In what cases will you receive a deduction?

The conditions are the same as when buying an apartment:

- You are a tax resident of the Russian Federation.

- Officially employed, and the employer pays 13% income tax (NDFL) for you.

- You have on hand documents confirming the costs of purchase and construction.

- The property was not purchased from a dependent person (spouse, parents (including adoptive parents), children (including adopted children), full and half siblings, guardian (trustee) and ward - Article 105.1 of the Tax Code of the Russian Federation).

- You did not use the right to receive a deduction or its balance.

If there are no problems with these conditions, then we analyze the property. You will receive a deduction if:

- We bought or built a house. At the same time, it does not matter at all how they built it: on their own or resorted to the help of hired workers. The main thing is to keep documents confirming expenses.

- We bought a plot of land for the construction of a residential or garden house. What is the difference between a residential house and a garden house, and whether a garden house can become residential, we will look into it below.

How to get a tax deduction for a house

Everyone knows that apartment buyers can get back part of the money spent on it in the form of a tax deduction; Russians who have built their own houses have the same opportunity.

Individual housing construction in our country is becoming more and more popular: last year, 46% of all housing commissioned were private cottages.

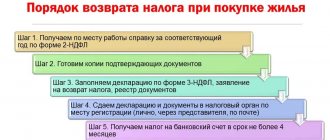

There are two ways to receive a tax deduction for a built house:

- Through the employer (the tax will not be returned and will not be withheld from the salary);

- Through the tax office (the entire amount of the tax deduction will be returned in a year or several years, depending on how much taxes were paid during the year).

You can submit a tax return using the electronic service “Taxpayer Personal Account for Individuals” or by visiting the tax office in person.

Alpha FORUMHOUSE user

The tax office must give you a list of documents required for the deduction. We have a special inspector who receives such newcomers, gives them a list, explains them, then you bring him what you need, he makes sure that this is exactly what you need, and then you go to the one who specifically accepts the documents for execution. The most difficult thing is to fill out the declaration correctly, but there are special programs where you simply insert the data from the 2-NDFL that you were given at work, and it generates a declaration.

What do you need to get a deduction?

The only condition for this (with the exception of the obvious: to be a citizen of Russia, to pay taxes, not to use your right to a tax deduction earlier, and the house must be built on the territory of the Russian Federation and be residential) is to have documents that will confirm construction costs. Therefore, experts always strongly recommend collecting payment documents, checks, etc.

If these conditions are met, the deduction can be received by anyone who

- bought a plot of land and built a house on it;

- bought and completed an unfinished house.

But until the ownership of the house is registered, there can be no talk of any tax deductions.

What expenses are taken into account?

Direct construction costs: for the purchase of a site, unfinished construction, building materials, finishing materials, for construction and finishing works or services, for the preparation of design estimates, for connection to utility networks and communications. This list is prescribed in Art. 220 Tax Code.

What expenses are not taken into account?

You can't get a tax deduction

- separately for the purchase of a plot - these expenses will be taken into account, but only after a house is built and registered on the plot;

- for expenses on landscaping, equipment rental, realtor services, installation of plumbing, shower cabin, gas equipment, meters;

- for the construction of a garage, swimming pool, bathhouse, gazebo and other buildings and structures;

- for the rebuilding, redevelopment or reconstruction of an already built house, the construction of a new floor or extension;

- If the house was built under a mortgage program, you can return income tax on the interest paid to the bank.

What will be the amount of the deduction?

Here everything is the same as in other types of property deduction: up to 13% of the total amount of expenses for construction and finishing of housing, but a maximum of 2 million rubles. It turns out that even if a person spends 6 million rubles on construction, he can return a maximum of 260 thousand rubles. This takes into account how much taxes you paid during the year - you cannot return more than this amount, the remainder will be transferred to the next year. Also: you need to apply to the tax structure for a deduction when the calendar year in which the house was built has ended.

On FORUMHOUSE you can talk about tax deductions and get answers from consultants or those who have already completed this quest.

How much tax can be returned from the budget?

The maximum deduction amount for the purchase or construction of a house is 2 million rubles (clause 1, clause 3, article 220 of the Tax Code of the Russian Federation). This means that only 13% of this amount – 260 thousand rubles – will be returned to your account.

If a house is purchased with a mortgage, then a deduction is allowed for the interest paid. Thus, the limit amount increases to 3 million rubles, and the amount of tax refund will be 390 thousand rubles.

Remember that the purchase or construction deduction can be used once in a lifetime, but for several real estate properties. This innovation has been in effect since January 1, 2014. And you can also receive a deduction for interest paid once, but strictly for one piece of real estate (clause 1, clause 3 and clause 8 of Article 220 of the Tax Code of the Russian Federation).

If you are legally married, then be prepared for pleasant bonuses. Each spouse has the right to a deduction (Letters of the Federal Tax Service dated November 14, 2017 No. GD-4-11/ [email protected] , GD-4-11/ [email protected] ). By this it should be understood that instead of 260 thousand rubles, spouses can return 520 thousand rubles. At the same time, it does not matter to whom the title and payment documents are issued. The property is jointly acquired, everyone will receive the money. It is logical that in this case, the cost of purchase and construction will be 4 million rubles.

Important point. Amounts received as maternity capital or other government subsidies cannot be taken into account as deductible expenses.

How much money will be returned?

So, how much state compensation can you expect when purchasing an apartment after January 1, 2014?

We answer: Your maximum limit for income tax refund from the purchase of an apartment is 2,000,000 rubles (for your entire life). You can return 13% of this amount, i.e. 260,000 rubles and nothing more.

For each calendar year, you can return an amount equal to your income tax, which your employer pays to the state for you (13 percent) for the reporting year, while the balance of the funds due to you does not expire, and in subsequent years you will also be able to issue a refund until don't reach your limit.

But you have the right to submit income declarations to the tax office only for the current year or for a maximum of three previous years, but more on that a little later. First, let's finally figure out the amount of tax compensation you can count on when buying an apartment. To make everything completely and completely clear, let’s look at two specific examples.

Deduction when buying or building a house

You can receive a deduction when buying a house using the same algorithm as when buying an apartment. You read about this in the previous article. What if you bought a house under construction and you plan to finish it?

In this case, you are buying an unfinished construction project. Please note that this clarification must be reflected in the purchase and sale agreement. Otherwise, you will not receive a deduction for construction work.

Example.

You bought a plot of land with an unfinished house. The purchase and sale agreement states that the house is an unfinished construction project.

Only after construction is completed and you have an extract from the Unified State Register of Property Rights in your hands, contact the tax office for a deduction. The deduction will include the costs of purchasing the house and the costs of completing it.

Receipt times

There is no statute of limitations for filing an application for a personal income tax refund. However, the taxpayer has the right to a tax refund only when the building is recognized as residential and becomes his property. Having these documents in hand, a person can apply for a deduction in a year or later.

As for the return period, it all depends on the authority where the deduction was issued. If the registration was carried out through the tax office, then the funds will arrive in the current account no earlier than in 6 months. If the documents are addressed to the employer, then payments begin from the moment of submission and throughout the year.

Features of obtaining a deduction when purchasing a land plot

You cannot receive a deduction for the purchase of land. A land plot has two purposes: a plot for individual housing construction (IHC) or a personal subsidiary plot (LPH). The second relates to garden plots.

The right to deduction will appear if you buy land for the construction of a residential building, that is, with the intended purpose of individual housing construction. It is not enough to buy land and build a house, which according to documents is listed as an unfinished construction project. Such a house has the status of non-residential premises. Previously, for the tax authorities, having the status of “residential building” was a fundamental condition. For residential buildings the deduction was denied.

On January 1, 2021, a new law was issued - No. 217-FZ “On the conduct of gardening and vegetable gardening by citizens for their own needs and on amendments to certain legislative acts of the Russian Federation.” It states that buildings on garden and dacha plots registered before January 1, 2021 with the designation “residential” or “residential building” are considered residential buildings from that date. The tax will be returned only if the house was built with the right of registration (registration) and is registered with Rosreestr.

Tips and tricks

Difficulties may arise when filing a property deduction. For example: the recipient of payments is a woman who went on maternity leave. To return the funds, she does not need to go to work; it is enough to give her husband permission and a power of attorney to receive all payments (in case of official marriage). This is feasible if the woman is the owner of the constructed housing.

Another difficulty arises with buildings on summer cottages. The way out of the situation lies in documents where there should not be a “dacha”, “non-residential” building.

All payments should be made out in your name, otherwise it will be impossible to prove that you paid for the money spent.

Attention! If difficulties arise, you can contact accounting firms for help. They will easily prepare and submit all the papers.

It is not difficult to issue a tax deduction, and if you have any questions, you can use the services of a lawyer at the right time.

Deduction when buying a garden house

Don’t be confused, people live in a residential building all year round, while in a garden house they live when it’s time to plant potatoes. If you bought a summer cottage with a garden house that is not recognized as residential, the deduction will be denied. But if you have patience and transfer it to residential status, you will receive a deduction not only for the house, but also for the purchased land (Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated 12/10/12).

From January 1, 2021 to March 1, 2021, summer residents and gardeners can re-register their real estate according to a simplified procedure (Federal Law dated August 2, 2019 No. 267-FZ).

The main thing is that the garden house meets the requirements of a residential one (clause 4 of the Government of the Russian Federation of January 28, 2006 No. 47 “On approval of the Regulations on the recognition of premises as residential premises...” (as amended on December 24, 2018). Namely, it is built from a solid foundation and is provided with the necessary communications: sewerage, heating, electricity.

Example 1.

In 2021, you built a house on a garden plot. In the Unified State Register of Real Estate the house is registered as “non-residential”. In summer you will enjoy spending time there with your family. From January 1, 2021, this house is officially considered a garden house. And if you want a deduction for it, then you need to re-register the purpose of the house as “residential”.

Example 2.

In 2009, you bought a plot of land with the purpose of individual housing construction. The house was built only in 2021, and then we received title documents. And we learned about the possibility of receiving a deduction in 2021. In 2021, you submit a declaration and claim a deduction for both the construction of a house and the acquired land.

When can I get an income tax refund when building a private house?

A citizen cannot return an amount whose amount is greater than the duty paid. Basic conditions for a tax refund:

- official employment;

- other income from which personal income tax is withheld;

- owned plot;

- registered marriage (to receive equal payments for both spouses).

Parents can receive 13% if the building (land plot) is registered in the name of a minor child. The total amount of expenses should not exceed 2,000,000 rubles, but purchasing land and building a house sometimes greatly exceeds the limit.

Dear readers!

To solve your problem right now, get a free consultation

- contact the on-duty lawyer in the online chat on the right or call: +7 (499) 938 6124 - Moscow and region.

+7 (812) 425 6761 — St. Petersburg and region. 8 (800) 350 8362 - Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will solve all your problems!

In addition to the owner of the house, his wife can claim the deduction, since the property was acquired jointly in an official marriage.

There are several different situations when constructing a residential building, which have different effects on the registration and receipt of funds. Let's look at them in detail:

- If the construction of a house was carried out using personal finances or money borrowed (credit), then the funds can be returned only after the construction is registered in the Unified State Register of Real Estate, when the house is recognized as residential and new residents are registered in it. Otherwise, a refund is not required by law.

- An unfinished property was purchased, the citizen carried out restoration or completion, and the house became residential. Upon purchase, an agreement was drawn up indicating that land and an unfinished building were purchased. The law states that compensation is due only for purchased property, but not for additional restoration.

- A plot of land was purchased and a country house suitable for living was built on it. The owner filled out the documents and confirmed that the building was suitable for habitation, but it was impossible to register in it. Tax refunds are not possible.

- A citizen bought an unfinished cottage, drawing up an official sales contract, bringing it to a habitable state and registering it as property. The owner is allowed to return the tax not only for the acquired property, but also for the funds spent to complete the construction.

The following categories of persons can apply for a tax refund for the construction of a house:

- officially employed citizen of the Russian Federation;

- home owner (if there are several of them, the deduction will be divided between them in equal shares);

- spouse of the owner (in case of official marriage);

- parents or guardians of minor owners;

- a citizen who built a house and registered it as his property;

- persons who received a mortgage loan from a bank for construction;

- citizens applying for refinancing of a loan issued for construction.

There are categories of persons who cannot claim personal income tax when building a house. These include:

- persons who are not citizens of the Russian Federation;

- Individual entrepreneurs operating on a simplified form of taxation;

- citizens without an official place of work;

- pensioners who retired 3 years before the end of construction.

Attention! You can exercise the right to return funds if the built house is recognized as residential.

What expenses are included in the deduction?

Do not think that absolutely all costs of building a house are included in the deduction. The tax code only specifies expenses:

- for the development of design and estimate documentation;

- for the purchase of construction and finishing materials;

- for construction and finishing works;

- for connection to electricity, water supply, gas supply and sewerage networks.

Remember that if you bought a built house and remodeled it, you will not be able to claim a deduction for construction costs. For this purpose, the house must have the status of an unfinished construction project.

Legislative regulations

The regulator of fiscal fees to the regional budget is taxation legislation, which is regulated by:

- Tax Code of the Russian Federation No. 117 of 08/05/2000 Part II, Section X, Chapter 23, Article 220, paragraph 5.

- Letters of the Ministry of Finance of the Russian Federation on tax deductions No. 03-04-05/20406, 03-04-05/21195, 03-04-05/22395, 03-04-05/23340, 03-04-05/40681.

Requirement: housing has been built - ownership has been acquired - cadastral value has been determined.

Deadline: until the first of January of the next year for the current tax period.

Condition: Homeowners who fail to comply will not be able to take advantage of tax credit rights when building a home anywhere.

The level of financial valuation of property should not be underestimated or overestimated. It is necessary to present the true cost figures and the reliable price of the apartment (house).

Discipline: Owner dishonesty is punishable. The FMS (Federal Migration Service) eliminates arrears by independently assessing personal income tax (personal income tax) by multiplying the amount of the identified cadastral value of residential premises by a coefficient of 0.7.

Documents for registration of deduction

As soon as your home has become residential, you have every right to submit a 3-NDFL declaration to the tax office for a tax refund. As with the deduction for an apartment, the declaration is submitted after the end of the tax period (clause 7 of Article 220 of the Tax Code of the Russian Federation).

If the title documents for the house are received in 2021, then the right to deduction will appear in 2021. But you will be able to file a declaration only in 2021.

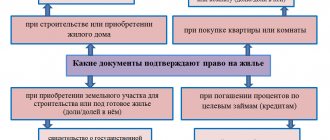

To apply for a deduction, prepare the following copies of documents:

- documents on ownership of the house and land (certificate or extract from the Unified State Register of Real Estate);

- contract for the sale and purchase of a house and land plot (if you are applying for a deduction for the plot);

- payment documents for the purchase of a house and land;

- payment documents for the purchase of a house, land, construction and finishing materials (bank statements, checks, receipts, acts on the purchase of materials, etc.);

- mortgage agreement and a certificate from the bank about the interest paid (if you are buying a house with a mortgage).

Of the originals, you will need a passport, a 2-NDFL certificate for the year the deduction was issued (given by the employer, or uploaded on the website nalog.ru) and a completed 3-NDFL declaration.

Compensation, or what an apartment owner dreams of

It turns out that you cannot put all the money spent into your own pocket from the state during this procedure.

You need to know the nuances of the legal regulator that regulates the list of costs for tax deductions that the homeowner incurred during the construction of a residential building on his territory.

So what's included:

- engineering work on communications: heat supply, electrical networks, sewer pipes and drains;

- purchase of materials for the construction of a residential building and consumables for its finishing;

- payment to designers and estimators if documentation for design and estimate work is available;

- services for the construction of residential premises, finishing works;

- if the apartment was purchased with a mortgage loan, interest payment is guaranteed.

- interest on refinancing will be reimbursed.

Possibility: the house was purchased unfinished - this condition is fixed in the purchase or sale agreement - income tax refund. The same is possible for a land plot registered as ownership during the construction of a house.

How to quickly and inexpensively issue a deduction

You can submit documents in person to the tax office, remotely through the taxpayer’s personal account, or apply for a deduction through your employer. No one will give you a guarantee that the tax office will accept your documents without problems, and no one will bother you for three months of a desk audit.

Repeatedly you will have to spend time and effort proving to the tax authorities the legality of including certain construction works as deductible expenses. You may have to wait more than three months for your tax refund. These are the harsh realities of the work of tax authorities. But everything is being resolved.

In less than 24 hours, the specialists of the Return.tax company will advise you on deductions, fill out a declaration, prepare and submit documents to the tax office. Minimal participation is required from you. The cost of filing a deduction for one calendar year under the “Standard” package is 1,690 rubles.

The Premium package offers full support for the verification from the moment of submission, resolution of controversial issues and until the receipt of money in your account. The cost of filing a deduction for one calendar year under the Premium package is 3,190 rubles.

The process of obtaining a tax deduction

The best way: obtain it yourself by contacting your tax office. You may have to fuss a little and run around for certificates, collecting them from different authorities, but in the end the procedure will turn out to be much cheaper than contacting a specialized company.

