Our new article contains the 2021 tax calendar. It will help individual entrepreneurs who carry out their activities independently, without hiring employees, and entrepreneurs who use hired labor.

To help you quickly navigate when and what reports need to be submitted, when to pay taxes and contributions to an individual entrepreneur in 2021 on different taxation systems, we have collected all the data in tables. For the convenience of users, the name of each report or tax contains a link, by clicking on which you can get additional information on calculations and.

Tax legislation in the Russian Federation changes frequently, and the rules for paying or filing certain taxes may change over time. We monitor changes in legislation and make appropriate changes. All you have to do is bookmark this page and periodically look at the tables so as not to miss the deadline for submitting a report or paying taxes in 2021.

Tax calendar for 2021: reporting deadlines

The table below reflects the reports that individual entrepreneurs must submit, both those using hired labor and individual entrepreneurs without hired workers.

| Tax system | Reporting | Deadline |

| OSN | VAT declaration (transmitted only in electronic format, starting from 2015) |

|

| OSN | Declaration in form 3-NDFL | For 2021 – until April 30, 2021 |

| OSN | Declaration in form 4-NDFL (about future profits) | Up to 5 days after the end of the month in which the profit was made |

| simplified tax system | Declaration according to the simplified tax system | For 2021 – until April 30, 2021 |

| UTII | Declaration on UTII |

|

| Unified agricultural tax | Declaration on Unified Agricultural Tax | For 2021 – March 31, 2021. |

| PSN | No reporting provided. It is necessary to submit an application for the use of PSN. | No later than 10 days before the start of application of the patent tax system. |

What reports are required to be submitted by individual entrepreneurs and employees?

If an individual entrepreneur hires workers, he reports to the Pension Fund, Social Insurance Fund and submits additional documents to the tax office.

In addition to declarations for a specific tax regime, individual entrepreneurs and employees submit:

To the tax office:

- declaration 2-NDFL once a year for each employee;

- information on the average number of employees - once a year;

- calculation of 6-NDFL - once a quarter;

- Insurance premiums are calculated once a quarter.

To the Pension Fund:

- report on insured employees in the SZV-M form - once a month;

- report on work experience in the form SZV-STAZH and EDV-1 - once a year.

To the Social Insurance Fund:

- report on contributions for injuries in Form 4-FSS.

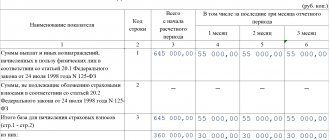

Reporting for individual entrepreneurs with employees in 2018

This table reflects reports exclusively from individual entrepreneurs with employees. Individual entrepreneurs who do not have employees do not submit these reports.

| Report name | Form approved | Place of submission of the report | Report submission deadline |

| 6-NDFL | By Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450 | Inspectorate of the Federal Tax Service | Rented quarterly. Last day of the first month of the next quarter:

|

| 2-NDFL | By Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485 | Inspectorate of the Federal Tax Service | Rented once a year.

|

| RSV-1 | By Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551 | INFS | Rented quarterly. Report on paper (with an average number of employees up to 25 people) - before the 15th day of the second month following the reporting quarter:

Electronic report (if there are more than 25 employees):

|

| Report on average headcount | by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174 | Inspectorate of the Federal Tax Service | Rented once a year - until January 20, 2018. |

| SZV-M | Resolution of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 N 1077p | Pension Fund | Rent monthly until the 15th day of the month following the reporting month: for December 2021 - until 01/15/2018; until 15.02; 15.03; 15.04; 15.05; 15.06; 15.07; 15.08; 15.09; 15.10; 15.11; 15.12. |

| SZV-STAZH | By Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p | Pension Fund | Rented once a year. For 2021 – until March 1, 2018. |

| 4-FSS | By Order of the FSS dated 06/07/2017 No. 275 | FSS | Rented quarterly. Up to 20 (25), depending on the report format, of the next month after the reporting quarter. Paper report:

Electronic report:

|

Individual entrepreneur reporting in 2021

Home / Other

The entire complex of reporting documentation that individual entrepreneurs are required to submit to regulatory authorities can be divided into 4 groups:

- Reporting depending on the applied tax regime.

- Reporting for hired personnel (submitted if the individual entrepreneur has employees);

- Reporting on other taxes;

- Statistical reporting (to Rosstat).

Note: in addition to submitting reports, records of income/expenses are kept in KUDiR, as well as records of cash transactions.

If you don’t want to sort through a bunch of reporting and waste time going to the tax office, you can use this online service, which has a free trial period.

