We submit an application to appeal the decision of the tax service to the court of first instance

In order to invalidate the decision of the tax authorities, you first need to contact the arbitration court at the location of the tax authority with an application (clause 4 of Article 138 of the Tax Code of the Russian Federation, subclause 2 of clause 1 of Article 29, Articles 34, 35 of the Arbitration Procedure Code of the Russian Federation).

Applications of taxpayers - individuals who do not have the status of an individual entrepreneur are considered in courts of general jurisdiction (clause 4 of article 138 of the Tax Code of the Russian Federation, article 24 of the Code of Civil Procedure of the Russian Federation, clause 2 of part 2 of article 1, article 19, part 1 Article 22, Parts 1, 5, Article 218, Part 3, Article 24 CAS RF).

According to paragraph 2 of Art. 138 of the Tax Code of the Russian Federation, before going to court, the taxpayer is obliged to go through the procedure of pre-trial dispute resolution.

ConsultantPlus experts explained step by step how to properly fill out the documents and where to submit them. If you do not have access to the system, get a trial online access and upgrade to the ready-made solution for free.

Consideration of applications takes place in accordance with the rules of claim proceedings and the features established by Chapter. 24 Arbitration Procedure Code of the Russian Federation.

The judge alone considers the case for no more than 3 months, including the period for preparing for the trial and making a decision. This period may be extended if the case turns out to be quite complex or a large number of participants will be involved in the process (Clause 1 of Article 200 of the Arbitration Procedure Code of the Russian Federation).

If the decision of the arbitration court does not suit the taxpayer, then he can appeal it to higher courts.

It will no longer be possible to appeal to the arbitration court again based on the same decision of the tax authority, even if new arguments are later presented to substantiate the applicant’s position. When re-applying in the same case, the arbitration court must terminate the proceedings with reference to clause 2 of part 1 of Art. 150 Arbitration Procedure Code of the Russian Federation. The taxpayer will be denied the renewal of the same case (Part 3 of Article 151 of the Arbitration Procedure Code of the Russian Federation).

Example

The arbitration court received an application from the taxpayer to recognize the decision based on the results of the tax audit as illegal due to violations by the tax inspectorate committed during the audit. No other arguments were stated. The court did not satisfy the applicant's request.

Later, the taxpayer again applied to arbitration with an application to invalidate the same decision, in which he indicated that additional income tax assessments were made unlawfully. Although the application presented new arguments, the court is obliged to terminate the proceedings in this case.

See also “The procedure for appealing a tax authority’s decision in court.”

How can I appeal

There are several ways to challenge the decisions of the tax authority:

Extrajudicial (pre-trial) appeal

This term means filing objections to a higher tax office.

At the same time, the legislation allows the payer to independently choose the method of protecting his rights: either directly to a higher body of the Federal Tax Service or directly to the court. However, not in all cases it is permissible to independently apply immediately for judicial protection. Thus, with regard to decisions made on the issue of holding an agent accountable for offenses committed in the field of taxation, it is possible to go to court only after considering the issue at a higher tax office. Accordingly, other decisions, such as on the issue of tax refund or offset, can be immediately appealed in court. Read also: Daily allowance for a business trip in 2021

At the same time, in an official letter, the Federal Tax Service makes it mandatory to have a procedure for pre-trial settlement of issues only for acts adopted after January 1, 2009.

The main advantages of this way of looking at the issue:

- no need to pay state duty;

- stopping the execution of the act until the final verdict is adopted;

- reduced time frame for reviewing materials;

- thorough preparation of the case if the need for a judicial appeal arises in the future.

Among the disadvantages are the following:

- disinterest of a higher authority in canceling decisions of its own structural units;

- suspension of execution is a right, not an obligation;

- The deadline for filing a complaint is short, and if the case is likely to be considered by the Federal Tax Service, there is a possibility that the deadline for judicial protection will be missed.

