Why does this question arise?

Many entrepreneurs who are faced with filling out invoices for the first time, or who have been dealing with them for a very long time, have a question about whether it is necessary, in addition to filling out all the required items on the invoice, to also put the organization’s seal.

And this is not surprising, because not so long ago any company was simply obliged to have an individual seal, and documents that did not have it were simply considered invalid. This is why this question comes up so often.

Looking ahead a little, we can immediately say that it is not at all necessary to put a stamp on this document.

Reference! According to the laws “On Joint-Stock Companies” and “On Limited Liability Companies”, recently companies may not have their own seal at all (if its mandatory presence is not specified in the company’s Charter).

Numbering of invoices out of order in 2021

The Tax Code does not have any requirements for the numbering order of invoices. Government Decree No. 1137 of December 26, 2011 (as amended on October 1, 2020), to which this article operates, also does not explain the numbering process. Therefore, the company develops it independently. And it is approved in the accounting policy.

Is it possible to number invoices out of order in 2021? This question is of great concern to many companies that are forced to issue a large number of invoices and deal with three, four and five-digit numbers. We will tell you whether the Tax Code of the Russian Federation has established firm rules regarding the numbering of invoices, what clarifications the Ministry of Finance gives in its letters, and whether buyers will have problems with deducting VAT if the invoice number is not in order.

07 Feb 2021 juristsib 533

Share this post

- Related Posts

- What are the benefits for traveling on railway transport for retired labor veterans?

- Sublease Agreement for Agricultural Land Sample 2020

- What is the contract price for a garden for 1 day in Ivanteevka in 2020

- Will I receive a Subsidy if, after submitting the Documents, I am 35 years old by the time I receive it?? Interested in 2021 Amendments to the Law

What is it for?

Based on the letters of the Ministry of Finance and Article 169 of the Tax Code of Russia, the presence of seals or stamps of the selling organization or the purchasing organization on the invoice is not required. Moreover, their presence is not at all stated in the rules for drawing up this document.

To affix a seal or not to affix a seal is a personal matter for each individual company. Its presence is not regulated by law, but many still install it. That is, the question of why a certain organization does not have a stamp on its invoice is not entirely relevant.

In this case, it is an additional confirmation of the conclusion of the transaction and at the same time another detail of the company on the document. Moreover, its presence does not in any way change the significance of the document, and it has full force both with and without a seal.

From what year and when was it canceled?

The first attempt to cancel the mandatory stamp on the invoice was to change Article 169, paragraph 6 of the Tax Code of Russia. This amendment came into force on January 1, 2002, after which the presence of a seal on the invoice became optional. In addition to these changes, the phrase “without a seal is not valid” was also removed from the document.

Since the sign "M.P." was not completely removed from the account, some regional tax authorities did not recognize such a document as valid and refused to calculate deductions. This caused a lot of controversy, as well as a lot of dissatisfaction on the part of the owners of such documents.

Important! "M.P." was finally removed from invoices, and the presence of the seal itself henceforth became completely optional.

If errors are made when preparing invoices and primary documents

But let's return from prospects to reality. The formats of not all of the above primary documents provide a special field to reflect the number and date of correction. And this (as mentioned earlier) is a necessary attribute for eliminating errors in the “primary”. However, this problem can be solved quite easily. After all, an economic entity has the right to supplement the document with designated fields independently: for example, the form of an electronic primary document - an information field in which information about the number and date of correction will be reflected.

*** Some courts (see Resolution of the FAS DVO dated June 10, 2014 No. F03-2116/2014 in case No. A51-17093/2013) believe that the signing of invoices by unidentified persons by virtue of clause 2 of Art. 169 of the Tax Code of the Russian Federation is already an independent basis for refusing to accept tax deductions for VAT. However, there are court decisions (see Resolution of the AS SKO dated June 11, 2015 No. F08-3452/2015 in case No. A32-26952/2012), in which the arbitrators recognized the signing of invoices by an unidentified and unauthorized person as an insignificant circumstance.

We recommend reading: When can bailiffs visit and in what case?

What happens if you don’t put it down or vice versa?

As already discussed above, if the seal is not affixed, no violations of the law or sanctions from the tax service will follow, since its presence is not at all necessary (and in most cases, all modern companies do not affix it at all).

Another question is what will happen if you do put a stamp? In fact, also nothing. The presence of a seal does not in any way reduce its legal significance, much less make it invalid.

Invoices with stamps must be accepted by all Russian tax authorities, and deductions for them are made in the same way as for invoices that do not have stamps.

Thus, stamps and seals on the account are simply additional details, and their presence is not regulated in any way by law.

Consequences if a signature is stamped

Another situation, completely different from the one discussed above, is the placement of signatures and seals on invoices. Unlike the organization's seal, the presence of a facsimile on an invoice is a serious violation.

Attention! Providing an invoice with such a signature automatically deprives the company of the right to a tax deduction, and the invoice itself is considered invalid.

Despite the fact that the Supreme Court clarified that in this case the production of a facsimile is not a violation, the position of the tax service itself remains unchanged.

In addition, even newly signed in person facsimile invoices that were previously rejected by the service also remain invalid. That is why you should absolutely not use signature seals instead of a real signature when certifying this document, since in 99% of cases such an invoice will be rejected and it will no longer be possible to receive a deduction.

Thus, when registering an invoice, the presence or absence of a seal is optional. Whether to add it or not is up to the company filling out the invoice to decide. As for seals and signatures, it is strictly forbidden to put them on this document, otherwise the invoice will become invalid and you will not be able to receive the deductions due on it.

Do I need a stamp on the invoice?

Any transaction is accompanied by the execution of a package of documents, one of which is an invoice. Basically, VAT taxpayers issue this form. Do I need a stamp on the invoice or can I do without this detail? Let's understand the current legal requirements.

The basic requirements for drawing up an invoice are listed in clauses 5-6 of the stat. 169 NK. It says in detail what details the document should contain.

For example, this is the serial number and date of issue; name of the parties to the transaction (seller, buyer, consignor, consignee); type of products or services sold; monetary and physical indicators of measurement; country of origin; total cost, VAT amount and rate, etc.

Additional requirements for the design of the form are contained in Decree of the Government of Russia No. 1137 of December 26, 2011.

This regulatory act provides line-by-line indicators that must be indicated in the invoice form.

If you carefully analyze the procedure for drawing up the document, it becomes clear that affixing a seal is not required. And the absence of this requisite will not be considered a violation of legal norms.

We figured out whether or not a stamp is placed on the invoice. This document is issued without a seal, but in a standard form and in compliance with the requirements of the stat. 169 NK.

Previously, the seal additionally certified the legality of the shipment, but has now been canceled.

How did such an innovation affect the procedure for obtaining tax deductions for VAT?

Deduction on an invoice without a stamp - legal or not

VAT is one of the main taxes, the payment of which often puts a dent in the taxpayer’s pocket. Therefore, it is important to correctly calculate this fee, reflecting not only accruals, but also deductions.

A VAT refund is recognized as legal if the documents are drawn up correctly.

Is it possible to deduct the tax for which an unstamped invoice is issued? Of course, the answer will be positive, because the seal is not a mandatory requirement.

What to do if the supplier of products (services) nevertheless issued the buyer a stamped invoice? Can its buyer deduct tax on such a transaction? Even if the counterparty has issued a stamped invoice for the client, the tax deduction is reflected in the accounting records without changes. Of course, provided that all mandatory requirements for filling out the document are met.

Read our article about the application of new invoices from October 2021.

New invoice form for the year: form and sample filling

As of October 1, 2017, changes have been made to the procedure for filling out line 2a of the invoice. Currently, this line indicates the location of the seller-organization in accordance with the constituent documents or the place of residence of the seller-individual entrepreneur. From 01.10.17, in line 2a it will be necessary to indicate the address of legal entities specified in the Unified State Register of Legal Entities, or the place of residence of an individual entrepreneur indicated in the Unified State Register of Legal Entities. You can check the address in the register on the official website of the Federal Tax Service using a special service. Here is the link. Also see “Exclusion of legal entities from the Unified State Register of Legal Entities from September 1, 2021.”

The code of the type of goods according to the foreign economic activity product nomenclature was required to be shown in invoices before October 1 (subclause 15, clause 5, article 169 of the Tax Code of the Russian Federation). However, there was no special column for this before, so the product code was usually indicated in column 1 - after the name of the goods.

Can an invoice be without a signature, only with a stamp?

Please tell me: suppliers receive invoices and delivery notes without signatures, only with stamps. Is it correct? After all, the fact of transfer of goods is confirmed by signatures, and invoices are not stamped at all.

No, that's right.

The invoice must be signed. It must be signed by the head and chief accountant of the selling organization (performer). Printing on the invoice is optional.

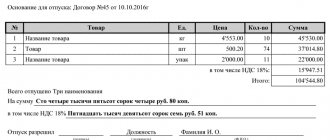

The primary document (invoices) must be signed. Moreover, in such a way that it is possible to identify those who signed it (persons responsible for processing the transaction). In the consignment note (form TORG-12), printing is required.

The rationale for this position is given below in the materials of the Glavbukh System for commercial organizations and simplified

1. Recommendation: Who can sign the invoice

Signatures of responsible persons

The invoice on paper must be signed by the manager and chief accountant of the selling organization (performer). The invoice can also be signed by other persons authorized to do so by order of the manager or by power of attorney on behalf of the organization.*

An invoice issued on behalf of an entrepreneur can be signed either by the entrepreneur himself or by the person to whom the entrepreneur has issued the appropriate power of attorney.

For example, an accountant who keeps records of a businessman’s activities.

In both cases, the invoice must indicate the details of the state registration certificate of the entrepreneur.

An invoice drawn up in electronic form must be certified by an enhanced qualified electronic signature of the head of the organization or another person authorized to do so by order of the head or power of attorney of the organization.

If the supplier (executor) is an entrepreneur, he must certify the electronic invoice with his enhanced qualified electronic signature.

When an organization prepares an invoice in electronic form, the indicator “Chief Accountant (signature) (full name)” is not generated.

This procedure follows from the provisions of paragraph 6 of Article 169 of the Tax Code of the Russian Federation, paragraph 8 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, paragraph 1.5 of the Procedure approved by Order of the Ministry of Finance of Russia of April 25, 2011 No. 50n.

Olga Tsibizova,

Head of Indirect Taxes Department

tax and customs tariff policy of the Ministry of Finance of Russia

2. Directories: List of documents on which the organization’s seal is required (optional)

| Documentation | Is a seal required? | Base |

| Material documents by type of transaction | ||

| Documents for accounting of trade transactions | Mandatory: only in the consignment note (TORG-12 form) and the goods journal of a small retail trade employee (TORG-23 form) - space for printing is provided in the document forms. However, the instructions for filling out these documents do not say anything about printing. | Instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 |

| Optional: in all other cases. For example, in the act of acceptance of goods (form TORG-1), invoice for internal movement, transfer of goods, containers (form TORG-13), act of write-off of goods (form TORG-16), goods report (form TORG-29) and etc.* | ||

| Tax documents | ||

| Invoice | Optional | Law No. 57-FZ of May 29, 2002 amended paragraph 6 of Article 169 of the Tax Code of the Russian Federation, Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137* |

| Tax return | Mandatory: stamps must be placed only where required by the instructions for filling out the form. That is, there is no need to stamp all the sheets that have the signature of the manager or representative | Orders of the Ministry of Finance of Russia and the Federal Tax Service of Russia on the approval of declaration forms |

3. Recommendation: How to organize document flow in accounting

Signatures in documents

Draw up all primary documents when performing a transaction (transaction, event). And if this is not possible - immediately after the end of the operation (transaction, event). Responsibility for registration lies with the employees who signed the primary document.