Reporting according to the applicable tax regime

Submitted to the Federal Tax Service Inspectorate at the place of residence of the individual entrepreneur (with the exception of the UTII declaration, which is submitted to the Federal Tax Service Inspectorate at the place of business).

| Tax system | Reporting type | Reporting deadlines |

| BASIC | VAT declaration | Based on the results of each quarter until the 25th day of the month (inclusive) following the reporting quarter |

| Form 4-NDFL | Rented after the actual appearance of income from business activities within 5 days after the end of the month in which the income appeared. Note: Based on the declaration, the Federal Tax Service calculates advance payments for personal income tax for the current year. If the individual entrepreneur has been working for more than a year and no significant fluctuations in income are planned for the current year, the form is not submitted (advances are calculated according to the data from Form 3-NDFL for the previous period). If during the current year there is a sharp jump in income (an increase or decrease of more than 50%) - an adjusting declaration is submitted to recalculate tax advances | |

| Form 3-NDFL | At the end of the calendar year until April 30 of the following year | |

| simplified tax system | Declaration of the simplified tax system | At the end of the year until April 30 of the following year |

| UTII | Declaration on UTII | At the end of the quarter no later than the 20th day of the month following the reporting quarter |

| Unified agricultural tax | Declaration on Unified Agricultural Tax | At the end of the year until March 31 of the next year inclusive |

| PSN | Reporting is not submitted | |

| Special regime officers working under agency agreements (commissions, orders) with counterparties on OSNO and receiving/registering tax invoices with VAT for this type of activity | Journal of received/issued invoices | At the end of the quarter no later than the 20th day of the month following the reporting quarter |

When combining tax regimes, reporting should be submitted separately for each applicable taxation system.

Reporting for employees

The reporting submitted by individual entrepreneurs for individuals working under employment agreements or civil partnership agreements does not depend on the tax regime, therefore the list is the same for all entrepreneurs.

| Reporting type | Where is it served? | Submission deadlines |

| Information on the average number of personnel | To the Federal Tax Service at the place of registration | At the end of the calendar year no later than January 20 of the year following the reporting year |

| Unified calculation of insurance premiums (ERSV) | Based on the results of the 1st quarter, half of the year, 9 months and the year. No later than the 30th day of the month following the reporting period (quarter) | |

| Form 6-NDFL | Similar to ERSV, with the exception of the annual report - for the year the form is submitted no later than April 1 of the next year | |

| Help 2-NDFL | At the end of the year no later than April 1 of the year following the reporting year | |

| Form SZV-M | To the Pension Fund branch at the place of registration of the individual entrepreneur as an employer | At the end of each month, before the 15th day of the month following the reporting month |

| Forms: SZV-STAZH, EDV-1 | At the end of the year until March 1 of the year following the reporting year When an individual submits an application for retirement - within 3 days from the moment the person contacts the employer | |

| Calculation 4-FSS | To the FSS branch at the place of registration of the individual entrepreneur as an employer | Based on the results of the 1st quarter, half of the year, 9 months and the year. No later than the 20th day of the month following the reporting period (when the form is submitted on paper), or before the 25th day of the month (inclusive) following the reporting period (when submitted electronically) |

| Application and certificate confirming the main type of activity | Annually before April 15 of the year following the reporting period |

Reporting on other taxes

An individual entrepreneur may conduct activities that are subject to other additional taxes and fees. In such cases, reporting is provided on the following types of other taxes (fees):

| Tax/fee | Reporting type | Submission deadlines |

| Water | Water tax declaration | Based on the results of each quarter no later than the 20th day of the month following the billing quarter |

| Excise | Excise tax declaration | Monthly until the 25th day of the next month (for straight-run gasoline and denatured alcohol: until the 25th day of the third month following the billing month) |

| Notice of advance payment and copies of payment documents | No later than the 18th of the current month | |

| For mining | Declaration on mineral extraction tax | Every month no later than the last day of the next month |

| Regular payments for subsoil use | Calculation of payments for subsoil use | Quarterly no later than the last day of the month following the billing quarter |

| Fee for the use of water resources | Information about issued permits and fees payable | Within 10 days from the date of issue of the permit |

| Information on the number of objects removed from the habitat | No later than the 20th day of the month following the last month of the permit validity period | |

| Fee for the use of wildlife objects | Information on issued permits for the extraction of animals | Within 10 days from the date of issue of the permit |

Reporting to statistical authorities

Entrepreneurs belonging to the small business sector who were included in the Rosstat sample, as well as individual entrepreneurs who own medium or large businesses, are required to submit statistical reports. Statistical authorities send relevant notifications to such individual entrepreneurs. You can check whether a businessman must submit statistical reports independently on the website: statreg.gks.ru

If an individual entrepreneur is required to report to statistical authorities, the following information will be displayed on the website:

- a list of reports to be submitted;

- deadlines for their submission;

- instructions for filling out reporting documentation.

