When can you receive a social tax deduction from the state, and can an individual entrepreneur qualify for payments? Details on how the deduction is calculated, as well as instructions for filling out documents for receipt, are in the article below.

According to the law

Russian legislation gives the following definition of a social tax deduction: this is the amount by which a taxpayer can reduce the amount of his income subject to personal income tax, spent on his social needs: treatment, study, non-state pension provision, as well as for charitable purposes.

The requirements of the law and the conditions for receipt are specified in Article 219 of the second part of the Tax Code of the Russian Federation, adopted on August 5, 2000 (Federal Law No. 117), as amended on August 3, 2021, amendments and additions to which came into force on September 4, 2021.

The law allows only individuals who are citizens of Russia to receive a social tax deduction who pay income tax on time - personal income tax: 13% of wages received. It is from these 13%, already transferred by the individual’s employer to the state budget, that a tax deduction is paid to the taxpayer. In fact, first a citizen of our country must pay a tax to the state, and then the state will return part of this money to him - in the amount of 13% of the funds spent on study, treatment, non-state pension insurance or charity.

For example, if an individual earned 200,000 rubles a year and paid a personal income tax of 26,000 rubles on this amount, and then spent 300,000 rubles on treatment, he will be able to receive payments for a maximum of the same 26,000 rubles, although 13% of expenses for treatment is 39,000.

A prerequisite for receiving a social tax deduction is the status of a tax resident. This means that an individual must stay in Russia for at least 183 days for 12 consecutive months. This norm is spelled out in Articles 224 and 207 of the Tax Code.

Are social tax deductions available to individual entrepreneurs?

Individual entrepreneurs can apply for such benefits only if they pay taxes to the state according to the general taxation system or have income that is subject to personal income tax. This right is confirmed by the Letter of the Ministry of Finance of Russia dated November 19, 2015, number 03-04-05/66945 .

When working on the general taxation system or paying taxes on personal income, an individual entrepreneur can also count on property tax payments when purchasing a home.

If an individual entrepreneur chooses the taxation system UTII (single tax on imputed income), simplified, unified agricultural tax, patent, he is not entitled to social tax deductions, because in this situation the individual entrepreneur is exempt from paying personal income tax.

What can you get a social tax deduction for?

Article 219 of the Tax Code of the Russian Federation clearly states for which expenses the right of an individual to receive a social tax deduction applies.

- Expenses for tuition: your own - in correspondence, full-time, distance learning; children, brothers and sisters, wards - only in person. If you plan to receive a social deduction for training not yourself, but another person, he must be no more than 24 years old. If funds from which an individual, by law, is not required to pay personal income tax, for example, maternity capital, were used to pay for studies, no deduction is allowed.

- Treatment costs – for yourself and for children under 18 years of age, parents or spouse.

- Expenses for paying contributions to non-state pension funds.

- Costs of voluntary life and health insurance if an insurance policy with a validity period of at least five years is purchased.

- Endowment life insurance, in which so-called long-term deposits are created - “airbags”, with the help of which a citizen can create additional protection for himself in old age.

- Contributions to the labor part of the pension. In this case, the taxpayer independently pays contributions to the pension fund in excess of what the employer pays for him in the funded part.

- Charity. As charity, the costs of which give the right to receive a deduction, the law names assistance to the development of science and culture, educational institutions and preschool education, and medical institutions; religious organizations. In this case, the amount of the social fiscal deduction cannot be more than 25% of the taxpayer’s income for the reporting period (year). Another important point: if the deduction in this case is not used in full, the balance cannot be transferred to the next year, according to Article 219 of the Tax Code, paragraph 1.

Social deductions provided by the tax agent

All citizens of the Russian Federation are considered tax residents of the Russian Federation. But there are certain cases when the payer has the right to reduce the amount of the fee for a number of reasons. Some of them can be obtained through a tax agent if there are appropriate grounds.

general information

Some expenses incurred by the taxpayer during the reporting period can be identified and reimbursed by submitting a petition to the tax office to reduce the amount of the final fee. One of these groups of costs consists of social deductions processed with the participation of a tax agent.

Income tax remitted for employees is usually fully calculated and remitted by the employer himself. Any person who has the right to attract personnel can act in this capacity:

Conditions of registration

There are a number of conditions regarding the registration of deductions:

- Not all tax is refundable, but part of the amount paid. It depends on the amount of the fee paid;

- Social benefits can only be obtained for a certain group of expenses;

- To receive a refund, you must first prepare and submit a declaration for the reporting year, attaching a number of accompanying documents to it.

Important! The maximum possible amount that can be returned from social payments is 120,000 rubles per year.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Main types

Social deductions can be divided into the following groups, based on the expenses incurred by the payer:

- for charity;

- for tuition fees;

- to purchase medicines and receive treatment;

- for voluntary replenishment of pension savings;

- for undergoing an independent assessment of their qualifications for compliance with qualification requirements.

The costs of life and health insurance are also taken into account, but only if such an agreement is concluded at one’s own discretion. The insurance agreement itself must be valid for at least 5 years. If the tax agent himself carries out this operation (for example, taking out car insurance), such expenses are not counted.

Legal grounds

The procedure is regulated in Article 219 of the Tax Code. It listed the reasons for receiving a deduction, and also stipulated the agent’s obligation to provide the citizen with all options for reimbursement of the funds paid.

Attention! Starting from 2021, an application for social benefits must be sent through the employer. However, it is worth noting that the employer does not provide social deductions for donation amounts and for the costs of undergoing an independent assessment of one’s qualifications. This is done by the taxpayer himself by submitting a 3-NDFL declaration with supporting documents attached to the Federal Tax Service at the place of registration of the taxpayer at the end of the tax period. Download for viewing and printing:

Who is a tax agent

Tax agents (according to Articles 24 and 226 of the Tax Code) are legal entities and individuals who employ citizens and pay taxes for them. Their responsibilities are as follows:

Agents send all the necessary documentation for the employee to the Federal Tax Service, and on its basis determines the amount of accrued payments.

Important! All payment certificates must be kept for at least 4 years.

How does a tax deduction work with a tax agent?

The main condition is that the employee submits a written request, which, in turn, the employer will forward to the Federal Tax Service. This requirement is defined in Letter of the Ministry of Finance No. 03-04-06/27013.

Download for viewing and printing:

Maximum amount of social tax deduction

The amount per year cannot exceed the amount of personal income tax paid by the taxpayer, that is, 13% of the amount of his income for the past year.

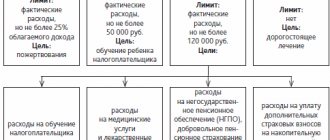

The law determines the maximum amount of expenses on the basis of which calculations can be made.

- For your own training – 120 thousand rubles from the income received for the year. This means that the deduction for the year can be no more than 15,600 rubles (120,000 rubles * 13% = 15,600 rubles). For the education of children, the amount for compensation is less - 50,000 rubles for one, that is, the amount of the deduction will be 6,500 rubles. Moreover, you can receive payments for yourself and for your child in one reporting period.

- For treatment (your own, your children’s, your parents’, your spouse’s) – 120 thousand rubles. If medical care is expensive, there is no limit on the taxable base for deduction.

- Contributions to the labor part of the pension - up to 120 thousand rubles.

- Contributions to non-state pension funds and long-term life and health insurance are also no more than 120 thousand rubles per year.

- For charitable donations, the deduction amount is not limited to a certain amount, but it is regulated by the taxpayer’s share of income - no more than his annual quarter.

Let's give an example of calculations. For example, citizen A. earned 1,200,000 rubles in a year. And during this same time, he spent 70 thousand rubles on his own education, and he paid a total of 105 thousand rubles for the education of his two children. Another 25 thousand rubles were spent on treatment. He donated 50 thousand to a medical fund.

In total, it turns out that the amount by which the taxable base of his annual income can be reduced was 245 thousand rubles: 100 thousand - for the education of two children (50 thousand for each), 70 thousand - for his studies, 25 thousand - for medical services, and another 50 thousand - for charity. Multiplying 245 thousand rubles by 13%, we get the amount that citizen A. has the right to return from the personal income tax paid - 31,800 rubles.

How does a tax deduction work with a tax agent?

The social tax deduction for education allows you to return money spent on your own education, the education of your children (or wards), brothers and sisters.

There are a number of conditions for receiving this type of tax refund.

The most important condition is the mandatory payment of personal income tax.

