A standard tax deduction is an operation to subtract a certain amount (its amount is determined by law), not subject to taxation, from the taxpayer’s total income. Income must be considered funds that were received from the actions of a citizen for a given taxable period. Different tax rates may apply. If we talk about START (standard tax deduction), then when presenting it, only income taxed at a rate of 13% is taken into account.

It's worth noting when looking at the standard child tax deduction in 2015: The tax code provides a variety of options for using them, which we'll discuss below. In this article we have collected information about this: what amount of deduction is intended for a child, deduction codes, limits, double deduction, how to take advantage of benefits for children, who is entitled to them.

Other types of strategic offensive weapons

When considering the standard child tax deduction for 2015, don't forget about other deductions. Thus, tax legislation provides for certain circumstances and categories of citizens in which and for which other tax deductions can be applied. The following are entitled to them:

- liquidators of the consequences of the accident that occurred at the Chernobyl nuclear power plant;

- disabled people of the Second World War;

- victims of a radioactive accident at the Mayak production association.

The amount of the deduction varies depending on these indicators. It is clear that the use of START by the above categories of citizens is a rare occurrence, since in most cases these individuals receive tax-free pensions. Now we will find out what standard tax deductions for children are provided in 2015, what changes are available in this area, and what important details taxpayers should pay attention to.

Law No. 462-FZ[11]

From 12/29/2014

in paragraph 27 of Art.

217 of the Tax Code of the Russian Federation has been amended, according to which, in relation to income in the form of interest received by taxpayers on ruble deposits in banks located on the territory of the Russian Federation, in the period from December 15, 2014 to December 31, 2015

, when calculating amounts of income not subject to personal income tax, the current refinancing rate of the Central Bank of the Russian Federation, increased by 10 percentage points.

Example 5.

On December 26, 2014, the taxpayer entered into a bank ruble deposit agreement for a period of 31 days. According to the terms of the agreement, interest on the deposit is accrued on the last day of the agreement based on 18% per annum. During the period for which interest was accrued, the refinancing rate of the Central Bank of the Russian Federation was 8.25%.

Since the amount of interest paid on the deposit does not exceed the amount calculated on the basis of 18.25% per annum (8.25 + 10), taxation is not carried out.

It is worth noting the technical negligence committed by the legislator when introducing the benefit in question in relation to paid interest income: it was not taken into account that the specifics of determining the tax base when receiving income in the form of interest received on deposits in banks are regulated not only by paragraph 27 of Art. 217, but also Art. 214.2 of the Tax Code of the Russian Federation, from the content of which it follows that interest calculated on the basis of the refinancing rate of the Central Bank of the Russian Federation increased by 5 percentage points is

.

Article 214.2 of the Tax Code of the Russian Federation continues to operate in 2015 without any changes

, which creates legal uncertainty in the taxation regime for the relevant income.

In our opinion, in the situation under consideration, one should be guided by the provisions of paragraph 7 of Art. 3 of the Tax Code of the Russian Federation, according to which all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer.

Accordingly, in the situation under consideration, the new rules of paragraph 27 of Art. 217 of the Tax Code of the Russian Federation, which are more preferential for taxpayers compared to Art. 214.2 Tax Code of the Russian Federation.

Right to deduction for a child

The deduction is applicable in relation to:

- adoptive parents;

- parents;

- guardians and other persons who are equated to the above category.

These statuses require official recognition; in other words, documented information is required, which is contained in acts of guardianship authorities, birth certificates, and court decisions recognizing paternity. In addition, the legislator determines the category of the child’s age in accordance with which the corresponding deduction is provided:

- up to 24 years of age, if the child is studying full-time at an educational institution or is an intern, graduate student, or resident;

- up to 18 years old.

In addition, standard child tax deductions in 2015 are provided separately for disabled children.

Parents have a question about whether it is possible to receive this deduction if their son/daughter is studying for a master's degree. Maybe. Currently, higher education is divided into two levels. Master's degree (2nd stage) is not considered as receiving a second higher education, therefore, if students are not yet 24 years old and are studying for a master's degree, then their parents can receive standard tax deductions for children in 2015, the maximum amount of which is 3,000 rubles , only on the condition that education is obtained for the first time at the second stage.

“Children’s” deductions: to whom and how much

The procedure for applying standard deductions for personal income tax is regulated by Art. 218 Tax Code of the Russian Federation. The amount of the deduction depends on the type of child in the family. For the first and second child, the deduction amount is 1,400 rubles each. monthly. For the third and each subsequent child - 3,000 rubles. monthly.

The following are entitled to such a deduction:

- each of the parents (including divorced ones);

- the parent's spouse (i.e., the child's stepfather or stepmother);

- each of the guardians, trustees, adoptive parents (if there are several of them);

- each of the adoptive parents (if there are two of them);

- spouse of the adoptive parent.

The deduction is valid for each child, without exception, under the age of 18, as well as for each child under the age of 24, if he is a full-time student, graduate student, resident, intern, student or cadet.

There are also separate deductions for children who are disabled. The amount of the deduction depends on age and sometimes disability group. So, if a disabled child is under 18 years old, then the disability group does not matter. If the child is a full-time student, graduate student, resident, intern or student under the age of 24, then a deduction is possible if disability group I or II.

The size of the deduction depends on who receives it. If this is a parent, his spouse or adoptive parent, then the deduction is 12,000 rubles. per month for one child. For an adoptive parent, his or her spouse, caregiver and guardian, the deduction is 6,000 rubles. per month.

The “children’s” deduction is valid until the month in which income taxed at a rate of 13% on an accrual basis from the beginning of the year does not exceed RUB 350,000. From the month in which income exceeds 350,000 rubles, the deduction does not apply. If an employee has been working at his current place of work not since the beginning of the year, then the deduction should be provided taking into account the income received since the beginning of the current year at his previous job.

In the near future, the size of the “children’s” deductions will most likely increase. Bill No. 751335-7 is being considered, according to which they plan to increase the deduction to 2,500 rubles. for the first and second child, up to 3500 for the third and each subsequent child. For disabled children, the deduction amounts are planned to be set at 8,000 and 12,500 rubles. (depending on the status of the employee: parent, guardian, etc.) In addition, the bill proposes to increase the maximum level of employee income, from which the application of the “children’s” deduction ceases: up to 400,000 rubles.

Deduction amount

Such a deduction can be taken into account up to the month when the taxpayer’s income since the beginning of the year, with an increasing total, exceeded 280,000 rubles. In this case, the size of the strategic offensive force is always differentiated:

- for the 1st and 2nd child – 1400 rubles;

- on the 3rd and subsequent days - already 3,000 rubles;

- standard tax deductions for a disabled child are 3,000 rubles. For example, if such a baby is the first-born, the deduction amount will still be 3,000 rubles.

The principle of using a deduction is additive, in other words, each deduction is added to the previous one, but is not absorbed. So, if there are 4 children, then the total deduction for them will be 8800 rubles.

It should be taken into account that each parent can receive a deduction in the specified amounts.

What income is reduced by deduction?

Standard deductions monthly during the tax period (calendar year) reduce only those incomes of a resident individual to which a personal income tax rate of 13% is applied, with the exception of income from equity participation (dividends).

Deductions cease from the month in which the total amount of such income since the beginning of the year has become more than 350,000 rubles. We recommend checking your child benefit eligibility every month.

If the income is partially exempt from personal income tax, only the taxable part should be included in the calculation of the maximum amount. For example, if an employee received financial assistance in the amount of 10,000 rubles in a year, 4,000 are exempt from personal income tax, 6,000 are taken into account when calculating the maximum base.

Don’t forget to take into account income from the employee’s previous place of work. If an employee came to you in June, and before that he worked in another company, take into account his income from the previous employer. Ask the employee to provide a certificate of income and tax amounts from the previous job.

If in certain months of the year the employee was not paid, standard (including children's) deductions do not disappear. They need to be accumulated and applied when paying income (even once in December), including for those months when income was not paid.

How is the order of babies determined?

Children are ranked chronologically, depending on their age. So, the first baby is the oldest, and then in descending order.

For example, there are four children in a family. 1st - 25 years old, 2nd - 17 years old, 3rd - 15 years old, 4th - 10 years old. In this case, standard tax deductions for children in 2015 will be distributed as follows:

- 1st child - 0 rub.;

- 2nd — 1400 rub.;

- 3rd - 3000 rubles;

- subsequent ones - 3000 rubles.

Or another example. There are 3 children in the family: the 1st child does not study at the age of 22, the 2nd child died at 15 years old, the 3rd is an 8-year-old child. In this case, parents have the right to a standard tax deduction for a child 8 years old in the amount of 3,000 rubles.

Who provides this deduction?

The deduction is provided to the recipient by his employer, and if there are several of them at once, the priority is determined by the choice of the employee. The employer makes the necessary calculations, after which he pays the tax and reports to the tax office. All you have to do is look through receipts and wage statements, carefully monitoring whether the deduction has been taken into account. If an error is identified, you need to report it to the company’s accounting department.

Refund of excess personal income tax through the tax office

If standard tax deductions for children were not made (documents were not provided to the company’s accounting department), or the company’s accounting department made mistakes and the deductions were not taken into account in full, then their recipient can independently contact the tax authority after the taxation period. But in practice, such cases are very rare; in general, it is easier to do this with the employer by submitting an application in a timely manner. The following must be submitted for a child tax refund:

- certificate 2-NDFL from the place of work;

- declaration 3-NDFL;

- certificate from school or other educational institution.

The standard child tax deduction is obtained by not withholding amounts from wages. The employer, if there are grounds, is obliged to subtract the deduction amount from the salary amount, and apply the tax rate to the remaining amount.

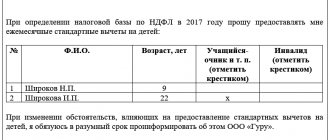

What documents need to be submitted to the company’s accounting department to receive this deduction:

- Documents for children (certificate of the guardianship authority, document from the court recognizing paternity, birth certificate).

- The employee provides the employer with a free-form deduction application at his or her request.

- If the child is 18-24 years old and is studying full-time at a university, a certificate of enrollment will be required.

- If one of the parents transfers the right to receive this deduction to the other, then a corresponding statement, as well as a certificate from work stating that there are no other deductions.

- If the baby is disabled, then a document confirming the disability and a medical report.

These documents can be provided to the employer only once; you do not need to write an application every year. Only when changing place of work do you need to submit an application and documents to the new employer, attaching a 2-NDFL certificate from your previous place of work.

Document submission time

At the birth of a child, each employee can write a statement and also provide a birth certificate. The deduction will be carried out from this moment.

Also, when applying for a new job, you must immediately write an application, bring a birth certificate, in addition, a 2-NDFL certificate received at your previous place of work.

If an employee was hired and for some reason did not immediately provide the documents, but brought them before December of this year, the accounting department is obliged to recalculate the overpaid amount of personal income tax for this year.

Standard tax deductions for children if parents are divorced or in a common-law marriage

How does the law work in cases where there is no marriage registration between the parents of a child? Standard tax deductions for a child, if the parents are divorced, can be received by both parents, but a prerequisite is confirmation of the fact that the minor citizen is supported by them. In this case, you must provide the following official documents:

- certificate of registration (registration of the child) at the place of residence of the parent;

- a copy of the court decision stating who the child lives with;

- agreement between parents regarding payment of child support.

Standard deductions for personal income tax in 2015

Thus, in a letter dated June 11, 2014, which has registration number 03-04-05/28141, the Ministry of Finance expressed its opinion, according to which the standard child tax deduction cannot be accumulated by a parent if in any month he has there was no income. For example, while on parental leave, when returning to work, the taxpayer does not have the right to count on the use of deductions accumulated in this calendar year. Documents confirming the right to a standard tax deduction include: 1. a copy of the child’s birth certificate; 2. a copy of the child’s adoption document; 3. a certificate from the educational institution stating that the child is a full-time student; 4. a copy of the passport (with a note on the registration of the marriage between the parents) or a copy of the marriage registration certificate; 5. copy of the death certificate of the second parent; 6.

Get double standard tax deductions

If adoptive parents (parents) wish, standard tax deductions for children can be replaced by a double deduction, which will be received by one of them. To do this, it is enough to bring a statement of refusal of either parent to receive such a deduction, and the refusing parent provides a 2-NDFL certificate every month.

For such a transfer of the right of deduction, a prerequisite is that the transferor has a permanent income that is subject to personal income tax; in other words, an unemployed person cannot transfer his right of deduction to his spouse.

Therefore, in order for one of the parents to receive standard double tax deductions for a child in 2015, additional documents are needed:

- every month - personal income tax certificate 2, in addition, a statement of refusal of the parent;

- application for a second tax deduction for a child from the second parent.

In addition, single mothers are entitled to a double deduction. They must provide a certificate of form 25, which was received at the registry office and confirms the status of a single mother.

The standard double tax deduction is applied, like a simple one, up to a certain total annual income, more precisely, up to the month when the salary reaches 280,000 from the beginning of the year.

Double benefits

Let's consider a number of cases that may differ from traditional situations. So, for example, if the parents of a daughter or son are not in a family relationship, then in order to receive benefits one of the parents will have to confirm the fact that the child is in his or her care. The following documents may be useful:

- - a court decision on the order of living of children after divorce,

- - agreement about children,

- — a document confirming the child’s registration at the parent’s address, etc.

You can apply for double child deductions in cases where the child does not legally have a second parent. In this case, the basis may not be divorce, but its actual absence, which is established by a death certificate, a court decision on missing persons, or a child’s birth certificate with the specified one parent.

Another option is to submit an application for the refusal of the father or mother to deduct the right in favor of the other. Of course, it is necessary that there be income that will be subject to income tax. A certificate in the so-called Form 2-NDFL must be provided starting from 2013 on a monthly basis if you receive double deductions. In this case, the list of documents is supplemented by an application for double benefits and an application from the other parent to refuse to receive them.

Standard tax deduction for a child with a single parent

The Ministry of Finance notes that a parent is not the only one if the marriage between the child’s parents is simply not registered. In other words, failure to pay alimony, divorce, or deprivation of parental rights of the second spouse is not the basis for the claim that the child has a single parent. To confirm the absence of the second parent, you must provide one of the following documents:

- birth certificate, which will indicate only one parent;

- a court decision legally establishing that the second parent is missing;

- a certificate from the registry office confirming the fact that the second parent was recorded on the birth certificate according to the mother’s words;

- death certificate of one of the parents.

START Limitations

According to the legislation, standard child tax deductions in 2015 are made taking into account income that is taxed at an interest rate of 13%, although this income is still not fully covered by this deduction. The legislator determined that deductions can be made from income declared by the tax agent.

In this case, the employer can declare as a tax agent only the wages of its own employee. Consequently, if a citizen did not work anywhere temporarily (for example, during 2014), he will not be able to receive a standard tax deduction. At the same time, at that time he could have had some other sources of income (for example, rent for real estate that this citizen rents out). A citizen can even report them to the tax authority, paying the tax in good faith, but still he will not receive a deduction.

If the deduction was not provided by the employer, it can be obtained after the tax period at the tax office by filling out the appropriate application there. In the future, you will only need to submit an application to your current employer, and then receive a deduction for all future periods, without wasting your own time and effort.

General rules for providing deductions for disabled children

The meaning of the tax deduction is that it allows you to reduce the income of the parents (or representatives) of a disabled child, subject to personal income tax at a rate of 13 percent. This reduction allows you to pay less tax.

The deduction is provided for a disabled child under 18 years of age. But if he is a full-time student and belongs to group I or II disabled people, then the deduction is provided until the age of 24 years.

When determining the amount of the standard tax deduction, the total number of children is taken into account. The first child is the oldest child, regardless of whether a deduction is provided for him or not. For a disabled child, the deduction is provided in an increased amount. In this case, the amount of the deduction for a disabled child is summed up with the amount of the standard deduction, which is provided for the child, taking into account the type of child in the family he is.

To apply for a deduction, certain documents are required, a list of which is given in

the section below

.

To establish a deduction for a disabled child, a certificate confirming the child’s disability is also required. This certificate is issued by the federal state institution of medical and social examination.

The certificate usually indicates the period until which the disability was established and the date of the next examination.

Depending on the degree of disability caused by a persistent disorder of body functions resulting from diseases, consequences of injuries or defects, a child under the age of 18 is assigned the category “disabled child” for 1 year, 2 years, 5 years or until he reaches age 18 years.

START compatibility

This type of tax deduction is compatible with other types of standard deduction, including property, social and professional. In other words, all these deductions complement each other and add up. But it is necessary to take into account that if the accrual of such deductions turns out to be even slightly more than income, then these excess amounts are equal to zero, since the deductions are exclusively compensatory in nature, and their effect depends directly on the tax activity of each taxpayer.