All individual entrepreneurs also submit reports to Rosstat as part of continuous monitoring, which is carried out once every 5 years. The next total audit will take place in 2021; accordingly, all businessmen will have to report to the statistical authorities in 2021.

Read in more detail: All individual entrepreneur reporting

Did you like the article? Share on social media networks:

- Related Posts

- Tax holidays for individual entrepreneurs in 2021

- Service

- Personal income tax (NDFL)

- Application for transfer of vacation

- Taxes and payments for individual entrepreneurs in 2021

- Reporting for employees in 2021

- Fixed contributions for individual entrepreneurs in 2021

- Personal income tax for employees (income tax)

Discussion: there is 1 comment

- Sergey:

01/10/2019 at 09:06Zero declaration for the simplified tax system for individual entrepreneurs for free or how much does it cost?

Answer

Leave a comment Cancel reply

Tax calendar 2021: tax payment deadlines

| Payment of taxes in 2021 for individual entrepreneurs without employees and for individual entrepreneurs using hired labor | ||

| Tax system | Tax | Deadlines |

| OSN | VAT | Until January 25, 2018; 02/25/2018; 03/25/2018 for the 4th quarter of 2021. Further, in equal shares until the 25th day of each month based on the results of the previous quarter (04/25; 05/25; 06/25/07/25; 08/25; 09/25/10/25; 11/25; 12/25). |

| OSN | Personal income tax | Until July 15, 2018 for 2021 |

| simplified tax system | Advance payments and simplified tax system | Payment of advance payment for the 1st quarter of 2018 by 04/25/2018 Tax payment for 2021 is due by 04/30/2018 Payment of advance payment for the 2nd quarter of 2018 by July 25, 2018 Payment of advance payment for the 3rd quarter of 2018 by October 25, 2018 |

| UTII | Tax on imputed income | Until January 25, 2018, payment of UTII for the 4th quarter of 2021 Until April 25, 2018, payment of UTII for the 1st quarter of 2021 Until July 25, 2018, payment of UTII for the 2nd quarter of 2021 Until October 25, 2018, payment of UTII for the 3rd quarter of 2021 |

| Unified agricultural tax | Unified agricultural tax | Tax payment for 2021 is due by March 31, 2018 Until July 25, 2018, payment of the advance payment of the Unified Agricultural Tax for 2018 |

Table with due dates in 2018

Despite everything, nothing has changed in the scheme for providing financial statements on the simplified tax system for LLCs and for individual entrepreneurs on the simplified tax system in 2021; it does not hurt to remember all the existing features of accounting. And how reports are submitted to the appropriate authorities.

Although the simplified taxation system is designed to facilitate the transfer of reports, which type to choose is another question. There are two options: 15 or 6 percent in 2021 for individual entrepreneurs and LLCs. Only strict forms in 2021 will depend on this choice, and everything else does not change much. For example, they submit LLC reports to the simplified tax system “Income” in the same way as to the simplified tax system “Income minus expenses”.

The only difference in these systems is that under the simplified tax system in 2021, payers using different types of taxation each fill out their own pages. Since different items are subject to tax, the calculation also changes, so of course you can simply fill out everything according to one sample, but it is very easy to make a mistake, it is important to monitor the filling personally.

Also, as mentioned above, there is one peculiarity in this system of simplifications. An LLC using the simplified tax system in 2021, just like an individual entrepreneur, can reduce tax payments. But this very much depends on some factors, such as: the taxation system, the presence of employees, the reporting period and the number of periodic insurance contributions.

To understand, only for individual entrepreneurs without employees with contributions under the simplified tax system “6%”, payments can be reduced down to a limit of zero. This is only possible if the taxpayer regularly pays insurance premiums throughout the entire reporting period in small amounts. Then, when submitting reports to Rosstat in 2018 for LLCs using the simplified tax system and individual entrepreneurs using the simplified tax system, taxes can be recalculated.

