Changes in reporting forms for 2021

Comparing the reporting procedure that was in effect last year and exists in the current 2016, we can highlight the following changes:

- The names of certain report forms have been clarified. For example, reporting on the balance sheet, financial results, financial flows and others.

- We approved a new method for submitting reports electronically (Order of the Federal Tax Service numbered “AS-7-6 / [email protected] ”, adopted on December 31, 2015).

- We defined new reporting in Form 4-FSS.

- You will now have to report to the tax office on a quarterly basis using Form 6-NDFL.

- The 2-NDFL report forms have changed.

- A new report on the intended purpose of funds has appeared.

- It is possible that new budget classification codes (BCC) will be approved.

- A new form RSV-1 has appeared, provided to the Pension Fund.

- Information about insured persons will be submitted using the new SZV-M form.

Perhaps these are the main changes in reporting forms for the current 2021.

Accountant calendar 2021: USN, UTII, PSN, Unified Agricultural Tax

Special tax regimes are designed to make tax accounting easier for companies and reduce the tax burden, so such companies pay less taxes than if they used SST.

Accountant calendar 2021 and for special regime employees:

| date | Tax | Period | Reporting | Payment |

| 20.01.2016 | Single declaration in the absence of activity and transactions on the current account | 2015 | Single (simplified) declaration | |

| ATTENTION! Taxes and contributions for 2015, which must be reported in March 2016, are indicated in the section “ Accountant Calendar for March 2021”. | ||||

| 25.04.2016 | simplified tax system | Advance for the first quarter of 2021 | V | |

| 25.04.2016 | UTII | I quarter 2021 | Declaration | V |

| 04.05.2016 | Property tax on objects included in the cadastral list | I quarter 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation |

| 25.07.2016 | simplified tax system | Advance for the 1st half of 2021 | V | |

| 25.07.2016 | UTII | II quarter 2021 | Declaration | V |

| 25.07.2016 | Unified agricultural tax | 1st half of 2021 | V | |

| 01.08.2016 | Property tax on objects included in the cadastral list | 1st half of 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation |

| 25.10.2016 | simplified tax system | Advance for 9 months of 2021 | V | |

| 25.10.2016 | UTII | III quarter 2021 | Declaration | V |

| 31.10.2016 | Property tax on objects included in the cadastral list | 9 months of 2021 | Property tax declaration | The payment deadline is determined by the law of the subject of the Russian Federation |

ATTENTION! The table does not contain deadlines for paying tax under PSN. The fact is that a businessman buys a patent for any period from 1 to 12 months, but within a calendar year.

For information about what kind of reporting may take place under PSN, read the material “Reporting of individual entrepreneurs on PSN - pros and cons”.

The above accountant’s calendar for 2016 lists reports and payments to the budget that are typical specifically for special regime employees. They also pay other taxes and fees if there are employees or certain activities that are subject to appropriate taxes, regardless of the special regime.

All accounting changes in 2021

Accounting specialists know that there are various reporting options, which are influenced by the status of the company or organization.

Small businesses can submit reports using a simplified scheme if they do not need to undergo an audit.

The procedure will include a report:

- On balance.

- About financial results.

What these documents look like can be found in the Order of the Ministry of Finance under number “66n”.

Other enterprises that are not classified as small businesses, or that need to be audited, will report in full .

It is mandatory to submit a report:

- Balance.

- About the results of financial activities.

- About money movements.

- About changes in capital.

You cannot exclude anything from the documents, but you can supplement them and add explanations.

Let's tell you in more detail what other changes have appeared:

According to personal income tax

Starting from 2016, you will have to get used to submitting every quarter not only certificates in Form 2-NDFL, but also a report in Form 6-NDFL . This document will include information about the amount of withheld funds that will be written off for tax from all employees of the enterprise. The innovation was adopted by the Ministry of Justice under the number “MMV-7-11/450” on October 14 last year.

