The concepts of “credit” and “loan”

Accounting for loans and borrowings in accounting is regulated by PBU 15/2008. The accountant should periodically recheck the document, since changes made to it entail adjustments to accounting. It is important to understand the difference between the concepts of “credit” and “loan”. A loan can only be issued by a specialized organization that has a license for this type of activity, for example, a bank (clause 1 of Article 819 of the Civil Code of the Russian Federation). It is issued only in cash and only at interest. The loan can be issued by any organization, individual entrepreneur or individual. There are no restrictions on the form of issuance for it: it can be either monetary or real. He may not have interest for use.

Control points when accounting for a loan

There are nuances to consider:

- The accrued interest must correspond to the refinancing rate established by the Central Bank for the write-off period.

- The amounts and conditions for writing off interest must be comparable to credit obligations and loans under the terms of the agreements.

- The tax difference and the amount of tax liabilities must be calculated in accordance with PBU 15/2008 and reflected in accounting and reporting documentation.

An accountant should monitor changes in regulatory documents, since new rules may be introduced by law regulating the accounting of loans and borrowings, canceling previously existing ones. If the accounting of loans and borrowings is carried out incorrectly, then the tax authorities may regard this as incorrect accounting with the application of appropriate penalties.

>

Short-term and long-term loans

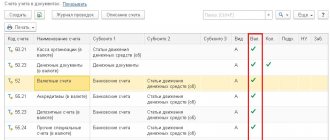

Accounting for loans in accounting depends on the time of use by the borrower. To make payments on short-term loans (issued for a period of up to 1 year), account 66 is used. For long-term loans (issued for a period of more than 1 year), account 67 is used. If it happens that long-term loans are repaid in less than 365 days, then they must be transferred to score 66.

Accounting for loans in accounting should be divided into analytics:

- by type of funds received;

- by sources of funds;

- for basic and additional costs.

An interest-free loan was issued: accounting

Let's consider what entries an accountant should make for an interest-free loan to an employee. For settlements of loans to employees, the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 200 No. 94n provides for account 73.

The financial investment account is not used in transactions for interest-free loans issued to employees; this is indicated in the instructions for the chart of accounts for account 58. It is also necessary to pay attention to the reflection of transactions for personal income tax, which must be paid if the employer does not charge interest on the loan. Read more about personal income tax in the following sections.

Postings on loans and borrowings

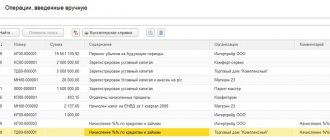

Costs are reflected as part of other expenses of the enterprise. If they were received for the investment activities of the enterprise, then the costs for them are included in the cost of the asset being created until the asset is put into operation (this condition does not apply to small businesses on the simplified tax system).

Loan entries in this article imply loan entries, since commercial organizations, as already mentioned, cannot issue loans.

It is necessary to create subaccounts for accounts 66 and 67 to account for the amount of principal and interest debt. For example, to account for the principal debt, use account 66-1 (67-1); to account for interest debt, use account 66-2 (67-2).

Credit received, posting:

- Debit 51, 50, 41, 08, 10 Credit 66-1, 67-1 - loan received (long-term loan, transactions);

- Debit 91-2 Credit 66-2, 67-2 - the amounts of basic costs are included in operating expenses;

- Debit 67-1 Credit 66-1 - long-term loan transferred to short-term;

- Debit 91-2 Credit 60, 76 - the amounts of additional costs are taken into account;

- Debit 60, 76 Credit 51 - additional costs paid.

Loan repaid, posting:

- Debit 66-1, 67-1 Credit 51, 50, 41, 08, 10 - loan repaid (loan repayment, posting);

- Debit 66-2, 67-2 Credit 51 - interest on loans repaid.

Regulations PBU 15/2008 do not contain precise instructions on what date must be indicated when reflecting debt. Typically, accountants use the date the contract was signed or the date the loan was actually received. Both options are correct. When receiving a loan in kind, there is no difference from a tax point of view. But some nuances are worth noting.

Postings for issuing a loan to an employee

The issuance of a loan to an employee is documented by posting:

- Debit 73 Credit 50 (51).

