Electronic interaction with tax authorities has become widespread. The possibility of paperless exchange becomes especially important during a pandemic. 1C experts tell you how you can submit documents in response to the requirements of the Federal Tax Service directly from 1C: Accounting 8, edition 3.0, using the 1C-Reporting service.

The tax authority has the right to request documents (information) from the taxpayer both when conducting a tax audit (Article 93 of the Tax Code of the Russian Federation) and when conducting a tax audit of the taxpayer’s counterparty - the so-called “counter audit”. In addition, the Federal Tax Service inspection may request documents outside of inspections, for example, information on a specific transaction in which the taxpayer participated or about which he has information (Article 93.1 of the Tax Code of the Russian Federation).

As a rule, in all these cases, the taxpayer receives a requirement to submit documents (information), drawn up in a certain form (approved by order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [ email protected] - see Appendix No. 17 to the order ).

Taxpayers submitting tax returns (calculations) to the tax authority in electronic form are required to ensure receipt of documents from the tax authority in electronic form via telecommunication channels (TCC) through an electronic document management operator (EDF) (clause 5.1 of Article 23 of the Tax Code of the Russian Federation).

The taxpayer’s obligation is considered fulfilled if he has:

- an agreement with an EDF operator for the provision of services to ensure electronic document management with the tax authority at the taxpayer’s place of registration;

- qualified electronic signature verification key certificate.

Thus, if an organization uses electronic document management with the tax authority, then requests for the submission of documents (information), as well as letters, notifications and other documents are received by the organization via telecommunication channels in accordance with the procedure approved by order of the Federal Tax Service of Russia dated July 16, 2020 No. ED- 7-2/ [email protected]

The requested documents can be submitted to the Federal Tax Service both in paper and electronic form (clause 2 of Article 93 of the Tax Code of the Russian Federation). It is obvious that paperless exchange has undeniable advantages: speed, technology and security. Let's look at how in "1C: Accounting 8" edition 3.0 you can submit documents electronically in response to the requirements of the Federal Tax Service.

Document formats for exchange with the Federal Tax Service

To ensure electronic interaction between the tax authority and the taxpayer, by order of the Federal Tax Service of Russia dated January 18, 2017 No. ММВ-7-6/ [email protected] (hereinafter referred to as Order No. 16), a document format was approved that describes the requirements for exchange files for data transfer via TCS or through the taxpayer’s personal account.

According to Order No. 16, documents can be sent to the tax authority in the following formats:

- xml – for documents that have an approved format;

- tif, jpg, pdf, png – for scanned images of documents compiled on paper.

Currently, the Federal Tax Service of Russia has approved formats for the following documents:

- invoice;

- adjustment invoice;

- waybill (TORG-12);

- act of acceptance and delivery of works (services);

- document on the transfer of goods during trade operations;

- document on the transfer of work results (on the provision of services);

- deed of transfer of rights;

- invoice and document on the shipment of goods (performance of work), transfer of property rights (document on the provision of services), including an invoice (UPD);

- an adjustment invoice and a document confirming changes in the cost of goods shipped (work performed, services rendered), transferred property rights, which includes an adjustment invoice (UCD);

- Book of purchases;

- sales book;

- additional sheet of the purchase book;

- additional sheet of the sales book;

- journal of received and issued invoices;

- waybill (waybill);

- act of discrepancies (TORG-2);

- document confirming the change in value.

1C:Accounting 8 users who electronically exchange documents with their counterparties through the 1C-EDO

or

1C-Taksk

.

A number of documents that have an approved format are not used in the electronic exchange of documents with counterparties. These are a purchase ledger, a sales ledger, an additional sheet of the purchase ledger, an additional sheet of the sales ledger, and a journal of received and issued invoices. In this case, these documents can be sent to the Federal Tax Service in xml format directly from the 1C: Accounting 8 accounting documents.

At the same time, electronic document management can use documents for which there are no approved xml formats:

- contract;

- addition to the contract;

- price specification.

Such documents are prepared and sent to counterparties in familiar formats (doc, pdf, etc.).

