Who is entitled to deductions for children Amount of deduction for a child If you have a common child in a remarriage Deduction for a disabled child Until what age is a deduction for a child allowed? Maximum amount of income for a deduction for a child How to get a double deduction for children under personal income tax Procedure and documents for receiving a deduction for a child How to return deductions for children for previous years

The standard child tax credit is an amount that the government provides to reduce your tax base.

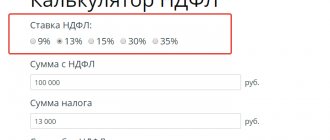

For a working parent, this base is wages, from which the employer monthly transfers 13% of personal income tax to the state budget. If you have a child, your employer deducts a tax deduction from your salary and transfers income tax from the remaining amount.

If a non-working parent has income and pays tax on it, then the tax base can be reduced by the amount of the deduction. Thus, each parent who cares for children saves certain funds.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

Who is eligible for the standard child deduction?

- parents;

- stepmother and stepfather;

- adoptive parents;

- adoptive parents;

- guardians;

- trustees;

- divorced parents;

- parents deprived of parental rights.

The right arises if certain conditions are met:

The child is supported by someone who claims the standard deduction. Even if the mother or father is deprived of parental rights, but participates in providing for the child, they are entitled to a personal income tax refund.

This is stated in the Letter of the Federal Tax Service dated January 13, 2014 No. BS-2-11 / [email protected] “On the provision of a tax deduction.”

You must be officially employed, receive a white salary and pay income tax at a rate of 13%. Or, as stated above, transfer personal income tax on other income.

Who cannot claim the child tax credit:

- An individual entrepreneur is on the simplified tax system (simplified taxation system), since he pays either 6% or 20%, and not 13%.

- Individual entrepreneur on UTII (single tax on imputed income).

- An employee who bought a patent.

- Stay-at-home mothers, students, pensioners – they have no taxable income.

An individual entrepreneur pays personal income tax under the OSNO (general tax system) and therefore can receive deductions for children.

Super deduction: payment for our services only after receiving the deduction!

Order service

Results

To summarize, we note that for 2020-2021. The positions of the Supreme Court of the Russian Federation and the Ministry of Finance of the Russian Federation regarding the possibility of simultaneously applying two deductions for disabled children coincide, and no one plans to change this procedure yet. Therefore, families with disabled children can save a little on personal income tax payments.

For examples of calculating the standard deduction for children, see this article.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Health and Social Development of Russia dated November 24, 2010 N 1031n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Amount of standard deduction per child

According to paragraphs. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation, the size depends on the number of children and the order of their birth. Both parents receive the standard child tax credit.

- 1,400 rubles for the first child;

- 1,400 rubles each for the second;

- 3,000 rubles for the third and each subsequent one.

As a result, each parent receives savings:

For one child 1,400 x 13% = 182 rubles. For two children (1,400 + 1,400) x 13% = 364 rubles. For three children (1,400 + 1,400 + 3,000) x 13% = 754 rubles. For four children (1,400 + 1,400 + 3,000 + 3,000) x 13% = 1,144 rubles.

Place your order and we will fill out the 3-NDFL declaration for you!

Order a declaration

How much tax can be refunded?

Personal income tax is returned monthly for each child in the family in an amount that depends on the number of children. The amounts from which 13 percent is returned are the following (these amounts are the deductions from which personal income tax is returned):

- 1,400 rubles - for the first child;

- 1,400 rubles - for the second child;

- 3,000 rubles - for the third and each subsequent child;

- 12,000 rubles - for a disabled child for a parent, spouse of a parent, adoptive parent;

- 6,000 rubles – per disabled child for a guardian, trustee, adoptive parent, spouse of an adoptive parent, regardless of birth order.

If each of the above amounts is multiplied by 0.13, you will get those personal income tax amounts that are subject to monthly return to each parent of the child.

The first child is considered to be the oldest in age, regardless of whether a deduction is provided for him or not.

In some cases, a double refund is possible. This can be done to the following citizens:

- to the only parent (adoptive parent) at his request until he gets married. A parent is considered a single parent if the child does not have a second parent due to death, unknown absence, or if only one parent is indicated on the child’s birth certificate;

- one of the parents, if the child’s second parent writes an application

for refusal to receive a tax deduction. The first parent submits this application to his employer; - the sole adoptive parent, guardian, trustee.

There are two ways to apply for a tax refund if you have a child: from the employer and from the tax authority.

Let's look at an example of determining the amount of child tax refund.

