Is insurance compensation received included in the VAT tax base?

The amount of insurance compensation that you received from the insurance company should not be included in the VAT tax base. These receipts are not related to payment for goods, works, services (clause 2, clause 1, article 162 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated December 8, 2017 N 03-03-06/1/81905).

An exception is provided only for banks, insurers and other organizations listed in clause 5 of Art. 170 of the Tax Code of the Russian Federation and those applying this paragraph. They include insurance payments in the VAT tax base if, when selling goods (work, services) with VAT, they insured the risk of the counterparty’s failure to fulfill its obligations (clause 4, clause 1, article 162 of the Tax Code of the Russian Federation).

Accounting of insurance premiums

Under the general tax regime, insurance premiums are accepted as expenses.

The contribution amounts are recorded in account 69, to which subaccounts are opened for each fund. The accrual of contributions is reflected by posting a credit to 69 and a debit to the cost account to which salaries are charged - 20, 23, 25, 26, 44, etc.

Article 264 of the Tax Code of the Russian Federation allows contributions to be taken into account among expenses to calculate income tax. Documentary evidence will be the employment contract with the employee and various orders for the payment of wages, bonuses and allowances.

Important! Premiums and allowances cannot be counted as expenses, but insurance premiums from them can be counted.

Is insurance activity subject to VAT?

Insurance, coinsurance and reinsurance services are not subject to VAT (clause 7, clause 3, article 149 of the Tax Code of the Russian Federation).

A specific list of non-taxable income is established in paragraphs. 7 paragraph 3 art. 149 of the Tax Code of the Russian Federation. These include, in particular:

- insurance payments under insurance, co-insurance and reinsurance contracts;

- interest accrued on depot premiums under reinsurance contracts;

- funds received by the insurer through subrogation, etc.

This exemption can only be applied by organizations that have the appropriate license (clause 6 of article 149 of the Tax Code of the Russian Federation, article 938 of the Civil Code of the Russian Federation, part 1 of article 6, article 32 of the Law of the Russian Federation of November 27, 1992 N 4015-1).

The insurer may refuse exemption (clause 5 of Article 149 of the Tax Code of the Russian Federation).

Other transactions and receipts are subject to VAT in the general manner (Letters of the Ministry of Finance of Russia dated December 5, 2016 N 03-07-07/72089, dated January 26, 2016 N 03-07-07/2853).

If the insurer simultaneously carries out both operations subject to VAT and exempt from VAT, then it must maintain separate accounting (clause 4 of Article 149, clause 4 of Article 170 of the Tax Code of the Russian Federation).

Is insurance premium received by an insurance organization subject to VAT?

Is not a subject to a tax. An insurance premium is a payment for insurance services that are exempt from VAT (clause 1 of Article 954 of the Civil Code of the Russian Federation, clause 7 of clause 3 of Article 149 of the Tax Code of the Russian Federation).

We recommend that you read:

Didn't find the answer to your question?

Find out how to solve

exactly your problem - contact the online consultant form. Or call us at:

How does a carrier calculate VAT on freight transport services?

Before calculating VAT on freight transportation services, determine the place of their sale. Tax only those of them whose place of sale is the Russian Federation (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

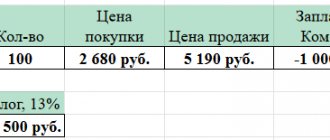

Calculate the amount of VAT on freight transportation services as the product of the tax base and the tax rate. The tax base is the cost of transportation excluding tax (clause 1, article 157, clause 1, article 166 of the Tax Code of the Russian Federation).

When calculating the tax, use a rate of 0% or 18% depending on the nature of transportation and type of transport (clauses 1, 3, Article 164 of the Tax Code of the Russian Federation). The application of the 0% rate must be documented (Article 165 of the Tax Code of the Russian Federation).

If transportation is taxed at a rate of 18% , then calculate VAT in the general manner - on the day the cargo transportation services are provided. If you received an advance payment for future transportation, then you need to calculate VAT on the advance payment, and then calculate the tax on the date of provision of services (clause 1, 14, article 167 of the Tax Code of the Russian Federation).

If transportation is taxed at a rate of 0% , then do not charge VAT on the advance payment for such transportation (clause 1 of Article 154 of the Tax Code of the Russian Federation), and calculate the tax on services provided as follows:

- if you have collected all the documents confirming the zero rate within the allotted period, charge VAT at a rate of 0% on the last day of the quarter in which you collected the documents (clause 9 of Article 167 of the Tax Code of the Russian Federation);

- If you have not collected documents confirming the 0% rate within the specified period, you will be charged tax at a rate of 18%. Do this on the day of provision of cargo transportation services (clause 3 of article 164, clause 9 of article 165, clause 1 of clause 1, clause 9 of article 167 of the Tax Code of the Russian Federation).

To do this, draw up an invoice with VAT at a rate of 18% in one copy, register it in an additional sheet of the sales book for the period of provision of services and submit an updated declaration for this quarter to the inspectorate. You will pay the tax at your own expense, since you did not present this VAT to the buyer (clause 1, article 81 of the Tax Code of the Russian Federation, clauses 2, 3, 22(1) of the Rules for maintaining a sales book);

- if you subsequently collect supporting documents, then recalculate the tax at a rate of 0% and reflect this in the declaration for the quarter in which you collect the documents. In this case, the VAT that you previously paid at a rate of 18% can be deducted (clause 9 of Article 165, clause 9 of Article 167, clause 10 of Article 171, clause 3 of Article 172 of the Tax Code of the Russian Federation).

The procedure for deducting “input” VAT on goods (work, services) that you use to provide transportation services (clause 9 of Article 167, clause 3 of Article 172 of the Tax Code of the Russian Federation) also depends on documentary confirmation of the 0% rate.

VAT rates for cargo transportation

VAT for cargo transportation must be calculated at a rate of 0% or 18%. The application of a particular rate depends on what kind of cargo you are transporting, from where, where and by what type of transport.

the 0% VAT rate in the following cases:

- international transportation of goods (except for transportation by Russian railway carriers) (clause 2.1, clause 1, article 164 of the Tax Code of the Russian Federation);

- transportation of goods by aircraft between points of departure and destination outside the Russian Federation with landing in Russia, if the place of arrival of the cargo in the Russian Federation coincides with the place of its departure from the Russian Federation (clause 2.10, clause 1, article 164 of the Tax Code of the Russian Federation);

- transportation by Russian railway carriers:

— exported (re-exported) goods (clause 9, clause 1, article 164 of the Tax Code of the Russian Federation);

— goods from the Russian Federation to the countries of the EAEU (clause 9.1, clause 1, article 164 of the Tax Code of the Russian Federation);

— goods through the Russian Federation from one foreign state to another (clause 9.1, clause 1, article 164 of the Tax Code of the Russian Federation);

- transportation by inland water transport across the territory of the Russian Federation of exported (re-exported) goods (clause 2.8, clause 1, article 164 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated January 23, 2012 N 03-07-08/10, dated August 2, 2011 N 03-07- 15/72 (clause 5) (sent by Letter of the Federal Tax Service of Russia dated August 12, 2011 N AS-4-3/));

- transportation within the Russian Federation of foreign goods placed under the customs transit procedure (clause 3, clause 1, article 164 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated September 25, 2012 N 03-07-15/125).

The right to a 0% VAT rate must be documented. In some cases, you can refuse the zero VAT rate on freight transportation services.

the 18% VAT rate in all cases where you do not apply the 0% rate. Including if you did not document the zero rate or refused it (clauses 3, 7, article 164, clause 9, article 165 of the Tax Code of the Russian Federation).

Is a 0% VAT rate applied when transporting cargo, which is a separate stage of international cargo transportation?

If the points of departure and destination of the cargo are in the Russian Federation, but the transportation is a stage of the international transportation of goods, then it is subject to VAT at a rate of 0%. This follows from paragraph 18 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 N 33, Letters of the Ministry of Finance of Russia dated October 30, 2017 N 03-07-08/71004, dated February 1, 2016 N 03-07-08/4526, Federal Tax Service of Russia dated June 14 .2016 N SD-4-3/

To apply the 0% rate in this case it is not important:

- who engages the carrier - the forwarder or the shipper himself;

- How many carriers are involved in international cargo transportation?

The application of a 0% rate to transportation, which is a separate stage of international cargo transportation, must be documented (Article 165 of the Tax Code of the Russian Federation).

In our opinion, the set of documents in this case should be similar to the set that needs to be used to confirm the 0% VAT rate for international cargo transportation, and include, among other things:

- an agreement or agreements (copies thereof) that confirm that cargo transportation is a stage of international transportation. For example, if you are transporting cargo across Russia for a customer who is organizing the international transportation of this cargo for a third party, then to confirm the 0% rate you will need two contracts: between you and your customer and between your customer and the third party;

- copies of transport, shipping or other documents that confirm the export of goods from the Russian Federation (import of goods into the Russian Federation).

If you do not have any of these documents, request copies of them from the customer of your services.

An example of applying a 0% VAT rate for international transportation of goods, which consists of several stages

The Alpha organization provides services for organizing the international transportation of goods from Russia to Poland (on the route Ekaterinburg - Warsaw). The transport expedition agreement stipulates that this international transportation is carried out by road in two stages:

- Stage 1 - transportation of goods along the route Ekaterinburg - Moscow;

- Stage 2 - transportation of goods along the route Moscow - Warsaw.

The Alpha organization does not have its own vehicles. Therefore, to fulfill the transport expedition agreement, Alpha hired two organizations as carriers: Beta (stage 1) and Gamma (stage 2).

In such a situation, both carriers can apply a zero VAT rate: the Beta organization and the Gamma organization.

How to confirm the 0% VAT rate for cargo transportation

The package of documents to confirm the 0% VAT rate depends on the type of transportation. Submit supporting documents simultaneously with the VAT return for the period in which you collected them and calculated VAT at a rate of 0% (clause 10 of Article 165 of the Tax Code of the Russian Federation).

From October 1, 2018, you do not need to submit documents if you previously submitted them to confirm the 0% rate for previous periods. Instead, a notification should be submitted indicating the details of the document with which the supporting documents were submitted and the tax authority to which they were submitted.

- for international cargo transportation (except for transportation by Russian railway carriers), confirm the zero rate (clause 2.1, clause 1, article 164, clause 3.1, article 165 of the Tax Code of the Russian Federation):

— a contract (a copy thereof) for the provision of services for the international transportation of goods;

— copies of transport, shipping or other documents that confirm the export of goods from the Russian Federation (import of goods into the Russian Federation). The specific types of such documents depend on the type of transport you use to transport the goods.

If you are exporting goods to a country that is a member of the EAEU (importing from it) and the customer for the transportation is not an exporter (importer), then you additionally need a copy of the agreement between the customer and the exporter (importer);

- When transporting cargo by aircraft with an intermediate landing in the Russian Federation and further departure from the landing point (Clause 2.10, Clause 1, Article 164 of the Tax Code of the Russian Federation), confirm the 0% VAT rate with a register of transportation, shipping or other documents. These documents must contain confirmation from the customs authority that the place of arrival and place of departure of goods in the Russian Federation are the same (clause 3.9 of Article 165 of the Tax Code of the Russian Federation);

- Russian railway carriers confirm the 0% VAT rate on transportation services with a register of transportation documents (clause 5, 1, article 165 of the Tax Code of the Russian Federation);

- when transporting exported (re-exported) goods across the Russian Federation by inland water transport (clause 2.8, clause 1, article 164 of the Tax Code of the Russian Federation), confirm the zero VAT rate (clause 3.8 of article 165 of the Tax Code of the Russian Federation):

— a contract (a copy thereof) for the provision of transportation services;

— copies of transport, shipping or other documents that confirm the removal of cargo from the Russian Federation;

- when transporting foreign goods within the Russian Federation that are placed under the customs procedure of customs transit (clause 3, clause 1, article 164 of the Tax Code of the Russian Federation), confirm the VAT rate of 0% (clause 4, article 165 of the Tax Code of the Russian Federation):

— a contract (a copy thereof) for the provision of cargo transportation services;

— customs declaration (its copy) with marks from customs authorities;

— copies of transport, shipping or other documents that confirm the import of goods into the Russian Federation and their export from the Russian Federation. The specific types of such documents depend on what transport you are using to transport the cargo (clause 4, clause 4, article 165 of the Tax Code of the Russian Federation).

The deadline for collecting supporting documents is no later than 180 calendar days. It is calculated (clause 9 of article 165 of the Tax Code of the Russian Federation):

- for international cargo transportation - from the date of the mark of the customs authorities on transport, shipping or other documents confirming the export (import) of goods. If you export goods to a country that is a member of the EAEU (import goods from it) - from the date of registration of such documents;

- for transportation of cargo by aircraft with an intermediate landing in the Russian Federation - from the date of the customs authority’s mark, which confirms the departure of goods from the Russian Federation;

- for Russian railway carriers - from the date of affixing the mark of the customs authority or the calendar stamp of the corresponding railway station on the transportation documents;

- for transportation of exported (re-exported) goods by inland water transport within the Russian Federation - from the date of the customs authority’s mark “Loading is permitted” on the order for the shipment of goods of a sea vessel that exports cargo outside the Russian Federation;

- for transportation of foreign goods within the Russian Federation under the customs procedure of customs transit - from the date of the customs authority’s mark on the customs declaration.

Deduction of “input” VAT from the carrier

The procedure for deducting input VAT on goods, works, and services that you purchased for cargo transportation depends on the rate at which the transportation itself is taxed.

For cargo transportation, taxed at a rate of 18% , deduct VAT in the general manner for three years, starting from the quarter in which the purchased goods, works, services were accepted for accounting (clause 2 of Article 171, clause 1.1 of Article 172 of the Tax Code RF).

For cargo transportation taxed at a rate of 0% , deduct VAT (clause 9 of Article 165, clause 1, clause 1, clause 9 of Article 167, clause 3 of Article 172 of the Tax Code of the Russian Federation):

- on the last day of the quarter in which documents confirming the 0% rate were collected - if you collected them within the established 180-day period. Declare the deduction in the declaration for the quarter in which you collected the package of documents;

- on the day of provision of cargo transportation services - if you have not collected supporting documents within the prescribed period. In this case, declare the “input” VAT in the updated declaration for the quarter in which you provided the services.

If you then collect supporting documents, the “input” VAT will need to be restored and deducted in the quarter in which these documents were collected (clause 9 of Article 167, clause 3 of Article 172 of the Tax Code of the Russian Federation, clause 41.3, 41.5 Procedure for filling out a VAT return).

If you have cargo transportation that is taxed at rates of 0% and 18%, then you need to keep separate records of “input” VAT on them (clause 10 of Article 165 of the Tax Code of the Russian Federation).

Press about insurance, insurance companies and the insurance market

Company

, December 6, 2009

Actions of retaliation

The only time the owner of an insurance company was held liable for bankruptcy. The former owner of IC "Doverie" embezzled the insurer's assets worth 96 million rubles. Petersburg Insurance ceased to exist back in 2005. Immediately after this, the owner of 80% of the shares of Doverie, Viktor Rudnitsky, disappeared without a trace. True, two years later he returned and [. ]

Tax statements

,

April 11, 2002

Calculation and payment of VAT by insurance organizations

The activities of insurance organizations are regulated by the Law of the Russian Federation dated 27.71.92 No. 4015-1 (as amended on 20.11.99) “On the organization of insurance business in the Russian Federation.” According to Art. 2 of this law, insurance is a relationship to protect the property interests of individuals and legal entities upon the occurrence of certain events (insured events) at the expense of funds generated from the insurance premiums they pay.

Certificate "NV" The following are exempt from VAT: - insurance premiums that the policyholder is obliged to pay to the insurer in accordance with the insurance or reinsurance agreement, including the reinsurance commission paid by the reinsurer to the reinsurer; — interest accrued on the depot of premiums under reinsurance agreements and transferred by the reinsurer to the reinsurer; - insurance premiums received by an authorized insurance organization that has concluded a coinsurance agreement in the prescribed manner on behalf of and on behalf of the insurers; - funds received under recourse claims from the person responsible for the damage caused to the policyholder, in the amount of the insurance compensation paid by the insurer to the policyholder.

As for insurance payments received by the policyholder when committing insurance events provided for by the insurance contract or the Law, they are also not subject to VAT, with the exception of the insurance payment received by the policyholder when insuring the risk of non-fulfillment of contractual obligations by the counterparty of the policyholder-creditor. Insurance can be carried out in voluntary and compulsory forms. In this case, voluntary insurance is carried out on the basis of an agreement between the policyholder and the insurer. This agreement, based on the rules of voluntary insurance, determines specific insurance conditions. Insurance is required by law. The types, conditions and procedure for compulsory insurance are determined by the relevant laws of the Russian Federation. Insurers in accordance with Art. 5 of Law No. 4015-1 recognizes legal and capable individuals who have entered into insurance contracts with insurers or are policyholders by virtue of the law. Insurers are legal entities of any organizational and legal form provided for by the legislation of the Russian Federation, created to carry out insurance activities and who have received a license to carry out insurance activities on the territory of the Russian Federation in the manner prescribed by this law.

Intermediary activities of the forwarder

When a freight forwarder engages third parties to perform work, such work is of an intermediary nature. Therefore, the work of the forwarder in such cases is regulated by the rules on commission and agency relations. Freight forwarders have the right to issue clients the necessary documents, including invoices with an allocated VAT amount.

In order to confirm the intermediary nature of forwarding activities, the following conditions must be met:

- Drawing up an agreement that indicates on whose behalf subsequent contracts for the transportation of goods are concluded - on behalf of the client himself or the forwarder. Separately, it is worth specifying the expected amount of remuneration for the services offered. Independently taking on additional functions without notifying the client may not be considered an intermediary activity.

- In addition to the contract, it is necessary to have forwarding documents, such as: an order to the forwarder indicating the fulfillment of conditions and work within the framework of the transportation of goods, a receipt confirming the fact of acceptance and transfer of goods, warehouse records for the shipment of goods.

Features and payment of VAT by insurance organizations

VAT (value added tax) is paid by:

- — when selling goods (works, services);

- — when transferring goods for one’s own needs, if the corresponding expenses are not reflected in tax accounting;

- - from the cost of imports.

According to the current tax legislation, insurance, coinsurance, and reinsurance services provided by insurance organizations are free from VAT in accordance with Art. 149 of the Tax Code of the Russian Federation. However, certain services of insurance organizations are subject to VAT. Despite the fact that insurance organizations have the right to be exempt from fulfilling taxpayer obligations, organizations in the financial sector of the economy are subject to general requirements for obtaining exemption from fulfilling taxpayer obligations. They are that the amount of revenue from the sale of services by financial organizations for the three previous consecutive calendar months, excluding tax, should not exceed 2 million rubles, while this limitation refers to the total amount of revenue from both taxable and non-VAT-taxable transactions. If insurance organizations' revenue for three months exceeds 2 million rubles, then they must pay VAT.

For insurance organizations, transactions that are not subject to VAT are clearly defined. Transactions on insurance, co-insurance and reinsurance are exempt from VAT, as a result of which the insurance organization receives:

- -insurance payments (remuneration under insurance, co-insurance and reinsurance contracts, including insurance premiums and paid reinsurance commission (including bonus);

- - interest accrued on the depot of premiums under reinsurance agreements, and interest transferred to the reinsurer by the reinsurer;

- - insurance premiums received by an authorized insurance organization that has concluded a co-insurance agreement in the prescribed manner on behalf of and on behalf of the insurers;

- - funds received by the insurer by way of subrogation from the person responsible for the damage caused to the policyholder, in the amount of the insurance compensation paid to the policyholder.

The legislation regulating the activities of insurance organizations establishes that the subject of direct activities of insurers cannot be production, trade, intermediary and banking activities. At the same time, insurers have the right to invest or otherwise place insurance reserves formed from received insurance premiums to ensure the fulfillment of accepted insurance obligations, and other funds, as well as issue loans to policyholders who have entered into personal insurance contracts, within the limits of the insured amounts under these contracts. Insurance reserves are placed in securities (state, municipal, corporate bonds, bills, etc.), bank deposits, etc. These transactions are also not subject to VAT.

VAT taxation of insurance transactions

In law enforcement practice, insurance organizations often have questions about the legality of exemption from value added tax for the services they provide. Let's consider these problems in detail.

Based on subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, the object of VAT taxation is the sale of goods (work, services) on the territory of the Russian Federation, including the sale of pledged items and the transfer of goods (results of work performed, provision of services) under an agreement on the provision of compensation or novation , as well as transfer of property rights. For the purposes of Chapter 21 of the Tax Code of the Russian Federation, the transfer of ownership of goods, the results of work performed, the provision of services free of charge is recognized as the sale of goods (work, services);