Any accountant knows that submitted VAT can be deducted under certain conditions. However, there are cases when, due to legislation or the current situation, this is impossible.

When is it permissible to take into account paid VAT as part of expenses that reduce the income tax base?

What does the Tax Code say about this?

How do tax authorities interpret its provisions, and is their point of view always supported by judicial practice?

All this will be discussed in this article.

What VAT can be included in the price of goods

Current legislation provides for very specific transactions when the VAT charged to the taxpayer can be included in the cost of goods, reducing the base for calculating income tax. This is stated in Article 170 of the Tax Code. According to paragraph 2 of this article, tax can be attributed to the costs of production and sale of goods (work, services) in the following cases:

- if they are used to carry out VAT-free transactions - Article 149 of the Tax Code;

- if products manufactured using them will be sold outside the territory of Russia - Article 148 of the Tax Code;

- if the person purchasing them is not a VAT payer or is exempt from paying this tax;

- if they were acquired for those operations that are not subject to VAT (for example, gratuitous transfer of structures to government agencies and other operations listed in paragraph) - Article 2, Article 146 of the Tax Code of the Russian Federation.

This is an exhaustive list of transactions for which input VAT can be attributed to the cost of goods, work or services, thereby reducing the income tax base.

It is worth noting that not only tax amounts presented directly upon purchase can be attributed to expenses, but also those recovered in accordance with paragraph 3 of Article 170 of the Tax Code of the Russian Federation.

In other words, if goods begin to be used to carry out the operations listed above, then the VAT previously deducted on them should be restored and taken into account as part of other expenses in accordance with Article 264 of the Tax Code of the Russian Federation.

Does the taxpayer have the right to choose?

It is important to keep in mind that the provisions of the law on tax deductions and the procedure for their application (Articles 171 and 172 of the Tax Code of the Russian Federation) are imperative in nature, that is, mandatory. This means that a buyer to whom a supplier has charged VAT does not have the right to choose whether to include the tax amount as an expense or to claim it as a deduction.

Thus, if the taxpayer had grounds for deducting VAT, but for some reason he did not use it, then he does not have the right to include the amount of tax in expenses.

Vote:

RSS

| Category : Cost and pricing | |

| Replies: 21 |

You can add a topic to your favorites list and subscribe to email notifications.

| Svetlana |

| Good afternoon. At our enterprise, we have an established form for calculating selling prices for products. VAT is always calculated from the wholesale price (which consists of the full s/s + profit). Full agricultural production includes raw materials, auxiliary materials, fuel and equipment, fuel, water, electricity, payroll, and fear. contributions, general expenses and general production expenses, non-production expenses. So, one of the clients insists that we calculate VAT only on the cost of raw materials and auxiliary materials. materials. Have you ever encountered this? I will be glad to all advice and comments, because... I work in production for a little while, and I don’t even know how to behave with such impudence |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Natalie [email hidden] Russia, Novosibirsk Wrote 1405 messages Write a private message Reputation: | #2[25618] April 20, 2015, 1:32 pm |

Notification is being sent...

Strong people are always a little rude, like to be sarcastic and smile a lot!| Denis [email hidden] Russia, Ryazan Wrote 891 messages Write a private message Reputation: | #3[25620] April 20, 2015, 2:17 pm |

Notification is being sent...

I don't give you a fish, I give you a fishing rod| Alexander [email protected] Russian Federation Moscow Wrote 76 messages Write a private message Reputation: | #4[25621] April 20, 2015, 6:50 pm |

Notification is being sent...

[Administration: advertising in signatures is prohibited (clause 1.5 of the rules)]| Boris [email hidden] Russia, Moscow Wrote 147 messages Write a private message Reputation: | #5[25629] April 20, 2015, 21:36 |

Notification is being sent...

| Svetlana [email hidden] Russia, Moscow Wrote 3 messages Write a private message Reputation: | #6[25630] April 21, 2015, 0:00 |

Alexander wrote:

Good day everyone! Svetlana, I wonder how the client motivates his demand. I’ve also never encountered anything like this, but it was always interesting to understand people’s motives, maybe it’s not a lack of education, but some previous supplier made them a “commercial offer”? ;))) But in essence, I agree that the Tax Code of the Russian Federation is helpful, but Since you still need to be a little more polite with the client, I suggest you try to find a common language with him and try to explain the situation.

