I am currently engaged in the supply of building materials and saw a little occupied niche - cargo transportation with VAT. Everyone either works on a simplified basis or for cash. The stool makers are tired of constantly giving birth to cash. For large enterprises, working with VAT is fundamental.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

News Tools Forum Barometer.

Cargo transportation is complete chaos!

I am currently engaged in the supply of building materials and saw a little occupied niche - cargo transportation with VAT. Everyone either works on a simplified basis or for cash. The stool makers are tired of constantly giving birth to cash. For large enterprises, working with VAT is fundamental. So I decided to take a closer look at this business and clarify a few points. Does anyone have experience in cargo transportation with VAT or understand taxes?

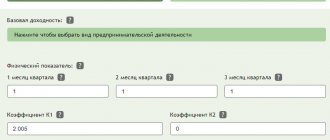

As you know, if you are directly involved in cargo transportation, then you can switch to OSNO only when there are more than 20 vehicles in the fleet, but you can organize cargo transportation, that is, through mediation. Here you can already work with VAT. I am receiving an application. I'm picking up a car. I'm sending the driver. The money has been received into my bank account. Now there is a gap in my knowledge.

What agreement should I conclude with the driver if he is an individual entrepreneur? What percentage of the order does the carrier usually have directly and how much does the intermediary, that is, me, have? For example, delivery by Gazelle from city A to city B costs rubles. This is the tariff for stool-dwellers and those who use the simplified system. I would be glad if someone answers the questions posed. Delivery throughout the city and region is planned. Margins are low, risks are high. If you don’t have some serious advantages, such as exclusive access to fat orders, you will lose money and time.

The transport expedition contract, as a service and the main activity of the enterprise, is immediately targeted by the tax authorities, and sometimes by the Economic Crimes Department. A competent accountant will regulate VAT on completely legal terms. You need to understand a simple truth: if a GAZelle comes from A to B as a private owner for rubles and the “local” rate is exactly that, you will not get through by issuing an invoice to your client by stupidly adding VAT. In small amounts you may not feel it, just like your client, but larger amounts will no longer be competitive.

You need to understand the geography of logistics. Moscow, St. Petersburg, the ports of Novorossiysk for example - there is always a lot of work there. There are 4 ways:. Everyone, from the tax office to the final buyer, does not like to sit on these three hundred and thousand, purely control rooms. A simple advertisement will not be enough, you will need, if not an office, then a couple or three girls in sales, so that the client will come to you.

A lot of hassle. A millionaire will bring net thousand per month from one GAZelle, provided that the task assigned to this GAZelle is competent and it works continuously. If this is Moscow time, then my GAZelles came out there clean every month. The fact that the transport must be fresh and the driver must be good - I think there is no need to explain this. If you are not poking around, there are a million and one ways to deceive you as the owner, then don’t bother at all.

With a fresh clutch and a good driver, a good driver is always a problem. Everything is the same as above, only you will have lift from the car even with a lazy setup. It's good to start with 3 trucks. Two earn money on their leasing, consumables, repairs, insurance, taxes, platon, salary for drivers, the third is just your pocket. A huge minus is that you are on your phone 24/7, literally 24/7.

The car went for a long drive, crashed and just a few thousand kilometers away it broke down, take it to repair it at minus 30 and then change it there. Detain the cargo and pay a fine. Rarely but it happens. You can write a whole separate post about consolidated cargo.

You can take their path, but small-town choose one region or a couple of neighboring ones, or a couple of large cities exchanging cargo with each other and pump them up. The mediator you call yourself is the stool maker you despise so much.

So before you call them that, think about why you are better. No duplicates found. All comments by the Author. The second is more profitable, since you need to pay VAT to the budget so that there are no problems. I work in an intermediary company in the intercity and urban segment, I’ll try to answer. It makes no difference what accounting system your driver uses. I haven’t worked with individuals, but in general the tax authorities are against carrying out entrepreneurial activities without at least forming an individual entrepreneur.