If you don’t want to do this yourself, or you simply don’t have time for it, then our online lawyer is ready to give you a free consultation on how you can significantly speed up and simplify this entire process.

To receive a property tax deduction in 2021, you need to fill out a new declaration in the established form 3-NDFL and attach it to the collected documents (it is also included in the list of required documents).

Together with copies, the package of documents is handed over to the tax service employee on duty, after which he will check them within a certain time and, if everything was done correctly, you will soon receive the long-awaited money transfer. As a rule, applications are reviewed and decisions are made within two to four months.

What cannot be included in the calculation?

The taxpayer will not be able to return funds spent on redevelopment or reconstruction of an object put into operation. Plumbing equipment and furniture are also not taken into account in the calculations. In addition, the property deduction does not include costs for the construction of outbuildings, bathhouses, fences and garages. If part of the costs for the construction (completion) of a house was not paid from the taxpayer’s personal funds, personal income tax cannot be received from this money. Maternity capital, budgetary funds, and employer's money are deducted from the total costs when calculating compensation.

Expenses related to property deduction

According to the letter of the law, Russians can return a tax percentage of the cost of housing, as well as money spent on improving the purchased house, apartment, room and other real estate. We wrote above that an unfinished house is an object for a tax refund. To some extent, this is very profitable, because the amount of actual expenses can successfully include: expenses for finishing and repair materials, expenses for “household life support” (providing light, heat, gas, sewerage), expenses for hiring a team of workers and payment of estimates and housing projects.

Important point! You will be able to include repair costs in the list of expenses only in a situation where the contract for the purchase of real estate clearly states that it is provided in a “rough” finish and is unfit for habitation until it is “completed.”

Who is eligible for the deduction and who is not?

The right to refund paid taxes is granted only to citizens of the Russian Federation who reside in the country for at least 183 days during the year. An exception is only for those liable for military service who are absent from Russia on duty, and residents studying abroad or undergoing treatment outside the country, but not more than 6 months during the year.

In addition, persons living in the Russian Federation must be officially employed and deduct 13% of their salary monthly. This rule also applies to pensioners, who can receive a deduction from the years they worked, provided that it was no more than 3 years ago.

Receipt of a deduction will be denied:

- Foreign citizens working in the Russian Federation;

- If the property was purchased by a citizen of the Russian Federation, but abroad;

- If it is proven that one person financed the purchase, and another became the owner;

- When purchasing real estate from relatives or an employer.

Conclusion: When buying a plot to build a house or a ready-made cottage, spending a little time collecting the necessary documents can save you up to several hundred thousand rubles. If you fill out the documents correctly and follow all the regulations, the procedure for receiving money will take several months.

Maximum amount available for receipt

The amount of compensation from the state issued for the construction or completion of a residential building on a land plot is determined according to the standard scheme for property deductions, that is, in the same way as for other types of property.

What can be the amount of compensation?

The maximum you can return is no more than 13% of the total amount of costs incurred during the construction of the object, and it is not allowed to exceed the amount of 2,000,000 rubles.

Every year you have the right to return an amount not exceeding the total funds deducted from your income to the country's budget at the same time. If within the specified time you do not receive the money in full, then the remaining amount is transferred to payment for the next 12 months and so on until all the money in the due amount is returned.

Let's give an example. In 2014, you built a house on the site for further living in it. The total funds spent on the construction procedure and finishing work amounted to 10,000,000 rubles. You have the right to a tax refund based on covering costs in the amount of no more than 2 million rubles of the amount. However, since you are married, your husband can also claim a return of funds in the amount of 13% of two million, and it turns out that out of 10 million only four will be compensated.

If you took out a mortgage and built a house not in 2014, but in 2013, then you can repay all the interest paid in full, without restrictions, since such restrictions came into force only in 2014, from the first day of January.

If, as in the problem above, the house was purchased in 2014, then you can get a maximum of 13% of 3,000,000 rubles to cover interest, that is, 390,000 rubles.

You have the right to receive compensation for credit interest only if the house was registered as housing with the right to register in it. Among other things, you have the right to submit a deduction also for expenses incurred during construction, and not just for mortgage interest.

House or plot?

It is important to understand that we are talking about the residential property itself, and not about the land. If a citizen buys a plot of land, he is not entitled to payments. But if the land is needed to build a house on it or the building has already been erected or is in the construction process, the cost of the land can be included in the list of actual expenses that a person incurred to acquire a place to live. The appearance of a house on the site is the only legal basis for receiving a deduction, therefore, until the moment when the building becomes the property of a citizen, it is too early to talk about returning the money.

The appearance of a house on the site is the only legal basis for receiving a deduction

We have already found out that you can also buy an unfinished house. An important point is that you will be able to obtain the right to a property deduction from the moment you become the owner of the property. The role is played not by the fact of transferring money (payment for the house), but by the fact of transferring ownership of the home to you. Thus, sufficient grounds for receiving a property benefit will be:

- Purchase of land on which housing will later be built. At the same time, the property and project of the future house must be discussed with employees of the Unified State Register of Real Estate and registered.

- Purchase of a ready-made residential building, cottage, mansion, villa or other buildings located on a separate plot of land and suitable for permanent (year-round) residence.

Expenses that are not subject to tax deduction

In accordance with the directives of the Ministry of Finance (No. 03-04-05/9-492 dated 08.24.2010, No. 03-04-05/9-545 dated 09.15.2010, No. 03-04-05/9-15 dated 01.20.2011 ) tax refund is not provided for:

- redevelopment of rooms in a constructed house;

- reconstruction of a finished building, including the addition of floors or premises;

- installation of plumbing, gas appliances, etc.;

- construction of buildings in the yard (bathhouse, swimming pool, barn, garage or fence);

- gas boiler;

- heated floor;

- air conditioners and air ducts;

- plumbing fixtures (water meters, bathtub, toilet, shower, etc.);

- glazing of loggias;

- installation of plastic windows;

- soundproofing;

- telecommunications (Internet, TV) and electricity.

Let's give an example. Let's say you purchased a plot where there is an unfinished house. Then it was completed and a swimming pool was installed in the yard. Its costs are not included in the tax deduction for housing construction. You can count on reimbursement for the costs of purchasing land, a house and finishing and construction work.

Is it possible to include expenses incurred after registering real estate in the list of expenses?

Very often, finishing work and expenses for the purchase of materials continue to occur for quite some time before receiving an extract from the Unified State Register of Taxpayers. Therefore, the question arises, is it possible to include them in the list of tax refund costs, and also, is it possible to change the amount required for deduction after it has already been declared once?

The Federal Tax Service of Russia decided that the answer to the question of including these funds in the list will be positive, in addition, even if the deduction had already been provided at the time of their inclusion, the amount can still be changed and the balance can be obtained. In this case, a change in the amount will only be possible by the amount of current costs.

Let's give an example. In 2014, you independently built a two-story house on a plot of land and registered it as your residential property, while construction costs amounted to one and a half million rubles. In 2015, you submit a declaration for the past year to the authorities and receive a refund. In the same year, you carry out additional finishing work on the house for another half a million, it turns out that in 2016 you will be able to submit another declaration to the authorities, already for 2015, thanks to which you will claim the full amount of 2 million for deduction and receive the missing 13% from 200 thousand rubles.

How is the deduction distributed among the owners?

If several persons were registered as homeowners, the deduction between them is distributed as follows:

- In common shared ownership, taking into account the size of the share of each co-owner of the property.

- In common joint ownership by personal decision of the parties, presented in a written statement. The legislative framework allows for the distribution of the deduction in the ratio of 100% to 0. At the same time, the owner who received 0% will not be able to use the right to a personal income tax refund in the future during the construction or completion of housing.

- In common shared ownership with children or wards under 18 years of age in full.

Each homeowner submits a declaration individually, i.e. creates a complete package of documents.

The procedure for filing tax deductions contains many nuances. Some of them turn out to be not particularly pleasant. So, for example, when preparing a package of documents for the Federal Tax Service, the applicant needs to duplicate each receipt and payment receipt. In this case, after 3 weeks of inspection, tax officials may require the taxpayer to provide the originals of these documents.

Official papers required for tax purposes

In order for the funds due for refund to be provided, the payer must, in turn, provide the tax inspectorate with a package of necessary papers. The list of documents looks like this:

- Passport.

- Declaration form according to form 3-NDFL.

- Certificate 2-NDFL, confirming that the payer regularly and timely paid taxes to the state treasury.

- Application for the return of property benefits.

- Papers that can confirm the fact of purchase of real estate and that the applicant is the owner.

- Checks, receipts or certified payment documents confirming that you spent money on repair and finishing work.

- Extracts from a credit institution on the transfer of funds from the seller to the buyer and check sheets for receipt orders for housing purchased with a mortgage.

Don’t know how to fill out forms 2-NDFL and 3-NDFL? You can familiarize yourself with these topics on our portal. Step-by-step instructions, sample forms, and how to avoid basic mistakes when filling out a declaration.

Form 3-NDFL may not be filled out if you receive the deduction through your employer

Special documents may be needed, provided that the transaction has nuances. A package of property return documents for an apartment purchased for a minor relative or adopted child requires a photocopy of the birth certificate (passport when the child reaches fourteen years of age). Property owned jointly by spouses will require a marriage certificate. Documents submitted in bulk over several years must formally be submitted in the form of separate packages of papers for each year. You can submit them to the tax authorities once, putting in each “set” a 2-NDFL certificate and a declaration for each annual period. Documents that are “common” for the entire period of time need only be attached once, to the “first year” package. But if you intend to collect papers meticulously, you can make copies by number of years and add them to each package.

Video - Property deduction when buying a home

When is it possible to exercise a privilege?

Property deductions for building a house can actually be used in various situations:

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 Moscow,

Moscow region

+7 Saint Petersburg,

Leningrad region

+7 Regions

(free call for all regions of Russia)

- Constructing the building yourself. The housing structure must be listed in such a way that it is possible to register in it. If you do not have the right to register in such a premises, you will not receive privileges.

- Acquisition of an unfinished building and its completion. According to documentation of this kind, the house should be classified as an unfinished construction project. Otherwise, you will be able to return the money spent only on the purchase of square meters, but not on completing the construction process and repairs.

Subjects

When constructing a building on your own on a plot of land for private housing construction, tax refunds are realized by the following entities:

- owners of the house or plot on which it is located;

- one of the spouses of the owner of the school or house;

- parents of the minor owner of the property.

When is refusal possible?

The regulations provide for cases when a deduction will not be received during the construction of a private house. Thus, applicants will not see compensation payments when:

- the expenses were incurred not by the applicant, but by another person;

- maternity capital or other assistance from the state was used for the construction of the building;

- An agreement has been concluded with an interdependent party.

Emergence of the right to receive state compensation for construction costs

A citizen has the right to demand monetary compensation for the costs of a house he built himself when he registers it as residential property. To prove that the taxpayer has successfully completed the registration procedure, it is necessary to provide the relevant structures with a certificate from the Unified State Register of Real Estate.

Applying to the tax office to receive money is possible only after the end of the calendar year period, which became the time of registration of real estate residential property

It turns out that if you built a cottage on your plot in 2014, then you have the right to apply to the Federal Tax Service for compensation of funds in 2015.

Let's give an example. You started the process of constructing a residential building at the beginning of 2012, and completed its construction in mid-2014. Registration of the constructed cottage as a property and entry into the Unified State Register of Real Estate took place in 2015; it turns out that you can apply to the authorities for the return of some of the funds only in 2021.

At the same time, filing for the next year after the registration procedure period is not mandatory; you still have time, since you can submit papers to receive a deduction for the past 36 months.

Let's give an example. In 2013, you built a cottage on your site and went through the procedure of registering ownership. In 2013 and 2014, you were not officially employed, and only in 2015 did you get a job with a “white” salary and an employment contract. It turns out that you can activate your income tax refund only in 2021 and receive all payments for 2015. At the same time, the amount due to you that has not been issued in full will be carried over to subsequent years.

If you already have a certificate from the Unified State Register of Real Estate in your hands and you don’t want to wait until the end of the year, then apply for funds at your place of work. Yes, you will not receive a single payment, but you will gradually return 13% of your salary every month until the entire amount due to you is paid.

It’s up to you to decide which method of receiving money is more convenient, but we think that it is better, if possible, to wait for the full amount to be returned, which you can actually feel

Deduction amount

Conventionally, the amount in which you can expect to receive a deduction can be divided into two types:

- basic - which is given for the purchase of real estate and land, in the amount of 2 million rubles;

- additional - at bank interest, if the land with the house was purchased on credit, in the amount of 3 million rubles.

Accordingly, you can count on a return of 13% of the above amounts.

The main deduction can be received several times for different properties, but there are a number of restrictions.

If a house with a plot was purchased on credit, then you can also get a tax refund on the interest paid on it. The amount of interest deduction is in no way tied to the principal. Thus, in general, the owner can count on claiming a deduction of 5 million rubles.