In what standard currency is the document drawn up?

A document that provides the basis for the acceptance of goods or services, property rights, or work is called an invoice. A document from the seller is drawn up, the design and filling details are discussed in Government Decree No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”, and in Federal Law No. 229. Read more about what details and how they are filled out in various invoices, we described here.

According to the standard model in the Russian Federation, invoices are issued in the currency that is accepted and established in Russia at the legislative level - in rubles.

The presence of a correctly completed document guarantees the return of VAT on the goods, services or work presented.

When can you issue an invoice in foreign currency?

According to paragraph 7 of Art.

169 of the Tax Code of the Russian Federation, an invoice in foreign currency can be drawn up if the terms of the transaction in the contract are expressed in foreign currency. At the same time, in parallel with this norm of the Tax Code, there is another one in the legislation: sub-clause. "m" clause 1 section. Resolution II of the Government of the Russian Federation “On filling out documents for VAT calculations” dated December 26, 2011 No. 1137 states that if the obligation under the contract is fixed in currency equivalent, but the payment currency is rubles, the invoice should be issued in rubles. Thus, ambiguity arises when applying these rules to transactions between residents of the Russian Federation:

- on the one hand, it seems that it is possible to issue an invoice in foreign currency if the obligation is expressed in foreign currency (conventional units);

- on the other hand, this violates the procedure for issuing invoices according to the rules established for residents of the Russian Federation, which are necessary for their acceptance in tax accounting for VAT.

This point is actively used by tax authorities who check the legality of deducting VAT. The tax accepted for deduction on an invoice issued in foreign currency is not confirmed and an understatement of VAT is registered with all the ensuing consequences. From time to time, the Federal Tax Service reinforces its position with its own explanatory letters. For example, one of the latest - letter No. ED-4-3/12813 dated July 21, 2015 - once again refers to the procedure for issuing VAT documents, approved by Resolution No. 1137 (in rubles), as the only correct one.

NOTE! Buyers have problems with deductions for foreign currency invoices. Tax authorities usually do not try to apply any sanctions to the seller who issued documents in foreign currency. Exceptions occur only in cases where the seller, reflecting data in tax registers, incorrectly recalculated the amount of revenue in rubles on such invoices and thereby underestimated the VAT base.

When is it possible to deposit foreign money?

Is it possible to issue this document in foreign currency, in euros and dollars, for example? Yes, this is acceptable. Modern suppliers are increasingly purchasing goods from foreign stores and foreign partners. In this case, contracts are concluded in the currency of the selling country.

This is done to eliminate currency exchange rate fluctuations. This is beneficial for managers, but for Russian accountants it is difficult to calculate and transfer tax deductions.

For tax purposes, by law, the invoice is issued in rubles (according to Article 317 of the Civil Code of the Russian Federation - monetary obligations are indicated in rubles and are equivalent to conventional units or foreign money). In cases where purchases are made from foreign sellers, the documentation indicates the currency of the selling party and its code.

The Tax Code does not prohibit the use of foreign currency when filling out documentation. In cases where payment for goods or services is made in foreign money, the invoice can be drawn up indicating the foreign currency. Thus, the currency is indicated in cases of purchases, provision of services and transactions with foreigners, foreign stores and partners, if there is legislative permission.

Special publications by our experts will help you avoid making mistakes when filling out invoices, from which you will learn:

- What is a document number and what does the standard form look like?

- What are the rules for issuing invoices for services, advance payments and return of goods?

- What is the deadline for issuing an invoice to the buyer?

- What are the rules for filling out the document by separate divisions?

The contract for the supply of goods and materials is in euros, and payment is in rubles. In what currency should primary documents be drawn up?

If settlements under the agreement are carried out in foreign currency, make accounting entries in rubles and at the same time in foreign currency. If settlements under the agreement are carried out in rubles, make accounting entries only in rubles (clause 20 of PBU 3/2006).

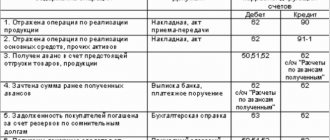

Acceptance for accounting of property, the value of which is expressed in foreign currency, is reflected by the following entries:

| Contents of operation | Debit | Credit | Primary document |

| OS, goods and other property received from the seller | (, and etc.) | Seller's shipping documents | |

| VAT is reflected on the value of the property | Invoice |

In tax accounting, convert the value of property expressed in foreign currency into rubles at the current rate (clause 10 of Article 272 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated August 31, 2010 N ShS-37-3 / [email protected] , Ministry of Finance of Russia dated 05/13/2010 N 03-03-06/1/328, dated 10/28/2010 N 03-03-05/239):

on the date of transfer of the advance to the seller - in the part paid in advance;

on the date of transfer of ownership of this property - in the part of the cost not covered by the previously transferred advance payment.

For conversion, use the rate established by the Bank of Russia. If the contract is in e. a rate different from the official one is provided, then use this rate (clause 10 of article 272 of the Tax Code of the Russian Federation).

Ready-made solution: How can a buyer take into account settlements under a contract in foreign currency or conventional units (ConsultantPlus, 2019) {ConsultantPlus}

- When supplying goods (performing work, providing services), the cost of which is expressed in foreign currency or conventional monetary units, but is payable in rubles, one should take into account the opinion of the regulatory authorities, according to which the preparation of primary documents in currency or conventional monetary units is unlawful. If settlements under the contract are made on the territory of the Russian Federation in rubles, goods (work, services) must be accepted by buyers (customers) for accounting on the basis of primary documents in which the cost is indicated in rubles (Letters of the Federal Tax Service of Russia for the Moscow Region dated February 28, 2014 N 16- 21/10933, Ministry of Finance of Russia dated July 17, 2007 N 03-03-06/2/127, dated March 6, 2001 N 04-02-05/1/47).

The same approach can be seen in the Rules for filling out an invoice, which do not allow the execution of a document in foreign currency when selling goods (work, services) on the terms of payment in Russian rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units. Obviously, the same requirements are imposed by regulatory authorities for filling out a universal transfer document (UTD), regardless of its status.

In our opinion, the Accounting Law does not contain a prohibition on the preparation or acceptance for accounting of primary accounting documents in currency or conventional units. There is also no requirement to draw up primary accounting documents in rubles. Moreover, the primary accounting document may not contain the monetary measurement of a fact of economic life at all (Clause 5, Part 2, Article 9 of the Accounting Law). The mandatory monetary measurement of accounting objects, and specifically in the currency of the Russian Federation, was established to reflect these objects in accounting registers. To do this, their value, expressed in foreign currency, is recalculated into rubles (Part 3 of Article 12 of the Accounting Law).

In a number of cases, taxpayers were able to prove in court that the preparation of primary documents in conventional monetary units or in foreign currency does not contradict the legislation of the Russian Federation and does not prevent the buyer (customer) from taking into account expenses for profit tax purposes, as well as deducting VAT (Resolutions of the Federal Antimonopoly Service of the Moscow District dated 08/19/2009 N KA-A40/7963-09, dated 01/11/2008 N KA-A41/12903-07, dated 03/02/2007, 03/09/2007 N KA-A40/129-07).

However, in order not to create tax risks for buyers (customers), to formalize the shipment of goods (performance of work, provision of services) under contracts providing for payment in rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units, we recommend approving in the accounting policy, the form of primary accounting documents in rubles, providing them with additional columns for indicating amounts in foreign currency (conventional monetary units).

An example of drawing up an invoice for goods, the cost of which in the contract is established in foreign currency, and payment is provided in rubles at the Bank of Russia exchange rate...

{Ready solution: Is it possible to draw up primary accounting documents in foreign currency if settlements with buyers (customers) are made in rubles (ConsultantPlus, 2019) {ConsultantPlus}}

- 1. When can you issue an invoice in foreign currency...

Ready-made solution: Invoice in foreign currency (ConsultantPlus, 2019) {ConsultantPlus}

- In what cases can you draw up a consignment note in foreign currency...

{Ready solution: In what cases can you draw up a consignment note in foreign currency (ConsultantPlus, 2019) {ConsultantPlus}}

How to display data correctly?

- Rubles – the invoice indicates the name and digital code of the currency – “Russian ruble, code 643, RUB”.

- Dollars – “US dollar, code 840, USA”.

- Euro – “Euro, code 978, EUR”.

In the invoice, line number seven indicates the name of the currencies and their code value. The digital code is checked against the All-Russian Classifier. The price can be expressed in both Russian and foreign currencies, depending on the situation.

For example, when shipping goods in both currencies, the price in the invoice is expressed in different monetary units, or if the final result of the cost is indicated in the ruble, then the Russian currency is indicated in the line.

BRANCH OF A FOREIGN COMPANY IS A VAT PAYER.

Let us first inform you: a branch or representative office of a foreign legal entity established on the territory of the Russian Federation is recognized as VAT payer organizations (see paragraph 2 of Article 11, Article 143 of the Tax Code of the Russian Federation), which have rights and perform duties in accordance with the tax legislation of the Russian Federation. Federations are on a par with Russian organizations if they are registered with the tax authority as a taxpayer. The Federal Tax Service recalled this in Letter No. SD-18-3/1011 dated September 29, 2016, and here also noted that taxpayers are foreign organizations that are not registered with the tax authorities as a taxpayer, the total amount of VAT by virtue of clause 3 of Art. 166 of the Tax Code of the Russian Federation are not calculated.

In the case we are considering, a branch of a foreign company (contractor) is a VAT payer and acts in accordance with the norms provided for in Chapter. 21 Tax Code of the Russian Federation. The contractor will determine the tax base taking into account clause 3 of Art. 153 of the Tax Code of the Russian Federation: revenue received in foreign currency will be converted into rubles at the rate of the Central Bank of the Russian Federation. The date of recalculation corresponds to the moment of determining the tax base for the sale (transfer) of goods (work, services), property rights, established by Art. 167 of the Tax Code of the Russian Federation, as the earliest of the following dates:

1) the day of shipment (transfer) of goods (work, services), property rights;

2) the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Violation of the law

When completing documentation, the name of the settlement currency and its digital code may be indicated incorrectly. In this case, the buyer will have problems when calculating VAT.

But taking into account the nuances of design, minor errors are allowed - for example, the code is not indicated, but only the name is present, this is acceptable in the document.

Articles 15, 25 of the Code of Administrative Offenses provide for administrative liability for violations in the field of currency turnover and regulation. Illegal currency transactions are actions related to illegal transfers and payments for goods and services that bypass tax deductions.

Monetary transactions associated with failure to comply with the requirements for foreign exchange transactions established at the legislative level - failure to use special reserve accounts, debiting/crediting amounts of money or external/domestic securities from accounts without fulfilling the requirements and reservation rules.

THE MOMENT OF DETERMINING THE TAX BASE IS THE DAY OF PAYMENT.

The situation is different when the contract contains a provision for advance payment. In this case, the contractor will have to recalculate the received currency into rubles twice, focusing on the exchange rate on the dates of receipt of the advance payment and completion of the work (clause 14 of Article 167 of the Tax Code of the Russian Federation).

In order to establish the moment of determining the tax base for VAT, the day of performance of work (provision of services), that is, the day of shipment, is recognized as the date of signing the acceptance certificate of work (services) by the customer.

Having calculated the “advance” VAT from the received prepayment, the contractor will issue an “advance” invoice and register the document in the sales book (similarly to how shown in example 2).

Subsequently, upon completion of construction and signing of the acceptance certificate for the completed construction facility, the contractor will again calculate VAT, issue a “shipping” invoice, register the document in the sales book, and “advance” VAT (by virtue of clause 8 of Article 171 of the Tax Code of the Russian Federation ) will be taken into account. “Advance” VAT is subject to deduction in the amount of tax calculated from the cost of goods shipped (work performed, services rendered), transferred property rights, in payment of which the amount of previously received payment, partial payment according to the terms of the contract (if such conditions exist) are subject to offset. 6 Article 172 of the Tax Code of the Russian Federation).

Example 3:

Let us slightly modify the conditions of example 1. Let us assume that the contract provides for a 100% prepayment, which the contractor received in the amount of 17,700 euros on 05/04/2017 (the exchange rate on that day was 62.32 rubles/euro).

The work acceptance certificate was signed on October 24, 2017. The euro exchange rate against the Russian ruble on this date was 67.56 rubles/euro.

The following entries were made in the contractor's accounting records:

| Contents of operation | Debit | Credit | Amount, rub. |

| 04.05.2017 | |||

| An advance payment was received for subsequent construction work. (17,700 euros x 62.32 rubles/euro) | 52 | 62 | 1 103 064 |

| “Advance” VAT charged* (2,700 euros x 62.32 rubles/euro) | 76‑av | 68 | 168 264 |

| 24.10.2017 | |||

| Accounting revenue is reflected based on the exchange rate valid on the date of receipt of the advance** (17,700 euros x 62.32 rubles/euro) | 62 | 90-1 | 1 103 064 |

| "Shipping" VAT is reflected*** (2,700 euros x 67.56 rubles/euro) | 90-3 | 68 | 182 412 |

| “Advance” VAT**** accepted for deduction | 68 | 76‑av | 168 264 |

* The “advance” invoice is reflected in the sales book for the second quarter of 2017 (we present only the columns that interest us):

| Column No. | Index |

| 13a | 17,700 (euros, 978) |

| 14 | 934,800 (RUB) |

| 17 | 168,264 (RUB) |

** In accounting, the amounts of received advance payment are not subject to further revaluation. The seller's income is recognized in rubles at the rate in effect on the date of conversion of the received prepayment into rubles, as indicated by clause 9 of PBU 3/2006.

*** Despite the fact that in accounting on the date of signing the certificate of completion of work, revenue is recognized in the amount of the prepayment received, for VAT purposes it is subject to recalculation on the date of completion of the work (clause 3 of article 153, clause 14 of article 167 of the Tax Code RF). Accordingly, the contractor will recalculate foreign currency earnings as of October 24, 2017 (17,700 euros x 67.56 rubles/euro = 1,195,812 rubles) and determine the amount of tax payable on the volume of work performed (2,700 euros x 67.56 rubles. /euro = 182,412 rubles).

He will record the “shipping” invoice in the sales book, in which the columns of interest to us will be filled in as follows:

| Column No. | Index |

| 13a | 17,700 (euros, 978) |

| 14 | 1,013,400 (RUB) |

| 17 | 182,412 (RUB) |

**** Since the taxpayer has the right to deduct VAT paid on prepayment, he will reflect the “advance” invoice in the purchase book (clause 22 of the Rules for maintaining the purchase book).

PLEASE CHECK...

The example under consideration demonstrated a situation where the “advance” VAT is less than the “shipping” tax (the budget is “not offended”). In a different scenario, the picture may change (the amount of “advance” VAT to be deducted due to the difference in exchange rates will exceed the amount of “shipping” VAT), and the budget will receive less. Will this fact “catch” the controllers?

In other words, can a contractor deduct the entire amount of VAT calculated on a 100% advance payment received in foreign currency, even when the VAT calculated on the cost of work performed expressed in foreign currency turns out to be less than the “advance payment” as a result of exchange rate fluctuations? » VAT? And how to deduct VAT and restore the tax to the buyer?

A taxpayer (the same branch of a foreign company - a contractor) asked a similar question, addressing it to the Ministry of Finance (see Letter dated July 27, 2017 No. 03-07-08/47922). And in order to get a clearer answer, he attached examples of calculations (Letter dated 09/05/2017 No. 03‑07‑08/56880), according to which in one case the exchange rate decreased from the moment of 100% prepayment of work until the day of their implementation, and in friend - grew up.