In addition, the conditions for providing a deduction for training are (clause 2, clause 1, article 219 of the Tax Code of the Russian Federation):

- training is carried out in educational institutions;

- the educational institution has an appropriate license or other document confirming the status of the educational institution;

- the taxpayer has documents confirming his actual expenses for training. In this case, all payment documents for training must be issued to the person who will subsequently receive a tax deduction.

Let us note that you can receive a deduction for your own education for any form of education, and in order to return the money for the education of children, brothers, sisters and wards, they must only be in full-time education.

We suggest you read: Tax on car winnings

Otherwise, the money will not be refunded.

An important point is also that in order to receive a social deduction for the education of a child (ward, brother, sister), his age should not exceed 24 years.

The size of the social deduction for training depends on the following factors:

- the amount of personal income tax paid for the year, since the amount of tax refund cannot exceed this amount;

- the amount of training costs, so the amount of deduction for training is determined as 13% of the amount of training costs.

For example, the maximum amount of expenses for your own education, as well as for the education of a brother or sister, according to the law is 120,000 rubles.

Thus, the maximum tax deduction for training will be 120,000 * 13% = 15,600 rubles.

The amount of social tax deduction for the education of a child (ward) is also limited by law.

In this case, the amount accepted for compensation is 50,000 rubles.

This means that for each child or ward you will be able to return 50,000 * 13% = 6,500 rubles.

Please note that you can simultaneously receive a social tax deduction for your own education and your child’s education.

To receive a social tax deduction, you can either contact the tax office or your employer.

When receiving a refund through the tax office, the amount of the social tax deduction will be returned immediately in full.

If you receive a deduction through your employer, the money will be returned in monthly installments.

That is, income taxes will not be withheld from wages until the maximum possible deduction is reached.

Please note that you can use your right to a deduction for the last three years, that is, in 2021 you can receive a social deduction for 2021, 2015, 2014.

To receive a social deduction for personal income tax from the tax office, you must submit documents at the end of the year in which the expenses were incurred.

The list of required documents to receive a social tax deduction through the Federal Tax Service will be as follows:

- declaration in form 3-NDFL;

- certificate from place of employment in form 2-NDFL;

- application for social benefits;

- payment documents from a medical or educational institution that confirm expenses incurred;

- agreement with the relevant institution.

In addition, if you receive a social tax deduction for treatment, you must have a certificate of payment for medical services.

If you plan to receive a tax refund for one of your relatives (children, spouses, parents), then you should attach a copy of the birth certificate or a copy of the marriage certificate to the remaining documents.

At the same time, in the certificate in form 2-NDFL, depending on the type of social deduction (deduction for ordinary treatment, for expensive treatment, for a child’s education, etc.), the corresponding social tax deduction code is entered in the certificate.

For example, code 203 is indicated when receiving a social deduction for a child’s education.

After the package of documents has been collected, you need to submit the collected documents to the Federal Tax Service and wait for the tax inspector’s decision.

In this case, the application for the deduction must indicate bank details.

Thus, to receive a social deduction through an employer you must:

- write an application to the Federal Tax Service to receive a notification confirming the right to deduct;

- in about a month, pick up a notification for social tax deduction;

- write an application to the employer to receive a social deduction (attach a notice to it).

To apply for a social tax deduction at your place of work, you need to prepare a package of documents.

We invite you to familiarize yourself with: Sample application for obtaining a property tax deduction

First, at the Federal Tax Service (FTS) at your place of residence, you must fill out an application to receive a document confirming your right to the corresponding benefit.

The application must be accompanied by documents that confirm the costs of training or treatment (contracts, doctor’s prescriptions, payment receipts, etc.).

The period for consideration of the application by the Federal Tax Service is 30 calendar days, after which the corresponding document will be issued.

Next, you need to write an application to the tax agent (employer), to which you should attach a copy of the document confirming the right to a tax deduction from the Federal Tax Service.

After this, the employer is obliged to reduce the tax base by the appropriate amount.

A tax refund is a government preference that gives citizens the right to return part of the money spent for certain purposes. These include: purchasing housing, paying for educational and medical services, contributions to charitable purposes, to non-state pension funds (as a voluntary additional pension) and insurance companies. To return part of the expenses, you must fill out the 3rd personal income tax declaration or contact your employer.

Important! To receive a deduction, you need an official source of income from which tax is withheld and transferred to the budget. Failure to do so will result in the inability to receive a refund.