Such rules are established by Article 9 of the Law of December 6, 2011 No. 402-FZ.

The list of employees who have the right to sign primary documents can be approved by the head of the organization by his order.

At the same time, the procedure for signing documents used to formalize transactions with funds is regulated, in particular, by Bank of Russia Directive No. 3210-U dated March 11, 2014 and Bank of Russia Regulation No. 383-P dated June 19, 2012. This was stated in the letter of the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012.

In any case, the primary document must be signed in such a way that it is possible to identify those who signed it (the persons responsible for processing the transaction). That is, the signatures in the document must be decrypted. *

This follows from Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ and is confirmed by the letter of the Ministry of Finance of Russia dated September 10, 2013 No. 07-01-06/37273.

Unlike organizations, an individual entrepreneur cannot transfer the right to sign primary documents to third parties. This is directly indicated in paragraph 10 of the Procedure, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxes of Russia No. BG-3-04/430.

Sergey Razgulin,

Actual State Councilor of the Russian Federation, 3rd class

* This is how part of the material is highlighted that will help you make the right decision

Invoice Errors: Important or Not

If at the time of payment the specific name and quantity of goods is still unknown (for example, they are shipped in accordance with the application/specification issued after payment), then the invoices must indicate the general name of the goods or their groups. Such names must be taken from the contract. For example: petroleum products, confectionery products, bakery products, stationery, etc. Letters of the Ministry of Finance dated July 26, 2011 No. 03-07-09/22, dated March 6, 2009 No. 03-07-15/39

The list of codes for types of transactions to be indicated in column 4 of part 1 and part 2 of the invoice accounting journal was approved by the tax service and Order of the Federal Tax Service dated February 14, 2012 No. ММВ-7-3/ [email protected] , a total of 13 such codes. At the same time, approved the codes do not cover the entire variety of transactions that an accountant encounters, and among them there is no code under which other transactions not listed in the list could be reflected.

Is there a stamp on the invoice for payment, how to fill out the invoice, is the invoice for payment an agreement?

An invoice for payment is a document with the recipient’s details, according to which funds are transferred for named inventory items (services, work) by the payer (customer, buyer), and, in fact, the amount of these funds.

It is important both for the party issuing it and for the recipient, since it contains all the information that is needed to complete the transaction.

Through it, the validity of the received (made) payment is confirmed, that is, it is a supporting document for accountants and financiers when writing off the owner.

How to fill out an invoice for payment?

Basically, two copies of such a document are drawn up:

- one is addressed to the buyer for payment;

- the second is addressed to the financiers (accountants) of the company.

Rules for issuing an invoice for payment. The invoice cannot do without indicating:

- numbers and dates of its registration;

- bank details of the company, its name (full name of the individual entrepreneur);

- Information identifying the agreement in pursuance of which it is written (if there is such an agreement);

- correct and accurate name of inventory items (works, services), price per item, total cost of all named goods (services);

- the amount of taxes included in the price;

These are all mandatory details that must be used to issue an invoice for payment.

Optionally you can also include:

- terms of sale (provision of services);

- possibility of self-pickup;

- Contact phone numbers;

- promotional offers, etc.

Forms and samples of invoices for payment

What if the invoice is incorrect?

If you provide incorrect information on the form, the payment will either be returned or will be listed as outstanding by the bank. Accordingly, the company will lose time and effort to return the money and make a new transfer.

It is likely that there will be a disruption in delivery (other obligations of the counterparty) and disciplinary consequences in relation to employees who made inaccuracies.

Normative base

In the albums of forms of primary accounting documentation currently used, there is no unified form of invoice; this issue is not directly regulated in the legislation.

Most companies independently develop the appropriate forms as one of the annexes to the order issued on the accounting policies and document flow schedule, and approve it on the basis of clause 4 of Art.

9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, clause 15 of the Regulations on Accounting and Financial Reporting in the Russian Federation.

Thus, the organization itself decides how to correctly fill out an invoice for payment.