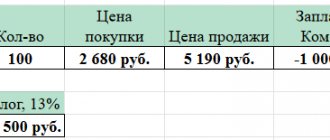

| Contents of the operation with the contractor (customer) | Contractor | Customer | Contractor | Customer |

| when the rate decreases from 65 to 60 rub./dollar. | when the exchange rate rises from 55 to 70 rub./dollar. | |||

| An advance payment of $118,000 was received (transferred). | 7 670 000 | 7 670 000 | 6 490 000 | 6 490 000 |

| “Advance” VAT is reflected (accepted for deduction) | 1 170 000 | 1 170 000 | 990 000 | 990 000 |

| Revenue from the sale of work (cost of work) is reflected without VAT* | 6 590 000 | 6 590 000 | 5 230 000 | 5 230 000 |

| VAT on work performed is reflected (accepted for deduction) | 1 080 000 | 1 080 000 | 1 260 000 | 1 260 000 |

| The advance payment amount has been credited | 7 670 000 | 7 670 000 | 6 490 000 | 6 490 000 |

| “Advance” VAT accepted for deduction (restored) | 1 170 000 | 1 170 000 | 990 000 | 990 000 |

* Recalculation of sales proceeds at the exchange rate valid on the date of receipt of the advance payment minus VAT calculated at the rate at the date of shipment. In particular:

- with a depreciation: $118,000 x 65 rubles/dollar. — ($118,000 x 18/118 x 60 rub./dollar) = 7,670,000 rub. — 1,080,000 rub. = 6,590,000 rub.;

- with an increase in the exchange rate: $118,000 x 55 rubles/dollar. — ($118,000 x 18/118 x 70 rub./dollar) = 6,490,000 rub. — 1,260,000 rub. = 5,230,000 rub.

The Ministry of Finance, as usual, does not differ in “specifics”: it did not comment on whether the procedure for refunding VAT on advances received from the contractor and restoring “advance” VAT from the customer is correct. The department’s specialists only referred to the norms of the Tax Code of the Russian Federation, indicating that:

- upon receipt of an advance payment in foreign currency for the performance of work not specified in clause 1 of Art. 164 of the Tax Code of the Russian Federation, the prepayment amount is recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of its receipt;

- the buyer has the right to claim a deduction for the VAT paid as part of the prepayment (clause 12 of Article 171 of the Tax Code of the Russian Federation);

- the conditions for deducting “advance” VAT by the buyer are listed in clause 9 of Art. 172 of the Tax Code of the Russian Federation: this is the presence of an “advance” invoice, documents confirming the actual transfer of the advance, and an agreement providing for the transfer of the advance payment.

Thus, when prepaying for work in foreign currency, the amount of tax to be deducted from the customer of the work is recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of transfer of funds.

VAT amounts presented by the contractor in relation to the work performed are accepted for deduction from the customer in the manner and under the conditions established by clause 2 of Art. 171 and paragraph 1 of Art. 172 of the Tax Code of the Russian Federation. In this case, foreign currency is converted into rubles at the rate of the Central Bank of the Russian Federation on the date of registration of goods (work, services), property rights (paragraph 4, clause 1, article 172 of the Tax Code of the Russian Federation). From this moment on, the customer has an obligation to restore the amount of “advance” tax previously accepted for deduction (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation). VAT is restored in the amount previously accepted for deduction in relation to payment (partial payment).

As for the contractor. According to paragraph 14 of Art. 167, paragraph 8 of Art. 171 and paragraph 6 of Art. 172 of the Tax Code of the Russian Federation, when determining the amount of tax payable to the budget for work performed on account of payment received (partial payment), the amount of VAT actually calculated on the date of receipt of payment (partial payment) is taken as deduction, regardless of the foreign currency exchange rate in effect on date of completion of work.