In addition, the above production methods can be combined. However, one deduction can only be used once. For example, reimbursement of voluntary pension contributions can be obtained from the employing organization, and for reimbursement of medical expenses you should contact the tax authority.

Important! The amount of deductions should not exceed 120,000 per year. The calculation does not include the cost of educating children and expensive treatment.

The employer provides compensation based on an application from the employee and notification from the tax department. To obtain the latter, the employee must contact the inspectorate with the established list of documents. In general, this is an application to receive notification and paper confirming the right to return: contracts, checks, certificates, etc.

The procedure for providing deductions by the employer

If the employee was provided with a deduction at work, then this fact is reflected in the 2nd personal income tax certificate. There is a special section on the form for this. A particular type is indicated using certain combinations of numerical values. The list of such code values is established and adjusted by legislative acts of government departments.

For example, social payments have code 327 in personal income tax certificate 2, which means receiving compensation for contributions to non-state pension funds or insurance organizations. The following code values also include social ones - 320, 321, 324, 325, 326 and 328. However, it is necessary to check the values from year to year to ensure the relevance of the data, since along with the new form of certificate 2 personal income tax, changes may be made to the digital values, used for data encryption.

When filling out a declaration, the question arises, if the certificate indicates social deductions provided by the tax agent, what to write. To do this, we will figure out when it is necessary to fill out 3 personal income taxes if there are social tax deductions provided by a tax agent.

This need may arise:

- if the employer provided only one type of deduction;

- if the employer did not provide compensation in full.

Even if there are proper reasons, a refund cannot be made:

- if the amount of expenses is more than 120,000 rubles;

- if the amount of expenses is greater than total earnings.

Important! Social deductions are not carried over to the next year.

So, let’s figure out, having deduction code 327 in the personal income tax declaration 3, how to put your details and fill out the declaration.

If a declaration is filled out using a special program, then first all the necessary data is filled in, reflecting general information about the applicant and his income.

We invite you to read: Valuation of a car for a notary by inheritance. Estimating the cost of a car for inheritance online and on site

Deduction code 327 in personal income tax certificate 2 means that it belongs to the social category, so we select the desired section.

In the voluntary insurance column, we indicate the total amount of contributions for checks (even if it exceeds the limit).

Next, you need to select the type of agreement from those presented by the system, the name of the organization (including INN and KPP), number and date of the agreement, the amount used with the employer, the total amount of contributions. The amount of deduction 327 is indicated in the personal income tax certificate 2 next to the code.

Procedure for filling out 3 personal income taxes

In the printed personal income tax declaration 3, code 327 is contained on sheets E1 and E2. On sheet E1 in clause 3.6.1 in 3 personal income tax, the amount of social deduction received from the agent is indicated. Sheet E2 reflects the data of the organization - a fund or an insurance company, as well as details of the agreement on the basis of which contributions and all the amounts described above are paid. Therefore, when filling out 3 personal income taxes in 2021 manually, you need to pay special attention to sheets E1 and E2.

Tax deduction 328 is provided for additional insurance contributions for a funded pension. When filling out the declaration, you need to select the type of contract, the amount of deduction from the employer and the amount of contributions. Entering information about the company or the basis agreement is not required.

On a note! When drawing up a return declaration using your personal account on the official website of the service, code 327 is automatically transferred to the personal income tax declaration 3 from the income certificate available in the unified system.

Thus, the state gives the taxpayer the right to choose a convenient method for receiving paid expenses for established purposes. At the same time, when receiving a deduction through the employer, do not forget that when submitting the declaration to the inspectorate, it must be reflected there.

Medical services and medicines that are subject to social tax deduction

Codes for medical services, for which the law gives the right to receive a tax deduction, are given in Article 219 of the Tax Code of the Russian Federation, in subparagraph 3, paragraph 4. This code must be indicated in the certificate indicating payment for medical services. If the services are ordinary, code “01” is written, if expensive – “02”.

A complete list of medical services, payment for which involves receiving such payments, can be found in the Decree of the Government of the Russian Federation of March 19, 2007. This document provides a list of services, as well as expensive types of treatment and medications, the costs of which are accepted to determine the social tax deduction.

