How to deal with operation codes?

Taxpayers who submit VAT returns to the inspectorate are often faced with the need to reflect the codes of certain transactions.

Codes are required to complete sections 2, 4-7. Find out what sections these are in the picture:

Codes are sets of 7 digits, each of which represents a specific operation. All codes are divided into 5 groups and are described in Appendix No. 1 to the Procedure for filling out a VAT return, approved. by order of the Federal Tax Service dated October 29, 2014 No. MMB-7-3/ [email protected]

The VAT return, starting with the report for the 4th quarter of 2021, must be submitted in a new form, as amended. Order of the Federal Tax Service of Russia dated August 19, 2020 No. ED-7-3/ [email protected] The changes did not affect transaction codes. ConsultantPlus experts spoke about the procedure for filling out the updated declaration. Study the material by getting trial access to the K+ system for free.

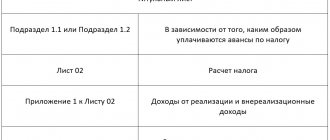

The figure below shows:

- the name of each group of operation codes;

- the range of codes provided for each group;

- link to the article of the Tax Code of the Russian Federation.

The list of codes valid in 2021 - 2021 can be downloaded in this material.

What happens if you don’t put the transaction code in the declaration? It will not pass logical control, and the controllers will not accept it. Therefore, it is necessary to understand the codes and correctly reflect them in the declaration, if the need arises.

Next we will tell you more about individual codes.

Transaction codes in the VAT return by section

Value added tax transaction codes that must be noted when filling out the report are given in Appendix No. 1 to the procedure for filling out the declaration, approved by the Federal Tax Service order No. ММВ-7-3 dated October 29, 2014 / [email protected]

This application is designed in a table, which in turn has several sections. They provide the encoding, a decoding of the type of transaction, as well as an indication of the specific article of the Tax Code, which provides for the rule for assessing VAT for a particular case.

Explanation of terms with links to legal regulations for code 1010292

What legal acts do you need to know in order to correctly reflect transactions under code 1010292 in the declaration:

- subp. 15 clause 3 art. 149 of the Tax Code of the Russian Federation - determines that loan transactions, including interest on them, are not subject to VAT on the territory of the Russian Federation;

- pp. 44.2-44.5 Procedure for filling out a VAT return - decipher the procedure for reflecting information in the lines of section 7, dedicated to non-taxable transactions.

- The Civil Code of the Russian Federation and other legal acts - regarding the definition of the terms “money loan”, “securities loan”, “loan interest”, “repo operation”.

Scheme for using code 1010292

Let's consider the scheme for using code 1010292, concentrating in it the necessary information for filling out the declaration:

Based on this diagram, we will fill out section 7 using the example data.

PJSC "Spring Wind" entered into a loan agreement with a domestic company. Its amount is 3,400,250 rubles. In the 2nd quarter, accrued interest on the loan amounted to RUB 38,253. When filling out section 7, please note that:

- for the lender (PJSC "Spring Wind"), issuing loans is not the main activity;

- The lender has no general business expenses for non-taxable transactions.

What the completed section 7 of the VAT return with transaction code 1010292 looks like, see below:

When filling out column 2, you should take into account that it is not the “loan body” that is entered, but the amount of accrued interest (letter of the Federal Tax Service dated April 29, 2013 No. ED-4-3/7896).

Codes for the seventh section

When filling out section 7 of the VAT return, special ones are used. codes. Their purpose is to indicate the type of operation performed. The codes valid in 2021 are:

- 1010806 – sale of land plots;

- 1010204 – sale of honey. goods;

- 1010235 – passenger transportation;

- 1010239 – letting of residential premises for temporary use;

- 1010291 – services of lawyers;

- 1010292 – issuance of credits and loans;

- 1010258 – assignment of rights of claim;

- 1010401 – sale of products under customs regime;

- 1011703 – temporary use by the state. and municipal property objects;

- 1011802 – real estate for own use.

