Order of the Federal Tax Service of Russia dated July 16, 2020 No. ED-7-2/448, effective August 30, 2021, approved a new procedure for electronic document management with the tax office. Let’s look at its main provisions and what has changed in the EDF with the Federal Tax Service, the Federal Tax Service and the Federal Tax Service.

Also see:

- New 2021 regulations for electronic document management with the Pension Fund for accounting

- We are entering the era of EDI

What regulates

Order No. ED-7-2/448 dated July 16, 2020 approved the procedure:

- sending and receiving documents provided for by the Tax Code of the Russian Federation and used by tax authorities;

- submission of documents at the request of the tax authority in electronic form via telecommunication channels (TCS).

At the same time the following were declared invalid:

- Order of the Federal Tax Service dated December 29, 2010 No. ММВ-7-8/781 with the Procedure for transmitting the act of joint reconciliation of payments for taxes, fees, penalties and fines in electronic form via TKS;

- Order of the Federal Tax Service dated February 17, 2011 No. ММВ-7-2/168 with the Procedure for sending a request for the submission of documents (information) and the procedure for submitting them at the request of the tax authority in electronic form via TKS;

- Order of the Federal Tax Service dated November 7, 2011 No. ММВ-7-6/735 with the Procedure for submitting applications, notifications and requests in electronic form for the purposes of accounting with the tax authorities of organizations and individuals;

- Order of the Federal Tax Service dated April 15, 2015 No. ММВ-7-2/149 with the Procedure for sending documents used by tax authorities;

- a number of federal laws and regulations.

To be more precise, the new order essentially combined the provisions of the listed acts into one document.

Inventory of documents for the tax office: form

When submitting documents at the request of tax authorities, the subject is obliged to provide the regional office of the Federal Tax Service with an established package of documents, the transfer of which is accompanied by a register (inventory).

The tax inventory is an accompanying document, the writing of which is imposed on the taxpayer by law. The document is a mandatory attachment to the documents specified in it. The standardized inventory form has not been approved by the tax office, so the taxpayer can use a free-form inventory or a form recommended for use at the tax office at the place where the declaration was submitted.

At the same time, the provided opportunity to compile an accompanying register in free form does not mean that the legislation does not impose any requirements on its content. The presence of an inventory (register) for transferring documents to the tax office is regulated by a number of regulations, including Appendix No. to the Order of the Federal Tax Service of the Russian Federation No. MMV-7-2 / [email protected] dated November 7, 2018 “On approval of document forms...”. This order regulates the presence of an accompanying inventory as part of the documents submitted to the Federal Tax Service. This may be a separately attached form for an inventory of documents submitted to the tax office or an inventory given in the text of the cover letter.

General rules

To exchange documents with the tax office under the TKS, you need to use an enhanced qualified electronic signature (ECES):

In the process of electronic interaction when sending and receiving documents, the following technological electronic documents also appear:

- confirmation of dispatch date;

- acceptance receipt;

- notification of refusal of admission;

- notification of receipt (generated for each document and technological electronic document);

- information message about representation in tax relations (if signed by a representative of the payer).

Participants in electronic interaction are required to ensure storage of :

- all sent and received documents and technological electronic documents (except for notification of receipt of an electronic document) from UKEP;

- qualified certificates of electronic signature verification keys.

at least once a day .

The date of sending the document in electronic form via TKS is the date recorded in the confirmation of the sending date.

Upon receipt of a receipt for acceptance of an electronic document, the date of its receipt is the date of acceptance indicated in the receipt of acceptance.

Add documents

Click Upload and add the required documents.

If they are in xml format with an electronic signature, select:

- “from VLSI” - for downloading documents that are stored in your personal account. Use the filter to select the ones you need. Mark the files with a flag and click “Add flagged”.

- “from disk” - if the files are uploaded from another accounting system (for example, 1C). Mark the required documents in *.xml format and their signatures in *.sgn or *.p7s format.

If the documents were prepared in paper form , certified by the organization's seal and signed manually, select:

- “scan” - if you don’t have scanned documents yet.

- “from disk” - to load already scanned documents. Mark the files and click "Upload". Select “To one document” or “To different documents”.

Requirements for uploaded files

- The file size after compression and encryption is no more than 60 MB, the total size of the set is no more than 72 MB.

- Scan in *.jpg, *.png, *.tif, *.pdf format - black and white image with a resolution of no less than 150 and no more than 300 dpi using 256 shades of gray.

- The name of the attached file is no more than 100 characters.

When uploading files that are not included in the list of approved documents, an informal letter will be generated.

For each scanned document, fill in all required fields. If you have enabled recognition of responses to a requirement, VLSI will automatically indicate their type and details. Check the data.

