The concept of a separate unit

According to Article 11 of the Tax Code of the Russian Federation, a division is recognized as separate if it satisfies two conditions:

- geographically isolated from the organization;

- has stationary jobs created for a period of more than a month.

In a letter dated August 18, 2015 No. 03-02-07/1/47702, the Russian Ministry of Finance explained that the territorial isolation of a unit from an organization is determined by an address different from the address of the specified organization. The concept of a workplace is defined by Article 209 of the Labor Code of the Russian Federation as a place where an employee must be, or where he needs to arrive in connection with work and which is directly or indirectly under the control of the employer (letter of the Ministry of Finance of Russia dated September 13, 2016 No. 03-02-07/1 /53392).

If a separate division through which business activities are carried out has not been registered for tax purposes, then the organization can be held liable under paragraph 2 of Article 116 of the Tax Code of the Russian Federation (see, for example, resolution of the Arbitration Court of the North Caucasus District dated July 21, 2015 No. F08 -4287/2015 in case No. A32-29169/2014). According to this article, conducting activities by an organization or individual entrepreneur without registering with the tax authority entails a fine in the amount of 10 percent of the income received during the specified time as a result of such activities, but not less than 40 thousand rubles.

If a separate division has just been created

Calculating the profit of a separate division involves using indicators in the formulas as a whole for the reporting period. But what if a separate division was opened recently, in the current reporting quarter?

In this case, data on the average number of employees, the amount of remuneration for their labor and the residual value of fixed assets are determined from the moment of creation of such a structure. This approach is discussed, in particular, in the letter of the Ministry of Finance of Russia No. 03-03-06/1/40 dated January 30, 2013.

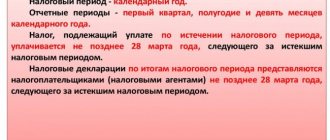

Calculation, payment and reporting of tax by separate divisions

The specifics of calculating and paying income tax by a taxpayer who has separate divisions are defined in Article 288 of the Tax Code of the Russian Federation.

The calculation and payment of advance payments (tax) to the federal budget is carried out by the taxpayer at the place of registration in the general manner, that is, without distributing these amounts among separate divisions. Advance payments (tax) to the budget of the constituent entities of the Russian Federation must be calculated and paid both at the location of its location and at the location of each separate unit. Tax amounts are determined based on the tax base (profit share) of the separate division and the tax rate established in the territory of each constituent entity of the Russian Federation.

Both the organization itself (hereinafter referred to as the head office) and its separate division, if it has a current account, can transfer advance payments (tax) to the budget of the constituent entities of the Russian Federation.

If a taxpayer has several separate divisions on the territory of one constituent entity of the Russian Federation, then he can choose a responsible division through which the tax will be paid. The organization must report such a decision to the tax authorities at the location of these divisions before December 31 of the year preceding the tax period.

If a taxpayer with separate divisions has changed the procedure for paying income tax, as well as if the number of structural divisions in the territory of a constituent entity of the Russian Federation has changed, or other changes have occurred that affect the procedure for paying tax, then the corresponding notifications must be submitted to the tax authority.

The recommended standard forms for such notifications, as well as the scheme for sending notifications when changing the procedure for paying income tax to the budgets of constituent entities of the Russian Federation, were provided by the Federal Tax Service of Russia in letter No. ShS-6-3/986 dated December 30, 2008.

Determination of profit share

The share of profit attributable to a separate division is determined as the arithmetic average of the share of the average number of employees (or labor costs) and the share of the residual value of the depreciable property of this division, respectively, in relation to similar indicators for the taxpayer as a whole (clause 2 of Art. 288 of the Tax Code of the Russian Federation).

The share of the average number of employees (labor costs) is called the labor indicator, and the share of the residual value of depreciable property is called the property indicator.

The rules for determining the average number of employees are set out in Rosstat Order No. 498 dated October 26, 2015. The Russian Ministry of Finance indicated that the average number of employees of a separate division must be determined based on the actual location of the employees’ labor activities (letter dated December 27, 2011 No. 03-03-06/2 /201).

The amount of labor costs is determined in accordance with Article 255 of the Tax Code of the Russian Federation.

The taxpayer must record the choice between one or another option for determining the labor indicator in an order on the organization’s accounting policy. It should be taken into account that it is not allowed to change the option for determining this indicator established in the accounting policy during the tax period.

