Accounting concept

To understand the difference between accounting and tax accounting, let’s study each concept separately. Let's start with the first one.

Accounting (AC) is the regular documentation of all operations of a subject’s economic activity and the preparation of a financial report based on this information. In other words, this is a reflection of the enterprise’s activities, a complete picture of its financial situation.

This takes into account not only net profit, but also property owned by the company, accounts payable and receivable, and dividends. The main goal of accounting is to compile a report, based on the indicators of which one can judge the profitability of the activities of a particular enterprise. This information is important both for the manager himself and for third parties - creditors, investors.

In addition to drawing up a complete picture of the organization’s budget, accounting tasks include searching for reserves, monitoring implementation and compliance with legal norms, and minimizing exit risks.

Individual entrepreneurs and small enterprises are exempt from the responsibility for accounting. Large companies must conduct accounting without fail. By law, the following may be involved in preparing a statement of financial position:

- chief accountant officially employed by this company;

- director of the enterprise;

- third-party organizations specializing in accounting (an appropriate agreement is required).

Their activities should include documenting all transactions, evaluating any company property in monetary terms, drawing up double tables when indicating financial turnover (debit and credit columns, what are they - we wrote in this article), calculating the balance sheet - both the tax and tax authorities will be interested in this information counterparties.

There are two types of accounting management:

- standard - carried out entirely in accordance with the law, operated by LLCs and JSCs;

- simplified - allows you to take into account financial activities in a simplified mode, used in small or non-profit enterprises.

Regardless of the type, accounting is based on two principles - frequency, that is, the report is compiled monthly, quarterly and annually; monetary measurement of any company activity.

Accounting profit and taxable profit.

accounting profit is reflected in its income statement in accordance with applicable accounting standards. Accounting profit, also called 'income before taxes', 'pretax income', does not include income tax expenses.

[Cm. definition in IAS 12:5]

Taxable income is that portion of a company's profits that is subject to income tax under the tax laws of its jurisdiction.

Because of different guidelines on how to report profits in a company's financial statements and how to measure profits for tax purposes, accounting profits and taxable profits may differ.

A company's taxable income is the basis for paying income tax (liability) or recovering it (asset). Both are calculated based on the company's tax rate and reflected on its balance sheet.

A company's tax expense, or tax benefit, if recovered, is recognized in the income statement and represents the aggregate of the income taxes payable (or refundable in the case of tax benefits) and any changes in deferred tax assets and liabilities.

When a company's taxable profits exceed its accounting profits, its income tax payable will be higher than it would otherwise be if income taxes were determined on the basis of accounting profits.

Deferred tax assets, which appear on the balance sheet, arise when income taxes are paid on the difference in profits (ie taxable profits are higher than accounting profits) and the company expects to recover the difference paid in future periods.

Thus, the actual amount of income tax will exceed the income tax expense in accounting (which is reflected in the income statement and is determined on the basis of accounting profit).

Associated with deferred tax assets is a valuation allowance , which represents a reserve for deferred tax assets. This valuation allowance is based on the likelihood of deferred tax assets being utilized in future reporting periods .

Deferred tax liabilities, which also appear on the balance sheet, arise when less income taxes are paid and the company expects to pay the remaining taxes in future periods.

In this case, the income tax expense in accounting exceeds the income tax payable.

Income tax paid is the actual amount of tax paid (i.e., not the accrued amount, but the actual outflow of funds).

The income tax paid may be less than the income tax expense due to payments in previous periods or tax refunds (from the state budget of the jurisdiction) received in the current period.

Income tax paid reduces the income tax payable, which is shown as a liability on the balance sheet.

- The tax value of an asset or liability (or tax base, English 'tax base', 'tax basis') is the amount at which the asset or liability is measured for tax purposes.

- The carrying amount of an asset or liability (English 'carrying amount', 'book value') is the amount at which the asset or liability is measured in accordance with accounting principles.

[Cm. definition in IAS 12:5]

The terms “tax base” and “tax basis” are used interchangeably. "Tax basis" is more often used in the USA. Similarly, the two terms “carrying amount” and “book value” refer to the same concept - book value.

Differences between tax and book value also result in differences between accounting profit and taxable profit . These differences may be carried forward to future periods.

For example, a tax loss carryforward occurs when a company incurs a loss in the current period that can be used to reduce future taxable income.

A company's tax expense on its income statement should reflect not only the taxes payable on taxable income, but also the impact of those differences.

Tax accounting concept

Now let’s look at what tax accounting (TA) is and how it differs from accounting.

