Concept and rules of accounting

Regulates the accounting of financial investments PBU 19/02 with the same name. It was approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n.

According to paragraphs 2-4 of PBU 19/02, financial investments are assets that do not have a material form, which generate income in the form of:

- percent;

- dividends;

- increase in value.

For example, these could be issued loans, contributions to authorized capital, shares, bills.

Financial investments are accounted for in account 58:

- by debit – receipt;

- for the loan - disposal.

It is intended to summarize information about the availability and movement of an organization’s investments:

- in government securities;

- shares, bonds and other securities of other organizations;

- authorized (share) capitals of other enterprises;

- loans provided to other organizations.

For account 58, it is allowed to open, for example, the following subaccounts:

- 58-1 “Units and shares”;

- 58-2 “Debt securities”;

- 58-3 “Loans provided”;

- 58-4 “Deposits under a simple partnership agreement”, etc.

Income and expenses arising from the disposal of financial investments are reflected in account 91 “Other income and expenses”.

Analytical accounting for account 58 is carried out by type of financial investments and the objects in which they were made. For example:

- organizations that sell securities;

- other organizations of which the enterprise is a member;

- borrowing organizations, etc.

KEEP IN MIND

The construction of analytical accounting should provide the ability to obtain data on short-term and long-term assets. At the same time, accounting for financial investments within a group of interrelated companies, the activities of which are compiled by consolidated accounting statements, is kept separately on account 58.

At least the following information must be generated for accepted securities:

- name of the issuer and name of the security;

- number, series, etc.;

- nominal price;

- purchase price;

- expenses associated with the acquisition of securities;

- total amount;

- date of purchase;

- date of sale or other disposal, storage location.

Also see “The concept of financial investments and what applies to them.”

PBU 19/02

Registered with the Ministry of Justice of Russia on December 27, 2002 N 4085

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION ORDER dated December 10, 2002 N 126n ON APPROVAL OF THE ACCOUNTING REGULATIONS “ACCOUNTING FOR FINANCIAL INVESTMENTS” PBU 19/02

(as amended by Orders of the Ministry of Finance of Russia dated September 18, 2006 N 116n, dated November 27, 2006 N 156n, dated October 25, 2010 N 132n, dated November 8, 2010 N 144n, dated April 27, 2012 N 55n, dated April 6, 2015 N 57n)

In execution of the Accounting Reform Program in accordance with international financial reporting standards, approved by Decree of the Government of the Russian Federation of March 6, 1998 N 283 (Collected Legislation of the Russian Federation, 1998, N 11, Art. 1290), I order:1. Approve the attached Accounting Regulations “Accounting for Financial Investments” PBU 19/02.

2. Recognize that Order of the Ministry of Finance of the Russian Federation of January 15, 1997 No. 2 “On the procedure for reflecting transactions with securities in accounting” has become invalid (Order registered with the Ministry of Justice of the Russian Federation on June 10, 1997, registration No. 1324).

3. Put this Order into effect starting with the financial statements for 2003.

Minister A. KUDRIN Appendix to the Order of the Ministry of Finance of the Russian Federation dated December 10, 2002 N 126n

ACCOUNTING REGULATIONS “ACCOUNTING FOR FINANCIAL INVESTMENTS” PBU 19/02

(as amended by orders of the Ministry of Finance of Russia dated 09/18/2006 N 116n, dated November 27, 2006 N 156n, dated 10/25/2010 N 132n, dated 08.11.2010 N 144n, dated 04/27/2012 N 55n, dated 04.04.2015 N 57n)

I. General provisions

1. These Regulations establish the rules for the formation in accounting and financial reporting of information about the organization’s financial investments. An organization is further understood as a legal entity under the laws of the Russian Federation (with the exception of credit organizations and state (municipal) institutions). (as amended by Order of the Ministry of Finance of Russia dated October 25, 2010 N 132n)

This Regulation is applied when establishing the specifics of accounting for financial investments for professional participants in the securities market, insurance organizations, and non-state pension funds.

2. For the purposes of these Regulations, in order to accept assets for accounting as financial investments, the following conditions must be simultaneously met:

- the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive funds or other assets arising from this right;

- transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

- the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value and so on.).

3. Financial investments of an organization include: state and municipal securities, securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills); contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies); loans provided to other organizations, deposits in credit institutions, receivables acquired on the basis of assignment of claims, etc.

For the purposes of these Regulations, contributions from a partner organization under a simple partnership agreement are also taken into account as part of financial investments.

The organization's financial investments do not include:

- own shares purchased by the joint-stock company from shareholders for subsequent resale or cancellation;

- bills issued by the organization-promissory note to the organization-seller when paying for goods sold, products, work performed, services rendered;

- investments of an organization in real estate and other property that has a tangible form, provided by the organization for a fee for temporary use (temporary possession and use) for the purpose of generating income;

- precious metals, jewelry, works of art and other similar valuables acquired for purposes other than normal activities.

4. Assets that have a tangible form, such as fixed assets, inventories, as well as intangible assets are not financial investments.

5. The accounting unit for financial investments is selected by the organization independently in such a way as to ensure the formation of complete and reliable information about these investments, as well as proper control over their availability and movement. Depending on the nature of the financial investments, the order of their acquisition and use, the unit of financial investments can be a series, batch, etc. homogeneous set of financial investments.

6. The organization maintains analytical accounting of financial investments in such a way as to provide information on the accounting units of financial investments and the organizations in which these investments are made (issuers of securities, other organizations in which the organization is a participant, borrowing organizations, etc.) .

For government securities and securities of other organizations accepted for accounting, analytical accounting must contain at least the following information: name of the issuer and name of the security, number, series, etc., nominal price, purchase price, expenses associated with acquisition of securities, total quantity, date of purchase, date of sale or other disposal, place of storage.

An organization can generate in analytical accounting additional information about the organization’s financial investments, including by their groups (types).

7. Features of the assessment and additional rules for disclosing information on financial investments in dependent business companies in financial statements are established by a separate regulatory act on accounting.

II. Initial assessment of financial investments

8. Financial investments are accepted for accounting at their original cost.

9. The initial cost of financial investments acquired for a fee is recognized as the amount of the organization’s actual costs for their acquisition, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation on taxes and fees).

The actual costs of acquiring assets as financial investments are:

- amounts paid in accordance with the contract to the seller;

- amounts paid to organizations and other persons for information and consulting services related to the acquisition of these assets. If an organization is provided with information and consulting services related to making a decision on the acquisition of financial investments, and the organization does not make a decision on such acquisition, the cost of these services is included in the financial results of a commercial organization (as part of other expenses) or an increase in the expenses of a non-profit organization of that reporting period when the decision was made not to purchase financial investments; (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

- remuneration paid to an intermediary organization or other person through which assets were acquired as financial investments;

- other costs directly related to the acquisition of assets as financial investments.

When purchasing financial investments using borrowed funds, the costs of received loans and borrowings are taken into account in accordance with the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 N 33n (registered with the Ministry of Justice Russian Federation May 31, 1999, registration N 1790), and the Accounting Regulations “Accounting for loans and credits and the costs of servicing them” PBU 15/01, approved by Order of the Ministry of Finance of the Russian Federation dated August 2, 2001 N 60n (according to Letter of the Ministry of Justice of the Russian Federation dated September 7, 2001 N 07/8985-UD The order does not require state registration).

General and other similar expenses are not included in the actual costs of acquiring financial investments, except when they are directly related to the acquisition of financial investments.

10. Excluded. — Order of the Ministry of Finance of Russia dated November 27, 2006 N 156n

.