To calculate the property indicator, the residual value of fixed assets (FPE), determined in accordance with paragraph 1 of Article 257 of the Tax Code of the Russian Federation, is taken into account, that is, according to tax accounting data. An organization has the right to use accounting data if it calculates depreciation in tax accounting using a non-linear method.

The average (average annual) residual value of fixed assets for the reporting (tax) period is determined according to the methodology set out in paragraph 4 of Article 376 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 10, 2013 No. 03-03-06/1/11824).

When determining the specific weight of the residual value of depreciable property:

- depreciable property of the separate division in which this property is actually used to generate income is taken into account, regardless of which division’s balance sheet it is accounted for (letter of the Federal Tax Service of Russia dated April 14, 2010 No. 3-2-10/11).

- the residual value of fixed assets not related to depreciable property is not taken into account (letters of the Ministry of Finance of Russia dated May 23, 2014 No. 03-03?РЗ/24791, dated April 20, 2011 No. 03-03-06/2/66), as well as the cost of capital investments in leased fixed assets (letter of the Ministry of Finance of Russia dated March 10, 2009 No. 03-03-06/2/36).

If fixed assets are not listed on the balance sheet of a separate division, then the share of depreciable property for this division is zero. Therefore, the share of profit attributable to this division is determined by dividing in half only the labor indicator of this division (letter of the Ministry of Finance of Russia dated 04/09/2013 No. 03-03-06/1/11551).

If neither the parent organization nor its separate divisions have fixed assets, then only the labor indicator is involved in calculating the share of profit for such a division (letter of the Ministry of Finance of Russia dated May 29, 2009 No. 03-03-06/1/356).

The share of profit of a separate (head) division is determined on an accrual basis at the end of each reporting period and at the end of the tax period.

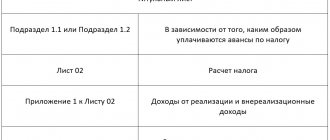

Submission of income tax returnsThe tax return for corporate income tax (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] , hereinafter referred to as the Order) is submitted to the tax authorities at the location of the parent organization and at the location of each separate division ( clause 5 of article 289 of the Tax Code of the Russian Federation, clause 1.4 of the Order). If the tax is transferred only through the parent organization or a responsible separate division, then a declaration at the location of the separate divisions through which the tax is not paid does not need to be submitted (letter of the Federal Tax Service of Russia dated April 11, 2011 No. KE-4-3 / [email protected] ). In what composition should an organization with separate divisions submit declarations in addition to those sheets that are common to all taxpayers? At the location of the head unit, it is necessary to fill out and submit Appendix No. 5 to Sheet 02 of the declaration in the number of pages corresponding to the number of existing separate units (clause 10.1 of the Order). At the location of the separate unit, a declaration should be submitted, which should include (clause 1.4 of the Order):

|

Calculation for separate divisions, if there are several of them

If a company works with several structural divisions, each of them located in different regions, then the distribution of profit shares occurs in a similar manner, a larger number is simply taken into account. If an organization has two OPs in the same region, then it is not necessary to carry out calculations for each of them. The data on them can be summed up, and income tax can be transferred as a general indicator through one separate division in this region.

The decision on choosing the structure responsible for transferring tax in a given region must also be conveyed to the local tax authorities with which the company is registered at the location of its OP. This must be done before December 31 of the year preceding the tax period in which the corresponding calculations will be made. You also need to inform the inspectorate about planned changes in the procedure for transferring income tax by separate divisions in the region.

Calculation of income tax in "1C: Accounting 8 CORP" (rev. 3.0)

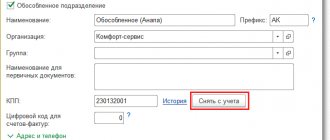

The distribution of income tax among the constituent entities of the Russian Federation in 1C: Accounting 8 CORP is performed automatically. For tax accounting of divisions in the context of constituent entities of the Russian Federation, the reference book Registration with tax authorities (registration with the Federal Tax Service) is used.

Registration data with the Federal Tax Service is indicated:

- for the parent organization and separate divisions allocated to a separate balance sheet - in the organization card;

- for separate divisions that are not allocated to a separate balance sheet - in the Divisions directory.

If the division is not separate and belongs to the internal structure of the head division or a separate division allocated to a separate balance sheet, then registration with the Federal Tax Service is not completed for it.

To determine the labor indicator, the program analyzes labor costs (determining the labor indicator based on the average number of employees in the program is not supported). Labor costs of a separate division are determined according to the list of organizations and divisions for which the same registration data is established by the Federal Tax Service, as turnover in the debit of cost accounting accounts by cost items with the types:

- Salary;

- Voluntary personal insurance, which provides for payment of medical expenses by insurers;

- Voluntary personal insurance in case of death or disability;

- Voluntary insurance under long-term life insurance contracts for employees, pension insurance and (or) non-state pension provision for employees.

To determine the share of the residual value of depreciable property, the program takes into account the residual value of fixed assets according to tax accounting data. The average residual value of fixed assets for the reporting (tax) period is determined as the quotient:

- the amount obtained as a result of adding the values of the residual value of fixed assets on the first day of each month of the reporting (tax) period and the first day of the month following the reporting (tax) period;

- the number of months in the reporting (tax) period, increased by one.

When calculating the property indicator for a separate division, the balance on the debit of accounts 01 “Fixed assets” and 03 “Income-generating investments in material assets” and the balance on the credit of account 02 “Depreciation of fixed assets” are analyzed according to the list of organizations and divisions for which the same registration data is established to the Federal Tax Service. Data on land plots and capital investments in leased property are excluded from the calculation.

The calculation of income tax in the context of budgets and inspections of the Federal Tax Service is carried out monthly by the regulatory operation Calculation of income tax, which is included in the processing of Closing the month, and is confirmed by certificates and calculations:

- Distribution of profits among the budgets of the constituent entities of the Russian Federation;

- Calculation of income tax.

Determination of profit shares in separate divisions

Let's look at how 1C:Accounting 8 CORP version 3.0 automatically calculates profit shares and fills out tax returns for separate divisions.

Example 1

| The organization Comfort-Service LLC applies OSNO, the provisions of PBU 18/02, and at the end of the reporting period pays only quarterly advance payments. The organization Comfort-Service LLC is registered in Moscow, and has two separate divisions, which are located in St. Petersburg, in Anapa (Krasnodar Territory) and are registered with the Federal Tax Service at their location. The accounting policy of the LLC stipulates that when calculating the share of profit of separate divisions, labor costs are used as a labor indicator. Transfer of advance payments (tax) to the budget of a constituent entity of the Russian Federation is carried out by the parent organization (Moscow). At the end of the first quarter of 2021, the tax base for income tax for the organization as a whole amounted to RUB 334,880. The income tax rates for the budgets of the constituent entities of the Russian Federation do not differ and amount to 17%. Labor costs and the residual value of fixed assets according to tax accounting data are presented in Table 1. Table 1 No.

|

Let's calculate the share of profit attributable to each separate division (including the parent organization) of Comfort-Service LLC for the first quarter of 2021.

The share of labor costs is:

- at the head office in Moscow - 65.22% (RUB 300,000 / RUB 460,000 x 100%);

- for a separate division in St. Petersburg - 21.74% (RUB 100,000 / RUB 460,000 x 100%);

- for a separate division in Anapa - 13.04% (RUB 60,000 / RUB 460,000 x 100%).

The average residual value of fixed assets is:

- for the organization as a whole - 211,950 rubles. (0 rub. + 150,000 rub. + 354,000 rub. + 343,800 rub.) / 4);

- for the head office in Moscow - 108,000 rubles. (0 rub. + 150,000 rub. + 144,000 rub. + 138,000 rub.) / 4);

- for a separate division in St. Petersburg - 103,950 rubles. (0 rub. + 0 rub. + 210,000 rub. + 205,800 rub.) / 4);

- for a separate division in Anapa - 0 rub. (0 rub. + 0 rub. +0 rub. +0 rub. / 4).

The share of the residual value of depreciable property is:

- at the head office in Moscow - 50.96% (RUB 108,000 / RUB 211,950 x 100%);

- for a separate division in St. Petersburg - 49.04% (RUB 103,950 / RUB 211,950 x 100%);

- 0.00% - for a separate division in Anapa (0 rub. / 211,950 rub. x 100%).

