VAT mechanism

Tax is calculated on all transactions within the framework of core and non-operating activities (entry D/t 90 K/t 68), the accountant records the amount of tax payable to the budget, and the entry D/t 91 K/t 68 reflects the VAT that the company must pay when performing other income-generating transactions.

When purchasing goods, the purchasing company has the right to reimburse from the budget the amount of tax indicated in the invoice by making the following entries:

D/t 19 K/t 60 — VAT on the purchased goods;

D/t 68 K/t 19 - tax is presented for deduction after the values are accepted for accounting. This algorithm allows you to reduce the amount of accrued VAT due to the “input” tax.

Thus, the accrued VAT is accumulated in the credit account. 68, and the reimbursable one is in debit. The difference between debit and credit turnover, calculated at the end of the reporting quarter, is the result that the accountant focuses on when filling out a tax return. If prevails:

- credit turnover - it is necessary to transfer the difference to the budget;

- debit - the amount of the difference is subject to reimbursement from the budget.

How to Prepare Accounting Entries

VAT accounting is carried out according to the following accounts in the chart of accounts (Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000):

- 68 “Calculations for taxes and fees”, subaccount 68.02 - accrual is recorded on the loan, VAT calculated and paid to the budget is carried out according to Dt 68;

- 19 “Value added tax on acquired assets” - to reflect input VAT, but not reimbursed from the budget.

If an organization is engaged in the sale of goods, works and services, then VAT is charged on the operation - the posting will be: Dt 90, 91 Kt 68.

When purchasing products, the customer has the opportunity to recover VAT from the funds paid to the budget. The procedure is carried out as follows: the paid amount of VAT is separated from the purchase price and recorded in account 19:

- Dt 19 Kt 60 - VAT on acquired assets is accepted for accounting;

- Dt 68 Kt 19 - VAT deductible (posting).

VAT to be refunded is accumulated on the debit of account 68, forming a payment that must be sent to the budget. VAT is the difference between debit and credit turnover. When the turnover on the loan account. 68 exceeds the debit, then the calculated amount of value added tax is subject to payment to the budget. If the debit of the account 68 more than the loan, then the total difference is reimbursed from budget payments.

Accounting entries for VAT: valuables purchased

Tax on purchases is taken into account using the following entries:

| Operations | D/t | K/t | Base |

| Reflects the “input” VAT on purchased goods and materials, fixed assets, intangible assets, capital investments, services | 19 | 60 | Invoice |

| Write off VAT on production costs for acquired assets that will be used in non-taxable transactions. | 20, 23, 29 | 19 | Accounting certificate-calculation |

| Write-off of VAT on other expenses if it is impossible to deduct the tax, for example, if the supplier fills out the invoice incorrectly, or if it is lost or not received. | 91 | 19 | |

| VAT previously claimed for reimbursement on inventory items and services used in non-taxable transactions has been restored | 20, 23, 29 | 68 | |

| VAT deductible on assets | 68 | 19 |

So, VAT can be reimbursed from the budget only when purchasing assets/services that will be used in transactions subject to VAT. Otherwise (when the property will be used in non-taxable transactions), the amount of tax on these assets is written off as production costs (by analogy with accounting for companies that do not pay VAT).

Attribution of VAT to other expenses, in common usage - write-off of VAT (entry D/t 91 K/t 19) is carried out both in cases of impossibility of obtaining an invoice, and in case of non-production expenses incurred on business trips (for example, for additional services specified in railway tickets), writing off accounts payable, gratuitous transfer of property, expiration of the three-year period allotted for tax refund, etc.

We reflect VAT when purchasing assets

To carry out its activities, the company needs to purchase works, products, services and raw materials (fuels and lubricants, utilities, building materials, household goods, etc.). The cost of some material assets already includes tax obligations under the VA; therefore, in order to avoid multiple taxation of goods, the buyer has the right to deduct VAT by posting the transaction in accounting.

