Why do you need a primary?

Any fact of economic life must be recorded in the primary accounting document. This requirement is enshrined in Article 9 of the Law “On Accounting” No. 402-FZ. The primary document must be drawn up at the time of the transaction or immediately after its completion.

When tax specialists or auditors check the statements, they will first of all make sure that there is a primary document for each transaction. No document means no business transaction, which means the reporting is drawn up incorrectly and taxes are calculated incorrectly.

For each type of operation, its own primary documents are used. For example, services rendered are usually recorded in an act of provision of services, the sale of goods - in an invoice, the receipt of money - in a cash receipt order, and the write-off of materials for production - in a demand invoice. All these documents must be stored and presented to controllers upon their request.

Let's sum it up

- The primary document is that mandatory element without which accounting is impossible. Each event reflected in accounting must be documented. Since the data from these same documents is also used in tax accounting, they are significant not only for accounting and accounting, but also for calculating taxes.

- The primary document must be drawn up at the time of the event to which it relates or immediately after it, in compliance with the requirements for the reliability of the information entered into the document and the rules established by the economic entity for its execution. Creation of a document is possible in paper and electronic form. It is permissible to make corrections to it if the document is not a cash or bank document.

- An economic entity that is not a public sector organization has the right to develop the forms of used primary documents itself. When developing, you can use unified forms approved by the State Statistics Committee. The final version of the set of used forms may include both unified forms (including modified ones) and those created independently. The fact of choice must be approved in the accounting policy.

- All used primary documents are united by the need to contain in them the required details for such a document - the name and date of creation of the document, the name of the economic entity that compiled it, a description of the essence of the economic event with its quantitative characteristics, information about the person/persons who executed the document.

Forms of primary documents

Once upon a time, primary documents had to be prepared only according to the forms developed by the State Statistics Committee. But since 2013, there is no such requirement for commercial organizations, with some exceptions, which we will discuss below. Companies themselves can develop forms of documents and consolidate them in their accounting policies.

In the document database of the “My Business” service you will find all forms of primary documents and several options for accounting policies. And by becoming a user of the service, you will completely get rid of the hassle of filling out documents. The service itself generates documents, automatically pulling data and details from the database.

In practice, many organizations and entrepreneurs continue to use unified forms, modifying them if necessary: removing unnecessary fields or adding new ones.

Even independently developed or modified forms must contain the mandatory details listed in paragraph 2 of Article 9 of the Accounting Law:

- Title of the document;

- Date of preparation;

- name of the organization on behalf of which the document was drawn up;

- content of the fact of economic life;

- meters in physical and monetary terms - rubles and, for example, pieces;

- the names of the positions of the persons responsible for the transaction and the correctness of its execution;

- personal signatures of these persons with transcripts.

For some documents, laws may provide for other mandatory details that are not mentioned in the accounting law. When developing such documents, special requirements will have to be taken into account. For example, in relation to a waybill.

All forms of primary documents that the organization uses must be enshrined in the accounting policy and applied for at least a year - until the new policy is approved.

The primary document does not have to be paper. Law 402-FZ allows for the preparation of primary accounting documents in electronic form and signing them with an electronic signature. If this is a bilateral or multilateral primary document, then both parties to the transaction must sign it electronically. Replacing the signature of one of the parties with a handwritten one in this case is unacceptable (letter of the Federal Tax Service of Russia No. ED-4-15/7760 dated April 23, 2021). That is, if you signed the invoice with an electronic signature, your counterparty must do the same. If someone does not have this opportunity, they will have to draw up a paper document the old fashioned way.

If you draw up the primary document on paper, the signatures must be strictly “live”. You must sign with a pen with blue, purple or black ink. Facsimiles cannot be used (letter of the Ministry of Finance No. 03-01-10/8-404 dated October 26, 2005).

Documents and their importance in accounting. Document details

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 3 of 6Next ⇒

A document is a written certificate of legal completion or confirmation of the actual implementation of a business transaction, in which the necessary details are filled in.

A distinctive feature of accounting is the registration of business transactions with primary documents. Therefore, with the help of documentation, a continuous reflection of business transactions is made at the time and place of their completion.

Documentation is a flow of information about the financial and economic activities of an organization, which is used to monitor the safety and correct use of resources, and is the basis for conducting documentary audits.

Accounting documents have legal evidentiary value and legal significance in resolving disputes.

Document details. Requirements for the content and execution of documents.

A document form is a material carrier of information of a certain form with permanent information printed on it.

The material carriers of accounting information can be floppy disks or disks when processed on a personal computer. They are used depending on the degree to which the organization is equipped with automated information processing tools.

Conventionally, the document can be divided into parts, the main of which are:

* header;

* meaningful;

* decorating.

Each part of the document reflects the relevant details. A detail is a separate indicator of a document that has independent meaning.

Main details of the header section

— this is the name of the document (cash receipt order, payment order, etc.).

Content part

The document can be

tabular

or

text

.

The tabular ones

include

attribute details

and

basis details

.

Requisites-signs

- these are the headings of tables, columns and rows. They are intended to characterize the object being described.

Ground details

are intended for quantitative characteristics of the accounting object.

The content part reflects the essence of the document.

The formal part of the document reflects the date of preparation of the document, approval, approval, visa, name of officials, their personal signatures and transcript, and, if necessary, a seal.

The details are divided into:

*required;

* optional (additional).

Required details

relate:

* title (name) of the document;

* date of document preparation;

* name of the organization where and on whose behalf the document was drawn up;

* the content of a business transaction and the basis for its implementation;

* operation meters (units of measurement);

— signatures of the persons responsible for the transaction and execution of the document and their decoding.

Optional (additional) details

determined by the characteristics of the reflected business transactions and the purpose of the documents.

There are certain requirements for the preparation of documents. All documents must be completed in a timely manner at the time of the transaction, in a high-quality, legible manner, without erasures, erasures or unspecified corrections. Free lines in primary documents must be crossed out. Documents should be written out in ink, blue, purple or black ballpoint paste manually, on writing devices, or on a personal computer. The date of compilation is indicated by the date in numbers, and the month in words. In monetary banking documents, the amount is indicated in numbers and in words with a capital letter.

All documents of a monetary, material, property, settlement and credit nature must be signed by the head of the organization and the chief accountant.

Documents documenting the acceptance and issuance of material assets and cash must contain the signatures of the persons who received and released these assets.

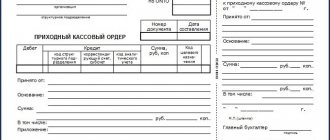

Individual documents, in accordance with current regulations, are classified as strict reporting forms. Such forms (blanks) of documents are produced in a typographical manner with the obligatory affixing of the number and series. These are invoices, goods invoices, cash receipt orders, etc. They are recorded in a standard form of receipt and expenditure book, which is numbered, sealed and signed by the manager and chief accountant.

Responsibility for the accuracy of the data in the document, its high-quality compilation and transmission within the established time frame for further processing lies with the officials who signed this document.

Document classification

To facilitate the study and use in accounting practice, a wide variety of primary documents are classified according to the following criteria:

| - appointment | · administrative; acquittal (executive); · accounting registration; · combined |

| - sequence (time) of compilation | · primary; · summary (advance report); · derivatives; · intermediate; |

| — method of use or extent of coverage of business transactions | · one-time (cash orders); · accumulative (limit-fence cards); |

| — number of positions (lines) | · one-line; · multiline; |

| - place of compilation | · internal; · external; |

| - form | · standard (unified); · specialized; |

| - method of filling | · manually; · on typewriters; · on a personal computer; |

| — reproduction of information | · originals (finance); · copies; · extracts from documents; |

| - shelf life | · current shelf life (from 1 to 5 years); · permanent storage. |

20.

Organization of document flow.

Document processing Documentation of business transactions

consists in perceiving data about the operation (counting, measuring) and entering the received data into the document (filling in its details).

The creation of a set of primary documents represents primary accounting. Primary accounting is a set of techniques for perceiving initial information and recording it in documents.

Primary accounting can be carried out manually and automatically.

The state (i.e., reliability and timeliness) of primary accounting depends on the organization’s provision with a variety of technical means for calculating and measuring quantitative quantities.

Consequently, primary accounting is an organized system of observation, measurement, and registration of data on business organizations and other facts of economic activity, used for making management decisions.

