Systematization of accounting

09/30/2018 Contents Equipment, buildings, structures, machines, equipment, vehicles and other property related to fixed assets can be written off from the balance sheets of enterprises, companies, organizations and institutions:

- in connection with the construction, expansion, reconstruction and technical re-equipment of enterprises, workshops or other facilities.

- that have become unusable due to physical wear and tear, accidents, natural disasters, violation of normal operating conditions and for other reasons;

- obsolete;

At the same time, property related to fixed assets is subject to write-off only in cases where it is impossible to restore it or is not economically feasible, and also when it cannot be sold or transferred to other organizations, institutions, companies, and enterprises. When decommissioning equipment at an enterprise, you should be guided, first of all, by the methodological instructions for accounting of fixed assets. Below we publish an extract from the guidelines for accounting of fixed assets, registered with the Ministry of Justice of the Russian Federation on November 21, 2003.

valid at the time of publication of the material on May 25, 2016. (You should check the official websites for changes and additions.) VI. Disposal of fixed assets 75. The cost of an item of fixed assets that is disposed of or is not constantly used for the production of products, performance of work and provision of services, or for the management needs of the organization, is subject to write-off from accounting.

76. The disposal of an item of fixed assets is recognized in the accounting records of the organization on the date of the one-time termination of the conditions for their acceptance for accounting given in “clause 2” of these Guidelines. Disposal of an item of fixed assets may occur in the following cases:

- transfers in the form of a contribution to the authorized (share) capital of other organizations, a mutual fund;

- liquidation in case of accidents, natural disasters and other emergency situations;

- sales;

- write-offs in case of moral and physical wear and tear;

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens. As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs.

Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist.

The convenience is that consultation with a lawyer is free and online.

Where and how to get free legal advice? is provided throughout the Russian Federation. Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support.

Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation. Legal advice is provided free of charge online around the clock, regardless of weekends and holidays. The response time from specialists on the website is up to 15 minutes.

There is no need to register on the Internet portal and you can send a personal appeal anonymously. Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties. Legal advice can be obtained in the following ways:

- use the online chat service;

- call the hotline.

- draw up a contact form for the feedback service;

Online legal consultation can also be carried out via email.

The advantages of the services of our law firm are due to the professional attitude of our specialists to their work, the receipt of regular training courses, as well as participation in official forums.

This ensures that individuals and businesses can receive advice that complies with current legal provisions.

Certificates are provided

Certificate of write-off of equipment that has become unusable

Using this link you can download “” for free in doc format, 12.0 KB in size. All organizations are faced with the need to write off old equipment.

Computers, office equipment and other property must be disposed of according to a write-off report. Correct write-off requires an expert opinion on the condition of the equipment, which contains an assessment confirming the impossibility of further use. A specially created commission or an invited expert organization draws up a technical inspection report, on the basis of which it is possible to write off fixed assets from the balance sheet and dispose of them.

Property tax has to be paid for equipment that has not been written off but is out of order or obsolete. You can write off fixed assets gradually - through depreciation, but there is a shorter way - drawing up an equipment write-off act. It is recommended to write off material assets that:

- obsolete;

- extremely worn out;

- damaged when repair is impossible or economically unfeasible.

- do not exist based on inventory results;

- cannot be used because they have become unusable;

Every year, the head of the organization must issue an order appointing a commission to write off fixed assets.

The chairman of such a commission is, as a rule, a deputy director, and the members of the commission are the chief accountant, economists and engineers.

In most cases, fixed assets are subject to write-off in the following cases:

- It is impossible or economically infeasible to restore the object.

- The property fell into disrepair.

- Equipment does not exist as a single entity.

All three circumstances must be present, otherwise the write-off will be illegal.

For example, you cannot write off a computer on the grounds that its performance is not sufficient to run a program. The hardware remains suitable for lower performance programs such as word processing or email.

How to write off a set of tools reasons

Equipment write-off act is a document that is drawn up by several persons and confirms the fact that the equipment has been written off.