11. If the amount of costs (except for the amounts paid in accordance with the agreement to the seller) for the acquisition of such financial investments as securities is insignificant compared to the amount paid in accordance with the agreement to the seller, the organization has the right to recognize such costs as other expenses of the organization, including the reporting period in which the specified securities were accepted for accounting. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

12. The initial cost of financial investments made as a contribution to the authorized (share) capital of an organization is recognized as their monetary value agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

13. The initial cost of financial investments received by an organization free of charge, such as securities, is recognized as:

- their current market value as of the date of acceptance for accounting. For the purposes of these Regulations, the current market value of securities is understood as their market price, calculated in the prescribed manner by the organizer of trading on the securities market;

- the amount of funds that can be received as a result of the sale of received securities on the date of their acceptance for accounting - for securities for which the market price is not calculated by the organizer of trading on the securities market.

14. The initial cost of financial investments acquired under contracts providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the value of assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets.

If it is impossible to determine the value of assets transferred or to be transferred by an organization, the value of financial investments received by the organization under agreements providing for the fulfillment of obligations (payment) in non-monetary means is determined based on the cost at which similar financial investments are acquired in comparable circumstances.

15. The initial cost of financial investments contributed to the contribution of the partner organization under a simple partnership agreement is recognized as their monetary value, agreed upon by the partners in the simple partnership agreement.

16. Excluded. — Order of the Ministry of Finance of Russia dated November 27, 2006 N 156n

.

17. Securities that do not belong to the organization by right of ownership, economic management or operational management, but are in its use or disposal in accordance with the terms of the agreement, are accepted for accounting in the assessment provided for in the agreement.

III. Subsequent assessment of financial investments

18. The initial cost of financial investments at which they are accepted for accounting may change in cases established by law and these Regulations.

19. For the purposes of subsequent assessment, financial investments are divided into two groups:

financial investments for which the current market value can be determined in the manner prescribed by these Regulations, and financial investments for which their current market value is not determined.

Organizations that have the right to use simplified accounting methods, including simplified accounting (financial) statements, can carry out a subsequent assessment of all financial investments in the manner established by these Regulations for financial investments for which their current market value is not determined. At the same time, these organizations may decide not to reflect the impairment of financial investments in accounting in cases where calculating the amount of such impairment is difficult. (paragraph introduced by Order of the Ministry of Finance of Russia dated November 8, 2010 N 144n; as amended by Orders of the Ministry of Finance of Russia dated April 27, 2012 N 55n, dated April 6, 2015 N 57n)

20. Financial investments for which the current market value can be determined in the prescribed manner are reflected in the financial statements at the end of the reporting year at the current market value by adjusting their valuation as of the previous reporting date.

The organization can make this adjustment monthly or quarterly.

The difference between the assessment of financial investments at the current market value as of the reporting date and the previous assessment of financial investments is attributed to the financial results of a commercial organization (as part of other income or expenses) or an increase in income or expenses of a non-profit organization in correspondence with the financial investment account. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

21. Financial investments for which the current market value is not determined are subject to reflection in accounting and financial statements as of the reporting date at their original cost.

22. For debt securities for which the current market value is not determined, the organization is allowed to attribute the difference between the initial cost and the nominal value during their circulation period evenly, as income is due on them in accordance with the terms of issue, to the financial results of the commercial organization ( as part of other income or expenses) or a decrease or increase in expenses of a non-profit organization. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

23. For debt securities and granted loans, an organization can calculate their valuation at a discounted value. In this case, no accounting entries are made.

The organization must provide evidence that the calculation is reasonable.

24. Financial investments are reflected in the balance sheet as of the reporting date at a cost determined based on the requirements of these Regulations.

If the current market value is not determined for an object of financial investment previously valued at the current market value, such object of financial investment is reflected in the financial statements at the value of its last valuation.

IV. Disposal of financial investments

25. The disposal of financial investments is recognized in the accounting records of the organization on the date of termination of the conditions for their acceptance for accounting, given in paragraph 2 of these Regulations. (as amended by Order of the Ministry of Finance of Russia dated 04/06/2015 N 57n)

Disposal of financial investments takes place in cases of redemption, sale, gratuitous transfer, transfer in the form of a contribution to the authorized (share) capital of other organizations, transfer on account of a contribution under a simple partnership agreement, etc.

26. When disposing of an asset accepted for accounting as a financial investment for which the current market value is not determined, its value is determined based on an assessment determined in one of the following ways:

- at the initial cost of each accounting unit of financial investments; at the average initial cost;

- at the original cost of the first financial investments acquired (FIFO method).

The application of one of the specified methods for a group (type) of financial investments is based on the assumption of consistency in the application of accounting policies.

Advertisement accounting of financial investments.

28. Securities may be valued by the organization upon disposal at the average initial cost, which is determined for each type of securities as the quotient of dividing the initial cost of the type of securities by their quantity, consisting respectively of the initial cost and the amount of balance at the beginning of the month and the securities received in during a given month.

29. Valuation at the historical cost of the first financial investments acquired (FIFO method) is based on the assumption that securities are written off within a month or another period in the sequence of their acquisition (receipt), i.e. the first securities to be written off must be valued at the original cost of the securities of the first acquisitions, taking into account the original cost of the securities listed at the beginning of the month. When applying this method, the valuation of securities in balance at the end of the month is made at the original cost of the latest acquisitions, and the cost of the securities sold takes into account the cost of the earlier acquisitions.

30. When disposing of assets accepted for accounting as financial investments for which the current market value is determined, their value is determined by the organization based on the latest assessment.

31. For each group (type) of financial investments during the reporting year, one assessment method is used.

32. The assessment of financial investments at the end of the reporting period is carried out depending on the accepted method for assessing financial investments upon their disposal, i.e. at the current market value, at the original cost of each accounting unit of financial investments, at the average original cost, at the original cost of the first financial investments acquired (FIFO method).

33. Examples of the use of valuation methods when disposing of financial investments are given in the appendix to these Regulations.

V. Income and expenses on financial investments

34. Income from financial investments is recognized as income from ordinary activities or other income in accordance with the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 N 32n (registered with the Ministry of Justice Russian Federation May 31, 1999, registration number 1791).

35. Expenses associated with the provision of loans by an organization to other organizations are recognized as other expenses of the organization. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

36. Expenses associated with servicing the financial investments of an organization, such as payment for bank and/or depository services for storing financial investments, providing an extract from a securities account, etc., are recognized as other expenses of the organization. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

VI. Impairment of financial investments

37. A sustained significant decrease in the value of financial investments for which their current market value is not determined, below the amount of economic benefits that the organization expects to receive from these financial investments under normal conditions of its activities, is recognized as depreciation of financial investments. In this case, based on the organization’s calculations, the estimated value of financial investments is determined, equal to the difference between their value at which they are reflected in accounting (accounting value) and the amount of such reduction.

A steady decline in the value of financial investments is characterized by the simultaneous presence of the following conditions:

- at the reporting date and at the previous reporting date, the accounting value is significantly higher than their estimated value;

- during the reporting year, the estimated value of financial investments changed significantly only in the direction of its decrease;

- As of the reporting date, there is no evidence that a significant increase in the estimated value of these financial investments is possible in the future.

Examples of situations in which impairment of financial investments may occur are:

- the issuing organization of securities owned by the organization or its debtor under a loan agreement has signs of bankruptcy or is declared bankrupt;

- execution of a significant number of transactions in the securities market with similar securities at a price significantly lower than their book value;

- absence or significant decrease in income from financial investments in the form of interest or dividends with a high probability of a further decrease in these income in the future, etc.

38. If a situation arises in which depreciation of financial investments may occur, the organization must check the existence of conditions for a sustainable decrease in the value of financial investments.

This check is carried out for all financial investments of the organization specified in paragraph 37 of these Regulations, for which there are signs of impairment.

If the impairment test confirms a sustained significant decline in the value of financial investments, the organization creates a reserve for impairment of financial investments in the amount of the difference between the book value and the estimated value of such financial investments.

A commercial organization forms the specified reserve at the expense of the organization’s financial results (as part of other expenses), and a non-profit organization - due to an increase in expenses. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

In the financial statements, the value of such financial investments is shown at book value minus the amount of the formed reserve for their depreciation.

A check for impairment of financial investments is carried out at least once a year as of December 31 of the reporting year if there are signs of impairment. The organization has the right to carry out this check on the reporting dates of the interim financial statements.

The organization must provide confirmation of the results of this inspection.

39. If, based on the results of an audit for impairment of financial investments, a further decrease in their estimated value is revealed, then the amount of the previously created reserve for impairment of financial investments is adjusted towards its increase and decrease in the financial result of a commercial organization (as part of other expenses) or an increase in expenses for a non-profit organization . (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

If, as a result of checking for impairment of financial investments, an increase in their estimated value is revealed, then the amount of the previously created reserve for impairment of financial investments is adjusted towards its decrease and increase in the financial result of a commercial organization (as part of other income) or decrease in expenses for a non-profit organization. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

40. If, based on available information, the organization concludes that a financial investment no longer meets the criteria for a sustainable significant decline in value, as well as upon disposal of financial investments, the estimated value of which was included in the calculation of the reserve for impairment of financial investments, the amount of the previously created reserve for impairment for the specified financial investments is included in the financial results of a commercial organization (as part of other income) or a decrease in expenses in a non-profit organization at the end of the year or the reporting period when the disposal of the specified financial investments occurred. (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

VII. Disclosure of information in financial statements

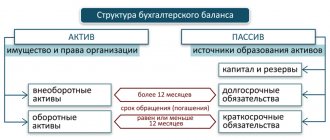

41. In financial statements, financial investments must be presented with a division depending on the maturity period (maturity) into short-term and long-term.

42. In the financial statements, at least the following information is subject to disclosure, taking into account the materiality requirement:

- methods for assessing financial investments upon their disposal by groups (types);

- the consequences of changes in the methods of assessing financial investments upon their disposal;

- the value of financial investments for which the current market value can be determined, and financial investments for which the current market value cannot be determined;

- the difference between the current market value as of the reporting date and the previous assessment of financial investments by which the current market value was determined;

- for debt securities for which the current market value has not been determined - the difference between the initial value and the nominal value during their circulation period, accrued in accordance with the procedure established by paragraph 22 of these Regulations;

- value and types of securities and other financial investments encumbered with collateral;

- the value and types of retired securities and other financial investments transferred to other organizations or persons (except for sale);

- data on the reserve for impairment of financial investments, indicating: the type of financial investments, the amount of the reserve created in the reporting year, the amount of the reserve recognized as other income of the reporting period; reserve amounts used in the reporting year; (as amended by Order of the Ministry of Finance of Russia dated September 18, 2006 N 116n)

- for debt securities and granted loans - data on their valuation at discounted value, on the value of their discounted value, on the discounting methods used (disclosed in the notes to the balance sheet and the income statement). (as amended by Order of the Ministry of Finance of Russia dated 04/06/2015 N 57n)

Appendix to the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by Order of the Ministry of Finance of the Russian Federation dated December 10, 2002 N 126n

EXAMPLES OF USE OF VALUATION METHODS WHEN DISPOSING FINANCIAL INVESTMENTS 1. Method of evaluation at the original cost of each accounting unit of financial investments

The cost of retiring financial investments is equal in this case to their original cost.

2. Valuation method based on average initial cost

The cost of securities being written off is determined by multiplying the number of retired securities (for example, shares of OJSC “S”) by the average initial cost of one security of this type (shares of OJSC “S”). The average initial cost of one security of a given type is calculated as the quotient of dividing the cost of securities of a given type by their quantity, respectively, consisting of the cost and quantity of the balance at the beginning of the month and of securities received in that month.

Example 1 (data are provided for one type of securities)

| date | Coming | Consumption | Remainder | ||||||

| quantity | price per unit, thousand rubles | amount, million rubles | quantity | price per unit, thousand rubles | amount, million rubles | quantity | price per unit, thousand rubles | amount, million rubles | |

| Balance on the 1st | 100 | 100 | 10,0 | — | — | — | 100 | 100 | 10,0 |

| 10th | 50 | 100 | 5,0 | 60 | — | — | 90 | — | — |

| 15th | 60 | 110 | 6,6 | 100 | — | — | 50 | — | — |

| 20th | 80 | 120 | 9,6 | — | — | — | 130 | — | — |

| Total | 290 | — | 31,2 | 160 | 107,6 | 17,2 | 130 | 107,6 | 14,0 |

1) Average initial cost of one security:

(10.0 million rubles + 5.0 million rubles + 6.6 million rubles + 9.6 million rubles) / 290 = 107.6 thousand rubles.

2) Value of the balance of securities at the end of the month:

130 x 107.6 thousand rubles. = 14.0 million rubles.

3) Cost of retiring securities:

31.2 million rubles. — 14.0 million rubles. = 17.2 million rubles.

or:

160 x 107.6 thousand rubles. = 17.2 million rubles.

This method can also be applied within a month for each date of disposal of securities within the month, using the estimate of the balance of securities determined by the average initial cost method on the date of the previous transaction (the so-called moving average initial cost method).

3. Method of valuation at the original cost of the first financial investments acquired (FIFO method)

Valuation of securities using the FIFO method is based on the assumption that securities are sold within a month in the sequence of their receipt (purchase), i.e. the securities that first went on sale must be valued at the original cost of the first ones acquired, taking into account the value of the securities listed at the beginning of the month. When applying this method, the valuation of securities in balance at the end of the month is carried out at the actual cost of the most recent acquisition, and the cost of sale (disposal) of securities takes into account the cost of the earlier acquisition.

The cost of retiring securities is determined by subtracting from the sum of the value of the balance of securities at the beginning of the month and the cost of securities received during the month the value of the balance of securities at the end of the month.

Example 2

| date | Coming | Consumption | Remainder | ||||||

| quantity | price per unit, thousand rubles | amount, million rubles | quantity | price per unit, thousand rubles | amount, million rubles | quantity | price per unit, thousand rubles | amount, million rubles | |

| Balance on the 1st | 100 | 100 | 10,0 | — | — | — | 100 | — | — |

| 10th | 50 | 100 | 5,0 | 60 | — | — | 90 | — | — |

| 15th | 60 | 110 | 6,6 | 100 | — | — | 50 | — | — |

| 20th | 80 | 120 | 9,6 | — | — | — | 130 | — | — |

| Total | 290 | 107,6 | 31,2 | 160 | 100,6 | 16,1 | 130 | 116,2 | 15,1 |

1) The value of the balance of securities at the end of the month based on the value of the latest receipts:

(80 x 120 thousand rubles) + (50 x 110 thousand rubles) = 15.1 million rubles.

2) Cost of retiring securities:

31.2 million rubles. — 15.1 million rubles. = 16.1 million rubles.

3) Unit cost of retiring securities:

16.1 million rubles. / 160 = 100.6 thousand rubles.

This method can also be applied within a month for each date of disposal of securities within the month, using the estimate of the balance of securities determined by the FIFO method as of the date of the previous transaction (the so-called rolling FIFO method).

Assessment of financial investments

Please note that as part of the organization of accounting for financial investments, most of them do not need to be revalued. The fact is that only securities listed on the stock exchange are taken into account at market value. The remaining financial investments - at least once a year on December 31 - must be checked for impairment and, if necessary, a reserve must be created (clauses 20 and 38 of PBU 19/02).

Also see “Which account are financial investments recorded in?”

Read also

28.05.2019