated by one person to another person (Articles 128, 129 of the Civil Code of the Russian Federation). We will tell you in our consultation what entries need to be made in accounting when providing services.

Provision of services: accounting entries

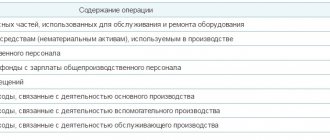

Accounting for services until the moment of their provision is carried out, as a rule, in cost accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

- 20 “Main production”;

- 23 “Auxiliary production”;

- 29 “Service industries and farms”, etc.

In addition, to account for expenses associated with the provision of services, account 44 “Sales expenses” can be used.

Accordingly, at the time of provision of services, the costs for them are written off to the debit of account 90 “Sales”. In this case, the credit of account 90 reflects revenue from the provision of services.

Here are the main accounting entries for services:

Operation Account debit Account credit

| Costs associated with the provision of services are reflected | 20, 29, 44, etc. | 10 “Materials”, 70 “Settlements with personnel for wages”, 69 “Calculations for social insurance and security”, etc. |

| Revenue from the provision of | 90, subaccount “Revenue” | |

| The cost of services provided is written off | 90, subaccount “Cost of sales” | 20, 29, etc. |

| VAT is charged on the cost of services provided | 90, subaccount “VAT” | 68 “Calculations for taxes and fees”, subaccount “VAT” |

| Expenses associated with the provision of services are written off | 90, subaccount “Sales expenses” | 44 |

Sometimes the question arises as to what accounting entries need to be made when reselling services. Let us immediately make a reservation that the term “resale” is not entirely applicable to services. After all, the acquisition and consumption of services is carried out simultaneously, therefore, it is impossible to buy services (i.e. consume them) and then resell them. It may be more about the provision of services with the involvement of third parties.

For example, to provide services for the delivery of goods to the buyer - organization A, the supplier organization (organization B) can attract a specialized organization that directly provides services (carrier - organization C). In this case, the accounting procedure for organization B will not differ significantly from the above procedure. The services provided by organization C will also be taken into account by organization B as a debit to the cost accounting accounts and a credit to account 60 “Settlements with suppliers and contractors”.

And having concluded, for example, an agency agreement with organization A, organization B will not include as expenses the costs presented by organization C.

Receipt of services: postings

The receipt of services in an organization is reflected depending on the features of the Accounting Policy, as well as the type of expenses. The organization’s services can be reflected both as part of current expenses (accounts 20, 26 “General business expenses”, 44, etc.) and as part of property under certain conditions.

For example, expenses for information or consulting services related to the purchase of goods will be reflected as follows (clause 6 of PBU 5/01, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit account 41 “Goods” - Credit account 60

And if a trading company incurs expenses for certification of copies of constituent documents when concluding an agreement with a buyer, then the accounting entry for notary services will be as follows:

Debit of account 44 – Credit of account 71 “Settlements with accountable persons”, 60

Source: https://glavkniga.ru/situations/k503275

Accounting for services from the contractor

The contractor's accounting directly depends on the type of activity and taxation regime. Most often, companies providing services in order to reduce the tax burden choose special regimes: UTII or simplified tax system. Along with them, OSNO can also be used.

Revenue from services provided is income from ordinary activities. The procedure for its accounting is regulated by clause 5 of PBU 9/99.

Postings from the contractor when selling services will be as follows:

- Dt 62 Kt 90.1 - reflects the sale of services.

- Dt 90.3 Kt 68 - VAT charged.

- Dt 90.2 Kt 20 (23, 25, 26, 43) - the cost of services provided is written off.

- Dt 50 (51) Kt 62 - services paid for by the customer.

- Cost accounting.

Consider, for example, training services. The main costs are salaries of employees, calculation of taxes and contributions, depreciation, etc. That is, to provide these services, the organization does not spend material assets on the production of any objects. At the end of the month, its costs are written off to the cost of sales by posting Dt 90.2 Kt 20.

Example

Materials in the amount of 17,342 rubles were spent on the production of the banner. (excluding VAT). The remuneration of employees amounted to 8,500 rubles, contributions from the payroll - 2,805 rubles.

- Dt 20 Kt 10 - 17,432 rub. — materials for making the banner were written off;

- Dt 20 Kt 70 - 8,500 rub. — wages accrued to employees;

- Dt 20 Kt 69 - 2,805 rub. — contributions from the payroll are calculated.

- Dt 43 Kt 20 - 28,737 rub. (17,432 + 8,500 + 2,805) - the banner was made at the actual cost.