Appealing decisions of the tax authority in court

This method of protecting themselves is used by payers when all other methods have been exhausted. Conventionally, all disputes can be divided into two large groups:

- cases related to objections to tax acts;

- cases considering the actions (inactions) of civil service employees.

In this case, the review authorities will be:

- arbitration court;

- arbitration court of appeal.

Among the advantages of this method of protection are the following:

- Disinterest (independence) of judges on the issue being considered in a particular case;

- Comprehensiveness and objectivity when examining documents;

- High professionalism of those reviewing materials.

The disadvantages are the following:

- The need to pay a fee;

- Long review period.

What are the deadlines for appealing a tax authority’s decision in an arbitration court?

A taxpayer may go to court if he is not satisfied with the result of the consideration by a higher tax authority of his complaint (appeal). Tax authorities must make a decision on the complaint within 1 month. from the date of its receipt (clause 6 of article 140 of the Tax Code of the Russian Federation).

Please note that the period for consideration of a complaint may be extended, but not more than by 1 month, of which the taxpayer must be notified within 3 days from the date such a decision is made by a higher tax authority.

Within 3 months after receiving the decision of a higher tax authority on the audit, the taxpayer may go to court to appeal this decision (part 4 of article 198 of the Arbitration Procedure Code of the Russian Federation, paragraph 1 of article 219 of the CAS RF, paragraph 3 of article 138 Tax Code of the Russian Federation). If the higher tax authority does not have time to make a decision on the taxpayer’s complaint within the time limits established by clause 6 of Art. 140 of the Tax Code of the Russian Federation, the taxpayer can go to court without waiting for this decision to be made (paragraph 2, paragraph 2, paragraph 3, article 138 of the Tax Code of the Russian Federation).

The 3-month period is calculated in accordance with the standards established by Art. 113, 114 of the Arbitration Procedure Code of the Russian Federation or Art. 107, 108 Code of Civil Procedure of the Russian Federation, Art. 92.93 CAS RF. Often, courts will restore the deadline for filing an application, but only if they consider that it was missed for a good reason.

Violations not related to the consideration of inspection materials.

Failure to meet inspection deadlines.

Articles 88 and 89 of the Tax Code of the Russian Federation establish the deadlines for conducting desk and on-site inspections. Is failure to comply with these deadlines grounds for declaring the tax authority’s decision illegal on formal grounds? There is no consensus among judicial authorities on this matter. As an example, here are two judicial acts from the same district.

FAS North Caucasus in Resolution No. A53-33611/2012 dated February 17, 2014 supported the position of the taxpayer, the decision on the desk audit in respect of which was made fifteen months after the expiration of the relevant period. The judges decided that the tax authority violated the principle of the inadmissibility of excessive or unlimited application of tax control measures. The inspectorate did not provide convincing evidence of the validity of such a long period of inspection.

The arbitrators noted the following. By virtue of Art. 88 of the Tax Code of the Russian Federation, the tax authority is obliged to carry out verification activities in relation to the tax return it has accepted within the established three-month period. Therefore, in the absence of the fact of requesting any information and documents within the specified period, the taxpayer had the right to assume that the inspectorate had no doubts about the legality of applying the tax amounts declared in the declaration. Moreover, the tax authority did not take any action not only within the period established for the audit, but also within ten months from the date of filing the tax return.

The long period of verification in the case under consideration was assessed by the arbitrators, based on specific circumstances, as violating the goals of tax administration, which cannot be of a discriminatory nature that impedes the entrepreneurial activity of the taxpayer. The result of the trial is that such a violation of the inspection procedure is significant and in accordance with paragraph 14 of Art. 101 of the Tax Code of the Russian Federation serves as the basis for canceling the decision of the tax authority.

