For a beginner, it may seem that using the 1C 8.3 program is very difficult and nothing is clear, but in fact, everything is completely the opposite. This software has a completely user-friendly interface, a significant part of the functionality of which is intuitive. And it will be very easy to use for both managers and office workers. In this article, we will sequentially look at the accounting of fixed assets in 1C with example screenshots.

First, let's define the terminology. Fixed assets are property used as a means of labor for more than one year and costing more than one hundred thousand Russian rubles. In a company, accounting for fixed assets includes a large number of different operations, including registration, putting into use, depreciation and, ultimately, disposal. Each is worth considering separately.

Receipt and commissioning, acceptance of fixed assets for accounting in 1C

So, some basic equipment is purchased, for example, a lathe. Information about this needs to be added to the program. To do this, we will use the corresponding item “Receipt of equipment”, which can be easily found in the section “OS and intangible assets”.

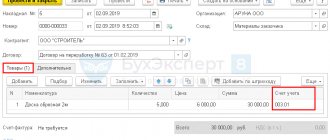

Filling out such a document will not be difficult. In its header we indicate the name of our organization and the name of the other company from which the purchase was made in accordance with the main agreement. Our example situation under consideration is the simplest. The part with the table will only have one row with the lathe. In addition, VAT, invoices and prices are noted there.

When the posting is completed, the document assigns the lathe, which in our example costs three hundred and fifty thousand rubles, to the required account.

In order for the lathe to be put into operation in accordance with the software accounting and depreciation to be calculated correctly, this must be noted in the document “Acceptance for accounting of fixed assets.” The document can be easily found in the “OS and intangible assets” section.

Next you need to fill out the header of the document that we created. In our case, we should select “Equipment” as the type of operation, because a lathe is precisely equipment. Next, we note the OS event and, if necessary, the financially responsible person and the place where the machine is located.

Now you need to go to the first tab of the document called “Non-current asset”, and there, in turn, to the directory position “Nomenclature”. In our case, again there will be a lathe. If necessary, it is permissible to note the method of its receipt (say, for a fee). The department field is also optional.

Let the lathe be listed on 04/08/01 (for example, this will be useful below when considering depreciation).

Next, about the “Fixed Asset” tab. There, only one position was added to the tabular part, selected from the corresponding directory. The directory has certain filling features. In the directory, we noted the price of our equipment at three hundred and fifty thousand rubles, some data on depreciation, and so on.

In our example, the purchased machine will be used for five years, that is, sixty months, and depreciation will be calculated using a linear method. Thus, the entire amount will be written off in equal parts throughout these five years, when the month closes.

Let's move on again to filling out the document for putting the lathe into use. There we are now interested in the “Accounting” tab. It is necessary to be a little more specific about the accounts, the method of calculating depreciation and the operating time of the machine. This data should already be in the card of our main asset, that same machine.

Next is the “Tax Accounting” tab. With almost the same data as in the one that came before. Only significantly less data should be noted, and such data will be used not for accounting, but for tax purposes.

In the last tab, data about the depreciation bonus is filled in. The percentage is indicated by the group in which our fixed asset (machine) should be included according to the period of use. For us it will be 30%.

When all the fields in all tabs are filled out correctly, it’s worth double-checking! - you can post the document.

If everything was done in full accordance with the instructions written above, then in the end 2 different accounting entries should be generated.

The first posting will include the actual acceptance of our machine for accounting with a note of the amount (three hundred and fifty thousand rubles). In the second line of movements, a depreciation bonus of 30% will be noted - in terms of money it turns out to be one hundred and five thousand rubles.

Our machine began operation in July 2021. Accordingly, in August 2021 the program will already take into account all the noted information.

Methods for calculating depreciation

Depreciation in accounting is calculated in the following ways:

- linear method;

- reducing balance method;

- method of writing off value by the sum of the numbers of years of useful life;

- method of writing off cost in proportion to the volume of products (works).

An organization needs to divide all its fixed assets into homogeneous groups based on common characteristics, for example, the “Buildings” group. For each group, you need to establish a method for calculating depreciation. It cannot be changed later.

The use of one of the methods of calculating depreciation for a group of homogeneous fixed assets is carried out throughout the entire useful life of the objects included in this group.

Moving fixed assets to 1C

The movement of a fixed asset in 1C 8.3 is quite similar in essence to the movement of goods. The key difference is that the product is moved between warehouses, and the asset is moved between departments, because it has already been taken into account.

When such a document is drawn up, only some details may cause difficulties, for example, the calculation of depreciation and the method of reflecting expenses on it. Information should be noted there only if additional depreciation is charged after the move. In the example on the screenshot, we will not fill them out. Depreciation, as usual, is calculated at the end of the month.

Depreciation rate of fixed assets: formula for calculating the balance sheet

You can find data on accrued depreciation of fixed assets in the notes to the balance sheet. They are in the form of Appendix No. 5 to the balance sheet, which was part of the financial statements until 2011. Despite the fact that the mandatory nature of this form has been cancelled, it is used to explain the dynamics of OS in the period under review. The formula used to calculate the amount of depreciation of fixed assets, in relation to the explanations, looks like this:

K = gr.5 lines 5200 f.5 / gr. 4 lines 5200 f.5 x 100

Analysts consider the depreciation rate of a fixed asset together with the serviceability rate of the fixed asset, calculated as the ratio of the residual value to the original value. These indicators characterize the state of the asset and have an analytical meaning, often conditional, since the method of calculating depreciation plays an important role.

Inventory of fixed assets in 1C

In the same way, inventory has few differences when compared with a similar operation carried out with goods. Only, again, instead of a warehouse, you need to indicate a division. Where there is a table, it will be necessary to note not the quantity, but the sign that the main means is there.

When a fixed asset is not noted in accounting, but in fact exists, then you need to make an inventory document for accepting the asset for accounting. And if, on the contrary, it is indicated in the accounting, but in reality is missing, it needs to be written off.

Accounting for depreciation of fixed assets using the cost write-off method based on the sum of the number of years of SPI

For assets with the maximum degree of return in the first years of operation, this method is also suitable - based on the sum of the number of years of useful life. Depreciation is calculated by multiplying the original cost of the asset and the ratio of the number of years remaining until the end of its service life to the sum of the number of years of SPI.

For example, for an OS object with an initial cost of 200,000 rubles. and three-year SPI depreciation will be calculated as follows:

| Period | Depreciation per year | Residual value at the end of the year |

| 1 year | 200,000 x 3 / (1+2+3) = 100,000 | 100 000 (200 000 – 100 000) |

| 2 year | 200,000 x 2 / (1+2+3) = 66,666.67 | 33 333,33(100 000 – 66 666,67) |

| 3 year | 200,000 x 1/ (1+2+3) = 33,333.33 | 0 (33 333,33 – 33 333,33) |

Accrual of depreciation of fixed assets in accounting will be recorded using the same posting - D/t 20 K/t 02.

Depreciation of fixed assets in 1C

Depreciation is typically performed once at the end of the month.

To perform it, go to the “Operations” menu, then to “Closing the month”. We choose a period, our company. Further everything is already automated in detail. The assistant makes the calculations sequentially and first calculates depreciation charges. If everything was done correctly, then a depreciation document will be created, as in the screenshot.

Let's look at a specific example. By the way, it is important to note that the rules and depreciation options are set up in the company’s accounting policy, and depreciation is calculated monthly from the month from which our fixed asset was added to the program and accepted for accounting.

So, the result was a transaction in the amount of 2950 rubles. The settings indicate a linear option for calculating depreciation. The machine, as we remember, must be used for five years. Everything is calculated correctly.

Buh. records on depreciation of fixed assets

Here are typical entries for accounting for depreciation of fixed assets:

- D08 – K02 – calculation of depreciation on items of fixed assets that are used for the purposes of personal capital construction.

- D20, 23, 25 – K02 – depreciation calculation for fixed assets used in the production process.

- D20, 23, 25, 26, 97 – K02 – depreciation was accrued on the PF, which were taken for temporary use under a leasing contract.

- D02 - K02 - depreciation was accrued for general business assets.

- D44 – K02 – depreciation has been accrued on PF items that are used in the activities of a trading company.

- D79 – K02 – accounting for depreciation of fixed assets received from a branch that has a separate accounting account. balance.

- D83 - K02 - additional accrual of depreciation when revaluing an asset (if a depreciation was not previously carried out).

- D91 - K02 - increase in the amount of depreciation when revaluing assets (if a markdown was carried out in previous periods).

- D02 - K01 - write-off of the amount of accumulated depreciation on PF items that have completely worn out and for this reason were removed from the company’s accounting.

- D02 – K01 – write-off of the amount of depreciation that accrued during the use of the asset.

- D02 - K03 - write-off of depreciation on PF, which were leased under a leasing contract and then sold.

- D02 – K83 – reflection of the recalculation of the amount of depreciation when depreciating PF objects.

Calculation of fixed assets depreciation

To contents

Any fixed asset (OS) loses its original qualities over time. It just wears out. Depreciation covers depreciation by moving the value of a fixed asset to expense accounts.

In accounting, an object is transferred to the fixed assets category when it is ready for use for its intended purposes. For example, a purchased machine that does not require installation can be depreciated as soon as the company receives it, since people begin working on it immediately. In taxation, the situation is different: property that is used to make a profit is initially considered depreciable. In both accounting and tax accounting, depreciation is accrued monthly from the first day of the month following the month the asset was accepted for accounting.

Fact! Before calculating depreciation of fixed assets, the organization selects accrual methods.

There are four ways to calculate depreciation in accounting, and two in tax accounting. In accounting, it is selected once for each OS object without subsequent changes. In the second option, due to the tax code, at each specific moment the method specified in the accounting documentation is applied.

Then the useful life is determined. In accounting, it is determined depending on the planned operational period and probable physical wear and tear, in tax accounting - on the depreciation group according to the Classifier, which was approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1.