- Dt 90.2 Kt 43 - 28,737 rub. — the cost of services is written off.

1C postings for services received and implemented

Quite often, to carry out the financial and economic activities of an organization (firm), we use the concept of service. It can be provided to the organization by contractors - suppliers or provided by the organization itself to third-party contractors - consumers of services. In this article, let's look at the topic of how they are provided by third-party organizations and are provided by the company itself, and also explain what accounting entries for services are prepared for these operations.

What documents are required when receiving the service?

Let's first start with what types of services exist. Depending on the field of activity, services are divided into groups:

- Transport and forwarding nature;

- Auditing;

- For rent, for example, transport, premises, fixed assets and inventories (MPS) and others;

- Communications, these include postal services, as well as telephone and telegraph services, Internet services, and others;

- Health care services are the services of medical workers in clinics, hospitals, clinics and other similar institutions;

- Services in the field of trade (services of specialists in displaying goods, consulting services on goods and others);

- Education services;

- Legal services;

- And others.

If they are provided to an organization (firm, company), there are always two parties:

- Customer (consumer);

- Salesman.

The main document that is provided upon receipt is the certificate of completion (rendered) of work (services) and the second document is an invoice, it is issued by organizations - VAT payers, mainly firms (companies) located on the general taxation system (OSNO ).

Accounting entries upon receipt of services

If the services were received earlier than payment, then the relationship with the seller is reflected first for the received costs specified in the act. The debit of the account indicates the expense account, and the credit of account 60 shows subaccount 01, which in the accounting chart of accounts is called “Settlements with suppliers and contractors.”

When receiving (receiving) different services, the same accounting account is not always indicated by debit; the following postings for services are generated, for example:

- For transport costs, the accounting account may be different, it could be:

- Account 26, when receiving office supplies for office workers by transport supplier;

- Account 44.01 “Distribution costs in organizations engaged in trading activities” when transporting sold goods to a counterparty by transport of a third-party organization;

- Account 44.02 “Business expenses in organizations engaged in industrial or other production activities” when transporting products of its own production by a transport organization;

- Account 26, reflected when sending correspondence when using the Internet line;

- For audit purposes, the account is indicated by debit. 26 “General business expenses”;

- Account 26, selected when receiving legal services and advice;

- Account 23 “Auxiliary proceedings”, Part. 20 “Main production”, count. 26 “General business expenses” when renting premises, warehouses, buildings, as well as equipment and fixed assets;

- Account 08 “Capital investments” upon receipt of a formalized estimate drawn up for the construction of a fixed asset facility (store, warehouse).

- And others.

When choosing a cost account, it is necessary to take into account “what these services were used for”, for the maintenance of the administrative apparatus, then we select account 26 “General business expenses”; for production, then select account 20 “Main production”; for the activities of auxiliary production, then select account 23 “Auxiliary production” or account 25 “General production expenses”.

When posting the act of completed (rendered) work (services) and the invoice received from the counterparty (service provider), do not forget to take into account the VAT amount separately on account 19 “Value Added Tax”, for further reimbursement of these amounts from the Federal Budget of the Russian Federation .

When making payments for services to a current account, entries are made in the accounting accounts on the debit of account 60.01 and on the credit of account 51 “Current account”. After this, mutual obligations are considered closed.

What documents are drawn up when providing a service?

When selling a service, exactly the same documents are drawn up as upon receipt; this is an act of completed (rendered) work (services). The act must contain the following mandatory details:

- Date and name of the document;

- Name of the organization that issued the act;

- Name of the counterparty;

- operations;

- A business transaction must be expressed in physical and monetary terms;

- FULL NAME. officials who signed the document;

- Signatures on both sides.

If the organization is a value added tax payer, then an invoice is issued along with the act in two copies, one copy is transferred to the counterparty (buyer), the other remains with the seller.

Accounting entries for the sale of services

When selling services, accounting entries for services are generated:

- By revenue by debit account. 62.01 “Settlements with buyers and customers” on credit account. 90.01 “Revenue”;

- By writing off the actual cost on the debit of the account. 90.02 “Cost of sales” on credit account. 20 “Main production” or accounts 23 “Auxiliary production”;

- Reflection of value added tax if the organization is a VAT payer in the debit of the account. 90.03 “Value added tax” on credit account. 68.02 “VAT calculation”;

- When paying for services by debit account. 51 “Current account” for a loan account. 62.01.

When entering expenses into an accounting program, you need to approach each operation individually and choose the right accounting and tax account; the financial result of your company will depend on this in the future.

Source: https://buh-spravka.ru/buhgalterskij-uchet/buhgalterskie-provodki/provodki-po-uslugam.html

Tax accounting of expenses for payment for services of third-party organizations

Tax accounting of expenses in the form of rental (leasing) payments Read more: Tax accounting of expenses for the formation of reserves for doubtful debts

7. Tax accounting of expenses for payment for services of third-party organizations

In accordance with Article 264 of the Tax Code of the Russian Federation, the following expenses are taken into account for profit tax purposes and relate to other expenses associated with production and sales:

— expenses for legal and information services;

— expenses for consulting and other similar services;

— expenses for audit services;

— expenses for managing an organization or its individual divisions, as well as expenses for purchasing services for managing an organization or its individual divisions;

— expenses for property protection services and other security services;

— expenses for services for the provision of workers (technical and managerial personnel) by third-party organizations to participate in the production process, production management or to perform other functions related to production and sales;

— expenses for accounting services provided by third-party organizations or individual entrepreneurs.

Expenses for payment of legal, information, consulting and other similar services, as well as for payment for services for managing an organization or its individual divisions, are taken into account when taxing profits, regardless of whether the performance of any production management functions is provided for by the organization’s staffing table or job descriptions.

For organizations using the accrual method, the date of recognition of expenses for payment for services of third-party organizations is one of the following dates:

— date of settlements in accordance with the terms of concluded agreements;

- date of presentation to the organization of documents serving as the basis) for making calculations;

— the last day of the reporting (tax) period.

For organizations using the cash method, expenses for payment for services of third-party organizations are recognized in tax accounting only after they are actually paid.

8. Tax accounting of interest on borrowed funds

In accordance with Art. 265 of the Tax Code of the Russian Federation, for profit tax purposes, expenses in the form of interest on debt obligations are classified as non-operating expenses and are recognized in the reporting (tax) period in which they were incurred.

Expenses in the form of interest on debt obligations are included in non-operating expenses, regardless of the nature of the credit or loan provided (current and investment).

It follows from this that interest on borrowed funds is accepted for profit tax purposes as only non-operating expenses, regardless of the purposes for which the borrowed funds were received.

In tax accounting, for example, expenses in the form of interest on long-term investment loans used for the acquisition or construction of fixed assets are not included in the initial cost of such an object (i.e., they do not increase it), and therefore are taken into account as part of non-operating expenses.

Only the amount of interest accrued for the actual time of use of borrowed funds is recognized as an expense.

In tax accounting, debt obligations are understood as credits, commodity and commercial loans, loans, bank deposits, bank accounts or other borrowings, regardless of their form.

For profit tax purposes, interest on debt obligations is recognized within the established norms.

The specifics of classifying interest on borrowed funds as expenses and the normalization of interest on debt obligations for profit tax purposes are established in Article 269 of the Tax Code of the Russian Federation.

When determining expenses on debt obligations, Article 269 of the Tax Code of the Russian Federation establishes two methods for taking them into account for profit tax purposes.

The first method is to determine the average level of interest, taken as the maximum amount of interest recognized as an expense.

This method is used when an organization receives borrowed funds from several lenders during one reporting period, for example, a quarter.

Interest accrued on a debt obligation of any type is recognized as an expense, provided that the amount of interest accrued by the organization on the debt obligation does not significantly deviate from the average level of interest charged on debt obligations issued in the same reporting period on comparable terms.

In this case, a significant deviation in the amount of accrued interest on a debt obligation is considered to be a deviation of more than 20 percent, upward or downward, from the average level of interest accrued on a debt obligation issued in the same quarter on comparable terms.

Debt obligations issued on comparable terms mean debt obligations that simultaneously meet the following criteria:

— issued in the same currency;

— issued for the same terms;

— issued against similar security;

— issued in comparable volumes.

Debt obligations that meet all comparability criteria, but were accepted from different categories of creditors - individuals or legal entities - are considered incomparable.

The second method is used in the absence of debt obligations to Russian organizations issued in the same quarter on comparable terms.

In this case, the maximum amount of interest recognized as an expense for tax purposes is taken to be equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 1.1 times - when issuing a debt obligation in rubles, and 15 percent - for debt obligations in foreign currency.

For organizations using the accrual method, expenses in the form of interest on loan agreements and other similar agreements, the duration of which exceeds one reporting period, are considered incurred and are recognized in tax accounting at the end of the corresponding reporting period.

For organizations using the cash method, interest on borrowed funds (including bank loans) is recognized for tax purposes only after they are actually paid to the lender.

Tax accounting of expenses in the form of rental (leasing) payments Read more: Tax accounting of expenses for the formation of reserves for doubtful debts

Information about the work “Tax accounting of entertainment expenses”

Section: Accounting and Auditing Number of characters with spaces: 42884 Number of tables: 0 Number of images: 0

Similar works

Tax accounting of entertainment expenses using the example of ZAO Sadko

20644

1

0

... they are not taken into account. Accommodation. Accommodation expenses are also not representative expenses, because they cannot be attributed to any expense item provided for in a closed list of entertainment expenses recognized in tax accounting. This position is given in Letter of the Ministry of Finance of Russia dated April 16, 2007 N 03-03-06/1/235. Directions Inviting representatives of counterparties to negotiations, the host…

Accounting of expenses for tax purposes of service sector enterprises

373699

37

0

... tax) period. In accordance with paragraph 3 of Art. 273 of the Tax Code of the Russian Federation for organizations using the cash method, rental (leasing) payments are recognized as expenses for profit tax purposes only after their actual payment. In the financial statements, expenses in the form of rental (leasing) payments are shown as part of other expenses on line 060, including line 100 of Appendix...

Tax accounting of standardized expenses

68451

4

0

... for the amount of value added tax related to entertainment expenses in excess of the norms and, accordingly, not subject to deduction - 400 rubles. (4,000 rubles – 3,600 rubles). 2. Tax accounting registers of standardized expenses The composition of expenses that reduce received income for the purposes of calculating income tax, from 01/01/02 is determined by the norms of Chapter 25 “Organizational Income Tax” of the Tax ...

Assessment of the current system of interaction between accounting and tax accounting of income tax payments

239654

10

11

...do not correspond with each other at all. This will be discussed in the next chapter of this work using the example of a specific organization in Moscow. 2. Assessment of the current system of interaction between accounting and tax accounting of income tax payments (using the example of OJSC COMCOR) 2.1. The concept of PBU 18/02 “Accounting for income tax calculations” in a practical aspect Existing discrepancies ...

Accounting posting services

Many companies, when carrying out their activities, resort to the services of third-party organizations. Most often this is associated with activities related to the production or sale of products. Any services provided to your organization must be justified and reflected in the accounting entries.

Legislative regulation of registration of services rendered

The legal regulation of accounting for the provision of services is based on the agreement that you have drawn up with the counterparty. Regulation is also carried out on the basis of tax legislation and the Civil Code. In addition, additional regulations apply in educational, security and some other areas.

Since both legal entities and individuals can provide services, settlements with counterparties can be carried out in both non-cash and cash forms. Expenses for services are processed in the same way as all other expenses. The accounting accounts in which transactions are carried out depend on the division, type of production and other factors.

Documents for registering entries for services in accounting

- Invoice.

- Work completion certificate.

- Extract from current account.

- Extract from the payment order.

Tips for registering service entries in accounting

- Before recording service transactions in accounting, it is necessary to obtain documents confirming that the work was completed. Sign an agreement with the company you are working with. The document must be correctly drawn up and reflect all services provided.

- When performing work, it is necessary to fill out the appropriate report. There is no exact form for this document, so it is compiled by the company’s accountant. VAT will be deducted only if there is an invoice, which must be attached to the deed.

- An entry is made in accounting that reflects the amount of expenses for the service excluding VAT. Value added tax is reflected on the basis of the invoice.

- The following accounting entry is made on the basis of statements from the current account and payment order after payment for the work of the company that provided the services. If you paid the counterparty in cash through the cash register, the expenses are processed through an expense order.

- Next, you can deduct value added tax. The VAT amount must be entered in the purchase book under the exact date and number. Then the expenses are written off to cost, which also needs to be reflected in the accounting records using the appropriate entries.

Source: https://biznesanalitika.ru/article/buhgalterskij-uchet-uslug-provodki

Accounting for services from the customer

Services are expenses of the customer enterprise and are most often included in expense accounts 20 (23, 25, 26, 44).

Let's continue the example

However, some services may increase the cost of purchased goods or fixed assets (clause 6 of PBU 5/01, clause 8 of PBU /01), for example, transport or information services. In this case, they are reflected as follows:

- Dt 08 (10, 41) Kt 60 - the cost of fixed assets (inventory, goods and materials) has been increased by the amount of transport or other services to be included in the price.

For the procedure for forming the cost of fixed assets and inventory items, see the articles: