What material assets are taken into account on the balance sheet?

Material assets that were transferred or came into the custody of an organization without transferring ownership rights to them, as well as strict reporting forms that are at the disposal of the organization, fall under off-balance sheet accounting of material assets.

The following material assets are subject to accounting on the balance sheet:

- fixed assets leased by the enterprise;

- property received for free use;

- materials and raw materials accepted from suppliers for processing;

- equipment accepted from customers for subsequent installation;

- goods accepted for commission;

- property in safekeeping:

- valuables sent by suppliers to the enterprise by mistake;

- defects from suppliers that have not passed acceptance;

- property released to buyers according to documents, but not actually taken by them from the enterprise.

For material assets that are the property of other economic entities, their balance sheet accounting is already carried out by enterprises and organizations to which they belong by right of ownership, and off-balance sheet accounting of material assets is necessary in order to exclude the possibility of their repeated balance sheet accounting at another enterprise.

Strict reporting forms - diplomas, work books, certificates cannot be taken into account as property belonging to the organization, since they are used to certify important facts, events and rights of third parties, but the organization in whose possession they are until the moment of use is responsible for their controlled expenditure .

The procedure for off-balance sheet accounting of material assets

The movement of material assets behind the balance sheet of an enterprise is carried out by simple transactions and does not involve double entry into accounts; off-balance sheet accounts do not correspond either with balance sheet accounts or with each other. Off-balance sheet accounting of material assets is carried out on the basis of primary accounting documents: claims-invoices, acts of acceptance and transfer of fixed assets, material assets for storage.

Analytical accounting is carried out in the context of the type of valuables, counterparties of the enterprise (owners, suppliers, lessors), storage locations and, in the case of personal liability of specific persons who were entrusted with the storage of the relevant objects.

Reflection of business transactions by postings to off-balance sheet accounts

| Operation | Debit | Credit |

| Obtaining lease of fixed assets | 001 | — |

| Return of previously leased fixed assets to the owner | — | 001 |

| Acceptance of inventory items for safekeeping | 002 | — |

| Return of previously accepted inventory items to the legal owner | — | 002 |

| Receipt of customer-supplied raw materials for processing | 003 | — |

| Disposal of customer-supplied raw materials - manufacturing of products from them | — | 003 |

| Receiving goods on consignment | 004 | — |

| Goods sold under a commission agreement | — | 004 |

| Equipment has been accepted for installation to the customer | 005 | — |

| Completed installation and installation of equipment for the customer | — | 005 |

| Strict reporting forms received | 006 | — |

| Strict reporting forms were used | — | 006 |

| Strict reporting forms are damaged and unusable | — | 006 |

The basis for mandatory write-off from the off-balance sheet accounting of an enterprise is the placement of this property on the balance sheet upon transfer of ownership rights to the object to the organization itself:

- repurchase of leased property from the lessor,

- transfer of ownership rights to material assets previously transferred free of charge,

- payment under the contract for raw materials previously received for processing, etc.

Off-balance sheet accounts of budgetary institutions

The account takes into account property received by the institution for use, but these are not rental objects. These are values that, in accordance with the legislation of the Russian Federation, are not subject to reflection on the balance sheet of the institution: museum objects and museum collections included in the state part of the Museum Fund of the Russian Federation, non-exclusive rights to use the results of intellectual activity, rights to limited use of other people's land plots. Property is registered on the basis of an acceptance certificate or other document that confirms receipt of the property and rights to it.

Property must be reflected at the cost indicated in the transfer and acceptance certificate.

Accounting is carried out in the context of property objects, owners (balance holders) of property, as well as by inventory, serial, register numbers specified in the transfer and acceptance certificate or other document.

Account 02 “Material assets accepted for storage.”

What off-balance sheet accounts are intended for accounting for inventory items?

The very definition of off-balance sheet accounts specified in the instructions to the Chart of Accounts (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) indicates that these are accounts that are not taken into account in the organization’s balance sheet; their indicators are not involved in assessing the financial position of an economic entity. The chart of accounts and its instructions provide for 11 off-balance sheet accounts, 3 of which are intended for accounting for inventory items:

- Account 002 - it records inventory items that are in the organization’s warehouse, but are not already or not yet its property.

- Account 003 is intended to account for raw materials and materials that the manufacturing organization receives from the customer for processing.

- Account 004 is used by commission agent organizations to account for goods accepted under the terms of a commission agreement.

You can get acquainted with the off-balance sheet accounts provided for in the Chart of Accounts and the features of their use in the article “Rules for maintaining accounting records on off-balance sheet accounts.”

The following is typical for all property off-balance sheet accounts: the receipt of assets is reflected only in debit, write-off only in credit, there is no correspondence in off-balance sheet accounts.

The procedure for writing off inventory items from an off-balance sheet account

> > > Tax-tax February 23, 2021 Writing off inventory items from an off-balance sheet account can occur in several cases. Next, we will tell you in which off-balance sheet accounts inventory items are recorded and how to correctly write them off from off-balance sheet accounts. Inventory assets (TMV) include inventories, finished products, goods (item.

3.15 Inventory guidelines, approved. by order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49). Off-balance sheet accounts are intended to comply with the requirement of property separation (clause.

5 PBU 1/08, approved. by order of the Ministry of Finance dated October 6, 2008 No. 106n). IMPORTANT! Maintaining off-balance sheet accounting is the responsibility of a legal entity (Law “On Accounting” dated December 6, 2011 No. 402-FZ, clause.

