Who should pay transport tax

The tax is paid by organizations and individuals, including individual entrepreneurs, for whom cars or trucks are registered with the State Traffic Inspectorate.

Also, transport tax is paid by companies and individuals (including individual entrepreneurs) who own registered self-propelled vehicles (tractors, excavators, tractors), helicopters, motor ships, boats, yachts, motor boats and other water and air vehicles. Fill out and submit your transport tax return for 2021 for free online

IMPORTANT

As for water transport, non-self-propelled (towed) vessels - barges, platforms, floating docks, etc. are also subject to tax. But in relation to trailers for land vehicles, there is no need to pay tax, even if the trailer is equipped with a motor necessary for the operation of the equipment installed on it (letter of the Ministry of Finance dated 02.16.11 No. 03-05-05-04/03).

Do I have to pay tax on quadcopters? It all depends on the maximum take-off weight of the aircraft. According to subparagraph 1 of paragraph 1 of Article 33 of the Air Code of the Russian Federation, official registration is required if the specified mass of the “drone” exceeds 30 kg. Unmanned civil aircraft with a maximum take-off weight from 0.25 kg to 30 kg inclusive are not subject to state registration, but registration (clause 3.2 of Article 33 of the RF Civil Code).

This difference in terminology is significant for transport tax purposes. As mentioned above, only registered vehicles are subject to it. Therefore, in relation to “drones” with a take-off weight from 0.25 kg to 30 kg, there is no need to pay transport tax (letter of the Federal Tax Service dated 02/11/19 No. BS-4-21 / [email protected] ).

ATTENTION

Evasion of registration of a vehicle (vehicle) will not relieve its owner from the need to remit transport tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/07/12 No. 14341/11).

Fill out waybills indicating the route and mandatory details in a special service

Main changes in transport tax for 2021

As of 2021, organizations have a new responsibility. They must report to the Federal Tax Service about available benefits for transport tax using a special form (approved by order of the Federal Tax Service dated July 25, 2019 No. ММВ-7-21/ [email protected] ; see “Approved application form for benefits for organizations on transport and land taxes ").

Previously, such a statement was not required - all information about benefits was reflected directly in the tax return. The Federal Tax Service clarified that applications need to be submitted only for tax periods starting from 2020. For previous years, as well as for periods during 2020 (for example, if the company was liquidated or reorganized), a separate application for benefits is not required (letter dated 09.12.19 No. BS-4-21 / [email protected] ).

ATTENTION

There is no deadline for applying for benefits. But, obviously, it is better to do this before the date of tax payment or the first advance payment on it. Therefore, if an organization has a tax exemption (advance payments) for 2021, then it is advisable not to delay submitting the application. Although, we note that the Federal Tax Service does not object to a later filing of the application (in 2021), that is, after paying the tax and receiving from the Federal Tax Service a message about the calculated (without benefit) amount of tax (letter of the Federal Tax Service dated December 3, 2019 No. BS-4- 21/ [email protected] ; see “The Federal Tax Service told how organizations can apply benefits for transport and land taxes from 2021”).

Apply for benefits in 2021 online Apply for free

There have also been changes in the form of transport tax declaration. The new form was approved by order of the Federal Tax Service dated November 26, 2018 No. ММВ-7-21/ [email protected] (see “The transport tax return for 2021 will have to be submitted using a new form”). Using this form, organizations should have submitted a declaration for 2021 (by February 3, 2021). It is also used to submit updated declarations for 2019.

But you do not need to submit a transport tax return for 2021. It was canceled by Federal Law No. 63-FZ dated April 15, 2019 (see “Amendments to the Tax Code of the Russian Federation on “property” taxes: cancellation of declarations on transport and land taxes, new rules on benefits for individuals”). This is precisely why the introduction of a separate statement of benefits is connected.

Another change will affect owners of expensive cars. When calculating the tax for 2021, they must take into account the new list of cars for which increasing coefficients are applied (see “The list of expensive cars for calculating the transport tax for 2021 has been published”). The list of expensive cars includes not only premium brands, but also “people’s” cars: Honda Pilot, Mazda CX-9 and Subaru Outback.

IMPORTANT

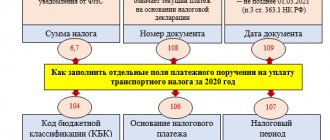

Organizations independently calculate advance payments and taxes at the end of the year and enter them into the budget within the established time frame. Starting from 2021, tax authorities will also determine the amount of tax (based on the information they have) and send messages to organizations in the form approved by Order of the Federal Tax Service dated July 5, 2019 No. ММВ-7-21/ [email protected] (effective from January 1, 2021 year; see “Forms for reporting the amounts of transport tax and land tax have been approved”). The message will be sent no later than 6 months after the tax payment date. If the organization believes that the inspectors calculated the tax incorrectly, it will be able to express its disagreement. In this case, you need to send explanations and supporting documents to the Federal Tax Service.

Receive messages from the Federal Tax Service about the amount of tax via the Internet and automatically generate payments based on the message data

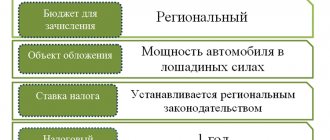

Transport tax table

There is no single rate for transport tax. Each subject of the Russian Federation has its own rates (but in most cases they cannot differ from the rates established in the Tax Code of the Russian Federation by more than 10 times). The rate depends on the type of vehicle (land, water, air), whether it has a motor and its power.

Information on current transport tax rates in a particular region can be found using a special service on the Federal Tax Service website. To do this, you need to indicate in the appropriate fields information about the tax period (the year for which the tax is paid) and the region. After this, you need to click the “Find” button and follow the “More details” link (located opposite the information about the regional law that appears).

Tax base of transport tax

To calculate transport tax for legal entities in 2021, you need to use basic information. This is especially true for those who make payments for the first time. The base for calculating the tax is determined separately for each transport.

The base can be:

- Engine power in l. s ., which is used for vehicles with an engine, with the exception of air vehicles with jet engines;

- Gross tonnage in registered tons - for towed water transport;

- Certified statistical thrust of a jet engine in kilograms of force - for air transport with a jet engine;

- Unit of vehicle - for other water and air transport.

Engine power is determined based on technical specifications. passport, which is attached to the vehicle. In cases where the power is not indicated in the passport, it is determined by a special examination on the basis of Art. 95 Tax Code of the Russian Federation .

To calculate transport tax, engine power is calculated exclusively in horsepower. Sometimes the technical passport indicates power - kW; to calculate the tax, it must be converted into horsepower using the formula: HP. = kW × 1.35 962 . The resulting value is rounded to the second decimal place.

It is worth considering that the calculation of transport tax for legal entities falls into the category of regional tax levies , so rates in individual regions may differ. These taxes are regulated by Art. 361 of the Tax Code of the Russian Federation , and each subject of the Russian Federation independently determines the rate, however, the article specifies limits on tax rates for vehicles.

For each type of vehicle, the Tax Code implies an individual rate , which can vary in each region separately, but not more than 10 times.

Regional authorities may use differential rates , which may vary depending on a number of factors:

- type of vehicle;

- age of transport;

- economic class.

For example, in St. Petersburg in 2021, the transport tax for legal entities is calculated as follows: a car aged 5 years from the date of manufacture - the rate is 50 rubles per 1 hp, and for a passenger car less than 5 years old - a rate of 30 per 1 horsepower strength.

The rates for transport tax in one region are the same for individuals. and legal persons with the exception of transport benefits.

Increasing coefficients for calculating transport tax

The tax on expensive cars is calculated taking into account the increasing coefficient (clause 2 of Article 362 of the Tax Code of the Russian Federation). It amounts to:

- 1.1 - for passenger cars worth from 3 million to 5 million rubles. inclusive, from the year of manufacture of which no more than 3 years have passed;

- 2 - for passenger cars worth from 5 million to 10 million rubles. inclusive, from the year of manufacture of which no more than 5 years have passed;

- 3 - for passenger cars worth from 10 million to 15 million rubles. inclusive, from the year of manufacture of which no more than 10 years have passed, as well as in relation to passenger cars costing from 15 million rubles, from the year of manufacture of which no more than 20 years have passed.

The list of such cars for 2021 is posted on the website of the Ministry of Industry and Trade. When using this list, please note that some of them have additional restrictions. We are talking about the column “Number of years that have passed since the year of issue” of the table. For example, for BMW M240i xDrive cars with a 2,998 cc petrol engine. see coefficient applies only if 1 to 2 years inclusive have passed from the date of issue.

How to determine the number of years that have passed since the car was manufactured? The Tax Code of the Russian Federation does not contain clear explanations in this regard. In practice, two approaches to calculating the age of cars have been developed.

The first is based on the explanations given in the letter of the Federal Tax Service dated 03/02/15 No. BS-4-11 / [email protected] It says that when calculating the transport tax for 2014 in relation to a 2011 car, the number of years that have passed since the year of its manufacture, is 4 years. That is, the number of years that have elapsed since the year of manufacture of the car is determined in whole years. Therefore, the age of a car just released by a factory is one year (for the period before the end of the calendar year in which it was manufactured).

This means that the transport tax for 2021 for an expensive car in 2021 must be calculated taking into account the fact that the number of years that have passed since the year of its manufacture is 1 year. Such a car falls into the category “from 1 to 2 years inclusive” as defined in the list. Therefore, you will have to apply a multiplying factor.

The second approach is also based on official explanations. The letter of the Ministry of Finance dated 06.11.14 No. 03-05-04-01/28303 (brought to the attention of the tax authorities by the Federal Tax Service letter dated 07.07.14 No. BS-4-11 / [email protected] ) states that when calculating transport tax for 2014 year for a 2014 car, the number of years that have passed since the year of its manufacture will be no more than 1 year.

It turns out that for a 2021 car, the number of years that have passed since the year of its manufacture will be no more than 1 year. Consequently, such a car does not fall into the “from 1 to 2 years inclusive” category defined in the list, and when calculating the tax for 2021, an increasing factor is not required.

Unfortunately, there is no arbitration practice on this issue. Therefore, the taxpayer will have to decide for himself which of the above approaches to apply when calculating the age of the car. You can also contact the tax authority at the place of registration with a written request about the procedure for calculating transport tax in relation to a specific car (subclause 1, clause 1, article of the Tax Code of the Russian Federation). Following this clarification will exempt you from tax liability and will become the basis for non-accrual of penalties (subclause 3, clause 1, article 111 and clause 8, article of the Tax Code of the Russian Federation).

Receive requirements and send requests to the Federal Tax Service via the Internet for free

Features of transport tax for legal entities

Transport tax for legal entities, as well as for individuals, is calculated using a simple formula:

Tax base × tax rate.

In addition, decreasing/increasing coefficients can also be added to this formula, and the tax rate in the region can be reduced or increased in relation to the basic values specified in paragraph 1 of Art. 361 Tax Code of the Russian Federation. But the tax rates established in the constituent entities of the federation cannot differ from the base ones by more than 10 times - such a limitation is specified in paragraph 2 of Art. 361 Tax Code of the Russian Federation.

Read more about the procedure for calculating transport tax for cars in our article “How to calculate transport tax for a car?” .

For expensive cars, the cost of which exceeds 3 million rubles, an increasing factor is applied. This coefficient can be found in paragraph 2 of Art. 362 of the Tax Code of the Russian Federation. Its value depends not only on the cost of the car, but also on the period of its use after release. Prices for luxury cars are updated annually and are available for viewing on the official website of the Ministry of Industry and Trade.

Taxpayers who are legal entities, unlike individuals, must calculate their taxes independently. Despite the fact that tax returns for 2020 have been canceled for organizations, and the Federal Tax Service must send them messages with the amount already calculated, legal entities must still calculate the tax themselves. First, they must know the amount in order to make advance payments throughout the year (if they are established in the region). And secondly, the message from the tax office is more of an informational nature, so that the company can compare its accruals with those made according to the tax authorities. After all, she will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

The message from the Federal Tax Service will indicate the object of taxation, tax base, tax period, rate and amount of calculated tax.

Important! Recommendation from ConsultantPlus Compare the amount of tax calculated by the inspectorate with the amount you calculated and paid yourself. If they are equal, then the tax was calculated and paid correctly. If the amounts differ, check:... What to check and what to do in case of an error (yours or the tax authorities), see K+. Trial access to the system can be obtained for free.

ATTENTION! If you do not receive the notification, you are required to independently inform the tax authorities about your taxable property. Read about the nuances in the material “Organizations will have to report transport and land plots to the tax authorities.”

Transport tax benefits

Just like rates, benefits are determined at the level of constituent entities of the Russian Federation. Article 361.1 of the Tax Code of the Russian Federation, which is called “Tax benefits,” establishes only a general procedure for their use. In particular, it says that in order to apply the benefit, the organization must submit an application to the Federal Tax Service. Thus, for companies, the transport tax benefit is strictly declarative in nature - just mentioning it in a regional law is not enough for an organization not to pay tax. But if an individual, including an individual entrepreneur, does not apply for a benefit, then the tax authorities will have to apply it independently based on the data they have.