Relationship between codes 1010292 and 1010256

The relationship is as follows: code 1010256 in the VAT return, just like code 1010256, is reflected in the same section (section 7). Both of these transactions belong to the group of non-taxable (exempt from taxation).

What else do these codes have in common? If there are the specified codes in section 7, tax authorities, when conducting desk audits, try to request additional documents from the taxpayer. Which? We are talking about documentary evidence of the legality of reflecting non-VAT-taxable transactions in the declaration. Moreover, the controllers justify their demands by the fact that the exemption of these operations from VAT is in the nature of a tax benefit.

However, the judges do not agree with them - the taxpayer manages to prove in court that the obligation to submit documents along with the declaration is contrary to clause 88 of the Tax Code of the Russian Federation (decrees of the Supreme Arbitration Court of the Russian Federation dated January 31, 2014 No. VAS-497/14, Supreme Arbitration Court of the Russian Federation dated November 12, 2012 No. VAS-6809/12).

We will tell you more about when you need to enter code 1010256 in section 7 of the VAT return in the next section.

Valid codes in 2021

In the current year, the following codes are used to reflect the type of transactions performed:

- 1011410 – sale of products through export;

- Transaction code 1010274 in the VAT return – sale of scrap, remaining color. metals and ferrous metals;

- 1010421 – sale of products to the EAEU states;

- 1010447 – adjustment of the amount of deductions and the tax base;

- 1010204 – sales of domestic and foreign products. honey. goods according to the following list:

- Medicines necessary for life first;

- Glasses and lenses, the purpose of which is to correct vision;

- Prostheses;

- Materials for honey production. products.

- Transaction code 1010410 in the VAT return – sales of products for export, including offshore;

- 1010806 – transactions that are not subject to VAT, including the sale of land;

- 1010211 – honey. services, except for veterinary, cosmetic and sanitary-epidemiological services;

- 1010292 – loan of cash or securities, including accrued interest on it;

- Transaction code 1010256 in the VAT return – implementation of use rights to various databases, unique inventions, know-how, computer software, industrial designs;

- 1011711 – sale of foreign products. persons who are not registered with the tax service as payers;

- 1010243 – implementation:

- Shares in the management company;

- Units in funds of a corporate and investment nature;

- Valuable papers;

- 1011703 – provision of property objects for temporary use by government and management bodies;

- Transaction code 1010245 in the VAT return – educational services provided by non-profit firms, with the exception of consulting services;

- 1010425 – transport and forwarding services, which are carried out on the basis of relevant contracts;

- 1011422 – sale of raw materials through export;

- Transaction code 1010288 in the VAT return – transfer of products or performance of work free of charge as part of a charitable activity.

Implementation according to code 1010256 (topologies of integrated circuits, industrial designs, etc.)

Code 1010256 is entered in the VAT return if exclusive rights to the results of intellectual activity are realized during the reporting period.

An exclusive right is the right of a person to use protected objects (including the right to prohibit their use).

What is meant by the term “results of intellectual activity”? The basic concepts are deciphered below:

So:

- Realization of exclusive rights to the specified objects under subparagraph. 26 clause 2 art. 149 of the Tax Code of the Russian Federation is not subject to VAT.

- When such transactions are reflected in section 7 of the declaration, code 1010256 is entered.

Features of using code 1010256

From the previous section we found out that the implementation of exclusive rights to intellectual property is not subject to VAT. A single rule applies to all the objects considered: if such a sale occurred in the reporting quarter, this operation is subject to reflection in section 7 of the VAT return with code 1010256.

This is a general approach that may have interpretations in the course of business activities.

