Due date for October 2021

The tenth month of 2021 usually marks the submission of quarterly reports to the Federal Tax Service on taxes and fees and calculations of contributions for injuries to the Social Insurance Fund.

In addition to quarterly reporting forms, employers are required to submit personal information about insured persons to the Pension Fund of the Russian Federation. Unified deadlines for submitting reports according to the accountant’s calendar for October 2020 in the table:

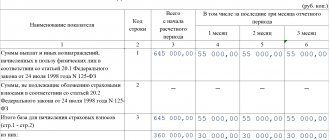

| Deadline | Reporting form | Where to take it | Recommendations for filling |

| Monthly reporting forms | |||

| 15.10.2020 | SZV-M for September | Territorial branch of the Pension Fund | Include in the report all employees with whom employment contracts and civil contracts have been concluded. All employees should be included in the SZV-M, even if they were not paid wages during the reporting period. For example, an employee has been on unpaid leave for the entire month or has fallen ill, but has not yet provided a certificate of incapacity for work. |

| 15.10.2020 Important! In case of dismissal or hiring, the SZV-TD should be submitted to the Pension Fund no later than the day following the day of approval of the order of hiring/dismissal. | SZV-TD for September | Territorial branch of the Pension Fund | Include in the reporting only those employees for whom personnel changes have occurred, or if the employee has requested an extract from his work history or submitted an application for the procedure for maintaining a work record book. |

| 28.10.2020 | Income tax return for September | Inspectorate of the Federal Tax Service | Monthly submission of income tax returns is provided for OSNO taxpayers who pay tax based on actual profits. |

| Quarterly reporting forms | |||

| 20.10.2020 | Paper calculation 4-FSS for the 3rd quarter | Territorial branch of the FSS | Only policyholders who have made payments to 24 or fewer employees have the right to report their insurance premiums for injuries on paper. If there are more than 25 people on staff, you cannot submit 4-FSS on paper. |

| 20.10.2020 | Declaration on UTII for the 3rd quarter | Inspectorate of the Federal Tax Service | All taxpayers using imputation are required to report on UTII. Fill out the report based on data for the 3rd quarter of 2021 (from July to September). Do not include information for previous quarters in your declaration. |

| 26.10.2020 | VAT return for the 3rd quarter of 2020 | Inspectorate of the Federal Tax Service | All OSNO taxpayers are required to file a VAT return. In addition, reports are submitted:

|

| 26.10.2020 | Electronic calculation of 4-FSS for the 3rd quarter of 2021 | TO FSS | Prepare 4-FSS in electronic form. Include in your calculation all types of benefits to employees, including those subject to personal injury contributions. Separately provide information about settlements with the fund. Don't forget to include information about mandatory medical examinations and special medical conditions. |

| 28.10.2020 | Income tax return for the 3rd quarter of 2021 | Inspectorate of the Federal Tax Service | All taxpayers report to OSNO (legal entities). |

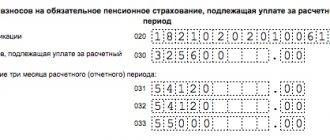

| 30.10.2020 | DAM for the 3rd quarter of 2021 | Inspectorate of the Federal Tax Service | All policyholders are required to submit calculations for insurance premiums. Include in the calculation information about wages and other remuneration for work, the amount of accrued and paid insurance premiums. |

Latest legislative innovations coming into force in 2020

Based on the adopted and approved Law “On Accounting” (No. 444-FZ dated November 28, 2018), several amendments will come into effect from January 1, 2021, adjusting the formats and deadlines for submitting reporting documents.

In particular, in order to simplify document flow and create a unified structured database, all financial statements, as well as audit reports, will need to be provided only in electronic form. The exception is small and medium-sized businesses, for which an additional annual deferment is provided.

In addition, if previously it was necessary to send the relevant documentation simultaneously to the Tax Service and Rosstat, then from 2020 there is no need to send reports to state statistics bodies. The new rule does not apply to organizations that use classified documents, state secrets, or special government regulations in their work.

Accounting statements in October

State employees are required to submit accounting reports in October 2020 for the past 9 months. The composition and content of accounting records for public sector institutions is determined by:

- Instruction No. 33n - for budgetary and autonomous institutions;

- Instruction No. 191n - for government institutions and authorities.

Commercial organizations are not required to prepare interim financial statements, but many accountants prepare a balance sheet for 9 months of the year. This allows:

- Identify counting and arithmetic errors in accounting.

- Correct any shortcomings.

- Find unrecorded transactions and facts of economic activity.

- Initiate reconciliations of mutual settlements with counterparties.

- Reduce the amount of overdue debt at the end of the year.

- Eliminate overpayments and arrears of taxes and contributions.

- Eliminate arrears in personnel remuneration calculations.

The preliminary balance sheet is drawn up according to general rules. There is no need to approve the report or submit it to the tax authority.

Accountant's production calendar for 2021

Accountant production calendar 2021 - working hours and holidays

The standard working time for certain calendar periods is calculated according to the calculated schedule of a five-day work week with two days off on Saturday and Sunday based on the duration of daily work: for a 40-hour work week - 8 hours;

with a 36-hour work week - 7.2 hours (36:5); with a 24-hour work week - 4.8 hours (24:5). For more details, see clause 1 of the Procedure for calculating the standard working time for certain calendar periods of time (month, quarter, year) depending on the established duration of working time per week, approved. by order of the Ministry of Health and Social Development of Russia dated August 13, 2009 N 588n (hereinafter referred to as the Procedure).

At the same time, it is necessary to remember about the prohibition of work on non-working holidays (part one of Article 113 of the Labor Code of the Russian Federation), the reduction of work by 1 hour on a pre-holiday day, that is, on the day immediately preceding a non-working holiday (part one of Article 95 of the Labor Code of the Russian Federation ), on postponing a day off if it coincides with a non-working holiday (part two of Article 112 of the Labor Code of the Russian Federation).

In accordance with part one of Art. 112 of the Labor Code of the Russian Federation, non-working holidays in the Russian Federation are:

- January 1, 2, 3, 4, 5, 6 and 8 — New Year holidays;

- January 7—Christmas Day;

- February 23 - Defender of the Fatherland Day;

- March 8—International Women's Day;

- May 1 - Spring and Labor Day;

- May 9 - Victory Day;

- June 12—Russia Day;

- November 4 is National Unity Day.

According to part two of Art. 112 of the Labor Code of the Russian Federation, if a weekend and a non-working holiday coincide, the day off is transferred to the next working day after the holiday, with the exception of weekends coinciding with non-working holidays from January 1 to January 8.

Weekends (January 1, 7 and 8) coinciding with non-working holidays from January 1 to 8 are not automatically transferred to the next working day after the holiday. The Russian government can only postpone two such days off.

For the purpose of rational use by employees of weekends and non-working holidays, weekends may be transferred to other days by federal law or a regulatory legal act of the Government of the Russian Federation (part five of Article 112 of the Labor Code of the Russian Federation).

Calculation of standard working hours per month - 2021

The standard working time for a specific month is calculated as follows. The length of the working week (40, 39, 36, 30, 24, etc. hours) is divided by 5, multiplied by the number of working days according to the calendar of the five-day working week of a particular month, and from the resulting number the number of hours in a given month for which work is carried out is subtracted reduction of working hours on the eve of non-working holidays.

The standard working time for the year as a whole is calculated in a similar manner . The length of the working week (40, 39, 36, 30, 24, etc. hours) is divided by 5, multiplied by the number of working days according to the calendar of a five-day working week per year, and from the resulting number the number of hours in a given year for which work is carried out is subtracted reduction of working hours on the eve of non-working holidays (clause 1 of the Procedure).

The standard working hours in 2021 will be:

with a 40-hour work week - 1973 hours (8 hours x 247 days - 3 hours); with a 36-hour work week - 1774.4 hours (7.2 hours x 247 days - 3 hours); with a 24-hour work week - 1181.6 hours (4.8 hours x 247 days - 3 hours).

Mandatory payments October

In addition to reporting, the accountant’s calendar for October 2020 also provides for the payment of mandatory payments to the budget and extra-budgetary funds. Payment deadlines:

| Insurance contributions to the Federal Tax Service and Social Insurance Fund for September 2021 | Until 15.10.2020 |

| Income tax for 9 months of 2021 | Until October 28, 2020 |

| VAT - first third for the 3rd quarter of 2021 | Until October 26, 2020 |

| UTII for the 3rd quarter of 2020 | Until October 26, 2020 |

These are generally accepted deadlines for paying taxes and contributions. But due to the coronavirus epidemic, payment dates for small and medium-sized businesses have been postponed.

New payment deadlines for SMP due to coronavirus

| Income tax | 08/28/2020 - 1st payment for the 2nd quarter. 09/28/2020 - final tranche for 2021, 3rd payment for the 1st quarter, 2nd payment for the 2nd quarter. 10.28.2020 - tranche based on the results of the 1st quarter, 3rd payment for the 2nd quarter. November 30, 2020 – payment based on the results of the 2nd quarter. |

| Tax under the simplified tax system for organizations | 09.30.2020 — final tranche for 2021 10.26.2020 - payment for the 1st quarter. 11/25/2020—semi-annual payment. |

| Tax under the simplified tax system for individual entrepreneurs | 10.26.2020 - payment for the 1st quarter. 10.30.2020 — final tranche for 2021 11/25/2020—semi-annual payment. |

| Unified agricultural tax | 09.30.2020 - final payment for 2021 11/25/2020—semi-annual payment. |

| UTII | 10/26/2020 — tax for the 1st quarter. 11/25/2020 — tax for the 2nd quarter. |

| Property tax, transport and land | 10/30/2020 — advance payments for the 1st quarter. 12/30/2020 — advance payments for the 2nd quarter. |

| Insurance premiums | 10.15.2020 - for March. 11/16/2020 - for April and June. 12/15/2020 - for May and July. |

| Insurance premiums for individual entrepreneurs for themselves | 02.11.2020 — additional payment for 2021 |

| Personal income tax on individual entrepreneur income | 10/15/2020 – tax for 2021 10.26.2020 - payment for the 1st quarter. 11/25/2020—semi-annual payment. |

| PSN | Patent payment deadlines for the 2nd quarter have been postponed by 4 months. For example, if the patent indicates a deadline of 04/01/2020, pay 08/03/2020, and if 06/30/2020, then the new deadline is 10/30/2020. |

For organizations and individual entrepreneurs included in the SME register as of 03/01/2020, whose main activity according to the Unified State Register of Legal Entities (USRIP) is on the list of affected industries, the deadline for paying taxes has been extended and automatic installments have been provided. Pay taxes and contributions gradually - 1/12 of the amount due. Payment due date is no later than the last day of each month, starting from the month following the one in which the new payment due date occurs.

The Federal Tax Service has postponed the deadline due to the self-isolation regime

A notice has been published on the website of the tax service stating that the deadline for filing reports is being postponed due to the announcement of quarantine in the period from March 30 to April 3, 2021.

The Federal Tax Service announced that the deadlines for paying tax contributions and submitting reports have been postponed. The reason for this was the Presidential Decree “On declaring non-working days in the Russian Federation”, according to which a nationwide quarantine is introduced from March 30 to April 3.

According to current legislation, the following dates for filing reports are established:

- balance sheet, as well as declarations according to the simplified tax system - until March 31;

- income tax reports – until March 28;

- property tax reports – until March 30.

However, given that this time the established dates are holidays, the deadline for submitting reports has been postponed to April 6, 2020. This is the first working day after the end of the self-isolation regime.

Statistical reporting

In addition to tax and accounting forms, companies and entrepreneurs submit statistical reports. The list of mandatory reporting forms is determined for each respondent individually. We recommend that you find out which reports to submit in October 2020 on the official Rosstat website. To obtain information, it is enough to enter the company’s TIN. Some forms and deadlines have been changed due to the coronavirus epidemic.