The couple has three children aged 2 years, 4 years and 7 years. Each spouse has the right to receive a monthly deduction in the amount of 5,800 rubles (1,400 rubles for two children (7 years old and 4 years old) and 3,000 rubles for a child aged 2 years, since he is the third of the children). The amount of tax that is returned monthly to each parent of the child is 5,800 rubles x 0.13 = 754 rubles. In total, both parents will receive a monthly return of 1,508 rubles.

If you are remarried and have a child together

Often during remarriages, the question arises as to how a common child will be considered if there are children from previous marriages. Let's consider the situations.

Example:

Ivan’s first marriage has two adult children, for whom he does not receive a tax deduction. In the second marriage a child is born. What is the standard deduction for Ivan and his new wife Olga?

Letter of the Ministry of Finance of Russia dated June 7, 2013 N 03-04-05/21379 interprets a similar situation as follows: “ In the situation under consideration, the parent’s spouse has the right to receive a standard tax deduction for the third child for each month of the tax period in the amount of 3,000 rubles. However, the standard tax deduction for the first and second adult children is not provided .”

In other words, Ivan receives 3,000 rubles for a common child, regardless of the age of the first children. Olga, as the parent’s spouse, also receives 3,000 rubles for their common child.

Example:

Sergei and Svetlana have children from their first marriages. In their new marriage they have a common daughter. Sergei pays alimony for a child from his first marriage, raises Svetlana’s son and their common daughter. What amount is due to each spouse?

Sergey receives 1,400 rubles for a child from his first marriage, 1,400 rubles for Svetlana’s son and 3,000 for their common daughter. Total 5,800 rubles. Savings (5,800 x 13%) = 754 rubles. Svetlana receives 1,400 rubles for her son from her first marriage and 3,000 rubles for her common daughter, since, counting Sergei’s child from her first marriage, her common daughter is her third child.

Total 4,400 rubles. Savings (4,400 x 13%) = 572 rubles.

Thus, you need to add up the children of both parents and count from oldest to youngest. You will receive a standard deduction for those children who are in your care. At the same time, adult children are also taken into account in the queue, despite the fact that a deduction for them is no longer allowed.

Example:

Nikolai has three children, two of whom are adults. And although Nikolai and his wife no longer receive tax deductions for adult children, all children participate in determining the priority. A minor child was born third, which means mom and dad receive 3,000 rubles for him.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Standard deduction for a disabled child

In this case, the tax deduction is higher and amounts to:

- 12,000 rubles if you are a parent, spouse of a parent or adoptive parent;

- 6,000 rubles if you are a guardian, trustee, foster parent, spouse of a foster parent.

In this case, the increased and basic deductions are summed up. According to the “Review of the practice of courts considering cases related to the application of Chapter 23 of the Tax Code of the Russian Federation” (approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015):

“The amount of the standard deduction provided to a taxpayer who is supporting a disabled child is determined by adding the amounts specified in paragraphs 8 - 11 of subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation.”

This means that if you have a disabled child in your care, first or second born, the tax deduction will be 13,400 rubles, and the refund will be 1,742 rubles.

Calculation: (12,000 + 1,400) x 13% = 1,742 rubles. If a disabled child was born third or subsequent, then the amount of the standard deduction will be 15,000 rubles, with a refund of 1,950 rubles. Calculation: (12,000 + 3,000) x 13% = 1,950 rubles.

Calculation example

Let's consider the calculation of double tax. Natalya Valerievna Vergunova has a salary of 37,000 rubles and one daughter. Her husband refused the subsidy in favor of his wife, and subsequently the citizen received the right to receive double funds. One child receives 1,400 rubles.

1400 + 1400 = 2800 – double deduction amount.

37,000 - (37,000 - 2800) * 13 = 32,554 - salary taking into account the calculated and withheld personal income tax.

The maximum amount of subsidies is 350 thousand rubles. To fill out, not only the established amounts are used, but also special codes:

- for the first child you can get 1400 rubles;

- for the second – 1400 rubles;

- for the third – 3000 rubles;

- for a disabled person - 12,000 rubles;

- for an adopted child - 6,000 rubles.

| To whom is it given (child) | Conditions | Official parent, adoptive parent | Guardian, trustee, foster parent |

| First | Education | 126 | 130 |

| Second | or | 127 | 131 |

| Third | age | 128 | 132 |

| Disabled person | up to 18 years old | 129 | 133 |

| Disabled group I and II | 129 | 133 |

Important! No child benefits can affect the amount of benefits.

