Expenses taken into account when calculating the unified agricultural tax

The Tax Code (Article 346.5) provides for a limited list of expenses that an agricultural entrepreneur can take into account when calculating tax. And not all costs will be included in this list. Let's consider the main ones:

- purchase of fixed assets and intangible assets, as well as their maintenance in working condition;

- rental and leasing of property;

- purchase of young livestock, poultry, fish fry;

- material expenses, including the purchase of seeds, fertilizers, seedlings, biological products, etc.;

- insurance;

- VAT on those amounts that are included in the expenses of the inventories;

- interest on loans and credits;

- for the acquisition of agricultural land;

- from the death of animals and chickens;

- fire safety expenses;

- to conduct an independent assessment of employee qualifications.

A complete list of costs is presented in Art. 346.5 Tax Code of the Russian Federation. It has recently become possible to include the costs of assessing qualifications, as well as training and retraining of personnel as costs. This item is included in the list of expenses only in 2021.

Who has the right to apply the Unified Agricultural Tax

In clause 2.1. Chapter 346.2 of the Tax Code of the Russian Federation determines that the following have the right to use a special taxation regime in business activities:

1. Organizations and individual entrepreneurs producing agricultural products, carrying out their primary and subsequent (industrial) processing (including on leased fixed assets) and selling these products, provided that in the total income from the sale of goods (works, services) such organizations and individual entrepreneurs, the share of income from the sale of agricultural products produced by them, including their primary processing products produced by them from agricultural raw materials of their own production, is at least 70 percent.

2. Agricultural consumer cooperatives (processing, marketing (trading), supply, horticultural, vegetable farming, livestock farming), recognized as such in accordance with Federal Law of December 8, 1995 N 193-FZ “On Agricultural Cooperation”, which have a share of income from sales agricultural products of own production of members of these cooperatives, including primary processed products produced by these cooperatives from agricultural raw materials of own production of members of these cooperatives, as well as from work (services) performed for members of these cooperatives, does not account for the total income from the sale of goods (work, services) less than 70 percent.

3. City- and settlement-forming Russian fishery organizations, the number of employees in which, taking into account family members living with them, is at least half the population of the corresponding locality.

Expenses on fixed assets

Since the beginning of 2007, agricultural organizations have taken into account expenses for fixed assets and intangible assets from the moment these facilities are put into operation. This applies to those objects that were purchased during the period of application of this special regime. This means that the cost of these objects is included in expenses in parts until the end of the year in which they were purchased.

In addition to the purchased operating systems, the costs of their construction and production can also be taken into account when calculating the unified agricultural tax.

The residual value of previously acquired assets is included in expenses depending on how long their useful life is. It is determined in accordance with the Classifier of fixed assets included in depreciation groups.

Declaration on Unified Agricultural Tax for 2021

The report consists of sections:

| Chapter | Content | Availability in the declaration |

| Title page | Basic information about the taxpayer | Required |

| 1 | Unified agricultural tax payable at the end of the year | |

| 2 | Calculation of Unified Agricultural Tax | |

| 2.1 | Calculation of losses carried forward from previous years | Present if there is loss carryover |

| 3 | Report on the intended use of funds | Present if target funds were received |

If the taxpayer did not carry out activities during the year, he is obliged to submit a zero declaration with mandatory sections 1 and 2. In this case:

- in section 1 on page 001 the OKTMO code is indicated (if the location has not changed during the year, page 003 is not filled in), on page 004 - 0;

- Section 2 indicates the tax rate on page 045.

The remaining fields are filled with dashes.

Expenses for leasing payments

Let's consider the expense item in the form of leasing payments. Who exactly has the property on their balance sheet does not matter. When transferring property to the lessee, that is, the payer of the Unified Agricultural Tax, its redemption value is included in expenses in the period in which the payment was made.

The peculiarity of accounting for these material costs as expenses is that they are taken into account as expenses at the time of payment. In other words, either at the time of debiting funds from the organization’s account, or paying from the cash register, or another method of repaying the debt. When paying interest on credit and borrowed funds, the same accounting procedure is used.