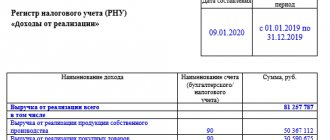

Tax accounting is also a systematic reporting of the financial activities of an enterprise, only here the data is needed to transfer it to the tax office and, accordingly, pay taxes on the basis of these reports.

Conclusion: the main purpose of accounting is to compile a complete summary of the company’s budget, while the purpose of tax accounting is to determine the income tax.

All companies - individual entrepreneurs, individuals, and LLCs - are required to maintain NU. There are no exceptions here. Even individuals who work for hire are required to maintain NU, only the counterparty employer does this for them. Both an accountant and the director of the enterprise can prepare data for the tax office.

All information about the company’s income and expenses for the current period is entered into the tax return - this is the main document for tax accounting. In addition to information about expenses and income, the declaration includes:

- accounting for tax benefits, if any, for a particular company;

- materials related to tax calculation;

- the amount of the final contribution to the Federal Tax Service for a specific period.

All financial transactions made by the company must be documented.

It is important that all papers are filled out correctly. They must contain the details of the parties involved in the monetary turnover, the full name of the company, the date of the agreement, the type of transaction, the income/expense that resulted from the transaction and the signatures of the responsible persons.

Tax Profit Facts

Tax profit is usually understood as the difference between income and expenses, which forms the tax base - if the company uses such systems for calculating fees, such as, for example, the simplified tax system according to the “income minus expenses” scheme or OSN. All those financial indicators that are subject to taxation constitute tax profit.

It may differ, in particular, from economic profit, which is the difference between actual income and expenses, reduced in some cases by the amount of opportunity costs.

It can be noted that in cases where a company’s expenses exceed income (and, accordingly, tax cannot be calculated based on the results of commercial activities), the organization’s financial specialists record a negative tax profit or tax loss.

Main differences

Based on the above, it is already clear what the difference is between accounting and tax accounting. Firstly, these are the goals : for accounting - drawing up a complete picture of the company’s financial position; for NU - accounting only for those cash flows that appear when preparing a tax return.

Secondly, the obligation to maintain : individual entrepreneurs and individuals are exempt from accounting; everyone, without exception, maintains tax records.

Thirdly, for whom the reporting is prepared : accounting - for company participants and third parties interested, tax reporting - in fact, for the tax service.

In addition, two types of accounting differ:

- legislative framework;

- features of the recognition of income and expenses, due to which permanent and temporary differences occur in the two reports;

- creation of reserves.

Let's look at each criterion in more detail.

The legislative framework

All information about accounting is enshrined in the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” . The rules for maintaining reporting at each stage are outlined in the PBU - an accounting regulation to which the law also refers.

As for NU, everything here is regulated by the Tax Code of the Russian Federation, in particular Article 313, which stipulates general provisions.

Accounting for income and expenses

Here the differences lie in two criteria at once. Firstly, not all income/expenses are recorded equally in tax and accounting, and secondly, the procedure for accounting for cash flow may differ.

Now, in order. When compiling the accounting system, absolutely all incoming and outgoing funds are taken into account. NU has a list of income/expenses that are not taken into account when compiling it.

For example, a transfer from contractors came in for 50 thousand rubles - this is the income of the enterprise. Of this amount, 10 thousand were allocated to pay workers; 6.5 thousand - personal income tax; 5 thousand - contributions to funds and 6 thousand rubles - payment for consulting services - these are all expenses.

operates under a simplified taxation system, which involves paying tax only on net profit, that is, “income minus expenses.” In accounting, to calculate net profit, we subtract all expenses from income and get:

50 000 – 10 000 – 6500 – 5000 – 4000 = 24 500

When drawing up the NU, consulting services will not be included in the list of expenses taken into account. Thus, the final net profit will be higher by 6 thousand rubles, which means the tax will be higher.

Important: income that is taxed is listed in Articles 246, 250, 346.15 of the Tax Code of the Russian Federation. Expenses that reduce tax deductions are in articles 254, 246.16. Non-taxable income is stated in Article 251, and expenses not taken into account when compiling the NU are in Article 270.

Two statements for the same period may not have the same amount of income. The differences can be permanent or temporary. The first are due to the fact that not all operations are taken into account when compiling the NU. The second ones have different accounting times for these operations.

Temporary differences are divided into two types:

- Deductible - the amount in NU is greater than in BU. In this case, a deferred tax asset (DTA) is formed. Its size is equal to the amount of the difference multiplied by the tax percentage.

- Taxable - the amount in NU is less than in BU. A deferred tax liability (DTL) is formed. It is calculated exactly the same.

Let's look at the example of accounting for depreciation, which will result in a taxable difference. For the needs of the company, a machine worth 1 million rubles is purchased. The useful life is set at 3 years. For calculations in BU, the cost of the car will be divided by the number of months for which it will be used (1,000,000 / 36 = 27,777 - the amount of monthly depreciation).

But when doing tax calculations, the picture turns out to be different. When compiling the NU, you can immediately write off 10% of expenses in the first month as a depreciation bonus. That is, 100 thousand are written off immediately as expenses (1,000,000 / 10). Accordingly, further monthly depreciation deductions will be calculated not from 1 million, but from 900 thousand (1,000,000 - 100,000), and will be equal to 25 thousand (900,000 / 36).

Then in the first month of using the car, the amount of depreciation in the BU will be 27,777 rubles, and in the NU - 125,000 (100,000 is the depreciation bonus, 25 thousand monthly depreciation). The taxable difference will be 97,223 rubles. The amount of deferred tax liability is 19,444 rubles (97,223 * 20%).

Starting from the next month, the expense in accounting will be higher than in tax accounting by 2,777 rubles (27,777 - 25,000), respectively, the difference will be reduced by this amount every month. And the tax liability will be repaid monthly by 554 rubles (2,777 * 20%).

Differences between accounting and tax

The differences apply to almost all areas of accounting.

Revenue recognition

Recognition in accounting is regulated by PBU 9/99, established by Order No. 32 of May 6, 1999. Paragraph 2 of PBU 9/99 states that a company’s income is an increase in economic benefits based on the receipt of assets and coverage of liabilities. At the same time, the capital of the subject increases. Contributions from company participants/owners will not be considered income.

The definition of income within the framework of tax accounting is contained in Article 41 of the Tax Code of the Russian Federation. This is an economic benefit that is recorded when it can be measured. It must comply with Chapter 23 of the Tax Code of the Russian Federation.

Both definitions are closely related to the concept of economic benefit. But the laws do not define this term. It is only in the Concept of Accounting in a Market Economy (clause 7.2.1). In particular, this is the ability of objects to be a factor in the flow of money into the company. That is, benefit is an influx of money.

Classification of receipts

Income within accounting:

- Income from standard areas of the company's work. For example, this is money from the sale of goods, performance of services (clause 5 of PBU 9/99).

- Other income. Their list is contained in paragraph 7 of PBU 9/99. It is not exhaustive. That is, income not included in this list may be considered other. Examples of other income: rental of property, payment of penalties by partners, differences between exchange rates.

Income within the framework of NU:

- Income from the sale of services and property rights. The exercise of rights means the sale of goods both of one’s own production and those previously purchased in bulk.

- Non-operating income. A list of them is contained in Article 250 of the Tax Code of the Russian Federation. It is closed. This category includes, for example, income from equity participation.

Classification in accounting and NU has its differences and similarities. In both forms of accounting, revenue appears. However, the list of other income in accounting is open, and the list of non-operating income is closed.

Restrictions on revenue recognition

Let's look at the limitations within accounting. These are incomes that are not recorded as part of accounting and are specified in paragraph 3 of PBU 9/99. In particular, these are receipts from legal entities and individuals. For example, this is a returned loan that was previously given to the borrower.

Within the framework of the NU, income specified in Article 251 of the Tax Code of the Russian Federation is not recognized. This is income that came in the form of property and rights to it as part of the prepayment. For example, this is property that is collateral.

The restrictions in both forms of accounting are similar. The lists are closed.

Revenue recognition sequence

In accounting, the sequence of income recognition is regulated by Section 4 of PBU 9/99. Revenue is recognized only if the conditions contained in paragraph 12 of PBU 9/99 are met. If not all conditions are met, the funds are recognized not as revenue, but as accounts payable. Typically, accounting is done through accrual accounting. But if the subject can maintain simplified accounting, then he is allowed to use the cash method.

Within the framework of NU, the procedure for recognizing receipts is specified in Article 271 of the Tax Code of the Russian Federation.

IMPORTANT! The dates for recognizing the receipt of funds in different forms of accounting differ.

Creation of reserves

Another difference in reporting is the specifics of creating reserves. Reserves are created when accruing vacations and in the case of doubtful debts, for example, accounts receivable.

In accounting, reserves for vacations can be created in advance, with a “reserve”, but in NU - only for the reporting year.

As for reserves for doubtful debts, in tax accounting this type of reserve is used “optional”, but in accounting it is an obligation. Based on this, discrepancies may also arise between the two reports.

So, tax and accounting have different purposes. From here there arise not only differences in the compilation, but also in the displayed finances. It is impossible to judge a company’s budget only on the basis of NU, just as it is impossible to pay taxes only on accounting data.

Fixed Asset Accounting

Differences in tax and accounting may also arise in transactions with fixed assets. First of all, it is worth noting that in accounting, each object can have its own method of calculating depreciation. For accounting purposes, the depreciation method is fixed in the accounting policy, and the chosen one is applied to all objects. In addition, in NU there are only 2 ways of calculating OS wear and tear - linear and nonlinear.

The useful life of an asset in accounting often depends on the physical characteristics of the asset. When determining this indicator, NU is guided by the OS Classification.

Another reason for discrepancies is the depreciation bonus, which allows you to write off part of the funds spent directly to current expenses. There is no such concept in accounting.

Peculiarities

Absolutely all companies are required to maintain tax records. Even those that use special modes for calculations. In this case, the accounting procedure must be specified in the accounting policy of the enterprise, which becomes the main document for calculating taxes. However, this occurs after approval by the manager.

Accounting includes documentation, balance sheets, inventory and some other measures that have a common goal. It consists in generating complete and reliable information about the economic activities of the enterprise.

What is the difference between accounting and tax accounting?

For each organization, it is important to maintain two legally established types of accounting.

Each of them has its own goals and objectives. What is the difference between accounting and tax accounting? First, the purposes of record keeping differ. Accounting provides information about the results of activities to the management of the organization and stakeholders. Tax accounting allows fiscal authorities to control the completeness of tax payment, the reliability of reporting and the implementation of legislation on taxes and fees.

Secondly, appropriate legislation has been developed for taxation purposes, in particular the Tax Code. Accounting statements are maintained in accordance with federal law, PBU and other documents. It is legislative regulation that is the main reason for the differences.

Requirements

Current legislation imposes a considerable number of requirements for reporting at an enterprise. All companies must comply with them.

In particular, this concerns the accounting of discounts. As you know, each enterprise independently determines the cost of its own goods. The discount does not apply to expenses, as it is a reduction in the cost that was originally stated. This is important information that is used not only in accounting, but also in tax accounting. In the latter case, discounts are attributed to a decrease in income.

You need to understand that this is only one of the impressive number of requirements imposed by law.

Main goals

To further understand the difference between accounting and tax accounting, let's find out what purposes they are used for. This information will allow you to stop confusing these concepts.

So, first we list the main tasks of accounting:

- First of all, it allows you to generate complete and reliable information about the financial activities of the enterprise, as well as the state of its property.

- Compilation of information that may be required by internal or external users to monitor compliance with current Russian legislation.

- Preventing losses in the enterprise and finding financial reserves to ensure its sustainability.

Recognition of income and expenses

In accordance with the requirements for financial statements, all cash flows must be reflected in them. When preparing tax reporting, slightly different rules apply. Moreover, legislative sources list categories that should be classified as income or expenses.

Accounting statements must reflect complete information about the economic activities of the enterprise. It directly takes into account direct and indirect costs. For example, the first category includes expenses that are directly related to production. For example, the purchase of materials or other raw materials, wages to employees who are involved in the manufacture of products, etc.

Now you know the difference between tax and accounting. This will allow you to clearly distinguish between both concepts and avoid confusion. This is especially important for those who have anything to do with the company’s reporting.

You need to understand that, even despite the differences, accounting and tax accounting in an enterprise are closely related to each other. After all, they are based on the economic activity of the enterprise. In addition, both types of reporting require the accumulation and synthesis of information about the income and expenses of the enterprise. It is this subtle relationship that underlies the confusion that often arises. However, now you can distinguish one from the other using simple criteria.

You need to understand that you should not neglect the preparation of financial statements at the enterprise. Even despite the fact that it is not required for submission to the tax authorities and can be intended exclusively for the manager. However, you need to understand that other principles apply when compiling it. Accordingly, if only tax reporting is used to assess the activities of an enterprise, management can be misled. This is due to the fact that the profit in it is usually higher than in the financial statements. After all, the volume of contributions that must be paid to the state budget depends on its size. In this case, the actual profit of the enterprise may be lower. This is why a manager should not give up accounting.