If the loan is interest-free, you need to calculate the material benefit. Personal income tax is withheld from it:

- Debit 73 Credit 68 Personal income tax.

Example:

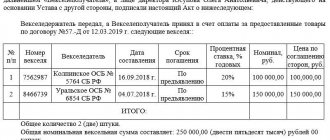

A loan was issued to an employee from the cash register in the amount of 70,000 rubles. from February 1 to July 1. The material benefit amounted to 70,000*(0.055-0)/365*151= 1592.74 rubles.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 73 | 50 | A loan was issued to an employee | 70 000 | Account cash warrant |

| 73 | 68 personal income tax | Personal income tax on the amount of material benefit | 207 | Accounting information |

| 50 | 73 | Loan returned | 70 000 | Receipt cash order |

Features of a loan in kind

When receiving a loan in kind, an enterprise is forced to purchase consumables or fixed assets associated with the use of the loan received. They should be taken into account in the amount of actual costs without including VAT. When returning, the cost of the property must be calculated equal to the expenses at the time of purchase. Thus, there will be a price difference between the assets received and the assets reimbursed to the borrower.

The accountant must include this difference in other expenses or income:

- Debit 91-2 Credit 66, 67 - the price difference that arose as a result of an increase in the value of property was written off;

- Debit 66, 67 Credit 91-1 - the price difference resulting from a decrease in the value of the property is written off.

How to prepare accounting entries for a loan from the founder?

The Civil Code does not prohibit issuing and receiving loans to any individuals and legal entities, regardless of their labor function or position in the organization.

Lending agreements in institutions of various forms of ownership are concluded on different terms (interest-free, interest-bearing), they are considered as a form of financial support. Even the founder of the company (director, immediate supervisor) has the right to transfer personal savings to the current account of his company for the purpose of purchasing additional equipment, opening new branches, etc.

Money from the owner’s pocket and the company’s personal assets cannot be mixed (with the exception of the property of an individual enterprise). But the founder of an LLC, CJSC, PJSC, if necessary, can lend finance to his institution. The opposite situation is also possible, when a company transfers property or monetary assets under a loan agreement to its owner (founder).

When the organization itself borrows money, the director acts as an individual. This means that he automatically becomes a payer of personal income tax.

The manager is “scared” not only by the fact that the money should be returned back, but also by the increased interest rate of 35 percent.

The conditions for obtaining a loan are as follows:

Savings on interest are taxed at a rate of 35%, forgiven debt is taxed at a rate of 13%.

A loan from the founder is an extremely unprofitable event for the lender. Firstly, the director usually chooses an interest-free transaction, which means he does not receive income from the use of money.

Secondly, he is authorized to “forgive the debt.”

Thirdly, you will need to pay taxes:

Postings for a loan from the founder to the current account

Both cash and property are transferred to the balance sheet of the enterprise from the owner in the form of a loan. Debt repayment is also made by non-cash method, and not from sales proceeds. Since the loan is not income, it is not taxed.

The entire transferred amount is reflected in the accounting accounts.

Money is reflected in one of two sub-accounts:

- with a loan term of up to one year on subaccount 67.03, the decoding of which sounds like “Short-term loans”;

- with a long-term repayment period in subaccount 66.03, the term and term loan sounds like No. “Long-term loans.”

The transfer of valuables is reflected in the debit of accounts depending on the type of loan and its method of receipt.

Possible options:

- account 51 “Current accounts”;

- account 50 “Cashier”;

- account 52 “Currency”;

- account 41 “Goods”;

- count 10 “Materials”.

When returning part of the principal amount, a reverse entry is made:

How to apply online for loans with any credit history, more details here.

An interest-free loan has the right to exist. The main condition is that this fact must be reflected in the agreement between the borrower and the lender.

If there is no clause in the “Conditions” clause that it is concluded at a rate of 0 percent, then interest is calculated at the refinancing rate.

Under interest-free conditions, no additional amounts are charged (=fees for using the loan), which means there is no need for additional transactions.

The receipt, or receipt, of funds is made in one of the available ways: to the organization’s cash desk, to a current account, when shipping materials and goods.

Accordingly, the moment of receipt of money and valuables is recorded in accounting:

In this case, the interest is clearly stated on the first page of the contract. Interest is calculated at the end of each month according to a formula.

In accounting, this operation is reflected:

In 2021, it is important to draw up a competent agreement. The wording in the agreement must be precise and definite, so that the Federal Tax Service, during an audit, cannot doubt the illegality of not charging taxes.

Otherwise, tax authorities have the right to independently assign fees and penalties in accordance with the legislation of the Russian Federation.

Example of a contract:

Citizen of the Russian Federation Ivanov Ivan Ivanovich, passport series, issued, residing:__, referred to as a lender, on the one hand, and LLC ___ represented by the General Director, acting on the basis of the Charter, referred to as a borrower, on the other hand, signed this loan agreement :

- Item

- The lender transfers funds to the borrower in numbers (in words), and the borrower receives the same funds, which he undertakes to return within the agreed period.

- The loan is interest-free.

- The Borrower undertakes to return the payment described in clause 1.1. amount within the date, month.

- Rights, responsibilities

- The lender undertakes to provide the information specified in clause 1.1. amount within 3 days after signing the agreement in cash to the company's cash desk.

- The date of receipt of the loan is the date of their transfer to the cash desk of the enterprise.

- The provision of the loan amount is confirmed by a cash receipt order. The loan amount is repaid using a cash receipt order.

- The date of fulfillment of obligations under the agreement is the date of transfer of funds within the period specified in clause 1.3.

- The borrower has the right to repay borrowed funds ahead of schedule, but with the consent of the lender.

Unlike banking conditions, the borrower will require a minimum of documents.

The following can be attached to the agreement:

- A copy of the organization's Charter;

- Economic justification for the purposes of the loan;

- Decision of the general meeting of LLC participants and shareholders to approve the loan;

- Consent to the processing of personal data for an individual;

- Documentary confirmation that the general meeting of participants is the sole executive body;

- Duplicates of documents on the appointment of a chief (manager).

The need for a loan is discussed at the General Meeting of Society Participants. However, the owner of the enterprise can make the decision alone. This is due to the unstable situation at the enterprise and the seasonal lack of profit.

In case of a critical financial situation, similar to bankruptcy, the creditor also has the right to refuse the demand for repayment of the debt. Thus, he gives the enterprise a chance to “find a new life.”

Repayment of loan amounts occurs in the same way as funds were received:

- If the creditor transferred finances by bank transfer, then the money should go back to his personal current account;

- If the lender transferred funds to the organization’s cash desk, then the issuance is organized through the same “window”;

- If the creditor has handed over the goods for use, then the products are returned to him in the same quantity and quality.

The tax consequences that may arise when signing an agreement are a nuisance that can be avoided. A loan from the founder allows you to avoid additional checks by the Federal Tax Service, calculation of income taxes, and payment of personal income tax to the budget.

A loan from a participant in the general meeting of owners has many advantages.

Some of them:

- The loan is not subject to taxes if the participant's share remains more than 50 percent.

- The loan allows you to save the company’s money (increased rates) and the employer’s precious time on collecting documentation, since there is no need to contact the bank.

- The loan gives a chance to rehabilitate unprofitable enterprises.

The disadvantage of credit is that it costs you to repay it. This is the responsibility of the borrower. Another drawback is that any loan agreements reduce the amount of net assets of the enterprise.

If the founder does not want to take risks by borrowing his personal savings, then he has the right to use these amounts to increase the authorized capital of the enterprise. From the point of view of economic benefits, the event can also contribute to the progressive development of the enterprise.

In general, a loan from the founder is a beneficial action. You can always reach an agreement with a participant in the General Meeting of Owners.

How to apply for a loan over the phone? The answer is in the link.

How to get the best loans without refusal, more details here.

The lender and the borrower are interdependent persons: it is possible to change the payment schedule, there will be no interest on the loan and a waiver of the requirement to fulfill debt obligations. Entrepreneurial success accompanies all those who are not afraid to take risks without tax consequences!

zaymcentr.ru