Invoice number and date

The number and date should always be reflected on the form. A unique number is assigned, and the date corresponds to the date of its issue (the day the invoice was issued).

The procedure for movement and storage of invoices among the relevant divisions of the company is determined by the approved document flow schedule.

If the seller is not required to pay value added tax, then the phrase “excluding VAT” must be printed under the table.

Is there a stamp on the invoice for payment?

“Do I need a stamp on the invoice for payment?” – one of the most popular questions regarding document preparation.

The absence of a seal will not invalidate the invoice. It must contain only those details that appear in Federal Law No. 402 of December 6, 2011.

“On Accounting” - the seal is not named there, so its presence is not required.

Thus, printing on the invoice for payment is mandatory, only according to the customs of business document flow

Who signs the invoice for payment?

According to the law, as of 2021, the personal signatures of employees who are responsible for carrying out a business transaction and its correct execution must be present in such a document.

Usually it is signed by the head of the company and the chief accountant (or other persons to whom powers have been delegated by the appropriate power of attorney). Thus, an ordinary manager can sign an account if he has a power of attorney allowing him to do this.

How to properly issue an invoice for payment. Do you need the original?

When contacting a counterparty, you must remember that the invoice can be a copy if the parties have originals of other documents - agreement, invoice, certificate of completion, etc. The decision to write off funds (or request the original) is made by the organization itself based on the principles of security and prudence.

Is an invoice a contract?

It is no secret that, given the peculiarities of work in the sales field, issuing an invoice is equivalent to an offer, and transferring money is an acceptance of such an offer. But to be identical to a contract, it must reflect all the conditions that are essential for contracts of a certain type.

In relation to the purchase and sale, this is a condition about the inventory items being sold (quantity and name), the deadlines for the transfer of such assets (as an option, within a calendar month from the moment the money is credited to the seller’s account), thus the deadline for payment of the invoice, so is very important.

If the essential terms are not reflected in the invoice, its issuance and payment are not equivalent to the conclusion of an agreement.

TOP 11 errors in primary invoices and invoices that will not affect taxes

Vitaly Sazansky recalled that tax authorities should be able to identify the taxpayer using an invoice. If the required invoice details (for example, name, INN/KPP of the buyer) are filled out correctly, the company should not have problems with VAT deductions due to shortcomings in the indication of addresses.

There is no stamp or facsimile on the “primary document”

True, sometimes companies in court manage to defend the right to deduction even in the absence of the chief accountant’s signature on the documents. For example, if the company’s staff does not provide for the specified position and the duties of the chief accountant are performed by the head (resolutions of the FAS East Siberian dated 04.12.11 No. A19-11133/08, North Caucasus dated 04.23.10 No. A53-3903/2021, Moscow dated 01/16/09 No. KA-A40/11421-08 and Ural district dated 05/05/08 No. F09-3199/08-S2).

How to correctly fill out an invoice to document the sale of goods (services)? The invoice form is not regulated by anyone, so the organization has the right to independently create an invoice form. The only rule is the presence in the form of the main details that are needed in order to document the facts of economic activity. To correctly fill out an invoice for payment, you must provide the following required information:

We recommend reading: Which family is considered low-income in 2021 in the Altai Territory

An invoice can be considered as an offer in which the seller (supplier) offers the buyer to purchase a certain product or service for a fixed amount. According to Art. 435 of the Civil Code of the Russian Federation recognizes a specific proposal sent to addressees, which fully expresses the intention of the person who sent it to enter into a contractual relationship with the addressee.

Invoice for payment: details of its completion

The absence of a seal will not invalidate the invoice. It must contain only those details that appear in Federal Law No. 402 of December 6, 2021. “On accounting” - the seal is not named there, so its presence is not required. Thus, printing on the invoice for payment is mandatory, only according to the customs of business document flow

If the seller or buyer are the largest taxpayers, the invoice may indicate their checkpoint assigned both when registering as the largest taxpayer, and when registering at their location (Letter of the Ministry of Finance dated May 14, 2021 N 03-01-10 /4-96).