"Main book":

— As part of a desk audit (if errors and/or contradictions are detected), the inspectorate may request the taxpayer to provide the necessary explanations (documents). This requirement must be fulfilled within five days <clause 3 of Article 88 of the Tax Code of the Russian Federation>. According to the general rule established by the Tax Code, the period begins on the next day after the calendar date or the occurrence of an event (action) that determines its beginning <clause 2 of Article 6.1 of the Tax Code of the Russian Federation>. In this case, the period defined in days is calculated in working days (if it is not established in calendar days) <Clause 6, Article 6.1 of the Tax Code of the Russian Federation>. Therefore, you must provide the explanations required by the tax authority within five working days. The countdown of this period begins the next day after you receive the request, which is determined by the date of the acceptance receipt submitted via TKS to the tax authority <subp. 12, 13 of the Order, approved. By order of the Federal Tax Service of February 17, 2011 N ММВ-7-2/168, art. 19 of the Law of 04/06/2011 N 63-FZ>. The Tax Code allows 6 working days from the date of sending the request by the tax authority <clause 5.1, article 23, clause 2, 6, article 6.1 of the Tax Code of the Russian Federation> to send the receipt to the inspectorate. For example, the inspection sent you a requirement via TKS on Monday, June 22. From Tuesday, June 23 to Tuesday of the following week (June 30), you are required to send a receipt to the inspectorate for acceptance of this requirement. From the day following the date of sending such a receipt, the five-day period for submitting the information itself begins to run. For example, you sent a receipt on the last day - June 30. In this case, June 30 is considered the date you received the inspection request. You must provide her with explanations/documents within 5 working days: from July 1 to July 7 inclusive. Thus, to the request sent by the TKS inspection on June 22, you can legally give the required explanations until July 7.

WHEN YOU CAN RESPOND TO THE REQUIREMENTS OF THE IFTS WITH A POLITE REFUSAL

Total - more than two weeks. However, keep in mind that now many special operators have configured their programs in such a way that the requirement cannot be read until you send a receipt for its receipt. And some inspectorates sometimes send a requirement by TKS, stating in it that if an acceptance receipt is not generated within a day, the requirement will be sent by mail. Let us remind you that when sending a request by mail, it is considered received after the expiration of a six-day period from the date of sending a registered letter <p. 1 tbsp. 93 and paragraph 4 of Art. 93.1 Tax Code of the Russian Federation>. Let us also recall that since 2015, the tax authority can suspend transactions on the taxpayer’s bank accounts if a receipt for the acceptance of any of the following documents has not been submitted through the TCS: (i) requirements for the presentation of documents <p. 1 tbsp. 93 Tax Code of the Russian Federation, clause 2, 4 art. 93.1 Tax Code of the Russian Federation>; (i) requirements for the provision of explanations <p. 3 tbsp. 88 Tax Code of the Russian Federation>; (i) notice of summons to the tax authority <pp. 4 paragraphs 1 art. 31 Tax Code of the Russian Federation>. The head of the tax authority (his deputy) can make an appropriate decision within 10 working days from the date of expiration of the deadline for transferring such a receipt <subparagraph 2, paragraph 3, article 76 of the Tax Code of the Russian Federation>.

Some dry facts

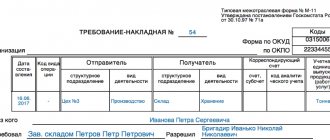

In accordance with the Tax Code, the Federal Tax Service official conducting a tax audit has the right to request from the organization being audited the documents necessary for the audit. The wishes of the tax authorities are formalized in the form of a request for the provision of documents, drawn up in the prescribed form (Appendix No. 15 to the order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2 / [email protected] ) and containing a list of required documents, including explanations.

The deadline for submitting papers or explanations at the request of the tax office begins to run from the date of receipt of the document. If the request was sent electronically via TKS, then the day of receipt will be the date indicated in the receipt for its receipt (clause 13 of the Procedure, approved by order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2 / [email protected] ). When sending a request by mail, the date of receipt is considered to be the sixth working day from the date of sending the registered letter (Clause 4 of Article 31 of the Tax Code of the Russian Federation).