Requirements for recognized expenses

The Tax Code of the Russian Federation defines four criteria for recognized expenses that reduce the taxable base. They should be:

- justified from an economic point of view;

- fully paid;

- confirmed by primary documents;

- named in the list from clause 2 of Art. 346.5 Tax Code of the Russian Federation.

Companies and individual entrepreneurs that have switched to a simplified system use the cash method of determining income and costs in their work. This means that it is permissible to recognize expenses if two conditions are simultaneously met:

- they are paid;

- they are actually incurred.

If a commercial structure has transferred an advance to the supplier against future deliveries, it is not included in the expense portion when calculating tax. Such a waste meets the first criterion (actual payment), but does not meet the second, because the counterparty who received the funds has not yet fulfilled the counter-obligations and has not provided the company with supporting primary documents.

Tags: asset, accountant, job description of the general director, loan, tax, order, expense, write-off, facility, economic

Agricultural Insurance Costs

Agricultural producers depend on weather conditions like no other. In a dry year, entrepreneurs may lose most of the harvest, and sometimes the entire harvest. In order to reduce the risk of unexpected losses as a result of weather conditions, entrepreneurs can insure their future harvest, for example, against drought.

The farmer has the right to include insurance costs in expenses to reduce taxes. Then insurance payments will need to be taken into account as non-operating income. In addition to drought insurance, an agricultural producer can reduce the tax base for other types of voluntary insurance costs. For example, insurance of fixed assets, transport, cargo, supplies, etc.

List of deductible expenses

According to the provisions of the Tax Code of the Russian Federation, commercial structures on the Unified Agricultural Tax have the right to reduce the tax base for the following types of expenses:

- Expenses for the purchase of fixed assets, repairs or bringing existing assets into line with the requirements of the time.

- Costs associated with the purchase or independent creation of intangible assets.

- Payments for rental or leasing of fixed assets.

- Expenses aimed at advertising manufactured products.

- Costs associated with the purchase of seeds and other planting materials, fertilizers, pest control products, and feed for farm animals.

- Payment of wages to employees of the organization, compensation, sick leave benefits.

- Expenses aimed at maintaining an adequate level of safety at work, and at creating and maintaining your own medical aid station.

- Costs associated with ensuring fire safety and protecting crops and property.

- Transfers to extra-budgetary funds for compulsory insurance of employees, voluntary insurance (crop, existing fixed assets, risks, cargo and vehicles).

- Interest and fees associated with servicing current loans and borrowings.

- Customs payments made when purchased goods cross the state border of the Russian Federation.

- Maintenance of company cars.

- Payment for employee business trips: daily allowance, hotels (or other accommodation), vehicle tickets, other expenses (visa fees, etc.).

- Payment for notary services, consulting, court fees.

- Expenses for the services of an engaged accountant or auditor, expenses associated with the publication of financial statements.

- Payment for office supplies and communication services.

- The amount of taxes and fees paid in accordance with current legislation.

- Amounts of VAT on material and production costs included in expenses for tax purposes.

- Losses caused by natural or man-made disasters (for example, crop loss due to fire or drought) and associated with the elimination of their consequences.

In total, the list of expenses that reduce the tax base includes 44 items. When calculating the amount of the single agricultural tax, you need to make sure that “extra” values are not included in the formula. If the fiscal authorities subsequently discover that the recognition of costs is illegal, the organization or individual entrepreneur will have to pay the arrears and penalties on it.

Expenses for young animals and animals

In addition to the costs of purchasing the youngest stock, for example, a young animal for forming a herd, or fish fry, the following costs are also included in the tax calculation:

- salaries for specialists directly involved in raising young animals;

- feed costs;

- other costs directly related to raising young animals.

But, you need to keep in mind that the shortage resulting from losses of young animals cannot reduce the tax base.

COMBINING UST WITH OTHER TAX REGIMES

Unified Agricultural Tax can be used in combination with PSN (patent system) and UTII (single tax on imputed income), if a type of business activity different from the Unified Agricultural Tax is carried out on PSN and UTII.

Moreover, when combining Unified Agricultural Tax and UTII (or PSN), entrepreneurs are required to keep separate records of income and expenses. If it is impossible to separate expenses when calculating the tax base for Unified Agricultural Tax and Unified Internal Internal Revenue (UTI), these expenses are distributed in proportion to the shares of income in the total amount of income received when applying these special tax regimes. Income and expenses from types of activities transferred to UTII (PSN) should not be taken into account when calculating the tax base for the unified agricultural tax (Clause 10, Article 346.6 of the Tax Code of the Russian Federation of the Tax Code of the Russian Federation).

The material has been updated in accordance with changes in the legislation of the Russian Federation on January 26, 2018

Material costs and expenses

One of the items on the list of expenses is material costs. They include costs such as the purchase of seedlings, seeds, feed, medicines, plant protection products, etc. These costs are taken into account in their full cost after the fact of their payment, regardless of the period in which they are transferred to production.

In addition to the above, material costs also include payment for services from third-party organizations, for example, raw materials processing services or OS maintenance services.

What documents can confirm the representation expenses incurred by the company?

There is no clear list of papers that must be completed to confirm entertainment expenses in the Tax Code. There is no such list in other regulatory documents. However, from time to time, representatives of fiscal authorities give advice on this issue. This is the recommendation given by the Moscow tax authorities (letter from the Federal Tax Service of Russia for Moscow dated October 6, 2006 No. 20-12/89121.2). According to officials, “...documents used to confirm hospitality expenses may be:

1) order (instruction) of the head of the organization on the implementation of expenses for these purposes;

2) estimate of entertainment expenses;

3) primary documents confirming the cost of goods used for entertainment events, services of third-party organizations, for example catering organizations, etc.;

4) an act on the implementation of entertainment expenses, signed by the head of the organization, indicating the amounts of entertainment expenses actually incurred;

5) a report on entertainment expenses (compiled specifically for entertainment events held), which indicates:

- the purpose of representative events and the results of their implementation;

- date and place of the event;

- program of events;

- composition of the invited delegation;

- host party participants;

- amount of expenses for entertainment purposes.”

Expenses for the acquisition of agricultural land

For expenses associated with the acquisition of property rights to a plot of agricultural land, a special accounting procedure has been established. If for other costs expenses are recognized immediately, then the costs of purchasing a plot are distributed into expenses in equal parts over a minimum of 7 years. These expenses can be deducted only after payment, as well as in the presence of supporting documents on state registration of the site, or that documents for registration have already been submitted. The supporting document is a receipt from the authorities involved in the registration of these rights.

Registration procedure

All values of the declaration’s cost indicators are indicated in full rubles. Discard values of indicators less than 50 kopecks, and round up 50 kopecks or more to the full ruble.

Fill text indicators in cells from left to right in capital letters. Also fill in integer numeric and code indicators from left to right, with a dash in the last unfilled cells.

The return may not correct errors by corrective or other similar means.

On each sheet of the declaration, indicate the TIN and KPP of the organization. Fill out the cells provided for the Taxpayer Identification Number (TIN) from left to right. Since the organization’s TIN consists of 10 digits, put a dash in the last two cells that remain free.

After the declaration is completed, number all pages sequentially.

This is stated in paragraphs 2.1–2.4 of the Procedure approved by order of the Federal Tax Service of Russia dated July 28, 2014 No. ММВ-7-3/384.

For more information on preparing tax returns, see How to prepare and submit tax returns.

Legislative basis for calculations

It is recommended to study the following documents:

| Legislative act | Content |

| Art. 346.5 Tax Code of the Russian Federation | “The procedure for determining and recognizing income and expenses” |

| Clause 1 of Article 252 of the Tax Code of the Russian Federation | That expenses must be justified and confirmed |

| Decree of the Government of the Russian Federation No. 431 of June 10, 2010 | “On the norms of expenses in the form of losses from the forced slaughter of poultry and animals” |

Nuances of recognizing costs associated with asset accounting

Expenses associated with accounting for fixed assets top the list. A distinctive feature of such expenses is that depreciation is not charged on fixed assets, and paid expenses are written off in a characteristic manner (clause 4 of Article 346.5 of the Tax Code of the Russian Federation). According to tax legislation, write-offs of fixed assets expenses cannot be accepted immediately in full. In this case, the rule of uniform allocation of costs applies, but the time period for this is different.

OS cost distribution:

| Purchasing an OS while using a special mode | The cost of fixed assets is taken into account as an expense from the moment of operation until the end of the tax period. |

| Purchasing an OS before switching to a special regime, the service life of which is less than 3 years | The cost of the operating system is taken into account as expenses from the moment of commissioning until the end of the tax period. |

| Purchasing an OS before switching to a special regime, the service life of which is from 3 to 15 years | Costs are accounted for as follows: · 1 year – 50%; · 2nd year – 30%; · 3rd year – 20%. |

| Purchasing an OS before switching to a special regime, the service life of which is over 15 years | Costs are recognized in equal installments over 10 years. |

Answers to common questions

Question No. 1. Can we take into account the milk that goes into fattening young animals? Are these costs related to feed?

If you use milk produced at your enterprise to fatten young animals, it cannot be taken into account in these costs. And if you purchase milk from a third party, then it can be classified as a material cost.

Question No. 2. In addition to our own transport, we also use rented transport on our farm. Can we reduce the tax on the amount of rental vehicle insurance?

You can. In this case, it does not matter whether the vehicle belongs to the manufacturer or is rented from a third party. The main thing is that the basic conditions for cost accounting are met. In this particular case, all conditions are met.

How to fill out a declaration under the Unified Agricultural Tax

We recommend starting the report from the last sections, because:

- targeted funds may be spent for other purposes and, as a result, will be reflected in income in section 2;

- losses carried forward from previous years are summarized in section 2.1 and transferred to section 2;

- the total tax amount for the year in section 2 is used to calculate the amount to be paid additionally (reduced) at the end of the year, taking into account the advance payment (section 1).

The declaration is filled out in printed capital letters, the totals are filled out in rubles without kopecks. Dashes are placed in empty cells.

Section 1

In section 1 of the Unified Agricultural Tax declaration, indicate:

- OKTMO code according to the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st (line 001). Additionally, enter the OKTMO code on line 003 if the organization’s location has changed (for an entrepreneur – place of residence). If the address has not changed, put dashes on line 003;

- the amount of the advance payment accrued at the end of the reporting period (line 002);

- the amount of tax to be paid (line 004) or reduced (line 005). The values of these indicators are determined as the difference between the amount of tax accrued for the year (line 050 of section 2) and the amount of the advance payment at the end of the reporting period (line 002 of section 1).

This procedure is provided for in Section IV of the Procedure, approved by Order of the Federal Tax Service of Russia dated July 28, 2014 No. ММВ-7-3/384.

The procedure for determining income for the purposes of the Unified Agricultural Tax (Article 346.5 of the Tax Code of the Russian Federation)

⇐ PreviousPage 5 of 10Next ⇒

When determining the object of taxation, the following income is taken into account:

- income from sales determined in accordance with Article 249 of the Tax Code of the Russian Federation;

- non-operating income determined in accordance with Art. 250 Tax Code of the Russian Federation.

When determining the object of taxation of the unified agricultural tax, the following are not taken into account:

- income specified in Art. 251 Tax Code of the Russian Federation;

- income of an organization subject to income tax at the tax rates provided for in paragraphs 3 and 4 of Art. 284 NK;

- income of an individual entrepreneur, subject to personal income tax at tax rates of 35% and 9%.

The procedure for determining expenses for the purposes of the Unified Agricultural Tax (Article 346.5 of the Tax Code of the Russian Federation)

When determining the object of taxation, taxpayers reduce the income received by the following expenses:

- expenses for the acquisition, construction and production of fixed assets, as well as for the completion, retrofitting, reconstruction, modernization and technical re-equipment of fixed assets (taking into account the specifics);

- expenses for the acquisition of intangible assets, the creation of intangible assets by the taxpayer himself (taking into account the specifics);

- expenses for repairs of fixed assets (including leased ones);

- rental (including leasing) payments for rented (including leased) property;

- material costs, including acquisition costs:

- seeds, seedlings, saplings and other planting material,

- fertilizers,

- feed,

- medicines,

- biological products and plant protection products;

- expenses for wages, compensation, temporary disability benefits in accordance with the legislation of the Russian Federation;

- expenses for ensuring safety measures provided for by regulatory legal acts of the Russian Federation, and expenses associated with the maintenance of premises and equipment of health centers located directly on the territory of the organization;

- expenses for compulsory and voluntary insurance, which include insurance premiums for all types of compulsory insurance, as well as for the following types of voluntary insurance:

- voluntary insurance of vehicles (including rented ones);

- voluntary cargo insurance;

- voluntary insurance of fixed assets for production purposes (including leased), intangible assets, objects of unfinished capital construction (including leased);

- voluntary insurance of risks associated with construction and installation work;

- voluntary insurance of inventory;

- voluntary insurance of crops and animals;

- voluntary insurance of other property used by the taxpayer in carrying out activities aimed at generating income;

- voluntary insurance of liability for causing harm, if such insurance is a condition for the taxpayer to carry out activities in accordance with the international obligations of the Russian Federation or generally accepted international requirements

- VAT amounts on purchased and paid for goods (work, services), the costs of acquisition (payment) of which are subject to inclusion in expenses;

- amounts of interest paid for the provision of funds (credits, borrowings) for use, as well as expenses associated with payment for services provided by credit institutions, including those associated with the sale of foreign currency when collecting taxes, fees, penalties and fines;

- expenses for ensuring fire safety in accordance with the legislation of the Russian Federation, expenses for property protection services, maintenance of fire alarm systems, expenses for the purchase of fire protection services and other security services;

- amounts of customs duties paid when importing (exporting) goods into the territory of the Russian Federation and other territories under its jurisdiction, and not subject to refund to taxpayers in accordance with the customs legislation of the Customs Union and the legislation of the Russian Federation on customs affairs;

- expenses for the maintenance of official vehicles, as well as expenses for compensation for the use of personal cars and motorcycles for official trips within the limits established by the Government of the Russian Federation;

- travel expenses, in particular for:

o the employee’s travel to the place of business trip and back to the place of permanent work;

o rental of residential premises. This item of expenses also covers the employee's expenses for additional services provided in hotels (except for expenses for service in bars and restaurants, expenses for room service, expenses for the use of recreational and health facilities);

o daily allowance or field allowance;

o registration and issuance of visas, passports, vouchers, invitations and other similar documents;

o consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees;

- fee to a notary for notarization of documents. Moreover, such expenses are accepted within the limits of the approved tariffs;

- expenses for accounting, auditing and legal services;

- expenses for the publication of financial statements, as well as for publication and other disclosure of other information, if the legislation of the Russian Federation imposes an obligation on the taxpayer to carry out such publication (disclosure);

- expenses for office supplies;

- expenses for postal, telephone, telegraph and other similar services, expenses for payment for communication services;

- expenses associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (licensing agreements). These costs also include costs for updating computer programs and databases;

- expenses for advertising manufactured (purchased) and (or) sold goods (works, services), trademark and service mark;

- expenses for the preparation and development of new production facilities, workshops and units;

- food costs for workers engaged in agricultural work;

- expenses for food rations for crews of sea and river vessels within the limits approved by the Government of the Russian Federation;

- amounts of taxes and fees paid in accordance with the legislation of the Russian Federation on taxes and fees;

- expenses for payment of the cost of goods purchased for further sale (reduced by the amount of expenses for compulsory and voluntary insurance), including expenses associated with the acquisition and sale of these goods, including costs of storage, maintenance and transportation;