Typical accounting entries:

| Contents of operation | Debit | Credit |

| Reflects the input value added tax on the purchase of assets and material assets (fixed assets, inventories, intangible assets, works, goods, services) | 19 | 60 |

| The DS tax is written off when transferring material assets into production, the sale of which is exempt from VAT. | 20 23 29 | 19 |

| BUT written off if it is not possible to confirm the input tax on the DS (the invoice is lost) | 91 | 19 |

| Reinstatement of VAT is reflected, postings according to the previously presented tax return on assets used in transactions not subject to tax return. | 20 23 29 | 68 |

| Tax liability accepted for deduction | 68 | 19 |

Note that the cases in which VAT should be restored are strictly regulated in paragraphs 1-4, 6, paragraph 3 of Article 170 of the Tax Code of the Russian Federation. The legislation does not provide for reservations or exceptions.

VAT on sales: postings

The sale of assets is accompanied by the accrual of VAT on the debit of account 90/3, on receipts from non-operating transactions - 91/2. Typical transactions for the sale of goods and other transactions with VAT will be as follows:

| Operations | D/t | K/t | Base |

| VAT charged: | |||

| — on sales (upon shipment) | 90/3 | 68 | invoice |

| — upon sale (upon payment) | 76 | 68 | |

| - for non-operating income (shipped or paid) | 91/2 | 68 | |

| — for construction and installation work carried out on a self-propelled basis | 08 | 68 | Accounting certificate |

| - for a gratuitously transferred asset | 91 | 68 | Invoice |

| - for the advance received from the buyer | 76 | 68 | Invoice for advance payment |

| VAT is credited from the advance payment (upon shipment) | 68 | 76 | Issued invoice |

| VAT paid | 68 | 51 | Bank statement |

VAT on advances received

Flamingo LLC received an advance payment from the buyer in the amount of 98,000 rubles against the upcoming delivery of goods. The amount of VAT intended for restoration to the budget: 98,000 * 18/118 = 14,949 rubles.

VAT on advances received transactions::

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62 | Receipt of advance payment | 98 000 | Payment order |

| 76(advances) | 68(VAT) | VAT charged on advance payment | 14 949 | SF issued |

After the sale has taken place, that is, the goods have been shipped to the buyer, or after canceling the transaction and returning the advance payment, this VAT can be deducted.

VAT on transaction advances:

| Dt | CT | Operation description | Amount, rub. | Document |

| 68(VAT) | 76(advances) | VAT is presented for deduction to the budget | 14 949 | Book of purchases |

VAT on reduction of sales value: postings

Often, disputes arise between counterparties after the shipment of goods regarding the value of the assets being sold. Any party can be vulnerable in such a situation, but more often this applies to the supplier. If he agrees to the price change, a sales adjustment is made. Let's consider the option of reducing the price of a product due to additional delivery.

Example:

An agreement was concluded between the two companies for the supply of products in the amount of 100 units for the amount of 500,000 rubles. + VAT 90,000 rub. The price of one product is 5000 rubles. + VAT 900 rub., cost price 3000 rub. After shipment, the supplier additionally supplied 8 products under the additional agreement. The sales adjustment in supplier accounting will be as follows:

Operations D/t K/t Sum Sales proceeds 62 90/1 500 000 VAT on revenue 90/3 68 90 000 The cost of goods sold is written off (3000 x 100) 90/2 43 300 000 The cost of products shipped additionally has been written off (3000 x 44 43 24 000 VAT charged on additional supply (5000 x 8 / 118 x 18) 44 68 6102 Payment received 51 62 500 000 A permanent income tax liability has been created (6102 x 20%)

99 68 1220

Reinstatement of previously deducted tax

It happens that VAT on acquired assets is initially deductible, but then it has to be restored. A typical example is receiving an advance payment. If the supplier deducts tax from the advance payment, then after shipment he must restore this amount. An entry is made to restore VAT previously accepted for deduction: Dt 60 - Kt 68.