5 PBU 1/08) in order to comply with the requirement for reliable reporting. An entrepreneur is not obliged to keep accounting, but can do it on his own initiative - in this case, off-balance sheet transactions should also be reflected correctly. Inventory and inventory items are recorded on off-balance sheet accounts in the following cases:

- Acceptance for storage - this is what the account is intended for. 002 “Inventory and materials accepted for safekeeping” of the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

- Acceptance of materials from other companies for processing - records of these operations are kept on the account. 003 “Materials accepted for processing.”

- Commission agents account for goods for resale on the account. 004 “Goods accepted for commission.”

Let's take a closer look at the procedure for writing off materials from these off-balance sheet accounts.

Postings for capitalization and write-off from the account. 002 look like this: Debit Credit Contents of transaction 002 Acceptance of inventory items for secondary storage 002 Disposal of inventory items accepted for secondary storage Write-off of inventory items from the account. 002 is carried out on the basis of:

- a form or similar document developed by the organization (taking into account the requirements of paragraph 2 of Article 9 of Law No. 402-FZ) to record the return of valuables accepted under a storage agreement;

- TORG-12, UPD or other documents - upon disposal of inventory items that were taken into account on the account. 002 within the framework of the supply agreement.

For operations with customer-supplied raw materials, the executing organization uses an off-balance sheet account.

003: Debit Credit Contents of transaction 003 Materials received for processing 003 Processed materials transferred to customer If products are made from customer-supplied raw materials, then the entries in off-balance sheet accounting may be as follows: Debit Credit Contents of transaction 003 Materials received for processing 003 Customer-supplied raw materials transferred to production 002 Products are capitalized , made from customer-supplied materials 002 Manufactured products were transferred to the customer From the account.

003 materials are written off based on:

- report on the consumption of customer-supplied raw materials (Article 713 of the Civil Code of the Russian Federation);

- work acceptance certificate;

- invoice M-15 or other similar documentation agreed upon by the parties.

When selling goods under a commission agreement, the commission agent is accounted for according to the account.

004 there will be the following accounting entries: Debit Credit Contents of transaction 004 Goods received under a commission agreement have been capitalized 004 Goods accepted on commission have been sold Write-off of inventory items from an off-balance sheet account. 004 is carried out on the basis of the primary document drawn up upon the sale of valuables - TORG-12, invoice, UPD or other documentation agreed upon by the parties to the commission agreement.

An organization can take into account not only other people's material assets on its balance sheet, but also its own.

An example would be low-value property, household supplies and inventory that are used for more than 1 year, with a cost below the limit for accepting an object for accounting as fixed assets (the organization sets this limit independently in its accounting policy, but it cannot be more than 40,000 rubles.

We recommend reading: Are the child’s opinions taken into account in court?

in accordance with clause 5 of PBU 6/01). Such materials are written off as expenses at a time.

But due to the long period of use, it is necessary to organize control over their safety.

For this purpose, you can create a record sheet for household supplies and equipment in use, or you can keep off-balance sheet accounting. In the Chart of Accounts, approved. By order No. 94n, there is no special account for these purposes, so the organization can develop an off-balance sheet account independently and approve the chosen procedure for writing off low-value materials in the accounting policy. If you use the 1C:Enterprise computer program for accounting, then in the chart of accounts of this program, special off-balance sheet accounts are provided for accounting for low-value materials written off the balance sheet: If the company has decided to take into account low-value materials off the balance sheet, then the postings will be as follows: Debit Credit Contents operations 20, 23, 25, 26, 29, 44 10 Released from the warehouse Inventory and household supplies Off-balance sheet account “Inventory and household supplies” Inventories transferred into operation were registered in Off-balance sheet account “Inventory and household supplies” Inventories written off The write-off from the off-balance sheet account of such inventory items is carried out:

- after they are completely worn out, another document is drawn up, developed taking into account the requirements for mandatory details (clause 2 of article 9 of law No. 402-FZ);

- sale, gratuitous transfer and other disposal.

Reflection of the receipt and write-off of materials using off-balance sheet accounts is carried out both to control one’s own property (low-value materials) and to reflect values received for a time and not becoming the property of the organization (raw materials supplied by customers; goods and materials accepted for safekeeping; goods taken on commission ).

We advise you to read the latest from the forum

How to transfer materials to an off-balance sheet account?

Paragraph 4 clause 5 PBU 6/01 indicates the need for proper accounting of property written off as expenses as inventories. And paragraph 5 of PBU 1/2008 talks about organizing accounting policies in such a way that assets and liabilities belonging to the organization are accounted for separately from others.

However, to account for material assets, the cost of which has already been written off as expenses, there are off-balance sheet accounts 002, 003 and 004. Instructions for using the Chart of Accounts also provide for the possibility of introducing additional off-balance sheet accounts. Thus, to account for materials that continue to be in the organization and used in its business activities, it is possible to provide an additional account on the balance sheet, and the regulations for its use can be fixed in the accounting policies. Such an off-balance sheet account may be account 012 “Material assets in operation.”

In the accounting program “1C: Accounting”, popular among accountants, for example, an MC account with a number of sub-accounts has been introduced for similar purposes:

- MC02 “Working clothes in operation”;

- MC03 “Special equipment in operation”;

- MC04 “Inventory and household supplies in operation.”

