Education is a matter of national importance, paying taxes even more so. Therefore, the state in the Russian Federation financially stimulates those who study at their own expense and at the same time are conscientious taxpayers. Citizens of the country have the opportunity to return part of the funds spent on their own education, as well as on educational services for certain categories of relatives. We will talk about what a tax deduction for education is, what its size is, who is entitled to it and what documents need to be prepared for this.

What is the education tax credit and who can get it?

Any person who officially pays personal income tax (NDFL) in Russia can count on a tax deduction for training (it is classified as social). By giving 13% of each salary to the state, you can get part of this money back if you enter into an agreement for the provision of educational services. And both for yourself and for your children and even for your sister or brother.

The following categories of taxpayers can count on a tax refund for training benefits:

- citizens of the Russian Federation paying personal income tax;

- pensioners who worked in the year for which the tax deduction is issued;

- foreigners-residents of the Russian Federation (spend more than 180 days a year in Russia and pay personal income tax).

Filling out 3-NDFL for studies: title page, Sections 1 and 2

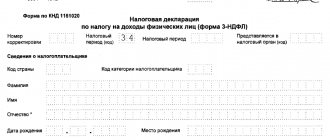

Initially indicate information on the Title Page

tax return. The TIN is written in the top field. Enter the correction number. If the report is submitted for the first time, enter “0”.

In the “Tax period” field indicate “34”. It shows that the report is submitted for the calendar year. Then enter the data in the “Reporting year” field. It indicates the year for which the declaration is being filled out.

Then indicate the code of the Federal Tax Service to which the declaration is submitted. Enter the country code. For the Russian Federation - 643. The taxpayer category code is prescribed in 3-NDFL. For individuals - 760. Indicate full name, date and place of birth, passport details, contact phone number. At the end of the sheet, write down the taxpayer status code - 1. In the field “Power of attorney and completeness of information...” indicate your full name or details of the representative acting on the basis of the power of attorney.

In Section 1

reflect the amount of tax payable or additional payment to the budget. It also indicates the amounts that must be returned from the budget.

The fields in Section 1 are filled in based on the data specified in Section 2.

At the beginning of the page indicate the TIN and full name of the taxpayer. Code 2 is entered in line 010, since a refund needs to be made from the budget. In line 020 enter KBK, in line 030 - OKTMO. This data can be found on the official website of the Tax Inspectorate.

In line 040, enter the value “0” if the taxpayer has fully paid the income tax. Line 050 indicates the amount of tax that needs to be returned from the budget (refund amount).

Section 2

is intended to reflect income that was received by taxpayers and which is subject to personal income tax. In field 001, enter a tax rate of 13%. In field 002 - income type code 3 “other income”. This group includes income received in the form of wages and others.

In field 010 indicate the total amount of income taxed at a rate of 13%. In field 030 - the amount that is subject to taxation. In field 040 - the amount of tax deductions.

Filling out other fields in Section 2:

- line 060 - tax base;

- 070 - total amount of tax calculated for payment;

- 080 - amount of personal income tax withheld;

- 160 is the amount of training expenses.

Data for filling out the fields in Section 2 is taken from pre-filled applications.

Sample of filling out 3-NDFL for training: title page, Sections 1 and 2

In what cases can you apply for a tuition deduction?

As with any other social deduction, the tax is returned to the person whose name is indicated in the contract for the provision of services as the payer.

The Tax Code of the Russian Federation (Article 119) stipulates several grounds on which the right to a deduction for training appears. Among them:

1Own training.

Currently, tax legislation does not limit the form of education in any way: you can receive education in a full-time, evening, correspondence, distance learning department of a university or secondary specialized educational institution, take short-term courses (advanced training, mastering a new profession), study in a driving school, participate in trainings, etc. Further. The main thing is that the educational institution has a license for educational activities. Interestingly, a deduction can also be obtained for education outside the Russian Federation - a notarized translation of the license is required.

2 Education of a child under 24 years of age.

Please note: You can receive a tax deduction for your child’s education only if he or she is a full-time student. As in the case of an adult, you can return your personal income tax for educating your offspring in any licensed educational institution. These could be vocational training courses, a private kindergarten (from the total payment under the contract, the amount spent specifically on training programs is allocated; food and care are not included), schools of additional education - music, art, etc. If the child studied with a tutor, he must be an individual entrepreneur under the patent tax system.

3 Education of the ward until he reaches 18 and 24 years of age.

In this case, the rule also applies: the child must study only full-time. There are two gradations: before reaching the age of 18, you apply for a deduction for the education of your ward (ward). When the latter reaches the age of majority, the documents indicate “former ward/ward.”

4Education of a brother or sister until they reach the age of 24 years.

A mandatory requirement is full-time study. A brother or sister can be either full-blooded (from the same mother and father) or half-blooded (for example, your mother’s son from her second husband).

There is no deduction for the education of a spouse, as well as non-immediate relatives (nephews, grandchildren, grandparents, etc.). The state will not return money for education using maternity capital funds. A deduction for training provided by an employer can be issued if you are contractually obligated to compensate for the funds spent on your education.

Filling out a document using special programs

The simplest way is to enter information into reporting using special software developed by the financial department.

The programs are located on the website of the Federal Tax Service of the Russian Federation and the State Scientific Research Center of the Federal Tax Service and are available for downloading absolutely free of charge. There are three ways to fill out reports using these programs:

- Taxpayer Personal Account (TPA);

- Declaration Program;

- “Legal Taxpayer” program.

Recommendation: The most adapted for use by individuals is the “Declaration” program, which is available on the website of the financial department. Filling out reports in the LKN is possible only after personally contacting the tax authority to register a user account. To send a document via electronic communication channels, you must have an electronic signature (digital signature).

The procedure for filling out a declaration when applying for tuition

Initial data

Malinin V.V. in 2015, I paid for advanced training courses, spending 75 thousand rubles on it.

During this period, Malinin worked as a turner with a salary of 45,700 rubles. per month. At the end of the year, his income amounted to 548,400 rubles, of which 71,292 rubles. went to pay income tax.

When drawing up the reports necessary to obtain a new report, he will have to fill out the following sheets: Title, Sections 1 and 2, Sheets A and E1.

Sample of filling out the TL

| Line (note number) | Explanation |

| 1 | The individual number of the n/a is reflected according to the issued certificate of registration in the n/a. |

| 2 | “0” - when submitting the primary declaration (in our case); "1, etc." — if an adjustment declaration is submitted (if errors were found in the previous one and the tax inspector demanded that corrections be made to the n/a) declaration. |

| 3 | The value “34” is indicated, since the declaration is annual. For other cases (when reporting is submitted, for example, by an individual entrepreneur), a different period is indicated in this cell. When declaring n/a, the value “34” is always indicated. |

| 4 | Enter the year in which the expenses for training were made, and accordingly for which the deduction is claimed. |

| 5 | Indicate the code of the no/no, which is registered with the applicant no/no. You can find out this code by the first 4 numbers of the TIN or by visiting the website of the Federal Tax Service of the Russian Federation. |

| 6 | Since it is declared in the Russian Federation, the value “643” is indicated. |

| 7 | For individuals who submit a new code, the code is always 760 |

| 8 | The blocks “Information about N/A” and “Information about identity document” are filled out strictly in accordance with the passport, including the place of birth. |

| 9 | For individuals declaring n/a, the value is always indicated – 1. |

| Line (note number) | Explanation |

| 10 | The address of the mother is indicated in accordance with the passport (place of registration). |

| 11 | The telephone number must be the contact number by which the tax inspector can contact the applicant n/a in case any questions arise. |

| 12 | The total number of sheets for this type of deduction, as a rule, does not exceed 5. A larger number can only be if the individual has a large number of sources of income and to indicate them requires filling out several sheets A. In the second field (on the right) it is necessary indicate the total number of sheets of documents attached to the declaration to confirm the right to a new title. The declaration is not counted in the total number of sheets. |

| 13 | If a citizen himself submits n/a, then only the value – 1 – is indicated, and the remaining fields are crossed out. If the taxpayer is a representative, then the value is set to 2; the full name of the representative and information about the power of attorney are entered below. |

Amount of tax deduction for training

The amount of tax refund for training is calculated in the same way as for any other personal income tax deduction. Since 13% of the cost is returned, you take the amount spent on educational services and multiply it by 0.13. There are two restrictions. Firstly, you cannot receive more than you paid in income tax in the year you completed your studies. Secondly, there is an upper threshold for deductions for educational services.

Unlike the deduction for treatment, where the maximum amount of personal income tax refund depends on the cost of services provided, in the case of training there are several gradations of tax deduction depending on the categories of students.

- 120,000 rubles - for your own education, as well as for the education of your brothers and sisters.

For example, in the reporting year you earned 800,000 rubles, paying 104,000 rubles in personal income tax on them. Even if you spent, say, 200,000 rubles on your own training, the tax will be returned only on 120,000 rubles (you will receive 13% of this amount in your hands - 15,600 rubles). Another important point: 120 thousand rubles is the maximum amount for all social deductions provided in the reporting year. That is, if you apply for a deduction for both treatment and education, you will get back at most 15,600 rubles. in total (how exactly to distribute these deductions in the declaration is up to you, the total amount will not change).

- 50,000 rubles - for training children and wards.

If you apply for deductions for both children and yourself, the maximum tax benefit for the education of your son or daughter still cannot be more than 50,000 rubles, and the total amount cannot be more than 120,000 rubles.

Example 1

Citizen G. spent 121,000 rubles on his university studies in 2021. His income in the same year amounted to 761,000 rubles. The maximum deduction that G. can count on is 120,000 rubles. The amount of tax to be refunded is 120,000 * 0.13 = 15,600 rubles.

Example 2

Citizen S. spent 54,000 rubles on his son’s foreign language courses in 2021. In addition, he underwent treatment at a sanatorium for 54,000 rubles. S.’s income in the reporting year amounted to 593,000 rubles. He is entitled to a tax deduction for his son’s education in the amount of 50,000 rubles and a deduction for treatment in the amount of 54,000 rubles. Total tax amount to be refunded: (50,000 * 0.13) + (54,000 * 0.13) = 13,520. Unfortunately, it is impossible to transfer the excess amount from the “children’s” deduction to the unused balance of the deduction for treatment.

Sample 3-NDFL for training in a driving school

3-NDFL for your training in a driving school is filled out in the same way as when studying in educational institutions.

Example 2

Daria Morskova is taking driving courses at the Forsazh driving school. She paid 25,000 rubles for the courses. At the same time, Daria works as an assistant accountant and receives a monthly salary of 30,000 rubles. During the year, she received a salary twice from her second place of work, at Zolotoe Runo LLC - in December and May, 20,000 rubles each.

A sample form can be downloaded here.

How to get a tax deduction for education: step-by-step instructions

There are two options for applying for a tax deduction for education. This can be done through the tax office at your place of residence, as well as through your employer. Both methods have common points, but there are also differences.

Method #1. Tax refund through the tax office

When you choose this option, you receive the entire amount at once. You can apply for a tax deduction for training through the Federal Tax Service at any time within three years from the year you received the educational service. Let's say in 2021 you completed training at a driving school. In this regard, you can express your desire to return part of the tax paid in 2017 until the end of 2021. There is only one rule: personal income tax must be paid in the same year in which the training was conducted. If you were, say, on maternity leave in 2017 and did not pay personal income tax, then no future tax payments will help you receive a deduction for 2017.

1 Collection of necessary documents.

The standard package of documents for applying for a tax deduction for education includes:

- Copy of Russian passport

- Tax return in form 3-NDFL. Next there will be a section with detailed step-by-step instructions on how to fill out and send the declaration through the tax website.

- A certificate of income for all places of work in the reporting year where the employer paid income tax for you (form 2-NDFL) is issued by the accounting department of the organization where you worked. Certificates must be provided both for the main place of work and in case of part-time employment.

- A copy of the agreement with the educational institution addressed to the payer. This is highly desirable, because if your child is studying and an agreement is concluded between him and the educational institution, difficulties may arise with the return of personal income tax. Find out how to overcome them in the “Frequently Asked Questions” section.

- A copy of the license of the educational organization, certified by the seal of this organization. However, the website of the Federal Tax Service notes that if there is information about the license in the contract, there is no need to attach a copy of it.

- Copies of receipts, checks or other payment documents confirming payment for educational services.

- Application to the Federal Tax Service with a request to return the tax amount and details where it should be transferred.

If the deduction is issued for the education of children, wards, a brother or sister, you must also attach:

- A copy of a document confirming relationship with the recipient of educational services. This could be a child’s birth certificate, similar documents for oneself, a brother or sister, a guardianship (trusteeship) agreement in which relatives are mentioned.

- A certificate of the form of study (if the full-time course is not specified directly in the contract).

2 Submitting documents to the tax office.

The package of documents must be submitted to the Federal Tax Service at the place of your registration. If you are registered in one locality and live in another (located in the area of responsibility of another Federal Tax Service), you will have to either travel or send documents in another way. You can find the address of your inspection using a special service of the Federal Tax Service: https://service.nalog.ru/addrno.do.

To submit documents to tax authorities, use one of four options:

- Personal delivery of documents at the tax office. You must take original documents with you (passport, contracts, birth certificates). The tax office will certify your copies and tell you if all the documents are in place. Most often, even if there is a shortage of any paper, the package is accepted and they are allowed to “deliver” the document a little later (but not before the start of the desk check). Please note: your papers will not be checked by the same employees who accept documents in the office. Therefore, there is no point in explaining to them the lack of any supporting documents. It's better to come another time, properly prepared.

- Send documents by Russian Post by registered mail with notification. In this case, you should make an inventory of the papers enclosed in the envelope.

- Submit the package of documents to the Federal Tax Service through an authorized representative. To do this you will need to issue a power of attorney.

- Submit documents electronically. The most convenient way, but in this case you need to fill out the declaration yourself and send it through the taxpayer’s personal account. Below there will be video instructions on how to do this through the tax website.

3 Tax refund.

The maximum period for returning personal income tax under a tax deduction is 120 days (90 days for a desk audit of the declaration and 30 days for transferring funds according to the applicant’s details).

Method #2. Tax refund through employer

In this case, you will receive a tax refund not in a lump sum, but in installments, in parts, in the form of a salary, from which personal income tax is not withheld. The advantage is that you don’t need to wait until the end of the year; you can apply for a deduction immediately after paying for your studies. The procedure is as follows:

1 Preparation of documents.

Unlike the package of documents submitted to the Federal Tax Service to receive a deduction through the tax office, in this case the list of documents will be shorter. A declaration in form 3-NDFL is not required, as well as a certificate of income from the place of work where you are going to return the tax. The application is filled out not for a tax refund, but for issuing a notice to the employer. The essence of the procedure is that the tax office checks the documents and confirms: yes, this citizen is indeed entitled to a tax deduction by law.

2 Submitting documents to the tax office.

Documents are submitted to the Federal Tax Service at your place of residence in the same ways as when filing a tax refund through the tax office: in person, by mail, electronically through your personal account on nalog.ru or through an authorized representative. Within 30 days, the Federal Tax Service is required to issue you a notice to your employer that you have the right to a tax deduction.

3 Transfer of notice to the employer.

The notification, together with an application for a deduction (sample - on the website nalog.ru) is submitted to the accounting department of your employer. Further all calculations are made there. You will begin to receive a salary increased by 13% (due to the fact that personal income tax is no longer withheld) from the month of filing the notice until the deduction is exhausted or the year ends. If the deduction amount has not been exhausted and the year has ended, you can apply for the remainder of the tax overpayment through the Federal Tax Service. To do this, perform all the actions mentioned for method No. 1.

List of accompanying documents

The declaration is completed and printed. Now you need to collect the entire package of documents. In addition to the 3-NDFL itself, you will need:

- Certificate 2-NDFL;

- A copy of the training agreement and all additional information. agreements to it, if there were changes in the cost of services;

- Copies of documents (receipts, bills, checks) confirming expenses.

Check that the contract or add. The agreement specified the cost and form of training, and included license details.

If the training of a third party was financed, you will additionally need:

- Documents on kinship (birth certificates, guardianship agreement, etc.);

- Certificate of full-time study;

Attention! To make a deduction, the agreement and payment documents must be issued to one person - the one who submits the declaration. The cost of training specified in the contract must match the amounts in the payment documents.

Video instructions for filling out the 3-NDFL declaration

Video: How to fill out the 3-NDFL declaration for a refund of training tax

- A sample of filling out a tax return for personal income tax in order to obtain a social tax deduction for taxpayer education expenses

Video: How to fill out an application for a personal income tax refund

- Sample application for personal income tax refund

Video: How to send 3-NDFL through the Taxpayer’s Personal Account in 5 minutes

How many declarations should I submit to return personal income tax for education for 3 years?

A declaration is a person’s statement about his income and rights to benefits, preferences and deductions for a certain period. In the case of 3-NDFL, the period is a calendar year, and the taxpayer needs to think about whether over the past year he had income outside the place of employment - for example, from winnings or from the sale of valuables. As a rule, if there was such income, a letter will be sent to his registered address notifying him of the existence of taxable objects.

For the Federal Tax Service, the relevance of the submitted form plays a key role when accepting reports.

You can receive a 3-NDFL refund for training for the last 3 years. It will be possible to fill out the 3-NDFL declaration for studies for 2021 only in 2021.

For any year, you must submit the form that was accepted at that time.

You can download the declaration of 13 percent income tax refund for education:

- for 2021 - here ;

- for 2021 - here ;

- for 2015 - here .

Instead of a refund, the applicant can apply for compensation for expenses at the place of employment - for this, the applicant submits the same list of documents to the Federal Tax Service, but receives not a decision from the inspectorate, but a notification that must be submitted to the boss.

The accountant will issue a deduction for the employee; from 2021, in this case, code 320 is in effect - a social deduction for training, and from next month the salary will be received in full.

We receive a deduction for children's education

You can receive a deduction for a child’s education only if the educational services were provided at the taxpayer’s own expense.

You can apply for a personal income tax refund for the education of a child under the age of 24 - both natural and adopted or under guardianship. It is allowed to issue a deduction for several children, within the total limit of 50,000 rubles and the income tax you paid (that is, they will return you at most 13% of 50 thousand rubles - 6,500 rubles).

Training must be carried out full-time, in an educational institution of any form of ownership (both public and private), in Russia or abroad.

Note! The parent must be indicated in the contract as the customer of educational services and the payer (mother or father - it doesn’t matter; according to Russian law, these expenses are considered joint). If you “blundered” at the stage of concluding the contract, and the customer indicated a child, the situation can be corrected by submitting payment documents issued in your name. For example, a receipt from the bank where you paid for the next semester for your offspring.

Example

In 2021 Ivanova A.M. entered into an agreement for her daughter to study full-time at a university. The cost of training in the first year was 125,000 rubles. Ivanova is on maternity leave and personal income tax was not transferred for her in 2021. Her husband Ivanov N.M. filed a deduction for himself, attaching a marriage certificate to the submitted documents. Since in 2019 his official income was 260,000 rubles, he received the maximum deduction - 50,000 rubles, returning 13% of this amount - 6,500 rubles.

Filling out 3-NDFL for training: Appendices 1 and 5

In Appendix 1

in field 010 indicate the tax rate of 13%. Then fill out information about your employer or other source of income. Lines 030-060 are intended to reflect such information.

In field 070 indicate the total amount of income that the individual received in the reporting year. In field 080 - the amount of tax withheld from the taxpayer's income.

In Appendix 5

reflect the amounts of standard, investment and social deductions that can be provided to an individual on the basis of an application (in accordance with Articles 218-219, 219.1 of the Tax Code of the Russian Federation).

In field 130, indicate the costs of your own education and the education of close relatives under the age of 24. The same amount is entered in fields 180-200.

Sample 3-NDFL for training: Appendices 1 and 5

We receive a deduction for the education of a brother/sister

You can receive a deduction for the education of full and half-siblings in the same amount as for yourself (up to 120,000 rubles). But the right to a tax refund only applies until the brother or sister turns 24 years old. As with children, a brother or sister must be a full-time student. The place of study is not of fundamental importance; it can be in Russia or abroad. A necessary requirement is a license from the country in which the educational organization is registered. A certified copy of this document must be provided to the tax authorities.

You will prove your relationship with your brother or sister using birth certificates – yours and your brother/sister’s. In rare cases, the Federal Tax Service may require other supporting documents (court decisions on the divorce of parents, decisions of guardianship and trusteeship authorities, and so on.

Note! The contract for the provision of educational services must include you as the customer. If the document was signed by a brother/sister, then receipts for payment of their education should be issued to you.

Example

Alexey P. paid 400,000 rubles for 4 years for his then 18-year-old sister’s full-time university education in 2021. In 2021, he decided to receive a tax deduction. All conditions were suitable: the three-year period had not passed, P.’s income in 2021 amounted to 930,000 rubles, all documents about his relationship with his sister (birth certificates) were available. My sister has not reached the age of 24. The maximum amount due to Alexey P. for return is 15,600 rubles (13% of 120,000 rubles - he is entitled to a deduction only for the year in which he paid for training). This amount could have been much larger if, say, he had placed his money on a deposit and used it to pay for his sister’s education every year for 100,000 rubles. Then you could get 15,600 rubles. for 2017, 2018 and 2019, and in 2020, issue for the current year. In total, P. could return 62,400 rubles.

Information about deductions

Finally, all that remains is to fill out information about the requested deductions. Select the appropriate tab. Tax deductions for education fall into the social category, so let’s move straight to the right position.

Further filling depends on what deductions are being claimed:

- On the left side, in the line “your own education”, indicate the amount spent on yourself or your brother/sister’s education;

- On the right, using the “+” button, we register expenses for children’s education, separately for each child.

Important! All numbers must match what is written in the training agreement and indicated in the payment documents. The program records only those expenses that were made in the reporting year (in our case, in 2018). We check the dates on the receipts.

Let's say that in 2021 the applicant attended German language courses and spent 45,500 rubles on them. He also paid for additional lessons for two children at the school for 31,500 rubles. for everyone. This means we fill out both columns of the declaration.

Important! You can receive a deduction before the end of the year. To do this, you need to contact your employer. Those who have used this method, when filling out the declaration, additionally indicate in the program the amount of social deductions that their employer provided to them.

FAQ

— How many times in your life can you make a tax deduction for education?

— According to the law, there are no restrictions on the number of deductions for training. You have the right to apply for a personal income tax refund every year if you used educational services that fall under all the requirements of the Tax Code. There are restrictions only on the amount: 120,000 rubles for yourself, brothers and sisters, 50,000 rubles for children and wards. Social deductions unused in the current year are not carried over to the next year. It is also impossible to carry over the deduction to the next year if the training costs were higher than the maximum amount for the tax benefit.

Example 1

Muscovite Alexander O. paid 111,500 rubles for his university studies in 2021. The personal income tax, which was transferred to the tax office at O.’s place of work in 2019, amounted to 12,500 rubles (the citizen received a significant part of his salary “in an envelope”). Accordingly, instead of the 13% due to him from 111,500 rubles (14,495 rubles), he received a personal income tax refund in the amount paid - 12,500 rubles.

Example 2

Marianna N. in 2021 completed paid advanced training courses for 49,000 rubles, training at a driving school (38,000 rubles), and also paid for her daughter’s education in the amount of 84,000 rubles. The total amount spent on training in 2021 was 171,000 rubles. N. decided to apply for the maximum deduction (50,000 rubles) for her daughter’s education, and for the remaining limit (120,000 – 50,000 = 70,000 rubles) to apply for a deduction for her expenses. The total tax refund was (50,000 rubles * 0.13) + (70,000 rubles * 0.13) = 15,600 rubles. Part of the expenses for your daughter (84,000 – 50,000 = 34,000 rubles) and for your education (49,000 + 38,000 – 70,000 = 17,000 rubles) will not be covered by the deduction, since they go beyond its maximum limits. These amounts cannot be transferred to the next year; they simply “burn out.”

— I am the mother of a full-time student. The contract is in my name, and the receipts are in my son’s name. Can I get a deduction for his tuition?

— The letter of the Federal Tax Service of the Russian Federation dated August 31, 2006 No. SAE-6-04 / [email protected] states that in your case, the parents have the right to receive a tax deduction if they prove that the son made the payment on behalf of his father or mother. To do this, you need to attach a free-form application to the standard package of documents, in which you instruct your son to complete the operation of paying for education using your funds.

— The contract is issued in the name of the daughter, and the receipts are in the name of the father. Can the father receive a tax deduction in this case?

— Clause 1 of Article 219 of the Tax Code of the Russian Federation connects the receipt of a deduction with the fact that the taxpayer submits documents confirming his educational expenses. If the father submits such documents to the Federal Tax Service, then he receives the right to a deduction regardless of who the contract with the educational organization is for. If there is a copy of the license and the training is full-time, a deduction will be provided to one of the parents without any problems.

— Are there any chances of getting a deduction for my son’s education if both the contract and the receipts are issued for him, although I actually paid?

— The taxpayer has the right to receive a deduction if he paid for the training himself, and this can be confirmed by any documents. The bank or payment system will not redo receipts. But an agreement with an educational organization can be redone - at least, it is easier to negotiate with representatives of the university than with a banking organization. The customer is the one who will receive the deduction (in this case, the father). Further, the procedure is the same as in the case of receiving a deduction by parents who ordered educational services for their son, who paid for his education himself (see above)

— Can my second husband, who is neither the father nor the child’s guardian, receive a tax deduction for his son’s education?

— Article 219 lists all categories of persons who have the right to a personal income tax refund for educating children. This:

- The student's mother and father.

- Guardian and his wife (husband).

- Brothers and sisters of the recipient of educational services.

Since in this case the husband of the author of the question does not belong to any of these categories, he is not entitled to a deduction. You, as a mother, can apply for a personal income tax refund.

— I turn 24 in the middle of the school year, which I have already paid for in full. How will the tax deduction be calculated?

— The Ministry of Finance of the Russian Federation, in its letter dated October 12, 2010 No. 03-04-05/7-617, established that if the age of 24 has arrived and training in an educational organization continues, the deduction is provided for the entire calendar year. It’s another matter if you’ve reached your age and graduated from college. Then the deduction ceases to apply from the month following the one in which the training was completed. Some accountants request two certificates from an employee per child student: at the beginning of the academic year and at the end of the semester. If a student is expelled, the right of deduction for parents is terminated.

— For three years now I have been receiving both social and property tax deductions (for the purchased apartment). How best to design such a neighborhood to get the greatest benefit?

— It is most logical to first apply for a deduction for training, and for the remaining personal income tax - a deduction for the apartment. If you do the opposite, the returned amount will remain the same, but the remainder of the social deduction will “burn out.” The remainder of the property deduction can be carried over to the next year.

Example

Golubev M.N. in 2019 and 2021, he received an income of 430,000 rubles, paying 55,900 rubles in personal income tax on it every year. In 2019, Golubev bought an apartment for 1.6 million rubles. For 2021, Golubev returned all 55,900 rubles of personal income tax paid that year. The balance of the property deduction in the amount of 1,600,000 – 430,000 = 1,170,000 rubles. has been postponed to 2021. In 2020, Golubev studied at a driving school, spending 28,000 rubles on it. When filing tax deductions for 2021, the citizen decided to first make a social deduction. Balance of 340,000 (annual income) – 28,000 (tuition deduction) = RUB 312,000. was registered as a property deduction. Thus, Golubev received back all 55,900 rubles of his personal income tax, and the balance of the property deduction in the amount of 1,170,000 - 312,000 = 858,000 rubles was transferred to 2021.

Filling using the program

You can fill out the declaration using the official Declaration software. The application is free and supported by all known Windows operating systems.

When using the program, the sequence of actions is important. We recommend that you use a simple video instruction in which the author shows how to correctly fill out 3-NDFL for training.

Step-by-step instructions for filling out 3-NDFL through the program

After downloading and installing the Declaration application, open it and follow a few simple steps as indicated in our instructions.

- Start filling out the document with the inspection number; to do this, in the “Inspection Number” line, select the Federal Tax Service Inspectorate you are a member of. If you cannot find the required number, then use the search through the Federal Tax Service website, following the link https://service.nalog.ru/addrno.do. The OKTMO code will also be indicated here, which will need to be specified further.

- Open the “Declarant Information” tab and enter all the necessary information about yourself.

- Enter code 21 in the line to enter the document code, or select “Passport of a citizen of the Russian Federation” from the list and fill in the required information.

- Go to the “Income received in the Russian Federation” section and click on the first “+” sign.

- In the form that appears, you need to enter information about the employer. To do this, you will need a 2-NDFL certificate, which you need to obtain from the HR department. The certificate will contain the following data: name of the source of payment, TIN, KPP and OKTMO. After filling out this information, check the box next to “Calculate standard deductions using this source.”

- There are cases when there are several workplaces, they can also be additionally added, and all the actions specified in paragraph 4 can be performed.

- After filling out the basic information about the employer, we proceed to filling out the second block. Here we click on the second “+” sign and indicate the income code 2000 and the amount of the monthly salary. This information is taken from the same 2-NDFL certificate.

- If you have the same salary for 12 months, then simply duplicate your income 12 times. If the income, based on the values in the certificate, is different, then you will have to enter each month separately. To do this, follow the sequence of actions as indicated in paragraph 7.

- Don’t forget to indicate the total amounts by source of payment at the very bottom of the “Income received in the Russian Federation” tab.

- Go to the “Deductions” tab and the “Social” subcategory. Select the “Provide social tax deductions” option and indicate the amount that was spent on training.

- Save the declaration and check it. Upon completion of the audit, print the document and submit it to the tax office.

The amount of funds received for your own training

The amount of funds returned for training payments is determined based on many circumstances.

- It is understood that it is impossible to receive compensation for studies, the amount of which will exceed the funds transferred from your salary to the country's budget for personal income tax.

- The maximum deduction amount provided to a Russian citizen is 120 thousand rubles, therefore, you cannot return more than thirteen percent of this amount. It turns out that 15 thousand 600 rubles are due for refund.

How much money can you get back for your own education?

The described restriction is valid not only for the return of funds for accounting, but also for all other types of deductions of a social nature, excluding the category of charitable payments and receipt of expensive treatment.

In total, all social compensation received from the state cannot exceed the required amount of 120 thousand rubles, that is, for all of them the maximum amount provided is 15 thousand 600 rubles.

Let's give an example. You completed your studies at a higher educational institution and spent 150,000 units of Russian currency on educational services. At the same time, during the reporting year, you received a salary in the amount of 250,000, and paid personal income tax on them in the amount of 31,000. According to all the criteria, you have the right to a refund of compensation funds from the state, however, the costs incurred will not be fully repaid by you, despite how much you paid to the treasury and how much you gave to the educational institution. The maximum amount stated above is what you are entitled to in the case presented.

Receiving a refund

So, let's take a closer look at how exactly to apply for a tax deduction for yourself or your child. To return part of the money spent on education, you need to collect a set of certain documents, and then take them to the tax authority.

This can be done both in person and through postal services. All documents, declaration and application are packed in a large envelope, an inventory of the contents is drawn up, then they are sent to the address of the relevant inspection by registered mail.

In addition, you can contact the tax office through the Taxpayer’s Personal Account, but you will first have to register there.

- First you need to fill out and submit the 3-NDFL declaration. It is important to enter information into the 3-NDFL form very carefully, since the deduction will be based on it. You can fill it out by hand or using a computer. In the first case, a pen with blue or black ink is used; data must be entered in block letters to avoid inaccurate reading. All empty columns are marked with dashes. All personal income tax figures are rounded to the nearest whole ruble, and in other cases they are entered to the nearest kopeck.

The corresponding declaration must be submitted at the end of the year in which payment for studies was made.

- Documents confirming income are attached to the declaration, usually a 2-NDFL certificate. It can be obtained from the accounting department at the applicant’s place of work.

- You must make a copy of the license in the educational department. In addition, you will need to attach a photocopy of the agreement on educational services.

- If you pay for a relative's education, you must provide a document confirming your relationship.

- Receipts, checks or bank statements for payment will also be required.

- At the end, an application for social tax deduction .

After submitting the documents, an inspection is carried out, which can last up to three months. If a positive decision is made on the application, the funds will be transferred to the account whose details are indicated in the application within one month.