A little theory

A gratuitous transfer can be made to an individual or legal entity. However, such transfers between two commercial organizations are prohibited, except for gifts worth up to 3,000 rubles. (Article 575 of the Civil Code of the Russian Federation). But in practice, if the transferred goods are not demanded back through the court, there will be no bad consequences for the receiving party.

In accounting, the cost of goods transferred free of charge is taken into account according to Dt 91.02 Other expenses.

In tax accounting, a gratuitous transfer is not considered a sale, so the organization does not generate income. The cost of the goods themselves and the costs associated with their transfer are not taken into account when calculating income tax.

The transaction is subject to VAT, with some exceptions: for example, when transferring goods, works, services (property rights) to charity, there is a tax exemption. VAT presented by the seller when purchasing goods intended for gratuitous transfer is accepted for deduction in the usual manner.

Free supply of OS to 1C:ERP and 1C:KA

Content:

1. What settings need to be made in 1C:Enterprise to display the operation of free receipt of OS

2. Acceptance of OS for accounting in 1C

What settings need to be made in 1C:Enterprise to display the operation of free receipt of OS

Before reflecting the transaction of gratuitous receipt of fixed assets, you need to make sure that the “Take into account other income and expenses”

in the “Financial result” section.

To do this, in the 1C:ERP program or in 1C:KA 8.3, go to the section Master data and administration - Financial result and controlling - Financial result.

Now let's turn to the document with which we will reflect the free receipt of the OS. To do this, let's turn to the section Financial results and controlling

and then move on to

Reflection of other income and expenses

.

After clicking on the “Create” button, select the “Registration of expenses” document.

Let's fill out the document as follows:

The expense item selected in the document must have the following settings:

After completing the document “Registration of expenses”

the following transactions will be generated in 1C:Enterprise:

Acceptance of OS for accounting in 1C

The next step is to perform the operation of accepting the operating system for accounting in 1C. To do this, in 1C:ERP or 1C:KA we will go to the section Non-current assets - OS Documents. Click the “Create” button to draw up a new document “Acceptance of OS for accounting in 1C”. In the 1C:ERP and 1C:KA 8.3 program, fill out the document as follows:

Attention!

In accounting, the cost of gratuitously received fixed assets is recognized in other income of the organization only as depreciation is calculated, and in tax accounting - on the date the parties sign the transfer and acceptance certificate in the amount of the market value of this fixed asset. As a result, there will be a temporary difference in our income estimates.

Now it is necessary to record income from gratuitously received fixed assets as part of income in NU. To do this, let's go to the section Financial results and controlling, then to Reflection of other income and expenses.

Click the “Create” button and select the document type “Registration of Income”. Let's fill out the document as follows:

We check the presence of transactions in 1C:Enterprise after the transaction. Amounts should be only for NU and VR.

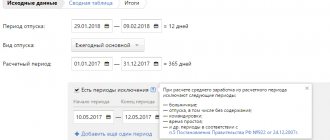

Next month, we recognize in the accounting book part of the cost of the fixed assets received free of charge in the amount of depreciation accrued for the month.

So, in April depreciation was accrued in the amount of 3,333.33 rubles. You can view this amount of accrued depreciation by opening the regulatory document “Depreciation of fixed assets.”

Using the document “Registration of Income” we recognize income in accounting. Let's fill out the document like this:

Now let’s check our postings in 1C Enterprise. Amounts should be only according to accounting and financial statements.

Specialist

Sergeeva Alsou

Gifts for employees

Cozy Home organization gives its employees gifts for their anniversary.

On February 1, we purchased sets of sweets at a price of 1,200 rubles. per piece, including VAT 20%.

On February 10, gifts were presented to employees.

Purchasing gifts

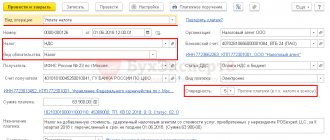

Reflect the purchase of candy using the standard document Receipt (act, invoice) in the Purchases – Receipt (acts, invoice, invoice) menu.

In total, 15 sets of sweets were purchased for the amount of 18,000 rubles, including VAT of 3,000 rubles. We take VAT for deduction, so in the VAT accounting method , select the option Accepted for deduction .

Acceptance of VAT for deduction

To reflect the VAT deduction, create a document Creating purchase ledger entries (Operations – Regular VAT transactions), click the Create button – Generating purchase ledger entries.