All organizations are faced with the need to write off old equipment. Computers, office equipment and other property must be disposed of according to a write-off report.

Correct write-off requires an expert opinion on the condition of the equipment, which contains an assessment confirming the impossibility of further use.

A specially created commission or an invited expert organization draws up a technical inspection report, on the basis of which it is possible to write off fixed assets from the balance sheet and dispose of them.

Property tax has to be paid for equipment that has not been written off but is out of order or obsolete. You can write off fixed assets gradually - through depreciation, but there is a shorter way - drawing up an equipment write-off act. It is recommended to write off material assets that:

- cannot be used because they have become unusable;

- do not exist based on inventory results;

- damaged when repair is impossible or economically unfeasible.

Every year, the head of the organization must issue an order appointing a commission to write off fixed assets. The chairman of such a commission is, as a rule, a deputy director, and the members of the commission are the chief accountant, economists and engineers.

Reasons for decommissioning equipment

In most cases, fixed assets are subject to write-off in the following cases:

— The property has fallen into disrepair.

— It is impossible or economically infeasible to restore the object.

— Equipment does not exist as a single object.

All three circumstances must be present, otherwise the write-off will be illegal.

For example, you cannot write off a computer on the grounds that its performance is not sufficient to run a program.

The hardware remains suitable for lower performance programs such as word processing or email.

The write-off of the printer will be considered unreasonable if the commission does not include a technical specialist who can confirm that the fixed asset cannot be repaired. It will also not be legal to write off equipment without a decision on its disposal.

If the organization does not have a technical service that can competently confirm the impossibility of restoring equipment, you should contact third-party specialists.

The list of activities of the invited organization must include an examination of the technical condition of equipment, a documented level of qualifications of specialists for conducting diagnostics of the relevant fixed assets.

An agreement is concluded with the selected organization with the wording “Diagnostics of equipment to estimate repair costs.” If the certificate of completion of work issued by the invited organization contains a conclusion about the malfunction and impossibility of restoring the equipment, the organization that owns the fixed assets will receive sufficient grounds for write-off.

To make an informed decision about the feasibility of restoring equipment, you should:

— compare the cost of repairs with the price of new equipment;

— assess the consequences taking into account the duration of the repair;

— compare the warranty period of new and repaired equipment.

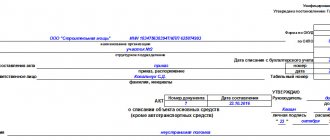

When making a decision to dispose of equipment, an appropriate act must be drawn up with photographic materials documenting the disassembled (destroyed) object.

An alternative way to write off the cost of special tools

The photographs must show the brand and serial number of the equipment.

General principles for drawing up a write-off act

Drawing up a write-off act is mandatory in office work. The fact is that each item on the balance sheet has its own value, which is indicated in the relevant accounting documents.

This means, sooner or later, there will be a need to present this item, be it to tax authorities or business buyers. And in case of its absence, documents confirming its write-off are presented.

Hence the importance of its correct preparation. The first thing to note is that, like any audit act, it has the right to be drawn up by a commission.

Its members should include:

— Heads of departments in whose department the value is located.

— Competent engineering staff.

— An accountant may be present.

“And it certainly wouldn’t hurt to have a lawyer involved.”

The act must indicate all identifying information about the value being written off.

This data may include:

— Distinctive technical characteristics.

In addition, it is necessary to clearly formulate the reason for the write-off. This reason will later become the basis. In case of write-off due to breakdown, damage received, etc., it is necessary to obtain a technical examination report before write-off. This act, in turn, will become the basis for write-off.

Structure of the write-off act

The write-off act has a header that includes the name of the document, city and date of preparation. The body of the act indicates all the data that was specified in the previous section.

After the descriptive part comes the part with the reasons. It refers to the grounds that give the right to decide on the impossibility of using the value in the future.

At the end of the body of the act, the commission makes a decision on write-off, taking into account all the grounds.

After the decision is made, all members of the commission are indicated at the end of the text. The act is signed and sent to an accountant for processing.

Sample equipment decommissioning certificate

Head of the institution _________________

(title, surname)

“__” ________________ 20__

Act of write-off of furniture, inventory, equipment and household items

from _____________ 20__

Commission consisting of: _____________________________________________,

acting on the basis of order ________________________________,

examined __________________________________________________________ (name of items)

and found them to be written off based on the following:

No. — Name of items subject to write-off — Unit of measurement — Quantity — Period established by order — Time of receipt in service

Technical condition and reasons for write-off________________________________________________________________________________________________________________________________________________ Conclusion of the commission _______________________________________________

__________________________________________________________________

Chairman of the commission _______________________

Members of the commission: _______________________ _______________________

_______________________

Conclusion of the commission in the act of acceptance of the transfer of fixed assets

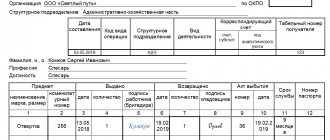

The act is endorsed by the head of the tool or planning department and submitted to the central tool warehouse (CIS), which issues tools (devices) to the workshop of the same name, brand and size according to the act without issuing requirements and limit cards.

After the warehouse issues the tools (devices), the act is transferred to the accounting department, where, according to these acts, the tools (devices) are written off from the warehouse, without reflecting their movement through the dispensing storerooms of the workshops.

Tools (devices) issued by the warehouse in the order of exchange according to acts are not reflected in the registration cards of distribution pantries.

[3] It is used to formalize the write-off of tools (devices) that have become unusable and exchange them for suitable ones at those enterprises where accounting is carried out using the exchange (working) fund method. According to the act, the unusable instrument is handed over to the storage room for scrap.

How to draw up an act for writing off materials

At his request, they collect a commission or simply attract an accounting employee to participate in the process of inventorying material assets to be written off. There is no single form of document established by law; the act is drawn up in any form, but there are also mandatory requirements for its content.

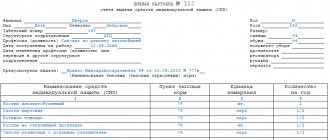

It should reflect:

- Name of the enterprise and date of registration, order number.

- Commission members participating in the write-off: their names and positions.

- List of materials to be written off: number of units or weight of each item with an indication of cost.

- Totals: total quantity and amount.

- Description of the causes of defects or damage.

- Signatures of persons participating in the process, including the financially responsible employee.

Source: https://si-center.ru/info/kak-spisat-nabor-instrumentov-prichiny/

Certificate of write-off of a tool that has become unusable

Copyright: Lori's photo bank Tools and equipment used in the enterprise become unusable over time.

If they cannot be restored and cannot be used in the future, they must be excluded from the organization’s property by writing off. This operation must be properly documented. The write-off of an instrument that has become unusable takes place in a strictly established manner and must be documented in an act (clause

56 Guidelines for accounting of special tools, approved. Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 No. 135n). This document confirms the fact of write-off and reflects the main reasons for its publication.

A well-drafted act will ensure the reliability of accounting, and regular write-off of worn-out instruments will reduce the tax burden on the organization.

Accounting and write-off of instruments

In practical activities, organizations engage a subcontractor to perform construction and installation work. The contract states that the subcontractor performs the work using the company’s materials, as well as its tools. Accounting for customer-supplied materials does not raise any questions. Let's look at how to correctly record the accounting, transfer, write-off and return of instruments if they cost up to 40,000 rubles. and are included in material and production costs (MPC).

In accordance with paragraph. 4 clause 5 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n (hereinafter referred to as PBU 6/01), assets in respect of which the conditions provided for in clause 4 are met PBU 6/01, and cost within the limit established in the organization’s accounting policy, but not more than 40,000 rubles. per unit, can be reflected in accounting and financial statements as part of the inventory. To ensure the safety of these objects in production, proper control over their movement and operation must be organized. The task of accounting is to create a system for analytical accounting of these assets. Even if assets are written off in accounting, we must ensure off-balance sheet accounting of such inventories - clause 23 of the Guidelines for the accounting of special tools, special devices, special equipment and special clothing, approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n (hereinafter referred to as the Guidelines instructions N 135n). To do this, it is necessary to reflect the cost of the instrument transferred for operation on the entered off-balance sheet account, for example 016 “Special equipment transferred for operation.”

