Non-finished method of accounting

Under the unfinished method, the product produced as a result of a separate stage of the production process is not accounted for as a semi-finished product in a separate account. Its transfer for further processing is reflected only in physical terms (i.e. in kg, pcs., etc.). In this case, do not calculate the cost of the finished product. With this option, consider the costs as part of work in progress along with other costs (i.e., on account 20).

Direct costs that are directly related to production are reflected in the debit of account 20 in correspondence with the expense accounts. In this case, do the wiring:

Debit 20 Credit 10 (02, 05, 23, 29, 69, 70...) – direct costs for the production of semi-finished products are taken into account.

First, record general production costs on account 25, and then at the end of the month write them off to account 20. At the same time, make the following entries:

Debit 25 Credit 10 (02, 05, 23, 69, 70...) – general production expenses are reflected;

Debit 20 Credit 25 – general production costs are taken into account as part of the expenses for the production of semi-finished products.

Consider general business expenses as part of production costs (i.e., on account 20) if they are not immediately included in the cost of products sold (i.e., are not written off to account 90 “Sales”). For more information about this, see How to write off general production and general business expenses. In this case, make the following entries:

Debit 26 Credit 10 (02, 05, 69, 70...) – general business expenses are reflected;

Debit 20 Credit 26 – general business expenses are taken into account as part of the expenses for the production of semi-finished products.

This order follows from the Instructions for the chart of accounts (accounts 20, 25, 26).

All costs collected on account 20, as finished products are released, are written off from the credit of the account to the debit of the corresponding accounts (accounts 40 and 43). For more information about this, see How to reflect the release of finished products in accounting. The balance on account 20 will show the value of work in progress. For more information on accounting for work in progress, see How to Determine the Value of Work in Process.

The advantages of the semi-finished method are that it is less labor-intensive. However, using it, the organization will not be able to control the costs of producing semi-finished products. This means constant control over the cost of finished products. In addition, if an organization decides to sell semi-finished products of its own production, difficulties will arise in determining their cost.

Accounting for semi-finished products of own production wiring

Accounting account 21 is the active account “Semi-finished products of own production”, used to record expenses associated with the production and processing of semi-finished products. Using standard postings and practical examples, we will consider the specifics of using account 21 and the features of reflecting transactions for accounting for semi-finished products of our own production

Account 21 in accounting: semi-finished products of own production

In the course of production activities, it may happen that there is a need to take into account semi-finished products of own production. In this situation, everything depends on the specifics of the activity of a particular enterprise.

Today’s topic will be devoted to questions about who uses 21 accounts, how accounting and evaluation of this category of goods is carried out, what are the features of their accounting, what typical accounting entries are recorded for such operations, and we will also analyze practical situations of this kind from life.

Who uses accounting account 21?

21 accounts, called “Semi-finished products of own manufacture,” are actively used by industrial enterprises to summarize data on the availability and movement of manufactured inventories that will be used in the manufacture of final products. It is also used to reflect the movement of workpieces between different workshops of an industrial company.

Thus, the designated position of the Chart of Accounts is intended to summarize data on incoming, available and further intermediate products for the further production process.

If we talk about what should be classified as semi-products of our own production, then we mean those blanks that were obtained as a result of the technological process, but did not go through all the stages of the production cycle necessary to obtain the final product.

Source: https://kpa.ru/uchet-polufabrikatov-sobstvennogo-proizvodstva-provodki/

Semi-finished accounting method

The semi-finished method assumes that the produced semi-finished products are taken into account in quantitative and total terms, and their cost is calculated. In this case, accounting for semi-finished products is kept separately in a separate account. Despite the fact that this method is more labor-intensive, it has its advantages. Using it, it is possible to control the costs of production of finished products at each stage of production. In addition, if an organization decides to sell a semi-finished product, knowing its cost, it will be able to realistically assess the financial result of this operation.

In accounting, reflect the costs of producing semi-finished products on account 20 “Main production”, to which open a separate sub-account “Production of semi-finished products”.

Direct costs that are directly related to the production of semi-finished products are reflected in the debit of this account in correspondence with the expense accounts. In this case, do the wiring:

Debit 20 subaccount “Production of semi-finished products” Credit 10 (02, 05, 69, 70...) – direct costs for the production of semi-finished products are taken into account.

First, record general production costs on account 25, and then at the end of the month write them off to account 20. At the same time, make the following entries:

Debit 25 Credit 10 (02, 05, 69, 70...) – general production expenses are reflected;

Debit 20 subaccount “Production of semi-finished products” Credit 25 – general production costs are taken into account as part of the costs for the production of semi-finished products.

General business expenses should be taken into account as part of the costs of producing semi-finished products (i.e., on account 20) if they are not immediately included in the cost of products sold (i.e., not written off on account 90 “Sales”). For more information about this, see How to write off general production and general business expenses. In this case, make the following entries:

Debit 26 Credit 10 (02, 05, 69, 70...) – general business expenses are reflected;

Debit 20 subaccount “Production of semi-finished products” Credit 26 – general business expenses are taken into account as part of the expenses for the production of semi-finished products.

This order follows from the Instructions for the chart of accounts (accounts 20, 25, 26).

Account 21 in accounting

Semi-finished products of own production are accounted for on account 21 in correspondence with account 20 - when semi-finished products are used in own production, and with account 90 - when semi-finished products are sold to a counterparty:

The debit of account 21 reflects the receipt of semi-finished products and their surpluses discovered during inventory. The account credit takes into account the consumption of semi-finished products during transfer for subsequent processing, their sale or identification of shortages in the warehouse.

On account 21, analytical accounting can be maintained by storage location, by name, type, grade, and so on.

Receipt from production

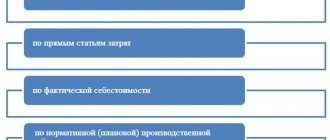

Receipts from the production of finished semi-finished products are accounted for in a separate account 21 “Semi-finished products of own production”. To capitalize semi-finished products, determine their cost. To calculate it, use the methods that are used to evaluate work in progress:

- at the cost of raw materials and materials used in the manufacture of semi-finished products;

- by the amount of direct costs;

- at actual or standard cost.

The use of these methods is explained by the fact that semi-finished products are part of work in progress.

This procedure follows from paragraph 64 of the Regulations on Accounting and Reporting.

Document the receipt of finished semi-finished products from production by posting:

Debit 21 Credit 20 subaccount “Production of semi-finished products” - semi-finished products of own production are capitalized.

Do it on the basis of the invoice requirement in form No. M-11, which is drawn up when semi-finished products are received into the warehouse.

This procedure follows from the Instructions for the chart of accounts (accounts 21, 20) and paragraph 57 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Accounting for receipt of spare parts for storage: postings

Analytical accounting of spare parts is carried out within the nomenclature (homogeneous groups) at the cost of acquisition. The basis for obtaining credentials is the invoice.

Example of spare parts receipt

Planer LLC has a car on its balance sheet that is used for business purposes. To carry out a medium repair, the purchase of a gearbox is required in the amount of 25,700 rubles, including VAT of 3,920.34 rubles. The following entries are made in the company's accounting:

- The supply of spare parts is reflected: Dt 10/5 Kt 60 in the amount of 21,779.66 rubles;

- The VAT presented by the supplier is taken into account: Dt 19 Kt 60 in the amount of 3,920.34 rubles;

- Payment to the supplier is taken into account: Dt 60 Kt 51 in the amount of 25,700 rubles.

Warehouse accounting is carried out using materials accounting cards No. M-17 in manual or electronic form. A special need for maintaining cards arises when an organization uses an exchange fund of spare parts that are repaired and subsequently installed on the operating system.

Enterprises independently determine the list of accounting documents for inventory items. A number of organizations with small warehouse receipts and issues keep a log of the movement of spare parts. If there is automated accounting, the journal is not used.

Write-off methods

Determine the cost at which semi-finished products are written off from account 21 in one of the following ways:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

The method for estimating the cost of write-off semi-finished products should be established in the accounting policy for accounting purposes.

Document the release of semi-finished products into production using the same primary documents as all other materials.

Such rules are established by paragraphs 73, 82 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, paragraph 16 of PBU 5/01 and the Instructions for the Chart of Accounts.

Accounting for receipt of materials under a supply agreement. Accounting entries

What are fuels and lubricants and how are they accounted for in accounting. Typical wiring for fuel and lubricants.

Expenses associated with the production of semi-finished products are usually reflected at actual cost as follows: Debit account 21 – Credit account 20 The cost of semi-finished products transferred for further processing is reflected as follows: Debit account 20 – Credit account 21 Of course, semi-finished products can also be transferred for other needs . To correctly reflect transactions with semi-finished products in synthetic accounting, you should be guided by the section “Accounting for Expenses” of the Methodological Recommendations on the Application of Accounting Registers, approved by Order of the Ministry of Finance dated December 29, 2000 N 356 (hereinafter referred to as Recommendations N 356).

Sales of semi-finished products

Semi-finished products of own production intended for sale are finished products. Therefore, arrange their implementation in a similar order. For more information, see:

- What documents should be used to document the shipment of finished products (performance of work, provision of services);

- How to record sales of finished products in accounting.

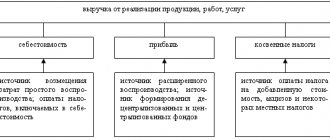

When selling semi-finished products, make the following entries:

Debit 62 Credit 90-1 – revenue from the sale of semi-finished products of own production is reflected;

Debit 90-2 Credit 21 – the cost of semi-finished products sold is written off;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” - VAT is charged on the sale of semi-finished products (if such sales are subject to VAT).

The procedure for accounting for expenses for the production of semi-finished products when calculating taxes depends on the taxation system that the organization uses.

BASIC

When calculating income tax, costs for the production of semi-finished products used in the manufacture of products should be taken into account as part of expenses in the general manner.

If an organization uses the cash method, then sales revenue will be reduced by all expenses for which the conditions for their recognition in the tax base are met (clause 3 of Article 273 of the Tax Code of the Russian Federation). For example, expenses for the purchase of raw materials and materials used in the production of semi-finished products can be written off as expenses only if three conditions are simultaneously met: payment, release into production and use in it at the end of the month (subclause 1, clause 3, article 273, clause 5, Article 254 of the Tax Code of the Russian Federation).

If an organization sells semi-finished products, recognize the proceeds from the sale as income from sales (Article 249 of the Tax Code of the Russian Federation). Revenue is recognized upon receipt of payment for shipped semi-finished products (Clause 2 of Article 273 of the Tax Code of the Russian Federation). The advance payment (advance payment) received from the buyer should also be taken into account as part of income at the time of receipt (clause 2 of Article 273, subclause 1 of clause 1 of Article 251 of the Tax Code of the Russian Federation). This rule applies despite the fact that at the time of receiving the advance, the semi-finished products have not yet actually been transferred to the buyer (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98).

If an organization uses the accrual method, write off indirect costs for the production of semi-finished products in full in the period to which they relate (according to the rules of Article 272 of the Tax Code of the Russian Federation). And direct costs need to be distributed. That part of them that relates to the balances of work in progress, finished products in the warehouse or shipped (but not sold) products will not increase the organization’s current expenses. This is provided for in paragraph 2 of Article 318 of the Tax Code of the Russian Federation.

The cost of semi-finished products that have not been transferred for further processing at the end of the month is taken into account as part of work in progress for direct expenses (clause 4 of Article 254 and Article 319 of the Tax Code of the Russian Federation). Also calculate the cost of semi-finished products if the organization plans to sell them. In this case, determine their cost based on the direct costs of producing semi-finished products (clause 4 of article 254, article 319 of the Tax Code of the Russian Federation, letter of the Department of Tax Administration of Russia for Moscow dated October 23, 2003 No. 26-12/59541). When calculating income tax, take into account the cost of semi-finished products at the time of their sale (i.e., at the moment of transfer of ownership of them to the buyer) (clause 1 of Article 272 and subclause 2 of clause 1 of Article 268 of the Tax Code of the Russian Federation).

As a general rule, revenue from the sale of semi-finished products is subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). For more information about this, see How to calculate VAT on the sale of goods (work, services).

An example of reflection in accounting and taxation of costs for the production of semi-finished products

LLC "Proizvodstvennaya" is engaged in the production of snack products - crackers. The process of making crackers consists of two stages. At the first stage, in workshop No. 1, unspecified crackers are produced, which are accounted for as semi-finished products. Then they are transferred to workshop No. 2 for final production.

In June, production costs in workshop No. 1 amounted to:

- the cost of materials transferred to production is 400,000 rubles;

- cost of materials used – 370,000 rubles;

- the amount of accrued salary is 240,000 rubles;

- the amount of accrued contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases - 62,880 rubles;

- other expenses (general production and general economic) – 550,000 rubles.

In Master's accounting, semi-finished products are valued based on the amount of direct costs. Therefore, to determine their cost, the accountant allocated direct costs between semi-finished products produced and work in progress balances. The organization's accounting policy establishes that direct costs are distributed in proportion to the cost of materials attributable to finished products and work in progress.

The cost of unspecified crackers produced in workshop No. 1 was calculated by the accountant as follows:

– first determined the amount of direct costs (except for materials) – 302,880 rubles. (RUB 240,000 + RUB 62,880);

- then determined the share of these direct costs attributable to the produced semi-finished products - 280,164 rubles. (RUB 302,880 : RUB 400,000 × RUB 370,000).

The total amount of direct costs attributable to manufactured semi-finished products amounted to 650,164 rubles. (RUB 280,164 + RUB 370,000).

The accountant reflected the receipt of finished semi-finished products from workshop No. 1 as follows:

Debit 21 Credit 20 subaccount “Production of semi-finished products” – 650,164 rubles. – semi-finished products of our own production were capitalized.

In accordance with the accounting policy, the transfer of semi-finished products to production is carried out at average cost. In June, unspecified crackers in the amount of 487,623 rubles were transferred to workshop No. 2. At the same time, the accountant made the following entry:

Debit 20 Credit 21 – 487,623 rub. – semi-finished products were transferred for the production of finished products.

In tax accounting, the accountant did not take into account the transfer of semi-finished products, since the costs of their production will be taken into account only when selling finished products in the production of which these semi-finished products were used.

If an organization sells semi-finished products of its own production at retail and in the municipality in which the organization is registered, retail trade is transferred to the payment of UTII, this operation does not fall under this special tax regime (subclauses 6 and 7 of clause 2 of Article 346.26 of the Tax Code of the Russian Federation). This is explained by the fact that the obligation to pay UTII when selling goods at retail depends, among other things, on the type of property being sold. The sale of products of own production does not fall under UTII (paragraph 12 of article 346.27 of the Tax Code of the Russian Federation).

An exception to this rule is the sale of semi-finished products of own production through public catering facilities (cafes, restaurants, canteens, snack bars, bars). This type of service, if other conditions are met, falls under UTII (Article 346.27 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated August 15, 2006 No. 03-11-04/3/376, dated August 23, 2006 No. 03-11-02- 185, dated November 1, 2006 No. 03-11-04/3/482). In this case, the sale of semi-finished products is not subject to income tax and VAT (clause 4 of Article 346.26 of the Tax Code of the Russian Federation). When calculating the single tax, take into account imputed income as an object of taxation (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). In addition, organize separate accounting of property, liabilities and business transactions in relation to the activities of the organization, subject to UTII, and the activities of the organization on the general taxation system for the purpose of calculating income tax and VAT (clause 9 of Article 274, clause 7 of Article 346.26 of the Tax Code RF).

Accounting for semi-finished products of own production - postings

Accounting for semi-finished products of own production.

If PSPs are sold externally, they appear in the form of finished products, so the sale operation is formalized by postings:

- Dt 62 Kt 90.1 for the amount of revenue;

- Dt 90.3 Kt 68 for the amount of VAT on revenue;

- Dt 90.2 Kt 21 for the amount of the cost of semi-finished products.

Since semi-finished products are part of unfinished products, the methods for evaluating them are the same (sub.

63-64 Regulations on accounting and reporting):

- at the cost of raw materials and materials;

- by direct cost items;

- at actual cost;

- at standard (planned) production costs.

With the first method, only the cost of raw materials and supplies falls in the cost account for semi-finished products. Let's look at an example.

Accounting for semi-finished products of own production and their evaluation

Semi-finished products of our own production are materials that have been processed at a completed technological stage. They can be used for subsequent processing at the same enterprise or can be sold to a counterparty for further processing.

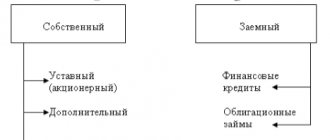

At full-cycle enterprises, where raw materials go through several stages of processing or reprocessing, account 21 “Semi-finished products of own production” can be used to account for semi-finished products produced in each processing stage.

Semi-finished products of own production can be classified as work in progress (clause 63 of the Regulations on accounting and financial reporting No. 34n, approved by the Ministry of Finance on July 29, 1998). There are several methods of assessment:

According to the requirements of Article 319 of the Tax Code of the Russian Federation, the cost of semi-finished products of own production is determined based on the assessment of finished products. Therefore, in tax accounting only one assessment method is used:

- Direct costs of the enterprise.

The accounting policy must include a list of direct expenses (letter of the Ministry of Finance No. 03-03-06/4/78 dated August 26, 2010). For example, the list of direct expenses includes: material costs, labor costs, social contributions, accrued depreciation.

When calculating the cost of finished products, semi-finished products of own production are included in the calculation in the form of a complex item or are included in detailed cost items.

Accounting entries for accounting for semi-finished products

The chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, provides for a separate account 21 to reflect semi-finished products. If the accounting policy of the enterprise does not stipulate separate accounting for semi-finished products, then they are reflected as part of work in progress on account 20.

PSP is received at the warehouse by posting Dt 21 Kt 20 based on the invoice requirement (you can use form M-11 or develop it yourself). The transfer of PSP from the warehouse to further production is formalized by posting Dt 20 Kt 21 also on the basis of the invoice requirement.

Methods for evaluating semi-finished products

Since semi-finished products are part of unfinished products, the methods for evaluating them are the same (subclauses 63-64 of the Accounting and Reporting Regulations):

- at the cost of raw materials and materials;

- by direct cost items;

- at actual cost;

- at standard (planned) production costs.

With the first method, only the cost of raw materials and supplies falls in the cost account for semi-finished products. Let's look at an example.

Examples of transactions with finished products

Operation Account debit Account credit

| Revenue from the sale of finished products is reflected | 62 “Settlements with buyers and customers” | 90 “Sales”, sub-account “Revenue” |

| The cost of shipped finished products is written off | 90, subaccount “Cost of sales” | 43 |

| VAT charged on sales of finished products | 90, subaccount “VAT” | 68 “Calculations for taxes and fees”, subaccount “VAT” |

Commercial expenses associated with the sale of finished products are also written off:

| Dt 90, subaccount “Sale expenses” – Kt 44 “Sale expenses” |

When selling goods at retail

A peculiarity of accounting for sales in retail trade is that proceeds from sales are not transferred to the current account, but mainly to the cash register.

Due to the fact that buyers are a fairly wide range of consumers, settlements with them are carried out without using account 62, but directly to the revenue account. In addition, the cost of goods sold usually also includes the costs of selling them.

Sales of services

The provision of services in accounting is carried out similarly to the sale of goods. But since they do not have a material embodiment, all costs are collected on one of the production accounts (20, 25, etc.), after which they are written off at the time of sale to account 90/2. Accounts 41, 43 are not used.

| Debit | Credit | Operation designation |

| 62 | 90/1 | Revenue from services performed is shown |

| 90/2 | 20 | The cost of services performed is written off |

| 90/3 | 68 | VAT on services provided is reflected |

| 51, 52 | 62 | Received payment for services |

In a budget institution

In such an institution, the sale of goods is carried out on the basis of a negotiated price. The institution independently determines the size of the markup, but it should not conflict with regulations.

In addition, the state determines a list of goods for which it sets prices independently. The institution sets the price for them based on approved tariffs.

Attention! The sale of goods is not included in the main activity of a budgetary institution, therefore operations should be accounted for through account 0 401 10 130 “Revenue from the provision of paid services.”

| Debit | Credit | Operation designation |

| 1 401 10 130 | 1 105 37 440 | Write-off of cost of products sold |

| 1 205 31 560 | 1 401 10 130 | Revenue has been accrued, including VAT |

| 1 304 04 440 | 1 303 05 730 | Cash receipts administrator notification reflected |

| 1 303 05 830 | 1 205 31 660 | Income from sales was credited to budget income by the institution that is the revenue administrator |

| 1 210 02 440 | 1 205 31 660 | Income from sales was credited to budget income by an institution that is not a revenue administrator |

How to Find Sales for Products. Sales of Products

Theoretically, even traffic police authorities can ask her if they are interested in the cargo being transported.

The slaughter of the animal itself is carried out in two stages.

At the first stage, veterinary station workers perform an external examination of the animal and measure its temperature. Certificates of pre-slaughter inspection are usually not given, only a receipt for payment for services. A positive inspection result is the first legal basis for the sale of meat, so it is best not to lose the receipt.

After inspection, you can slaughter, but this must be done no more than 24 hours in advance.

According to the rules, veterinarians must be present at the slaughter itself, however, since paramedic veterinary stations have now been liquidated everywhere in villages, they may agree to examine the carcass the day after slaughter.

Magazine headings

Is it necessary for a store to issue a receipt for its own goods with VAT or without VAT?

The tax office told us that when transferring finished products to a store for sale, we must issue an invoice, a delivery note, and this moment will be considered a sale for sewing production. Is it so?

In accordance with paragraph 2 of Art. 346.26 Tax Code of the Russian Federation

The taxation system in the form of a single tax on imputed income for certain types of activities can be applied to retail trade carried out through shops and pavilions with a sales area of no more than 150 square meters for each trade facility.

Types of finished product assessment

Accounting for finished products and their sales is kept on active account 40 “Finished Products”. The debit records the receipt of goods from production to warehouse storage, the credit shows the shipment/issue. Account balance 40 is the balance of manufactured products at the end of the month. Information about goods is shown in conditionally natural, natural and cost indicators.

Registration of commodity items is carried out through invoices, specifications, acceptance certificates, and other primary documentation. Accounting is required to include the preparation of a price list.

In addition, the accounting department develops directories of taxable and non-taxable products, consignees and payers, average annual and average quarterly costs.

The finished products category includes the following products:

- goods or semi-finished products of own production;

- purchased products that are purchased for assembly;

- design and survey, construction and installation, scientific research work;

- passenger and cargo transportation services;

- car rental and delivery services;

- communication services and other goods, works that have completely gone through the stages of production.

If all production stages have not been completed for products, they are considered work-in-progress goods.

Source: https://ark-product.ru/menedzhment/6829-uchet-polufabrikatov-sobstvennogo-proizvodstva-provodki.html

simplified tax system

The procedure for accounting for income and expenses associated with the production and sale of semi-finished products depends on the object of taxation chosen by the simplified organization.

If an organization pays a single tax on income, expenses for the production of semi-finished products do not reduce the tax base (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization sells these semi-finished products, income from their sale will be taken into account when calculating the single tax (Clause 1, Article 346.15, Article 249 of the Tax Code of the Russian Federation). Recognize it in the period in which semi-finished products will be paid for. The date of receipt of income is the day the debt to the organization is repaid (the day money is received in a bank account or cash register, receipt of property, etc.). If a bill of exchange is received as payment, recognize income at the time it is paid or transferred by endorsement to a third party. This is stated in paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

If an organization pays a single tax on the difference between income and expenses, take into account the costs of producing semi-finished products in the general manner, regardless of which cost accounting method the organization uses (semi-finished or unfinished) (Articles 346.16, 346.17 of the Tax Code of the Russian Federation).

If in the municipality in which the organization is registered, retail trade has been transferred to the payment of UTII, when selling semi-finished products of its own production at retail, this tax does not need to be paid (subclauses 6 and 7 of paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation). This is explained by the fact that the obligation to pay UTII when selling goods at retail depends, among other things, on the type of property being sold. The sale of products of own production does not fall under UTII (paragraph 12 of article 346.27 of the Tax Code of the Russian Federation). An exception to this rule is the sale of semi-finished products of own production through public catering facilities (cafes, restaurants, canteens, snack bars, bars). This type of service, if other conditions are met, falls under UTII (Article 346.27 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated August 15, 2006 No. 03-11-04/3/376, dated August 23, 2006 No. 03-11-02- 185, dated November 1, 2006 No. 03-11-04/3/482). In this case, the sale of semi-finished products is not subject to a single tax under simplification (clause 4 of Article 346.12 of the Tax Code of the Russian Federation). When calculating UTII, take into account imputed income as an object of taxation (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). In addition, organize separate accounting of property, liabilities and business transactions in relation to the activities of an organization subject to UTII and the activities of an organization subject to a simplified tax regime (clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

Specifics of working with the account

Self-made semi-finished products include previously purchased materials that have been subjected to special technological processing. They are subsequently used to obtain the finished product. Since full-cycle enterprises may employ several processing lines, account 21 is used to account for all costs associated with their production.

Semi-finished products produced by the enterprise can also be regarded as work in progress.

To systematize all emerging costs, the accounting policy of the enterprise must define a method for valuing semi-finished products. There are several options:

- at the cost of raw materials and materials;

- on direct costs;

- at actual cost;

- at standard cost.

In tax accounting, only one method is used - according to the direct costs of the enterprise. When calculating the cost of production, semi-finished products can be included in the calculation as a complex item, or taken into account under different expense items in detail.

Account 21 is logical to use to account for semi-finished products by category - storage location, names, types and varieties, as well as other significant characteristics.

UTII

The object of UTII taxation is imputed income for a specific type of activity of the organization (clauses 1 and 2 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, expenses associated with the production of semi-finished products do not affect the determination of the tax base for UTII.

If an organization sells semi-finished products of its own production at retail, this operation does not fall under this special tax regime (subclauses 6 and 7, clause 2, article 346.26 of the Tax Code of the Russian Federation). This is explained by the fact that the obligation to pay UTII when selling goods at retail depends, among other things, on the type of property being sold. The sale of products of own production is not subject to UTII (paragraph 12, article 346.27 of the Tax Code of the Russian Federation). This means that in this case, the organization must pay taxes in accordance with the general taxation system or a simplified tax system (clause 7 of Article 346.26 of the Tax Code of the Russian Federation). An exception to this rule is the sale of semi-finished products of own production through public catering facilities (cafes, restaurants, canteens, snack bars, bars). This type of service, if other conditions are met, falls under UTII (Article 346.27 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated August 15, 2006 No. 03-11-04/3/376, dated August 23, 2006 No. 03-11-02- 185, dated November 1, 2006 No. 03-11-04/3/482).

OSNO and UTII

If an organization combines the general taxation system and UTII for semi-finished products used in activities transferred to UTII and activities on the general taxation system, it is necessary to organize separate accounting for income tax and VAT (clause 9 of article 274, clause 4, 4.1 of art. 170 of the Tax Code of the Russian Federation).

The cost of semi-finished products, which relate to activities on the general taxation system, will increase income tax expenses. The cost of semi-finished products spent in activities on UTII is not taken into account when taxing (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

The procedure for accounting for input VAT on the costs of producing semi-finished products also depends on the activity in which these semi-finished products are used. If semi-finished products are used in activities on the general taxation system, VAT can be deducted subject to the general conditions established by Article 171 of the Tax Code of the Russian Federation. If semi-finished products were used in activities on UTII, then VAT must be taken into account in their cost (clause 4 of article 170 of the Tax Code of the Russian Federation).

On the application of VAT deduction on the costs of production of semi-finished products, the purposes of which are initially unknown, see How to deduct input VAT when separately accounting for taxable and non-taxable transactions.

As a rule, it is always possible to determine which type of activity the costs of producing semi-finished products relate to. However, there may be situations where expenses relate simultaneously to two types of activities. In this case, distribute them in proportion to income (for income tax purposes) or in proportion to the share of transactions exempt from VAT (for VAT calculation purposes) (clause 9 of article 274, clause 4, 4.1 of article 170 of the Tax Code of the Russian Federation).