He motivates this by the fact that he “would like to” (literally)... and there really was a “commercial offer”. I don’t know how, but a previous economist with many years of experience, under pressure from this client, made a column for “fixed expenses” in the calculation, and included in this column everything that was listed in my first post, and even profit, and I’m trying to sort out this initiative.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Natalie [email hidden] Russia, Novosibirsk Wrote 1405 messages Write a private message Reputation: | #7[25631] April 21, 2015, 4:16 am |

of this Code, taking into account excise taxes (for excisable goods) and without including tax. Maybe we can compete in VAT knowledge? Blitz survey: how much VAT rates do you know? I want to draw the moderator's attention to this message because:

Notification is being sent...

Strong people are always a little rude, like to be sarcastic and smile a lot!| financemanager [email hidden] Russian Federation, Moscow Wrote 77 messages Write a private message Reputation: | #8[25634] April 21, 2015, 9:44 |

Notification is being sent...

| Denis [email hidden] Russia, Ryazan Wrote 891 messages Write a private message Reputation: | #9[25636] April 21, 2015, 9:54 am |

Natalie wrote:

I didn’t understand the attack, Boris!

Did I say something wrong? We bought materials, paid VAT to the supplier, accepted it for deduction, sold the finished product, adding profit and everything else to the cost of materials, added VAT on it and paid the difference to the budget. Thus, we will pay tax on the difference between the cost of materials and revenue. This is all figurative and rude of course. The added value will include wages and our other costs and profits. We pay VAT stupidly according to the formula Sales book minus purchase book = VAT payable to the budget. Article 40 of the Tax Code of the Russian Federation was repealed on January 1, 2012. 1. The tax base when a taxpayer sells goods (work, services), unless otherwise provided by this article, is determined as the cost of these goods (work, services), calculated on the basis of prices determined in accordance with Article 105.3 of this

Code, taking into account excise taxes ( for excisable goods) and without including tax. Maybe we can compete in VAT knowledge? Blitz survey: how much VAT rates do you know?

I told you, don’t embarrass me) most people think literally)

financemanager wrote:

0, 10, 18

I also know “Without VAT”, here

Boris wrote:

I would recommend that “experts”, before giving advice, refresh their memory of the relevant regulatory documents when it comes to accounting, i.e. PBU and NK. So the answer about profit indicates the complete ignorance of the author and the need to urgently re-train in taxation. The answer with revenue is much warmer, but does not take into account the fact that VAT itself is included in revenue.

I’m wildly sorry, but in the second form you also indicate revenue with VAT? If yes, then I have no more questions, if not, then why, because in your opinion, “VAT itself is included in revenue”?

Svetlana wrote:

He motivates this by the fact that he “would like to” (literally)... and there really was a “commercial offer”. I don’t know how, but a previous economist with many years of experience, under pressure from this client, made a column for “fixed expenses” in the calculation, and included in this column everything that was listed in my first post, and even profit, and I’m trying to sort out this initiative.

and what difference did it make? anyway, VAT is the last line in the calculation, after profit, and is added to the entire amount, no?

I want to draw the moderator's attention to this message because:Notification is being sent...

I don't give you a fish, I give you a fishing rod| financemanager [email hidden] Russian Federation, Moscow Wrote 77 messages Write a private message Reputation: | #10[25637] April 21, 2015, 10:00 |

Quote:

financemanager wrote:

0, 10, 18

I also know “Without VAT”, so C is the last line in the calculation, after profit, and is added up to the entire amount, no? Without VAT - this is no longer a VAT rate

I want to draw the moderator's attention to this message because:Notification is being sent...

| Denis [email hidden] Russia, Ryazan Wrote 891 messages Write a private message Reputation: | #11[25638] April 21, 2015, 10:32 |

Notification is being sent...

I don't give you a fish, I give you a fishing rod| Natalie [email hidden] Russia, Novosibirsk Wrote 1405 messages Write a private message Reputation: | #12[25639] April 21, 2015, 11:19 |

Notification is being sent...

Strong people are always a little rude, like to be sarcastic and smile a lot!| financemanager [email hidden] Russian Federation, Moscow Wrote 77 messages Write a private message Reputation: | #13[25640] April 21, 2015, 11:39 |

Natalie wrote:

No one guessed right - there are 5 of them! Who will name everything? “Without VAT” is not a rate!

and what are the remaining 2?

I want to draw the moderator's attention to this message because:Notification is being sent...

| Natalie [email hidden] Russia, Novosibirsk Wrote 1405 messages Write a private message Reputation: | #14[25641] April 21, 2015, 11:44 |

Notification is being sent...

Strong people are always a little rude, like to be sarcastic and smile a lot!| financemanager [email hidden] Russian Federation, Moscow Wrote 77 messages Write a private message Reputation: | #15[25642] April 21, 2015, 11:46 |

Natalie wrote:

There are 2 more calculated VAT rates: 118/18 and 110/10

Sorry, but it's the same thing only on the side.

I want to draw the moderator's attention to this message because:Notification is being sent...

« First ← Prev.1 Next → Last (2) »

In order to reply to this topic you need to register.

Unrealized right to deduct VAT: special cases

A situation where a company has not exercised its right to deduct VAT can arise for various reasons. The most common of them are the following:

- lack of invoices issued by the seller;

- missing the deadline to claim a deduction.

The first situation often arises when making a purchase in a retail chain. Most often these are some “little things”, for example, stationery for office needs or refueling a car. In this case, it is unlikely that you will be able to obtain an invoice from the seller, and in the opinion of the tax service, it is unlawful to claim VAT deduction based on a cash receipt. The absence of an invoice will be identified immediately when the company's VAT return is processed by the tax office's automated system.

It turns out that it is impossible to deduct the amount of VAT on purchased assets, but at the same time, as mentioned above, it cannot be attributed to expenses that reduce the income tax base. However, those companies and entrepreneurs who want to fight for the deduction of the tax amount in this situation in court have every reason to do so.

The Resolution of the Presidium of the Supreme Arbitration Court No. 17718/07 dated May 13, 2008 determined that under such circumstances it is unlawful to refuse a taxpayer a VAT deduction. This is true provided that there is a cash receipt confirming the purchase, and also the fact that the taxpayer used the purchased goods outside the scope of taxable activity has not been proven.

Nevertheless, the official position of the Federal Tax Service has not changed: VAT can be deducted only on the basis of an invoice , and issues of presenting other primary documents as justification for the deduction are resolved in court.

Speaking about the second obvious reason why a taxpayer may lose the right to deduct VAT, let us turn to paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation. Since its entry into force, namely from the beginning of 2015, the procedure for applying for VAT deduction within three years from the date of registration of goods has been legislated. However, this deadline may also be missed, for example, by mistake or due to lengthy preparation of documents. Be that as it may, it is unlawful to claim VAT deduction outside this period. That is, in this case, the tax will have to be paid, but it will not be possible to attribute its amount to income tax expenses.

As an illustration, let us cite the situation of a Russian exporting company that took too long to collect a package of documents to confirm the zero VAT rate. As a result, she declared “input” tax on transactions taxed at 0% beyond the three-year period, and on this basis was denied a deduction. The amount of tax that the company had to pay was included in income tax expenses, however, the Supreme Arbitration Court did not agree with this position (determination of the Supreme Arbitration Court of the Russian Federation No. 305-KG15-1055 dated March 24, 2015).

An example of a situation where VAT can be attributed to expenses

Another special case is also related to the non-confirmation of the zero VAT rate, but this is not about the tax presented by the taxpayer, but about the cost of his services calculated “on top of” the cost of his services. The situation was discussed in the letter of the Ministry of Finance No. 03-03-06/1/42961 dated July 27, 2015. The department is of the opinion that if the legality of applying the zero VAT rate cannot be confirmed, then the amount of calculated tax at a rate of 18 or 10% on the basis of subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation should be taken into account as expenses.

