Deadlines for transferring personal income tax

Responding to the tax agent’s request, the drafters of the Letter indicated that according to line 120 of section. 2 “Tax payment deadline” should indicate the date in accordance with the provisions of clause 6 of Art. 226 and paragraph 9 of Art. 226.1 of the Tax Code of the Russian Federation, no later than which the amount of personal income tax must be transferred. Well, as they say, “brevity is the sister of talent.” But the Russian writer who wrote this phrase drew the attention of the brother to whom this recommendation was addressed to the fact that this rule should be used to argue the content where there is freethinking (when writing a play, for example). And there should be no freethinking in the interpretation of the Tax Code of the Russian Federation. The meaning of the answer lies in its content. And in order to be understood, I would like the officials who make up the answers to be more verbose.

Well, since there are no specifics in the answer, let’s turn to the specified norms of the Code.

As follows from paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the day following the day the income is paid to the taxpayer .

For many taxpayers, the main type of income is wages. The date of actual receipt by the taxpayer of income in the form of wages in accordance with clause 2 of Art. 223 of the Tax Code of the Russian Federation recognizes the last day of the month for which income was accrued for fulfilled labor duties in accordance with the employment agreement (contract).

In accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, the tax agent is obliged to withhold the accrued amount of personal income tax directly from the taxpayer’s income upon their actual payment, taking into account the features established by clause 4 of Art. 226 of the Code.

Thus, the tax agent is obliged to transfer personal income tax to the budget no later than the day following the day the income is paid to the taxpayer. This day should be reflected in line 120 of section. 2 as the tax payment deadline . When paying wages for the first half of the month (advance), personal income tax does not need to be withheld. The tax agent calculates the amount of personal income tax on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income for which a tax rate of 13% is applied (clause 1 of Article 224 of the Tax Code of the Russian Federation). In this case, the amount of tax withheld in previous months of the current tax period is offset. And before the end of the month, income in the form of wages cannot be considered received by the taxpayer. Therefore, personal income tax cannot be calculated before the end of the month (Letters of the Ministry of Finance of Russia dated April 10, 2015 N 03-04-06/20406, Federal Tax Service of Russia dated January 15, 2016 N BS-4-11/320).

Example. The terms of the collective agreement provide for the payment of wages on the 3rd and 18th. For the first half of the month, the advance payment is paid on the 18th, and the final payment for the past month is paid on the 3rd of the next month. It is this date, the 3rd date, that should be reflected on line 120 of section. 2 as the tax payment deadline.

If the employment relationship is terminated before the end of the calendar month, the date of actual receipt by the taxpayer of income in the form of wages is considered to be the last day of work for which the income was accrued to him (clause 2 of Article 223 of the Tax Code of the Russian Federation). This means that personal income tax in this case must be transferred no later than the day following the last day of work .

Tax inspectorates distribute information about received amounts of taxes and fees to the “Settlements with the Budget” (CRSB) cards in accordance with the dates and details specified by the taxpayer in the payment order for the payment of taxes (fees). And discrepancies in the dates indicated in the calculation in Form 6-NDFL and in the tax agent’s KRSB (KRSB NA) may indicate a violation of the tax payment deadline. We’ll tell you a little later how tax inspectors will check the relationship between this and other information between documents and within the calculation form itself.

In the meantime, let's return to the deadlines for transferring personal income tax.

As can be seen from the previous explanations, the rules on the timing of personal income tax transfers are applied in conjunction with the rules for determining the date of actual receipt of income established by Art. 223 Tax Code of the Russian Federation.

In addition to income from employment, which was mentioned earlier, individuals can receive other types of income. For example, this may be income in the form of material benefits generated from savings on interest on borrowed funds (Article 212 of the Tax Code of the Russian Federation). In this case, the date of actual receipt of income is considered to be the last day of each month during the period for which the borrowed (credit) funds were provided. This means that the deadline for paying personal income tax on such income must be no later than the first day of the month following the month in which the income was received .

If income in the form of material benefits is received from the acquisition of goods (work, services) in accordance with a civil contract from individuals, organizations and individual entrepreneurs who are interdependent in relation to the taxpayer, then the date of receipt of the income is considered to be the date of acquisition of goods (work, services) ) (Clause 3, Clause 1, Article 223 of the Tax Code of the Russian Federation). No later than the day following this date, the deadline for paying personal income tax should be determined.

The same can be said about the deadline for transferring personal income tax on material benefits received from the acquisition of securities. But if the acquired securities are paid for after the transfer of ownership of them to the taxpayer, then the date of actual receipt of income is determined as the day the corresponding payment is made to pay for the cost of the acquired securities (clause 3, clause 1, article 223 of the Tax Code of the Russian Federation).

As for business trips, the date of receipt of income when calculating personal income tax is considered to be the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Income subject to personal income tax may arise when paying daily allowances in excess of the established norms (700 rubles per day on a business trip in Russia and 2,500 rubles per day on a business trip abroad). Personal income tax must be withheld from compensation for undocumented expenses for accommodation on a business trip in excess of the same norms. In this case, income is also determined on the last day of the month in which the advance report is approved. The next day will be the deadline for tax payment.

From January 1, 2021, new rules apply to amounts of vacation pay and amounts of temporary disability benefits (including benefits for caring for a sick child). withheld from these incomes must be transferred to the budget no later than the last day of the month in which they were paid . For example, if the vacation was paid on February 26, 2021, personal income tax on vacation pay must be transferred to the budget no later than February 29.

The day of personal income tax transfer may fall on a weekend or non-working holiday. In this case, the payment deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

If we return to the conditions of the previously considered example, we will see that the deadline for payment of wages (3rd day) for April 2016 falls on a non-working day - May 3rd. In this case, the payment deadline is postponed to May 4.

If for different types of income that have the same date of their actual receipt, there are different deadlines for tax remittance, then lines 100–140 of the calculation are filled in for each tax remittance deadline separately .

Here is such a simple form - with difficult indicators.

Recommendations from the Federal Tax Service on filling out and checking 6-NDFL

We also recommend taking into account the clarifications of the Federal Tax Service of Russia:

- In line 020 there is no need to reflect income that is not subject to personal income tax (Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4-11/).

- Line 070 does not need to reflect personal income tax, which will be withheld only in the next reporting period. For example, in the calculation for the first quarter, personal income tax should not be reflected on the salary for March, which was paid in April (Letter of the Federal Tax Service of Russia dated 08/01/2016 N BS-4-11/).

- Income in the form of temporary disability benefits must be reflected in the calculation for the period in which it is paid (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4-11/).

- In lines 100, 110, 120 you need to provide information about transactions for which the tax payment deadline occurred in the period for which the calculation is submitted (Letter of the Federal Tax Service of Russia dated July 21, 2017 N BS-4-11/).

- When reflecting information about wages in line 100, it is necessary to indicate the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated February 25, 2016 N BS-4-11/). The date of transfer of funds does not matter.

Read also

21.06.2017

Desk audit 6-NDFL

The main goal pursued by tax authorities when checking 6-NDFL is to identify violations. In its principle, it does not differ from other desk checks. The difference between it and on-site inspections is that the inspector conducts it directly at his workplace and goes to the organization to visit the tax agent. The procedure for conducting a desk audit is as follows:

- First of all, the general information specified by the taxpayer is subject to verification, that is, they check whether the name of the organization or individual entrepreneur and details are correct.

- After this, they check that the form is filled out correctly. All indicators are filled in with an accrual total.

- Next, the control ratios are verified. Tax officials check whether the information specified in the document corresponds to the information held by the tax authority.

- Then the tax inspector performs simple arithmetic calculations and checks whether the accountant made any mistakes when filling out the document.

Checking information in sections 1, 2 of form 6-NDFL

The calculation data must correspond to the control ratios given in the letters of the Federal Tax Service dated March 10, 2016 No. BS-4-11/3852, dated March 20, 2019 No. BS-4-11/4943:

- first there is a check on internal indicators;

- Assessors then compare the data with other taxpayer reports.

The compliance of the indicators with the CRSB (budget settlement card) is also checked. If errors or discrepancies are found, the tax authority sends a request to the tax agent for clarification or elimination of the error by submitting an updated calculation.

We talked in more detail about checking internal and inter-document control relationships in our previous publications.

Control ratios

When conducting a desk audit of 6-NDFL, a tax official checks the correctness of the amounts accrued and indicated in the document. He compares the specified data with the information that federal service employees have exclusively for internal use . The following indicators are meant:

- The date indicated on the cover page of the form - if the report is submitted untimely, the taxpayer faces penalties.

- The value indicated in column 020 (accrued income) should not exceed the value indicated in column 030 (tax deductions). However, equal values in these two columns are allowed.

- The value indicated in column 040 (accrued tax) should not exceed the value indicated in column 050 (fixed advance payment). As with the previous control ratio, equal values of indicators in these columns are allowed.

- The value indicated in column 040 is calculated using the following formula: 010 x (020 – 030) = 040.

- The values of columns 040 and 070 should not be equal, since personal income tax should not be accrued in one tax period, but withheld in another.

- The amount of payments transferred to the current account must correspond to the difference between lines 070 and 090.

- The tax payment date must not be later than the date indicated in line 120.

Important! If during the audit the tax authorities do not find any errors in the calculation on Form 6-NDFL, then the desk audit is completed. But if the tax inspector has any questions, he draws up a report based on the results of the audit.

Concept of procedure in 2021

This is an inspection that is carried out by inspection employees directly at their workplace, and excludes their visiting the office of the 6-NDFL report submitter. The criteria for the desk audit were approved by letter of the Federal Tax Service BS-4-11/3852 and they relate to the control relationships between the data of this report form and other types of company reporting or. 6-NDFL checks:

- The date of execution and submission of the calculation, indicated on the title page upon acceptance.

- The difference in the values of the 020th and 030th lines, which must be at least zero.

- In the same way, the 040th row entry must be greater than (or equal to) the 050th row entry.

- Tax calculation taking into account rate, income and deductions.

This is followed by payment control:

- The amount passed through the current account should be equal to the difference between lines 070 and 090.

- The date of payment through the account must be no later than indicated in the 120th line of the report.

Desk audits for 6-NDFL, their essence and features are discussed in the video below:

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. Write your question using the form (below), and our lawyer will call you back within 5 minutes with a free consultation.

Reconciliation of 6-NDFL and 2-NDFL

When checking form 6-NDFL, the tax inspector must compare its indicators with another document - 2-NDFL. That is, the amount indicated in the calculation that was paid to employees must correspond to the amounts given in the 2-NDFL certificate.

When performing reconciliation, the following values are checked:

- accrued income;

- accrued dividends;

- calculated tax.

A quantitative check of individuals to whom the company or entrepreneur transferred funds is also carried out.

Reconciliation with other statements

Tax inspectors can compare data from different reports to analyze reporting. During a desk check of 6-NDFL, the following forms are taken:

- DAM data (Calculation of insurance premiums). Discrepancies between the DAM and 6-NDFL are most often due to different rules for taxation and insurance contributions. Therefore, it is usually not difficult to explain such differences to the taxpayer;

- 2-NDFL certificates. Since 2-NDFL certificates are submitted at the end of the year, inspectors will only be able to check them with the annual figures in 6-NDFL;

- some figures are correlated with the indicators available in the income tax return.

Correcting errors in 6-NDFL

Important! If during a desk audit the tax inspector discovers errors or inconsistencies, the taxpayer is obliged to correct them. Corrections must be made within 5 business days from the date of receipt of the notification from the tax authority.

Tax officials check the deadlines for payment of personal income tax, while considering those indicated in the calculation and checking them with those indicated in the personal cards of the company or individual entrepreneur. Such cards are kept specially; they are necessary to verify the timely payment of taxes to the budget.

If during the camerawork it is discovered that the amount required for payment has not been transferred, the inspector will point this out to the taxpayer. The company or individual entrepreneur is required to eliminate this within 8 working days from the date of receipt of the relevant notification from the tax office.

When submitting a 6-NDFL calculation with errors, the taxpayer will have to correct them, and in addition to this, also pay a fine. The fine for a report submitted with errors will be 500 rubles.

Failure to submit Form 6-NDFL on time will result in a fine of 1,000 rubles for each month of delay. If it turns out that a company or individual entrepreneur has not paid some part of the tax, then he will need:

- pay the remaining balance;

- pay a fine equal to 20% of the debt amount;

- pay penalties in an amount depending on the time of delay in payment and the amount of debt.

In this case, the tax authority will send a notification to the taxpayer, which will indicate all the amounts that must be paid.

Important! If during the year the tax agent did not transfer funds to individuals, then the zero calculation in Form 6-NDFL will not need to be submitted to the tax office. If payments were not transferred to individuals only for a certain period, then the columns corresponding to it will remain empty, and the rest will be filled in.

Thus, a desk audit of 6-NFDL is carried out on the basis of those documents provided by the tax agent - an organization or individual entrepreneur. Particular attention is paid to amounts transferred to individuals, for example, wages or dividends.

Checking personal income tax payment to the budget

The Federal Tax Service checks the 6-NDFL data with personal income tax payment cards, in which it enters all information about the dates of tax withholding and payment. A discrepancy between the actual dates of depositing funds into the budget and the calculation data regarding payment deadlines is a reason for the accrual of sanctions in the form of penalties.

The tax agent may be fined if the tax has not been paid at the time of detection of non-payment on time by the inspectors of the Federal Tax Service. The fine will be 20% of the amount of tax unpaid to the budget (Article 123 of the Tax Code of the Russian Federation). The demand for payment of arrears received from the tax authority must be fulfilled within 8 working days, unless a longer period is specified in the request itself (Article of the Tax Code of the Russian Federation).

Subjects and objects of desk inspection

Desk audits are carried out by territorial tax authorities, and the subjects of the audit are:

- institutions, organizations;

- commercial, manufacturing companies, regardless of the form of economic organization;

- individual entrepreneurs;

- cooperatives, unitary enterprises;

- joint ventures.

The object of the desk audit is the activities of a company or individual entrepreneur (its inactivity) in terms of proper accounting of the income of employees and other individuals, as well as the correctness of calculation, withholding and transfer of personal income tax to the budget.

How tax authorities analyze calculations of ERSV and 6-NDFL

All calculations that you submitted to the inspectorate fall into the unified AIS “Tax-3” software package. The program consists of subsystems. A separate block in the program is reserved for desk checks (see screenshots below).

What does the 6-NDFL check block look like?

The tax program accepts the report and checks it against control ratios. If there are discrepancies with the formulas, inspectors will require clarification. After receiving a message about contradictions, you have five working days to submit clarifications or clarifications. If you remain silent, you will be fined.

The fine is 5 thousand rubles. (Clause 3, Article 88 and Clause 1, Article 129.1 of the Tax Code). In addition, if inspectors find violations, they will draw up a report and assess additional personal income tax and contributions. Next, find out what explanations inspectors most often require and how to respond to requests so as not to be subject to additional charges.

Salary is less than the minimum wage or the industry average

The most common reason why explanations are required for the calculation of contributions is that employees’ income is below the minimum wage or the industry average salary. During the coronavirus epidemic, many companies and individual entrepreneurs worked, but transferred their employees to work less than 4 hours a day. As a result, they paid less than the minimum wage. Formally, there is no violation here, since many employees themselves agreed to work part-time. But for inspectors, low income is a signal to begin an in-depth inspection and invite the manager to a salary commission. Moreover, tax authorities have now resumed activities related to direct contact with taxpayers.

Tax inspectors compare wages with the minimum wage and the industry average using control ratios. Formulas for verification are below.

If the ratio is not met, tax authorities believe that the company could have underestimated the contribution base. The program will generate a discrepancy and send it to payers (letter of the Federal Tax Service dated 02/07/2021 No. BS-4-11/ [email protected] ) (see screenshot below).

How the Federal Tax Service's program shows wages less than the minimum wage

As for the average salary in the region, these are statistical data, they are “built into” the Federal Tax Service program. The tax authorities do not calculate them. But the controllers themselves note that the reference point to average indicators is incorrect, since the Labor Code does not establish the obligation to pay average earnings. Therefore, inspectors are more loyal to this indicator than to the minimum wage.

How to answer. The Labor Code does not require wages to be higher than the industry average. Tax officials can only recommend paying such earnings. Therefore, point out that you cannot pay the industry average now, but if orders increase, raise wages. The main thing is that payments are not lower than the minimum wage. Although there are workers who may receive less than the minimum wage per month. These are those who:

- worked part-time;

- quit in the middle of the month;

- were on sick leave, maternity leave or maternity leave;

- were on vacation the whole month and received money in the previous month;

- were on leave without pay.

You do not violate the Labor Code if you paid such employees less than the minimum wage. Explain why income is less than the minimum wage. An example of an explanation is below. You are not required to attach documents to your explanations. Only if you want to further justify why your income is below the minimum wage, provide staffing, vacation orders, etc.

If the salary is not explained, the next step of the tax authorities is to call the low salary commission. Inspectors have still carried out salary commissions in accordance with the letter of the Federal Tax Service dated July 25, 2017 No. ED-4-15 / [email protected] In July, this document was canceled (letter dated July 7, 2021 No. BS-4-11 / [email protected] ) . This means that inspectors should not hold interdepartmental commissions with the participation of representatives of administrations, funds, labor inspectorates, police officers and prosecutors.

Despite the official abolition of commissions, the Federal Tax Service did not abandon its work on legalizing wages. For example, if inspectors have suspicions about a company, a representative will be invited to the inspection for clarification, as this is an effective method. Inspectors have the right to do this at any time, including outside the scope of inspections (clause 4 of article 31 of the Tax Code). After the calls, the companies themselves recalculate the official salaries and update the reports.

At the meeting, inspectors will ask why wages are low and ask other questions. In addition, the company may be included in the on-site inspection plan (clause 5 of Appendix 2 to Order No. MM-3-06/333

Substantive check

Next, a desk audit of the Calculation begins, which can be carried out within 3 months from the date of submission of form 6-NDFL (paragraph 1, clause 2, article 88 of the Tax Code of the Russian Federation). When conducting a desk audit, inspectors are guided by the Control Correlations of Indicators of Accounting and Tax Reporting Forms (Letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11/ [email protected] ), which were reviewed by us in a separate consultation.

The Calculation check ends if, as a result of the camera meeting, no questions arise for the tax agent. Otherwise, he will receive a request to clarify or correct the Calculation data, which will need to be done within 5 working days from the date of receipt of the request (paragraph 1, clause 3, article 88 of the Tax Code of the Russian Federation).

We talked in more detail about the features of conducting a desk audit of the Calculation in our separate material.

Report 6-NDFL is mandatory for all tax agents paying wages to their employees, including those working under a civil contract. A mandatory procedure is also the control of the submitted information displayed in the report by the fiscal authority. How does the tax office check 6-NDFL? What should you pay special attention to when creating the form? These are the questions we will talk about in our article.

Did not fulfill the conditions for a reduced tariff

The second most common request on the payment calculation desk is questions about reduced tariffs. From April 1, new tariffs apply to affected industries and SMEs - 0 percent and 15 percent for payments above the minimum wage. Each preferential rate has its own control ratios (letters from the Federal Tax Service dated May 29, 2021 No. BS-4-11/ [email protected] , dated June 23, 2021 No. BS-4-11/ [email protected] and dated June 10, 2021 No. BS- 4-11/9607).

The most significant error is that the payer is not a victim or is not listed in the SME register, but has declared benefits to the ERSV. What other ratios will be checked, see the table below. If the formulas do not agree, tax officials will ask you to explain the discrepancies.

How tax authorities will check the 0 and 15 percent tariffs in the ERSV

| Rate | Control ratios |

| 0 percent - for affected companies and individual entrepreneurs | Tariff code (field 001) adj. 1 and 2 = 21 → the payer is the victim, and the company is still in the SME register Category code AP (field 130) etc. 3.2.1 = HF |

| 15 percent of payments above the minimum wage - for SMEs | Tariff code (field 001) adj. 1 and 2 = 20 → the payer is in the SME register Tariff code (field 001) adj. 1 = 20 → there is application 1 with tariff code (field 001) = 01 AP category code (field 130) etc. 3.2.1 = MS → there is other 3.2.1 with AP category code (field 130) = NR AP category code (field 130) etc. 3.2.1 = MS → Payments (field 150) etc. 3.2.1 by AP category code (field 130) HP = 12,130 |

How to answer. Check whether you are entitled to a reduced tariff and whether the ratios in your calculations are met. If not, submit a clarification and pay additional fees.

If you have the right to a reduced tariff, explain this to the tax authorities. For example, you have the right to claim a benefit, but not be in the register if you are late with your report and then submitted it, but the tax authorities have not yet updated the database. Those who did not submit information on the average number of employees and a declaration under the simplified tax system for 2021 by 07/01/2021 were not included in the SME register. However, the companies were promised to be returned to the register if they submitted their reports no later than 06/30/2021 (Clause 5, Article 23 of Federal Law No. 166-FZ of 06/08/2021). If this is your case, but your company is not in the register, draw up an explanation for the tax authorities.

See below for an example explanation. The inspectors assured us that they would accept this answer, but in August they would check whether you were added to the SME register. If not, they will draw up a report and add additional fees.

How the tax office checks 6-NDFL

The camera room is held directly within the walls of the tax authority, without visiting the tax agent. This type of verification lasts for 3 months from the date of submission of the calculation (Clause 2 of Article 88 of the Tax Code of the Russian Federation).

Current information on the criteria for finding violations in the calculation is contained in the letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] Data analysis occurs within the calculation, as well as in comparison with the card of settlements with the budget and other reports submitted to Inspectorate of the Federal Tax Service.

Let's list what control ratios tax authorities use to find inconsistencies in the calculation of 6-NDFL:

- The date of submission of the calculation, recorded by the tax authority on the title page, is tracked. It must not be later established by law.

- The value on line 020 must be greater than or equal to the value on line 030.

- The value on line 040 must be greater than or equal to the value on line 050.

- The following equality must be observed: line 040 = line 010 × (line 020 – line 030).

Note that the equality of lines 040 and 070 should not be observed, since personal income tax can be accrued in one period and withheld in another. For example, if employees' salaries are paid the next month after the month in which they were accrued. In such a situation, personal income tax on wages for the last month of the quarter is calculated in one quarter, and is withheld and transferred to the budget in the next.

Tax officials also reconcile the data in 6-NDFL with the ERSV. ConsultantPlus experts explained what to do if a gap is identified between reports. Get free demo access to K+ and go to the Ready Solution to see expert recommendations.

Checking form 6-NDFL for errors

Check 1

Income on line 020 must be greater than or equal to the amount of deductions on line 030. An error means that the amount of deductions provided is greater than the amount of income. In such a situation, check:

- line 020 - have you reflected all the income for the reporting period, add the missing ones, delete the extra ones;

- line 030 – are there any excess personal income tax deductions reflected for the period? Delete them.

Check 2

The calculated personal income tax on line 040 should be equal to: (line 020 – line 030): 100 x line 010.

An error means that the tax base, deductions or personal income tax amount are reflected incorrectly. To fix, check:

- line 040 - whether the amount of personal income tax was calculated correctly at a specific rate, whether personal income tax was calculated on all income, correct errors in income and deductions, including arithmetic ones;

- line 020 – have you reflected all the income at this rate for the period, add the missing ones, delete the extra ones;

- line 030 – are there any excess personal income tax deductions reflected for the period? Delete them.

Check 3

The calculated personal income tax on line 040 must be greater than or equal to the amount of fixed payments on line 050.

The error indicates that you have unnecessarily reduced the personal income tax for foreigners on a patent by the amount of fixed advance payments. Check:

- line 050 - whether the extra fixed advance payments for personal income tax of foreigners working under a patent were not taken into account;

- line 040 - whether the amount of personal income tax was calculated correctly at a specific rate, whether personal income tax was calculated on all income, correct errors in income and deductions, including arithmetic ones.

Check 4

Line 050 can only be completed if you have a notification from the tax authority allowing you to reduce personal income tax for foreigners working under a patent by fixed advance payments.

How to write an explanatory letter correctly

Upon completion of the desk audit, the Federal Tax Service may require clarification of certain points if errors or inconsistencies were found in the 6-NDFL report. The organization has 5 working days to respond, during which time they must draw up a detailed explanation of the existing claims.

Since there is no standard form for an explanatory letter to the tax office, you can draw up an appeal in free form, but following the general rules for preparing such documents. The details of the document, the response to which is provided to the tax office, must be indicated. In the explanation, you must clearly formulate your response and, if necessary, attach documents confirming the correctness, certified in the appropriate manner.

Explanation to the tax office. Example 1

The example shows how to compose an explanatory letter in case of an error made in the KBK code:

Explanation to the tax office. Example 2

The explanation explains the composition of the personal income tax amount with a correctly generated 6-personal income tax report:

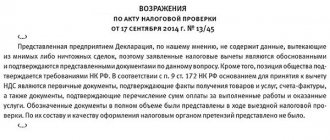

How to write about disagreement with the results of an inspection

The law does not establish a specific form of objection to the desk audit report. Therefore, the tax agent has the right to submit an objection, written in writing, to the act in a free format. It is necessary to draw up two documents, one of which will be transferred to the tax office, the second remains with the organization. The answer must list:

- The name of the tax office that carried out the desk control;

- name of the organization - tax agent;

- TIN;

- legal address of the organization;

- date of written request;

- the name of the document in which discrepancies were identified;

- deadline for submitting the report;

- start and end date of the audit.

Then list in order the points on which objections arose.

If the organization has complaints about the progress of the audit, such an objection should not be filed. This can lead to negative consequences. Objections should be submitted only regarding the completion and calculation of form 6-NDFL. All data should be justified with reference to legislative acts or clarifications of the Ministry of Finance.

Explanations to the tax office regarding 6 personal income tax: sample 1

In this case, the response to the tax office was given due to an error in the KBK:

Explanations to the tax office for 6 personal income tax sample 2

This explanation explains the personal income tax amount in the report. The error form does not contain:

How to correctly submit explanations for 6 personal income taxes

The results of desk control in the organization must be reviewed within 5 working days from the date of receipt of the request. Explanations should be provided if necessary. There is no standard form provided. The explanatory note must contain all the data in accordance with the requirements for filling out such documents.

Be sure to indicate which document the explanation is being provided for. The text must clearly describe the situation and, if necessary, attach copies of supporting documents and calculation of fixed contributions. They must be certified in the prescribed manner.

Declaration 6 personal income tax: filling out line 060 in the report

Connecting control ratios

You can carry out such work as checking whether the calculation of 6-NDFL is correct using control ratios. Control ratios are a sequence of mathematical calculations between certain lines that must coincide with other report indicators, that is, all calculations encrypted in the report lines must, when crossed, give the corresponding results. The organization is not obliged to check the control ratios of 6-NDFL (for the 3rd quarter of 2021, by the way, they will probably differ compared to the 1st quarter of the same year). This procedure is advisory in nature to eliminate elementary errors in the report made by the accountant. Some new accounting programs already include an option such as “check form 6-NDFL”, that is, automatic verification of information entered in the lines of the report for compliance with control ratios. As a result of the analysis, the program offers options for adjusting the data. However, it is recommended to take such a step as checking 6-NDFL yourself, recalculating several or all control ratios manually on a calculator - this will protect the accountant from making adjustments. The letter from the tax service contains twelve points of those indicators, the discrepancy of which will cause additional clarifications from the tax authorities. Here are some of them:

- the actual date of filing 6-NDFL coincides with the date indicated on the title page of the report;

- the calculated value of total income indicated in line 20 must be no less than the value of total deductions on line 30;

- the value of line 40 must correspond to the result of the following operations: the difference between lines 20 and 30 *line 10/100;

- the value from line 40 must be no less than the value from line 50;

- the total amount contributed to the budget must be no less than the delta between the amount of personal income tax actually withheld (line 70) and the value of line 90 (refund to the payer) of the tax.

Returning to the question of how to check 6-NDFL, we will give an example of changes in control ratios. In previous editions of the letters, it was recommended to use 6-NDFL as a control ratio for checking: line 070 should be equal to the sum of lines 140. Let us recall that in line 70 the enterprise informs how much it withheld personal income tax, in line 140 - the same tax with distribution by dates of payment of all types of remuneration. Then the tax authorities changed their minds and admit that this control ratio is not always valid. An exception to the previously proposed ratio was the transfer of actual payments in the quarter following the accrual, for example, of wages. Therefore, some amounts do not fall into line 140 in the second part of the report. There is no violation of the law in this case: one quarter ends, the report is closed, and salaries are paid in the next quarter. Hence the discrepancy in the results according to the verification formula previously proposed by the tax authorities. Based on the assumption that some organizations calculate and pay salaries according to this scheme, the Federal Tax Service excluded this control ratio from the list of mandatory ones. The department confirmed on its official website that this ratio is not mandatory. Therefore, in order to perform such an operation as checking 6-NDFL for 2021 (for any reporting period of this year), there is no need to apply this control ratio. If the accountant nevertheless decides to conduct a more pedantic study of the report being prepared for submission, we remind you that the difference in the values of the highlighted lines is the amount of the actual payment of remuneration on which tax was accrued in the current reporting period, and the payment will be made in the next quarter.

Deadlines for conducting a desk audit on the 6-NDFL report

Article 88 of the Tax Code of the Russian Federation explains that tax authorities can carry out a desk audit within 3 months from the date of submission of the 6-NDFL report.

If the audit reveals violations or inconsistencies that require additional explanation, a request for this is submitted to the tax agent. The tax officer is given 10 days to formulate such a requirement, after which all verification procedures are considered completed (clause 5 of Article 100 of the Tax Code of the Russian Federation).

After the tax agent responds to the claim in the form of a detailed explanation of the reasons for the discrepancies, the tax inspector draws up a conclusion on the reliability of the data provided and the calculations made.

Objection to the desk tax audit report

At the legislative and legal level, a specific form of objection to the desk audit report has not been approved. Therefore, any tax agent who has objections to the results of an audit of his 6-NDFL reporting can submit a written appeal to the Federal Tax Service, written in free form.

The objection must be drawn up in two copies, one of which will be submitted to the tax office, and the second will remain with the head of the organization. The application must list the following:

- Name and code of the tax service department that carried out the desk audit

- Full name of the enterprise (full name in the case of individual entrepreneurs)

- TIN

- Legal address of the organization

- Date of written request

- Name and number of the document in which the violations were recorded

- Date of submission of the 6-NDFL report to the Federal Tax Service

- Timing of inspection activities (first and last day)

After this, you need to list the existing objections point by point.

You should not contact the tax office with objections regarding disagreement with the procedure for verification activities. Such a step could lead to negative consequences. Therefore, you can only challenge issues related to filling out and calculating form 6-NDFL.

Arguments in this case must be supported by references to articles of relevant legislation or clarifications of the Ministry of Finance of the Russian Federation.

In some cases, tax officials may not accept an objection to a desk audit report. However, this is a violation of the law, and if refused, the tax agent has the right to appeal to the higher authorities of the Federal Tax Service of Russia or the court.

In this case, it is necessary to have reasons and evidence that the tax authorities made a mistake when conducting audit activities.

Cases requiring explanation

If the organization that submitted the 6-NDFL report for verification does not agree with the results of tax control, it has the right to respond with an objection. Arguments must be recorded in writing, since oral objections are not accepted by the tax authorities, and also, a written objection, as an official document, will be valid in court if the dispute is not resolved at the local level.

You should only make an objection if you are completely sure that you are right. The person responsible for generating the 6-NDFL report must be free to navigate Tax and Labor legislation so that the arguments given in the objection have links to real articles and laws confirming the taxpayer’s correctness.

In this case, it is necessary to provide for such a result that a repeated, more thorough inspection may reveal other serious violations. Therefore, before submitting explanations or objections to the tax office, you must carefully check the correctness of all data entered in the reporting tax document.