Depreciation is the gradual transfer of the cost of fixed assets to finished products, work, and services as physical wear and tear occurs. Passive account 02 Depreciation of fixed assets is used by organizations if they have fixed assets that are subject to depreciation.

In the balance sheet, fixed assets are accounted for at their residual value—the cost of acquisition minus accrued depreciation. Land plots and natural resources are not subject to depreciation, since their consumer properties do not change over time. Such fixed assets are reflected in the balance sheet at historical cost.

Account 02 Depreciation of fixed assets

Depreciation of fixed assets can be calculated in the following ways:

- in a linear way;

- reducing balance method;

- the method of writing off the cost by the sum of the numbers of years of useful life;

- by writing off the cost in proportion to the volume of products (works).

The chosen method is fixed in the accounting policy. You can use different depreciation methods for different groups of homogeneous fixed assets.

Depreciation is accrued monthly starting from the month following the one in which the property was accepted for accounting as a fixed asset.

The amounts of accrued depreciation are written off as expenses for ordinary activities, these are:

Debit 20,23,25,26,29 - Credit 02.

Or included in other expenses (if the object is of a non-production nature or is intended for rent, if rent is not a normal activity):

Debit 91-2 - Credit 02.

If a fixed asset is used to create, modernize or reconstruct another non-current asset, then:

Debit 08 - Credit 02.

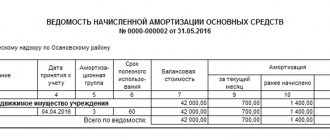

Reflection of depreciation of fixed assets in the accounting of budgetary and autonomous institutions

On a monthly basis, the institution reflects the amount of accrued depreciation as a debit to “cost” accounting accounts. For this we use:

- if depreciation is accrued on fixed assets involved in the capital construction of real estate or the creation of other non-financial assets of the institution - account 0 106 00 000 “Investments in non-financial assets” (according to the corresponding analytical accounts);

- if depreciation of a fixed asset is involved in the formation of the cost of finished products, work, services or is taken into account in distribution costs - account 0 109 00 000 “Costs for the manufacture of finished products, performance of work, services” (according to the corresponding analytical accounts);

- if depreciation of a fixed asset does not participate in the formation of the cost of finished products, works, services and is not taken into account in distribution costs - account 0 401 00 000 “Expenses of the current financial year” (analytical account 0 401 20 271 “Expenses for depreciation of fixed assets and intangible assets” ).

When using account 0 109 00 000, the following analytical accounting accounts are used (depending on the direction of use of fixed assets):