IMPORTANT

Individual entrepreneurs pay transport tax like ordinary individuals. This means that they must remit the transport tax based on the payment notice received from the tax office. It will include tax for no more than three years preceding the year in which the notice is sent. Tax authorities receive information for calculations from the authorities that register vehicles. If during the period of ownership of the vehicle the individual entrepreneur has not received a notice of tax payment, it is necessary to inform the inspectorate about the subject of taxation.

Generate a payment invoice for payment of tax (penalties, fines) in one click based on the request received from the Federal Tax Service

The Tax Code contains a list of vehicles for which you do not have to pay tax at all. This is not about a benefit, but about the exclusion of a vehicle from the object of taxation (clause 2 of Article 358 of the Tax Code of the Russian Federation). This means that such transport does not need to apply for a benefit - the tax exemption is automatic.

Thus, throughout the entire territory of the Russian Federation you can avoid paying tax if the vehicle is wanted or the search has been stopped. The tax does not need to be transferred from the month the search began. In this case, the fact of theft (theft) is confirmed by a document issued by the police (State Traffic Safety Inspectorate) or information that the Federal Tax Service receives through interdepartmental information exchange (Article of the Tax Code of the Russian Federation). Also see: “When are stolen vehicles not subject to tax?”

Also not subject to tax are tractors, self-propelled combines of all brands and special vehicles (milk tankers, livestock tankers, vehicles for transporting poultry, vehicles for transporting and applying mineral fertilizers, veterinary care, technical maintenance). The exemption is valid if vehicles are registered to agricultural producers and are used for agricultural work.

Submit a free notification of the transition to the unified agricultural tax and submit tax reports

In addition, fishing sea and river vessels, as well as vessels registered in the Russian International Register of Vessels, are not subject to the tax. Organizations and individual entrepreneurs that carry out passenger and (or) cargo transportation do not have to pay tax for passenger and cargo sea, river and aircraft vessels that they own (under the right of economic management or operational management).

Rules and procedure for paying transport tax

The payer of transport tax on freight transport, as in the case of passenger cars, is the owner in whose name the vehicle is registered.

A truck can be registered to an individual or a company (organization, institution).

Payment of transport tax is made by the car owner after receiving the appropriate notification sent by the tax office 30 days before the date of payment to the address that the car owner indicated when registering the vehicle.

The absence of a postal tax notice is not grounds for exemption from payment of the transport tax. If there is no such notice, you should contact the tax office to find out the reasons and receive a tax receipt in person.

If payment of transport tax is not made within the deadlines established by law, then this may be considered a tax, administrative offense or even a criminal offense . In case of tax evasion (including transport tax), enforcement measures are provided.

In accordance with Art. 45 Part 2 of the Tax Code of the Russian Federation, debt is collected in the manner prescribed by Articles 46,47,48 of the Tax Code of the Russian Federation :

- The car owner-taxpayer is notified of the need to pay the debt and penalties for each overdue day.

- Tax authorities file a claim in court , which may decide to collect transport tax by:

- writing off funds (electronic or from bank accounts);

- seizure of property.

For physical individuals, tax can be collected by deducting the required amount from wages. In addition, the defaulter’s travel outside the Russian Federation may be limited.

Article 15.5 of the Code of Administrative Offenses of the Russian Federation provides for administrative punishment for late provision of tax information (declarations, calculations of insurance premiums): a warning or a fine for officials.

If the car owner, evading paying tax, did not report the purchased vehicle to the Federal Tax Service (hid tax information), then the measures provided for in Art. 198 of the Criminal Code of the Russian Federation : fine, forced labor, arrest, imprisonment. For organizations, such measures are provided for in Art. 199 of the Criminal Code of the Russian Federation .

In this regard, car owners (individual, individual entrepreneur or organization) must be personally interested in promptly reporting information about the vehicle to the Federal Tax Service and paying the transport tax on a car (including a truck) on time and in full.

Calculation of transport tax in 2021

Tax must be paid only for those months when the vehicle was registered to the taxpayer. In this case, the calculation is carried out monthly and in full months, while registration can take place on any day. In this regard, the following rules have been established.

If the car is registered from the 1st to the 15th day of the month inclusive, then this month is taken as a full month. And if registration took place between the 16th and the last day of the month, then this month is not taken into account when calculating the tax.

When registration is terminated, the situation is reversed. If a car is deregistered from the 1st to the 15th of the month inclusive, then no tax is paid for that month. And if the date of deregistration falls on the period from the 16th to the last day of the month, then the tax will have to be paid for the full month (clause 3 of Article 362 of the Tax Code of the Russian Federation).

Regional laws for organizations may establish advance payments. In this case, at the end of each reporting period (first, second and third quarters), an amount equal to ¼ of the product of the tax base and the tax rate, taking into account the increasing coefficient (clause 2.1 of Article 362 of the Tax Code of the Russian Federation), is paid.

An example of calculating transport tax in 2021

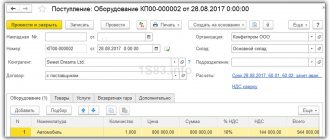

The organization owns two cars. Truck with engine power 300 hp. s., which was purchased and registered on March 16, 2021. And a passenger car with an engine power of 205 hp. s, which was purchased in the previous tax period. This machine is included in the list of expensive ones (cost from 3 million to 5 million inclusive).

Based on regional law, the tax rate for a truck is 100 rubles/hp, and for a passenger car - 50 rubles/hp. With. The tax base is the engine power in horsepower. Regional law establishes advance tax payments.

Let's calculate the tax on a truck.

Since the car was purchased in mid-2021, you need to determine the number of months for which tax is paid. Since the registration date falls on the 16th day of the month, this means that the month of registration (March) is not taken into account when calculating the tax. And in January and February the organization did not have a car.

Thus, for the first quarter the amount of the advance payment is not formed, since the ownership coefficient (Q) for this period will be 0/3, that is, it will be equal to zero. For the second and third quarters you will need to pay 7,500 rubles (1/4 × 300 hp × 100 rubles/hp). And you will have to pay the same amount at the end of the year, since the annual Kv will be 9/12 or 0.75. (300 hp × 100 rub./hp × 0.75 – 7,500 rub. × 2) = 7,500 rub.

Let's calculate the tax on a passenger car.

Kv will always be equal to one, since the car was in the possession of the company throughout 2020. An “expensive” coefficient of 1.1 must be additionally applied to the amount of tax and advance payment.

It turns out that for each quarter the organization will pay 2,819 rubles. Here's the calculation: 1/4 × 205 hp. × 50 rub./hp × 1.1 = 2,818.75 rub.; According to the rules of paragraph 6 of Article of the Tax Code of the Russian Federation, this amount is rounded up to the full ruble. The tax at the end of the year will be 11,275 rubles (205 hp × 50 rubles/hp × 1.1). Therefore, you will have to pay an additional 2,818 rubles (11,275 rubles – 2,819 rubles × 3).

In total, for two cars the organization must pay:

- for the first quarter - 2,819 rubles (0 + 2,819).

- for the second quarter - 10,319 rubles (7,500 + 2,819)

- for the third quarter - 10,319 rubles (7,500 + 2,819)

- at the end of the year - 10,318 rubles. (7,500 + 2,818).

The total amount of transport tax for 2021 will be 33,775 rubles (22,500 rubles + 11,275 rubles).

Transport tax reporting in 2021

Organizations from all regions were required to submit a declaration for 2021 no later than February 3, 2021. The “transport” declaration for 2021 needs to be submitted only to those companies that will be reorganized or liquidated before the end of this year. “Interim” declarations (calculations) based on the results of reporting periods are not provided.

From January 1, 2021, Article 363.1 of the Tax Code of the Russian Federation, which establishes the obligation to submit a “transport” declaration, ceases to apply (clause 3 of Article 3 of the Federal Law of April 15, 2019 No. 63-FZ). Therefore, there is no need to submit reports at the end of 2021 (February 2021) and later periods.

IMPORTANT

For individual entrepreneurs, no reporting on transport tax is provided.

Fill out and submit your transport tax return for 2021 for free online

Deadlines for payment of transport tax for legal entities

Payment deadlines are also set by regional authorities, both for advance and annual payments. The only restriction that is specified in the Tax Code of the Russian Federation is that payment for the annual period must be made no earlier than February 1 of the year following the reporting year.

For example, the tax payment deadline in St. Petersburg is no later than February 10 , the tax is paid for the tax period, there are no advance payments in the region.

In the Moscow region, advance payments are made until the end of the month following the reporting period; for the year, tax is paid no later than March 28 .

In the Krasnoyarsk Territory, payment must be made no later than February 10 of the year following the reporting year. Advance payments are provided in the region.

In the Tomsk region, payment of transport fees for legal entities must be made before March 10 of the year following the reporting period. Advance payments are not provided in the region.