What to follow when filling out

All reports established by the Federal Tax Service of Russia are contained in the relevant orders. The orders include several attachments. Among them:

- form form;

- format for electronic submission;

- instructions for filling out paper and computer versions.

There may be other applications, but the above 3 sections are required. Why is this important - any document submitted to the Federal Tax Service must be filled out according to the instructions. Sometimes, in addition to them, the Federal Tax Service or the Ministry of Finance also issues clarifications, answers questions in special letters, and publishes control ratios that the submitted reports must comply with.

Important! When filling out personal income tax certificate 2, follow the rules developed by the Federal Tax Service of Russia.

In some cases, disputes arise that are resolved in court. Judicial rulings are another source of action algorithm, but Form 2 of Personal Income Tax is not so complex and conflicting a form as to cause disagreements among users.

The latest form 2 of personal income tax was introduced by order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/02/2018. There are 5 applications attached to it:

- Help for the Federal Tax Service.

- Procedure for filling out the form.

- Electronic format – file requirements.

- Procedure for submitting reports.

- Form for employees.

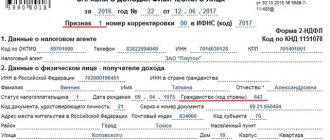

Appendix No. 2 will help you fill out the form correctly. The upper half of the first sheet of Form 2 Personal Income Tax – information about the employee, incl. date of birth, passport details, citizenship (country). What does the instruction say about the latter?

Note! In paragraph 3.7 of the third section of the Procedure for filling out personal income tax certificate 2, it is indicated that the country code is written according to the OKSM classifier (countries of the world).

However, the classifier is not included in the instructions due to its large size. Therefore, you need to look for it yourself.

Country of citizenship code

Every citizen must know the code of Russia, the country of citizenship for personal income tax certificate 2, since incomplete completion of this document may lead to the accrual of penalties. The necessary numerical data can be found in OKSM - the all-Russian classifier of countries of the world.

The income of a person with a Russian indigenous background must be taken into account in the 2-NDFL certificate. Each field of the document is formatted according to established rules. Moving on to the second block “Data about an individual” we must fill out all the lines of paper.

Having reached paragraph 2.5 “Citizenship”, we will already need information from the all-Russian classifier of countries of the world described above, which is where all state codes are indicated.

If a person has citizenship, the Russia country code for the 2-NDFL certificate is 643.

There are situations when the taxpayer has the status of a stateless person (a person without citizenship), in which case in the line “Country code” the employer must enter the code designation of the state that issued the document proving his identity.

Going down the document below, you can note that in paragraph 2.9 “Address in the country of residence” you also need to enter the country code. In addition to it, it is necessary to enter the full address of residence of the person without citizenship and the immigrant (in the state from which they came). The legislation allows you to draw up a line in any form (both in Latin letters and Cyrillic).

Attention! In this case, it is allowed not to fill out the item “Residence address in the Russian Federation,” but provided that item 2.9 has already been completed.

Any physical labor of a migrant must be documented. The document for each person has a single form, but the data entered may vary depending on the situation, so each line requires special study.

Filling out this field is mandatory if a migrant employee is registered for tax purposes. Although even if you have a TIN, you don’t have to indicate it in the 2-NDFL certificate

If the migrant has a TIN in the country from which he arrived, then this should also be included in the document.

This block contains information from the main identity document. You are allowed to enter your full name in Latin letters. If there is no surname or patronymic, the fields are not filled in.

This field is also formatted according to a specific classifier. The code denotes who the immigrant himself is:

In any case, 643 is indicated here, since registration is carried out on the territory of Russia.

- Identity document code

- Residence address in the Russian Federation

- Home state code

- Personal income tax was not withheld from income paid in 2021 - until March 1.

- In 2021, individuals were paid income until April 3.

- Tax return for income tax (Order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3/ [email protected] ). Details “Citizenship (country code)” of Appendix No. 2 to the tax return;

In most cases, “10” is indicated here - a foreign passport, but if it is not there, then you can enter a birth certificate (03), a military serviceman’s ticket (07), a residence permit in (12), a Temporary ID card (14), RVP in the Russian Federation (15), etc.

In this block, you should indicate the full coordinates of the person’s residence at which the migrant is registered in Russia.

Code of the country

Now we move on to the main part of the document. In this block it is necessary to enter the country code of the state of which the migrant is a citizen, taking into account the all-Russian classifier of countries of the world. A striking example is the hiring of a citizen of the Republic of Azerbaijan. You must enter 031. In this line you should indicate the migrant’s residential address in the country from which he came. The legislation allows you to make entries in any order (Latin letters are allowed). Completing the 2-NDFL certificate for an employee who has received a patent to work in the Russian Federation, in some cases, the Federal Tax Service Inspectorate agrees to reduce personal income tax by the amount of the established advance payments that were paid to a visitor with an existing patent. This amount must be indicated in the document. Every year new rules are introduced regarding the preparation and submission of the 2-NDFL certificate, but the deadlines for submission remain unchanged. For the current year, tax agents must provide reports in 2018:

visatochka.ru

Russia country code for tax return

Current as of: June 19, 2021 When preparing individual tax returns, you may be required to complete a Country Code line. We will tell you where to get this indicator and what country code you need to indicate for Russia in our consultation.

Indicator "Country code" in tax returns

The indicator “Country code” (“Code of country of citizenship”, etc.) is given in some tax returns in which information is filled in regarding an individual taxpayer. Such declarations include, in particular:

Source: https://advokatnik.ru/4417/

What to indicate on the citizenship line

If the employee has Russian citizenship, then the code in the personal income tax certificate 2 is standard – 643. It is on all reporting samples submitted to the inspectorate. It is used not only in the income form, but also in the declaration 3 of personal income tax and other documents relating to individuals.

Important! For citizens of the Russian Federation, the country code is 643.

Country code by classifier. Citizenship codes: what are they and where to find them

To fill out some documents, both Russians and citizens of other countries need to know citizenship codes in order to enter them in the appropriate fields. Failure to fill out official papers correctly will result in penalties. An individual, whether a foreigner or a citizen of Russia, being a taxpayer, is required to know all the necessary codes for the 2-NDFL certificate.

All the necessary information for preparing tax documents can be found in a special all-Russian classifier, which includes identification character sets for all countries of the world (abbreviated name OKSM).

Regardless of whether your place of permanent registration is Russia, Ukraine, Belarus or another country, when filling out tax forms and other documents related to work and income, you must know all the necessary codes, OKIN, citizenship, etc. Until they are entered in the appropriate boxes, the document will be considered invalid, since it will not provide complete and comprehensive information about you.

Russian citizens will need to indicate the code combination of numbers assigned by the Russian Federation in the 2-NDFL certificate. It is written in paragraph 2.5 of the second block of the document called “Data on a civilian.” The OKSM of the Russian Federation is assigned the number 643. It must be entered in the above column.

The status of a stateless person does not relieve you of the obligation to enter the data recorded in the classifiers into the certificate. In the document, such a person needs to enter information about the country that issued him the identity paper. and can be downloaded here.

Next, continuing to work with the help, you should repeat the number from paragraph 2.5, but in line 2.9. Next, indicate the detailed address where the person for whom the document is being filled out lives.

If we are talking about a foreign citizen, it is not the Russian temporary registration where the registration was carried out that is entered, but information about the foreigner’s place of residence in his homeland, the code of which he indicates, taking it from the all-Russian classifier.

For convenience, the line can be filled in with both Cyrillic characters and Latin characters.

Features of issuing certificates for foreign citizens

A citizen of whatever country you are, when applying for work in the Russian Federation, you become registered with the tax service.

Employed foreign citizens are subject to the legislation of the Russian Federation, which they must strictly follow.

Having received taxpayer status, you become the owner of a TIN. If this abbreviation is also relevant in your home country, both INNs are indicated in the personal income tax.

A foreign worker is allowed to write his personal data in Latin letters. For example, holders of Moldovan citizenship can enter their first and last names as is customary in their homeland. This will not be considered an error.

It is important that the certificate data corresponds to the data of the foreign passport and other documents.

2-NDFL includes the code and address of the Russian Federation, as well as the code and address of the country of residence.

Table of codes of states, a large percentage of whose citizens work in Russia.

| № | State | Code in numbers | Code in letters | |

| Alpha2 | Alpha3 | |||

| 1. | Russia | 643 | RU | RUS |

| 2. | Abkhazia | 895 | AB | ABH |

| 3. | The Republic of Azerbaijan | 031 | AZ | AZE |

| 4. | Armenia | 051 | A.M. | ARM |

| 5. | Belarus | 112 | BY | BLR |

| 6. | Georgia | 268 | G.E. | GEO |

| 7. | Ukraine | 804 | U.A. | UKR |

| 8. | Kazakhstan | 398 | KZ | KAZ |

| 9. | Kyrgyzstan | 417 | KG | KGZ |

| 10. | Moldova | 498 | M.D. | MDA |

| 11. | Tajikistan | 762 | T.J. | TJK |

| 12. | Turkmenistan | 795 | TM | TKM |

| 13. | Uzbekistan | 860 | UZ | UZB |

That is, in relation to the Russian Federation, everyone should write “643” in the column dedicated to encoding, and below, in the column “Code of country of residence,” - the code of the country of citizenship. If this is Belarus, indicate “112”, citizens of Ukraine write “804”, citizens of Armenia - “051”, an individual whose main country is Kyrgyzstan must write “417”.

Thus, information about the citizenship of the registered taxpayer is entered into the document. Sometimes accountants have a question about what to do with persons who are not citizens of any country. The code 999 is relevant for them.

The full one can be downloaded here.

When preparing individual tax returns, you may be required to complete a Country Code line. We will tell you where to get this indicator and what country code you need to indicate for Russia in our consultation.

How to find the code number

All citizenship and country codes are placed in a single OKSM classifier, adopted on January 14, 2001 by Gosstandart in Resolution No. 529-st.

Let's look at some numbers from the document.

Table 1. Countries of the world and codes

| Azerbaijan | 031 |

| Belarus | 112 |

| