Methods for submitting information to the Pension Fund

To make it more comfortable for entrepreneurs, several options for submitting documents are offered:

- Personal visit. The entrepreneur himself comes to the Pension Fund and submits reports to the service employee in paper or electronic form. It should be noted that you can bring paper documents containing information about no more than 50 employees. Otherwise, in accordance with the law, you must submit reports on a flash drive. A few years ago they accepted disks and floppy disks. Today these carriers are no longer accepted. To reflect financial flows electronically, an individual entrepreneur needs to master computer skills using specific programs. An electronic digital signature and a pre-verified agreement with the Pension Fund will be required.

- Sending by mail. This transfer method eliminates the need to wait in line outside the office for a long time. The report is included in the letter. It is recommended to issue it by mail as a registered one. This way, the entrepreneur will receive confirmation that the letter has been delivered personally to the Pension Fund employee. In this case, the date of dispatch is considered the date of submission of documents.

Please note that the postal service may provide reports with a delay. If Pension Fund employees do not receive documents on time, they will send a report explaining the violation. If the payer does not respond in a timely manner, the Pension Fund will block the counterparty's accounts. Therefore, it is better to send reports in advance, and be responsible for sending the information yourself.

Advice! It is best to save your printed and completed forms after submitting your information electronically. The Pension Fund may request documents again to clarify the data.

The Pension Fund reminds: reporting deadlines in 2021

For employers, the reporting campaign to the Russian Pension Fund began in January 2021. The PFR branch for the Republic of Sakha (Yakutia) reminds the deadlines for submitting the Unified Reporting Form to the Pension Fund for 2015. Thus, the date of submission of reports in paper form is February 15, 2021, in the form of an electronic document – February 20, 2021.

In addition, in February, the last day of the period for submitting the Unified Reporting Form in paper form coincides with the last day of payment of insurance premiums for January. In order to pay insurance premiums and submit reports on time, the Pension Fund advises employers not to wait until the last day. For those who violate the deadlines for submitting calculations, the law provides for the application of penalties.

Employers must submit unified reporting quarterly no later than the 15th day of the second calendar month in paper form. In the form of an electronic document - no later than the 20th day of the second calendar month following the reporting period (quarter, half-year, nine months and calendar year). If the last day of the period falls on a weekend or non-working holiday, then the end of the period is considered to be the next working day following it. If the number of employees exceeds 25 people, reporting must be submitted electronically with an electronic digital signature.

Programs for preparing and checking reports, which greatly simplify the process of submitting reports, are freely available on the PFR website www.pfrf.ru in the “ Electronic Services ” section. In addition, you can use the electronic service of the website “Cabinet of the Insurance Contribution Payer”. All document forms, data formats, and reporting verification rules are posted here. In the Account you can view the register of payments, receive a certificate on the status of settlements, issue a payment order, calculate insurance premiums, issue receipts, check statements and much more in real time.

As Mikhail Argunov, head of the department for organizing the administration of insurance premiums and debt collection of the PFR Branch of the Republic of Sakha (Yakutia), told us, to date, of the total number of insurance premium payers, 14,382 policyholders and entrepreneurs have submitted reports. Of these, 13,302 are in the form of an electronic document.

In total, policyholders will need to report 4 times this year. Quarterly reports in paper form will need to be sent no later than February 15, May 16, August 15, November 15, electronically - February 20, May 20, August 22, November 21.

From April 2021, a new simplified form is being introduced: every month, employers will have to report the SNILS, full name and TIN of their employees to the Pension Fund. This form is being introduced to timely record the pension rights of pensioners who have stopped working.

Share news

Why is it better to hire a specialist?

Some difficulties await people who submit documents taking into account the demonstration of the number of hired employees, as well as their age limits. It is very difficult to avoid mistakes. To avoid errors, as well as to avoid fines, it is recommended to hire an experienced specialist. He must have an excellent understanding of the calculation of insurance premiums, amendments, innovations and all existing bills that relate to the Pension Fund service.

It is recommended to discard the idea that if you have crossed the time limit for waiting for papers, then they have forgotten about you. This option is possible when working with non-governmental services. The state apparatus works in such a way that all processes are under strict control. Civil servants receive salaries for regularly researching necessary processes.

Where to submit RSV-1 for 2021

The electronic RSV-1 report form is required to be submitted by payers whose average number of employees for 2021 is 25 people or more. All other payers can provide reporting in one of the ways, at their own discretion: either in paper form or electronically.

The report for 2021, as before, should be submitted to the relevant territorial divisions of the Pension Fund at the location of the enterprise or at the place of residence of the entrepreneur. It should be borne in mind that this is the last time funds will accept reports of this type. From January 1, 2021, the functions of administering insurance pension payments are transferred to the tax authorities, which will subsequently accept reports. At the same time, primary and updated reporting for reporting periods up to 2017 will continue to be provided to the Pension Fund.

What a sole proprietor needs to know

The individual entrepreneur must provide information about persons who are registered in the Pension Fund system. This makes it possible to monitor the income of those who have already retired. Among other things, the authorities have adjusted the system of liability borne by a payer who fails to provide information on payment of contributions on time. Thus, the government will deprive pensioners of payments if their salary is above a certain level. These documents must be submitted every month. The Ministries of Finance and Labor are going to save budget money on working pensioners. In addition, in the process of calculating pensions next year, the calculation will be for the standard 12 calendar months, and not for the calendar year, which begins in January and ends in December.

All forms of quarterly and annual reporting for 2021

The review includes only quarterly and annual reporting forms for 2021. Monthly reporting: SZV-M mineral extraction tax, gambling tax, etc. not indicated in the table.

| Declaration form, calculation, information | Approved | Deadline |

| Form 4 FSS of the Russian Federation. Calculation of accrued and paid insurance premiums for mandatory social services. insurance in case of temporary disability and in connection with maternity and compulsory social services. insurance against industrial accidents and occupational diseases | Approved by order of the Federal Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 (as amended on July 4, 2016) | January 20 (hard copy) January 25 (in the form of an electronic document) |

| VAT and excise taxes | ||

| Presentation of the log of received and issued invoices in the established format in electronic form for the fourth quarter of 2021. The log is submitted by non-VAT payers, taxpayers exempt under Article 145 of the Tax Code, not recognized as tax agents, in the case of issuing and (or) receiving invoices by them - invoices when carrying out business activities under intermediary agreements. | Clause 5.2. Article 174 of the Tax Code of the Russian Federation | January 20th |

| Submission of a tax return on indirect taxes when importing goods into the territory of the Russian Federation from the territory of member states of the Eurasian Economic Union | Approved by order of the Ministry of Finance of the Russian Federation No. 69n dated 07.07.10 | January 20th |

| Tax return for value added tax | Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 10/29/14 | The 25th of January |

| UTII | ||

| Tax return for UTII | Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 07/04/14 (as amended on 12/22/2015) | January 20th |

| Unified (simplified) tax return | ||

| Unified (simplified) tax return | Approved by order of the Ministry of Finance of the Russian Federation No. 62n dated 10.02.07 | January 20th |

| Water tax | ||

| Tax return for water tax | Approved by order of the Federal Tax Service of Russia dated November 9, 2015 N ММВ-7-3/ [email protected] | January 20th |

| Information on the average number of employees | ||

| Information on the average number of employees for the previous calendar year | Approved by Order of the Federal Tax Service of the Russian Federation dated March 19, 2007 No. MM-3-25/ [email protected] | January 20th |

| Transport tax | ||

| Tax return for transport tax | Order of the Federal Tax Service of Russia dated February 20, 2012 N ММВ-7-11/ [email protected] (as amended on April 25, 2014) | 1st of February |

| Land tax | ||

| Tax return for land tax | Approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10/28/11 ( as amended by Order of the Federal Tax Service of Russia dated 11/14/2013 N ММВ-7-3/ [email protected] ) | 1st of February |

| Insurance contributions to the Pension Fund and Health Insurance Fund | ||

| Calculation of accrued and paid insurance premiums for compulsory pension insurance in the Pension Fund of the Russian Federation, insurance premiums for compulsory medical insurance in the FFOMS and TFOMS by payers of insurance premiums making payments to individuals (RSV-1 PFR) | Approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 194p dated 06/04/15 | February 15 (hard copy) February 20 (in the form of an electronic document) |

| Calculation of accrued and paid contributions to the Pension Fund of the Russian Federation, used when monitoring the payment of contributions for employers paying contributions for additional social security (form RV-3 PFR) | Approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 20, 2015 N 269p | February 15 (hard copy) February 20 (in the form of an electronic document) |

| Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and insurance contributions for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund by heads of peasant (farm) households (form RSV-2 PFR) | Approved by Resolution of the Board of the Pension Fund of the Russian Federation dated September 17, 2015 N 347p | 28th of February |

| Income tax | ||

| Tax return for corporate income tax | Approved by order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/ [email protected] | March 28 |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld | Approved by order of the Federal Tax Service of Russia dated 03/02/2016 N ММВ-7-3/ [email protected] | March 28 |

| Tax return for income tax of a foreign organization | Approved by order of the Ministry of Taxes and Taxes of the Russian Federation dated January 5, 2004 No. BG-3-23/1 | March 28 |

| Tax return on income received by a Russian organization from sources outside the Russian Federation | Approved by order of the Ministry of Taxes and Taxes of the Russian Federation dated December 23, 2003 No. BG-3-23/ [email protected] | March 28 |

| Property tax | ||

| Tax return for corporate property tax | Approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/895 dated November 24, 2011 ( as amended by Order of the Federal Tax Service of Russia dated November 5, 2013 N ММВ-7-11/ [email protected] ) | 30th of March |

| Financial statements | ||

| Financial statements | Approved by Order of the Ministry of Finance No. 66n dated 07/02/10 ( as amended by Order of the Ministry of Finance No. 57n dated 04/06/2015 ) | March 31 |

| Simplified accounting (financial) reporting | Approved by Order of the Ministry of Finance No. 66n dated 07/02/10 ( as amended by Order of the Ministry of Finance No. 57n dated 04/06/2015 ) | March 31 |

| Single tax paid in connection with the application of the simplified tax system | ||

| Tax return for tax paid in connection with the application of the simplified taxation system | Approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected] | March 31 (organizations) May 2 (IP) |

| Unified agricultural tax | ||

| Tax return for the unified agricultural tax | Approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 07.28.14 | March 31 |

| Personal income tax | ||

| Providing tax agents with information about the impossibility of withholding personal income tax from individuals (form 2-NDFL) | Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.30.15 | March 1 |

| Calculation of personal income tax amounts calculated and withheld by the tax agent (form 6-NDFL) | Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.30.15 | April 3 |

| Certificate of income of an individual (form 2-NDFL) | Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.30.15 | April 3 |

| Tax return for personal income tax (form 3-NDFL) | Approved by order of the Federal Tax Service of Russia dated December 24, 2014 N ММВ-7-11/ [email protected] (as amended on October 10, 2016) | May 2 |

| Pollution charge and environmental fee | ||

| The calculation of payment for negative impact on the environment | The form has not yet been installed | 10th of March |

| Calculation of the amount of environmental fee | Approved by order of Rosprirodnadzor dated August 22, 2016 N 488 | 14th of April |

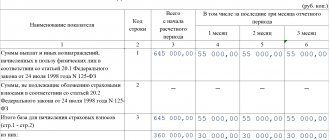

Amount of insurance premiums

The contribution for entrepreneurs in 2021 will be charged at 30%. They are distributed like this:

- 22% will be transferred to the Pension Fund service without distribution into the savings and insurance shares for pension payments. In this case, the KBK participates, the purpose of which is to make contributions to the insurance portion of the pension.

- 2.9% – for Social Insurance Fund assets.

- 5.1% – for FFOMS.

It is worth considering that a tariff of 22% operates until the employee’s contributions do not exceed a certain amount. After this, payments will be made at a rate of 10%. Please note that next year, individual companies will be allowed to enjoy reduced rates for insurance payments.

Pension Fund reporting for employers

Since all employers who pay insurance premiums will report, it would be a good idea to consider the contribution rates:

- in the Pension Fund - 22%,

- in the Federal Compulsory Medical Insurance Fund - 5.1%,

- in the Social Insurance Fund - 2.9%.

The total rate is 30%.

Employers in 2021 legislation are advised that in the new year, personal income tax has undergone such changes as no other tax, as described in the tax procedure of Federal Law No. 113-FZ (dated 05/02/2015).

These changes in personal income tax in 2021 are reflected in the table

Program for submitting reports to the Pension Fund of Russia in 2021 online

Undoubtedly, it is more convenient and faster to submit the form via the Internet. However, if there are fewer than 25 employees, reporting on paper is sufficient.

A program called "Spu_orb" provides the latest free version of the report. Testing has shown that this is one of the most successful ways to organize financial reporting in electronic form. To install, you don’t need any connection application or power of attorney, just download it from the Pension Fund website and install the file for yourself.