It is necessary not only to prepare documents correctly, but also to submit them for processing in a timely manner, i.e. The document flow schedule must be maintained.

Document flow is the movement of a document from the moment of its preparation through all stages of accounting processing to transfer for storage.

The organization must develop a document flow schedule, which indicates the deadlines for submitting documents to the accounting department for processing (by type) with an indication of the responsible persons. The document flow schedule provides for a uniform workload not only for the accounting apparatus, but also for all other employees associated with primary accounting.

The document flow schedule is developed by the chief accountant. He also monitors its implementation.

Every organization should develop a document management system

, including:

* development of regulations on the accounting service;

* drawing up job descriptions for the accounting apparatus;

* drawing up a document flow schedule;

* creation of technology for processing accounting information;

* development of a list of files for current and permanent storage.

Document processing in accounting

| - according to form | · establishment of all details; · signatures; · erasures, unspecified corrections; |

| - essentially | · legality of a business transaction, compliance with current legislation; |

| - arithmetic check | · correct calculations, highlighting totals, calculating percentages. |

Processing of documents verified and accepted by the accounting department includes the following steps:

| - taxation | determining the monetary value of the business transaction reflected in the document (i.e., converting natural and labor measures into monetary ones); |

| - grouping | combining documents based on homogeneous characteristics for a certain period; |

| - account assignment | an indication in the document of the relationship between the accounts arising from the contents of the document (i.e. this is the affixing of correspondence accounts). |

After the corresponding accounts are entered, the documents are used to record transactions on sets in accounting registers.

Ensuring the safety of documents and reporting forms is the responsibility of the head of the organization.

After preparing the financial statements, the primary documents are transferred for storage. The storage time of documents is determined by a special list in which storage periods are established for specific types of documents.

Documents of permanent storage are transferred to departmental and state archives.

Seizure of documents from an organization can only be carried out on the basis of decisions of the investigative bodies and courts. The seizure is formalized by an act, a copy of which is handed over to an official of the organization against receipt. With the permission and in the presence of representatives of the authorities conducting the seizure, the chief accountant (another official) can make copies of the seized documents indicating the grounds and date of their seizure.

⇐ Previous3Next ⇒

When can only unified forms be used?

Organizations and entrepreneurs do not always have complete freedom in choosing the form of the primary document. Sometimes you need to use strictly unified forms.

Thus, when transporting goods by road, you can only use a consignment note approved by Decree of the Government of the Russian Federation No. 272 of April 15, 2011.

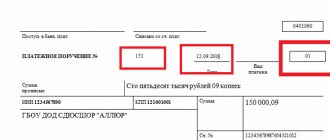

When carrying out non-cash payments, payment documents approved by banking legislation are used. In particular, by the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012.

Cash documents must be unified: receipt and expenditure orders, a book of accounting for funds accepted and issued by the cashier, a cash book, payment and settlement statements. This is a requirement of Bank of Russia Directive No. 3210-U dated March 11, 2014.

Bank details of individual entrepreneurs

This separate group of details contains the information required to make a non-cash payment to the individual entrepreneur’s account. These include:

- the entrepreneur's current account number, often indicated on the letter as r/s;

- name of the bank, if applicable - number or other identifier of the office, branch and branch of the bank in which the account is opened;

- BIC is a bank identification code used for internal bank identification. Usually, not only the head office of the bank, but also each of its branches, except for operating cash desks/offices and cash offices, has its own BIC. In this case, you need to indicate the BIC of your branch;

- number of the bank's correspondent account with the Bank of Russia (Central Bank of the Russian Federation), where every Russian bank has such an account. Usually in everyday life it is called a correspondent account, and in writing it is denoted as k/s;

- TIN and KPP of the bank.

When communicating with bank employees, if you need to clarify the details, it is better to use the abbreviated and commonly accepted designations they are familiar with - BIC, correspondent account, etc.

Every entrepreneur should know their bank details by heart.

In some cases, the bank details may include the address of the bank or a specific branch.

Before signing an agreement and issuing invoices, you can contact the counterparty’s accounting department and clarify which set of details for your account they need for payment. Various specialized accounting services, for example, 1C, My Business and others, help you prepare accounts correctly.

Is it possible to issue a primary document in foreign currency?

There is no specific provision in the accounting law that primary documents must be drawn up in rubles. But the same law says that accounting objects must be reflected in rubles, and if their value is expressed in foreign currency, they must be converted into rubles. And you need to prepare reports in rubles. Therefore, the primary payment should also be in rubles.

If you need a primary document in a foreign language or currency for a foreign counterparty, you can do this:

- provide in the document several columns for rubles and other currencies;

- draw up two copies - one in foreign currency or in a foreign language, and the second - to confirm the completion of the transaction in accordance with the norms of Russian legislation;

- draw up an additional document (for example, an accounting statement) explaining the contents of the document drawn up in foreign currency (in a foreign language).

How to make corrections to primary documents

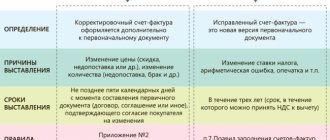

If, after a document has been accepted for accounting, an error is discovered in it, it is no longer possible to replace it with a new one, you can only correct the existing one. An exception is invoices and UPD. Correction forms are provided for them.

To make a correction to a paper document, you need to follow these steps:

- Cross out the incorrect text or amount with one line. So that you can read the corrected one.

- Above the crossed out text, write the corrected text or amount.

- Confirm the correct data with the entry “Corrected” and the signatures of the persons who compiled the document being corrected, indicating their last names and initials (other details that allow identifying these persons), indicate the date the corrections were made.

The organization can decide for itself how to make corrections to electronic primary documents. The chosen method must be recorded in the accounting policy.

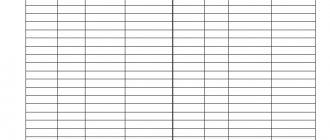

Accounting registers and their details

An organization can develop the forms of some accounting registers independently, however, it is necessary to comply with the presence of a number of certain details. This order is necessary to unify the documents:

- The name of this register.

- Name of the organization.

- Start and end date or period for maintaining the register.

- Grouping of objects that relate to accounting.

- The monetary value of these objects.

- Indication of the positions of those responsible for maintaining the register.

- Signatures of those responsible indicating last names and initials or other identification options.

The list of listed details is mandatory, but the organization can also add additional items to them at its discretion, if necessary for any reason. The use of additional details may be required for accounting due to some special specifics of the organization or other similar circumstances that require certain details when characterizing any business transaction.

For financial reporting forms, there are also certain details established by the relevant decree. In addition, the forms used to maintain documentation have their own purpose. All systematization of documents is necessary to maintain order in document flow, as well as unification, which facilitates interaction between various departments and organizations.

Also see “ What are the required details for primary accounting documents .”

Read also

17.01.2019

Is it necessary to certify the primary document with a seal?

The seal is not mentioned in the mandatory details of the primary documents. Therefore, organizations have no such obligation. But there are exceptions.

- Stamping is required in some documents, the form of which is approved by regulations not related to the field of accounting. For example, settlement (payment) documents.

- If you decide to use previously used unified document forms without making any changes to them, a seal is needed because these forms contain seal details.

If the documents that you developed yourself and secured in your accounting policies contain seal details, it should always be affixed to such documents.

It is advisable for organizations to certify executed documents with a seal. This minimizes the possibility of its falsification and allows for the most reliable identification of the organization and the powers of its authorized representatives.

General concept of details

This word comes from the Latin “requisitum” and means “necessary”. According to some dictionaries this meaning implies:

- The content of data in a document that allows it to be recognized as legally valid.

- This is information that must be contained in official documents in the required order.

- Details are data that identifies documentation.

Organization details

Without indicating and correctly filling out the details of a specific organization, the document has no legal basis. If, for example, a company was registered using incorrect details, it will not be legal.

This procedure must be treated with special care and all regulatory requirements must be observed:

The name of the organization is considered the main point, which is indicated in the details. In this case, it is necessary to register the organizational and legal form of ownership - CJSC, OJSC, LLC. The name of the company must completely coincide with the constituent documents. In this case, you cannot use a reduction, or even minimal changes. Any registration actions involve indicating the full name of the LLC. For example, it could be the Talisman Closed Joint Stock Company or the Flagman Open Joint Stock Company.- The second most important point related to the details of the organization is the abbreviated name. In this case, we mean an abbreviation, an abbreviation of the legal form of ownership, namely OJSC, CJSC, JSC, LLC.

- The third mandatory point of details is the legal address where the enterprise is located, which is also indicated in the documents. Here, in addition to the house and apartment number, you need data about the country, locality, as well as an index. If the legal address differs from the actual one, it is also indicated for timely receipt of correspondence, and in this case a telephone number is also required.

- The following data, although not mandatory, can be added to the LLC details by adding a position, as well as the full name of the manager. In written form it looks like this: General Director Fedorchenko Ivan Nikolaevich.

- A mandatory element of LLC details is the TIN. This taxpayer number is assigned to each enterprise when it is registered and consists of 10 digits.

- For some time now, each organization has been assigned a reason code or CAT, and it is used together with the TIN. This data makes it possible to determine the isolation of the enterprise.

- The organization’s details also include the main state registration number, the abbreviation of which looks like this: OGRN. This number has 13 digits and corresponds to a single state number. register of legal entities. In order to be able to carry out registration actions, each legal entity must have an extract from the Unified State Register of Legal Entities, for example: OGRN 1358149852954. Here it is also possible to indicate the date when the organization was registered.

- The extract received from the Unified State Register of Legal Entities makes it possible to find a code consisting of a maximum of 6 digits; it will correspond to the type of activity of a particular organization. Externally, the code looks like this: OKVED 22.21.

- In a contract or in any other document, OKPO should be indicated (this is an enterprise code corresponding to the all-Russian classifier of enterprises and organizations), this information helps to simplify the accounting of all enterprises in the database, it consists of 8 or 10 digits.

- The all-Russian classifier of administrative-territorial division of objects is assigned to each locality and consists of 11 digits. The necessary information can be obtained by TIN on the official website of Rosstat.

Important details of the individual entrepreneur

Details for an individual entrepreneur allow you to obtain all the necessary information about it from the tax office.

Required data includes:

- Information about the entrepreneur, namely last name, first name, patronymic.

- The assignment of the main state registration number of an individual entrepreneur occurs during registration and subsequently serves as the main identifier. OGRNIP consists of 15 digits, it can be found in the registration certificate of an individual entrepreneur, which was issued before the beginning of 2021. Registered entrepreneurs from January 1 of the same year can receive the necessary number in the Unified State Register of Entrepreneurs.

- Individual entrepreneurs use their physical TIN as a taxpayer number, as opposed to a legal entity. This set consists of 12 numbers, and if a person does not have one at the time of registration of an individual entrepreneur, the assignment occurs simultaneously. It is necessary to identify the tax payment made on behalf of the owner. If a businessman receives other income, namely salary or from renting out premises, from gambling on the stock exchange, all taxes are paid using the same number. As confirmation, the owner has a certificate with the necessary data. Unlike a private entrepreneur, a legal entity also receives a checkpoint, their number depends on the type of company.

- An individual entrepreneur indicates the registration address with a mention of the country and city in the required details.

Important! The above details constitute a mandatory set, which must be specified in the contract or other official documents regarding the activities of the individual entrepreneur.

In some cases there are optional details that are also indicated:

- A power of attorney for an individual entrepreneur that can be issued to a representative is a document indicating the date of issue, as well as the number of the power of attorney with the full name of the holder.

- In some cases, it is necessary to indicate the actual address, for example, when working with suppliers. In this case, you need to indicate exactly the location of the warehouses, then the supplier will know where to go if it is necessary to ship the goods.

- The telephone number is not considered an important detail, but its absence sometimes makes it difficult if you need to urgently contact the owner. When providing details to your partners, it is better to indicate contact information, which can be the key to successful interaction.

Important! The list of data for communication depends on the preference of the individual entrepreneur. It should minimally consist of an email address or mobile number. This will make it possible to easily communicate with municipal and government agencies.

Bank details for individual entrepreneurs and LLCs

The company's details must also include bank information. Any organization can have several accounts at the same time and one of them must be specified.

The banking service agreement contains all the necessary data, including account details. When indicating them, you need to carefully rewrite or copy:

- To make payments with other organizations, she must have her own bank account, the number of which includes 12 digits. The resulting code allows you to easily search for an organization in the bank’s system. For an LLC, having a bank account is a prerequisite.

- An important point for the bank details of individual entrepreneurs and LLCs is the name of the bank with which the service agreement was concluded. In addition to the name, you need to register the bank branch, as well as the city of location.

- It is important to indicate the BIC in the details of a legal and private organization. Assignment of a bank identification code is mandatory for all banking divisions and branches in the country. This number confirms the legality of the activities of each Russian bank.

Important! A BIC can be assigned not only to the main branch, but also to a branch, with the exception of an operational or cash office. When opening an account in one of the branches, you must correctly and completely indicate all the details of a particular branch. The last 3 digits of the number coincide with the correspondent account number.

- The presence of a correspondent bank account is also a mandatory requisite for the organization, consisting of 20 characters. It is assigned to any financial institution and is used for settlement transactions of a bank client with other institutions, this facilitates interbank interaction. Account appearance: account number 30101832000002600589.

Individual entrepreneur details for the tax service

This information is necessary in order to pay taxes or make contributions to non-budgetary organizations.

The recipient of any social contribution can be a medical or social insurance company, a pension fund; any reporting on transfers must be sent to the tax office.

In order to pay taxes, you can personally contact the tax office or do it by mail. With the beginning of 2021, the easiest way is to use a service that allows you to determine the necessary details.

How to organize the storage of primary documents

According to clause 6 of the Regulations of the USSR Ministry of Finance dated July 29, 1983 No. 105, primary documents that are used in current activities, before being transferred to the archive, must be stored in the accounting department in special rooms or locked cabinets under the responsibility of persons authorized by the chief accountant.

After documents are no longer used in current activities, they are placed in an archive for storage. You can use your own archive or use the services of specialized third-party organizations.

You can also store the primary document in electronic form, but only if it is certified with an electronic signature. At the same time, it is necessary to store means for reproducing electronic documents and verifying the authenticity of an electronic signature.

It is better to specify the procedure for storing documents and the procedure for transferring documents to the archive in the internal documents of the organization.

We described in detail the storage periods for documents with the latest changes in this article. For most accounting and tax documents, the retention period is 5 years, and for documents on personnel and information that affects the calculation of pensions - 50/75 years.

Document flow in the enterprise and its fundamentals.

Document flow is a system for the movement of documents in an enterprise from the moment of their creation (registration), or receipt from individuals and legal entities, until the moment of transfer to the archive.

The document flow system at the enterprise is carried out in accordance with the schedule. For each document, the workflow can be drawn up in the form of instructions, diagrams, tables.

The document flow schedule determines the procedure for generating primary documents, processing and transferring them for making certain entries in accounting. Responsibility for compliance with deadlines and execution lies with the persons who compiled and signed it.

Document flow for certain types of documents is established by the federal executive authorities of the Russian Federation (for example, for monetary ones).

Accounting documents, such as financial statements, accounting registers, primary documents are subject to mandatory storage in accordance with Art. 29 Federal Law “On Accounting” No. 402-FZ dated December 6, 2011. Documents are subject to storage for periods determined by the rules of state archival affairs, but not less than 5 years after the reporting period.

Documents can be removed from the archive only by the tax inspectorate and tax police, investigative bodies, prosecutorial and preliminary investigation bodies, and courts on the basis and in accordance with the legislation of the Russian Federation.

What to do if documents are lost

It is necessary to investigate the reasons for the loss and find or restore documents. A special commission is appointed to investigate. If necessary, with the participation of government agencies. Based on the results of the investigation, a report is drawn up.

If the documents are not found, you need to send written requests to counterparties, banks and the tax office to provide duplicates.

If some part of the documents cannot be restored, you need to draw up a report about this and indicate the reasons.

All documentation supporting the investigation and document recovery work must be retained. These are acts, requests, correspondence, etc.

What are IP details and what elements do they consist of?

Details are usually called a set of information about an individual entrepreneur that allows the counterparty to:

- Identify a potential partner, check the information he provides about himself, and ensure its accuracy.

- Fulfill your obligations to him arising from the cooperation of the parties.

It is very convenient to fill out your details in a separate partner card

Mandatory and additional details of individual entrepreneurs

The details of each entrepreneur are divided into two groups:

- mandatory;

- additional.

Mandatory details of the individual entrepreneur

Mandatory details of an individual entrepreneur are information that allows you to check its status with the tax office. These include:

- FULL NAME.

- OGRNIP: the main state registration number of an individual entrepreneur is a unique set of 15 digits assigned to an entrepreneur upon state registration and subsequently used as his main identifier. Contained in the individual entrepreneur registration certificate issued before January 1, 2017, and for businessmen registered after this date - in the USRIP registration sheet (Unified State Register of Individual Entrepreneurs).

- TIN: individual taxpayer number - entrepreneurs, unlike legal entities, do not receive a separate TIN, but use the existing number of an individual. Unique set of 12 digits. If the future individual entrepreneur does not have a TIN, it is assigned simultaneously with registration in this capacity. Used to identify all tax payments on behalf of its owner. If a businessman simultaneously receives other income, for example, a salary while working for hire, rents out an apartment as an individual, receives dividends, plays on the stock exchange, etc., when he pays taxes on all these incomes, one TIN is used. A special certificate is issued about the assignment of a TIN, which contains it. Legal entities, along with the TIN, are assigned a KPP - a code for the reason for registration. One company may have several such codes. However, for an individual entrepreneur all this is irrelevant; he does not need a checkpoint and is not assigned it.

- Registration address.

This is a minimum set of details that are included in contracts and other official documents, regardless of the particular circumstances of the activities of a particular individual entrepreneur.

Additional IP details

The category of additional details of an entrepreneur includes those that he uses in addition to the mandatory ones for the following reasons:

- due to circumstances;

- on their own initiative;

- at the request or request of the counterparty.

These details are:

- actual address;

- Contact Information;

- Bank data.

The actual address is used if it does not match the registered address. This is possible due to the following reasons:

- The individual entrepreneur does not live at the registered address;

- uses an office for activities and conducts all business communications through it, which seems quite logical;

- uses warehouses, production and administrative (office) premises at different addresses, and the counterparty needs to know where they are all located for the most comfortable interaction.

In all cases where it is necessary to indicate the actual address, it is included in the set of details in addition to the registration address.

The set of contact information depends on the means of communication that the individual entrepreneur and his counterparties prefer. The minimum most often includes a mobile phone number and email address. This set, combined with a postal and physical address (if applicable), is necessary for communication with government and municipal authorities. Messengers are not included in the set of official communication channels between officials and citizens in 2021, although changes in the future cannot be ruled out. As for instant messengers in communicating with counterparties, it all depends on the preferences of a particular client.

One of my current customers conducts business correspondence exclusively through Telegram. His policy: no Telegram - no cooperation. And since our joint project is interesting and beneficial to me, for its sake I created an account in this messenger for myself. Others prefer WhatsApp, and I also meet them halfway. And in previous years, when I myself was still an individual entrepreneur (now I interact with customers as an individual), I actively used Skype.

If an individual entrepreneur prefers to conduct business correspondence through a post office box, it makes sense to indicate it among the contact information, designating it as a postal address or address for correspondence.

An entrepreneur will need to use the services of the Russian Post, at a minimum, to exchange with counterparties, who may be located throughout the country and abroad, original contracts, additional agreements to them, etc. Options are also possible when, for example, the customer is ready to pay the invoice electronically form, but asks to be sure to send the original with a “wet” seal if the individual entrepreneur uses it.

The use of bank details becomes mandatory when an individual entrepreneur has a bank account and plans to make non-cash payments. Payment by bank transfer is most often most convenient when an entrepreneur interacts with legal entities or between individual entrepreneurs, and sometimes individual entrepreneurs with individuals. But the entrepreneur may not have a bank account, as well as a seal, and make all payments with counterparties in cash. Therefore, bank details are not included in the mandatory set. And they do not perform the function of identifying individual entrepreneurs.

Sample full details of individual entrepreneur

Responsibility for lack of documents

The absence of primary documents is considered a gross violation of accounting rules. Tax authorities may fine you for this:

- by 10,000 rubles for a violation in one tax period;

- for 30,000 rubles for violation in several tax periods;

- by 20% of the unpaid tax or contributions, but not less than 40,000 rubles, if the violation led to an understatement of the tax base.

Failure to submit primary documents for tax control will result in a fine of 200 rubles for each document. Plus there is administrative liability, which can reach 50,000 rubles depending on the type and consequences of the violation.

Become a user of the “My Business” service, and you will be able to automatically generate primary documents, fill out reports, calculate taxes and receive expert advice.

IP registration address

The registration address of an individual entrepreneur means the address of his registration at the place of residence. In common parlance, this registration is also called permanent registration or registration. This is the same address that contains the stamp in the individual entrepreneur’s passport in the “Place of Residence” column.

An individual entrepreneur is registered exclusively at the place of residence of the future entrepreneur. Even if he does not live at his registration address, he will still be registered with the tax office at his place of residence, and he has the right to conduct activities throughout the country without geographical restrictions.

The law does not prohibit an individual entrepreneur from being registered in one region and operating in another

If an individual entrepreneur applies the general taxation system (OSNO), simplified tax system (USN) or pays the unified agricultural tax (UST), he pays taxes at the place of registration, no matter where he resides or conducts business. But when he becomes a payer of the single tax on imputed income (UTII) or applies the patent system (PSN), the situation changes. After all, the possibility of applying these regimes, tax rates or the cost of a patent are regulated by local legislation. Therefore, in such cases, an individual entrepreneur must register at his actual location and pay taxes to the budget of the territory of residence. But contributions to extra-budgetary funds continue to be made at the place of registration.

If a person does not have registration at his place of residence, he has the right to register an individual entrepreneur at his place of residence. Such registration is also commonly called temporary.

If an individual entrepreneur is permanently registered at one address, and temporarily at another, he uses the one where he is permanently registered as the registration address.

It also happens that an individual entrepreneur is permanently registered at one address, lives at another, and has temporary registration at a third address, where he has never been. Fictitious registration is a violation of the law. But often people do this to make it easier for their child to enroll in a kindergarten or school, to pass a license at a place other than their place of registration, etc. In such a situation, you can indicate the actual postal address. And the address of the fictitious temporary registration should not be mentioned anywhere at all, except for the cases for which it was issued. And they are usually not associated with entrepreneurial activity.

How to find out the registration address of an individual entrepreneur

Unlike a legal entity, whose legal address can be found using an extract from the Unified State Register of Legal Entities or the service “Business risks: check yourself and your counterparty” on the website of the Federal Tax Service (FTS) of Russia, neither an electronic or paper extract from the Unified State Register of Legal Entities, nor the mentioned address information service IP registrations are not included. This information is protected by federal privacy laws and cannot be provided so easily.

A mark on registration of place of residence is affixed to the passport

However, there is a way to obtain this information legally.

To do this, you need to contact any tax office for a government service, which is called providing information from the Unified State Register of Individual Entrepreneurs. Not to be confused with a paper official extract from the Unified State Register of Individual Entrepreneurs, where, as already mentioned, this information is not available.

In the header of the application you must indicate the following information about yourself:

- FULL NAME.;

- TIN;

- passport data: series, number, when and by whom it was issued, department code, registration address;

- telephone for communication;

- postal or email address.

The text itself states:

- the essence of the appeal;

- Full name of the entrepreneur whose address is needed;

- his TIN and OGRNIP;

- method of providing the requested information: issue in person or send by mail. If no method is specified, the response will be sent by mail by default.

The document is dated and signed. A sample will help you draw up an application.

This government service is paid; the state fee in 2021 is 200 rubles for a standard request and 400 rubles for an urgent one. An urgent statement will be ready on the next business day; a regular statement will have to wait five business days. If you choose the postal delivery option, please add postage time.

Typically, the registration address of an individual entrepreneur is needed to go to court and pre-trial settlement of claims if the transaction is legally subject to consideration in arbitration court. This option only applies to disputes between individual entrepreneurs and individual entrepreneurs with legal entities. However, if an agreement was concluded between the disputants, all the necessary information about the individual entrepreneur should be in it.

If an individual wants to sue an individual entrepreneur, for example, a client or buyer who is dissatisfied with the quality of a product or service, there is another option. It is enough to contact the court of general jurisdiction at your place of residence and petition the tax office to provide the entrepreneur’s registration address. There are usually no problems with such requests. And the tax authorities have no right to refuse the court.

The TIN and OGRNIP of the individual entrepreneur are usually contained in the check issued to them or the strict reporting form.