If an organization does not carry out electronic document flow with its counterparties or there is no approved format for the requested documents, such documents are sent to the Federal Tax Service in the form of scanned images. According to the format, approved. By Order No. 16, you can send any documents that the tax authority requests from the taxpayer in the form of scanned images.

Scanned images of documents can be stored as external files on disk, but it is much more convenient to have them at hand, especially if they are often requested by external users (in addition to the Federal Tax Service, these can be credit and other organizations). For these purposes, it is recommended to attach scanned documents to infobase documents.

Common mistakes

Error:

The taxpayer received a demand from the Federal Tax Service addressed to another person. The taxpayer does not respond to the request of the Federal Tax Service.

A comment:

It is necessary to respond to the request of the Federal Tax Service in any case, even if it is not drawn up in accordance with the form, does not contain an electronic signature and was addressed to another person. It is required to send an electronic “Notice of Refusal” to accept the request to the Federal Tax Service.

Error:

During the desk audit, the tax inspectorate requests documents that were previously submitted to the tax authority. The taxpayer does not respond to the request of the Federal Tax Service.

A comment:

In this case, the tax inspector’s demand cannot be left unanswered. It is necessary to send a notice that the documents have already been transferred (indicating the date and details of the document).

Receiving a request from the Federal Tax Service and confirming its receipt

1C-Reporting service built into 1C programs

allows you not only to send regulated reports to regulatory authorities, but also ensures the receipt of documents from them in electronic form, and also provides convenient tools for preparing a response to the requirements of the Federal Tax Service, including the requirement to submit documents (information).

1C:ITS

For instructions on using the 1C-Reporting service in 1C programs, see the section “Instructions for accounting in 1C programs,” including on submitting documents as required by the Federal Tax Service.

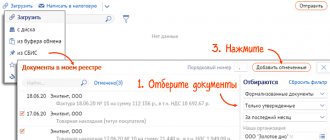

Requirements received from the Federal Tax Service are displayed in a single workplace 1C-Reporting

in

the Inbox

and

New

(Fig. 1).

In the list of incoming documents, the newly arrived request is highlighted in bold, and its status is set to Confirm receipt

.

Rice. 1. Receipt of request

If acceptance of the request is not confirmed within 6 business days from the date of sending, then the tax authority has the right to block the organization’s current account (clause 5.1 of Article 23, subclause 2 of clause 3 of Article 76 of the Tax Code of the Russian Federation).

The requirement is considered accepted by the taxpayer if the tax authority has received an acceptance receipt signed with the taxpayer’s electronic signature (clause 10 of Order No. 448).

To confirm receipt of a request from the Inbox

You can immediately follow the link

Confirm your appointment.

Or you can open the request form (Fig. 2) to first familiarize yourself with its contents, and only then confirm acceptance.

Rice. 2. Request form

The essence of the requirement is set out in a separate pdf file, which is attached to the electronic requirement and which can be opened using the link located under the caption Attached files

. The pdf file indicates the requested documents point by point, as well as the deadlines within which these documents must be submitted.

If there are grounds, the taxpayer generates a notice of refusal to accept, signs it with an electronic signature and sends it to the tax authority. To do this, just click on the Refuse

.

A notice of refusal is generated only in the following cases (clause 17 of order No. 448):

- the demand was sent to the taxpayer by mistake (it was intended for another addressee);

- the requirement does not comply with the established format;

- the requirement does not contain (does not correspond to) the electronic signature (ES) of an authorized official of the tax authority.

If there are no grounds for refusing to accept the request, then click on the Confirm Acceptance button.

The requested documents must be sent to the Federal Tax Service within the prescribed period, otherwise the taxpayer may be subject to a fine of 200 rubles. for each document not submitted (clause 1 of Article 126 of the Tax Code of the Russian Federation).

Who is required to report taxes electronically?

Certain categories of organizations and individual entrepreneurs do not have the right to choose between submitting documents to the tax service in paper form and in electronic form. The responsibility for submitting tax reports in electronic form lies with:

- Organizations and entrepreneurs who issue invoices to clients.

- Tax agents for value added tax.

- VAT payers.

- Organizations and individual entrepreneurs with an average number of employees exceeding 100 people.

Important!