The Ministry of Finance of Russia in Letter dated May 30, 2006 N 03-03-04/4/98 explained that if an organization decides to take into account objects as part of the inventory, it must maintain the appropriate primary documents (receipt order in form N M-4, demand invoice in form N M-11, materials accounting card in form N M-17, etc.). These forms were approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction” (hereinafter referred to as Resolution N 71a).

Since these objects meet the characteristics of fixed assets, it is advisable to indicate the expected period of use of such assets. The procedure for determining the period of use of such objects must be prescribed in the accounting policy. However, the organization should not set this period by order, since such assets are not subject to the rules for accounting for fixed assets. To indicate the expiration date, you can use the “Expiration date” column in the material accounting card M-17. In addition to maintaining primary documents, it is necessary to conduct an inventory of such objects. By means of an inventory, the compliance of accounting data with the actual availability of property and liabilities is verified.

There are no special instructions in accounting legislation regarding the inventory of assets that have already been written off from balance sheet accounts, but are actually used in production, but since the institution will use these objects for several years, it is necessary to have information about their availability. This will make it possible not to consider such objects as surpluses identified during the general inventory. The results of the inventory of inventories are documented in a separate inventory. The need for an inventory is also indicated by the fact that if shortages of such property are discovered, damages can be recovered from the guilty parties. The unified form of inventory inventory of goods and materials (INV-3) was approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88 “On approval of unified forms of primary accounting documentation for recording cash transactions, for recording inventory results” (hereinafter referred to as Resolution N 88). If during the inventory process unusable material assets are discovered, the commission draws up acts for their write-off. There is no unified form of such an act, therefore, in the accounting policy of the organization, it is necessary to approve its form of the act, and it must contain all the mandatory details listed in paragraph 2 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”.

The cost of special tools, special devices and replacement equipment is repaid only by writing off the cost in proportion to the volume of products (works, services). The cost of special tools and special devices intended for individual orders or used in mass production is allowed to be fully repaid at the time the corresponding tools and devices are transferred to production. (Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n “On approval of the Regulations on accounting and financial reporting in the Russian Federation”, paragraph 50).

Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n “On approval of the Guidelines for accounting of special tools, special devices, special equipment and special clothing” paragraph 56.

DOWNLOAD LINK:

RECORDING OF INSTRUMENTS pr. dated December 26, 2002 N 135n.docx

Accounting, transfer, write-off and return of instruments.docx

, S.A. Eagle owl, 2013

Reasons and grounds for writing off material assets

- /

- /

October 3, 2021 0 Rating Share We recommend a selection The reasons for writing off material assets can be varied: from identified defects to obsolescence. Find out more in our material about the reasons and grounds for writing off valuables. Material assets are subject to write-off if they:

- Consumed during the normal production process in the manufacture of final products or semi-finished products.

- They have lost their original properties and cannot be used for their intended purpose.

In the first case, for the write-off of each batch of raw materials and materials, there is no need for a special written permission from management - the write-off is carried out according to established standards, which must be justified and approved by the head of the enterprise.

We recommend reading: Power of attorney to represent the interests of an individual docx

The write-off process has its own characteristics, which will be discussed in one of the subsequent sections.

In the second case, writing off valuables requires an individual approach, and in each case, writing off is carried out on commission. Methods for writing off material assets should be reflected in the accounting policies of the enterprise. Detailed write-off processes (templates for documents for write-off, regulations for their execution and reflection on accounting accounts, other aspects) are prescribed in the internal regulations of the enterprise (Regulations on accounting and write-off of valuables, orders, instructions, instructions).

Thus, even before the start of writing off assets, the enterprise needs to regulate this process (develop internal regulations and instructions) and consolidate important accounting aspects in the accounting policy.

Writing off valuables during the production process is a natural process. It is impossible to make a product without using up certain materials.

