Minimum wage: decoding the concept

The acronym MROT, widely used since the 1990s, stands for minimum wage.

And today the importance of this indicator is difficult to underestimate, because this is the basis from which the minimum amounts of sick leave and benefits for pregnant women are calculated, as well as mandatory insurance payments of self-employed persons for periods until the end of 2021 (from 2021 this link has been canceled). To learn about the amounts in which self-employed persons pay contributions starting from 2021, read the article “What insurance premiums does an individual entrepreneur pay in 2018-2019?” .

Previously, this universal indicator also served to calculate some taxes, fines and a number of obligations under civil contracts, in which the condition of linking to the minimum wage was introduced. But currently the minimum wage is not applied for these purposes.

The total amount of all such payments from May 1, 2021 must be at least 11,163 rubles

If, from May 1, 2021, the employee’s salary is less than the minimum wage (11,163 rubles), then the employer may be held accountable in the form of fines. The fine for an organization can range from 30,000 to 50,000 rubles, and if detected again - from 50,000 to 70,000 rubles. For a director or chief accountant, the liability may be as follows: for a primary violation, they can issue a warning or a fine of 1,000 to 5,000 rubles, for a repeated violation, a fine of 10,000 to 20,000 rubles. Moreover, they can be disqualified for a period of one to three years.

Initially, the government assumed that the increase would take place in several stages, spread over two years. This action plan was approved by Federal Law No. 421-FZ dated December 28, 2017. The first stage of increasing the minimum wage took place in January 2021, the second was planned to start on January 1, 2021, when these amounts would finally be equal, but in January 2021 it was decided to speed up the process.

Since the positive dynamics of the domestic economy are still maintained, the government has the opportunity to bring the minimum wage to the level of the subsistence level faster. The draft law on increasing the minimum wage, prepared by the Ministry of Labor, has already been adopted, which amended Article 1 of Federal Law No. 82-FZ of June 19, 2000. It will come into force on May 1, 2021.

Minimum wage in Russia

The Federal Law on the minimum wage is adopted by the State Duma of the Russian Federation annually. The essence of each new law comes down to amending Art. 1 and 2 of the Law “On Minimum Wages” dated June 19, 2000 No. 82-FZ. So, in Art. 1 indicates the new minimum wage established in the Russian Federation for the current year (for example, for the minimum wage in 2021, in force from May 1, 2018, - 11,163 rubles per month), and in Art. 2 determines the start of the new minimum wage (for example, the start of the 2018 minimum wage is 05/01/2018).

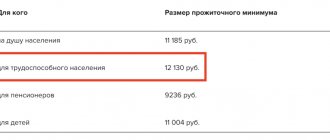

The minimum wage applied from January 1, 2019 is equal to the subsistence level of the working-age population for the 2nd quarter of 2018. Its value is 11,280 rubles.

The minimum wage established by the State Duma of the Russian Federation is called federal. In addition to the federal minimum wage, regional minimum wages may be established in the constituent entities of the Russian Federation.

Read about the dynamics of the federal minimum wage and the relationship between its value and the level of the subsistence level in the Russian Federation here .

Minimum wage in the Moscow region in 2021

The standards of the city of Moscow and the Moscow region in matters of remuneration are not comparable. These territories have different subsistence levels, which are targeted by the regional wage limit. The minimum wage for the Moscow region in 2021 is regulated by:

- Agreement between the regional government, trade unions and employers dated November 30, 2016 No. 118;

- Agreement No. 41, signed by the government of the Moscow region with trade union organizations and employers on 03/01/2018.

The first document established the minimum wage, which was in force from December 1, 2016 - it was 13,750 rubles. This indicator was used until 04/01/2018, then by agreement No. 41 the regional minimum wage was increased to 14,200 rubles. (Clause 1 of Agreement No. 41 dated 03/01/2018). In connection with the change in the federal minimum wage from May 1, 2018, the Moscow region did not change this indicator; it remained at the level established from April 1, 2021.

The validity of the mentioned regional legal acts is mandatory for all employers in the region (with the exception of federally subordinate enterprises and persons who have formalized a reasoned refusal to join the agreement). Violation of the norms for providing workers with an income not less than the established regional minimum wage is punishable according to the provisions of Art. 5.27 Code of Administrative Offenses:

- The fine imposed on legal entities varies in amounts from 30 to 50 thousand rubles. (repeated offense is punishable by a fine of up to 70 thousand rubles);

- for individual entrepreneurs, the fine is 1-5 thousand rubles, in case of repeated cases - up to 20 thousand rubles.

What is included in the minimum wage

Art. 133 of the Labor Code of the Russian Federation provides that the salary of an employee who has worked a full month and fulfilled all his job duties cannot be lower than the minimum wage. Therefore, if an employer is checked to ensure that employees’ wages comply with the minimum wage approved for the current year, the inspector will check the level of the salary established for him with the minimum wage in force in the region.

Read about which of the components of the salary cannot be set less than the minimum wage in the material “Art. 135 of the Labor Code of the Russian Federation: questions and answers" .

New minimum wage in Moscow from May 1, 2021

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation). However, keep in mind that an employee may receive less than the minimum wage in person - minus personal income tax and other deductions, for example, alimony. Accordingly, from May 1, 2018, it is impossible to pay less than 11,163 rubles.

It is worth noting that an employee’s salary from May 1, 2021 may be less than 11,163 rubles.

After all, the total salary cannot be less than the minimum wage, which includes (Article 129 of the Labor Code of the Russian Federation): 1. remuneration for work; 2. compensation payments, including additional payments and allowances; 3. incentive payments (bonuses).

Minimum wage in 2018–2019 in the regions

The minimum wage established in the region cannot be less than the federal minimum wage. It is determined by an agreement between representatives of the government of a constituent entity of the Russian Federation, trade unions and employers. Employers in the region who have not submitted to the government of a constituent entity of the Russian Federation compelling reasons for not joining this agreement are required to apply the regional minimum wage when setting wages (Article 133.1 of the Labor Code of the Russian Federation).

To learn about the cases in which additional payment is made up to the minimum wage, read the article “Additional payment up to the minimum wage for external and internal part-time workers .

How is the minimum wage calculated in the capital region?

In the Moscow region, the cost of living and minimum earnings differ significantly from Moscow. The minimum wage in the region is 13,750 rubles, and this figure has remained unchanged since December 2021. Until the regional government, the leadership of trade unions and the association of regional organizations prepare a new resolution, this indicator will remain at the same level.

Will the minimum wage change from January 1, 2021 in Moscow? A decision on this has not yet been made, and it is difficult to predict the direction of economic policy. Increasing the recognized minimum wage leads to increased costs for the state and employers, so it is difficult to predict how events will develop. It is possible that the cost of living will not be increased, despite rising prices, and accordingly the minimum wage will remain at the same level.

Minimum wage in Moscow

In Moscow, the minimum wage is also established by signing a regional agreement between the capital government, local trade union associations and Moscow employers' associations. Currently, the agreement dated December 15, 2015, relating to the period 2016–2018, is in force. It stipulates that the minimum wage for Moscow is revised quarterly and brought to the subsistence level of the working population. However, if the cost of living decreases, then the minimum wage is not subject to reduction, but remains equal to that in force in the previous quarter.

In all other aspects, the minimum wage in Moscow is subject to the general requirements of the minimum wage legislation.

Table of changes in the minimum wage value in the region

| date | Value, rub. | Normative act |

| from 01/01/2021 |

| Previous agreement. |

| from 01.01.2020 |

| Previous agreement. |

| from 01/01/2019 |

| Moscow tripartite agreement for 2021 - 2021 between the Moscow government, Moscow trade union associations and Moscow employers' associations. |

| from 05/01/2018 |

| Moscow tripartite agreement for 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers' associations. |

| from 01/01/2018 |

| Moscow tripartite agreement for 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers' associations. |

| from 01.07.2017 |

| Decree of the Moscow government of June 13, 2017 No. 355-PP. |

| from 01.10.2016 |

| Moscow tripartite agreement for 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers' associations. |

| from 01/01/2016 |

| Moscow tripartite agreement for 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers' associations. |

| from 01.11.2015 |

| Agreement on the minimum wage in Moscow for 2015 between the Moscow government, Moscow trade union associations and Moscow employers dated December 23, 2014 No. 77-783. |

| from 06/01/2015 |

| Agreement on the minimum wage in Moscow for 2015 between the Moscow government, Moscow trade union associations and Moscow employers dated December 23, 2014 No. 77-783. |

| from 01.04.2015 |

| Agreement on the minimum wage in Moscow for 2015 between the Moscow government, Moscow trade union associations and Moscow employers dated December 23, 2014 No. 77-783. |

| from 01/01/2015 |

| Agreement on the minimum wage in Moscow for 2015 between the Moscow government, Moscow trade union associations and Moscow employers dated December 23, 2014 No. 77-783. |

| from 06/01/2014 |

| Agreement on the minimum wage in the city of Moscow for 2014 between the Moscow Government, Moscow trade union associations and Moscow employers' associations dated December 11, 2013. |

| from 01/01/2014 |

| Agreement on the minimum wage in the city of Moscow for 2014 between the Moscow Government, Moscow trade union associations and Moscow employers' associations dated December 11, 2013. |

FILES

Note to the table: updated minimum wage values for a specific date are highlighted in bold. The values in Moscow for 2014, 2015, 2021, 2021, 2021, 2021, 2021, 2021 are given.