After the property is capitalized and put into operation, its value is written off as the organization’s expenses, and the property itself, assigned to the responsible persons, will be listed on the balance sheet. When this property ceases to be used for one reason or another, it will need to be written off from the off-balance sheet account in which it was recorded.

At the same time, analytical accounting of materials is carried out according to nomenclature and storage locations, which makes it possible to control the availability and use of these values, and in the case of additional costs associated with their use, to justify these costs.

When transferring material assets into operation, the relevant documents are issued, for example, a demand invoice (form M-11), and the following entries are made:

- Dt 20, 26, 44 (cost accounts) Kt 10 “Materials”;

- Dt 012 (MC).

In the event of complete depreciation of the property recorded off the balance sheet, or its disposal for other reasons, a document for write-off is drawn up and a posting is recorded on the credit of the off-balance sheet account: Kt 012 (MC).

Regulations for accounting for values recorded on the balance sheet and monitoring them, as well as a list of documents used for these purposes, must be developed by the organization itself and consolidated in its accounting policies.

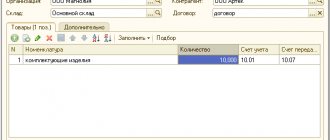

Receipt of materials in 1C 8.3

Go to the “Purchases” section (1) and click on the “Receipts (acts, invoices)” link (2). A window will open for creating an invoice for the receipt of materials. In the window that opens, click on the “Receipt” button (3) and click on the “Goods (invoice)” link (4). An invoice form will open for you to fill out.

Guest, you have free access to a chat with an expert accountant

Request a call back to connect or call:

8

(free in the Russian Federation).

In the invoice form please indicate:

- your organization (1);

- materials supplier (2);

- to which warehouse the materials were received (3);

- details of the agreement with the supplier of goods and materials (4);

- number and date of the seller's invoice (5).

Click the “Add” button (1) and click on the “Show all” link (2). The nomenclature directory will open. In this directory, select the material (3) that you received. Next, indicate on the invoice:

- quantity (4). Indicate the quantity of materials received at the warehouse;

- price from the invoice (invoice) from the supplier (5);

- VAT rate from the invoice (UPD) from the supplier (6).

The delivery note is complete. To complete the posting of materials, click the “Record” (7) and “Post” (8) buttons. Now in accounting 1C 8.3 there are entries for the debit of account 10 “Material”. To view the transactions for the created invoice, click on the “DtKt” button (9).

In the posting window, you can see that the material is credited to account 10.01 “Raw materials and materials” (10). Also, the debit of account 19.03 “VAT on purchased inventories” (11) reflects the receipt of VAT. These accounts correspond with account 60.01 “Settlements with suppliers and contractors” (12). So, the receipt of materials has been processed, now the next stage is write-off.

We suggest you read: Colleges deprived of accreditation

Go to the “OS and intangible assets” section (1) and click on the “Equipment receipt” link (2).

In the window that opens, click the “Create” button (3).

The “Receipt: Equipment (creation)” window will open. In the upper section of the document (4) in the “Organization” field, indicate your organization, in the “Warehouse” field, indicate which warehouse the equipment was received at. In the “Counterparty” and “Agreement” fields, indicate the supplier of fixed assets and the details of the agreement with him. In the “Invoice No.” field, indicate the number of the invoice under which the property was received.

The lower section consists of five tabs (5):

- Equipment;

- Goods;

- Services;

- Returnable packaging;

- Additionally.

In the “Equipment” tab, click the “Add” button (6) and enter data on the received fixed asset. In the “Nomenclature” field, indicate the name of the OS; in the “Quantity” and “Price” fields, indicate the quantity and price of the received equipment. “Accounting account” 1C 8.3 will be determined automatically, depending on the type of equipment received (fixed assets, equipment to be installed).

The second stage is the acceptance of the OS for accounting in 1C 8.3 - commissioning. A fixed asset ready for operation is placed on the balance sheet on the basis of a transfer and acceptance certificate. For this purpose, create a document “Acceptance for accounting of fixed assets”. To do this, go to the section “Fixed assets and intangible assets” (8) and click on the link “Acceptance for accounting of fixed assets” (9).

In the window that opens, click the “Create” button (10). The “Acceptance for accounting of fixed assets” window will open.

https://www.youtube.com/watch?v=ytcreators

In the upper section of the “Acceptance for accounting with OS” window (11), fill in the fields:

- "Organization";

- "Type of operation." In this field, you can select one of three values: “Equipment”, “Construction objects” or “Based on inventory results”;

- "OS Event". In this field, select the appropriate operation from the list, for example, “Acceptance for accounting with commissioning”;

- "MOL." Specify the financially responsible person;

- "Location of OS". Indicate in which department the fixed asset will be operated.

The lower section of the window consists of five tabs (12):

- Non-current asset;

- Fixed assets;

- Accounting;

- Tax accounting;

- Depreciation bonus.

In the “Non-current asset” tab (13), indicate the appropriate “Method of receipt”, for example “Purchase for payment”. In the “Equipment” field, select from the “Nomenclature” directory the equipment that you are putting into operation. Also indicate the “Warehouse” where it is located. In the “Account” field, the accounting account in which the object was reflected upon receipt of goods will be automatically set (Step 1).

In the “Fixed Assets” tab (14), you need to create a new fixed asset object. To do this, click on the “Add” button (15), and then on “ ” (16).

A window will open for filling in data on the fixed asset. In this window, fill in the fields:

- "Assets accounting group". In this field, you must select a suitable group from the list, for example, “Machinery and equipment (except office)”;

- "Name";

- "Full name".

We suggest you read: How to take academic leave at the university

Click on the “Classification” link (17), select the depreciation group in the “OKOF Code” field. After filling, click “Save and close” (18). The entered data is saved.

In the “Accounting” tab (19) indicate:

- "Accounting procedure". Specify “Depreciation calculation”;

- "Method of calculating depreciation." Here, select the depreciation method for the object, for example linear;

- “Method of reflecting depreciation expenses.” In this reference book, indicate in which accounting account depreciation should be calculated;

- "Useful life (in months)." Here, indicate how many months the fixed asset will be depreciated in accounting.

In the “Tax Accounting” tab (20), fill in:

- “The procedure for including costs in expenses.” Here you can select one of the methods from the list, for example, “depreciation calculation”;

- "Useful life (in months)." In this field, fill in how many months the object will be depreciated in tax accounting.

All data for commissioning the fixed asset has been completed. Now you can save and post the document. To do this, click “Record” (21) and “Pass” (22). Fixed assets in 1C 8.3 Accounting are registered. The fixed asset was put into operation, and entries were made in the accounting records to debit account 01 “Fixed Assets”.

How to sell materials from an off-balance account?

To sell property recorded off the balance sheet, its contractual value is determined. When selling, an entry for the sale of other property is generated:

- Dt 62 “Settlements with buyers and customers” Kt 91 “Other income and expenses.”

If an organization operates on OSNO, VAT is charged upon the sale of an asset:

- 91 “Other income and expenses” Kt 68 “Calculations for VAT”.

The disposal of property is carried out according to the credit of the off-balance sheet account of its accounting:

- Kt 012 (MC).

Moreover, the cost of such property is zero due to the fact that it has already been taken into account in the organization’s costs when transferring it into operation. Funds from the sale of this property are the income of the organization.

IMPORTANT! To generate documents for sale and the corresponding entries in the accounting program, it is often necessary to restore the property being sold in the organization’s assets, if the functionality of the program does not provide for transactions for the sale of property recorded off the balance sheet. For this purpose, inventory items to be sold are restored to the account from which they were previously written off, at a symbolic cost - for example, 1 kopeck.

What is usually taken into account?

I propose to consider the most common assets and liabilities that find a place to be reflected on the balance sheet. This list is not a guide to action. These are the most common situations that most companies experience.

Account 001 “Leased fixed assets”

A) We reflect the premises that we rent. The basis for the reflection is the acceptance certificate of the premises, which is signed upon conclusion of the contract. Most often, there is no information about the cost of premises in the contract. You can ask the landlord for cost information, but most likely you will be refused. In this case, there is no point in ordering an appraiser for money; you can use a conditional assessment. For example, 1 rub. for each rented square meter. The main thing is to spell out the rules for contingent valuation in accounting policies or corporate accounting principles.

B) Property transferred along with the rented premises, according to the transfer and acceptance certificate. These could be air conditioners, blinds, tables, cabinets, etc.

C) Floor coolers received from suppliers for a fee or as a bonus received for water consumed in 18.9 liter bottles. Accounting is carried out according to the equipment acceptance certificate at the time of receipt of the cooler from the supplier. This act, as a rule, indicates the collateral value at which the cooler is reflected on the balance sheet.

Account 002 “Inventory assets accepted for safekeeping”

Most often, 18.9 liter bottles for coolers are taken into account here. On the day of water delivery, the supplier, in addition to the standard invoice, encloses a receipt invoice for bottles and a consumable invoice (or a combined version). The collateral value of the bottles can be indicated either in these invoices or in the contract.

Another most common example of what is included in account 002 is rugs that belong to a cleaning company. These mats are regularly changed based on acceptance certificates.

Account 006 “Strict reporting forms”

Typically, BSO are taken into account in the conditional valuation, and the quantity to be reflected in accounting is determined by the direct counting method.

Typical transactions that are recorded on account 006:

– check books received by the organization from the bank;

– forms of work books and inserts for them;

– season tickets to be issued;

– blank forms of diplomas and certificates.

Less trivial options for using account 006:

– writs of execution for employees (for which alimony is paid);

– sick leaves (those brought by employees after the sick leave was closed);

– constituent documents (TIN, OGRN, record sheets, etc.).

The usefulness of this accounting lies in the ability to track those responsible for storing these documents.

Account 007 “Debt of insolvent debtors written off at a loss”

The written off receivable is reflected. The period of reflection on the account is within 5 years. The basis for recording will be an accounting certificate and an order to write off the debt.

Account 008 “Securities for obligations and payments received”

The received guarantees, after receiving a document, for example, from a bank, confirming these guarantees, must be reflected in account 008. Most often, companies whose buyers are state-owned companies encounter bank guarantees.

Account 009 “Securities for obligations and payments issued”

In the case where our company is a guarantor, this information should be reflected in account 009, in the amount of this guarantee. The basis for recording information in accounting will be a contract.

Types of off-balance sheet accounts

There are the following off-balance sheet accounts provided for in the Chart of Accounts.

To account for property that does not belong to the organization, off-balance sheet accounts are used:

- 001 “Leased fixed assets.” This account reflects the leased fixed assets at the valuation specified in the agreement;

- 002 “Inventory assets accepted for safekeeping.” If inventory items are received by the company, but under the terms of the contract, ownership of them is transferred to the organization after certain conditions are met (for example, after transfer of 100% of payment), then the company reflects such inventory items on off-balance sheet account 002;

- 003 “Materials accepted for processing.” This account reflects the customer's raw materials and materials accepted for processing (supplied raw materials), which are not paid for by the manufacturer;

- 004 “Materials accepted for commission” This account reflects goods accepted by the commission agent for sale;

- 005 “Equipment accepted for installation.” This account reflects the equipment received by the contractor from the customer for installation.

- To account for the organization's property written off as expenses, off-balance sheet accounts are used:

- 006 “Strict reporting forms.” This account reflects strict reporting forms - receipt books, forms of certificates, diplomas, various subscriptions, coupons, tickets, forms of shipping documents;

- 007 “Debt of insolvent debtors written off at a loss.” This account reflects the debt of insolvent debtors, taken into account on the balance sheet for five years after write-off in case of a change in the property status of the debtors.

To collect information for disclosure in notes to financial statements, off-balance sheet accounts are used:

- 001 “Leased fixed assets”;

- 011 “Fixed assets leased out.” If, under the terms of the lease agreement, the property is taken into account on the balance sheet of the tenant (tenant), then for the owner it is reflected in account 011 “Fixed assets leased”;

- 008 “Securities for obligations and payments received.” Account 008 “Securities for obligations and payments received” is intended to summarize information on the availability and movement of guarantees received to secure the fulfillment of obligations and payments, as well as security received for goods transferred to other organizations (individuals);

- 009 “Securities for obligations and payments issued.” Account 009 “Securities for obligations and payments issued” is intended to summarize information on the availability and movement of guarantees issued to secure the fulfillment of obligations and payments. If the guarantee does not specify the amount, then for accounting purposes it is determined based on the terms of the contract.

At the same time, the Organization can also open off-balance sheet accounts not provided for in the Chart of Accounts.

It should be noted that you should not neglect accounting for business transactions on off-balance sheet accounts, since during a tax audit, goods, fixed assets, etc., not accounted for anywhere, can be regarded as surpluses, which in accounting are classified as non-operating income and on which income tax must be paid .

Types and functions of off-balance sheet accounts

It states that the accounting of an organization's assets should not coincide with the accounting of the assets of its owners, as well as the assets of other organizations under the care of this organization.

The same principle applies not only to assets, but also to liabilities.

Objects temporarily included in the assets, provided under certain agreements, do not belong to the enterprise. However, during a certain period of time, it is the enterprise that is responsible for them, which means it must take them into account in a certain way. But such values cannot be mixed together with those owned by right of ownership within the same accounting accounts.

Off-balance sheet accounts are auxiliary accounts within the framework of accounting.

They become relevant if you need to obtain information not contained in balance sheet accounts. This feature explains their name.

Balances from off-balance sheet accounts will not be included in the balance sheet.

What are the features of writing off off-balance sheet accounting of property of a budgetary institution worth up to 3,000 rubles?

Law and market by narodirossii • 06/15/2016 Answer: Fixed assets worth up to 3,000 rubles.

inclusive, when they are issued for operation, they are written off from the balance sheet of the institution on the basis of the statement of issuance of material assets for the needs of the institution (f.

0504210) and are simultaneously reflected in off-balance sheet account 21 (clause

clauses 332, 373 of Instruction No. 157n, clause 10 of Instruction No. 174n). Acceptance of such objects for off-balance sheet accounting is carried out on the basis of a primary document confirming the entry (transfer) of the object in a conditional valuation (one object - one ruble), or according to the book value of the object (if such a procedure is approved in the accounting policy of the institution).

——————————– Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved.

By Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n. Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved.

By Order of the Ministry of Finance of Russia dated December 16, 2010 N 174n. Clause 51 of Instruction No. 157n specifies the main reasons for writing off fixed assets, including those recorded on off-balance sheet accounts: - making a decision to write off fixed assets based on their disposal against the will of the institution - theft, shortage, damage identified during the inventory of assets; – liquidation in case of accidents, natural disasters and other emergency situations; – making a decision to write off a fixed asset item on other grounds provided for by the legislation of the Russian Federation, including on the grounds of moral and physical wear and tear of a fixed asset item, the inexpediency of further use of a fixed asset item, its unsuitability, the impossibility or ineffectiveness of its restoration. Disposal of inventory items of fixed assets, including items of movable property worth up to 3,000 rubles.

inclusive, accounted for off-balance sheet accounting, is reflected on the basis of the decision of the commission on the receipt and disposal of assets, and is drawn up in the prescribed manner with the corresponding primary accounting document. For example, an act on the write-off of fixed assets (except for vehicles) may be applied (f.

0306003). Note. The disposal of fixed assets from off-balance sheet accounting, including in connection with the detection of damage, theft, shortages and (or) a decision to write them off (destruction), is carried out at the cost at which the objects were previously accepted for off-balance sheet accounting on the basis of .

373 Instructions No. 157n. Thus, write-off of fixed assets worth up to 3,000 rubles.

carried out by the institution according to the following rules: – based on the decision of the commission on receipt and disposal of assets created in the institution on a permanent basis; – in the manner approved in the accounting policy of the institution.

When a write-off is made due to moral or physical wear and tear or liquidation as a result of an emergency, in order to establish the feasibility of repairs or further operation of the facility, an appropriately formalized decision of the commission on the receipt and disposal of assets and an order from the head of the institution is sufficient. Example. As a result of a short circuit, an electric kettle burned out, which is accounted for in account 21 at a cost of 2,550 rubles. By decision of the commission, it was declared unfit for further operation.

The following transactions will be formed in the accounting of a budgetary institution: Contents of the transaction Debit Credit Amount, rub. The object was written off from off-balance sheet accounting 21 2550 “Explanations of executive authorities on the conduct of financial and economic activities in the public sector”, 2021, N 2 Rate this item:1.002.003.004.005.00Submit Rating Rating: 5.0/5.

From 1 vote. Please wait. Related materials:

- On which accounting account should you take into account computer speakers, mice, rugs worth up to 1000 rubles?

- On the reflection in budget accounting of accounting objects arising under lease agreements, agreements for the gratuitous use of forest plots located within the boundaries of the forest fund lands

- The owner of energy receiving devices (electric energy (power) production facilities, power grid facilities) who has not fulfilled the obligation to equip them with metering devices within the prescribed period

- Article 59. Seizure of illegally obtained objects of the animal world and instruments of illegal production of objects of the animal world

- Accounting and tax issues

We recommend reading: Features of the structural construction of territorial bodies of the Ministry of Internal Affairs of Russia at the district level

Tags: Accounting Post navigation ← Which of several checkpoints should be indicated in the payment order for the transfer of income tax to the budgetary system of the Russian Federation HOW TO FILE PRIMARY DOCUMENTS →

Off-balance sheet accounting of fixed assets

Fixed assets need to be taken into account off the balance sheet in several cases.

Fixed assets worth up to 40,000 rubles

Perhaps the most common situation for accounting for fixed assets off the balance sheet is accounting for assets worth up to 40,000 rubles.

Let us remind you that fixed assets no more than 40,000 rubles can be written off at a time as expenses in accounting (clause 5 of PBU 6/01). First, such assets are credited to the inventory account (account 10), and then written off to cost accounts (accounts 20, 25, 26, etc.). When writing off low-value fixed assets from the balance sheet, the question arises of control over the safety of property. This is where off-balance sheet accounts come in handy.

The chart of accounts does not provide an off-balance sheet account for recording assets written off the balance sheet. The company has the right to independently introduce a new off-balance sheet account by assigning a code to it (for example, account 015 “Property worth up to 40,000 rubles”). Information about created off-balance sheet accounts should be reflected in the accounting policies of the enterprise.

Example. The company purchased a chair for the director at a cost of 24,780 rubles, including VAT of 3,780 rubles. According to the accounting policy, the company writes off such assets to off-balance sheet account 015. The postings will be as follows:

Debit 10 Credit 60 - 21,000 - chair was capitalized as part of inventories

Debit 19 Credit 60 - 3,780 - VAT allocated

Debit 68 Credit 19 - 3,780 - VAT taken for deduction

Debit 44 Credit 10 - 21,000 - the cost of the chair is included in the costs of the trading company

Debit 015 - 21,000 - the chair is included in the balance sheet

When the chair becomes unusable, it should be written off off-balance sheet with the following posting:

Credit 015 – 21,000

When conducting an inventory, off-balance sheet accounting data should also be taken into account.

Fixed assets under a rental or leasing agreement

Off-balance sheet accounts will be needed by tenants and landlords. Keeping records of rented objects is prescribed by paragraph. 7 clause 32 PBU 6/01. In appendices to the financial statements, the accountant is also required to disclose information about leased fixed assets (clause 27 of PBU 4/99). The absence of off-balance sheet accounting for a significant share of such objects can lead to fines (Article 15.11 of the Code of Administrative Offenses of the Russian Federation, Article 120 of the Tax Code of the Russian Federation).

Tenants rent various objects - from office space to industrial equipment. Based on a rental or leasing agreement, the tenant (lessee) must register the received fixed assets. For this purpose, a special account 001 “Leased fixed assets” is provided. The lessee takes into account the received property on its balance sheet if the agreement stipulates that the property is taken into account on the lessor's balance sheet.

Leased objects are accepted for off-balance sheet accounting at the price specified in the contract. The lack of property value in the lease agreement is not an obstacle to reflecting the property off the balance sheet. Analytical accounting is usually carried out by types of fixed assets and lessors.

When a leased fixed asset is received, the following posting is made:

Debit 001

When disposing of a leased property (returning it to the lessor), you need to make a reverse entry:

Credit 001

Off-balance sheet accounting will confirm the appropriateness of lease payments transferred to the lessor. With reliable off-balance sheet accounting, the lessee will be able to reasonably write off the amount of lease payments as expenses.

Lessors also keep records of fixed assets if, under the terms of the agreement, the property is taken into account on the balance sheet of the tenant (lessee). Account 011 “Fixed assets leased out” is intended for accounting.

When is it impossible to transfer property from off-balance sheet accounts 03 and 07?

The answer is obvious - when it does not satisfy at least one of the conditions listed above.

Let's take a closer look at examples.

Example 1. In the accounting of the institution, fuel cards are taken into account in off-balance sheet account 03 in accordance with the provisions of the accounting policy. There is no need to transfer them from off-balance sheet account 03 to the balance sheet as part of material inventories. The fact is that fuel cards, as a rule, are the property of the company that issued them. Accordingly, they do not satisfy the concept of an asset.

More on the topic: Long-term contracts in 2021: accounting features (video)

Example 2. In the accounting of the institution on off-balance sheet account 07, certificates acquired in 2014-2015 are taken into account. The institution does not have a warehouse. The certificates are kept by the employees responsible for issuing them. In this case, there is no need to transfer certificates from off-balance sheet account 07 to balance sheet account 105 06.

Off-balance sheet accounting of materials and equipment

In addition to fixed assets and goods, other material assets can be taken into account on the balance sheet.

Inventory in safekeeping

In some cases, buyers cannot account for material assets on balance sheet accounts. In this case, records should be kept.

Invoice 002 is needed if the buyer accepted inventory items for storage when:

- receiving goods and materials from suppliers for which the organization legally refused to accept invoices of payment requests and pay them;

- receiving from suppliers unpaid inventory items that cannot be used under the terms of the contract until they are paid;

- receipt of goods and materials, the ownership of which has not been transferred to the organization, etc.

Note! VAT deduction cannot be claimed while inventory items are taken into account on the balance sheet (letter of the Ministry of Finance of Russia dated August 22, 2016 No. 03-07-11/48963).

Suppliers can also take into account inventory items on account 002 if the goods are paid for, but not removed by the buyer for reasons beyond the control of the organizations.

Provided raw materials

If a company works with customer-supplied raw materials, then account 003 “Materials accepted for processing” is used for accounting. Most often, they work with customer-supplied raw materials during the construction of facilities. In this case, the customer’s building materials are used to complete the work. Also, customer-supplied raw materials are used in the production of products for the customer. While the manufacturing process is underway, customer-supplied materials are accounted for in account 003.

Reception of customer-supplied raw materials is reflected in the debit of account 003, disposal (return of remaining raw materials or manufactured products) is reflected in the credit of account 003. Analytical accounting in account 003 is carried out by customers, types, grades of raw materials and materials and their locations.

Installation equipment

When installing equipment owned by the customer, contractors keep records of the equipment in account 005 “Equipment accepted for installation.”

Acceptance of equipment for installation is reflected in the debit of account 005; write-off of equipment from accounting after installation and delivery of it to the customer is reflected in the credit of account 005. Analytical accounting is carried out for customers, objects, and components of the equipment being installed.

Recording property in off-balance sheet accounts will help control its safety. Also, such accounting will increase the vigilance of financially responsible persons and help the company avoid fines.

Why are off-balance sheet accounts needed?

Off-balance sheet accounts are provided for by the chart of accounts approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. There are 11 such accounts in total. They are created to control certain business transactions, assets that are not owned by the organization, as well as contingent rights and obligations. The information on such accounts does not determine the financial position of the company, since it is not data for the balance sheet.

Double entry rules do not apply to such accounts. To reflect the movement on them, a simple entry is made: either by debit for inflows, or by credit for outflows. Let's look at a simple entry using an example.

Example

Kaleidoscope LLC purchased raw materials in the amount of 277,300 rubles. (incl. VAT 18% - RUB 42,300) November 1, 2021. Upon receipt, the warehouse manager discovered that the goods were worth 11,328 rubles. (incl. VAT 18% - 1,728 rubles) came with a defect. According to the contract, the buyer has the right not to accept defective goods, and the supplier is obliged to remove them from the buyer’s warehouse within 3 days. The parties drew up a statement of discrepancies upon acceptance of the goods. The supplier delivered the goods within the stipulated time frame. The following entries were reflected in the accounting of Kaleidoscope LLC.

November 1, 2021:

Dt 10 Kt 60 - 225,400 rubles, high-quality raw materials have been capitalized;

Dt 19 Kt 60 - 40,572 rubles, input VAT is reflected;

Dt 76 subaccount “Calculations for claims” Kt 60 - 11,328 rubles, a claim was submitted to the supplier;

D 002 - 11,328 rubles, defective raw materials remaining in the warehouse of Kaleidoscope LLC are reflected off the balance sheet.

November 4, 2021:

K 002 - 11,328 rubles, defective raw materials were removed by the supplier from the warehouse of Kaleidoscope LLC.

Why do you need an off-balance sheet account of a budget organization?

Off-balance sheet accounts are also needed to reflect transactions on those obligations that are awaiting fulfillment, and the movement of values not intended for accounting on the main accounting accounts. Such accounts are auxiliary accounting accounts.

The balances for them are not included in the balance sheet and are illustrated behind the results of the main balance sheet, that is, behind the balance sheet.

They do not affect the financial result and are not reflected in the periodic and final reports of the organization.

Balance sheet accounts are opened by enterprises for the following cases:

- Collection of information that must be indicated in the subject of the explanatory note to the balance sheet and final reporting.

- Keeping records of property that either does not belong to him or is written off as expenses.

Off-balance sheet accounts in budgetary institutions in 2021 are regulated by Order No. 157n of the Ministry of Finance of the Russian Federation dated December 1, 2010 (Instruction No. 157n).

Features of accounting for material assets in off-balance sheet accounts

For inventory items reflected on the balance sheet, the chart of accounts provides the following accounts:

- 002 - “Inventory and materials accepted for safekeeping”;

- 003 - “Materials accepted for processing”;

- 004 - “Goods accepted for commission.”

In the first example, we have already considered the option of using account 002. In addition to reflecting unaccepted goods on it, you can also use it to show goods for which, for some reason, ownership has not been transferred (for example, the condition for the transfer of rights is payment, it has not yet been made , but delivery to the buyer’s warehouse has already occurred). The concept of “responsible storage” is specified in Art. 514 Civil Code of the Russian Federation. An important condition for responsible storage is that the buyer must monitor the safety of the received valuables. This is why off-balance sheet accounting is needed; it allows you to control the availability and transfer to the supplier of inventory items not accepted on the balance sheet.

Transactions on toll processing are also common. In such interactions, the customer gives the processor his raw materials and pays for services for their processing into a finished product or semi-finished product. After the work has been completed, the processed raw materials are returned by the processor back to the customer. In this case, it is also important to monitor the safety and movement of customer-supplied raw materials. This problem is solved using account 003. Let's consider a similar situation using an example.

Example

Pomoschnik LLC received from Fermer LLC customer-supplied raw materials in the form of beef half-carcasses in the amount of RUB 2,560,000. for processing into semi-finished meat products. The cost of work by Pomoschnik LLC amounted to 531,000 rubles. (incl. VAT 18% - RUB 81,000).

During production, our own materials were used to package goods in the amount of 54,000 rubles, workers' salaries amounted to 216,000 rubles, insurance premiums - 65,232 rubles, the amount of depreciation of machines was equal to 13,000 rubles.

Pomoschnik LLC reflected the following entries in its accounting:

D 003 - 2,560,000 rubles, raw materials accepted for processing;

Dt 20 Kt 10 - 54,000 rubles, the cost of own packaging material is written off;

Dt 20 Kt 70 - 216,000 rubles, staff salaries are reflected;

Dt 20 Kt 69 - 65,232 rubles, insurance contributions for staff salaries are reflected;

Dt 20 Kt 02 - 13,000 rubles, depreciation is reflected;

Dt 62 Kt 90.1 - 531,000 rubles, revenue from processing services is shown;

Dt 90.3 Kt 68 - RUB 81,000, VAT charged on revenue;

Dt 90.2 Kt 20 - 348,232 rubles, the cost of services is written off;

Dt 90.9 Kt 99 - 101,768 rubles, the financial result of the transaction has been determined;

Kt 003 - 2,560,000 rubles, the cost of processed raw materials is written off.

Read more about accounting for transactions with raw materials supplied by customers in the article “Transactions with raw materials supplied by customers in accounting.”

For commission agents selling non-own goods, account 004 is provided. It is used according to a similar scheme. When the commission agent receives goods from the principal for their sale, entry Dt 004 is made; when these goods are shipped to the buyer, they are recorded in accounting in Kt 004 at the prices indicated in the acceptance certificates.

We also note the importance of organizing analytical accounting for the considered off-balance sheet accounts. Analytics is carried out by types of inventory items, by counterparties (suppliers, vendors, consignors), and storage locations.

Off-balance sheet accounting is provided to control the availability and safety of material assets that do not belong to the organization, but for which it is responsible to third parties. Entries on such accounts are made according to a simple scheme.

For information on how materials that are the property of an organization are accounted for, read the article “Accounting entries for accounting for materials.”

Off-balance account

An off-balance sheet account is an account designed to summarize information about the presence and movement of values that do not belong to a business entity, but are temporarily in its use or disposal, as well as to control individual business transactions. The concept of “off-balance sheet account” is also synonymous. The latter is most often used in relation to credit institutions.

Off-balance sheet accounts include:

- reserve funds of notes and coins

- borrowers' obligations

- payment documents submitted to the bank for collection (to receive payments)

- valuables accepted for storage

- strict reporting forms, check and receipt books, letters of credit for payment, etc.

Accounting for these values is carried out using a simple system and is not taken into account when drawing up the balance sheet. Off-balance sheet accounts do not correspond with balance sheet accounts. In accounting theory, off-balance sheet accounts also do not correspond with each other, however, in modern accounting programs it is generally accepted that off-balance sheet accounts can correspond with each other.

Organizations in the Russian Federation (except for credit or budget organizations) use the following off-balance sheet accounts in accordance with the Chart of Accounts for accounting the financial and economic activities of organizations:

- Account 001 “Leased fixed assets”

- Account 002 “Inventory assets accepted for safekeeping”

- Account 003 “Materials accepted for processing”

- Account 004 “Goods accepted for commission”

- Account 005 “Equipment accepted for installation”

- Account 006 “Strict reporting forms”

- Account 007 “Debt of insolvent debtors written off at a loss”

- Account 008 “Securities for obligations and payments received”

- Account 009 “Securities for obligations and payments issued”

- Account 010 “Depreciation of fixed assets”

- Account 011 “Fixed assets leased out”

An organization can supplement the list of these accounts and apply them in accounting if it describes their characteristics in its accounting policies.

> See also

- Balance account

Which inventory items are taken into account on account 002

Let's take a closer look at account 002 “Inventory assets accepted for safekeeping.” Account 002 takes into account values that the company, for a number of reasons, cannot reflect on the balance sheet:

- The received goods are defective, damaged, do not meet the stated requirements and characteristics specified in the supply agreement and must be returned to the supplier;

- According to the terms of the contract, ownership of the goods passes not at the time of shipment, but upon payment;

- Inventory and materials are accounted for under the pledge agreement;

- Inventory and materials have been paid for by the buyer, but have not yet been transported from the warehouse for technical or other valid reasons, that is, they are temporarily in safekeeping;

- Inventory and materials were received from the bailor under a storage agreement;

- The goods and materials were received by mistake, by an exchange agreement, etc.