The main condition is to officially work and pay interest on taxes.

Up to what age is the child deduction allowed?

The standard tax deduction is paid until your 18th birthday. But this does not mean that the last payment will occur in the month when the child turns 18 years old - your right remains until the end of the calendar year.

If the child is a full-time student, the deduction is extended for the entire period of study or until he turns 24 years old, whichever comes first.

If the child is 24 years old and has not yet graduated, the standard tax deduction is provided until the end of the current year (or earlier if the diploma is issued in the same year). If a child has completed his studies and is not yet 24 years old, then receiving a tax deduction stops after receiving a diploma.

Example:

After school, your 17-year-old son entered a full-time university and graduated in four years. Despite the fact that the boy is not yet 24 years old, starting from the next month after receiving his diploma, you will no longer receive a tax deduction.

Example:

Your daughter finished school, then graduated from a full-time university and entered graduate school full-time. Even before graduation, she turned 24 years old. You will continue to receive the standard tax deduction until the end of the current year or until your daughter graduates, whichever comes first.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

Amount of deduction

Despite the fact that the main topic of our article is the provision of funds for a disabled child by deducting the amount of the standard deduction from the base subject to personal income tax, it is necessary to mention the amounts due to parents of healthy children.

How much funds are provided?

For them, the conditions also remain the same: the funds are received by parents who take part in providing for the child. It doesn't matter whether they are:

- married;

- or divorced.

The fact is that if a parent who has left the family pays child support to another, this is also understood as providing decent living conditions. Therefore, he is also legally entitled to the standard child deduction.

The amount of payments for parents of healthy children is affected by the birth of each specific offspring:

- the baby born first receives a deduction in the amount of 1 thousand 400 Russian rubles;

- the second child in line brings the parents an amount of compensation similar to that mentioned above;

- the third child and the brothers or sisters born after him each bring parents 3 thousand Russian rubles.

These payments continue until the child reaches adulthood, or until he is 24 years old, provided that he enters the full-time department of a higher educational institution and successfully continues his studies there.

Child tax deduction: how to prepare documents

In the material presented, we discuss how to go through this bureaucratic procedure and use the right to receive a cash deduction for children.

As for children with disabilities, after the end of 2015, a decree came into force on calculating the amount of deduction due to parents according to their relationship to the child.

Thus, 12 thousand rubles of standard state compensation are awarded to parents of disabled children if they are:

- his biological relatives, that is, they gave birth to an offspring;

- spouses of biological parents;

- adoptive parents who have gone through the procedure of adopting an offspring.

Funds are provided until the children reach adulthood, provided that the parents actually take part in providing for their own child. Funds of a similar amount are provided for disabled people studying in higher educational institutions under the age of twenty-four, but provided that they are representatives of the following disability groups:

- first;

- second.

If a parent has accepted guardianship or trusteeship of a child, he and his spouse providing for the child have the right to receive 6 thousand Russian rubles. The conditions for the provision of funds remain the same: it lasts until the offspring reaches the age of majority and can be extended for disabled people successfully studying at the university until the age of 24.

The deduction can be issued during the tax period directly at the place of employment of the employee receiving the deduction. In this situation, papers are provided to the accounting department of the employing company that confirm the right to receive funds.

Table 1. Documents confirming the right to receive funds

| Document | Content |

| Document No. 1 | Child birth certificate |

| Document No. 2 | A certificate issued by a medical institution indicating the disability of the offspring |

| Document No. 3 | A document certifying the completion of the adoption procedure, registration of guardianship or guardianship |

The deduction can also be made at the end of the one-year period. The procedure is carried out at the branch of the Federal Tax Service to which a specific taxpayer belongs according to the place of official registration.

Receiving funds is not difficult. To do this, you just need to draw up an appropriate application addressed to the head of the inspection, supplement it with a package of necessary documents that confirm the requirements specified in the application.

In addition, it is necessary to fill out according to the rules and submit the declaration form in form 3-NDFL. We will tell you how to do this in our article.

Video - Standard deductions for disabled children

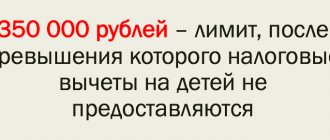

Maximum amount of income for deduction per child

Since the essence of the standard deduction is financial support for families with children, there is an income limit. As soon as your income from the beginning of the year exceeds 350 thousand rubles, you lose the right to a tax deduction. This is stated in paragraphs. 4 paragraphs 1 art. 218 Tax Code of the Russian Federation.

