Execution period

In order to understand how a credit institution fulfills clients’ requests for financial transfers, you need to know the differences between:

- The established deadline for execution of the payment order.

- The period during which such an order is valid.

So, the deadline for executing a payment order is the time during which the payer’s funds are transferred. This period is determined by Article 31 of the Federal Law of 1990 “On Banks and Banking Activities”.

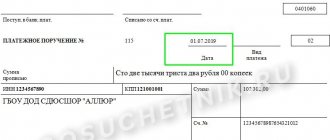

Also see “Rules for putting the date of a document in a payment order (field 109).”

The credit institution executes the order no later than one business day after the day it was received. Moreover, the bank determines the length of the operating day independently. If the order is not executed on time, the bank is obliged to pay interest.

Please note that this period does not coincide with the time period during which the order is valid. This time is determined based on other legislative norms, which we will consider further.

Please note that the time for execution of tax orders is also regulated by separate rules. According to Article 60 of the Tax Code of the Russian Federation, such a payment must be made within one business day. But if it is untimely, Articles 133 of the Tax Code of the Russian Federation and 15.8 of the Code of Administrative Offenses of the Russian Federation come into force. And the responsibility for them is completely different than just paying interest.

Having received a client request, the bank takes the following actions:

- approves the sender's right to use funds;

- analyzes the integrity of the payment order;

- analyzes the correctness of payment details;

- determines whether there are enough funds in the account to make the transfer.

If the transfer has not yet arrived at the account - that is, the irrevocability period has not expired - the payer has the right to cancel the order.

Also see “Filling out a payment order in 2021: sample.”

Important points

Payment orders can be created in paper or electronic format. In both cases, it is necessary to correctly fill out the fields of the document and enter the necessary information.

Successful settlement is possible if the required amount is available in the payer’s account. But the bank must accept a correctly drawn up payment order regardless of the presence or absence of money in the client account.

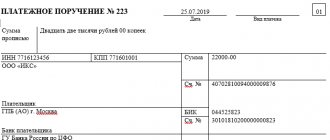

Execution of the order may be delayed until the required amount becomes available. When filling out a payment order, you need to indicate such important information as:

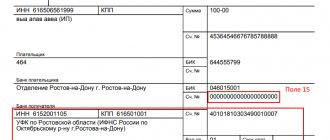

- information about the payer and recipient;

- information about participating banks;

- information about the purpose of the payment and its amount;

- date of document preparation.

Identification information is required to correctly execute the order and transfer the required amount to the specified recipient. But the date the payment was created also matters.

You can submit a payment order to the servicing bank within a certain period. If this is violated, acceptance of the document will be refused even if all other aspects are met.

The payment order submitted to the banking institution is carefully checked for errors and incorrect execution.

The operator also checks signatures and seals with the originals, checking the correspondence between the name of the recipient's bank and the correspondent account number.

After accepting the payment, the bank employee puts his signature and bank stamp on it. The accepted payment order is recorded in the registration journal and is assigned a serial number.

From this moment on, the bank assumes responsibility for the execution of the order. The payer must only ensure that there are sufficient funds in his own account.

Required terms

A payment order is a documentary order from the owner of a bank account to the servicing bank to transfer a predetermined amount to the account of a specified recipient.

An order can also be drawn up by a person who does not have a bank account, provided that he deposits cash to transfer it to the recipient in a non-cash form.

The validity period of a payment order is the period during which the document is submitted to the bank. When checking a payment for correctness, the first thing to check is the date of its creation.

An expiration date that does not meet the standards does not allow the bank to accept the order for execution. After acceptance, the bank is obliged to execute the payment document within the period specified by law.

In some cases, a shorter execution period may be established, determined by the bank account agreement or business customs.

The total period for execution of non-cash payments should not exceed:

- two working days within the territorial boundaries of a constituent entity of the Russian Federation;

- five working days within the Russian Federation.

If there are no or insufficient funds in the payer's account, unpaid payment orders are moved to a special file cabinet of documents not paid on time.

Payments are executed upon receipt of funds in the order of priority determined by law.