Another example is Resolution No. A53-33617/2012 of the Federal Antimonopoly Service of the North Caucasus Region dated January 31, 2014. The desk audit ended with a decision a year after filing the declaration. The judges concluded that this fact does not affect the legality of the decision. Arguing their conclusion, they referred to clause 9 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71. This document explained: when applying Art. 88 of the Tax Code of the Russian Federation, one should proceed from the fact that the period established by it is not preemptive; its expiration does not prevent the identification of facts of non-payment of tax and the adoption of measures for its forced collection.

Having assessed the nature of the procedural violations committed by the tax authority and their impact on the legality and validity of the decision made, the cassation court came to the conclusion that there were no significant violations of the desk audit procedure. Moreover, the arbitrators blamed the taxpayer himself for the fact that the audit took so long. The judges pointed out the dishonesty of his behavior: the entrepreneur did not provide the inspection with explanations and documents confirming the accuracy of the data included in the declaration. Therefore, the inspectors were forced to request these documents from other persons, which was partly the reason for the violation of the deadline for conducting the desk audit.

Technical details of the application

The application must be formulated correctly and clearly. It is best to provide links after each argument:

- on the legislative acts and norms of the Tax Code in force at the controversial moment;

- links to judicial acts issued by the Supreme Arbitration Court of the Russian Federation, the Supreme Court of the Russian Federation or arbitration courts of your judicial district;

- clarifications from the Ministry of Finance and the Federal Tax Service of Russia, if they correspond to the controversial issue.

You should definitely pay attention to the following circumstances that may influence the court’s decision if the taxpayer is nevertheless held accountable:

- circumstances excluding prosecution (Article 109 of the Tax Code of the Russian Federation);

- mitigating circumstances (Articles 112, 114 of the Tax Code of the Russian Federation);

- circumstances excluding the taxpayer’s guilt in committing an offense (Article 111 of the Tax Code of the Russian Federation), etc.

Thus, drawing up an application to the court is quite difficult, so it makes sense to turn to competent lawyers to complete this task.

What documents should be attached to the application to the arbitration court?

The application is usually accompanied by the documents listed in Art. 126 Arbitration Procedure Code of the Russian Federation. Here are the most important of them:

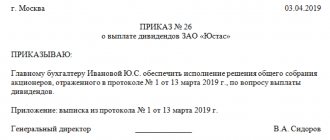

1. A copy of the contested decision of the tax authority (Part 2 of Article 199 of the Arbitration Procedure Code of the Russian Federation).

2. A copy of the decision of the higher tax authority on the taxpayer’s complaint.

This document is proof that the pre-trial appeal procedure was followed, since it is possible to go to court with a statement only after appealing the decision of the tax authorities to a higher tax authority (clause 7, part 1, article 126, part 2, article 199 of the Arbitration Procedure Code of the Russian Federation).

If the higher tax authority did not make a decision in a timely manner, then you can attach to the application a copy of the complaint with a note from the higher tax authority about its acceptance or a copy of the list of contents in the postal item and notification of its delivery, if the complaint was sent by mail.

3. Petition to suspend the action of the disputed decision of the tax authority (Part 3 of Article 199 of the Arbitration Procedure Code of the Russian Federation, information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 13, 2004 No. 83).

If the application to the court is submitted electronically, then all attached documents are also submitted electronically (paragraph 2, part 1, article 41, part 2, article 126 of the Arbitration Procedure Code of the Russian Federation).

In addition, all documents attached to the application, along with the application itself, must be sent to the tax service and all persons involved in the case. Documents should be sent by registered mail with return receipt requested. Receipts evidencing postal items are attached to the statement of claim submitted to the arbitration court (clause 1, part 1, article 126 of the Arbitration Procedure Code of the Russian Federation).

Learn the basic rules for resolving tax disputes from this publication .

Judicial acts in favor of taxpayers.

As an example, let us cite the Resolution of the Federal Antimonopoly Service of the Far East Branch of March 11, 2014 No. F03-557/2014.