The second example is that an entity with OSNO switches to a simplified tax regime. He should restore the tax on the balance of goods and fixed assets, if it was accepted for deduction. In such circumstances, it is advisable to make the following entry: Dt 91 - Kt 68.

Thus, the restored tax is accumulated under the credit of account 68 and increases the organization’s obligations to the budget.

VAT accounting when returning goods

Failed acquisitions are also reflected in accounting, but they are recorded depending on the reasons for the return.

- If the goods turned out to be defective, and this was discovered after posting, VAT is reflected by postings like this:

| Operations | D/t | K/t |

| From the buyer | ||

| REVERSAL VAT on marriage | 19 | 60 |

| REVERSE previously accepted for deduction of VAT on the amount of marriage | 68 | 19 |

| From the seller | ||

| VAT REVERSE upon acceptance of defects (if shipments and acceptance occur in the same tax period) | 90 | 68 |

| VAT REVERSE upon receipt of a defect in the next period | 91 | 68 |

- if the product is of appropriate quality:

| Operations | D/t | K/t |

| From the buyer | ||

| VAT accrual on returned goods | 90 | 68 |

| From the seller | ||

| Input VAT on return of inventory items | 19 | 60 |

| VAT is deductible on returned goods | 68 | 19 |

VAT refund for arrears

If there is arrears of VAT, unpaid penalties and fines, then tax officials can independently carry out offsets using the refundable tax amount.

Please note that if the arrears arose between the date of filing the declaration and the date of the decision, and it does not exceed the amount of VAT to be reimbursed, then in this case the accrual of penalties is not provided!

If the amount of the arrears exceeds the amount of the VAT refund, then the taxpayer has the right to receive the declared amount for reimbursement or demand that it be credited to future payments of VAT or other federal taxes.

Postings for attributing input VAT to expenses

VAT presented by suppliers is allocated from the total cost, prescribed documentation, and is entered into the debit of account 19. It is then included in the cost of inventory or fixed assets, after which it is gradually transferred to expenses as goods are sold, materials are used, and depreciation of intangible assets and fixed assets is calculated.

Postings when writing off VAT as expenses for purchased MC involved in the production process

| Operation | Debit | Credit |

| The cost of purchased materials (excluding VAT) is credited upon receipt | 10 | 60 |

| The added tax on capitalized materials, specified in the supplier’s documentation, has been highlighted | 19 | 76 (60) |

| Money was transferred to the supplier for purchased materials (total cost including tax) | 60 | 51 |

| Added tax after payment is included in the cost of materials | 10 | 19 |

| The cost of the MC is written off as the cost of production | 20, 23 | 10 |

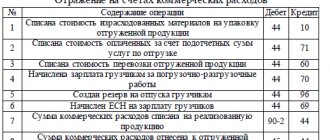

Postings when writing off VAT as expenses on goods purchased for sale

| Operation | Debit | Credit |

| The cost of purchased goods is reflected upon receipt into the warehouse | 41 | 60 |

| The added tax on accepted commodity values, specified in the accompanying documentation, has been highlighted | 19 | 76 (60) |

| Money was transferred for goods (including tax) based on an invoice received from the supplier for payment | 60 | 51 |

| Paid added display tax in the cost of goods | 41 | 19 |

| The cost of goods is transferred to the cost price upon their sale | 90.2 | 41 |

If the enterprise organizes separate accounting of input tax, which is important when simultaneously performing taxable and non-taxable transactions, then different analytical accounts will be opened on account 19, each of which will maintain separate VAT accounting. The tax subject to deduction (19-deductible), inclusion in the price (19-cost) and subject to proportional distribution (19-distribution) will be separately allocated. It is enough to open 3 sub-accounts for the 19th account. Initially, VAT is credited to the subaccount for distribution, after which the tax is distributed among the remaining subaccounts.