See also: - living wage in Moscow - minimum wage in other regions

What is the minimum wage in 2018–2019 in Moscow

The minimum wage (Moscow) from 10/01/2017 was increased to 18,742 rubles. in accordance with the increase in the cost of living in the region (Resolution of the Moscow Government dated September 12, 2017 No. 663-PP).

Based on the results of the 3rd quarter of 2021, the cost of living in Moscow turned out to be lower than in the 2nd quarter of 2021, therefore the minimum wage has not changed since 01/01/2018 and amounted to 18,742 rubles. Since November 1, 2018, the cost of living in Moscow has increased slightly and amounted to 18,781 rubles. (Decree of the Moscow Government dated September 19, 2018 No. 1114-PP).

Increase in the minimum wage from January 1, 2021

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation).

The Moscow authorities increased the minimum wage in Moscow from January 1, 2021. What is the size of the new minimum wage in Moscow in 2021? From January 1, 2018, the minimum wage in Moscow is 18,742 rubles (Decree of the Moscow Government dated September 12, 2017 No. 663-PP).

At the end of 2021, Moscow authorities recorded the cost of living for the third quarter of 2021. (Decree of the Moscow Government dated December 5, 2017 No. 952-PP). But the amount turned out to be 289 rubles less than the subsistence level for the second quarter. Therefore, the minimum wage in Moscow from January 1, 2021 remained at 18,742 rubles. After all, it is impossible to reduce the minimum wage due to a decrease in the cost of living (clause 3.1.1 of the agreement dated December 15, 2015). By the way, this amount has not changed since October 1, 2021. You can trace how the minimum wage increased in Moscow (see table by year):

| Validity | Amount (rubles per month) |

| 01.10.2017 – | 18742 |

| 01.07.2017 – 30.09.2017 | 17642 |

| 01.10.2016 – 30.06.2017 | 17561 |

| 01.01.2016 – 30.09.2016 | 17300 |

| 01.11.2015 – 31.12.2015 | 17300 |

| 01.06.2015 – 31.10.2015 | 16500 |

| 01.04.2015 – 31.05.2015 | 15000 |

| 01.01.2015 – 31.03.2015 | 14500 |

| 01.06.2014 – 31.12.2014 | 14000 |

| 01.01.2014 – 31.05.2014 | 12600 |

| 01.07.2013 – 31.12.2013 | 12200 |

| 01.01.2013 – 30.06.2013 | 11700 |

| 01.07.2012 – 31.12.2012 | 11700 |

| 01.01.2012 – 30.06.2012 | 11300 |

| 01.07.2011 – 31.12.2011 | 11100 |

| 01.01.2011 – 30.06.2011 | 10400 |

| 01.05.2010 – 31.12.2010 | 10100 |

| 01.01.2010 – 30.04.2010 | 9500 |

| 01.09.2009 – 31.12.2009 | 8700 |

| 01.05.2009 – 31.08.2009 | 8500 |

| 01.01.2009 – 30.04.2009 | 8300 |

| 01.09.2008 – 31.12.2008 | 7650 |

| 01.05.2008 – 31.08.2008 | 6800 |

| 01.09.2007 – 30.04.2008 | 6100 |

| 01.05.2007 – 31.08.2007 | 5400 |

| 01.09.2006 – 30.04.2007 | 4900 |

| 01.05.2006 – 31.08.2006 | 4100 |

| 01.10.2005 – 30.04.200 | 3600 |

| 01.05.2005 – 30.09.2005 | 3000 |

| 01.10.2004 – 30.04.2005 | 2500 |

| 01.05.2004 – 30.09.2004 | 2000 |

| 2nd half of 2003 | 1800 |

| 01.01.2003 – 30.06.2003 | 1500 |

| 01.09.2002 – 31.12.2002 | 1270 |

| 01.01.2002 – 30.08.2002 | 1100 |

Results

The abbreviation MROT stands for minimum wage.

It is installed at both the federal and regional levels. The federal minimum wage increases 1–2 times a year. The regional minimum wage may be revised more often, but in any case cannot be less than the federal minimum wage. The size of this parameter determines the minimum salary level and the minimum amount of sick leave payments and child benefits. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to compare the federal and Moscow region minimum wages in 2021

Employers in the Moscow region (organizations and individual entrepreneurs) must set a salary no less than the Moscow region minimum wage (RUB 13,750) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it. If such a refusal was sent, then the salary in the Moscow region from January 1, 2021 can be compared with the federal minimum wage (9489 rubles). If there was no refusal, then from January 1, 2018, rely on the minimum wage of the Moscow region - 13,750 rubles.

The minimum wage of the Moscow region, applied from January 1, 2021, already includes the tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow region minimum wage.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.