Sending the document via TKS

In general, it includes the following steps:

| 1 | The sender generates a document in electronic form, signs it with UKEP and sends it via TKS to the EDI operator. In this case, the sender records the date of sending. |

| 2 | sends the sender a notification of receipt of the electronic document within 1 hour , no later than the next business day , a confirmation of the sending date. The sender, having received confirmation of the date of dispatch, sends a notification to the operator about receipt of the electronic document within 1 hour . |

| 3 | The EDF operator, no later than the next business day after the day the sender transferred the document to him, sends the recipient the document and confirmation of the date of dispatch, signed by the operator’s UKEP. The recipient, having received the document and confirmation of the date of dispatch, within 1 hour sends 2 corresponding notifications to the operator about receipt of the electronic document. |

| 4 | Upon receipt of a document and there are no grounds for refusal to accept it, the recipient generates an acceptance receipt, signs it with the UKEP and sends it to the operator. The recipient sends the receipt to the sender via TKS within 6 working days from the date the document was sent by the sender. |

| 5 | The EDF operator, having received an acceptance receipt or notification of refusal, within 1 hour sends the recipient a notification of receipt of the electronic document. EDF operator no later than next business day after transmitting the receipt of acceptance or notice of refusal of acceptance to him, sends the receipt of acceptance or notice of refusal of acceptance to the sender. sends a notification of receipt of the electronic document to the operator within 1 hour |

If there are grounds for refusal to accept a document, the recipient generates a notification about this, signs it with the UKEP and transfers it to the operator for forwarding to the sender.

The grounds for refusal may be (exhaustive list):

- wrong direction to the recipient;

- absence (inconsistency) of the sender's ECID;

- sending the document not according to the format approved by the Federal Tax Service of Russia.

Upon receipt of a notification of refusal of acceptance, the sender corrects the errors indicated in it and repeats the procedure for sending the document.

If the sender has not received an acceptance receipt from the recipient, he sends the document to the recipient on paper . But there is an exception. This is when the tax authority has not received from the payer, who is obliged to submit an electronic tax return (calculation), an electronic receipt of acceptance:

- requirements for the submission of documents;

- requirements for providing explanations;

- and/or notification of a summons to the tax authority.

The Federal Tax Service does not send the listed documents on paper.

Read also

07.02.2020

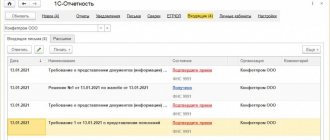

Receiving requirements for new rules

From July 1, 2021: 1) When a taxpayer receives a request for our company, we in any case confirm its receipt and send a confirmation receipt to the Federal Tax Service. 2) The confirmation receipt is sent within 6 days from the date of receipt of the request to our address. 3) The taxpayer is responsible for failure to provide information necessary for tax control in accordance with the norms of the Tax Code of the Russian Federation. From January 1, 2017: Tax inspectorates stopped accepting explanations on paper for requirements received electronically. If the inspector accepted your explanation on paper, it is considered not provided.

How to receive claims through an authorized representative

In order to receive requests through an authorized representative, you must issue a power of attorney for electronic filing of reports and submit any report electronically to the tax office.

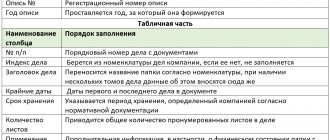

Design rules and structure

There is no approved form, so the tax inventory is drawn up in any form. The papers are numbered, stitched, certified by the manager’s signature and seal.

The firmware should allow:

- freely read text, details, dates, visas, resolutions, other inscriptions, seals, stamps and marks;

- study and copy each sheet without mechanical destruction of the firmware.

An inventory is also included with the papers, indicating:

- name of the Federal Tax Service;

- claim number and date;

- name of the organization (full name of the individual entrepreneur), TIN;

- title;

- serial number, name of each document sent, its status (original, copy), number and date (if any), number of sheets;

- total number of applications and sheets;

- signature of an authorized person and seal.

If the document is drawn up by an individual entrepreneur who works without a seal, a corresponding note is made.

| IP Semenov S.A. TIN 6154977400184 Appendix to the covering letter dated 03/02/2020 N 604 IP Semenov S.A. (TIN/6154977400184) List of documents submitted at the request of the Federal Tax Service for the city of Taganrog dated February 25, 2020 N 118 No. | Title of the document | Number of pages | Page numbers |

| 1 | Explanations for the simplified tax system declaration | 2 | 3-4 |

| 2 | Copy of letter from Marka LLC regarding clarification of payment No. 276 dated December 25, 2019 | 1 | 3 |

| 3 | Copy of payment order No. 254 dated December 24, 2019 | 1 | 4 |

| 4 | Copy of invoice No. 376 dated 12/02/2019 | 1 | 5 |

| TOTAL: | 5 |

Individual entrepreneur

Semenov S.A. Semenov

Note: works without printing

The list is compiled on the company's letterhead in two copies, one is submitted to the inspectorate along with a covering letter, the other - with an acceptance mark - remains with the taxpayer.

When sending by mail, the contents should be listed on form 107 for a valuable letter, in two copies. In this case, the shipment is not immediately sealed - the postal worker checks the attachment for compliance with the register, certifies the form with a signature and stamp, inserts one copy into the letter, and returns the second to the sender.