Example:

Your monthly salary is 35 thousand rubles. In November, your total income since the beginning of the year will exceed 350 thousand, so you will not receive a deduction for the last two months. But from the beginning of next year, the accounting department will resume accrual of deductions.

How to get a double standard deduction for children under personal income tax

In order to receive double payment, you must be the only parent. The same applies to the sole guardian, adoptive parent, trustee, foster parent. Legally, it must be recognized that the other parent is absent, dead or missing.

Single mothers also receive a double deduction if there is a dash in the “father” column on the birth certificate or the data is entered from the words of the mother.

For a child born out of wedlock, you can also receive a double standard deduction, but to do this, one parent must write a waiver of the deduction in favor of the other. This rule also applies to divorced parents.

Main condition! The parent who renounced his right must have income from which he pays personal income tax. That is, he should not be unemployed, a simplified individual entrepreneur, on maternity leave, etc.

In order to pay an employee a double deduction, the employer must be sure that the second parent works and his annual income does not exceed 350 thousand rubles. To do this, the parent who renounced his rights must submit a 2-NDFL certificate to the partner’s accounting department on a monthly basis.

To receive the double standard deduction for children, you must file a claim for the deduction in your employer's name.

Super deduction: payment for our services only after receiving the deduction!

Order service

Didn't receive the required deduction?

It happens that a taxpayer, for one reason or another, during the year did not receive the tax benefit due to him for his children. Or maybe this deduction was not fully accrued to him: tax agents also make mistakes. This does not mean at all that the possibility of deduction is lost for him.

In the coming year, he has the opportunity to return part of the amount in the amount of a deduction from the tax already paid.

The main thing is to timely submit your tax return and the required documents for a personal income tax refund:

- birth or adoption certificate (copies) for each child;

- Form 3-NDFL (declaration);

- for a son or daughter from 18 to 24 years old - a certificate of in-patient education.

Procedure and documents for obtaining a standard deduction for a child

There is nothing complicated about filing a standard tax deduction. You need to collect several documents and contact the accounting department of your company.

From now on, everything will happen automatically - you won’t even have to renew your license every year. You only need to inform your employer about changes if you get married, have a child, or have other important changes that affect the amount or eligibility for a tax deduction.

Documents for accounting:

- Application addressed to the employer.

- If you are married, then a copy of your passport with a marriage mark or a marriage certificate.

- Child birth or adoption certificate. Copy.

- If your child is a student, a certificate from the educational institution confirming full-time study.

- If the child is disabled, then a certificate of disability.

- For a single parent, you will need a death certificate of the second parent or a court order declaring the parent missing.

- For a single mother, confirmation is required that she is not married and is raising a child alone. This will be confirmed by a copy of the corresponding page of the passport and a certificate of birth of the child in form 25. Issued at the registry office.

- Guardians or trustees need documents about their rights to the child.

- When moving to a new job, provide the accounting department with a 2-NDFL certificate from your previous job.

It is important to know! No matter what month you submit documents for a standard deduction to the accounting department, you will receive money from the beginning of the year.

Example:

In February 2021, your son was born. In June 2021, you returned from maternity leave and wrote an application for a tax deduction. Your accounting department will begin to calculate the deduction from June 2021 and, in addition, will return personal income tax from January to May 2021.

Find out what documents need to be submitted in your case!

To get a consultation

Double deduction amount

The law gives the right to certain categories of citizens to make a “children’s” tax deduction, doubled. If a child is being raised by a single mother, she has this right unconditionally (just like a father raising a child alone). Any parent can refuse to receive the child deduction due to him, then his share of this tax benefit will go to the other parent. If the child is adopted, then if one of the adoptive parents refuses the deduction, the other will receive it double.

When there is only one parent

There is no term “sole parent” in legislative acts. A single mother (less often a father) is considered the only parent by law if this is proven in the following documents:

- the second parent is not listed on the child’s birth certificate;

- The registry office issued a certificate (form 25) that information about the second parent was recorded in the certificate from the words of the first (most often the father is entered from the words of the mother);

- the second parent has died, for which there is official medical evidence;

- the second parent is officially deprived of parental rights;

- there is a court decision declaring the second parent dead or missing.

ATTENTION! An unregistered marriage cannot be grounds for recognizing a parent as single.

If a single parent registered a marriage, he will no longer be entitled to receive a double tax deduction, since he is no longer the sole caregiver of his child. But the new spouse automatically acquires the right to this benefit.