To maintain accounting records, entrepreneurs undertake the responsibility of drawing up established reporting forms for a certain period. Among them is the balance sheet.

Many authorized state and regulatory bodies consider it one of the main documents, so every accountant must clearly understand what the procedure for drawing up is and whether individual entrepreneurs submit a balance sheet as a whole.

The submission of balance sheets by entrepreneurs is indicated in the Letter of the Ministry of Finance No. 66n

What is a balance sheet

Before the changes were made, the balance sheet was called Form 1. In 2021, the document is considered one of the most significant during the preparation of annual reporting.

Important! When compiling a balance sheet, individual entrepreneurs enter into it data regarding the financial position as of December 31 of the reporting calendar year.

This must be done in order to provide reporting upon request to authorized state regulatory authorities, including the regional representative office of the tax service. Moreover, the reporting in question is used additionally:

- individual entrepreneur;

- management of the company - if a legal entity;

- TOP managers.

The balance sheet provides an opportunity to get acquainted with the full picture of the work done for the reporting calendar year, and in financial equivalent. It is for this reason that many Russian individual entrepreneurs prefer to create a balance sheet for complete control during the development of their own business (it does not matter whether the simplified form is used or UTII).

Balance sheet - reporting form

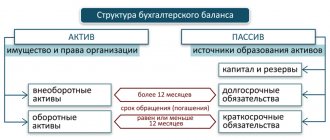

The balance sheet, regardless of whether the simplified tax system is used or another taxation regime, necessarily includes the assets and liabilities of the company. Assets mean a display of all resources, without exception, that are available on the balance sheet of an individual entrepreneur’s company. In this case, it is worth talking about all assets and non-current assets, including:

- existing real estate;

- operating equipment;

- financial investments.

Everything that cannot be returned within at least one calendar year is taken into account.

Additional Information! Balance sheet liabilities are considered to be any sources for financing assets.

Do not forget that the main feature of the document is the need for sections to match in full.

Does the individual entrepreneur hand over the balance, being on the “simplified” system?

2 tbsp. 54 of the Tax Code of the Russian Federation, individual entrepreneurs calculate the tax base at the end of each tax period on the basis of accounting data for income and expenses and business transactions in the manner determined by the Ministry of Finance of the Russian Federation. Accounting for income and expenses and business transactions is carried out by individual entrepreneurs by recording in the Book of Accounting of Income and Expenses and Business Operations of an individual entrepreneur (hereinafter referred to as the Book of Accounting) transactions on income received and expenses incurred at the time of their commission on the basis of primary documents in a positional manner (clause 4 PROCEDURE FOR ACCOUNTING INCOME AND EXPENSES AND BUSINESS OPERATIONS FOR INDIVIDUAL ENTREPRENEURS. That is, individual entrepreneurs do not keep accounting and do not prepare accounting records, they are required to keep a book of income and expenses. For OSNO and USNO there are different samples of books of income and expenses.

Individual entrepreneurs (individuals) may not be required to account. accounting (double entry) and preparing accounts. reporting. For themselves they can. Required to keep records of households. transactions in the household accounting book. transactions for individual entrepreneurs (there is a form) regardless of the taxation system. Do not confuse it with KUDiR under the simplified tax system, which is required to be maintained by legal entities. persons and individual entrepreneurs on the simplified tax system.

What is your tax system? If you have the simplified tax system or UTII, you can look at the list of reports on a special website service for individual entrepreneurs in Russia. He will show you the terms and amounts of payments, reporting forms, etc. The service website address is: https://elba-skbkontur. RF

if simplified is not necessary. if the general mode is boo. balance required in statistics

Individual entrepreneurs are not required to keep accounting records, so they do not submit a balance sheet. But in addition to accounting, there is also tax accounting, personnel and banking documents, contracts, etc., that is, the accounting that individual entrepreneurs maintain. Here is a good step-by-step instruction on how an individual entrepreneur can do his own accounting

Login to write a reply

June 20, 2018

Objectives of its delivery

Registration number in the Pension Fund of the Russian Federation for individual entrepreneurs - how to find out and why it is needed

It is necessary to understand that the balance sheet is one of the basic elements of annual reporting used by legal entities. There are no mandatory conditions for use for individual entrepreneurs. Moreover, according to federal legislation, they are completely exempt from the need to register.

Despite this, most individual entrepreneurs use the form in question for the purpose of maintaining internal control. Thanks to this financial information, the individual entrepreneur has the opportunity to:

- evaluate the profitability of previously developed and already used projects - perhaps some of them will need to be closed or modified in order to increase income levels, issue bonuses to employees for successful development, etc.;

- analyze the effectiveness of management decisions made - as a rule, this is manifested in total annual income. Based on the results of the data obtained, you can assess your strengths, for example, when making a decision to purchase a home with a mortgage.

The Tax Code of the Russian Federation determines the goals and objectives of the balance sheet

When figuring out whether individual entrepreneurs submit their balance sheet or not, it is worth saying that submitting the document is advisable when using the general taxation regime. In fact, for individual entrepreneurs, reporting is considered a comprehensive analysis of available resources and assigned obligations. Surrender is not required under federal law.

Is it necessary to submit a balance sheet under the simplified tax system?

The question of whether a company submits its balance sheet to the simplified tax system arises quite often. The fact is that previously such enterprises were exempt from accounting. However, several years ago, changes were made to the legislation obliging any company to submit reports. Therefore, it does not matter which tax object the company has chosen. The balance under the simplified tax system “income” or “income minus expenses” still needs to be filled out and submitted within the deadlines established by law - before March 31 of the next year (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

Applicable form

Forms of financial statements are given in Order of the Ministry of Finance dated July 2, 2010 No. 66n. On June 1, 2019, changes came into force (approved by Order of the Ministry of Finance dated April 19, 2019 N 61n) concerning the applicable forms. Two forms of balance remain relevant:

- regular;

- simplified.

The organization decides independently which balance sheet to fill out under the simplified tax system, taking into account the current legislation when choosing.

What balance is submitted to the simplified tax system?

In a simplified form, unlike the usual one, all indicators are indicated in a larger scale, without fine detail. It can be used by the enterprises named in paragraph 4 of Art. 6 of the Law on Accounting dated December 6, 2011 No. 402-FZ. In particular, small enterprises can choose a simplified reporting option if there are no other restrictions for them established by Art. 6 of Law No. 402-FZ, for example, mandatory audit. Most often, the balance sheet of an LLC using the simplified tax system is prepared in a simplified form.

You can check whether an LLC on the simplified tax system is a small enterprise under Art. 4 of the law of July 24, 2007 N 209-FZ.

Balance example

The norms of federal legislation establish that the balance sheet form 1 and 2 report on profits and losses, including other mandatory types of documents, must be transferred to:

- to the regional representative office of the tax service - reporting is submitted to the place of registration of the company or individual entrepreneur. If there are separate structural divisions or branches, only general reporting of the parent company. This must be done at the place of tax registration;

- to the statistics service - in 2021, reporting to Rosstat is considered a mandatory requirement. If the deadlines for delivery are ignored, an administrative fine in the prescribed amount will be issued to authorized officials;

- owners of companies (relevant for legal entities) - the annual report is submitted to them for approval and further transmission to the authorized bodies;

- other authorized state regulatory authorities - in order to comply with federal legislation.

LC IP - what it is and why an individual entrepreneur needs it

The document must be completed by authorized accounting employees (for legal entities) or individual entrepreneurs.

Additional Information! Many large enterprises, when signing a contract for the supply or provision of services, first require the provision of a balance sheet. However, this is not considered a requirement of federal law, but solely the personal desire of the administration.

There are a huge number of services on the Internet, using which you can check online the individual entrepreneur or company you are interested in using the Taxpayer Identification Number (TIN), OGRN. All these services are obtained from reports, including the balance sheet.

According to the rules of federal legislation, the balance sheet must be transferred to a tax specialist:

- by personal contact;

- by registered mail with a description of the contents and notification of receipt.

Sample balance sheet

If you have an electronic digital signature (EDS), the document can be transferred remotely. Just go to the official website of the Federal Tax Service and use the appropriate form. The rule is relevant if there are more than 100 employees.

To eliminate the possibility of making mistakes, it is advisable to use a form.

Annual reporting of individual entrepreneurs on OSNO

Individual entrepreneurs who remained on the main taxation system (OSNO) will be required to report for the year on the following items:

1. Personal income tax (NDFL).

You submit declarations in forms 3-NDFL and 4-NDFL no later than April 30 of the year following the reporting year. Do not forget that if there are employees, a report on their income is also submitted to the Federal Tax Service. In this case, the tax office expects an annual certificate from you in form 2-NDFL no later than April 1.

2. Average number of employees (ASN).

KND form 1110018 is filled out and submitted to the Federal Tax Service no later than January 20 of the year following the reporting year.

3. Calculation of insurance premiums.

Form RSV-1 is filled out if you have employees. It is submitted to the Pension Fund no later than the 15th day of the second calendar month following the reporting year. That is, for 2021 the report will need to be submitted no later than February 15, 2018. For those individual entrepreneurs who report electronically, this deadline is slightly shifted - no later than February 20, 2021.

4. Statistical reporting.

Statistical information is filled out using the OKUD form 1601305 “1-entrepreneur” and sent to the territorial office of Rosstat. For 2021, information must be submitted by April 1, 2021.

Individual entrepreneurs on OSNO must once a year submit 2-, 3-, 4-personal income tax in their tax returns, report to the Pension Fund of the Russian Federation, submit a certificate of social insurance and statistical reporting.

Does an individual entrepreneur need to submit a balance sheet?

Declaration of individual entrepreneur - what it is, how and when it is submitted, rules for registration

It is advisable to maintain full accounting records and prepare the reports in question for individual entrepreneurs under the general taxation regime. Under the simplified tax system, a similar need arises when there is a stable increase in the price of fixed assets.

According to the rules of tax legislation, the right to use the special regime remains relevant for owners of assets whose valuation does not exceed 150 million rubles. Regarding the standards that are relevant for individual entrepreneurs, the Ministry of Finance indicated in detail in the relevant Letter. From its content it follows that all simplifiers, without exception, take upon themselves the responsibility to control the value of existing property.

You can submit your balance online

Additional Information! Individual entrepreneurs have the right to keep accounting records on UTII in order to eliminate the possibility of theft of personal property and assess the profitability of their business. At the same time, the specifics of the regime used do not have any significant impact on the established procedure for processing information.

An example of filling out a simplified balance sheet for the simplified tax system

As an example of filling out a simplified balance sheet for the simplified tax system, let’s take a conditional enterprise that applies only a simplified taxation regime.

The balance sheet consists of the following lines:

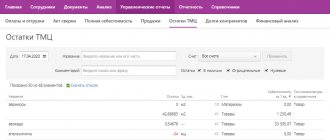

1. Tangible non-current assets are fixed assets, construction in progress, fixed assets acquired but not put on the balance sheet. 2. Intangible assets: licenses, computer programs, etc. 3. Inventories - goods, raw materials, materials and semi-finished products, finished products, if the company is engaged in production. 4. Cash – the balance of funds in the enterprise’s cash register and bank accounts. 5. Financial assets – accounts receivable, bills of exchange, prepayments and other financial investments.

The asset balance consists of the sum of the lines (the total cost of the organization's working and non-current assets).

The liability balance consists of the amount of capital (authorized, reserve and additional), retained earnings or losses, long-term and short-term monetary obligations (loans, credits, accounts payable, tax liabilities).

Useful: Who can apply the simplified tax system

When preparing annual financial statements, the balance sheets of assets and balance sheets of liabilities must be equal. In the general ledger, the numbers are reflected in rubles and kopecks, and they must converge to the kopecks. In the form submitted to the Federal Tax Service, the values are enlarged (up to thousands of rubles, millions of rubles).

Sample (algorithm) for drawing up a balance sheet:

• line 1150 indicates the residual value of non-current assets; • line 1170 – residual value of intangible assets; • in line 1210 enter the total cost of all materials, goods, etc. available in warehouses; • if buyers owe you money, the amount of debt must be indicated in line 1230; the amount of prepayments made to suppliers is also added here; • in line 1250 you should indicate the amount of balances on current accounts in banks and the amount of cash stored in the company's cash desk.

To summarize: we add up the values for all rows.

Next, we create a passive section:

• the amount of authorized capital, reserve capital, remaining retained earnings must be indicated in line 1370; • lines 1410, 1510 are filled in if there are loan obligations to financial institutions; • line 1520 – the amount of unpaid supplier invoices, arrears of staff wages and tax obligations, as well as insurance payments that will need to be paid in January from the December salary; • line 1700 – total amount for the passive section.

If the balance sheet is drawn up correctly, the amounts of lines 1600 and 1700 should be equal. Accounting statements can be sent to the tax office.