Purpose of payment

Funds are transferred through payment orders:

- for the supply of goods, performance of work, provision of services;

- for prepayment or for making periodic payments;

- into the budget system and extra-budgetary funds;

- to repay loans and interest on them;

- for other purposes provided for by law or agreement.

Payment order is one of the options for non-cash payments. Based on it, the bank transfers funds from the payer’s account to the account of a certain person.

Legal basis

The validity period for a payment order is established by the “Regulations on the rules for transferring funds”, approved by Order of the Bank of Russia No. 383 dated June 19, 2012.

In accordance with clause 5.5 of this standard, the validity period of a payment order is 10 calendar days from the day following the day the document is drawn up. Thus, you can submit an order to the bank not immediately, but throughout the entire period of validity.

It should be taken into account that the number of days is determined in calendar days, not working days. The total validity period includes weekends and holidays.

Validity

Now let’s look at how long a payment document for transferring money has a valid status. In accordance with clause 5.5 of the Money Transfer Rules, which were approved by the Central Bank on June 19, 2012, the validity period of a payment order is 10 calendar days (do not confuse a working day with a calendar day!).

EXAMPLE

Let's say the payment order was generated on May 15, 2017. To determine the time of its validity, you need to count 10 calendar days starting from May 16, 2021. The date you are looking for will be May 25, 2021.

Thus, the order can be presented to the credit institution for execution no later than May 25, 2021 inclusive. If you present the document later, the bank will refuse to execute it because the validity period has expired.

Knowing that the payment order is valid for 10 days, it is not difficult for the payer to calculate the date of presentation of this document to the credit institution. Therefore, taking into account the allowable period, he can plan his time wisely and visit the bank when it is convenient for him, and not immediately after drawing up a payment order.

Therefore, before going to the bank, you should make sure that the payment order is valid today.

Also see “What to write in the “Purpose of payment” column.”

Read also

07.07.2017

How many days is a payment order valid?

Now let’s consider another period of time, namely the validity period of the payment document for the transfer of funds.

It is normatively established that a payment order is valid for ten days from the date following the day of its preparation. This period is calculated not in working days, but in calendar days (clause 5.5 of the Transfer Rules approved by the Bank of Russia on June 19, 2012).

For example, a payment order was drawn up on January 10, 2021. In order to answer the question of how long a payment order is valid from the specified date, you should calculate ten calendar days starting from January 11, 2021. The relevant date is 20 January 2021. Therefore, this order can be presented to the bank for execution no later than January 20, 2021 (inclusive). If the order is submitted later, the bank will not be able to execute it due to the expiration of the deadline.

Thus, the payer, if he has information that the validity period of the payment order is ten days, has the opportunity to determine the date of presentation of the specified document for execution within the specified period.

1. If any document is missing or the external appearance of the documents does not correspond to the collection order, the executing bank is obliged to immediately notify the person from whom the collection order was received. If these deficiencies are not eliminated, the bank has the right to return the documents without execution. 2. Documents are presented to the payer in the form in which they were received, with the exception of marks and inscriptions of banks necessary for processing the collection transaction. 3. If documents are payable at sight, the executing bank must make presentation for payment immediately upon receipt of the collection order. If the documents are subject to payment at a different time, the executing bank must, in order to obtain the payer's acceptance, submit the documents for acceptance immediately upon receipt of the collection order, and the payment request must be made no later than the day the payment deadline specified in the document occurs. 4. Partial payments can be accepted in cases where this is established by banking rules, or with special permission in the collection order. 5. The received (collected) amounts must be immediately transferred by the executing bank to the issuing bank, which is obliged to credit these amounts to the client’s account. The executing bank has the right to withhold from the collected amounts the remuneration and reimbursement of expenses due to it.

