A desk tax audit is...

A desk audit is a check of the taxpayer’s compliance with tax legislation based on the reports he submitted.

It is mandatory and is carried out in relation to any reporting submitted to the tax authority. The first stage of the desk tax audit 2021 is the registration of the submitted report data in the automated information system of the tax authorities (AIS “Tax”).

At the next stage of the desk tax audit, control ratios are reconciled. In addition, the indicators of the current tax (calculation, reporting) period are analyzed in comparison with similar indicators for the previous period. Also, during a desk audit, the indicators of the submitted declaration (calculation) are reconciled with the indicators in other reporting and, in particular, with reports on other taxes (insurance contributions).

At the same time, during a desk audit, tax service representatives monitor the following points:

- Compliance with the deadlines for submitting a declaration or calculation (clause 1 of article 23, clause 6 of article 80, clause 2 of article 88 of the Tax Code of the Russian Federation).

- The presence or absence of contradictions, errors, inconsistencies in reporting (Article 88 of the Tax Code of the Russian Federation).

- Availability of grounds for an in-depth desk audit.

It should be noted that during a desk audit, not only compliance with the reporting deadline is monitored, but also those deadlines that give the tax authorities the right to impose penalties for late submission of the report. If the filing of a declaration (calculation) is delayed for 10 days or more, the tax authorities have the right to suspend transactions on current accounts (clause 3 of Article 76 of the Tax Code of the Russian Federation). The seizure from the taxpayer’s bank accounts will be lifted only the next day after reporting is submitted (Article 76 of the Tax Code of the Russian Federation).

Read about the specifics of conducting a desk audit for VAT in the article “Desk tax audit for VAT: deadlines and changes in 2021. ”

On-site verification of the contribution payer

When conducting an on-site event, regulatory authorities often combine the verification of several taxes and contributions into one procedure. The start of the inspection is indicated by the decision of the head of the control body with the obligatory presentation of the document to the head of the enterprise. Without familiarizing the director of the company with the decision and personal identification documents, inspectors do not have the right to begin an inspection. The procedure for submitting documents for verification:

- Before the start of the inspection, the head of the enterprise is presented with a request with a list of requested documents.

- The number of requirements may be more than one document.

- Documentary forms not specified in the requirement cannot be requested by inspectors during the inspection (unless there is an additional clause on the presentation of other documents confirming the calculation of contributions).

- Documents are provided in certified copies. Familiarization with the original forms is allowed on the territory of the enterprise. The exception is inspections in which enterprises cannot provide separate premises for the location of inspectors and the event is carried out at the location of the control body.

10 days are given to provide documents. Verification of contributions requires considerable time to prepare voluminous material, especially for organizations with a large staff. A taxpayer may reschedule the filing date by providing written notice requesting the extension, the reasons for filing, and the filing date. Based on the notification, the head of the Federal Tax Service makes a decision to postpone the deadline.

How long does a desk audit last?

The deadline for conducting a desk audit corresponds to 3 months from the date of submission of reports to the tax service (clause 2 of Article 88 of the Tax Code of the Russian Federation).

The frequency of the desk audit depends on the submission of reports.

The decision to conduct a desk audit does not depend on the taxpayer.

The procedure for conducting a desk audit is regulated by the Tax Code of the Russian Federation.

About making a decision based on the results of a desk audit, read the material “A decision on a desk audit can be made before the expiration of a three-month period .

Inspections by the Federal Tax Service as part of the control of insurance premiums

Tax authorities have the right to conduct desk and on-site audits regarding the correctness of calculation of contributions. The checks differ in the order they are carried out.

| Condition for checking | On-site inspection | Desk control |

| Verification decision | Required, with mandatory familiarization with the head of the enterprise | Not required, inspection is carried out as part of the inspector’s duties |

| Verification period | 3 years of activity preceding the event | 3 months from the date of submission of the declaration |

| Verification method | Solid | Selective |

| Location | The territory of the enterprise or the Federal Tax Service in the absence of conditions for inspection | Territorial body of the Federal Tax Service at the place of registration of the organization or individual entrepreneur |

| Submission of documents | Originals or certified copies | Certified copies if you can see the original |

| Decision based on inspection results | Compiled unconditionally with the review of the manager | If there are no violations, the decision made is not presented to the head of the enterprise |

A tax or contribution is not re-verified in one period, with the exception of control measures carried out by a higher authority.

Desk audits of tax authorities without grounds for an in-depth audit

It happens that at the initial stage of a desk audit, no violations are revealed in the reporting provided to the tax authorities. Accordingly, there are no grounds for an in-depth desk audit, and the desk audit ends at this stage.

The duties of the tax authorities do not include drawing up a desk audit report in such situations (Article 88 of the Tax Code of the Russian Federation), and they are not obliged to inform taxpayers about its completion. An exception is a desk audit carried out on VAT claimed for reimbursement (Article 176, 176.1 of the Tax Code of the Russian Federation).

For information about what distinguishes a desk audit for VAT, read the article “Features of a desk audit for VAT for refund.”

The criteria by which tax authorities check a declaration when refunding VAT are discussed in detail in the ConsultantPlus Ready Solution. Get trial access to the system and start learning the material for free.

When is an in-depth desk tax audit carried out?

All declarations and reports submitted to the tax authorities undergo an initial desk audit in an automated manner. The desk audit ends at this stage if no violations (contradictions) are identified and there are no grounds for an in-depth check.

If tax authorities have questions regarding submitted reports, they have the right to conduct an in-depth desk audit. The procedure for carrying out an in-depth desk audit depends on its grounds.

An in-depth desk audit can be carried out on formal grounds for an in-depth audit (declared VAT benefits, provision of explanatory documents, etc.). For these reasons, tax inspectors evaluate the submitted documents and carry out specific tax control activities. They may request additional documents from taxpayers or some information from the bank regarding the current account.

When conducting a desk audit of a declaration under the simplified tax system with the object “income,” does the Federal Tax Service have the right to request primary documents confirming the taxpayer’s expenses? The answer to this question is given by 2nd class State Civil Service Advisor E. S. Grigorenko. Study the material for free by getting trial access to ConsultantPlus.

Tax authorities carry out these procedures in order to ensure that there are no errors or distortions in reporting data or to identify violations of tax legislation.

If, during a desk audit, any violations, contradictions, or errors are identified in the declaration (reporting), tax authorities are obliged to notify the taxpayer and require documentary evidence of the data presented or reliable reporting (clause 3 of Article 88 of the Tax Code of the Russian Federation).

In cases where the basis for an in-depth desk audit are technical errors or obvious discrepancies in financial indicators in the reporting, the inspectors will require explanations or adjustments.

From 2021, it has become mandatory to submit explanations for VAT in electronic format. Read more about this in the material “Explanations on VAT are accepted only in electronic form.”

Contributions subject to tax control

In accordance with the innovations, tax authorities control:

- Contributions to pension insurance.

- Payments to the social insurance fund, with the exception of payments for the prevention of occupational diseases and insurance against industrial accidents.

- Health insurance premiums.

Payment administration includes the right to reconcile accounts with taxpayers, offset amounts, return overpaid contributions, and collect arrears. If violations of legislative norms are detected, the Federal Tax Service Inspectorate has the right to impose penalties and fines and collect them forcibly. The authorities received the right to conduct tax control activities.

Identifying inconsistencies in submitted reports

A desk audit allows you to identify mistakes taxpayers made when preparing reports.

Let's consider options for the development of events when receiving a message from inspectors about identified inconsistencies (Article 88 of the Tax Code of the Russian Federation).

If a taxpayer discovers errors and contradictions that lead to an understatement of the amount of tax payable, it is necessary to make amendments and submit an updated declaration (report) no later than 5 working days (clause 1 of Article 81, Article 88 of the Tax Code of the Russian Federation). Providing corrections is also allowed if any other errors are identified (Article 81 of the Tax Code of the Russian Federation).

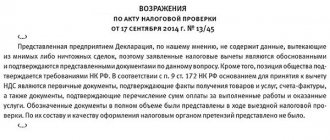

As a rule, taxpayers provide additional clarification with clarification. This right is granted by Art. 21, 24 Tax Code of the Russian Federation. Explanations are also necessary in the case where the taxpayer only partially agrees with the tax authorities.

When an updated declaration is submitted, a new desk audit begins. The desk audit of previous reporting is considered completed (clause 9.1 of Article 88 of the Tax Code of the Russian Federation).

Despite the fact that the desk audit is considered completed, the documents provided for it can be used by tax officials when conducting other desk audits or carrying out any tax procedures (Article 88 of the Tax Code of the Russian Federation).

Taxpayers do not always agree with errors identified by auditors during a desk audit. In this case, it will be sufficient to provide explanations on this issue and supporting documents (Article 88 of the Tax Code of the Russian Federation). Tax authorities are obliged to accept and consider them (clause 5 of Article 88 of the Tax Code of the Russian Federation).

For information on how to prepare explanations for the tax authorities, read the article “Explanatory note to the tax office upon request - sample.”

Tax authorities, based on the explanations provided, compare the indicators with the information already available in their information base (clauses 1, 5 of Article 88 of the Tax Code of the Russian Federation).

If the inspectors find the explanations and evidence provided unsatisfactory, they have the right to call the taxpayer to the tax office to provide additional explanations (Article 31 of the Tax Code of the Russian Federation).

Read about the procedure for checking an updated declaration in the material “The Inspectorate will “cameralize” your update in full .

Results

A desk audit is carried out by tax officials upon receipt of each declaration or calculation. The period for conducting an audit cannot exceed 3 months, and for VAT returns - 2 months (with rare exceptions). The check usually takes place automatically. The system analyzes the declaration based on control ratios. If there are no gaps, then the check ends there. If there is, tax authorities begin a more in-depth study of the information provided.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.