Free transfer of goods

To account for a gratuitous transfer, go to the Sales – Gratuitous Transfer section and create a document of the same name.

Fill in the information:

- Number ... from - the number will be assigned automatically, transaction date - the date of gift transfer;

- Organization - indicate your organization;

- Warehouse —warehouse for storing gifts;

- Recipient - although it is highlighted in red, it is not always filled in. If there is a specific recipient, indicate it. In this example, a general document is created for all employees, so leave the field blank.

On the Goods , select the goods to be transferred, their quantity and market value (in our example, the cost of purchasing candy without VAT). account will be determined automatically.

On the Cost Account , check:

- Cost account - 91.02 “Other expenses”;

- VAT account — 91.02.

For the subconto Other income and expenses, a predefined item is selected:

- Expenses for the transfer of goods (work, services) free of charge : Type of article - Expenses for the transfer of goods (work, services) free of charge and for one’s own needs .

Make sure that in the selected option the Accepted for tax accounting .

Save the document and create an invoice using the Issue invoices . Since the transfer is gratuitous, the transaction type code will be 10 “Gratuitous transfer of goods, works, services.”

Postings according to the document

The document generates transactions:

- Dt 91.02 Kt 41.01 - writing off the cost of goods as other expenses not taken into account in the NU;

- Dt 91.02 Kt 68.02 - calculation of VAT on the transfer with write-off to other expenses not taken into account in the NU.

BP 3.0: Recognition of income in the form of property received free of charge - how to reflect it in the program.

Answer:

The program must reflect the receipt of gratuitously received property with the document “Receipt (act, invoice).” Type of operation “equipment” (menu “purchases” - section “purchases” - receipt (act, invoice) - create - equipment). We fill out the “equipment” tab: indicate the quantity, amount, accounting account “08.04.1”. In the “settlements” column we indicate the account for accounting of settlements with counterparties and for advances “98.02”. Next, you need to take into account the fixed asset transferred free of charge. To do this, open the menu “Fixed assets and intangible assets” - section “Receipt of fixed assets” - acceptance for accounting of fixed assets - create. Type of operation “equipment” - we indicate the financially responsible person from the card of individuals - location of fixed assets: main division - event of fixed assets: acceptance for accounting with commissioning. We fill out the “non-current asset” tab: method of receipt “gratuitous receipt”; indicate the received equipment; select a warehouse; accounting account “08.04.1”. On the “Fixed Assets” tab, we create a new fixed asset that is an object of fixed assets and indicate the depreciation group, after which the inventory number is filled in automatically. In the document “acceptance for accounting” on the “accounting” tab we indicate the accounting account “01.01”; accounting procedure: depreciation calculation; method of calculating depreciation: linear method; accrual account “02.01” and check the “accrue depreciation” checkbox. We set the reflection method and indicate the useful life. On the “tax accounting” tab, we indicate the procedure for including the cost in the “depreciation calculation” expenses and check the box. The amount of depreciation is calculated using the routine operation “closing the month.” Lastly, we reflect in the program the recognition of income in the form of property received free of charge. To do this, you need to create “Operations entered manually” (menu “operations” - accounting - operations entered manually - create). We set the account as “98.02” for debit and “91.01” for credit. In the first sub-conto for the loan “other income and expenses” we create a new type “Income associated with the gratuitous receipt of property” and the type of article “gratuitous receipt of property, work, services, property rights”, and also check the box “accepted for tax accounting” . In subconto 2 we indicate the property received free of charge (realizable asset). Since income from property received free of charge will be written off during its useful life in proportion to accrued depreciation, we do not indicate anything in the “amount” field, because this field is intended to be reflected in accounting. We fill in the amounts “VR Dt” and “VR Kt” if the organization applies PBU 18/02.

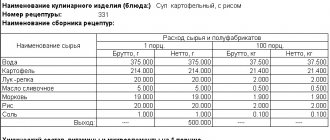

Goods for charity

The Cozy House organization provides charitable assistance to an orphanage.

On March 2, a computer was transferred in the amount of 60,000 rubles.

Setting up separate accounting

Since the organization donates goods for charitable purposes, its activities include an operation that is not subject to VAT (clause 12, clause 1, article 149 of the Tax Code of the Russian Federation). This means that you need to set up separate accounting in the program.

To do this, go to the Main menu - Settings - Taxes and reports and in the VAT , check the box Separate accounting of incoming VAT by accounting methods is maintained .

Donation of goods to charity

Create a document Gratuitous transfer .

Filling out the document is similar to the example described earlier, with some exceptions:

- in the Recipient , select the counterparty to whom the computer is being transferred. In this case, there is a specific recipient of assistance, documents will be transferred to him;

- %VAT column - select the option Without VAT ;

- Transaction code - since the transfer is within the framework of charitable activities, enter the code 1010288 . To automatically fill out Section 7 of the VAT return, make sure that the checkboxes are checked in the reference card Transaction codes of Section 7 of the VAT return : The operation is not subject to taxation (Article 149 of the Tax Code of the Russian Federation) ;

- Included in the register of supporting documents.

On the Cost Account , leave the settings as default as in the first example.

Do not issue an invoice.

Postings according to the document

We have looked at how the gratuitous transfer of goods is reflected in 1C 8.3.

LiveInternetLiveInternet

Quote from SoftServiceGold message

Read in full In your quotation book or community!

The requirements of the current legislation establish: if the owner’s share in the authorized capital of a company exceeds 50%, he can provide it with assistance in the form of gratuitous provision of funds without tax consequences. The amount, as a rule, is deposited into the organization’s account and must have a specific purpose (for example, increasing working capital). When one of the owners provides gratuitous assistance, an appropriate agreement must be concluded between him and the company.

First of all, you should reflect the receipt of money in the company’s bank account. In 1C Accounting, a document of the same name is used for this. When working with it, you should be very careful, since it generates postings, and therefore affects the content of the reporting.

When filling out a document registering in 1C Accounting 8.3 the receipt of funds into an organization’s bank account, you should follow certain rules:

- It is recommended to create it from the menu section with bank statements using the button that records the receipt of funds.

- As a transaction type, you should select settlements with other counterparties.

- In the fields with the incoming number and date, you should enter the corresponding details contained in the bank order.

- The founder who transfers gratuitous financial assistance should be indicated as the payer. Information about it must be entered into the directory with counterparties.

- The basis for the transfer is an agreement on the provision of assistance, therefore, in the field with the details of the agreement, information about such an agreement should be indicated. The contract type in this case is “Other”.

- Account 98.02 is used for posting, which reflects gratuitous receipts of funds.

- After completing the filling procedure, the document must be submitted.

Since the document generates transactions, it is recommended to check their correctness. For this, standard processing is used in the 1C Accounting solution, which displays all document movements on the screen.

The second step is to reflect the gratuitous financial assistance received in the registers of the 1C Accounting 8.3 program. To do this, you should use a manual operation, since there is no standard document in the legislation for such an action. It should also be borne in mind that the “Operation” document generates transactions, therefore, before conducting it, it is necessary to check the contents to be sure that in 1C Accounting software accounting for gratuitous assistance is carried out correctly.

When filling out the form for the operation, you must consider the following nuances:

- The document is located in the menu section with all operations that are entered manually. To display a form to fill out, use the “Create” button.

- The document type is an operation.

- In the appropriate field you should briefly describe the essence of the operation. This must be done so that in the future you can easily remember the content of the operation and the documents supporting it, since regulatory authorities pay close attention to such actions.

- To generate a transaction, use the add function. The debit account should be 98.02 (used to register gratuitous receipts), and the credit account should be 91.01 (records all other income that is not reflected in other accounts when generating the financial result). You must indicate the subaccount for the loan. To do this, you should select the desired name from the list of types of other income. If the element does not exist, it should be created. The need for such an action is due to the fact that assistance from the founder, received free of charge, does not affect the taxation of profits, therefore, the appropriate settings must be made for this element of the directory (the checkbox indicating the need to be reflected in the NU is unchecked). The founder making the gratuitous transfer of funds should be indicated as a debit subaccount.

- The amount of receipts should be entered in the appropriate field.

- Fields with data for tax accounting and the value of the permanent difference will be filled in automatically in the 1C Accounting 8.3 program. It should be remembered that as a result of such a transaction, a permanent difference between accounting and tax accounting will arise in the company due to the fact that gratuitous assistance is not taken into account for tax purposes.

- To print an accounting statement for this operation, use the button of the same name.

- At the end of the filling process, the document must be recorded and closed.

Check the correctness of the reflection of gratuitous financial assistance in 1C Accounting using the balance sheet for account 98.02.