Commentary on Article 875

In accordance with the Regulations on Non-Cash Payments, payment requests and collection orders are presented by the recipient of funds (collector) to the payer's account through the bank serving the recipient of funds (collector). The recipient of the funds (collector) submits the specified settlement documents to the bank in the register of settlement documents submitted for collection, compiled in duplicate. The first copy of the register is drawn up with two signatures of persons authorized to sign settlement documents and a seal. Unaccepted documents are deleted from the register of settlement documents submitted for collection and returned to the recipient of funds (collector), the number and amount of settlement documents in the register are corrected. The issuing bank, which has accepted payment documents for collection, undertakes the obligation to deliver them to their destination. This obligation, as well as the procedure and terms for reimbursement of costs for the delivery of settlement documents, are reflected in the bank account agreement with the client. Institutions and divisions of the settlement network of the Central Bank of the Russian Federation carry out forwarding of settlement documents of credit institutions themselves and other clients of the Central Bank of the Russian Federation in the manner prescribed by the regulations of the Central Bank of the Russian Federation. Credit organizations (branches) organize the delivery of payment documents to their clients independently. Payment requests and collection orders from clients of credit institutions (branches) submitted to the account of the credit institution (branch) must be sent to the institution or division of the Central Bank of the Russian Federation servicing this credit institution (branch). Payment requests and collection orders received by the executing bank are recorded in a journal indicating the payer's account number, number, date and amount of each settlement document. During registration, institutions and divisions of the settlement network of the Central Bank of the Russian Federation additionally indicate the bank identification code (BIC) of the payer's bank and the BIC of the recipient's bank (collector). All copies of received payment requests and collection orders are marked with the date and time of receipt of the settlement document. The responsible executive of the executing bank monitors the completeness and correctness of filling in the details of payment requests and collection orders, with the exception of checking the signatures and seal of the recipient of funds (collector), and also checks the presence of the stamp of the issuing bank and the signature of the responsible executor on all copies of settlement documents. Payment documents issued in violation of the requirements are subject to return. When returning payment requests or collection orders, an entry is made in the registration journal indicating the date and reason for the return. If there are no or insufficient funds in the payer’s account and if there is no provision in the bank account agreement for payment of settlement documents in excess of the funds available in the account, payment requests accepted by the payer, payment requests for direct debit of funds and collection orders are placed in the card index as “Settlement documents , not paid on time." The executing bank is obliged to notify the issuing bank about the placement of settlement documents in the card index. The specified notice is sent by the executing bank to the issuing bank no later than the business day following the day the settlement documents are placed in the card index. The issuing bank delivers a notice of filing to the client upon receipt of a notice from the executing bank. Payment of settlement documents is made as funds are received into the payer's account in the order established by law. Partial payment of payment requests, collection orders located in the card index is allowed. If payment is not received on a payment request, collection order or notice of placement in the card index, the issuing bank may, at the request of the recipient (collector) of funds, send a request to the executing bank about the reason for non-payment of the specified settlement documents not later than the business day following the day of receipt of the relevant document from the recipient of funds (collector), unless another period is provided for in the bank account agreement. In case of non-fulfillment or improper execution of the client’s order to receive payment on the basis of a payment request or collection order, the issuing bank is liable to him in accordance with the law. We are talking about liability on the grounds and in the amount provided for in Chapter. 25 Civil Code, i.e. liability that accrues in the general order. If banks fail to comply with the requirements for verifying payment documents, banks are liable for losses resulting from the execution of unlawfully issued payment requests, paid without the payers’ acceptance, or collection orders. When executing a collection order, the executing bank must present the payer with the documents of the collector in the form in which they were received, with the exception of the marks and inscriptions of the banks necessary for processing the collection operation. Calculations of payment requirements. A payment request is a settlement document containing a demand from the creditor (recipient of funds) under the main agreement to the debtor (payer) to pay a certain amount of money through the bank. Payment requirements are applied when making payments for goods supplied, work performed, services rendered, as well as in other cases provided for by the main agreement. Settlements through payment requests can be carried out with prior acceptance and without the payer’s acceptance. Without the payer's acceptance, settlements with payment requests are carried out in the following cases: 1) established by law; 2) provided for by the parties to the main agreement, subject to the provision of the bank servicing the payer with the right to write off funds from the payer’s account without his order. The payment request must indicate: a) the terms of payment; b) deadline for acceptance; c) the date of sending (handing over) to the payer the documents provided for in the contract if these documents were sent (handing over) to the payer; d) name of the goods (work performed, services rendered), number and date of the contract, numbers of documents confirming the delivery of goods (performance of work, provision of services), date of delivery of the goods (performance of work, provision of services), method of delivery of goods and other details. Settlements by payment requests, paid with the acceptance of payers. The period for accepting payment requests is determined by the parties to the main agreement. In this case, the period for acceptance must be at least 5 working days. When registering a payment request, the creditor (recipient of funds) under the main agreement indicates the number of days established by the agreement for acceptance of the payment request. In the absence of such an indication, the period for acceptance is considered to be 5 working days. On all copies of payment requests accepted by the executing bank, the responsible executor of the bank in the “Payment due date” field enters the date upon which the deadline for accepting the payment request expires. When calculating the date, working days are taken into account. The day the bank receives the payment request is not included in the calculation of the specified date. The last copy of the payment request is used to notify the payer of the receipt of the payment request. The specified copy of the payment document is transferred to the payer for acceptance no later than the next business day from the date of receipt of the payment request by the bank. The transfer of payment requests to the payer is carried out by the executing bank in the manner prescribed by the bank account agreement. Payment requests are placed by the executing bank in the file cabinet of settlement documents awaiting acceptance for payment until the payer's acceptance is received, the acceptance is refused (full or partial), or the acceptance period expires. The payer, within the period established for acceptance, submits to the bank the appropriate document on the acceptance of the payment request or refusal in whole or in part from its acceptance on the grounds provided for in the main agreement, including in the event of a discrepancy between the applied payment form and the concluded agreement, with a mandatory reference to clause, number, date of the contract and indicating the reasons for refusal. Acceptance of a payment request or refusal to accept (full or partial) is formalized by a statement of acceptance or refusal of acceptance. When accepting payment requests, the application is drawn up in two copies, the first of which is drawn up with the signatures of officials who have the right to sign settlement documents and the payer’s seal. In case of complete or partial refusal of acceptance, the application is drawn up in triplicate. The first and second copies of the application are drawn up with the signatures of officials who have the right to sign settlement documents and the payer’s seal. The responsible executive of the bank servicing the payer's account checks the correctness and completeness of the client's application for acceptance or refusal of acceptance. The last copy of the application for acceptance or refusal of acceptance is returned to the payer as a receipt for receipt of the application. An accepted payment request is paid from the payer’s account no later than the business day following the day the application was received. In case of complete refusal to accept the payment request, no later than the business day following the day of receipt of the application, it must be returned to the issuing bank along with a copy of the application for return to the recipient of the funds. In case of partial refusal to accept, the payment request is paid no later than the business day following the day of acceptance of the application in the amount accepted by the payer. One copy of the application, together with the first copy of the payment request, is the basis for debiting funds from the client’s account; another copy of the application, no later than the business day following the day the application is received, is sent to the issuing bank for transfer to the recipient of the funds. If the application for acceptance or refusal of acceptance is not received within the established period, the payment request is returned to the issuing bank on the next business day after the expiration of the acceptance period, indicating on the reverse side of the first copy of the payment request the reason for the return: “Consent for acceptance was not received.” All disagreements arising between the payer and the recipient of funds are resolved in the manner prescribed by law. Settlements with payment requests paid without the payers' acceptance. In a payment request for the direct debiting of funds from payers’ accounts on the basis of legislation, in the “Terms of payment” field, the recipient of the funds puts “without acceptance” and also makes a reference to the law on the basis of which the collection is carried out. In the “Purpose of payment” field, the collector, in established cases, indicates the readings of measuring instruments and current tariffs, or makes a record of calculations based on measuring instruments and current tariffs. In the payment request for direct debit of funds based on the agreement, in the “Terms of payment” field, the recipient of the funds indicates “without acceptance”, as well as the date, number of the main agreement and its corresponding clause providing for the right to direct debit. Direct debiting of funds from an account in cases provided for by the main agreement is carried out by the bank if there is a condition in the bank account agreement on direct debiting of funds or on the basis of an additional agreement to the bank account agreement containing the corresponding condition. The payer is obliged to provide the servicing bank with information about the creditor (recipient of funds), who has the right to submit payment requests for debiting funds without acceptance, the name of the goods, works or services for which payments will be made, as well as about the main agreement (date, number and the corresponding clause providing for the right of direct debit). The absence of a condition on direct debit of funds in a bank account agreement or an additional agreement to a bank account agreement, as well as the absence of information about the creditor (recipient of funds) and other above information are grounds for the bank to refuse to pay a payment request without acceptance. This payment request is paid in accordance with the preliminary acceptance procedure with a period for acceptance of 5 working days. When accepting payment requests for direct debiting of funds, the executive officer of the executing bank is obliged to check the presence of a reference to the legislative act (main agreement) giving the recipient of funds the right to the specified settlement procedure, as well as, in established cases, the presence of readings of measuring instruments and current tariffs or records of settlements based on measuring instruments and current tariffs. In the absence of an indication “without acceptance”, payment requests are subject to payment by the payer in the order of preliminary acceptance with a period for acceptance of 5 working days. Banks do not consider the merits of payers’ objections to debiting funds from their accounts without acceptance. Settlements by collection orders. A collection order is a settlement document on the basis of which funds are written off from payers' accounts in an indisputable manner. Collection orders are used: 1) in cases where an indisputable procedure for the collection of funds is established by law, including for the collection of funds by bodies performing control functions; 2) for collection under enforcement documents; 3) in cases provided for by the parties to the main agreement, subject to the provision of the bank servicing the payer with the right to write off funds from the payer’s account without his order. When collecting funds from accounts in an indisputable manner in cases established by law, a reference to the relevant law must be made in the collection order in the “Purpose of payment” field. When collecting funds on the basis of enforcement documents, the collection order must contain a reference to the date of issue of the enforcement document, its number, the number of the case on which the decision subject to enforcement was made, as well as the name of the body that made such a decision. If the enforcement fee is collected by a bailiff, the collection order must contain an indication of the collection of the enforcement fee, as well as a reference to the date and number of the enforcement document of the bailiff. Collection orders for the collection of funds from accounts issued on the basis of writs of execution are accepted by the recovering bank with the attachment of the original of the writ of execution or its duplicate. Banks do not accept for execution collection orders to write off funds in an indisputable manner if the executive document attached to the collection order is presented after the deadline established by law. Banks servicing debtors execute received collection orders with attached enforcement documents, or if there are no or insufficient funds in the debtor's account to satisfy the demands of the collector, they make a note on the enforcement document about the complete or partial non-fulfillment of the requirements specified in it due to the lack of funds in the debtor's account and place the collection order with the attached executive document in the file cabinet. Collection orders are executed as funds are received in the order established by law. The undisputed procedure for writing off funds is applied to obligations in accordance with the terms of the main agreement, with the exception of cases established by the Central Bank of the Russian Federation. Write-off of funds in an indisputable manner in the cases provided for by the main agreement is carried out by the bank if there is a condition in the bank account agreement on the write-off of funds in an indisputable manner or on the basis of an additional agreement to the bank account agreement containing the corresponding condition. The payer is obliged to provide the servicing bank with information about the creditor (recipient of funds) who has the right to issue collection orders to write off funds in an indisputable manner, the obligation under which payments will be made, as well as the main agreement. The absence of this information is grounds for the bank to refuse to pay the collection order. The collection order must contain a reference to the date, number of the main agreement and its corresponding clause providing for the right of undisputed write-off. Banks do not consider the merits of payers’ objections to the debiting of funds from their accounts in an indisputable manner. Banks suspend the write-off of funds in an indisputable manner in the following cases: - by decision of the body exercising control functions in accordance with the law to suspend collection; - if there is a judicial act on suspension of collection; - on other grounds provided by law. The document submitted to the bank indicates the details of the collection order, the collection of which must be suspended. When the write-off of funds under a collection order is resumed, its execution is carried out while maintaining the priority group specified in it and the calendar order of receipt of the document within the group. The writ of execution, for which the collection of funds was not carried out (except for cases of termination of enforcement proceedings) or was carried out partially, is returned together with the collection order to the issuing bank for delivery to the recoverer personally against receipt of receipt or by registered mail with notification. A writ of execution, the collection of funds for which has been made or terminated in accordance with the law, is returned by the executing bank to the court or other body that issued the writ of execution. In this case, the executing bank makes a note on the writ of execution indicating the date of its execution indicating the amount collected or the date of return indicating the basis for termination of collection.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...