In this article we will tell you who is issued a 2nd personal income tax certificate during maternity leave and why, and what data it contains. Let's look at the wording first.

Maternity leave, maternity leave - for simplicity, this is the name for the time when an employee is:

- on maternity leave

- on maternity leave for up to one and a half years

During such periods, the employee, as a rule, does not work, but receives benefits in accordance with Federal Law No. 255-FZ of December 29, 2006.

Income in the form of maternity benefits and child care benefits up to one and a half years old

These types of income are not subject to personal income tax. This is directly established by paragraph 1 of Article 217 of the Tax Code of the Russian Federation. In what cases can an employee on maternity leave be issued a 2-NDFL certificate:

- If the employee is on maternity leave for up to one and a half years and, in accordance with Article 256 of the Labor Code of the Russian Federation, has written a statement of desire to work during this leave on a part-time basis. The benefit is retained.

- If it is not the woman herself who is on maternity leave for a child under one and a half years old, but her husband, one of the parents, other relatives or a guardian, such persons can also go to work on a part-time basis in compliance with all the requirements of Article 256 of the Labor Code .

- If an employee on vacation was paid, for example, a bonus for the previous year or financial assistance. Both the bonus and financial assistance must relate to payments subject to personal income tax.

- If, for example, a lease agreement is concluded with an employee for a car that she owns, and she receives rent while on maternity leave.

- In all other cases of receiving other income subject to personal income tax.

| ★ Manual “How to calculate maternity benefits in a new way in 2021” (practical examples, complex cases, step-by-step instructions) purchased > 2600 |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Sample income certificate if an employee is on maternity leave

At the time of giving birth, he will only be at his current job for 2 months. Before that I didn’t work for 1.5 months. Where can I get (and. To receive benefits as a low-income family, I need to provide a certificate of income.

Chief accountant of LLC ". » __________________/Deciphering: The phone number of the organization’s accounting department was also told to be indicated and the phrase should be written like this: from such and such to such and such a maternity leave sheet (if he was included in these 6 months) and from such and such on maternity leave child under 1.5 years old. Next write: son/daughter full name date of birth.

Answers to common questions

Question No. 1. An employee who is on maternity leave asks for a 2-NDFL certificate to receive a subsidy. The employee did not have any income this year, what should I do?

Benefits are paid directly by the territorial body of the Social Insurance Fund. This means that you do not have the right to issue even a certificate in any form to such an employee.

In everyday life, maternity leave is a leave that is taken out in connection with childbirth, as well as for caring for a baby until he reaches 1.5 years of age. According to the law, benefits are issued during this period. A woman who is on maternity leave can contact the bank to open a credit line or apply for a visa to the consulate. In such cases, she will need a declaration, but how to issue a certificate in Form 2 of personal income tax for a maternity leave, if the type of income is not subject to income tax. Let's consider all the features of filling out documents in this case.

Certificate of maternity leave

If you have recently gotten a job, the accountant may require you to present a salary certificate from your previous place of work. Usually it is issued upon dismissal, but if the document is missing, it can be restored - just visit the accounting department of your previous employer. Regulatory documents regulating issues related to the payment of maternity benefits and the issuance of a certificate of stay on maternity leave are separate articles of the Labor Code of the Russian Federation (Article 255, Article 256) and Federal Law No. 255, which includes provisions on social insurance and material support in connection with motherhood.

Please note => Replacement of a Gas Stove for a Veteran of Labor in St. Petersburg

When is the 2nd personal income tax declaration completed?

A business entity can issue an employee a personal income tax certificate 2 only if income that is subject to income tax was transferred in her favor.

These include:

- Salary and equivalent payments, bonuses and allowances;

- financial assistance, the amount of which exceeded the minimum threshold for calculating personal income tax of 4,000 rubles. in year;

- amounts accrued for sick leave, including child care;

- other income, for example from the rental of real estate, is subject to personal income tax.

Where can I order 2 personal income taxes for maternity leave?

The company will provide assistance if you urgently need to obtain certificates to apply for a loan from a bank or in any other cases, for example, for alimony, visa, social security. assistance for a child. Our team are true professionals who are accustomed to performing assigned tasks efficiently. By contacting us in a convenient way, you will receive complete information on the service you are interested in. The income certificate specifies all the norms of current legislation.

It only takes a day for the customer to receive the order. By prior arrangement, the document can be delivered anywhere in the city. This is a real opportunity for those mothers who cannot leave their child to do the paperwork themselves. Women will be confident that the certificate will reach the address within the agreed time frame.

We cooperate with clients who simply do not waste time. The company will fulfill any order for any certificate.

Are maternity workers subject to income tax and how can I issue a 2-NDFL certificate for an employee going on maternity leave? What has changed in this matter in 2019–2020? This is discussed in our article.

Procedure for payment of amounts

The following categories of women have the right to maternity benefits:

- Working;

- registered with the central control center;

- full-time students;

- military.

The amount of payments depends on the amount of accrued income. It should be separately noted that the state also took care of those women who took in children from the orphanage.

If an employee on maternity leave refuses subsidies and continues to work, she is not entitled to transfer benefits, since she receives her basic income, which is subject to personal income tax. At any time she can go on maternity leave, in which case the payment of remuneration will be stopped and the benefit will replace it.

The subsidy is transferred to the woman at her place of employment. If the company was liquidated during maternity leave, payments continue to be made to the social insurance at the place of residence.

The subsidy is calculated based on the amount of earnings, for students - from a scholarship, for military personnel - from salary allowance. For dismissed employees due to the liquidation of the organization, 300 rubles are paid.

The amount of maternity leave is calculated based on average earnings for the last 2 years. If a woman was on maternity leave during a given period of time, it can be replaced by previous months. It is important to exclude periods of sick leave from the calculation.

How to fill it out correctly?

A certificate of maternity leave will be valid if it is drawn up in accordance with the requirements of the legislation of the Russian Federation and complies with the general rules of office work. In each specific case, the employer is obliged to clarify with the employee for what purpose this paper is required and to which organization it is planned to provide it.

The document is drawn up on the organization’s individual letterhead and must include the following items:

- full name of the enterprise and its details;

- outgoing reference number;

- Name;

- Full name of the employee to whom it is intended, his position in the company;

- if necessary, an indication of where this paper will be provided.

The employer is obliged to put his signature on the document and certify the paper with a wet seal (if the organization has one).

Expert opinion

Irina Vasilyeva

Civil law expert

If the certificate contains information about the employee’s position, his period of work in the organization and other similar information, they must be confirmed by references to the relevant orders and instructions issued within the enterprise.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

When you can and cannot replace years to calculate maternity payments

The legislation allows in some cases to replace the billing periods for calculating subsidies:

- To calculate maternity and child care benefits;

- if during the billing period the woman was on maternity leave;

- if the average salary increases with such a replacement, the amount of the benefit will increase accordingly;

- you can replace both the first and second years of accrual, and it does not matter which of them was the time after maternity leave;

- can be replaced by earlier periods;

- it is important to take into account the number of days in the period being replaced, taking into account leap years;

- The average daily earnings of the year being replaced should not exceed the maximum permissible average value for the given period.

Sample application for transferring years to calculate benefits:

Scheme for issuing a certificate for subsidies when you are on maternity leave

- It must be remembered that a certificate of incapacity for work for granting pregnancy leave as the first part of maternity leave must be issued within a strictly defined period, namely a certain number of days before the birth.

- In order to register temporary absence from work due to the approaching date of birth, you need to write an application addressed to the employer.

- Such a statement is written personally by the applicant and signed by her.

- As a rule, the entire procedure is carried out under the guidance of a personnel department employee, who will be able to help correctly formulate the text of the relevant application.

- It will be necessary to indicate the reason and duration of absence.

We recommend reading: Documents required for registering ownership in a new building

If a woman worked for a short time before pregnancy (less than six months), then the benefit is paid to her in any case, but is calculated based on the minimum wage that is in effect at the time the payment is calculated.

Calculation of maternity benefits for a part-time worker

Maternity benefits for the expectant mother are calculated for each place of employment, and it does not matter whether it is the main place or a combination. She must provide the original certificate of incapacity for work to all employers, apply for leave and receive the benefit amount.

In this case, the benefit will be accrued for the last two years. If employment during this period was in several places, each earnings must be calculated separately. It is important to take exactly those incomes where contributions to the Social Insurance Fund were made. If there were rewards and contributions were not accrued, such amounts are not taken into account.

For 2021, the maximum amount of earnings has been determined to be 815 thousand rubles. In case of combination, this limit is considered for each enterprise.

Example calculation calculator:

- The woman’s earnings at one company amounted to 600,000 rubles;

- for the second – 100,000 rubles;

- on the third – 300,000 rubles;

- the total amount of income is 1,000,000 rubles.

The minimum amount of benefits in case of combination cannot be lower than the calculated value of 43,675.40 rubles.

The maximum calculation of maternity leave for 2 years for part-time workers is:

- (755000+718000)/730*140 = 282493.15 rubles.

The size of the maximum payment amounts by year:

Maternity leave: highlights

Is income tax calculated on maternity leave? This question worries both the culprit of the event and accountants involved in payroll issues, since mistakes are fraught with fines or even the FSS’s refusal to reimburse accrued payments.