If the inspection is carried out on the territory of the organization, then from the date of transfer of the requirement for signature to the head (legal or authorized representative) of the organization.

It should be noted that this year, in connection with the high alert regime, the Russian Ministry of Finance issued a letter dated April 15, 2021 No. 03-02-08/29938, based on the Decree of the Government of the Russian Federation dated April 2, 2021 No. 409 “On measures to ensure sustainable development economy." So, in paragraph 3 of the letter, some deadlines established by the Tax Code of the Russian Federation were temporarily extended.

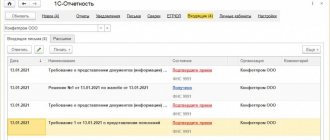

Electronic document management with the tax authority

Order of the Federal Tax Service of Russia dated June 13, 2013 N ММВ-7-6/ [email protected] approved the Methodological recommendations for organizing electronic document flow between tax authorities and taxpayers for information services and informing taxpayers in electronic form via telecommunication channels (hereinafter referred to as the Methodological recommendations). The document regulates information services and informing taxpayers in electronic form via telecommunication channels (TCS).

Information services and taxpayer information

In accordance with paragraphs. 4 paragraphs 1 art. 32 of the Tax Code of the Russian Federation, tax authorities are obliged to inform free of charge (including in writing) taxpayers, payers of fees and tax agents about current taxes and fees, legislation on taxes and fees and normative legal acts adopted in accordance with it, the procedure for calculating and paying taxes and fees, the rights and obligations of taxpayers, fee payers and tax agents, the powers of tax authorities and their officials, as well as provide forms of tax returns (calculations) and explain the procedure for filling them out.

In order to implement the procedure for the exchange of electronic documents between tax authorities and taxpayers (representatives) when providing information services and informing in electronic form on the TKS in accordance with the Administrative Regulations of the Federal Tax Service of Russia <1>, Methodological Recommendations have been developed. The document defines:

- sequence of electronic document flow between tax authorities and taxpayers using an electronic signature (ES);

- a list of mandatory functions and the frequency of their implementation for each participant in the interaction, which must be implemented in the relevant software products;

- requirements for timing characteristics of functions, software products, interaction in emergency situations.

<1> Administrative regulations of the Federal Tax Service for the provision of public services for free information (including in writing) to taxpayers, fee payers and tax agents about current taxes and fees, legislation on taxes and fees and regulatory legal acts adopted in accordance with it , the procedure for calculating and paying taxes and fees, the rights and responsibilities of taxpayers, fee payers and tax agents, the powers of tax authorities and their officials, as well as for the acceptance of tax returns (calculations), approved. By Order of the Ministry of Finance of Russia dated July 2, 2012 N 99n.

Direct participants in information interaction are taxpayers (representatives), tax authorities, and specialized telecom operators. In this case, information interaction between the taxpayer and the tax authority can occur both through a special operator and directly.

What is an “information letter from the tax office”?

If you have received an information letter from the tax office, do not rush to answer it or react in any other way.

The main document on the basis of which the taxpayer interacts with the Federal Tax Service of the Russian Federation (hereinafter referred to as the “RF Federal Tax Service”), and the Russian Federal Tax Service interacts with the taxpayer, is the Tax Code of the Russian Federation. It is the Tax Code that contains mandatory rules governing each stage of taxation, including the rules for conducting correspondence between tax authorities and taxpayers regarding taxes. The same rule was established by the Law “On Tax Authorities” No. 943-1 of March 21, 1991.

If you have received an information letter from the tax authorities, check with the Tax Code.

The tax authorities of the Russian Federation exercise power on behalf of the state and can limit the rights of citizens and organizations.

For example, being a government body that has the right to confiscate property belonging to them free of charge from taxpayers - and taxes are property transferred free of charge (Article 8 of the Tax Code of the Russian Federation), tax authorities also have the right to impose fines for non-payment of taxes, and to conduct checks on the correctness of calculation and payment of taxes , demand explanations from taxpayers, etc.

