What is “finished product”?

To carry out accounting operations, it is necessary to clearly understand what is hidden behind the term “finished products”. These are assets included in the inventory, which are the final result of production and are intended for sale. At the same time, they are properly modified, are fully equipped and meet all the requirements put forward by customers. These can be either individual products or semi-finished products. Some of the finished products are sometimes sent to the needs of the enterprise itself.

Do not confuse finished products with goods. These are also assets within the inventory, but only those that were acquired for sale from other companies or individuals. persons, and not produced independently. Goods are accounted for separately.

Account 43: characteristics

Data on the prices of manufactured products are reflected on the 43rd account. The balance of account 43 “Finished products” is formed only by debit. Its value is shown in the balance sheet as assets.

When products arrive at the warehouse, account 43 “Finished products” is debited. When selling or otherwise transferring inventory, it is credited. Making transactions using an account is quite simple. More often, the snag occurs in the cost at which inventory is recorded. According to PBU on the account. 43 products ready for sale can only be listed at actual cost, but in some sub-accounts it is allowed to evaluate products in other ways.

Organization of analytical accounting on account 43

Products ready for sale must be continuously accounted for and monitored to avoid damage, loss and other negative consequences. It is recommended to create a separate sub-account for each product category. Due to the fact that these are material values, they can be reflected in a natural meter. This means that it is necessary to organize analytical accounting not only in monetary units, but also in natural ones. This will ensure accuracy and also allow you to easily calculate the cost of one item.

In addition, inside the account. 43 sub-accounts can be created:

- 43/1 – for accounting for products at planned cost;

- 43/2 – for accounting for products at actual cost.

Recommendations for the use of certain prices for accounting purposes, as well as the accounts that can be applied, are indicated in the accounting policies of the enterprise.

Debit 90.2 Credit 43

To exercise control over activities and calculate financial results, additional sub-accounts are opened:

- 90.01. Revenue – receipts from customers for goods sold, work performed, services rendered. The subaccount is passive: the loan shows the amount of revenue received in correspondence with the account for mutual settlements with customers.

Note from the author! According to PBU, when maintaining accounting records, the company independently determines whether the resulting income relates to ordinary activities or is it other income.Revenue is recorded in monetary terms and is equal to the assets received from the buyer and (or) the amount of the resulting receivables (for example, in case of incomplete payment for goods or when selling goods or services on a deferred payment basis).

Note from the author! Separate accounting of revenue under the special tax system and under special taxation systems is provided.

To recognize revenue, the following conditions must be met:

there is confirmation of the company’s right to receive this revenue (existence of an agreement);

you can determine the full amount of revenue;

there is confidence that the company will receive economic benefits from this transaction: assets have been received as payment or there is confidence in their receipt in the future;

ownership of the sold products has been transferred to the buyer (the work has been completed and there is confirmation, for example, a document has been signed);

the costs associated with a given operation can be calculated.

- 90.02.

Cost of sales is an active subaccount. Transactions on this account are displayed simultaneously with the posting of revenue in correspondence with the accounts for assets sold to the buyer (43,41,44,20, etc.).For enterprises engaged in agriculture: when selling products according to Dt90, the planned cost of products during the reporting period is recorded, as well as the resulting difference between the planned and actual cost at the end of the year.

For retail sellers and those who record goods at sales prices: the debit account 90 records the accounting price of products sold. At the same time, the reversal of the amounts of discounts provided (accrued mark-ups on goods) that were related to goods sold in correspondence with account 42 is carried out.

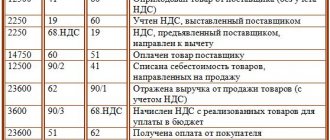

Practical example.

Solnyshko LLC purchased 30 phones from a supplier (the purchase price of the goods was 9.5 thousand rubles per unit, including VAT) for subsequent resale. Accounting for LLC goods is carried out at purchase prices. The selling price of the phone is 11 thousand rubles. per piece This product was purchased for the first time and was fully sold within a month.

Reflection of business transactions:

Dt41 Kt60 – 241.5 thousand rubles – receipt of phones from the supplier.

Dt19.03 Kt60 – 43.5 thousand rubles – accounting for input VAT.

Dt50 Kt90.1– 330 thousand rubles. – revenue received from the sale of phones.

Dt90.3 Kt68 – 50.3 thousand rubles. – VAT payable to the Federal Tax Service.

Dt90.02 Kt41– 241.5 thousand rubles. – write-off of the accounting value of goods sold.

ANALYSIS OF SCH.90 Start Start 50,3 241,5

291,8 Skon. Scon.38.2 Analysis of invoice 90 showed that this markup is enough to cover expenses and make a profit from the sale of phones (More details about calculating the markup in the video).

- 90.03.

VAT: this subaccount records information about value added tax, which the seller must receive from the customer and subsequently transfer to the Federal Tax Service. Note from the author! When filling out a VAT return and calculating the tax payable, the following data compliance must be observed: 90.01 * 18/118 = 90.03 (when selling goods, works, services at a rate of 18%). - 90.04. To reflect information about the amount of excise taxes that is included in the price of sold assets.

- 90.05. Amounts of duties on export of products.

- 90.09. This subaccount is the calculated financial result for the company’s normal activities. It is active-passive: the debit balance reflects the company’s loss in the current period, the credit balance reflects the profit received.

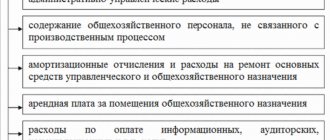

What amounts should not be included in account 43?

Not all products that have passed the production stages are subject to inclusion in the finished product list. It is worth remembering a few exceptions, in the event of which the registration of a receipt to account 43 “Finished products” will be incorrect:

- the amount of services provided and work performed externally (the cost is written off immediately from account 20 to debit 90);

- products that are handed over to customers immediately “on the spot” and are not documented in an acceptance certificate (reflected in the number of work in progress);

- products purchased for the purpose of completing your own products or further resale (accounted for in account 41).

Care when organizing accounting on account 43 will allow you to avoid mistakes that in the future may distort the results of calculations of cost and sales totals.

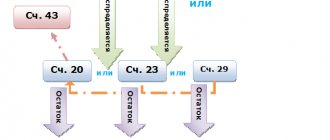

Correspondence with other accounts

In order to understand with which accounts, and most importantly, why account 43 “Finished Products” interacts, it is necessary to know, at least in general terms, the process of releasing products from production and its further movements. The product production accounts for the reporting period collect the amounts of expenses for their production. The enterprise has the right to produce finished products at standard cost or actual costs. In this case, one way or another, the amounts are written off from the production accounting account and arrive at the warehouse. Then the process of selling or using the products begins, which entails debiting amounts from the account.

Thus, the correspondence of account 43 “Finished products” by debit is carried out with the following accounting accounts:

- production (main, auxiliary, servicing);

- production output (used for accounting at standard prices);

- 79;

- 80 (if the products were transferred as a contribution to the authorized capital);

- 91 (in terms of other income).

Postings are made to the account credit when a certain amount of finished products is written off from the warehouse. This happens for various reasons:

- low-quality release, use for production needs (20–25);

- use for the sale of another product (account 44) or when shipping products to the buyer (account 45);

- write-off for the needs of the organization (account 10);

- when transferring finished products from a branch to the head office or vice versa (account 79);

- transfer of finished products to a participant in the partnership who has left it (account 80);

- in case of damage, shortage, write-off of cost and other incidents affecting the financial result, the amounts are reflected in the account. 90, 91, 94, 97.

To correctly prepare transactions, it is worth remembering: the debit of account 43 “Finished products” takes into account the receipt of products, and the credit – the expense.

Dt 90, 45 Kt 43

This greatly simplifies accounting.

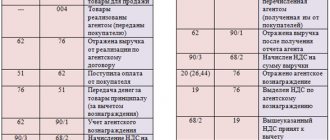

Accounting at wholesale trade enterprises can generally be reflected by a combination of the following entries.

Accounting for sales of goods in wholesale trade

| № P/P | Account correspondence | Contents of a business transaction | |

| Debit | Credit | ||

| 1 | 60 | 51 | Payment has been made to the supplier of goods |

| 2 | 41 | 60 | Goods are taken into account at the purchase price excluding VAT |

| 3 | 19 | 60 | VAT on purchased goods is reflected |

| 4 | 68 | 19 | The amount of VAT on paid goods has been accepted for deduction |

| 5 | 76 | 51 | Paid to transport companies for delivery of goods |

| 6 | 44-P | 76 | Delivery costs (RD) of goods excluding VAT are taken into account |

| 7 | 19 | 76 | VAT is reflected on the costs of delivery of goods |

| 8 | 68 | 19 | The amount of VAT on paid delivery of goods has been submitted for deduction |

| 9 | 44-K | 10,76 | Material costs taken into account |

| 10 | 44-K | 70 | Staff wages accrued |

| 11 | 44-K | 69 | The amount of unified social tax from personnel remuneration is taken into account |

| 12 | 44-K | 02 | Accrued depreciation of fixed assets |

| 13 | 44-K | 05,68, 69,76 | Other expenses are taken into account, including taxes, insurance costs, advertising costs, depreciation of intangible assets |

| 14 | 45 | 41 | Goods were shipped to the buyer without transfer of ownership |

| 15 | 90 | 45 | Sold goods written off at purchase prices |

| 16 | 90 | 45 | A part of goods previously (in previous periods) shipped to customers was written off after the transfer of ownership to them |

| 17 | 90 | 44-P | Direct expenses written off to sales minus the share attributable to the balance of unsold goods |

| 18 | 90 | 44-K | All indirect costs are written off for sales |

| 19 | 62 | 90 | Invoices presented to customers |

| 20 | 90 | 68 | VAT accrued on sales of goods |

| 21 | 90 | 99 | Financial result (profit) determined |

Go to page: 12

34

Organization of production of finished products

After the products have passed the final stage of the production cycle, they are transferred to the customer immediately for sale or to the financially responsible person to the warehouse. In this case, the procedure is accompanied by the execution of various documents, including: an acceptance certificate for goods and materials, delivery and delivery notes, payment orders and others. The storekeeper accepts the goods and materials into the warehouse on the basis of these papers, keeping one copy for himself.

The main feature of reflecting products ready for sale in accounting is its assessment in monetary terms. As a rule, when a product is released from production, it is impossible to establish for certain how much it cost to produce it. During the period, adjustments are made to the cost of products. The previously reflected amount is adjusted to the actual amount.

Accounting for finished products (account 43) can be carried out at the following prices:

- actual (production, abbreviated);

- normative;

- wholesale;

- free vacation pay;

- free market.

Each method of evaluating finished products is convenient in its own way. It is up to the management to decide which one to use at an individual enterprise; this point must be indicated in the accounting policy.

Accounting at actual prices

There are two types of actual costs for the production process: full and reduced. The second option excludes general business expenses from the calculations. Accounting for finished products using account 43 is quite simple: all costs for the production of products accumulated on account 20 are written off in Dt 43. Synthetic accounting is carried out according to the amount of actual costs, but in some sub-accounts entries are made at accounting prices. At the end of the period, the actual cost of the products received into the warehouse is calculated, and then its deviation from the accounting prices is calculated. If the production of products costs more than expected, the amount of the difference is made by posting Dt “Finished Products” Ct “Main Production”. If, on the contrary, the actual cost is lower, then the red reversal method is used.

It is worth noting that when using this method, other accounts are not used, but 43 sub-accounts are opened for the account: “Products at discount prices” and “Deviation of actual prices from standard prices.” Amounts are written off as sales occur. The deviation of unsold products in the warehouse remains in the subaccount. Postings are carried out in the order described above. The income is made to the subaccount for recording products at actual prices, and the deviation is reflected in a separate subaccount. Standard values are written off to the cost of sales.

The method is very convenient for small-scale production when producing products every day. The main disadvantage of accounting based on actual production costs is the inaccuracy of calculations of the actual cost after the products are delivered to the warehouse. Only at the end of the month can you find out the true price of the product, and therefore adjustments have to be made.

Accounting for finished products at planned cost

When accounting for production results at standard cost on account 43, finished products are reflected at planned, predetermined prices. Their calculation is carried out before the start of the production process. In order to record the actual cost and subsequently determine the deviation of different prices from each other, use the 40th account. In this case, postings to account 43 “Finished products” are made in the following order:

- When transferring products to the warehouse, accounting is carried out at standard cost, which is reflected in the credit of account 40: Dt “Finished products” Ct “Product output”.

- As products are sold, its standard cost is written off to the financial result: Dt “Cost of sales” Kt “Finished products”.

- At the end of the month, the accountant calculates the actual cost of production of products received into the warehouse. The resulting value is included in Dt 40: Dt “Product Output” Kt “Main Production”.

- By comparing credit turnovers (normative value) with debit turnovers (actual value), it is easy to determine the deviation of one price from another. Having determined it, the amount is written off when the actual cost is exceeded by posting Dt “Cost of sales” Ct “Product output”. If the standard cost exceeds the actual cost, then the reversal method is used. The posting looks the same, but the amount is written with a negative sign.

Keeping records of products ready for sale at standard prices has a number of advantages. During the period, the assessment remains unchanged and predetermined. This facilitates planning and reporting processes, especially in mass production environments.

Basic accounting entries - examples

> > > Tax-tax January 09, 2021 Accounting entries record each business transaction of an enterprise.

They must be done correctly, otherwise you will distort your accounting records. False reporting may result in a fine. Also, incorrect information about the financial situation can jeopardize the company’s relationship with investors or lead to a refusal of a loan or credit. Other adverse effects are also possible. To prevent this from happening, read our article.

Every commercial company is created for the purpose of making a profit.

At the same time, she makes various transactions every day, the accounting of which is very easy to get confused without a clearly organized accounting structure. Moreover, according to Art. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, all legal entities are required to maintain accounting records.

Other methods for evaluating products ready for sale

In addition to actual and pre-calculated (normative) prices, the company has the right to use other types of costs. For example:

- Wholesale – involves calculating the difference between actual prices and the cost of wholesale supplies. The stability of wholesale prices allows us to reliably estimate the volume of products produced and most accurately draw up production plans for the following periods.

- Free including VAT - applicable for accounting for products or work that are carried out to order individually. The VAT amount is taken into account separately.

- Free market - used to evaluate products that are sold through retail.

All valuation methods, with the exception of the use of actual cost values, require the calculation of deviations of estimated amounts from production amounts.

Accounting entries for main business transactions with account 90

- Receipt of funds from the buyer for sold products, works, services:

Dt50 Kt90.01 – cash payment;Dt51 Kt90.01 – through a current account;

Dt52 Kt90.01 – receipts in foreign currency;

- Display of sales revenue:

- Cost display:

Dt90.02 Kt20 – cost of work, services;Dt90.02 Kt41 – accounting price of goods.

- Reversal of trade margins at retail enterprises:

- VAT and excise taxes included in the cost of goods sold:

Dt90.03 Kt68 – VAT;Dt90.04 Kt68 – excise taxes.

- Financial result for ordinary activities:

Dt99 Kt90.09 – loss;Dt90.09 Kt99 – profit.

Victor Stepanov, 2017-12-04

Shipment of goods

After the conclusion of the supply contract, the products are shipped to the buyer. Active account 43 “Finished products” is credited for the amount of transferred products. In this case, depending on the content of the contract, the products are reflected in account 90.1 or 45. If it is impossible to recognize revenue immediately after delivery and the ownership of the products has not yet transferred to the buyer, then the entire delivery period in the seller’s accounting records, the amount of shipped goods remains in account 45. More often This usually happens when exporting or agreeing to pay for products in full.

The amount of shipped products is reflected in the accounting records by posting: Dt “Shipped goods” Ct “Finished products”. After receiving full payment, revenue from the sale is recognized: Dt “Cost of sales” Ct “Shipped goods”.

The use of active account 43 is one of the inevitable stages of organizing accounting in production. Thanks to it, you can track information about the quantity and cost of products in the warehouse for sale, analyze the costs of their production and sales turnover.

When the entry is applied: Debit 43 Credit 43

Let's consider several situations.

Example 1

LLC "Choco Land" is engaged in the production of chocolate. When finished chocolate arrives from production to the warehouse, an entry is made in accounting: Debit 43 Credit 20 - means capitalization of finished products in the warehouse

The posting is registered on the basis of the invoice for the transfer of finished products to storage locations.

More information about how the invoice should be drawn up correctly is described in the article “Unified form No. MX-18 - form and sample.”

Example 2

Let’s say that during the crisis, plain chocolate began to be bought less frequently. Then Shoko Land LLC decided to produce chocolate with game inserts. To do this, we had to open additional production for the production of gaming inserts.

In this case, after receiving the main and additional products, the following postings are made:

- Dt 43 (subconto “Chocolate”) Kt 20 - ready-made chocolate arrived from the main production;

- Dt 43 (subconto “Inserts”) Kt 20 - manufactured gaming inserts were received from additional production to the warehouse.

Due to the fact that chocolate and inserts for it are planned to be sold as one product, a summary entry is made: Dt 43 (sub-account “Chocolate”) Kt 43 (sub-account “Inserts”), i.e. the cost of manufactured inserts is reflected in the main products - chocolate.