In accordance with Article 230 of the Tax Code of the Russian Federation, a report on the income of individuals should be submitted:

- The first quarter had to be completed by May 4th.

- For the six months, don’t forget, until August 1st.

- 9 months of work must be completed before October 31st.

These are quarterly reports, and annual reports must be submitted before April 1 . That is, the accountant must report for 2021 by April 1, 2021.

You can submit a report in a strictly established form by printing it on paper. But, please note that if your staff is more than 25 people, you will have to prepare the document electronically.

It is better to submit documentation on time, otherwise:

- The company will be fined one thousand rubles. Moreover, this amount will be charged for each overdue month.

- All company accounts will be blocked. This is an extreme measure, but according to the law, if you are 10 days late, the Federal Tax Service has the right to block accounts.

It is worth knowing that the company will have to report on unwithheld taxes twice (Article 226 of the Tax Code of the Russian Federation) and submit a tax certificate in form 2-NDFL:

- No later than March 1 of the current year.

- Until April 1st.

The reporting form is also new.

Please note that the annual accounting report can now be submitted without the signature of the company's chief accountant!

Tax withholding period

We set deadlines for employees of organizations to receive income that was taxed.

Here are some examples:

- Upon dismissal. The calculation must be completed before the employee works his last day of work. He must receive income on this very day (Article 223 of the Tax Code of the Russian Federation).

- On sick leave. Payments should be made at the end of the month. For example, an employee went on sick leave from May 1 to May 14. The report is submitted until May 31.

- On vacation. The calculation period for vacation income is the same as for sick leave.

- When on a business trip. The employer must approve the expense report, and then the accountant will calculate the income that the employee should receive for the business trip. But no later than the last day of the month.

Payments for children

The employee has the right to demand compensation from the employer , which will come from child taxes .

Federal Law No. 317, approved on November 23, 2015, states that the amount of payments has increased. Now they amount to 350 thousand rubles - but this is if the child is considered disabled.

In other cases, their personal income tax deduction is different: for adoptive parents or guardians - 6 thousand rubles , for parents - 12 thousand rubles .

Social payments

Starting this year, an employee has the right to demand social deductions from personal income tax . The employee must return 13 percent of the income.

This money will be targeted. You will have to spend it on your education or children/siblings, or on medical care.

Previously, employees could only claim this deduction at the end of the year. Now the situation has changed.

You can request a social benefit at any time once a year.

Number of fixed assets in tax calculations

Income tax can now be written off from property whose value is more than 100 thousand rubles .

If the property of the enterprise is worth less, then it is written off as expenses (Article 256 of the Tax Code of the Russian Federation).

Revenue tax

In the new year, it will be possible not to pay advances on income tax every month. Some enterprises may refuse, provided that their profit, calculated on average for one quarter, is less than 15 million rubles (Article 286 of the Tax Code of the Russian Federation). Previously, the limit was 10 million rubles. To calculate the average profit for the quarter, you should: divide the annual revenue by 4.

Income declarations should be submitted:

- For the first quarter of this year until April 28.

- For the first half of 2016 until July 28.

- For 9 months of this year until October 28.

For companies that make advance payments every month, the declaration is also submitted monthly (Articles 287 and 289 of the Tax Code of the Russian Federation).

You can provide it in paper form if the number of employees of the company is less than 100 people.

Otherwise, only an electronic version of the declaration should be prepared (Article 80 of the Tax Code of the Russian Federation).

Registration of organizations

They will be more strict in checking whether the company is reliable. Inspectors now have the right to inspect the organization's real estate and show up without warning . If the inspector finds out that any of the information is incorrect or missing, he will write a notice that lists what you need to do and what information you need to provide.

- The period for correcting defects is 1 month.

- The deadline for registering an organization is now 3 working days!

Please note that existing organizations must use a new standard charter in their work; its form is still being approved.