To avoid arbitrariness, tax authorities cannot go beyond the rights established by law. This is how the principle of the rule of law is implemented: a government agency is prohibited from everything that is not expressly permitted by law.

The basic rights of tax authorities are formulated in Article 31 of the Tax Code of the Russian Federation, as well as in the law on tax authorities.

The same principle fully applies to the document “Information Letter from the Tax Inspectorate”.

The Tax Code directly establishes an exhaustive list of forms of documents and methods of official communication between the Russian tax authority and the taxpayer (Part 4 of Article 31 of the Tax Code of the Russian Federation), according to which, as part of performing the functions of monitoring the completeness and timeliness of tax payment, the tax authority has the right to send documents to the addressee either in the form paper document or in digital form, in which case the document is transmitted:

- directly (in person) against receipt;

- by mail, registered mail;

- transmitted in electronic form via telecommunication channels through an electronic document management operator or through the taxpayer’s personal account.

Attention: the above norm of the code directly limits the discretion of the tax inspectorate in choosing the method of sending a document with a reservation: the tax authority can choose any of the listed methods of notification - if the procedure for their transmission is not expressly provided for by the Tax Code of the Russian Federation.

The second rule of this article:

The forms and formats of documents provided for by the Tax Code and used by tax authorities, as well as the procedure for filling out the forms of these documents, the procedure for sending and receiving such documents on paper or in electronic form via telecommunication channels or through the taxpayer’s personal account are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, unless the powers to approve them are assigned by this Code to another federal executive body.

This means that any documents sent by tax authorities to the taxpayer must be drawn up in approved forms, as a rule, these are orders of the Federal Tax Service of the Russian Federation, or orders of the Ministry of Finance of the Russian Federation.

If you have received an Information Letter from the tax office, in order to act correctly, you need to determine within the framework of what activities this letter was sent, and what requirements the information letter contains.

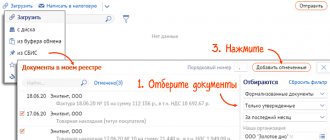

What documents can be obtained electronically via TKS?

Information services to taxpayers (representatives) include submission by tax authorities in electronic form of the following documents:

- certificates on the status of settlements for taxes, fees, penalties, fines (form and format approved by Order of the Federal Tax Service of Russia dated January 28, 2013 N ММВ-7-12/ [email protected] );

- certificates confirming the fulfillment by the taxpayer (payer of fees, tax agent) of the obligation to pay taxes, fees, penalties, fines (form and format approved by Order of the Federal Tax Service of Russia dated January 21, 2013 N ММВ-7-12/ [email protected] );

- statements of transactions for settlements with the budget (the form is given in Appendix 4 to the Methodological Recommendations);

- list of tax returns (calculations) and financial statements presented in the reporting year (the form is given in Appendix 5 to the Methodological Recommendations);

- act of reconciliation of calculations for taxes, fees, penalties and fines (form approved by Order of the Federal Tax Service of Russia dated August 20, 2007 N MM-3-25/ [email protected] ).

Note! Responses to requests are generated automatically based on data from information resources of tax authorities.

Document forms are RTF, XML, XLS, PDF files. In this case, the names of RTF and XLS files must match the name of the XML file, but with the extension .rtf, .xls, .pdf.

Requirements for the taxpayer

Information interaction in electronic form according to the TKS is carried out between taxpayers (representatives) and tax authorities with which taxpayers are registered:

- at the location of the organization;

- at the location of its separate divisions;

- at the place of residence of the individual, as well as at the location of the real estate and vehicles belonging to him;

- on other grounds provided for by the Tax Code of the Russian Federation.

Taxpayers classified as the largest taxpayers carry out information interaction in electronic form via TKS with the tax authority at the place of registration as the largest taxpayer. Tax authorities at the location of the largest taxpayer, at the location of his separate divisions, as well as at the location of the real estate and vehicles owned by him and on other grounds provided for by the Tax Code of the Russian Federation, interact with the taxpayer through the tax authority at the place of his registration as such a taxpayer .

Tax authorities provide these information services in electronic form via the TKS if the taxpayer (representative) interacts with them via the TKS and is registered as a participant in electronic document management in accordance with the requirements of the electronic document management system of the Federal Tax Service.