In our country, women are provided with benefits from social insurance funds for 70 days before giving birth and the same amount after (with the exception of complicated pregnancy and childbirth). Unlike regular sick leave, in which the employer pays for the first 3 days, the cost of sick leave for pregnancy and childbirth is fully borne by the Social Insurance Fund. The main points of the procedure for calculating and paying maternity benefits are regulated by law dated December 29, 2006 No. 255-FZ. To receive maternity benefits, the following documents are required:

- sick leave (or leaves if the woman has several jobs and plans to receive benefits in each of them);

- a certificate of earnings for the years, data for which will be taken into account for sick leave payments, if the woman had other jobs in these years.

Read about the rules by which the duration of maternity leave is determined in this article.

Certificate 2-NDFL during maternity leave

In this article we will tell you who is issued a 2nd personal income tax certificate during maternity leave and why, and what data it contains. Let's look at the wording first. Maternity leave, maternity leave - for simplicity, this is the name for the time when an employee is:

- on maternity leave

- on maternity leave for up to one and a half years

During such periods, the employee, as a rule, does not work, but receives benefits in accordance with Federal Law No. 255-FZ of December 29, 2006. When a certificate in form 2-NDFL is issued A certificate in form 2-NDFL is issued only if there have been income payments to the employee.

- Salary and bonuses

- Over 4 thousand in financial assistance.

rub.

How to get income data for a woman on maternity leave, sample

The certificate is ordered at the place of work in the accounting department and is drawn up in accordance with the current Federal Law “On the budget of the Social Insurance Fund of the Russian Federation” and Federal Law No. 202. According to these regulations, data is taken for the period actually worked in accordance with the general rules for calculating earnings.

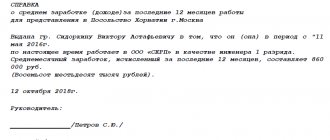

Here is an example of a certificate of income for 3 months:

The document is issued within 1–2 days free of charge. The shelf life is no more than 30 days. Presented at the place of request.

Will they give you a 2nd personal income tax certificate while on maternity leave? what will it look like?

This is done so that the new employer can assign a decent salary to the new employee. The purpose of a certificate of income when assigning alimony is great. It does not matter in what form alimony is assigned - as a percentage of earnings or as a fixed amount. Information from the certificate will help the court determine the required amount of alimony and make the right decision. Certificates are presented to the court when assigning alimony, both for children and for parents and other needy relatives. The most common purpose of this certificate is when applying for a loan.

Banks require the provision of such a certificate, both in a unified form and in the bank’s form. It's no secret that many workers receive two salaries - official and in an envelope. The salary that is received in the envelope is not reflected in any way on the 2-NDFL certificate.

Certificate of income for child benefit for 3 months: norms, deadlines, samples

Since legislative acts do not provide for a strict document form, the form of the certificate depends on the purpose - when requesting it, the employee should clarify which department and under what circumstances it is required. To receive child benefits, a certificate is submitted to Social Security or the subsidy department of the municipality or district.

Any employee may need local documents from the accounting department at the place of work; income certificates are especially often needed - depending on the purpose of the employee or the requesting department, they contain information on various periods, calculations and amounts. To receive child benefits, a certificate of income for 3 months is required; its sample and registration rules are discussed in the article.

Certificate 2-personal income tax and maternity leave

2-NDFL certificates are submitted to the inspectorate at the location of the unit. Therefore, it is necessary to attach a certificate and another document that confirms an additional source of income. Certificate 2-NDFL is an official document that has legal force in many government agencies. This is done when she is going to quit after the end of maternity leave and she needs to receive benefits through the social security authorities.

If the length of service of a woman who is going on maternity leave is not enough to calculate sick leave payments, she must bring a certificate in form 2-NDFL from her former employer. The bank requires such a certificate if not all of the salary is paid to the borrower officially - that is, not all of it is subject to income tax. 2-NDFL and maternity leave The main thing is that the employer’s stamp is on the certificate. If the latter has the right to sign, then only his signature can be on the certificate.

Purpose and procedure for issuing a certificate of income for 3 months

Often, to obtain a certificate of income, it is enough to orally contact the accounting department of your home enterprise, explaining exactly what kind of paper you need and for what purposes.

Another life situation when you will need a certificate of income for 3 months is to register the official status of unemployed and receive the corresponding benefits. This does not apply to young people who are looking for work for the first time: then such paper cannot be physically obtained. In all other cases, in order to register with the Employment Center, you must provide information on average income for the last 3 months before dismissal or layoff. This was approved in the Decree of the Government of the Russian Federation of September 7, 2012. N891 “On the procedure for registering citizens in order to find a suitable job, registering unemployed citizens and requirements for selecting a suitable job.” Information on average monthly income is taken into account when calculating the amount of unemployment benefits.