Reporting table for and for 2021

Also, the simplified tax system in 2021 has a special accountant’s calendar for the year, where the deadlines in the table are provided for different situations. The main rule in it is, of course, the simplest thing, to submit everything on time to prevent the occurrence of possible problems and errors at the tax authority.

| № | Document type | Deadline |

| 1 | Declaration of the simplified tax system | must be submitted by March 31 of the year following the reporting year, and in fact - 04/02/2019. |

| 2 | Set of accounting reports (balance sheet and profit and loss account) | must be submitted by March 31 of the year following the reporting year, deadline is 04/02/2019. |

Employee reports table

The following are separate reports for employees:

| № | Document type | Deadline |

| 1 | Form SZV-M | due before the 15th day of the month following the reporting month, in fact - 01/15/2019. |

| 2 | Form SZV-Experience | can be submitted until March 1 following the reporting year, in fact, again - 03/01/2019. |

| 3 | Form 6-NDFL | submitted before April 1 following the year of the report, in fact - 04/02/2019. |

| 4 | Report to social security 4-FSS | submitted in paper form - before the 20th day of the month following the reporting period, or electronically - before the 25th day, in fact - 01/22/2019 when submitted in paper form, 01/25/2019 - in electronic form |

| 5 | 2-NFDL | before April 1 of the year, after the reporting year, in fact - 04/02/2019. |

| 6 | Calculation of insurance premiums | until the 30th day of the month following the reporting month, the deadline is 01/30/2019. |

| 7 | Average headcount | is provided until January 20 of the following reporting year, but no later than January 22, 2019. |

Report table when the corresponding database is present

There are also reports that are submitted only in cases where there is an appropriate database (if there is none, zero ones are not submitted):

| № | Document type | Deadline |

| 1 | Income tax return | until March 28 of the year following the reporting year, and actually until March 28, 2019. |

| 2 | VAT declaration | the deadline is the 25th day of the month following the reporting month, the deadline is 01/25/2019. |

| 3 | Property tax | provided by March 30 of the year following the reporting year, no later than March 30, 2019. |

| 4 | Transport tax | until February 1 following the reporting period, in fact until February 1, 2019. |

| 5 | Declaration of negative impact | are handed over before March 10 of the year after the reporting year, but actually a little later - 03/12/2019. |

| 6 | Water tax | until the 20th day of the month following the reporting period, in fact - 01/22/2019. |

| 7 | Declaration on UTII (only in cases where it is combined with the simplified tax system) | are handed over before the 20th day of the month following the reporting month, in fact until 01/22/2019. |

The most important thing is that all the terms and dates listed above will not apply to every taxpayer, because not every one of them pays the taxes described in the relevant tax articles. Also, not everyone has a tax base specifically for such taxes, and accordingly is exempt from them.

So it is not a fact that under any circumstances the company will have to submit such a number of documents. But still, as everyone knows, late payment is punishable by a fine, and since no one wants to receive it, this means that you need to monitor and submit everything on time.

That is why every taxpayer, whether it is an LLC or an LLC, needs to know exactly and calculate the taxes he pays in order not to be late in paying them. And also submit a return on time with the appropriate information about these same taxes. The study of the table must be approached carefully, with an understanding of the matter, otherwise the accountant will not be able to obtain any useful information.

Insurance premium payment calendar

An individual entrepreneur, regardless of the presence or absence of employees, the taxation system, or the amount of income, pays fixed contributions to compulsory pension and health insurance. The table below shows the deadlines for paying fixed contributions.

It should be noted that there are some nuances when you should not wait for the deadline for paying contributions, but it is more advisable to pay them quarterly.

Such cases occur if the individual entrepreneur uses the simplified tax system or UTII. The fact is that by paying contributions quarterly, an individual entrepreneur has the right to reduce the advance payment of the simplified tax system or the tax on imputed income by the amount of contributions paid. This is written in detail here:

- Reducing the simplified tax system for insurance premiums.

- Reducing UTII for insurance premiums.

| Contribution | Payment deadline |

| For compulsory pension insurance | Until December 31, 2017 for 2021 Until December 31, 2018 for 2021 |

| For compulsory health insurance | Until December 31, 2017 for 2021 Until December 31, 2018 for 2021 |

| For pension insurance in case of excess of real (imputed, potential) income during the year by 300,000 rubles | Until 04/01/2018 for 2021 |

You can pay taxes and fixed contributions using a receipt through a bank, if the individual entrepreneur does not have a current account, or from a current account, if there is one, using payment orders or a client bank.

In conclusion, we recommend that the reader pay attention to two more important publications:

- Production calendar for 2021. Necessary for accountants and managers to calculate working hours, business trips, vacation pay and sick leave.

- The size of the minimum wage in 2021. Insurance contributions, wages, and social benefits are tied to the minimum wage.

The page was last edited and contains current information as of 09/22/2017

This might also be useful:

- What taxes does the individual entrepreneur pay?

- Calculation of income tax from salary

- Tax system: what to choose?

- Inspection of individual entrepreneurs by the tax inspectorate

- What reporting must an individual entrepreneur submit?

- Individual entrepreneur reporting on the simplified tax system without employees

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!