It does not matter what type of final product is manufactured - write-off of raw materials is inevitable. Its quantity and types depend on the complexity and composition of the final product.

Certificate of write-off of a tool that has become unusable

If the write-off process continues for several days, for example, an inventory of property is being carried out, then you need to indicate in the act the time period of the entire process. Document title Can have two forms - “Writ-off act ...” or “Writ-off act ...”, any of the options is correct Text part Begins indicating the basis for creation. Since in most cases this is an order from the manager, this is how it is written “Based on the order...”.

The exact details of the administrative document must be indicated. Approval stamp by the manager. Placed in the upper right part of the form.

For the write-off procedure, interested parties are invited: this may be the immediate manager of the enterprise, an accounting employee, a storekeeper or another person responsible for storage and sales. The chief engineer may be invited if obsolete or defective equipment is being written off. All of the above members of the commission are personally present when the act is drawn up and seal it with their signatures. Attention: The document is approved by management and transferred to the accounting department for further accounting actions.

ImportantFor current repairs To confirm the validity of writing off materials for current repairs, an inspection report of the premises to be repaired is drawn up, indicating the indications. The list of upcoming work is approved by the manager.

Based on the estimate, an act of writing off materials for current repairs is drawn up. The act displays the actual materials consumed, indicating their cost and acquisition costs.

Example of filling out The form of the act for write-off of materials is arbitrary. But the document should be drawn up in such a way that no additional questions arise regarding the reasons and grounds for write-off.

The inventory results, prepared accordingly, will confirm the fact of a shortage of property. In addition, you need to contact the internal affairs authorities with a statement of theft. If this is not done, then the organization will not be able to reduce the income tax base on the value of stolen assets. It is possible to prove with documents that the thieves have not been found only with a copy of the decision of the investigator or inquiry officer to suspend the criminal case on the basis of subparagraph 1 of paragraph 1 of Article 208 of the Criminal Code. procedural code of the Russian Federation.

Accounting for tools and equipment

To formalize the write-off of worn-out and unsuitable for further use of MBP, an act for write-off of low-value and wear-out items is used (Form N MB-8). An organization can independently develop document forms to record the movement of property in use, which must contain the mandatory details provided for in Art. 9 Federal Law of November 21, 1996 N 129-FZ “On Accounting”, also reflecting this in its accounting policies (clause 4 PBU 1/2008 “Accounting Policy of the Organization”).

In tax accounting, costs for the acquisition of property that is not depreciable property are included in material costs in full as they are put into operation (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation). According to paragraph 1 of Art.

Certificate of write-off of a tool that has become unusable

› › › Any production process is accompanied by the acquisition, storage and use of material assets, which include tools. After completing the service life established by the manufacturer, they lose their functionality. Due to the active use of equipment to ensure production of products, premature wear is possible.

Disposal of unusable instrumentsAccidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use.

If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed.

All material assets of a business entity are taken into account in its financial documentation.

Therefore, it is impossible to simply throw away an item that is unusable.

At the very first inventory of valuables, a shortage will be identified, and the chief accountant will be presented with claims about the unreliability of accounting. Instruments that have become unusable must be removed from the register by writing off. The procedure is regulated by the norms of legal sources.

Its competent implementation makes it possible to eliminate inconsistencies in various reporting forms. In order to prevent theft of the enterprise’s property, to implement the write-off procedure it is necessary to involve a group of specialists assigned to the commission by administrative documentation. It is formed from the chairman of the commission and its members. Representatives of the organization document the fact that it is impossible to further operate the tools due to their damage, as well as the amount of equipment that is subject to write-off. A mandatory element of the write-off procedure is the drawing up of an appropriate act indicating the fact of the event and the justified reasons for its initiation.

How to write off tools that have become unusable

Contents Page 1 Instrument accounting in the IRC is carried out in the same way as in the CIS, using accounting cards. The instrument is received based on requirements, invoices or limit cards.

Writing off as expense is carried out on the basis of reports of loss (wear, breakage or loss) of the tool, which indicate the reasons and culprits for the premature failure of the tool.