After the completion of the on-site audit, the tax inspectorate made attempts for three months to notify the organization of the time and place of consideration of the results of control activities. The situation was complicated by the fact that the location of the company’s management bodies, which is its legal address, was significantly removed (over 500 km) from the location of the inspection. In addition, the organization's postal address did not coincide with its legal address.

Initially, consideration of the audit results was scheduled by the tax authority for September 20, 2012. The inspectors sent the corresponding notice a month before the specified date to the legal and postal addresses of the organization. Subsequently, the consideration was postponed three times, since at the next appointed date the inspectorate did not have information about the delivery of registered letters to the taxpayer (all correspondence was received, but late). Inspectors have repeatedly tried to serve representatives of the public (albeit unsuccessfully) with notices about the time of consideration of the inspection materials, visiting the legal and postal addresses. Telegrams were sent to the same addresses.

Articles 101 and 101.4 of the Tax Code of the Russian Federation do not contain any reservations about the need to notify the taxpayer of the time and place of consideration of the audit materials in any specific way, in particular by sending a registered letter by mail with return receipt requested or delivering it to the addressee against signature. In this regard, the said notification cannot be considered improper only on the grounds that it was carried out in some other way, for example by sending a telephone message, telegram, fax or electronic transmission via TKS (clause 41 of the Resolution of the Plenum of the Supreme Arbitration Court RF No. 57).

As a result, the review took place at the appointed time on November 16, 2012, in the absence of the taxpayer - but only after the inspectorate received information that registered mail with the next notice was delivered to the representative of the organization on November 13, 2012 (a copy of the postal notice at the request of the tax authority was received from the post office at fax).

The courts of three instances rejected the inspectorate's arguments about compliance with the decision-making procedure. The arbitrators found that the letter, which contained a notice of the time and place of consideration of the audit materials, was issued at the post office to an unidentified person unrelated to the taxpayer. The controllers did not confirm the authority of this person with the corresponding power of attorney. The judges also did not recognize the facsimile copy of the postal notification of delivery of the registered letter. The tax authorities did not register this document as an incoming document. Consequently, the tax authority did not have evidence that the said copy was in the inspectorate on the date of reviewing the results of the audit and making a decision (11/19/2012). The original postal notice with a mark of delivery of the correspondence was received by the inspectorate on November 19, 2012.

In connection with these circumstances, the arbitrators came to the conclusion: the tax authority did not provide

the taxpayer

the opportunity

to take part in the consideration of the audit materials, since the decision to prosecute was made in the absence of the applicant, who was not properly notified.

Judges make similar conclusions quite often. They believe that at the time of reviewing the audit materials and making a decision, the tax authority is obliged

have not information about the sending of registered letters and other items, but

evidence of their delivery

to the person being checked.

The arbitrators note that within the meaning of clause 3 of Art. 101 of the Tax Code of the Russian Federation, the head (deputy head) of the inspection has the right to make a decision to consider the results of control activities without the participation of the taxpayer only

when notified in the prescribed manner. Recognition of the latter as having been properly notified of the consideration of the inspection materials by sending him a corresponding notification, regardless of its receipt by the addressee in accordance with the provisions of Art. 101 of the Tax Code of the Russian Federation is not provided for. This position is set out, for example, in the resolutions of the FAS MO dated January 24, 2014 No. F05-17623/2013, No. F05-16692/2013 dated January 20, 2014, FAS VSO dated February 25, 2014 No. A19-1342/2013, FAS North Kazakhstan region dated July 13. 2012 No. A32-11821/2011, etc.

However, there is also other judicial practice.

Results

An application to the court can be submitted on paper or electronically. State in it the arguments supporting your position. Explain why you think the tax authorities’ arguments do not correspond to reality and/or the law.

Please attach supporting documents and other papers from the list specified in Art. 126 of the APC (copies of the contested decision of the tax authority, copies of the decision of the higher tax authority on the taxpayer’s complaint, etc.).

For information on what form to use to file objections to an audit report, read the material “Writing objections to a tax audit report—sample.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.