In making this conclusion, the Ministry of Finance refers to the resolution of the Supreme Arbitration Court of the Russian Federation dated April 9, 2013 No. 15047/12, issued in a dispute between a large Russian air carrier and the Federal Tax Service. The company failed to collect documents to confirm zero VAT, calculated it at a rate of 18%, paid and included this amount as expenses that reduce profits. The tax service saw this as a violation. However, the Supreme Arbitration Court did not agree with this position and explained that the dispute concerns VAT calculated “from above.” In this case, the rules of tax legislation regarding the accounting of these amounts as expenses should be applied. The court also indicated that this VAT should be expensed immediately after the expiration of the 180-day period provided for submitting documents confirming the zero rate.

Calculation of product costs in Excel

It has already been noted that each company will have its own list of costing items. But you can substitute any data into the existing framework, change the formulas if necessary, and get a ready-made calculation.

For an example of costing and selling price calculation, let's take data from the following table:

Costing calculation scheme:

- We calculate returnable waste from the costs of raw materials and materials (we take the specified percentage).

- To determine the additional salary, we take into account the following data: if the basic salary is more than 200 thousand rubles, then the additional salary is equal to 10% of the basic salary; less than 200 – 15%.

- Salary accruals - 30% of the amount of basic and additional wages (the additional 10%, which were introduced in 2015 for annual income of more than 600 thousand rubles, are not taken into account here).

- Equipment maintenance costs are 5% of the basic salary.

- General expenses – 9% of the average basic salary.

- General production – 18% of (25% OZP + 75% DZP). WZP – basic salary, DZP – additional salary.

- Production cost = the sum of expenses for the maintenance of equipment, raw materials and materials, fuel and energy, components, spare parts and additional parts, accruals for salary, general production and general expenses minus returnable waste.

- Non-production costs (costs) – 3% of production costs.

- Total cost = production cost + production costs.

- We calculate the manufacturer's profit as a percentage of the total cost.

- Wholesale price = full cost + manufacturer's profit.

- VAT is calculated based on the wholesale price.

- Selling wholesale price = manufacturer's wholesale price + indirect taxes (VAT in the example).

Based on the diagram, we will enter the data and formulas for calculation into an Excel spreadsheet.

Explanations for the calculation of some costing items:

- Returnable waste – =B2*12.54% (percentage taken from the first table).

- Additional salary – =IF(B6

- Salary accruals – =(B6+B7)*30%. If we follow the letter of the law and take an additional 10% from an annual salary over 600 thousand rubles, then we use the same “IF” function.

- Equipment content – =B6*5%.

- General production costs – =18%*(B6*25%+B7*75%).

- General expenses – =9%*B6.

- Production cost – =(B2+B3+B5+B6+B7+B8+B9+B10+B11)-B4.

- Production costs – =3%*B12.

- Total cost – =B12+B13.

- Manufacturer's profit – =B14*3.45%.

- Manufacturer's wholesale price – =B14+B15.

- The formula for calculating VAT is =B16*20%.

- To calculate the wholesale selling price – =B16+B17.

The same principle is used to calculate the cost of products B and C.

You can make Excel take the initial data for calculation immediately in the appropriate tables. For example, raw materials and materials - from the production report. Salary - from the payroll. Unless, of course, all this is done in Microsoft Excel.

VAT included in bad debts

Another case when VAT is included in expenses is if it is part of accounts receivable that are overdue and must be written off . This situation may arise as a result of an unpaid delivery or the transfer of an advance payment for which the goods were never shipped.

After three years, the debt becomes uncollectible and is written off as an expense.

In this case, the company has the right to write off the amount of receivables along with VAT. This procedure does not contradict the official point of view of the Ministry of Finance, as reflected in letter No. 3-07-05/13622 dated March 13, 2015.

It is worth paying attention to one nuance that arises when writing off bad receivables for prepayment. If the VAT presented upon its transfer was previously accepted for deduction, then when the receivables are written off, the tax must be restored. This is the position of the Ministry of Finance, however, many experts consider it controversial, since paragraph 3 of Article 170 of the Tax Code of the Russian Federation does not say anything about the restoration of VAT in this case.

The income tax base reflects not only written-off receivables, but also written-off accounts payable. It arises as a result of non-payment for shipped goods or failure on the part of the company to deliver on account of the advance received when the three-year statute of limitations for these transactions has expired. How to deal with VAT as part of such a “creditor” when writing it off? Let's look at this issue in more detail using specific situations.

If the company’s debt arose due to the fact that goods received were not paid for, then the amount of debt is charged to the income tax account in full, that is, together with VAT. At the same time, tax amounts accepted for deduction upon receipt of goods are not subject to restoration (letter of the Ministry of Finance dated June 21, 2013 No. 03-07-11/23503).

Another case is when accounts payable arose due to the fact that goods were not shipped against the advance received, on which VAT was paid . After the expiration of the limitation period, the amount of debt is included in the income that forms the income tax base. What should I do with the VAT previously paid on this amount? Logically, it should be excluded from income. However, the Ministry of Finance is of the opinion that the Tax Code does not allow reflecting this VAT in expenses (letter of the Ministry of Finance dated December 7, 2012 No. 03-03-06/1/635).

But according to many experts, there is another way out of this situation. They propose to take into account as income tax income not the full amount of the prepayment received, but the amount minus the VAT paid on it. In doing so, they refer to paragraph 2 of Article 248 of the Tax Code of the Russian Federation, which prescribes that the amounts of taxes presented by the taxpayer to the buyer should be excluded from income. However, if the company decides to take this path, it is very likely that it will have to defend its case in court.

Procedure for writing off VAT on expenses

Mandatory actions

The goods and services that an organization purchases to carry out its activities are used in various operations. Some of them are subject to VAT, while others are not. In order to be able to write off VAT in the future, it is necessary to keep separate records of input tax. However, such a requirement is not regulated, but is a practical conclusion.

Mandatory actions when writing off VAT on expenses are:

- The cost of the purchased product must be confirmed by relevant documents.

- When an individual entrepreneur applies UTII, during capitalization the tax is reflected in the cost of the product.

- With various types of “simplified” VAT can be taken into account at any time or after payment for the product is made.

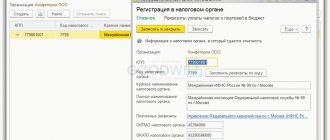

Writing off VAT on expenses is actually a simple procedure, since it is automated by the 1C system. The software package has a section regarding accounting policies. It is necessary to select the option of inclusion in the cost or write-off. The entered data will be shown in the invoice request. In the section that reflects inventories, you need to select accounting by batch, quantity or amount.

The entries regarding the attribution of VAT to income tax expenses are discussed below.

Postings

Product for sale

In accounting and tax accounting, in order to write off VAT on expenses, it is necessary to create transactions (where Dt is a debit, Kt is a credit) that correspond to each specific transaction if the goods are purchased for sale:

- Dt 41 Kt 19 means that VAT is included in the price of a product or service;

- Dt 60 Kt 51, 50. 71 – the cost of goods and services has been fully paid;

- Dt 41 Kt 60 – purchased goods;

- Dt 19 Kt 60 tax was allocated;

- Dt 90.2 Kt 41 means that the cost is transferred to the cost price.

Products for your own activities

If products are purchased for your own activities, then the following transactions must be completed:

- Dt 20.23 Kt 10 – cost written off as cost;

- Dt 10 Kt 19 means that VAT is included in the price of products after payment;

- Dt 60 Kt 51 – purchased goods paid for;

- Dt 19 Kt 76, 60 – VAT is indicated in the documents of the seller from whom the goods were purchased;

- Dt 10 Kt 60 – the cost is indicated at the time of capitalization.

Writing off VAT on expenses is not a deduction. This operation is performed in order to increase the organization’s expenses and profit margin, which is reflected in the bank account.

From this video you will learn whether and how to write off VAT as expenses under the simplified tax system:

Accounting for “foreign VAT”

Companies working with counterparties from neighboring countries often have questions about how to deal with VAT, which appears in the primary documents received from them. It is important to understand the following: despite the fact that this tax is called the same as Russian, it has nothing to do with our VAT. This is a tax of a foreign country; it is calculated and paid according to the laws of the country where the company’s partner is a resident.