According to these acts, worn-out instruments are handed over to a restoration base or scrapped.

Accounting for tools and devices in factory warehouses and distribution warehouses is organized similarly to accounting in material warehouses.

Accounting for instruments in the CIS is carried out in an accounting group using graded turnover cards, filled out daily on the basis of primary receipt and expenditure documentation, or in a document-copy form by laying out primary documents in a card index with the output of the current balance and monthly recording of the turnover results in a monthly graded turnover card . Instrument accounting should be concentrated in the OGM.

Each instance of a flat tool is assigned an individual number.

The book of registration of flat tools indicates the workshop in which the tool is operated and the frequency of its inspection.

Planar tools are repaired only in a special area. The quality control department systematically monitors the condition of flat tools in the workshops according to a schedule.

A tool that has lost its accuracy is removed from service and sent for repair to the RMC. If the instrument being tested turns out to be suitable, a note is made about this in its passport. Accounting for tools, fixtures and low-value equipment is kept in a separate sub-account.

Accounting is organized in the same way as accounting for materials in a warehouse. Accounting for tools, devices and equipment in use is organized in different ways in workshops. To account for tools (devices) issued to a worker from the shop storeroom for short-term use, a tool mark is used, which is returned to the worker when the tools are handed over to the storekeeper.

Certificate of write-off of a tool that has become unusable

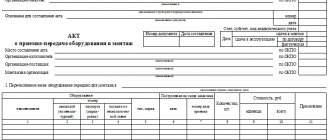

The act on write-off of inventory and household supplies in the form 421-APK is intended to formalize the write-off of small inventory and other household supplies upon their complete or partial liquidation due to wear and tear and loss of their consumer properties or upon expiration of the established service life and inexpediency (economic, physical, etc.). etc.) their further use. The same document serves as the basis for recording returnable waste or items for disposal received during the liquidation of inventory and household supplies (scrap metal, rags, firewood, tools and other items that have become unusable, etc.).

The report is drawn up by the commission for each case of industrial and household equipment and other household supplies that have become unusable at the relevant places of their operation (departments, farms, teams, workshops, etc.). The commission includes the head of the on-farm unit, the financially responsible person and other employees associated with the operation of these items. The act must indicate the full names of the disposed items, quantity, price, amount, reasons for disposal and methods of destruction of the named items so that during the re-inventory they are not presented in place of new items.

On the back of the act is a calculation of the results of the liquidation of written-off items.

In this case, returnable waste (scrap metal, firewood, rags, etc.) is subject to capitalization as material assets received from the liquidation of the corresponding inventory items and household supplies.

The act is checked by the chief accountant (especially from the standpoint of the legality of writing off items and posting returnable waste) and approved by the head of the farm, after which the accounting department makes all the necessary entries in the accounting accounts based on the document.

We recommend reading: Obtaining a residence permit for a child of a Russian citizen

Contents Hello, help me find information about the correct write-off of gasoline used in lawn mowers, on the basis of which the documents. The legislation has developed standards for fuel write-off only for motor vehicles.

Monitoring the safety of valuables and their timely write-off

Please note that if tools and inventory are accounted for as inventories, their cost is transferred to costs immediately at the time of transfer to production. How then to control the safety of property?

IMPORTANT: even if the SPI of inventory and tools is less than 12 months, it is necessary to develop a system for monitoring their safety.

It turns out that such a procedure is not enshrined in law, which means that each company must develop and fix it independently. In practice, this is solved in the following ways:

- Accounting sheet by department

- Off-balance sheet accounting of MC

The main thing is to consolidate the chosen method in the accounting policy and strictly follow it. So in the chart of accounts there are no separate sub-accounts for such values; you need to create such an account yourself.

If everything is done according to the rules, the write-off of inventory and household supplies will not go unnoticed by the accounting service. They will have to make a reverse posting based on the relevant act.

If you find an error, please select a piece of text and press Ctrl+Enter.