Sometimes we close the trip for Delta, sometimes for Plus, it probably depends on the region. In any case, your rates should be at a competitive level. Check out the local GP market. I'll add one more thing on my own. Please note that new companies now have very big problems opening bank accounts. The Federal Law has become stricter; this is the only way financial monitoring blocks accounts. Mostly due to transfers to individual entrepreneurs due to the cash-out topic. We transfer money to a normal individual entrepreneur, we didn’t cash it out, we provided all the documents, it seems like the banks don’t even look at them.

It’s easier for them to close and not worry. We're tired of opening these accounts. St. Petersburg region Basically not pay? It’s possible, but the tax office really doesn’t like this kind of bullshit.

Profit and VAT are the main headache in my memory. Be healthy. They usually pass the stools. They reduce VAT on fuel, spare parts. And most intermediaries cannot work without cashing out.

Related posts. There are no more similar posts. You might be interested in other posts tagged:.

Is it possible to work with VAT under the simplified tax system and UTII?

Moreover, in accordance with paragraph 5 of Article 174 of the Tax Code of the Russian Federation, taxpayers (tax agents) are required to submit a tax return to the tax authorities at their place of registration and pay tax to the budget. The difficulty lies in the fact that if an entrepreneur applies a simplified taxation system “income minus expenses”, then he will not be able to include the amount of VAT paid to the budget in his expenses.

If for some reason an individual entrepreneur applying a simplified tax regime issues an invoice to his counterparty with the amount of VAT allocated in it, then he automatically falls under clause 5 of Article 173 of the Tax Code of the Russian Federation and becomes a payer of this tax.

VAT refund

View full version: Organization of freight transportation. Good day! Please help me understand this issue that is difficult for me.

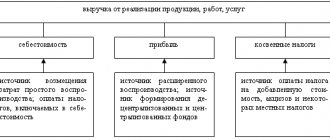

Often, a novice entrepreneur does not fully understand how the VAT scheme works in the field of international cargo transportation. The situation is complicated by the fact that such transportation has its own characteristics and VAT is also subject to separate rules. Let's try to understand this issue and make our life a little easier. But first things first. VAT or value added tax is one of the most important taxes that has a direct impact on the formation of the country's budget and one of the most difficult to understand. This type of taxation is considered indirect, its essence is that a percentage determined by law is deducted from the cost of goods, services, etc., to the country’s budget. At the same time, VAT is deducted from those goods and services that are sold or provided with a markup, that is, their final price higher than the cost of the product.

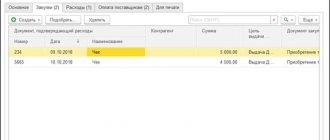

If we take the previous example of rubles, then it is not clear with the payment of tax, who pays it? I am reporting the information I found out. I found a competent accountant. Hello everybody.

VAT when providing transport services to the buyer

As a rule, if a trading company’s client is located in another region, it pays for the services of the transport company itself, and the buyer compensates for these expenses. According to officials, in this case, the buyer does not have the right to deduct the “input” VAT charged by the carrier to the trading company

.

Let's analyze the situation.

Determining the type of contract

A supply agreement with the buyer may provide that the goods are delivered by a trading company with the subsequent obligation of the buyer to compensate it for the costs incurred in transporting the goods to the buyer's warehouse. In this case, the price of the product is formed without taking into account the costs of its delivery to the buyer. In this case, the trading company itself enters into an agreement with a transport or freight forwarding company, draws up documents and pays for delivery services. The question of how to calculate VAT and what documents a trading company must prepare when re-billing its costs to the buyer for compensation has been on the agenda for a long time and has been resolved differently over the years. The Ministry of Finance of Russia, in a letter dated August 15, 2012 No. 03-07-11/299, outlined its position on this issue from the point of view of the Rules for filling out invoices, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (hereinafter referred to as the Rules) . According to officials of the main financial department, if, according to the terms of the supply agreement, the seller of goods undertakes to organize their delivery to the consignee, and the buyer undertakes to reimburse the transportation costs incurred by the seller, then this is an element of an agency agreement. Accordingly, the trading company acts as an agent, and its buyer acts as a principal. It seems to us that we should agree with this position, because the supply agreement with the conditions under consideration on the organization of transportation of goods by a trading company is a mixed agreement.