A tax refund, for example, is provided for the purchase of anesthesia, narcotic and non-narcotic painkillers, antihistamines, drugs for the treatment of alcohol and drug addiction, antifungal drugs, vaccines and hormonal agents, serums and vitamins, and so on.

The same Resolution provides a list of types of expensive medical care provided in Russia, for which the deduction is calculated based on the amounts actually spent on

- surgical operations in the treatment of respiratory organs, circulatory system, developmental defects, eyes, nervous system, digestion and so on;

- surgeries for endoprosthetics, reconstruction and tissue restoration;

- organ transplantation and prosthetic implantation;

- plastic and reconstructive surgeries;

- for therapeutic treatment of malignant diseases, hereditary and chromosomal disorders, myasthenia gravis and polyneuropathies; connective tissue diseases;

- complex treatment of burn injuries;

- treatment of certain forms of infertility using the IVF method;

- nursing premature babies;

- combined treatment of pathologies, including complications of pregnancy and childbirth;

- and so on.

Required documents to fill out and submit

Since a fiscal deduction, as follows from its definition, is calculated from the amount of taxes paid, you will need to provide the tax office with complete information about your income. On this basis, the fiscal authorities will calculate the amount of tax. And the calculation of payments will be based on it.

Data on income received is submitted to the Federal Tax Service in the form of an income declaration in Form 3 of personal income tax . And to fill it out, you need a certificate in form 2-NDFL, which indicates how much taxes you paid on your salary for a certain reporting period. For filing an income tax return, this time is one calendar year.

According to the law, the employer must submit data on taxes paid to the Federal Tax Service, and do this no later than a specific deadline. In 2021, this had to be done before April 1. And the income declaration in form 3-NDFL had to be submitted before April 3 by individuals, and by May 3 by individual entrepreneurs.

In addition, you will need to provide the fiscal authorities with

- documents confirming payment for services: receipts, checks, bank statements, payment orders and others;

- contracts for the provision of services, as well as agreements on donations made and acts of acceptance and transfer (if we are talking about charity);

- certificates from the organization providing the services, indicating that payment for the services was made in a certain amount;

- documents that confirm the status of the organization where the taxpayer received services for training, treatment, insurance, or a charitable organization. You will need copies of licenses for the right to conduct certain activities, constituent documents, budget estimates, and so on.

How to fill out an income tax return?

There are several ways to do this.

- The first is by hand on paper. To do this, you can take the tax return form from the tax office or print it out and then fill out all the fields. This is the most difficult option, since you need to know exactly which sheets need to be applied in a particular situation. If you make a mistake, the tax authorities will not accept the application.

- The second is to use a special program that can be downloaded from the tax office website. To do this, you will need a computer with Windows software installed on it.

- The third option is to register on the Federal Tax Service website, open your “Personal Account” there, and fill out the declaration directly there. According to the experience of those who have used this path more than once, it is the simplest and most reliable.

Obtaining a password for your “Personal Account” on the Federal Tax Service website

First, you will need to open the taxpayer’s “Personal Account” on the website of the Federal Tax Service. A password is required for this.

- You can get it at any tax office in Russia by presenting your passport and TIN certificate (if you go to the office at your place of registration, you don’t need to present the TIN). When you come to the Federal Tax Service, you will need to take a coupon from the electronic terminal: it should indicate the type. After a service employee registers you, you will receive a printed login and password for your personal account on the Federal Tax Service website. This procedure requires little time.

- Another option is to use a qualified electronic signature - you will need to purchase it.

- Another way is to use an account on the government services portal.

Instructions for filling out personal income tax declaration 3 on the Federal Tax Service website

- First step . If you decide to choose the first method - get a password from the inspectorate, the next step is to go to your “Personal Account”. When you visit it for the first time, the system will prompt you to change your password: this must be done within a month after the original password is received from the Federal Tax Service, otherwise you will have to go get a new one. Next, follow the system instructions.

By going to the “Personal Account” tab “Income Tax and Insurance Contributions”, you need to create a qualified electronic signature. To do this, install a special program on your personal computer or generate a signature on the fiscal service server.

- The second step is preparing documents.

- Firstly, certificates in form 2-NDFL for the previous year. This information should be displayed in the “Taxpayer’s Personal Account” automatically - after the employer has submitted the relevant data to the regulatory authorities. If he has not done this yet, he will have to obtain a certificate from the accounting department of his enterprise.