Clause 5.1 art. 23 of the Tax Code of the Russian Federation obliges taxpayers who must submit declarations in electronic form to ensure the possibility of receiving requests from tax authorities via electronic means of communication. They are also responsible for transmitting receipts for receipt of such documents in electronic form to the Federal Tax Service (the period is 6 days from the date of sending the request by the tax service).

Options for responding to the Federal Tax Service’s request to provide documents

Next, the accounting service should estimate the time for the upcoming preparation of documents and click on the Prepare response

choose one of the options (Fig. 3):

- Response to requests for documents (information)

– to answer the requirement on the merits in a formalized form in accordance with Order No. 16;

- Notification of failure to respond on time -

to send a notification about the impossibility of submitting documents (information) in electronic form within the established time frame (clause 3 of Article 93 of the Tax Code of the Russian Federation). The form and format of such a notification are approved by order of the Federal Tax Service of Russia dated April 24, 2019 No. ММВ-7-2/ [email protected] ;

- Register of documents confirming VAT benefits

– to reduce the volume of requested documents during a desk audit. Instead of a package of documents confirming the VAT tax benefit, the taxpayer can send a register of these documents in electronic form. The recommended form, format and procedure for filling out the register are given in the letter of the Federal Tax Service of Russia dated November 12, 2020 No. EA-4-15/18589.

Rice. 3. Options for responding to the requirement

When selecting the option Response to request for documents (information)

The Response to request for documents submission

form opens (Fig. 4).

Rice. 4. Options for selecting documents

Depending on where documents are stored, their selection in response to a requirement can be performed in two modes:

- by loading from files from disk - using the button Load from disk

;

- by selecting documents from the 1C:Accounting 8 information base - using the button Select from database

.

It may take several days for a company to prepare a response to a request. The response to the request can be saved by clicking the Write

and continue working with it at another time. You can open a response to a requirement for viewing and editing both from the list of requirements form and from the requirement card.

The procedure for document flow, which is carried out electronically

The procedure for document flow between the tax inspectorate and the taxpayer, who is obliged to ensure the possibility of electronic correspondence with the regulatory authority, is as follows:

- The tax authority generates and then sends the request electronically.

- A “Confirmation of the date of dispatch” is generated - this is done by the electronic document management operator (the taxpayer is obliged to enter into an agreement with him, and then purchase an enhanced qualified electronic signature). This confirmation records the date the request was sent through an electronic document management tool. The confirmation is then sent to both sides of the document flow - the taxpayer (recipient) and the tax inspectorate (sender).

- The taxpayer receives a demand.

- On the part of the taxpayer, either a “Receipt of Acceptance” or a “Notice of Refusal” is sent to the Federal Tax Service - both notifications are a way to confirm that the request has been received. In any case, it is necessary to send such confirmation, even if the Federal Tax Service made a mistake and sent the document to the wrong address - otherwise, based on the explanations given in the Letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071, the inspection receives the right to block taxpayer's current account.

- The taxpayer studies the requirement and fulfills it within the time limits specified in this requirement. If the recipient does not agree with the request, it cannot be left unanswered - it must be contacted by the Federal Tax Service, which sent the document.

- If a company or individual entrepreneur can say in advance that they will not be able to fulfill the requirement within the specified time frame and send the required documents, they must send a written notification to the Federal Tax Service about the impossibility of submitting all the requested papers on time. The notification is drawn up in a unified form established by Order of the Federal Tax Service of the Russian Federation dated January 25, 2017 No. ММВ-7-2/ [email protected] The deadline for sending such a notification is 1 day following the day the request is received.

Important!

If the tax inspectorate sends a request for the presentation of documents during an on-site audit, it may request any documents that are related to the calculation and payment of taxes (related to the tax being audited and the period covered) (clause 12 of Article 89 of the Labor Code of the Russian Federation). If we are talking about a desk audit, the requirement is allowed to include only those documents that are mentioned in Art. 88 Tax Code of the Russian Federation.

Selection of documents for the Federal Tax Service by downloading from disk

the Load from disk button

The user has a choice (Fig. 5):

- on command Scanned document -

upload image files (scanned documents);

- on command Documents from another database

– upload an archive with images or xml files downloaded from another database.