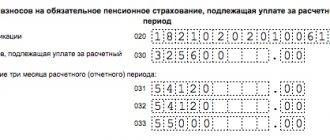

New budget classification codes (KBK)

It was planned that pension deductions would be sent to different codes, depending on the income limit limits.

But the document has not yet been accepted.

The current BCCs for insurance premiums look like this:

- The first three digits are the government agency code

- The next one digit is the income code (group of this income)

- The third two digits are the tax or other payment code

- The next 5 digits indicate the item and subitem of income

- Next are 2 numbers by which you can understand the level of the budget (regional, federal, or even the budget of one of the funds - the Pension Fund of Russia, the Social Insurance Fund, etc.)

- Next are 4 key numbers that determine the “reason” for the payment. Here it is important to understand that there can be only three such reasons - 1) payment of the tax itself (fee, contribution), 2) payment of penalties on it, 3) payment of a fine on it.

- And finally, the last three digits of any code are a classifier of the type of income (tax, non-tax, from property, etc.).

Patent tax system

More enterprises will now be able to work under a patent, as the list of activities has expanded. This is evidenced by Federal Law No. 232, approved on July 13, 2015.

The list now includes:

- Catering points that do not serve visitors in the hall.

- Companies producing dairy products.

- Firms for growing vegetables, preparing canned fruits and vegetables.

- Organizations providing services for walking and transporting livestock.

- Enterprises producing flour and bakery products.

- Translation companies.

- Enterprises engaged in waste processing and disposal.

- Firms engaged in repair of equipment and PCs.

- Organizations providing care and care services for the elderly and disabled.

- Other forestry activities.

You can find out more in Article 2 of this law.

Transition to the EGAIS system

This transition affects companies selling alcoholic beverages. By July 2016, all retail outlets must switch to the system.

In addition, management must keep a sales log in a special form approved by the RAR Order No. 164, dated June 19, 2015.

Violators will be fined.

Work on the simplified tax system and UTII system

Income limits have increased for enterprises that operate under simplified rules:

- To switch to these systems starting next year 2017, you will need to confirm your income for 9 months of this year . The amount of income must be at least RUB 59,805,000.

- For those who already use one of the systems, their annual income should be at least 79,740,000 rubles .

Companies with representative offices and a network will now be able to use the special regime.

Rates for simplified tax system and UTII

Regional tax services can now reduce rates under the simplified system to 1% for the “income, profit” object. And with the object “income minus expenses,” the rate reduction remained at the same level – at least 5%.

Administration representatives can reduce the UTII rate to 7.5%, previously it was 15%. The deflator coefficient will not change. This figure is 1.798.

VAT for special regimes

Now, when submitting a VAT invoice, companies can take it into account in profit . Previously this could not be done. This innovation applies only to organizations working under the simplified tax system and the simplified agricultural tax system.

Information on the average number of employees

You should report how many employees you have in your company once a year - before January 20. This applies to new organizations or reorganized ones (Article 80 of the Tax Code of the Russian Federation).

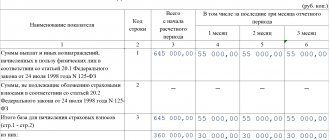

Form RSV-1 PFR

Companies that have at least one employee must report for them quarterly, semi-annually and 9 months. The form for this was approved - RSV-1 (Federal Law number 212, dated July 24, 2009).

Reporting must be done electronically.

Form SZV-M

Information about insured persons working for the company must now also be submitted to the Pension Fund. The SZV-M form is intended for this. It must be submitted completed by the 10th of each month. The first report should have been submitted for April, before May 10.

Property tax

Companies that have property must report by filing the appropriate declaration before:

- May 4 for the 1st quarter.

- August 1 for the half year.

- October 31 for 9 months.

- March 30, 2021 for the previous year.

Again, if there are more than one hundred employees in the company, then the declaration is submitted electronically (Articles 80, 386, 379 of the Tax Code of the Russian Federation).

Transport tax

Organizations that own transport must also report to the tax office (Article 357 of the Tax Code of the Russian Federation) once a year, no later than February 1 (Article 363.1 of the Tax Code of the Russian Federation).

The electronic version is also provided by companies with more than one hundred employees.

Land tax

Applies to those organizations that own land plots that are taxed (Article 388 of the Tax Code of the Russian Federation). The declaration must be submitted before February 1 (Articles 397 and 398 of the Tax Code of the Russian Federation).

Those with fewer than one hundred employees are allowed to submit a document in paper form (Article 80 of the Tax Code of the Russian Federation).

Accountant calendar 2015–2016: OSN

The specificity of OSN is that, unlike special regime companies, a company on OSN pays and reports VAT, income tax and property tax, regardless of whether their property is included in the cadastral list.

For information on the form that will need to be used when drawing up a property tax return for 2021, read the material “Corporate Property Tax Declaration 2016.”

Plus, companies on OSN report for employees and submit declarations and transfer taxes depending on the specifics of their activities: alcohol producers declare production volumes and pay excise taxes, trading companies in Moscow are required to pay a trade tax, etc.

Below in the firm's accountant's calendar on OSN, we have provided a list of general basic reports, taxes and fees that must be submitted to government agencies and paid in 2021:

Accountant's calendar for 2021 - reporting deadlines in 2016

Follow the calendar to see when you need to report - then you definitely won’t go wrong.

Explanations for each month:

Balance due date in 2021

As a general rule, the balance sheet must be submitted no later than three months after the end of the reporting year. The reporting year in our case is 2021.

The reporting period for annual financial statements (i.e., reporting year) is the calendar year - from January 1 to December 31 inclusive. An exception is cases when an organization is registered, reorganized or liquidated in the middle of the year.

It turns out that the balance sheet for 2021 must be submitted no later than April 2, 2021 (this is Monday).

New organizations

For companies created after September 30, 2021, the first reporting year is from the date of their registration to December 31, 2021 (Part 3 of Article 15 of Law No. 402-FZ). For the first time, they must submit a balance sheet only at the end of 2021.

Example

Zhdun LLC was organized and registered with the Federal Tax Service as a new company on November 8, 2021. In this case, for the first time, the company must submit its balance sheet for 2021 no later than April 1, 2021 inclusive (since March 31, 2019 is a Sunday).

If the company was organized no later than September 30, 2017, then the first reporting period will begin from the date of registration and end on December 31, 2021 (Part 3, Article 15 of Law No. 402-FZ).

Liquidated organizations

For liquidated organizations, the last reporting year is the period from January 1 to the date of making an entry about liquidation in the Unified State Register of Legal Entities (Article 17 of the Law of December 6, 2011 No. 402-FZ). Therefore, reports must be submitted within three months from this date. For example, an entry on the liquidation of an organization was made in the Unified State Register of Legal Entities on October 27, 2021, prepare financial statements as of October 26, 2017, the reporting period is from January 1 to October 26, 2017.

Reorganized companies.

In case of reorganization, the last reporting year is from January 1 of the year in which the last of the companies that emerged was registered until the date of such registration (Part 1, Article 16 of Law No. 402-FZ). An exception is cases of merger, when the last reporting year is the period from January 1 to the date when an entry was made in the Unified State Register of Legal Entities about the termination of the activities of the merged company (Part 2 of Article 16 of Law No. 402-FZ). The reorganized company must submit its balance sheet no later than three months from the day that precedes the date of state registration of the last of the established companies or the date when an entry was made in the Unified State Register of Legal Entities about the termination of the activities of the affiliated organization (Part 3 of Article 16, Part 2 of Article 18 of the Law No. 402-FZ).

Organizations created as a result of reorganization draw up a balance sheet as of December 31 of the year in which the reorganization took place (Part 5, Article 16 of Law No. 402-FZ). This balance must be submitted no later than March 31 of the following year.