For example, a Russian organization acquired from a foreign company the rights to use the results of a production secret (know-how). The transfer of rights to the results of intellectual activity is a service. The question arises: what will be recognized as the place of sale of the service in this situation? According to sub. 4 paragraphs 1 art. 148 of the Tax Code of the Russian Federation is the territory of the Russian Federation if the buyer operates in our country. And the operation to exercise exclusive rights to a production secret is not subject to VAT (for the position of officials of the Ministry of Finance, see letter dated November 18, 2016 No. 03-07-08/68105).

Check whether you are using the codes correctly in your VAT return with the help of explanations from ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

When do technical inspection services fall into section 7 of the VAT return with code 1010203?

Section 7 of the VAT return reflects a wide variety of transactions that are not subject to VAT. Thus, code 1010203 is intended to reflect a VAT-free transaction for the sale of technical inspection services (subclause 17.2, clause 2, article 149 of the Tax Code of the Russian Federation). However, such a service will not be taxed only under certain conditions - they are specified in the Law “On Technical Inspection...” dated July 1, 2011 No. 170-FZ. What are these conditions?

VAT is not assessed on technical inspection if it is carried out by a company or individual entrepreneur (including a dealer) duly accredited to conduct technical inspection (subclause 7 of Article 1 of Law No. 170-FZ). They are called inspection operators. At the same time, the rules for accreditation of operators are strictly regulated (approved by order of the Ministry of Economic Development of Russia dated November 28, 2011 No. 697). Only in this case will the taxpayer who provided the service legally fill out code 1010203 in section 7 of the declaration.

If a technical inspection service is provided by a company or individual entrepreneur that has not been accredited, such services are subject to VAT, and this operation should not be reflected in section 7 with code 1010203 (letter of the Ministry of Finance of Russia dated 04/05/2012 No. 03-07-11/101).

Reflection of transactions in the columns of section 7 of the declaration

Box 1

Column 1 of Section 7 of the VAT return reflects transaction codes in accordance with Appendix 1 to the Procedure. For example, transactions that are not recognized as an object of taxation (clause 2 of Article 146 of the Tax Code of the Russian Federation) have code 1010800; those of them that are reflected in paragraph 3 of Art. 39 of the Tax Code of the Russian Federation, code 1010801.

At the same time, some transaction codes are not here, which is due to legislative changes and the lack of timely adjustments to the Procedure.

Thus, from July 1, 2019, the provisions of paragraphs came into force. 19 and 20 paragraph 2 art. 146 of the Tax Code of the Russian Federation (Federal Law dated April 15, 2019 No. 63-FZ), according to which, accordingly, operations for the free transfer of real estate objects to the state treasury of the Russian Federation and the free transfer of property into the ownership of the Russian Federation for the purposes of organizing and (or) conducting scientific research in Antarctica.

From 01.10.2019, the norms of paragraphs. 3.2 clause 3 art. 149 of the Tax Code of the Russian Federation (Federal Law No. 212-FZ of July 26, 2019), on the basis of which banking transactions specified in this norm are not subject to taxation.

In accordance with paragraphs. 36 clause 2 art. 149 of the Tax Code of the Russian Federation (Federal Law No. 211-FZ of July 26, 2019) operations for the provision of MSW management services by regional municipal solid waste (MSW) management operators are not subject to VAT. The norm applies to operations for the sale of such services at maximum unified tariffs introduced from 01/01/2020.

Under these circumstances, that is, in the absence of appropriate codes, the Federal Tax Service issued additional recommendations. The Letter dated October 29, 2019 No. SD-4-3/ [email protected] states, in particular, that before making appropriate changes to Appendix 1 to the Procedure on the basis of the norms of the Tax Code of the Russian Federation, it is necessary to reflect the following transaction codes in section 7 of the declaration for the relevant tax periods :

– 1011450 (clause 19, clause 2, article 146 of the Tax Code of the Russian Federation); – 1011451 (clause 20, clause 2, article 146 of the Tax Code of the Russian Federation); – 1011207 (clause 3.1, clause 3, article 149 of the Tax Code of the Russian Federation); – 1011208 (clause 36, clause 2, article 149 of the Tax Code of the Russian Federation).

For your information:

In

Letter No. SD-4-3/

[email protected] , the tax service clarified that until the official approval of the above codes, the use of codes 1010800 and 1010200 by taxpayers is not a violation.

Columns 2, 3, 4

According to clause 44.3 of the Procedure, in column 2, section 7 of the declaration for each transaction code, the taxpayer or tax agent reflects:

– the cost of goods (work, services) that are not recognized as an object of taxation in accordance with clause 2 of Art. 146 Tax Code of the Russian Federation; – the cost of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation in accordance with Art. 147, 148 of the Tax Code of the Russian Federation, paragraph 3, 29 of the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services (Appendix 18 to the Treaty on the EAEU); – the cost of goods (work, services) sold (transferred) that are not subject to taxation (exempt from taxation) in accordance with Art. 149 of the Tax Code of the Russian Federation, taking into account clause 2 of Art. 156 of the Tax Code of the Russian Federation.

When reflecting transactions that are not subject to taxation (exempt from taxation), under the corresponding transaction codes (for each of them), the taxpayer fills in the indicators in columns 2, 3 and 4 on line 010.

In column 3, section 7 of the declaration it is indicated (clause 44.4 of the Procedure):

– the cost of purchased goods (works, services), sales transactions of which are not subject to VAT in accordance with Art. 149 Tax Code of the Russian Federation; – the cost of goods (work, services) purchased from taxpayers applying for an exemption from the taxpayer’s obligations to pay tax in accordance with Art. 145 and 145.1 of the Tax Code of the Russian Federation; – the cost of goods (work, services) purchased from persons who are not VAT payers.

Column 4, Section 7 of the declaration reflects the amounts of tax presented when purchasing goods (work, services) or paid when importing goods into the territory of the Russian Federation, which are not subject to deduction on the basis of clauses 2 and 5 of Art. 170 of the Tax Code of the Russian Federation (clause 44.5 of the Procedure).

Note:

according to

paragraphs.

2 p. 2 art. 170 of the Tax Code of the Russian Federation (as amended by

Federal Law No. 63-FZ dated April 15,

2019) from July 1, 2019, the amount of VAT on purchased (imported) goods (work, services), including fixed assets and intangible assets used for production operations and (or) sales of goods, the place of sale of which is not recognized as the territory of the Russian Federation, are not accepted for deduction, but are taken into account in the cost of acquisition.

The provisions of this norm do not apply to works (services), the place of implementation of which in accordance with Art. 148 of the Tax Code of the Russian Federation does not recognize the territory of the Russian Federation. Amounts of “input” (“import”) VAT on acquisitions intended for such operations are subject to deduction (clause 3, clause 2, article 171 of the Tax Code of the Russian Federation). Exceptions include the operations listed in Art. 149 of the Tax Code of the Russian Federation.

The indicators in columns 3 and 4 are not filled in by tax agents (dashes are added).

When reflecting transactions that are not recognized as an object of taxation, as well as transactions the place of implementation of which is not recognized as the territory of the Russian Federation, in column 1, section 7 of the VAT return, under the corresponding transaction codes, the taxpayer provides the indicators in column 2. In this case, the indicators in columns 3 and 4 are not filled in – dashes are added (clause 44.2 of the Procedure).

No license: will codes be needed?

Lack of a license for certain types of activities specified in Art. 149 of the Tax Code of the Russian Federation (transactions not subject to VAT), deprives companies and individual entrepreneurs of this benefit.

For example, one of the types of transactions that must be reflected in section 7 of the VAT return is gambling services (code 1010226). However, gambling organizers have the right to use the VAT exemption only if they have a special license (Clause 6, Article 149 of the Tax Code of the Russian Federation). Mandatory licensing of this activity is provided for in clause 31, part 1, art. 12 of the Law “On Licensing of Certain Types of Activities” dated 04.05.2011 No. 99-FZ.

If there is no such license, VAT must be calculated and paid in the general manner (clause 11 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33).

The same rule equally applies to other operations exempt from VAT (if a license is required). For example:

publication will introduce you to a complete list of transactions not subject to VAT .

Let's get acquainted with the code 1011712

In order to correctly reflect transaction code 1011712 in the VAT return, you also need to familiarize yourself with some terms and articles of the Tax Code of the Russian Federation.

This code is entered in section 2 of the VAT return by tax agents. Let's see who tax legislation classifies as tax agents and when they should enter the specified code in the declaration:

Please note that code 1011712 is entered when ordering work or services from a foreigner - not when purchasing goods (when purchasing goods from a foreigner, the transaction code is 1011711).

This is where we encounter the difficulty associated with determining the place where the work or service will be sold. If everything is more or less clear with the goods (the goods were shipped in Russia, which means the Russian Federation is recognized as the place of sale), then services and work are a separate matter.

We will tell you how a tax agent can correctly determine the place of sale of work (services) in the next section.

VAT benefits: cases of provision and features of their application

- The company does not have sufficient revenue (limit – 2,000,000 million rubles for three consecutive months).

- Organizations and companies participating in the implementation of government innovation projects.

- Importers of products specified in Article 150 of the Tax Code of the Russian Federation (benefits for payment of VAT when importing goods).

- types of work or goods described in the Tax Code . This is due to activities in the field of medicine, transport, art, sports, postal services, housing construction, and advertising. And also when carrying out research, repair, restoration and warranty work.

- Benefits that apply to certain categories of companies . The condition for benefits in this case should be work in: the field of culture, education, cinema, sanatorium rehabilitation, sales of agricultural products, funeral services, archival affairs, banking and insurance operations. Services for extracurricular work with children and assistance to the disabled and elderly citizens are also considered here as a condition.

- Benefits covering certain commercial and business operations . Research work, participation in targeted programs, rental housing, some financial services, charitable activities, trading in shares or shares in the authorized capital.

Please note => What payments are required by law when a person reaches 100 years of age?

Nuances of using code 1011712

What might be difficult? The fact is that it will be necessary to fulfill the duties of a tax agent of a Russian company or individual entrepreneur only if a transaction with a foreigner (for the purchase of works or services) took place on the territory of our country. Therefore, before you start preparing section 2 of the VAT return, make sure of this (Article 148 of the Tax Code of the Russian Federation). The diagram below will help us understand this circumstance:

As you can see, difficulties in determining the place where the service is provided (the work is performed) are quite possible. An incorrect assessment of this circumstance may affect the correct completion of section 2 of the VAT return and the reasonable application of code 1011712.

Results

Transaction codes are entered in sections 2, 4-7 of the VAT declaration. They encode transactions that are not recognized as subject to VAT, are not subject to taxation (exempt from taxation), transactions at a 0% rate, etc. If you do not put them in the declaration, it will not pass logical control, and the tax authorities will not accept such a report.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

VAT benefits, their documentary evidence

In accordance with Art. 56 of the Tax Code (hereinafter referred to as the Code), tax and fee benefits are recognized as benefits provided to certain categories of taxpayers and fee payers provided for by the legislation on taxes and fees compared to other taxpayers or fee payers, including the opportunity not to pay a tax or fee or to pay them in a smaller amount . For example, to exempt from taxation research and development work carried out at the expense of the federal budget, a contract for the performance of work indicating the source of funding is required, as well as a written notification to the contractors and co-executors of the customer, to whom funds have been allocated from the federal budget. targeted budget funds allocated to him to pay for these works. To justify this benefit, tax authorities have the right to request from the taxpayer other documents: technical specifications, additional agreements to the contract, calendar plan, maintaining separate records, etc.

Please note => Who is paid for sick leave in 2019