- Secondly, an agreement for the provision of services and a copy of it, for example, with a medical clinic, as well as checks and a certificate stating that you paid money for treatment , and a copy of the license of the medical institution. You will first have to fill out an application addressed to the management of the clinic in order to receive a certificate and a copy of the license, which must be certified by the director of the company. To do this, the clinic will ask you to show receipts. It may take several days or weeks to obtain the necessary documents.

- The third step is filling out an income statement, as well as an application for a personal income tax refund. For this purpose, there is a special section in the “Personal Account” - “Tax on personal income and insurance premiums”. Here you need to find the column “Fill out/send the declaration online” and then go to the “Fill out a new declaration” tab.

Sample of filling out 3-NDFL

If you received a deduction at work during the year, you will need to file a declaration in 2 cases:

Important!

If you received a deduction in full at work and do not plan to claim others, you no longer need to file a declaration.

Example

Nikolay and Vasily colleagues. Both work in a trading company as purchasing managers. Salary 26,500 rub. (of which personal income tax is 3,445 rubles) In April 2021, colleagues simultaneously decided to get a driver’s license. The cost of training at a driving school amounted to 39,400 rubles.

Nikolay promptly received a tax notice and submitted an application for a deduction to his employer in September 2021. He reimbursed the entire due amount of personal income tax in 2 months. Nikolai does not need to submit 3-NDFL and report to the tax office.

Vasily filed a statement only in December. He received his December salary including deductions. The employer transferred personal income tax for the month, 3,455 rubles, not to the budget, but to Vasily. For the remaining unreimbursed amount, the deduction is 12,900 rubles. (39,400 – 26,500) Vasily needs to submit a declaration. According to it, he will return 1,677 rubles. (13% of 12,900).

Vasily filled out 3-NDFL in the “Declaration” program:

- On the income page, I indicated information from the 2-NDFL certificate.

- On the “Deductions” tab, I indicated the total expenses for studying and the deduction already received at work.

An example of a completed declaration is available here .

Deadlines for receiving tax deductions

The law gives the tax service quite a lot of time so that its employees can check whether you filled out your income tax return correctly. The period for such a desk audit is up to three months.

Inspectors are not required to tell the taxpayer when an audit begins and ends. During the verification process, a Federal Tax Service specialist may call with a request to provide the original documents submitted to calculate the deduction.

You can find out at what stage the verification is at in your “Personal Account” in the section where the declaration was filled out. There is an item “3-NDFL verification status”.

When the audit is completed, the tax service must transfer the money within the next month.

Statute of limitations for tax refunds under 3-NDFL

The law allows filing an application with the tax office to receive this type of payment within three calendar years after the taxpayer has incurred the expenses specified in Article 219 of the Tax Code of the Russian Federation. This means that, for example, if money for education, treatment, non-state pension, charity, life and health insurance was spent from 2021 to 2021, you can apply for a personal income tax refund in 2021.

This also makes it possible to spread the payment amount over several years. For example, if a citizen with an annual income of 1 million rubles paid 240 thousand rubles at a time for her education, in the next reporting year she can receive a deduction only from 120 thousand, that is, 15,600 rubles. However, after another year, she can use her right to receive payments for the second part of the tuition fee - and return another 15,600 rubles.

Social deduction for charity

The social deduction for charity allows you to reimburse expenses for charitable purposes.

Moreover, the amount of this type of deduction should not exceed 25% of the taxpayer’s income.

The balance of the unused deduction is not carried over to the next year (clause 1, clause 1, article 219 of the Tax Code of the Russian Federation).

To take advantage of the deduction, an individual must have tax resident status, that is, actually be in the Russian Federation for at least 183 calendar days over the next 12 consecutive months (clause 2 of article 207, clause 3 of article 210, clause 1 of article 224 Tax Code of the Russian Federation).

Only a tax authority can provide a social deduction for charity on the basis of a tax return in Form 3-NDFL at the end of the tax period (calendar year) in which the charity expenses were incurred (clause 2 of Article 219 of the Tax Code of the Russian Federation).

Differences between social, standard and property tax deductions

Social tax is one of the types of tax deductions that are provided to Russian citizens. In addition, there are standard and property deductions.

What all three options have in common is that they can be received by individuals and individual entrepreneurs who pay personal income tax.

- The difference between standard and social deductions is the fixed amount of the former. In 2021, it is minus 500, 1400, 3000, 6000, 12000 rubles from taxable income. Article 218 of the Tax Code defines two types of such payments - for the taxpayer himself and for his children. The law states who exactly has the right to such deductions, for example, parents of disabled children.

- Property tax deductions are described in Article 220 of the Tax Code. They are valid for the sale of an apartment or house, vehicles, shares, for the purchase of housing on a mortgage and on credit, and for the construction of housing. For example, by purchasing an apartment or concluding an agreement for shared construction, you can get back from 2 million rubles paid for the apartment to 260 thousand.

The essence of the personal income tax deduction

This is a refund of tax paid or receipt of income without levying tax until the person receives the full amount of the deduction.

Initially, the deduction assumed the second option, which is where its name came from. Deduction - i.e. subtracting the amount of tax from income, receiving income in its entirety, without income taxation.

Thus, the most important condition for providing a deduction is the presence of personal income tax on behalf of the person in the budget. If a person has not paid tax, he has no way to get a benefit. Or - personal income tax accrual: the tax has not yet been paid, it is not in the budget, but the person has the right to declare a desire not to transfer these amounts, but to receive them along with the salary, i.e. in the salary - full earnings without taxation.

For example, Mr. A paid and received an annual salary of 1000 rubles, from which the employer calculated, withheld and paid 130 rubles in tax to the state treasury. Mr. A has the right:

- return 130 rubles from the budget;

- declare a deduction in the new period - next year you will receive all 1000 rubles, without remitting tax.

In any of these cases, the submission of a 3-NDFL declaration form is required. The form is designed specifically for claiming the right to deduction, as well as reflecting additional income not related to the main job.

Deadlines in 2021

An important point in filing a declaration is to take into account the period for which the data is being submitted and the form. For each year, you must submit the form that was in force at that time. Since the standard three-year statute of limitations cannot be exceeded, as of February, individuals are eligible to file forms for:

Each type of benefit has its own nuances for submitting a declaration and attaching documents. Below we will look at them in more detail.

In what cases is a deduction available?

Being a personal income tax payer is not enough to receive a deduction. The second requirement recognizes the conditions specified in the articles of Chapter 23, upon the occurrence of which the right to a deduction arises.

First you need to decide on the deduction system:

- property;

- social;

- standard;

- professional.

When do you need the help of a specialist to fill out a declaration?

It is not difficult to fill out a declaration on the website of the fiscal service yourself, if it is simple and does not require taking into account additional cash receipts, property and standard deductions, and other points. In such cases, it will be more difficult to cope with the task - it is better to attract a specialist who is well versed in accounting and knows what data to enter in which columns in each specific case.

Of course, you will have to pay for the service, but it is more profitable than filling out a declaration with errors, and then, at the end of the desk audit, discovering that this was the reason for the refusal of payments. This is especially important when large sums are involved.

Property deduction

The largest income deduction is realized in four forms, of which one is when selling property, and the other three are when purchasing property.

Sale of property

Items for sale:

- property, its shares;

- part in the authorized capital.

Deduction amount:

- income from the sale of a home, house, apartment, room, garden plot, dacha, land that was owned for up to three years, but not more than a million rubles;

- income from the sale of other real estate, but not more than 250 thousand rubles;

- income from the sale of other property, but not more than 250 thousand rubles.

IMPORTANT: If a part of the authorized capital is alienated, the amount of the person’s expenses for purchasing the share can be deducted.

It is important to note here: the amount of the deduction - for example, a million rubles, this is the base, this is not the amount that will be returned. Only 13% of the deduction amount is subject to refund or reduction. In the case of a million - 130 thousand rubles.

Acquisition of property

Objects:

- the cost of land and structures on it, provided by the Russian budget in connection with the seizure of this land for state needs;

- expenses for individual housing construction or the purchase of finished housing - land, home ownership, residential building, apartment, room;

- repayment of interest on a loan provided and spent on housing construction or the purchase of finished housing, i.e., on a mortgage.

IMPORTANT: The benefit only applies to interest; it does not apply to the loan itself.

Deduction amount:

- upon withdrawal - redemption value;

- for expenses on individual housing construction - no more than 2 million rubles;

- for a mortgage - in the amount of actual expenses, i.e. interest, until 2013, and no more than 3 million rubles - after 2013.