Write-off of a tool that has become unusable

› The MB-5 act is endorsed by the head of the tool department and submitted to the central tool warehouse (CIS), which issues the workshop tools (devices) of the same name, brand and size according to the act without issuing invoices for release of form M-11 and limit-fence cards.

After the tools are issued by the warehouse, the act is transferred to the accounting department, where, according to these acts, the tools are written off from the warehouse, without reflecting their movement through the dispensing storerooms of the workshops. Instruments issued by the warehouse in the order of exchange according to acts are not reflected in the storage cards for distributing storerooms. [13] It is used to formalize the write-off of tools (devices) that have become unusable and exchange them for suitable ones at those enterprises where accounting is carried out using the exchange (working) fund method.

According to the act, the unusable instrument is handed over to the storage room for scrap. The act is endorsed by the head of the tool or planning department and submitted to the central tool warehouse (CIS), which issues tools (devices) to the workshop of the same name, brand and size according to the act without issuing requirements and limit cards.

After the warehouse issues the tools (devices), the act is transferred to the accounting department, where, according to these acts, the tools (devices) are written off from the warehouse, without reflecting their movement through the dispensing storerooms of the workshops.

Tools (devices) issued by the warehouse in the order of exchange according to acts are not reflected in the registration cards of distribution pantries. All this is done without passing through dispensing pantries in the company’s scattered workshops.

The document must be filled out clearly according to the instructions in accordance with the assigned fields. For current repairs As confirmation of the validity of writing off materials for current repairs, an inspection report of the premises to be repaired is drawn up, indicating the indications. The list of upcoming works is approved by the manager.

Based on the list, a repair estimate is prepared, which shows the required amount of materials. Cost indicators are conditional.

Sample document for decommissioning of power tools

Related Articles

Supervision of judges in Russia

Agreement on shared ownership of an apartment in a new building

At what age does the inheritance of a gift come into effect?

Who endorses acts for writing off tools and inventory The form must be endorsed correctly. It is legally regulated that the document must bear the signature of the head of the tool shop. He can also be replaced by the head of the planning department. Only in this form should paper arrive at the production CIS - the central tool warehouse. It is the CIS at the manufacturing enterprise that is responsible for issuing tools to workers and equipment to employees. The CIS has the authority to keep records of the movement of property without issuing special limit cards and invoice requirements, but the department is obliged to draw up acts. The finished document is sent to the accounting department. The accountant will write off items using this form. All this is done without passing through dispensing pantries in the company’s scattered workshops. The document must be filled out clearly according to the instructions in accordance with the assigned fields.

Write-off of a tool that has become unusable

A full explanation on the topic: “writing off a tool that has become unusable” from a professional lawyer with answers to all your questions. Contents Any production process is accompanied by the acquisition, storage and use of material assets, which include tools.

After completing the service life established by the manufacturer, they lose their functionality. Due to the active use of equipment to ensure production of products, premature wear is possible. Accidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use.

If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed. All material assets of a business entity are taken into account in its financial documentation.

Therefore, it is impossible to simply throw away an item that is unusable. At the first inventory of valuables, a shortage will be identified, and the chief accountant will be presented with claims about the unreliability of accounting records.

Instruments that have become unusable must be removed from the register through write-off. The procedure is regulated by the norms of legal sources. Its competent implementation eliminates inconsistencies in various reporting forms. In order to prevent theft of the enterprise's property, to implement the write-off procedure it is necessary to involve a group of specialists assigned to the commission by administrative documentation.

It is formed from the chairman of the commission and its members. Representatives of the organization document the fact that it is impossible to further use the tools due to their damage, as well as the amount of equipment that is subject to write-off.

A mandatory element of the write-off procedure is the drawing up of an appropriate act indicating the fact of the event and the justified reasons for its initiation. The number of instruments and their identifying information are displayed in the receipt documentation.

Write-off of materials that have become unusable

Free consultation by phone Contents

What the inspectorate will be able to request from auditors From 2021

a new article will appear in the Tax Code. 93.2, which will oblige auditors to provide the tax service with information and documents relating to companies that were audited.

What is this innovation connected with and how does it threaten organizations? → Accounting consultations → Inventories Updated: June 6, 2021 Organizations often face a situation where their inventories or valuables become unusable or are used in production (for example, raw materials).

In this case, the law requires organizations to deregister these values.

To do this, an act of writing off material assets is drawn up, a sample of which is given in this article. The organization’s material assets include:

- raw materials;

- finished products.

- stocks;

- unfinished production;

The write-off of material assets means the documented removal of material assets from the organization’s records. The need to write off material assets most often arises in connection with the following circumstances:

- loss of quality as a result, for example, of a flood or fire;

- putting raw materials into production;

- end of service life;

- incurring losses in connection with the maintenance of material assets.

- breaking;

- wear;

These circumstances are usually identified by persons responsible for material assets in the organization. In all cases, accounting for such material assets is unprofitable for the organization and entails additional costs. In addition, failure to write off material assets can become a basis for abuse by persons directly working with the assets. Before the manager makes a decision to write off, a special commission carries out its work.

Material write-off act

In particular, during the procedure for writing off materials, supporting documents can be used. Before writing off material assets, the enterprise must conduct an inventory of property and enter its results into the relevant documents. This document must necessarily contain information about the enterprise and the members of the write-off commission: their positions, surnames, first names, patronymics, as well as a detailed list of materials being written off, including their quantity and cost (piece and total), the reason for write-off.

Reason for writing off a tool that has become unusable

Any production process is accompanied by the acquisition, storage and use of material assets, which include tools. After completing the service life established by the manufacturer, they lose their functionality.

Due to the active use of equipment to ensure production of products, premature wear is possible.

Accidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use. If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed.

Equipment write-off act is a document that is drawn up by several persons and confirms the fact that the equipment has been written off. All organizations are faced with the need to write off old equipment. Write-off of a tool that has become unusable The Equipment Write-Off Certificate is a document that is drawn up by several persons and confirms the fact that the equipment has been written off.

All organizations are faced with the need to write off old equipment.

Computers, office equipment and other property must be disposed of according to a write-off report. Correct write-off requires an expert opinion on the condition of the equipment, which contains an assessment confirming the impossibility of further use.

A specially created commission or an invited expert organization draws up a technical inspection report, on the basis of which it is possible to write off fixed assets from the balance sheet and dispose of them. Property tax has to be paid for equipment that has not been written off but is out of order or obsolete. You can write off fixed assets gradually - through depreciation, but there is a shorter way - drawing up an equipment write-off act.

It is recommended to write off material assets that: Every year, the head of the organization must issue an order appointing a commission to write off fixed assets.

Related documents

- Sample. Act on writing off damaged work record forms

- Sample. Act on write-off of low-value and high-wear items. Form No. MB-8

- Sample. Act on write-off of fixed assets. Form No. os-3 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Sample. Act on mutual settlements (offsets)

- Sample. Act on liquidation of fixed assets. Form No. os-4 (order of the Central Statistical Office of the USSR dated December 14, 1972 No. 816)

- Sample. Certificate of valuation of machinery, equipment and other fixed assets (appendix to the agreement on the procedure for using federal property assigned to a state educational institution with the right of operational management) (pi

- Sample. Certificate of assessment of the cost of unfinished capital construction and uninstalled equipment (appendix to the agreement on the procedure for using federal property assigned to a state educational institution on the right

- Sample. An act of assessing the value of isolated water bodies, forests, perennial plantings, buildings, structures, aircraft and sea vessels, inland navigation vessels, space objects and other property that is subject to special regulations

- Sample. Act report on the consumption of alcohol from the warehouse

- Sample. Statement No. 1

- Sample. Statement No. 10

- Sample. Statement No. 11

- Sample. Statement No. 12

- Sample. Statement No. 13

- Sample. Statement No. 15

- Sample. Statement No. 16

- Sample. Statement No. 18

- Sample. Statement No. 2

- Sample. Statement No. 2.1

- Sample. Statement No. 5