Calculation of personal income tax for maternity leave in 2021

- Benefits for temporary disability (including for caring for a sick child)

- Other income (for example, rental of property owned by an employee).

- Other payments listed in Chapter 23 of the Tax Code of the Russian Federation.

Income in the form of maternity benefits and child care benefits up to one and a half years old. These types of income are not subject to personal income tax. This is directly established by paragraph 1 of Article 217 of the Tax Code of the Russian Federation. In what cases can an employee on maternity leave be issued a 2-NDFL certificate:

- If the employee is on maternity leave for up to one and a half years and, in accordance with Article 256 of the Labor Code of the Russian Federation, has written a statement of desire to work during this leave on a part-time basis.

Certificate for social security benefits on income for 3 months sample

A typical situation is when people apply for benefits during maternity leave. Maternity benefits are paid in a lump sum for a total of 140 calendar days. As a result, in some months the income will be very large, in others it will be zero.

The certificate for social security benefits is signed by the head of the enterprise and the chief accountant (accountant). If there is no chief accountant (accountant) in the organization, then a note is made about this, for example, “the position of an accountant is not provided for in the staffing table.”

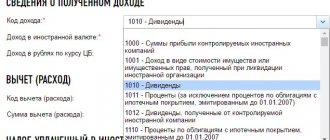

What is a certificate of income of an individual (form 2-NDFL)

What programs are there for filling out personal income tax certificate 2? Personal income tax is levied on all employed citizens whose wages exceed the non-taxable minimum. If the need arises, Russian citizens can request from their employers a certificate, Form 2-NDFL, which will indicate their earnings for a certain period of time. Procedure... What are the consequences of falsifying a 2-NDFL certificate (consequences) If the income is not official, the employee cannot receive a 2-NDFL certificate at all.

ContentsWhat you need to know? What are the consequences of falsifying a 2-NDFL certificate? Judicial practice (decisions and cases) Either the data in it does not correspond to his actual income - in this case, many try to forge this document. What do you need to know? ↑ Certificates... How to obtain a 2-NDFL certificate for a military personnel in 2021 Of course, income tax is also withheld from allowances. The bank certificate also indicates the amount of the taxpayer’s unofficial income. If a foreign citizen works at an enterprise and an official salary is paid to him, then the employer is also obliged to withhold income tax from him. And since there is income tax, then a certificate in form 2-NDFL exists.

If the taxpayer has the right to a deduction, then information about him must be reflected in the certificate. For example, a taxpayer can receive a property deduction both at his place of work and at the tax office. To prove to the tax authorities that he is or is not receiving a deduction, he must present to the tax authorities a certificate that either indicates the information about the deduction or not.

Information from the certificate in form 2-NDFL plays a huge role when adopting a child. Based on this data, the court makes a decision whether the future parents will be able to financially support the child or not.

What does a sample certificate of income for three months for social security look like?

The accountant refers to information from statements, personal accounts, and orders. The total amount of payments is entered. One-time charges that are not subject to insurance premiums are excluded from the list of mandatory data. Additionally, the legislator gives the authority to indicate periods with the same salary. The template requires the signature of the accountant and the head of the company.

- Information about the enterprise and contact information of the employer are indicated.

- Information about the specialist is indicated: his position, grounds for employment - type, contract number.

- It is recommended to enter the start and end date of the activity if the employee has already resigned.

Taxation of maternity leave in 2019-2020: is personal income tax withheld from these payments?

In paragraph 1 of Art. 217 of the Tax Code of the Russian Federation contains an unambiguous answer to the question of whether income tax is withheld from maternity leave. The text of this article states that maternity benefits are not subject to personal income tax. This makes maternity benefits different from regular sick leave, from which personal income tax must be withheld.

Unemployed women are not entitled to maternity leave, with the exception of those who were dismissed due to the liquidation of the organization. Like women who go on regular maternity leave, they receive all the required payments without having to reduce them by the amount of income tax.

In addition, all pregnant women have the right to 2 more benefits:

- A one-time payment for those who registered at the antenatal clinic before the 12th week of pregnancy. Its basic amount established by law is 300 rubles. Taking into account indexation from 02/01/2019, it is equal to 655.49 rubles.

- A lump sum payment for the birth of a child. Its basic value, established by law, is 8,000 rubles. Taking into account indexation, this benefit from 02/01/2019 is equal to 17,479.73 rubles.

Income tax is not deducted from the amounts of these payments, as well as from maternity payments.

Read more about the types and amounts of child benefits in 2021.