Rice. 5. Options for loading files from disk

Uploading scanned documents

Command Load from Disk – Scanned Document

is used if the scanned documents were not attached to the infobase documents in advance. This opens a standard dialog for selecting files from disk (Fig. 6).

Rice. 6. Selecting a file from disk

Selected scanned documents are included in response to a request for the Open

.

This opens the form Preparing a document for sending

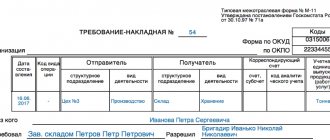

, where the selected documents should be pre-processed as follows (Fig. 7):

- add pages of a scanned document if the document is multi-page (button Add

);

- fill in the field Name, details or other characteristics of the source document

. You can manually enter the document details or select a document from the information base using the selection button;

- fill in the field Name, details or other characteristics of the base document (optional)

, if the added document has a basis document (agreement, invoice for payment or other primary document confirming the emergence of contractual relations between the parties to the transaction);

- in field Notary's signature

select a notary’s electronic signature file if the electronic document contains such a signature (for example, a document related to the registration of a legal entity (IP), power of attorney, etc.).

Rice. 7. Preparing a scanned document for sending

After filling out the required document description, click on the Add button in response to the requirement

(Fig. 7).

This opens the Requirement Item

, where you need to indicate the point of the original requirement from the pdf file, in response to which a scanned document is sent (Fig. 8).

Rice. 8. Item requirement

Click OK

The document data will be stored in the request response form.

Loading an archive of documents from another database

If xml documents or scanned documents that need to be sent in response to the request of the Federal Tax Service are located in another information database, then they can be downloaded from this database into a special archive file (exchange file), and then loaded into the information database from which the response is being prepared to the requirement.

To load documents from another database, click the Load from disk

and select

the Documents from another database

(Fig. 9).

Rice. 9. Loading documents from another database

In this case, a form appears where the Load

You can choose one of two download options:

- Loading 1C-EDO or 1C-Taksk xml documents from another database.

- Uploading scanned documents from another database

.

When you select the first option, a form for downloading electronic documents from the exchange package appears and a standard dialog for selecting files from disk opens. The archived file should be highlighted and selected using the Open

.

The electronic document download form displays a list of xml files from the archive file. The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

In this case, not only the xml documents themselves are loaded, but also the files of electronic signatures for them.

If you select the second option Upload scanned documents from another database

a form for downloading scanned documents from an external source appears and a standard dialog for selecting files from disk opens.

The exchange file should be highlighted and selected using the Open

.

The Upload Scanned Documents from External Source form will display a list of scanned documents from the exchange file that can be included in response to the request.

Details of the scanned document and its image can be viewed in a separate form, which opens by double-clicking.

The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

To edit details and other features of a document, as well as the base document, just double-click on the document line. This opens a document editing form, as in Figure 7, where you can make the necessary adjustments.

How to send informal documents

Officials refer to paragraph 2 of Article 93 of the Tax Code. It says: if the requested documents are compiled electronically in established formats, the taxpayer has the right to send them to the tax authority electronically via telecommunication channels. Therefore, documents can only be submitted electronically if they are in accordance with the prescribed format.

The Federal Tax Service specialists supported their position with explanations from the Ministry of Finance and arbitration practice. Thus, in letters from the financial department dated 07.07.11 No. 03-03-06/1/409, dated 06.14.11 No. 03-02-07/1-190 it is said: if the requested document is compiled in electronic form not in established formats, the submission the document is produced on paper in the form of a copy certified by the taxpayer with a mark indicating that the document has been signed with a qualified electronic signature. This does not mean that you will have to ask the counterparty to re-make documents with handwritten signatures. It will be enough to print out the document, certify it in the usual manner and make a note that the document was signed with an electronic digital signature (for more details, see “Officials told how to submit electronic documents not compiled in the established format to tax authorities”).

Note that previously, in practice, Federal Tax Service specialists allowed sending non-formalized documents to the inspectorate in the form of scans signed with an electronic signature. That is, an electronic non-formalized legally significant document should have been printed, certified in the usual manner, scanned, signed with an electronic signature and sent to the inspection through the system for sending reports (see “Users of the Kontur-Extern system can send documents requested by the inspection in electronic form”). .

Selection of documents for the Federal Tax Service by selecting from the information base

Click the Select from database button

In response to a request, the user can select documents from the current information database, that is, from the database where the EDI with the Federal Tax Service is configured, and from where the response is sent. In this case, the user has options regarding which documents to add (Fig. 10):

- xml documents received as a result of exchange with counterparties 1C-EDO

and

1C-Takskom

- by command

Electronic documents 1C-EDO, 1C-Takskom

; - xml documents of purchase books, sales books and invoice journals - by command Purchase/sales books, invoice journals

;

- other scans and xml documents - by command Documents from the database

.

Rice. 10. Selection of documents from the database

To add xml documents received as a result of exchange with 1C-EDO

and

1C-Takskom

, a special form is available

Selecting a source document

, where an accountant can quickly select the necessary documents by type, amount, date, number, organization, counterparty and source document (Fig. 11).

Rice. 11. Selection of electronic documents 1C-EDO and 1C-Takskom

To insert the required document into the request response form, select it in the list and click on the Select

. In this case, you will need to indicate the requirement item from the pdf file.

When using the Select from database command – Purchase/sales books, invoice journals

VAT reports in xml format can be attached to the response to the request:

- shopping book;

- sales book;

- journal of received and issued invoices;

- additional sheet of the purchase book;

- additional sheet of the sales book.

To add the specified documents in response to a request, a special selection form is used (Fig. 12), where you can apply selection by period, organization, and set any other search. The list of VAT documents displays the date, number, document type, tax period, organization and comment.

Rice. 12. Selection of electronic VAT reports

If documents for the selected tax period are not in the list, they should be created using the Generate for period

.

To move documents in response to a request, select them in the list and click the Select

, then indicate the requirement item from the pdf file.

When using the Select from database – Documents from database

You can attach arbitrary documents in xml format and scanned documents attached to the information base documents to the response to the request.

To select a document from the database, first select its type (Fig. 13).

Rice. 13. Selecting the type of document

Let’s assume that the document type is Receipt (act, invoice) –

A list of documents of the specified type opens (Fig. 14).

Rice. 14. List of documents of the specified type

Documents from the list can be selected by date, number, organization, counterparty, amount and other key fields. Infobase documents may have attached scans or corresponding xml documents - these are what are needed to be included in response to the requirement. To do this, select them in the list and click the Select button.

For selected documents, a description is automatically generated and attachments are added - xml documents or scans (Fig. 15).

Rice. 15. Preparation of documents of the specified type

From the same form you can add missing scanned documents by selecting them from the disk.

Click the Add button in response to a request

the selected documents are transferred in response to the request. In this case, you should indicate the number of the requirement item from the pdf file.

Advantages of electronic communication with tax authorities

Sending documents electronically frees the company from visiting and paying for notary services, significantly saves time on paperwork, and saves the company or individual entrepreneur from visiting the tax office.

ELECTRONIC INVOICE – INVOICE

ZERO FINANCIAL REPORTING

Editing the response to the Federal Tax Service's request to provide documents

Documents to be submitted is filled out in the response form

.

To edit the tabular part, select the line(s) and use the command bar buttons located above the tabular part (Fig. 16):

- Change

– to edit a document line;

- Remove current item

– to delete a document line from a response to a requirement or the entire requirement item with all document lines;

- Change requirement clause –

to change the number of the claim item;

- Move current element...

– to move a document line up or down within a requirement item group. To move a document to another requirement item, simply drag it while holding down the mouse button.

Rice. 16. Ready answer

In what cases is a “Notice of Refusal” generated?

If the taxpayer does not agree with the requirement, he must contact the Federal Tax Service from which the requirement was received. In the cases listed below, it also becomes necessary to send a “Notification of Refusal” instead of a “Receipt of Acceptance” in response to the Federal Tax Service’s requirement.

:

- The request does not contain an electronic digital signature of an authorized official of the Federal Tax Service. Or the digital signature does not correspond to the official.

- The requirement does not comply with the established format.

- The demand was not intended for the taxpayer - it was sent to another person, and reached the taxpayer by mistake.