A person has the right to receive the entire amount of the deduction, even if he has not paid as much income tax for three years - the remainder of the deduction will be carried forward from year to year and provided as the tax is calculated.

IMPORTANT: To receive a deduction, a document confirming ownership is strictly required - a certificate from Rosreestr or an extract from the Unified State Register of Real Estate.

Expenses for individual housing construction include:

- formation of the project and estimate;

- purchase of materials for construction and finishing;

- buying an unfinished house;

- payment for services and works on finishing and construction;

- integration into the public utilities system - gas, water, electricity, sewerage, or the creation of new systems.

Housing purchase costs include:

- direct purchase price;

- purchase of finishing materials;

- payment for finishing work, design and budgeting in connection with finishing.

Required documents

Documents attached to the declaration:

- purchase agreement (usually a purchase and sale agreement);

- document of ownership - an extract from Rosreestr or a certificate;

- act of acceptance and transfer;

- payment documents confirming expenses;

- personal documents of applicants;

- certificate 2-NDFL;

- documents on loan and interest;

- other documents depending on the individual circumstances of each case.

Procedure for filling out the declaration

Filling out the declaration is a key part of the procedure. Required form sheets:

- title;

- section 1;

- section 2;

- sheet A;

- sheet D1.

IMPORTANT: The last sheet - D1 - is the page that reflects information on expenses for individual housing construction or the purchase of housing.

You can download the declaration in form 3-NDFL from the link below.

Documents for download (free)

- Declaration 3-NDFL

The form is subject to strict graphic design requirements so that an automated data processing program can read the information and “digitize” it:

- Requires blue or black pen.

- Each cell contains one character.

- Capital block letters are used.

- Corrections, circling, and highlighting are not permitted.

- It is allowed to fill out the form on a computer and even submit the declaration electronically.

The first page is filled out according to the standard scheme:

- the TIN is indicated - if the registration certificate is lost and the person cannot find his number, then it is easy to find out through the Federal Tax Service website, or contact any inspector at the computer in the operating room with a passport;

- adjustment number - 000, if the person does not submit an updated declaration;

- taxable period;

- inspection code - can also be found through the Federal Tax Service website or in the inspection building;

- country code - Russia is the 643rd code;

- payer code - usually 760 - individual;

- then fill in the lines with the name, the name is indicated in the nominative case;

- passport data is duplicated strictly from the passport with such abbreviations;

- At the bottom in the left field, the type of representation is selected - personally or through an authorized representative, the date is indicated and a signature is placed.

In Section 1 you should fill out:

- TIN column - a number is indicated on each sheet of the declaration;

- the surname and initials are indicated in words;

- in line 010 you need to select the result of the declaration; in case of deduction, this is a return from the budget;

- KBK - 182 1 0100 110 - the account through which personal income tax was received from a person through a tax agent;

- OKTMO - use the service at this link, or find out the code from tax office employees, look at the stands;

- line 040 - put a dash;

- line 050 - the amount of the deduction calculated at the rate;

- sign the sheet and indicate the date.

IMPORTANT: In fact, Section 1 is more convenient to fill out after filling out the other sections, since it indicates the results of the declaration.

Section 2 requires more careful completion. Minimum lines that cannot be skipped:

- indicate the rate - usually 13%;

- type of income - usually “other”;

- line 010 - if during the period there was no income other than basic earnings, then the total amount of wages from the 2-NDFL certificate is indicated;

- line 040 - the amount of deductions, the addition of all deductions if property and standard deductions are presented, for example;

- line 060 - identification of the tax base by subtracting line 040 from line 010;

- lines 070, 080 are filled out according to the 2-NDFL certificate, line 140 - based on the calculation on sheet D1;

- In all unfilled lines, a dash is placed in the first cell.

Sheet A is filled out according to the 2-NDFL certificate. If there were additional income, for example, from the sale of property, they are indicated on the form. Sheets A are attached as many as needed to reflect all income.

On sheet D1 - the most important sheet of the form - the upper part is filled out in accordance with the real estate documents. Then the numbers are entered in lines 120, 140, 160, 200, 230. If there is a loan agreement and loan repayment, the remaining columns are filled in accordingly.

The declaration with the attached document can be submitted at any time during the year.