- expenses for information and consulting services;

- expenses for training and retraining of personnel on the taxpayer's staff on a contractual basis;

- legal costs and arbitration fees;

- expenses in the form of fines, penalties and (or) other sanctions paid on the basis of a court decision that has entered into legal force for violation of contractual or debt obligations, as well as expenses for compensation for damage caused;

- expenses for training specialists for taxpayers in educational institutions of secondary vocational and higher vocational education. These expenses are taken into account provided that training agreements (contracts) have been concluded with individuals studying at these educational institutions, providing for their work with the taxpayer for at least 3 years in their specialty after graduation from the relevant educational institution;

- expenses in the form of negative exchange rate differences arising from the revaluation of property in the form of foreign currency values and claims (liabilities), the value of which is expressed in foreign currency, including on foreign currency accounts in banks, carried out in connection with a change in the official exchange rate of foreign currency to the Russian ruble, established by the Central Bank of the Russian Federation;

- expenses for the acquisition of property rights to land plots (taking into account the specifics) (including expenses for the acquisition of the right to conclude a lease agreement for land plots, subject to the conclusion of a lease agreement, including:

- for land plots from agricultural lands;

- on land plots that are in state or municipal ownership and on which buildings, structures, structures used for agricultural production are located);

The procedure for recognizing income and expenses when applying the unified agricultural tax (Article 346.5 of the Tax Code of the Russian Federation)

Income

The date of receipt of income is the day of receipt of funds into bank accounts and (or) to the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt in another way (cash method) . Features for certain types of income:

| Type of income | When are they taken into account? |

| When used by the buyer in payments for goods (work, services) purchased by him and (or) property rights of the bill | the date of payment of the bill or the day the taxpayer transfers the bill under endorsement to a third party. |

| Amounts of payments received from the budget to promote self-employment of unemployed citizens and stimulate the creation by unemployed citizens who have opened their own businesses of additional jobs for employing unemployed citizens at the expense of budget funds | during 3 tax periods with simultaneous reflection of the corresponding amounts as expenses within the limits of actually incurred expenses of each tax period, provided for by the conditions for receiving payment amounts. |

| In case of violation of the conditions for receiving payments (specified above), | the amounts of payments received are reflected in full as part of the income of the tax period in which the violation was committed. |

| If at the end of the 3rd tax period the amount of payments received exceeds the amount of expenses taken into account, | the remaining unaccounted amounts are reflected in full as part of the income of this tax period. |

| Financial support in the form of subsidies received in accordance with the Federal Law “On the development of small and medium-sized enterprises in the Russian Federation” | as part of income in proportion to expenses actually incurred from this source, but not more than 2 tax periods from the date of receipt. |

| If, at the end of the 2nd tax period, the amount of financial support received exceeds the amount of recognized expenses actually incurred from this source | the difference between the indicated amounts is fully reflected in the income of this tax period; |

Expenses

Expenses of the taxpayer are recognized as expenses after their actual payment. In this case, payment for goods (work, services) and (or) property rights is recognized as the termination of the obligation of the taxpayer - the purchaser of the specified goods (work, services) and (or) property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services ) and (or) transfer of property rights.

| Features for some types of expenses: Type of expenses | When are they taken into account? |

| material costs | At the time of repayment of debt by debiting funds from the taxpayer’s current account, payment from the cash register, and in the case of another method of repayment of debt - at the time of such repayment |

| labor costs | |

| payment of interest for the use of borrowed funds (including bank loans) | |

| payment for third party services | |

| payment for goods | after their actual payment; |

| expenses for paying taxes and fees | in the amount actually paid by the taxpayer. |

| expenses for repaying debts on taxes and fees (if any) | within the limits of the actually repaid debt during those reporting (tax) periods when the taxpayer repays the specified debt; |

| expenses for the acquisition (construction, production), completion, additional equipment, reconstruction, modernization and technical re-equipment of fixed assets | on the last day of the reporting (tax) period in the amount of paid amounts. |

| expenses for the acquisition (creation by the taxpayer himself) of intangible assets | |

| when the taxpayer issues a bill of exchange to the seller in payment for purchased goods (work, services) and (or) property rights | after payment of the said bill. |

| When the taxpayer transfers to the seller a bill of exchange issued by a third party in payment for purchased goods (work, services) and (or) property rights | on the date of transfer of the specified bill for purchased goods (work performed, services provided) and (or) property rights. (based on the contract price, but in an amount not exceeding the amount of the debt obligation specified in the bill) |

Taxpayers who determine income and expenses in accordance with the Unified Agricultural Tax do not take into account amount differences in income and expenses if, under the terms of the agreement, the obligation (claim) is expressed in conventional monetary units.

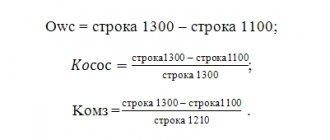

Tax base (Article 346.6 of the Tax Code of the Russian Federation)

- The tax base is the monetary expression of income reduced by the amount of expenses.

- Income and expenses expressed in foreign currency are converted into rubles at the official exchange rate of the Central Bank of the Russian Federation on the date of receipt of income and (or) the date of expenditure.

- Income received in kind is taken into account based on the contract price (taking into account market prices in cases established by law.)

- Income and expenses are determined on an accrual basis from the beginning of the tax period.

- Losses are accepted for tax purposes according to certain rules

Features of determining the tax base when transitioning to the Unified Agricultural Tax from other taxation regimes and when transitioning from the Unified Agricultural Tax to other taxation systems

When switching to Unified Agricultural Tax

Organizations that, before the transition to paying unified agricultural tax, used the accrual method when calculating income tax:

- on the date of transition to the payment of the unified agricultural tax, the tax base includes the amounts of money received before the transition to the payment of the unified agricultural tax in payment under contracts, the execution of which taxpayers carry out after the transition to the payment of the unified agricultural tax;

- do not include in the tax base funds received after the transition to paying the Unified Agricultural Tax, if, according to the rules of tax accounting on an accrual basis, these amounts were included in income when calculating the tax base for corporate income tax

- expenses incurred by an organization after the transition to paying the unified agricultural tax are recognized as expenses deducted from the tax base on the date of their implementation, if payment for such expenses was made before the transition to paying the unified agricultural tax, or on the date of payment, if payment of such expenses was made after the organization switched to paying the unified agricultural tax. ;

- do not deduct from the tax base funds paid after the transition to paying the unified agricultural tax to pay for the organization’s expenses, if before the transition to paying the unified agricultural tax such expenses were taken into account when calculating the tax base for income tax;

- material costs and labor costs related to work in progress on the date of transition to the payment of the unified agricultural tax, paid before the transition to the payment of the unified agricultural tax, are taken into account when determining the tax base for the unified agricultural tax in the reporting (tax) period for the manufacture of finished products;

- costs for the acquisition of quotas (shares) of production (catch) of aquatic biological resources

, actually paid before the transition to payment of the Unified Agricultural Tax and not attributed to expenses, are included in the tax base on the date of the transition to payment of the Unified Agricultural Tax.

It is also necessary to take into account the following features when switching to paying unified agricultural taxes:

- accounting as of the date of such a transition reflects the residual value of acquired (constructed, manufactured) fixed assets and acquired (created by the organization itself) intangible assets that were paid before the transition to paying the Unified Agricultural Tax.

- organizations and entrepreneurs using the simplified tax system, the residual value of fixed assets and intangible assets is reflected in their accounting as of the date of transition.

- organizations and entrepreneurs using UTII, in accounting as of the transition date, reflect the residual value of fixed assets and intangible assets that were paid before the transition to paying the unified agricultural tax, in the form of the difference between the purchase price (construction, manufacturing, creation by the organization itself) of fixed assets and intangible assets and the amount of depreciation , accrued in the manner established by the legislation of the Russian Federation on accounting, for the period of application of the taxation system in the form of UTII.

⇐ Previous5Next ⇒

Recommended pages:

Use the site search: