What is an agency agreement

An agency agreement is a document for formalizing the relationship between an agent (intermediary) and a principal (customer), within the framework of which the former is obliged to perform certain actions on behalf of the latter for a fee. In this case, the intermediary acts on his own behalf or on behalf of the customer, but always at the expense of the latter . The difference in the way interests are represented affects the obligations under the contract. If the agent acts on his own behalf with reference to the principal, the obligations under the contract fall on the agent, but if the agent participates on behalf of the customer, then the obligations arise on the latter.

The amount of the agency fee and the method of payment are fixed in the contract. As a rule, this is a certain amount or percentage of the transaction.

Within the terms established by the contract, the intermediary provides the principal with a report on the execution of the order and attaches supporting documents to it regarding expenses in relation to the principal.

Organizations involve agents in their activities in various areas. These could be orders for the sale of the principal’s goods to buyers, the acquisition of property for the customer, or legal issues.

Having difficulties drawing up an agency agreement?

Use the “My Business” service and draw up any contracts in 3 clicks

Try for free

Sale of goods

Option 1. The principal and intermediary are VAT payers

When selling goods (work, services) through an intermediary, the obligation to pay VAT on this transaction arises with the principal, since according to the Civil Code he remains the owner of the goods transferred to the intermediary “for sale” (Articles 996, 1011 of the Civil Code of the Russian Federation).

Accordingly, the documents for this transaction must also ultimately come from the principal. The procedure for completing these documents depends on whether the intermediary is acting on his own behalf or on behalf of the principal. In the latter case, everything is simple: when completing a transaction (receiving an advance), the intermediary receives an invoice from the principal, does not register it in the purchase book, and simply transfers the document to the buyer. If (which happens more often) the transaction takes place on behalf of an intermediary, then the document flow becomes more complicated. First, the intermediary issues an invoice on his own behalf and gives one copy to the buyer of goods, works, and services. The intermediary assigns a date and number to the document based on its current chronology. In lines 2, 2a and 2b, the intermediary indicates his data.

This invoice must be registered in part 1 of the log of received and issued invoices, without registration in the sales book (clause 7 of the rules for maintaining a log of received and issued invoices*, paragraph 6 of clause 20 of the rules for maintaining the sales book **).

Then the indicators of this invoice must be reported to the principal. Based on this data, he will draw up an invoice on his own behalf and transfer it to the intermediary. The intermediary, having received this document, does not enter it into the purchase book, but registers it in part 2 of the journal of received and issued invoices (clause 11 of the rules for maintaining a log of received and issued invoices, paragraph “c”, clause 19 of the rules maintaining a purchase book).

Finally, after the mediation service has been provided, the mediator issues another invoice for his fee. This document is registered in the sales book and part 1 of the journal for recording received and issued invoices (clause 1, 7 rules for maintaining a journal for recording received and issued invoices, paragraph 1, paragraph 20 of the rules for maintaining a sales book).

Option 2. The principal is a VAT payer, but the intermediary is not

As we have already said, when selling goods (work, services) through an intermediary, the principal remains the owner of the goods transferred to the intermediary “for sale” (Articles 996, 1011 of the Civil Code of the Russian Federation). Accordingly, VAT on such sales is paid not by the intermediary, but by the principal. Therefore, the fact that the intermediary is not a VAT payer will affect the document flow for this tax only in terms of the invoice for remuneration. This document simply will not exist.

However, the intermediary prepares all other documents in exactly the same way as in option 1. But here the intermediary must remember that from January 1, 2015, in such a situation, he must submit to the tax authority a log of invoices received and issued in electronic form. Only intermediaries who are also tax agents were exempted from this obligation (clause “b”, paragraph 2 of Article 12, part 5 of Article 24 of Law No. 134-FZ).

Option 3. The intermediary is a VAT payer, but the principal is not

In a situation where the principal is not a VAT payer, the sale of goods will take place without VAT. Consequently, invoices for this transaction will not be drawn up and issued (letter of the Ministry of Finance of Russia dated May 31, 2011 No. 03-07-11/152; see “When an agent sells the services of a principal who has switched to the Unified Agricultural Tax, invoices are not issued”) . So the intermediary will only have to issue an invoice for the amount of his remuneration (letter of the Ministry of Finance of Russia dated January 22, 2015 No. 03-07-11/1698; see “The Ministry of Finance explained the procedure for issuing and registering invoices by an agent when selling goods of a principal using the simplified tax system "). This document is registered in the usual manner - in the sales book and part 1 of the log of received and issued invoices.

In this situation, the intermediary does not have any additional obligations to submit documents to the inspectorate in electronic form.

Option 4. Neither the principal nor the intermediary pays VAT

This is perhaps the simplest option - there will be no VAT-related paperwork at all! There are also no additional obligations to provide electronic documents to tax authorities, since within the framework of intermediary activities the intermediary does not issue or receive invoices for the sale of goods (work, services, property rights). And receipt/issuance of such invoices is one of the mandatory conditions provided for by law (clauses 5.1, 5.2 of Article 174 of the Tax Code of the Russian Federation).

VAT on agency agreement

Business activity without the involvement of an agent, when the buyer is on OSNO and the seller is on the same taxation regime, does not raise questions regarding the calculation of VAT. The situation is the same with tax in an agency agreement. Accounting difficulties arise if one party uses the OSNO and the other the simplified tax system. Let's see how to account for VAT depending on who pays the VAT.

Agent on the simplified tax system, principal on the OSNO

An agent on the simplified tax system does not pay VAT, therefore he does not issue an invoice to the principal on OSNO for his services and does not allocate the amount of tax from the remuneration.

If an agent on the simplified tax system operates on behalf of the principal-buyer, invoices received from the seller are issued to the principal. The intermediary’s task is only to transfer these documents to the principal within the time period specified in the agency agreement.

If the intermediary is instructed to sell goods (works, services) on behalf of the principal to third parties, he transfers to the buyer the principal's invoice issued in the name of this buyer.

If a simplified agent acts on his own behalf, he issues an invoice to the principal-buyer on OSNO on behalf of the seller. The intermediary transfers data from the invoice received from the seller and independently assigns a number to the document, taking into account the chronology of its document flow, but with the date specified by the seller.

When selling the principal's goods on OSNO on behalf of the agent on the simplified tax system, the intermediary issues an invoice in the name of a third-party buyer and informs the principal of the document indicators for re-issuing it on behalf of the principal. The principal then issues an invoice to the buyer on his behalf.

An agent on the simplified tax system is obliged to keep a log of invoices received and issued in relation to business activities in the interests of a third party.

The mediator fills out the section of the journal “Information on mediation activities.” The journal must be submitted to the Federal Tax Service on a quarterly basis in electronic form according to the format approved by Order of the Federal Tax Service of Russia dated March 4, 2015 N ММВ-7-6/93 , no later than the 20th day of the month following the expired quarter ( clause 5.2 of Article 174 of the Tax Code of the Russian Federation ).

If the intermediary allocates VAT in the amount of the agency fee, in accordance with clause 5 of Art. 173 of the Tax Code of the Russian Federation, he has the obligation to calculate and pay tax, as well as submit a VAT declaration to the Federal Tax Service.

At the same time, there is no right to deduction for simplification even in this case, because organizations using the simplified tax system are not VAT payers ( clause 5 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 ).

For the principal at OSNO, this situation is also difficult. He expects to receive a deduction, but tax authorities may question the deduction from the organization using the simplified tax system. Judicial practice in the issue of obtaining a deduction from a simplified person takes the side of the taxpayer ( Determination of the Constitutional Court of the Russian Federation dated March 29, 2016 No. 460-O ). However, the Ministry of Finance has a different position: if an invoice was issued by an organization using the simplified tax system, which is not a VAT payer, then the tax cannot be deducted ( Letter of the Ministry of Finance dated October 5, 2015 No. 03-07-11/56700 ).

If the principal at OSNO decides to take a risk and accept VAT deduction on an invoice from a simplifier, you need to be prepared for legal proceedings with the tax authorities.

To strengthen your position, we recommend paying attention to the clause in the agreement on the intermediary’s remuneration - the amount of VAT must be allocated, and also keep the agent’s written confirmation of the payment of tax to the budget. Properly executed documents prove the agreement of the parties in this situation and the conscious intention to impose the payment of VAT on the agent.

Are taxes too expensive? We know 45 ways to legally reduce them!

The funds saved can be used to develop your business!

More details

Agent on OSNO, principal on simplified tax system

The intermediary on OSNO, being a VAT payer, issues an invoice for the amount of his remuneration. If acting on his own behalf, the agent on OSNO reissues the seller's invoice in the name of the buyer on his own behalf, similar to the procedure specified above for agents on the simplified tax system.

An invoice for agency fees is not entered into the Register of received and issued invoices ( clause 3.1 of Article 169 of the Tax Code of the Russian Federation ).

Please note that invoices re-issued by an agent for a principal or by a principal for a third-party buyer are not recorded in the sales ledger and purchase ledger of the intermediary.

If an agent on OSNO purchases goods on his own behalf for the principal-buyer and re-issues an invoice from the seller in the name of the buyer, it does not need to be taken into account in the agent’s sales book, since he does not have the obligation to charge VAT ( clause 3 of the Rules for maintaining the sales book , approved by Resolution No. 1137 ).

When an intermediary sells a customer’s goods on his own behalf, he does not make an entry in the sales book, since the goods belong to the principal, and the intermediary does not have the obligation to charge VAT ( clause 20 of the Rules for maintaining the sales book ). Having received a reissued invoice from the principal, the intermediary does not make an entry in the purchase book ( clause “c” clause 19 of the Rules for maintaining the purchase book ).

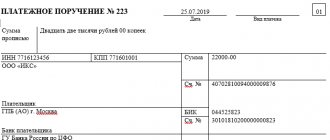

How is tax calculated?

The moment of provision of intermediary services is considered to be the date of endorsement of the act by both parties to the transaction or the day of recognition of the agency’s report by the principal. On this date, the agent has a legal obligation to charge VAT on the amount of remuneration received. He has five days to prepare an invoice and issue it to the counterparty.

To determine the amount of remuneration with tax, the agent must add 18% to the cost of services. This algorithm is enshrined in law and does not change depending on the terms of the contract. If goods and services sold by an intermediary are not subject to VAT, 18% is still charged on the amount of income for transactions in the interests of the principal.

Invoices issued to the principal for agency fees are not recorded in the invoice journal.

Funds received by the agent from the principal to perform the functions specified in the contract (purchase of goods and services, payment of port dues or freight charges, etc.) are not subject to VAT. The intermediary should not include them in the income (expenses) from which the base for calculating income tax is formed.

The amount of VAT calculated on agency fees is subject to payment to the budget as part of the total tax. According to the general rule, it is transferred no later than the 25th day of the month following the reporting quarter.

Invoice with VAT

Why does an agency agreement attract the attention of tax authorities?

Let's look at the amount of taxes payable for transactions of an organization on OSNO without the involvement of an intermediary and with the participation of an agent on the simplified tax system with the taxable object “Income”.

| Transaction without an agent | Transaction with the participation of an agent on the simplified tax system (6%) |

| Iskra LLC purchased goods at a price of 300 rubles, incl. VAT 20%, then it sold this product at a price of 600 rubles. with VAT LLC "Svet". | Iskra LLC purchased goods at a price of 300 rubles, incl. VAT 20%, then with the help it sold this product at a price of 600 rubles. with VAT LLC "Svet". Remuneration for LLC “Pomoschnik” under the terms of the agreement = 100 rubles. |

| Input VAT: 300 / 1.2 x 0.2 = 50 rub. VAT on sales: 600 / 1.2 x 0.2 = 100 rubles. VAT payable : 100 – 50 = 50 rub. | Input VAT: 300 / 1.2 x 0.2 = 50 rub. VAT on sales: 600 / 1.2 x 0.2 = 100 rubles. VAT payable: 100 – 50 = 50 rub. |

| Revenue excluding VAT: 600 – 100 = 500 rub. Expenses excluding VAT: 300 – 50 = 250 rub. Income tax : (500 – 250) × 0.20 = 50 rub. | Revenue excluding VAT: 600 – 100 = 500 rub. Expenses excluding VAT: 300 – 50 = 250 rub. Income tax taking into account agent services: (500 – 250 – 100) × 0.20 = 30 rubles. LLC "Assistant" on the simplified tax system (6%) will pay: 100 x 6% = 6 rubles. |

| TOTAL to be paid to the budget: 50 + 50 = 100 rubles. | TOTAL to be paid to the budget: 50 + 30 = 80 rubles. , and 6 rub. at the intermediary. |

Taxes for transactions with and without an intermediary

Save time and money

Accounting services at “My Business” from only 1,667 rubles per month

More details

The example shows that with the advent of an intermediary in the transaction, the amount of income tax was significantly reduced.

Tax authorities often question the advisability of agents participating in business activities. The logic of the Federal Tax Service is that even without the help of an intermediary it is possible to cope with the sale of goods and other operations.

Taxation of agency actions

In accordance with the provisions of the Tax Code, the income of an agent is not considered to be goods transferred for sale or funds received from the principal for the execution of an order. Costs incurred by the agent to fulfill the contract and reimbursed by the principal are not taxed.

For an agent acting in the interests of the principal under an agency agreement, income is only the amount of commission and other similar income in accordance with subparagraph 9 of paragraph 1 of Article 251.

The rule applies to VAT taxpayers , that is, the tax base is considered to be the amount of income received by the agent in the form of a commission.

Why do you need certificate 182n and how to fill it out? Read the answer to this question in the article at the link.

Remuneration for certain types of goods and services, such as medical goods, funeral services, handicrafts and others, is not included in the taxable base for calculating VAT in accordance with paragraph 2 of Article 156 of Part Two of the Tax Code of the Russian Federation.

Article 1005 of the Civil Code of the Russian Federation. Agency contract.

Tax base of the agent

The agent pays income tax on the commission received . The date of recognition of income is the date of submission of the report or the date of signing by the parties of the contract for the provision of services.

What to do if your relative or friend, due to illness, cannot independently pick up important documents, salaries and perform other important transactions in the state. organs? It is necessary to draw up a power of attorney to represent the interests of an individual. A sample document is in this article.

Tax base of the principal

Economically feasible expenses of the principal for the payment of agency fees are included in the taxable base when calculating VAT.

The principal is required to have documents confirming the agent's participation in the transaction. Such nuances are taken into account as: the agent’s negotiations with the counterparty, whether he is an interdependent person in relation to the buyer.

It is often important to obtain documents confirming that the agent has fulfilled the terms of the contract , signed by the buyer. Tax authorities can verify the authenticity of the agency relationship between the principal and the intermediary.

Thus, a request may be made to the service consumer to confirm the agent’s participation in the transaction.

Participation in settlements

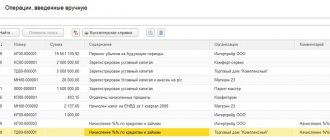

Let's consider another example when the agent sells the principal's goods and at the same time participates in the settlements.

Debit 45 Credit 41

— 20,000 rubles – goods are transferred to the agent for sale (act or TORG-12);

Debit 44 Credit 60

— 1000 rubles – based on the agent’s report, remuneration expenses are reflected;

Debit 19 Credit 60

— 180 rubles – based on the report and invoice, VAT on agency fees is reflected;

Debit 90 Credit 45

- 10,000 rubles - according to the report and copies of documents for the sale of goods, the cost of products sold is reflected;

Debit 62 Credit 90

— 17,700 rubles – based on the report and copies, sales revenue is reflected;

Debit 90 Credit 68.2

— 2700 rubles – VAT is charged on the sale of goods;

Debit 60 Credit 51

— 1180 rubles – the agent has been paid a fee;

Debit 51 Credit 62

— 17,700 rubles – funds received from the agent for goods sold.