Thus, the tax called VAT, which appears in the invoices of a foreign counterparty, is not deductible under any circumstances.

How should the “foreign VAT” that is presented to the buyer be reflected in accounting? The point is that it does not need to be taken into account separately. It forms the cost of purchased goods (works, services) and is included in income tax expenses.

In other words, for a Russian company it makes no difference which taxes are included in the cost of goods purchased from a foreign supplier, because the costs will take into account the full amount of the contract.

On the other hand, “foreign VAT” appears in a situation where, when paying for services rendered, a foreign partner, who is a tax agent, withholds this tax from the contract amount. For example, a Russian company provided services to a foreign enterprise, the cost of which was 1,200 conventional units (cu). However, the domestic company received 1000 USD The partner withheld the remaining amount in accordance with the laws of his country as a tax agent.

How should this transaction be reported in income? The Ministry of Finance believes that in full, including withheld foreign tax. That is, in our example, the Russian company must record income from the operation in the amount of CU 1,200. But the amount of tax withheld is 200 USD. can be attributed to expenses taken into account for calculating income tax. (letter of the Ministry of Finance dated May 18, 2015 No. 03-07-08/28428).

True, 21 of the Tax Code does not indicate on the basis of which document the withheld tax can be accepted as an expense. Therefore, in this matter one should be guided by the norms of Chapter 25 , and specifically Article 313 of the Code. It defines the documents on the basis of which income tax withheld by a tax agent can be offset against the tax payable by the taxpayer. Thus, if a foreign partner has withheld s as a tax agent, you should require a document from him confirming this process. If the latter is compiled in a foreign language, it will need to be translated into Russian.

Methods

Calculation can be carried out in various ways:

- Transverse. Processing represents the final step of processing and production. Calculations are made on the basis of information on processing or manufacturing. The method under consideration is used in the oil refining and food industries. Cross-cutting calculation is considered simple. It does not involve compiling statements or redistributing indirect expenses. The first step is to perform the calculation in conventional units. The second step is to establish the cost of a conventional unit of goods. The third step is determining the cost.

- Process-by-process. When making calculations, you need to use information for a specific process, which includes a list of processes. The process is a technological stage that is a component of production. The method under consideration is suitable for the mining and chemical industries. Relevant for mass production of goods. If there are no work in progress items, the cost is determined by dividing the costs by the quantity of manufactured products. Both expenses and volume of goods are determined for a specific reporting period. If the production cycle is long, costs need to be distributed between production and work-in-process items.

- Custom. Relevant for the construction and aviation sectors. It is used in small and medium businesses. Suitable for companies engaged in tailoring, furniture production, and repairs. This is a simple way to account for costs. The peculiarity of this technique is that it can only be used after completion of the work. This is due to the fact that calculations require complete information.

The considered costing methods are needed for effective management of the production department.

Where to include VAT when re-importing?

Goods that the exporter for some reason is forced to import back into the country are placed under the customs procedure of re-import. In practice, customs authorities generally charge VAT on the value of such goods. The legality of this can be debated, but taxpayers usually prefer to pay the tax in order to get their own goods back as soon as possible. And here the question arises: what to do next with the amount of this tax?

Let us immediately note that VAT paid during re-import cannot be deducted. Paragraph 2 of Article 171 of the Tax Code of the Russian Federation lists all cases when customs VAT can be deducted, and operations for the re-import of goods do not appear there. Based on Article 170 of the Tax Code of the Russian Federation, the amount of tax also cannot be included in the cost of imported goods. After all, most likely, they will be sold in the future, that is, used in activities subject to VAT.

According to experts, it is advisable to attribute VAT withheld when re-importing goods to other expenses that reduce taxable profit, as a tax paid in accordance with the law.

And although paragraph 19 of Article 270 directly prohibits the inclusion of VAT in expenses, it refers to the tax presented by the taxpayer. When re-importing, the owner of the goods does not present the withheld VAT to anyone, therefore, the specified legal norm is not applicable to this situation. This is confirmed by judicial practice. Thus, customs VAT withheld during re-import can be included in other expenses taken into account when calculating the income tax base.