Payer status codes for 2021

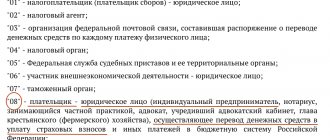

Until September 2021 inclusive, the following values apply:

- “01” - taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - legal entity;

- “02” - tax agent;

- “06” - participant in foreign economic activity (FEA) - legal entity;

- “08” - payer - a legal entity (individual entrepreneur, lawyer, notary, head of a farm), transferring funds to the budget system except for taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” - the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “13” - an individual paying taxes, fees for the performance of legally significant actions by tax authorities, insurance premiums and other payments administered by tax authorities;

- “16” - participant in foreign trade activities - an individual;

- “17” - participant in foreign economic activity - individual entrepreneur;

- “18” - a payer of customs duties who is not a declarant;

- “19” - organizations and their branches that transfer funds withheld from the wages (income) of a debtor - an individual to repay debts on payments to the budget on the basis of an executive document;

- “21” - responsible participant in the consolidated group of taxpayers (CGT);

- “22” - member of the group;

- “24” - payer - an individual transferring funds to pay fees, insurance premiums administered by the Social Insurance Fund, and other payments to the budget (except for fees for the performance of legally significant actions by tax authorities and other payments administered by tax and customs authorities);

- “28” - participant in foreign trade activities - recipient of international mail.

Starting October 1, 2021, the values "09", "10", "11" and "12" cannot be used. For all individuals (including individual entrepreneurs, lawyers, etc.) the same value will remain - “13” (see “How to fill out payments for taxes and contributions in 2021: do not miss important innovations”).

Automatically generate a tax payment invoice based on the data from the declaration and submit reports via the Internet

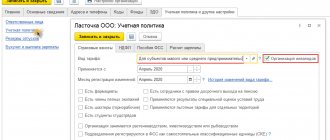

Filling out a payment form for taxes, fees and insurance premiums: current standards

The main source of law, which sets out the rules for indicating the status in payment orders sent to the bank in order to fulfill budget obligations, is Appendix 5 to Order No. 107. In accordance with these rules, the status of the payer should be considered as the key identifier of the person generating the order for the transfer of financial funds into the budget system of the Russian Federation.

The relevant information must be indicated in details 101 of the payment order. It can record statuses such as:

- 01 - indicated by the taxpayer in the status of a legal entity (this could be, for example, LLC, JSC, PJSC);

- 02 - indicated by the tax agent (this can be a legal entity or individual entrepreneur, who, for example, are required to calculate personal income tax from the salaries of employees and transfer it to the budget);

- 03 - indicated by the FPS organization (actually, this is the Federal State Unitary Enterprise “Russian Post”);

- 04 - indicated by the tax authority (these are the Federal Tax Service of Russia and its territorial divisions);

- 05 - indicated by the territorial structure of the Federal Bailiff Service;

- 06 - indicated by the legal entity carrying out foreign economic activities;

- 07 - indicated by the customs authority (that is, the Federal Customs Service);

- 08 - indicated by a legal entity, individual entrepreneur, notary, lawyer, head of a farm who transfer funds to pay insurance premiums and other payments to the Russian budget system;

- 09 - individual entrepreneur is indicated (when paying various taxes, for example, with OSN, simplified tax system, UTII);

- 10, 11, 12 - indicated respectively by notaries, lawyers, farmers (also when paying taxes);

- 13 - indicated by the payer in the status of an individual who owns a bank account;

- 14 - indicated by the payer who carries out transactions in favor of individuals;

- 15 - indicated by the credit structure or its branch, paying agent, FPS when drawing up orders with a register for a transfer accepted from an individual;

- 16, 17 - indicated respectively by individuals and individual entrepreneurs carrying out foreign economic activities;

- 18 - indicated by the payer of customs duties, who is obliged to pay them by force of law, but is not a declarant;

- 19 - indicated by legal entities that collect debts to the budget from the salaries of hired employees on the basis of a received executive document;

- 20 - indicated by credit institutions, as well as their branches that issue orders for the transfer of funds for individual payments by individuals;

- 21, 22 - indicated by responsible participants who are part of consolidated groups of payers and ordinary participants, respectively;

- 23 - indicated by the body monitoring the payment of contributions to extra-budgetary funds;

- 24 - indicated by an individual who pays insurance premiums, taxes, fees and other payments to the budget of the Russian Federation;

- 25 - indicated by guarantor banks when generating orders in the process of VAT refund, when paying excise taxes;

- 26 - indicated by the founders of the debtor company, the owners of the property of the unitary enterprise, as well as third parties intending to collect the debt from the corresponding company in the bankruptcy process.

Note! From October 1, 2021, the following statuses are excluded: 09,10,11,12. They will be replaced by a single status 13. At the same time, the following statuses will be excluded: 18, 21, 22, 25, 26. And from 07/01/2021 two new statuses will be introduced. Which ones and for whom they will be intended, see ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

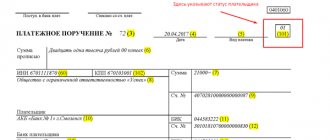

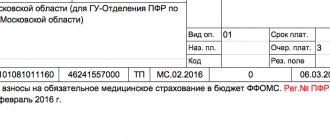

Where to indicate taxpayer status in a payment order

The status is entered in field 101 of the payment. Its form is given in Appendix No. 3 to the Bank of Russia Regulation No. 383-P dated June 19, 2012.

ATTENTION. If you fill out field 101 incorrectly, the money will fall into the category of unexplained payments, and the organization or individual entrepreneur will have a debt. Then you will have to make clarification. To do this, you need to submit an application to the tax office, indicate the payment details and report that an error was made in field 101. The Federal Tax Service will carry out a reconciliation and offset the funds against the arrears of the required tax, fee or insurance premiums.

Value in payment

For correct crediting to the budget, you must correctly indicate the value in the appropriate field. If a specialist or accountant makes mistakes, the Treasury will designate the payment as “unclarified,” which will not contribute to the timely fulfillment of the monetary obligation, since it will take time to clarify the payment details.

The total values, in accordance with regulatory documentation, are 28. The main ones are:

- 01 - the organization transfers mandatory fees;

- 02 - companies and individual entrepreneurs pay as agents;

- 08 - contributions for injuries;

- 09 — individual entrepreneur performs duties to the supervisory authority;

- 10 - engaged in private practice;

- 11 - lawyers;

- 12 - heads of peasant farms;

- 13 - individual.

Point 14 is currently excluded.

Where can I get the data to accurately fill out the payment order in field 101? All values are indicated in Appendix No. 5 to Order of the Ministry of the Russian Federation dated November 12, 2013 No. 107n. The last changes to it were made on 04/05/2017, some of which came into force on 10/02/2017. This document should be used as a guide when filling out the payment order form. Below are examples of the most common values in practice.

Features of payer status for individual entrepreneurs

In January-September 2021, individual entrepreneurs enter the following payer status codes:

- “09” - when paying taxes (except personal income tax on employee salaries) and fees;

- “02” - when paying personal income tax on employees’ salaries;

- “09” - when paying insurance premiums “for yourself”;

- “09” - when paying insurance premiums from employees’ salaries.

Starting from October 2021, codes for individual entrepreneurs will be as follows:

- “13” - when paying taxes (except personal income tax on employee salaries) and fees;

- “02” - when paying personal income tax on employees’ salaries;

- “13” - when paying insurance premiums “for yourself”;

- “13” - when paying insurance premiums from employees’ salaries.

Fill out a free payment slip for individual entrepreneurs with the current details for today

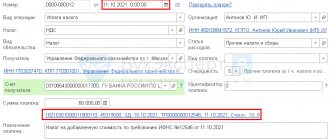

How to fill out field 101 correctly?

The payer's status is determined in accordance with his activities. For each category of persons, the code designation will be individual.

Since 2021, the list of combinations has increased due to the fact that it has become possible to make transfers not personally, but through proxies. In addition, payment for insurance is now made through the tax service, so filling out a payment slip for insurance premiums will differ from a settlement document for paying taxes only in the purpose of the payment and the budget classification code.

In what case and what to indicate?

To correctly determine the payer status, you need to familiarize yourself with the decoding of the codes for the “101” field. The combination encrypts not only the position of the person who deposits the funds, but also the purpose of the payment.

For example, to deduct taxes, legal entities need to enter the code “01” , and individual entrepreneurs need to indicate the payer status “09” . Organizations that transfer income tax for employees write code “02” , and companies that withhold part of an employee’s salary to pay off his debt on mandatory payments write “19” . Code “20” is entered by banks or payment agents that prepared a document on money transfers from individuals for each payment.

List and explanation of statuses.

Status “13”, what is it?

Previously, code “13” was indicated by individuals who were owners of open bank accounts. In the latest amendments to the order of the Ministry of Finance dated 04/05/2017, the situation was changed. Now this code is indicated by individuals paying taxes, insurance premiums and other payments.

Status “24”, what is it?

In the new edition, the meaning of the combination “24” has been expanded. Since 2017, the code has been entered by individuals paying insurance premiums or other payments, with the exception of tax and customs duties.

Status “08”, what is it?

The status of “08” was also affected by changes. Previously, it was entered only by legal entities and individual entrepreneurs to make non-tax payments. Now the number of payers has been added:

- private notaries;

- lawyers practicing individually;

- heads of peasant farms.

Important: in one of the changes to the document it was proposed to use code 08 for contributions to the Social Insurance Fund for “injuries” for employees, but since many errors arose due to this provision, it was decided to leave code “08” for non-tax transfers.

Sample payment order with payer status

IP Feofanov uses a simplified taxation system. He employs two employees.

In February, Feofanov transferred pension contributions from the salaries of his employees for January 2021. He entered “09” in field 101 of the payment slip.

Feofanov transferred the contributions “for himself” in March 2021. At the same time, in field 101 he put the code “09”. The same value is indicated in the payment order for the payment of a single “simplified” tax for 2020. And when transferring personal income tax from the salaries of employees, the individual entrepreneur reflects the payer status “02”.

Please note: errors when filling out payment slips for taxes and insurance premiums can be avoided if you generate payment slips automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in one click based on data from the declaration (calculation) or the request for tax payment (contribution) sent by the inspectorates. All necessary details - codes for payer status, KBK, UIN, recipient data - are updated automatically in the service, without user participation. When filling out the payment slip, the current values are entered automatically.

How to determine the value for state employees?

A unified system for identifying field 101 in payments is established at the legislative level. Officials in Appendix No. 5 to Order of the Ministry of Finance No. 107n dated November 12, 2013 listed the general rules for filling out the field.

In field 101, the payment processor must indicate a special code that corresponds to the type of payment, category of payer and recipient of the transferred funds. Key values for a budget organization are indicated in the table.

| Status | Purpose | Example |

| 01 | Payment of taxes, fees, insurance premiums and other payments administered by the Federal Tax Service | When transferring compulsory medical insurance, compulsory health insurance or VNiM contributions |

| 02 | Calculations of tax obligations in cases where the company acts as a tax agent | Calculations with the budget for personal income tax, payment of VAT by a tax agent |

| 08 | Settlements with the budget, with the exception of tax obligations controlled by the Federal Tax Service | Payment of contributions to the Social Insurance Fund for accidents and occupational diseases |

| Do not fill out | Settlements with counterparties, including suppliers and contractors, buyers and customers, staff and freelancers | Transfer of wages, advance payment under a supply agreement, final payment for services of third-party companies |

For information on how to correctly fill out the remaining fields of a payment order, read the separate material “Sample of filling out a payment order.” And in order not to get confused in filling out the details for paying insurance coverage for hired employees, read the article: “How to pay insurance premiums for a budget organization.”