The share of the tax base (profit) is:

- at the head office in Moscow - 58.09% ((65.22% + 50.96%) / 2);

- for a separate division in St. Petersburg - 35.39% ((21.74% + 49.04%) / 2);

- for a separate division in Anapa - 6.52% ((13.04% + 0%) / 2).

To avoid errors associated with rounding, in “1C: Accounting 8 KORP” version 3.0, the calculation of profit shares is carried out with an accuracy of ten decimal places (Fig. 1).

Rice. 1. Help-calculation of profit distribution according to the budgets of the constituent entities of the Russian Federation

Based on the calculated shares, the program automatically determines the tax base, calculates the amount of tax for each separate (including the head) division, and generates transactions by budget and the Federal Tax Service (Fig. 2). To simplify the example, we assume that the balance of settlements with budgets of all levels for all Federal Tax Service Inspectors at the beginning of 2021 is equal to zero.

Rice. 2. Analysis of account 68.04.1 for the first quarter of 2107

We will generate a set of tax returns for the first quarter of 2021 in the 1C:Reporting service. When creating a new version of the Income Tax Declaration report, the default title page contains the details of the head office (Moscow), namely:

- in the Submitted to the tax authority (code) field—indicate the code of the tax authority in which the head office is registered (7718);

- in the field at the location of the registration (code) - indicate the code: 214 (At the location of the Russian organization that is not the largest taxpayer).

The main sheets and indicators of the Declaration, including Appendix No. 5 to Sheet 02, are filled in automatically (Fill button) according to tax accounting data.

The income tax declaration, which is submitted at the location of the head unit, includes Appendix No. 5 to Sheet 02 in the amount of three pages corresponding to the number of registrations with the Federal Tax Service (for the head office and two separate units). Figure 3 shows a fragment of the first page of Appendix No. 5 to Sheet 02 of the Declaration, compiled for the head unit.

Rice. 3. Appendix No. 5 to Sheet 02 of the Declaration - page 1

In the Calculation compiled (code) field, the value will be indicated: 1 - for an organization without separate divisions included in it. The field assigning the obligation to pay tax to a separate division must be filled in manually (specify the value: 1 - assigned).

In Appendix No. 5 to Sheet 02 compiled for separate divisions (on pages 2 and 3), in the field Calculation compiled (code) the value will be indicated: 2 - for a separate division. The field assigning the obligation to pay tax to a separate division must be filled in manually (specify the value: 0 - not assigned).

Subsection 1.1 of Section 1 of the Declaration for the head unit will be automatically filled in according to the declaration data:

- on line 040 - the amount of tax to be paid additionally to the federal budget is indicated (RUB 10,046);

- on line 070 - the amount of tax to be paid additionally to the budget of the city of Moscow is indicated (RUB 33,068).

When filling out a tax return, which is submitted at the location of a separate division, on the title page the user must indicate the appropriate code of the tax authority, selecting it from the list of registrations, and the code for the place of submission of the declaration: 220 (At the location of a separate division of the Russian organization). By clicking the Fill button, the program will automatically generate a set of Declaration sheets for the specified separate division. Appendix No. 5 to Sheet 02 is filled out similarly to the corresponding page of Appendix No. 5 to Sheet 02 of the Declaration, which is submitted at the location of the head unit.

In subsections 1.1 of Section 1 of the Declaration for each separate division, only line 070 will be filled in:

- RUB 20,148 — the amount of tax to be paid additionally to the budget of St. Petersburg;

- RUB 3,713 — the amount of tax to be paid additionally to the budget of Anapa.

Calculation of income tax at different tax ratesAccording to the laws of the constituent entities of the Russian Federation, the tax rate can be lowered for certain categories of taxpayers (clause 1 of Article 284 of the Tax Code of the Russian Federation). That is why, for organizations that have separate divisions, only the tax rate for calculating the tax payable to the federal budget is entered in Sheet 02 of the Declaration (line 150), and lines 160 and 170 are not filled in (clause 5.6 of the Order). Let's change the conditions of Example 1: let the tax rates to the regional budget for separate divisions be different. In this case, in the Taxes and reporting settings form in the Income tax section (hereinafter referred to as income tax settings), next to the Regional budget field, you must set the Differs for separate divisions flag. After setting the flag, the Tax Rates for Separate Subdivisions hyperlink becomes active. This hyperlink opens the form “Income tax rates for the budget of the subjects of the Republic of Belarus”, where you need to indicate the tax rate for each separate division (for each registration with the tax authority). Let’s say the tax rate for the head division (Moscow) is 13.5%. The reduced rate will not affect the calculation of profit shares in any way. It will only affect the calculated tax. Figure 4 shows the Certificate of Income Tax Calculation for March 2021, which clearly shows the tax calculation for each separate division based on the corresponding profit shares and rates, and also determines the calculated rate. Rice. 4. Help - calculation of income tax at different rates Why is an estimated rate required? According to the Accounting Regulations “Accounting for calculations of income tax of organizations” PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n, hereinafter referred to as PBU 18/02), the conditional income tax expense (income) and permanent and deferred tax assets and liabilities (PNA and PNO) are determined based on the income tax rate established by the legislation of the Russian Federation on taxes and fees and in force on the reporting date. At the same time, PBU 18/02 does not contain a description of the specifics of calculating these indicators for a taxpayer with separate divisions. Therefore, the accountant has the right to indicate it in the accounting policies of the organization at his own discretion. Users of “1C: Accounting KORP” version 3.0 are asked to use the estimated rate when calculating the conditional expense (income) for income tax, PNA and PNO. The estimated rate is determined for each month using the formula: Estimated rate = Tax amount / Base amount, where: The tax amount is the total amount of income tax for all constituent entities of the Russian Federation payable in the current month; The base amount is the profit of the current month, calculated according to accounting data. |

How to report taxes

The presence of a branch network obliges the taxpayer to report for himself, for the legal entity as a whole and for each branch. The income tax return of a separate division is submitted to the Federal Tax Service at the place of registration of the branch, and the final reporting for the legal entity is sent to the inspectorate at the place of registration of the parent organization.

The declaration of the head institution must contain information on the amounts of non-profit income calculated for each structural department. To do this, fill out Appendix No. 5 to sheet 02 of the tax return for NNP. In this part of the reporting, the branch’s checkpoint and the amount of the fiscal liability calculated from the amount of profit are indicated.

New opportunities for tax accounting in 1C:Accounting 8 KORP

The 1C:Accounting 8 CORP program, edition 3.0, provides functionality that significantly simplifies accounting, as well as the generation and presentation of income tax reporting in the presence of separate divisions:

- starting from version 3.0.45, you can generate a single declaration for a group of separate divisions registered in the same region;

- Automated filling out of declarations when closing separate divisions. This functionality is supported with the release of subsequent versions.

One region - one declaration

The legislation of the Russian Federation allows the use of a centralized procedure for calculating and paying income tax: if several separate divisions are located in one region, then the organization has the right to submit to the tax authority a single income tax return for this region, without distributing profits to each of these divisions (clause 2 Article 288 of the Tax Code of the Russian Federation).

In this case, one should take into account the opinion of the Federal Tax Service of Russia, according to which a taxpayer who has separate divisions in various constituent entities of the Russian Federation does not have the right to pay tax in one subject for a group of divisions through a responsible division, and in another subject - for each division separately. In letter No. 3-2-10/8 of the Federal Tax Service of Russia dated March 25, 2009, it is noted that the Tax Code of the Russian Federation does not provide for the simultaneous application by taxpayers in various constituent entities of the Russian Federation of the procedure for calculating and paying tax through a responsible separate division and for each separate division.

The tax payment procedure applied by the taxpayer applies to newly created separate divisions from the moment of their creation.

If an organization and its separate division are located on the territory of one constituent entity of the Russian Federation, then the taxpayer has the right to decide to pay income tax for this division at the place of its registration. In this case, the declaration is submitted only to the tax authority at the location of the head office (letter of the Ministry of Finance of Russia dated November 25, 2011 No. 03-03-06/1/781).

Now the possibility of centralized calculation and payment of tax also exists in the 1C: Accounting 8 CORP program (rev. 3.0). In the income tax settings, you can select the order for submitting the declaration:

- Separately for each separate division;

- One declaration for all separate units located in the same region.

To submit a single declaration, you need to select a tax office for each region - the recipient of the income tax return.

Let's look at how 1C:Accounting 8 CORP version 3.0 automatically calculates profit shares and fills out tax returns for separate divisions located in the same region.

Example 2

| The organization Comfort-Service LLC is registered in Moscow (IFTS No. 18) and has separate divisions in: - Moscow (IFTS No. 20); — Moscow (IFTS No. 31); - Saint Petersburg; — Anapa (Krasnodar region). At the end of the first half of 2021, the tax base for income tax for the organization as a whole amounted to RUB 381,370. The income tax rates for the budgets of the constituent entities of the Russian Federation do not differ and amount to 17%. |

If an organization submits separate declarations for each separate division, then the procedure for calculating income tax and generating declarations in the program does not differ from the procedure described for Example 1. Figure 5 shows the calculation of tax for each separate division based on the corresponding profit shares and rates.

Rice. 5. Certificate of income tax calculation for June

According to the calculated tax amounts for each separate (head) division, postings are generated in the context of the Federal Tax Service (now there are five of them and one more to the Federal Budget).

The income tax return for the first half of 2021, which is submitted at the location of the head office, will include Appendix No. 5 to Sheet 02 in the amount of five pages. In addition, it is still necessary to generate 4 declarations for submission at the location of each separate division (in St. Petersburg, Anapa and two in Moscow).

Let's see how tax calculation and declaration generation will change if in the income tax settings you select a centralized procedure for submitting declarations in one region. Let's follow the hyperlink Tax Inspectorates - Recipients of Declarations to a form where we will indicate the “responsible” Federal Tax Service Inspectorate for each region (Fig. 6).

Rice. 6. Federal Tax Service Inspectorate - recipients of declarations

After completing the regulatory operation Calculation of income tax for June, the Certificate for calculation of income tax will change (Fig. 7). Accordingly, the number of transactions for calculating income tax according to the Federal Tax Service will change towards a decrease.

Rice. 7. Certificate of income tax calculation for June 2021 using a centralized calculation procedure

We will generate a set of tax returns for the first half of 2021. The income tax return, which is submitted at the location of the head office (Moscow), now includes Appendix No. 5 to Sheet 02 in the amount of three pages.

In Appendix No. 5 to Sheet 02, compiled for Moscow divisions, in the field Calculation compiled (code) the value will be indicated: 4 - for a group of separate divisions located on the territory of one subject of the Russian Federation.

In addition, it is still necessary to generate declarations for submission at the location of each separate division, but now there are only two of them (in St. Petersburg and Anapa).

Needless to say, how much document flow is simplified due to a significant reduction in both the number of declarations in general and the number of pages in the declaration for the head division.

Distribution of income tax between divisions

Part of the profit tax sent to the federal budget should be transferred in full to the location of the organization’s head office (clause 1 of Article 288 of the Tax Code of the Russian Federation). And part of the profit tax sent to the regional budget must be distributed between the head office of the organization and its separate divisions (clause 2 of Article 288 of the Tax Code of the Russian Federation). The tax must be distributed regardless of whether separate divisions have income (expenses) that are taken into account when calculating income tax or not (letter of the Ministry of Finance of Russia dated October 10, 2011 No. 03-03-06/1/640).

Situation: is it necessary to pay part of the income tax based on the location of the real estate? The real estate is located in another region, it is leased, and the organization’s employees do not work there.

No no need.

Tax registration in connection with the presence of property (real estate) does not entail the creation of a separate division. A necessary feature of a separate division is the presence of jobs for the organization’s employees, but in this case there are none. This conclusion can be made on the basis of Article 11 of the Tax Code of the Russian Federation. Therefore, do not transfer income tax on rental income to the location of such property (Article 288 of the Tax Code of the Russian Federation).

A similar point of view is expressed by the Ministry of Finance of Russia (letters dated September 23, 2005 No. 03-06-01-04/376 and dated December 15, 2005 No. 03-03-04/1/427).

How to make calculations for seasonal work

If the company conducts seasonal work, when distributing money between branches, you can replace such an indicator as the average number of employees with expenses on wages. The need for such a change arises due to the fact that it is difficult to determine an adequate average number of employees. In August, the company may have 50 employees, and in February - one.

If you decide to use an indicator such as labor costs, you need to record this decision in your accounting policies. It also needs to be agreed upon with the tax authorities. The corresponding instructions are contained in Article 288 of the Tax Code of the Russian Federation. The amount of expenses for wages is established on the basis of Article 255 of the Tax Code of the Russian Federation. These are expenses for salary and vacation pay.