Cryptographic information protection means used in information interaction must be certified in accordance with the legislation of the Russian Federation and compatible with similar means used by the Federal Tax Service.

Request for clarification or correction of tax returns

In addition to the documents reviewed, there may be a requirement to provide clarifications or correct tax returns if, during audits, the tax office discovered errors or any discrepancies between the information submitted by the individual and the data at the disposal of the tax authority.

For reference: each submitted document is checked by tax officials; these activities are called a desk tax audit (i.e., this audit does not require visiting the taxpayer, which distinguishes it from an on-site tax audit).

The obligation to send a declaration can arise only in connection with the payment of personal income tax (in cases provided for by the Tax Code of the Russian Federation). For example, a declaration must be submitted if income was received under a civil contract from another individual (for example, from renting out your property), if there was a sale of real estate that was owned for less than a specified period, if you are applying for tax deductions.

Since the possibility of sending demands during control activities is directly provided for by the Tax Code of the Russian Federation, the taxpayer is obliged to comply with them. The deadline for submitting documents is 10 days from the date of receipt of the request.

If you do not have time to submit documents and information within this period, you must notify the tax authority about this in writing.

Basic principles of electronic document management

In the process of electronic document management, the parties exchange the following electronic documents:

- request;

- appeal;

- information message about the representation;

- acceptance receipt;

- notification of refusal of admission;

- confirmation of dispatch date;

- response to a request;

- letter from the tax authority;

- newsletter;

- technological electronic messages;

- notification of receipt;

- error message.

For your information. Confirmation of the date of dispatch is an electronic document generated by a specialized telecom operator or tax authority, containing data on the date and time of sending by the taxpayer (representative), the tax authority of the document in electronic form according to the TKS.

Receipt of acceptance is an electronic document generated by the tax authority confirming the fact of acceptance for processing of a request (application) submitted by a taxpayer (representative) in electronic form under the TKS.

Notice of receipt is a technological electronic message generated by the recipient for the sender, informing the sender about the receipt of the electronic document.

Forms and formats of documents are approved by Order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/ [email protected]

If the taxpayer is a participant in the electronic document flow, in order to receive information from the tax authorities, he must send a request (application) in electronic form, signed by electronic signature, to the tax authority. If a representative of a taxpayer applies for information, a power of attorney is required confirming his right to receive information services or a response from the tax authority, which is submitted to the tax authority before the request (application). A copy of the power of attorney is retained by the tax authority for three years after its expiration.

The right to sign electronic signatures of documents participating in electronic document management is granted to officials of the taxpayer (representative) and special operators whose powers are established (confirmed) in accordance with the legislation of the Russian Federation. Documents sent by the tax authority are signed using electronic signature tools used to automatically create electronic signatures in the system.

In response to the request, the taxpayer (representative) is sent a set of responses and (or) notifications of refusal to accept, generated by the tax authorities at the taxpayer’s place of registration.

The Methodological Recommendations provide the reasons why information at the request of a taxpayer (his representative) is not provided :

- the request is sent to the tax authority, whose competence does not include providing information on it;

- the request does not comply with the established format;

- the request of the taxpayer's representative was sent without attaching an information message about the representation, confirming in the prescribed manner the authority of the representative to receive information;

- there is no ES of the taxpayer (representative), the owner of the ES who signed the request does not have the appropriate authority, the signatory data from the request does not correspond to the data of the owner of the electronic signature verification key certificate, the ES does not correspond to the document.

In such cases, the taxpayer (representative) is sent a notice of refusal to accept, indicating the reason for the refusal.

When sending a request to a taxpayer, the following rules must be taken into account:

- one request contains information on one taxpayer for one reporting year, for one period;

- Only one of the documents listed above can be requested in one request;

- The request must indicate the date as of which the response to it is generated. If the request does not indicate a date or indicates a future date, the response is generated on the date of registration of this request with the tax authority;

- when sending a request for information on the organization as a whole, the identifier of the final recipient in the file name and the details “IFTS” are filled in equal to “0000”, the details “Taxpayer Checkpoint” are not filled in;

- additional request details (KBK, OKATO/OKTMO) can be filled in when requesting an extract and reconciliation report. If additional details are not filled in, the response to the request is generated for all tax obligations of the taxpayer. If the request specifies KBK and OKATO/OKTMO, for some of which the tax authority does not have open tax obligations, the tax authority generates a response only for open tax obligations. If the tax authority does not have open tax obligations for all KBK and OKATO/OKTMO specified in the request, then a corresponding entry is made in the response.

We also note the following features of submitting individual documents in electronic form:

- a certificate of the status of settlements is generated by the tax authority for all tax obligations opened therein;

- the reconciliation act is intended only to inform the payer about the status of his payments and is not subject to return to the tax authority with the completed columns “Taxpayer Data”, “Differences”, “Results of Joint Reconciliation”;

- When submitting a certificate of fulfillment of an obligation, the list of responses generated by the tax authorities, in which the taxpayer is registered on various grounds provided for by the Tax Code of the Russian Federation, is automatically analyzed, and if there is no debt, the entry “does not have an unfulfilled obligation” is entered. Otherwise, the taxpayer is sent a certificate with the entry “has an unfulfilled obligation” indicating in the appendix the codes of the tax authorities in which he has an unfulfilled obligation.

Storage of electronic documents

According to the requirements of the Methodological Recommendations, sent and received electronic documents are subject to storage in electronic document storages of participants in information interaction together with the corresponding open certificates of electronic signature verification keys. This means that taxpayers who are participants in such information interaction are also required to comply with these requirements for storing electronic documents.

The storage of electronic documents of tax authorities for each electronic document must contain the following information, provided for by the List of mandatory information on documents used for the purpose of recording and searching for documents in the electronic document management systems of federal executive authorities, approved by Decree of the Government of the Russian Federation of June 15, 2009 N 477:

- addressee;

- destination;

- position, surname and initials of the person who signed the document;

- document type;

- document date;

- Document Number;

- date of receipt of the document;

- incoming document number;

- link to the outgoing number and date of the document;

- title or abstract of the document;

- case index;

- information about document forwarding;

- number of sheets of the main document;

- number of applications;

- total number of application sheets;

- instructions for the execution of the document;

- position, surname and initials of the performer;

- privacy notice.

The storage period for electronic documents must comply with the List of documents generated in the activities of the Federal Tax Service, its territorial bodies and subordinate organizations, indicating storage periods, approved by Order of the Federal Tax Service of Russia dated February 15, 2012 N ММВ-7-10/ [email protected]

The storage period for the documents in question should not exceed five years. At the same time, the storage period for electronic documents is similar to the storage period for paper documents.

Software tools for participants in information interaction should provide search, visualization, saving to a file and printing of electronic documents from the electronic document storage, as well as their uploading to external media in accordance with the specified parameters for the selection of electronic documents.

The Methodological Recommendations propose destroying electronic documents in the manner prescribed by the Basic Rules for the Operation of Organizational Archives, approved by the Decision of the Board of Rosarkhiv dated 02/06/2002:

- Every year, for files with expired storage periods, an act is drawn up on the allocation for destruction of documents that are not subject to storage;

- the act on the allocation of documents for destruction is drawn up after the summary inventories of permanent storage cases for the same period. The specified inventories and acts are considered at a meeting of the expert commission. The acts agreed upon by the expert commission are approved by the head.

In this case, notifications of receipt and error messages are stored in the electronic document storage for at least six months after completion of the document flow procedure.

* * *

In practice, these rules mean that if a taxpayer is a participant in electronic document flow with the Federal Tax Service, then he needs to specify in a local act the procedure for working with the tax authority electronically (who has the right to send requests, who is issued a power of attorney to represent relevant interests, who coordinates requests, who receives the answer to them, etc.), as well as the procedure for storing electronic documents and protecting them from unauthorized deletion.

A complete transition to electronic interaction with the Federal Tax Service is a matter of time. Agree, it is more convenient and faster to receive a list of tax returns (calculations) and financial statements submitted in the reporting year, or a reconciliation report for calculations of taxes, fees, penalties and fines in electronic form, without leaving the table, than to first go to the tax office with a letter confirming the submission of the relevant documents, and then pick them up a few days later. And this can be done quarterly, and if necessary, monthly, which will completely eliminate problems with tax payments. And as a bonus, the tax authority will send information posted on its stands (racks) and necessary for taxpayers to fulfill their obligations under the Tax Code of the Russian Federation.

S.G. Novikov

Journal expert

"Tax audit"

Explanation submission format

The taxpayer submits explanations to the declarations to the tax office in a format convenient for him: on paper or according to the TKS.

Explanations for VAT reporting must be submitted in electronic format through an EDI operator. But if a company has the right to submit a VAT return on paper, then the form of presentation of explanations can be any: both on paper and in electronic form.

Documentation:

- Letter of the Federal Tax Service dated January 11, 2021 N AS-4-15/ [email protected]

- Letter of the Ministry of Finance dated July 22, 2021 N 03-02-08/54231

We recommend:

Explanations to the tax office: rules, deadlines, samples

Service Temporarily Unavailable

3.2. Calculation of the dates for the entry into force of legal acts, taking into account various formulations indicating the moment of entry into force

Often the regulations themselves define the procedure for their entry into force. In this case, a wide variety of wording is used indicating the time of entry into force, of which the most common in federal regulations are the following:

- from the date of official publication;

- upon expiration... from the date of official publication;

- upon expiration... after the day of official publication;

- after... from the date of official publication;

- through... after the day of official publication.

Considering that the Federal Law of June 14, 1994 N 5-FZ and the Decree of the President of the Russian Federation of May 23, 1996 N 763 (clauses 7 and 12) allow for the establishment of a procedure for the entry into force of legal acts that is different from the rules provided for therein, wording on the conditions and procedure The entry into force of these acts should be taken as carefully as possible.

First of all, it is necessary to distinguish between the wording “from the day of official publication” and “after the day of official publication”. This determines the decision on what day (on the day of publication or the day after publication) the document comes into force or what day is considered the beginning of the period if the entry into force of the document is associated with the expiration of a certain period.

Supporters of one position believe that if “with” is indicated, then the first day should be considered the day of official publication, if “after”, then the period begins to be calculated on the next day after publication. This point of view is justified by the fact that since the legislator, for some reason, uses two different prepositions, it means that they differ in meaning, and therefore they must be understood literally.

Proponents of another position believe that regardless of the wording “with” or “after”, the period begins to run the next day after publication. As an argument, the rules for calculating deadlines established by industry laws are given, for example: the Civil Code of the Russian Federation (Chapter 11), the Tax Code of the Russian Federation. It is also noted that this approach is more consistent with the provisions of special regulations governing the general procedure for the entry into force of legal acts, including Federal Law dated June 14, 1994 N 5-FZ, Decree of the President of the Russian Federation dated May 23, 1996 N 763 (paragraphs 5, 6 and 12). In the listed acts, when establishing the general procedure for the entry into force of legal acts, the preposition “after” is used.

Since the legislation does not currently regulate the issue of when the period associated with the entry into force of documents begins and ends, the possibility of using existing codes to determine these terms needs to be discussed in more detail. Is it correct to apply the rules of law by analogy in this case?

There are different points of view on this issue. According to one of them, there is no reason to use the norms of industry codes to calculate the terms for the entry into force of legal acts, since these codes establish the procedure for calculating the terms for regulating specific types of legal relations. Another point of view assumes the possibility of partial use of the norms of industry codes, in particular, Articles 191 and 192 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), establishing, respectively, the beginning and end of a period defined by a period of time. In this case, one should proceed from the admissibility of applying civil legislation by analogy on the basis of Article 6 of the said Code.

But even if we partially use the norms of the Civil Code of the Russian Federation, ambiguity still remains. Thus, Article 192 establishes that “a period calculated in months expires on the corresponding date of the last month of the period.” The question arises: does the period expire at 00 hours or at 24 hours of the corresponding date of the last month of the period? For example, a normative act was published on January 1 and comes into force after one month from the date of official publication. If we assume that the period began to run from the date of publication, i.e. from January 1, then the date of entry into force of the document can be determined as either February 1 (if the period expires at 00 hours) or February 2 (if the period expires at 24 hours). And, by applying Article 191 of the Civil Code of the Russian Federation, according to which the course of a period defined by a period of time begins the next day after the calendar date or the occurrence of an event that determines its beginning, you can get the following date options - February 2 and February 3.

Response to tax demand under TKS: deadlines

Thus, with different options for calculating deadlines, you can get different dates.

To illustrate the ambiguity in the issue of calculating the dates for the entry into force of legal acts, we will give examples of different definitions of the date of entry into force of the same document.

Example 1.

Paragraph 1 “Jurisdiction” of Chapter 4 of the Arbitration Procedure Code of the Russian Federation was put into effect ten days from the date of its official publication. The Code was published in Rossiyskaya Gazeta on July 27, 2002.

The Federal Arbitration Court of the West Siberian District determined the date of entry into force of the specified paragraph - August 6, 2002 (FAS of the West Siberian District dated 08.08.2002 N F04/2741-501/A03-2002), and the Plenum of the Supreme Arbitration Court of the Russian Federation - August 7 2002 (Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 9, 2002 N 11).

Example 2.

Federal Law No. 57-FZ dated 29.05.2002 “On introducing amendments and additions to part two of the Tax Code of the Russian Federation and to certain legislative acts of the Russian Federation” came into force after one month from the date of its official publication. The law was published in Rossiyskaya Gazeta on May 31, 2002.

The Federal Arbitration Court of the West Siberian District determined the date of entry into force of this Law - July 1, 2002 (FAS of the West Siberian District dated June 21, 2004 N F04/3382-1441/A27-2004), and the Federal Arbitration Court of the Far Eastern District - June 30 2002 (FAS Far Eastern District dated July 14, 2004 N F03-A59/04-2/1507).

About the deadlines for providing documents at the request of the Federal Tax Service

Question:

Upon receipt of a request to submit documents from the Federal Tax Service Inspectorate in electronic form via telecommunication channels, the recipient is obliged, within six days from the date of sending by the tax authority, to submit to the Federal Tax Service Inspectorate a receipt for the receipt of the specified document. At the same time, in accordance with Article 93.1 of the Tax Code of the Russian Federation, the person who received the demand is obliged to submit the requested documents within 5 days from the date of receipt of the demand. From what day should 5 days be counted - from the day the request was received or from the day the receipt of receipt of this request was sent?

Answer:

If a desk tax audit reveals errors in the tax return (calculation) and (or) contradictions between the information contained in the submitted documents, or reveals inconsistencies between the information provided by the taxpayer, the information contained in the documents available to the tax authority, and received by it during the tax control, the taxpayer is informed about this with the requirement to provide the necessary explanations within five days or make appropriate corrections within the prescribed period.

Art. 88, “Tax Code of the Russian Federation (Part One)” dated July 31, 1998 N 146-FZ (ed.

Claim (tax claim)

Taxes that are not paid on time become arrears, on which penalties are charged for each day of delay. If there is such a debt, the tax authority sends a demand (this is the next version of the letter from the tax office). The demand is a notification about the existence of a tax debt with a requirement to pay it off, about the amount of penalties accrued for the days of delay.

Typically, the request is sent within 3 months from the day following the due date for tax payments. Penalties in the request are calculated on the day specified in the request. For penalties that accrue after this date, a separate claim will be sent after the tax amount has been paid.

The tax must be paid within the period specified in the request (if the request does not indicate a deadline, then you have 8 working days from the date of receipt of this document ).

If the requirement is not fulfilled, the tax authority has the right to go to court to collect taxes and penalties.

Do you have questions about the legality of the actions of the tax authority?

Let's help YOU!

Order a consultation

Deadline for response to tax request

dated 12/28/2016) {ConsultantPlus}

A person belonging to the category of taxpayers obliged, in accordance with paragraph 3 of Article 80 of this Code, to submit tax returns (calculations) in electronic form, must, no later than 10 days from the date of occurrence of any of the grounds for classifying this person as a specified category of taxpayers, ensure receipt of documents that are used by tax authorities in the exercise of their powers in relations regulated by the legislation on taxes and fees, from the tax authority at the place of registration in electronic form via telecommunication channels through an electronic document management operator.

The person specified in paragraph one of this paragraph is obliged to submit to the tax authority in electronic form via telecommunication channels through an electronic document management operator a receipt for the acceptance of such documents within six days from the date they were sent by the tax authority.

Art. 23, “Tax Code of the Russian Federation (Part One)” dated July 31, 1998 N 146-FZ (as amended on December 28, 2016) {ConsultantPlus}

Order of the Federal Tax Service of Russia dated February 17, 2011 N ММВ-7-2/ [email protected] approved the Procedure for sending a request for the submission of documents (information) and the procedure for submitting documents (information) at the request of the tax authority in electronic form via telecommunication channels (hereinafter referred to as the Procedure ).

According to clause 12 of the Procedure, the requirement to submit documents is considered accepted by the taxpayer if the tax authority has received an acceptance receipt signed with the taxpayer’s digital signature.

Order of the Federal Tax Service of the Russian Federation dated February 17, 2011 N ММВ-7-2/ [email protected] (as amended on November 7, 2011) “On approval of the Procedure for sending a request for the submission of documents (information) and the procedure for submitting documents (information) at the request of the tax authority to electronic form via telecommunication channels" {ConsultantPlus}

Thus, based on the provisions of the Procedure, if a request for the submission of documents (information) is sent to the taxpayer in electronic form, but is not actually opened (not read) by the taxpayer, and an acceptance receipt has not been generated and sent to the tax authority, such a request cannot be considered received by the taxpayer. In such a case, the tax authority, based on paragraph 19 of the Procedure, must send the taxpayer a request to submit documents (information) in paper form.

(Letter of the Federal Tax Service of Russia dated February 16, 2016 N ED-4-2/ [email protected] ) {ConsultantPlus}}

The period begins on the next day after the calendar date or the occurrence of the event (action) that determines its beginning.

Art. 6.1, “Tax Code of the Russian Federation (Part One)” dated July 31, 1998 N 146-FZ (as amended on December 28, 2016) {ConsultantPlus}

For example, the inspection sent you a requirement via TKS on Monday, June 22. From Tuesday, June 23 to Tuesday of the following week (June 30), you are required to send a receipt to the inspectorate for acceptance of this requirement. From the day following the day of sending such a receipt, the five-day period for submitting the information itself begins to run. For example, you sent a receipt on the last day - June 30th. In this case, June 30 is considered the date you received the inspection request. You must provide her with explanations within 5 working days: from July 1 to July 7 inclusive. Thus, you can legally give explanations to the requirement sent by the TKS inspection on June 22 until July 7. Total - more than 2 weeks.

(“General Ledger”, 2015, N 14) {ConsultantPlus}}

Thus, the period for providing documents upon request of explanations from the tax authority begins to run from the day the notification of receipt of this request is sent.

Answer prepared by: Expert “Consultation Line” NTVP “Kedr-Consultant” Maria Yuryevna Krasnoperova

When preparing the answer, SPS ConsultantPlus was used.

The answer passed quality control: Reviewer - Associate Professor of the Department of Accounting, Finance and Auditing of the Federal State Budgetary Educational Institution of Higher Education "Izhevsk State Agricultural Academy"

Selezneva Irina Akhmatyasavievna

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE (www.ntvpkedr.ru).

Responsibility for failure to comply with requirements

For failure to comply with the requirement to provide explanations to the declaration at the request of the tax authorities or failure to comply with deadlines for filing documents, the company will be fined:

- 5 thousand rubles for the primary violation;

- by 20 thousand rubles for repeated violation within a calendar year.

In addition, there are precedents for holding officials – managers – accountable for failure to provide explanations on a court decision. According to the court, the responsibility of the head of the organization is to organize accounting and storage of documents, and, consequently, to control responses to the requirements of government bodies. The fine for an official for failure to provide information necessary for tax control is 300-500 rubles.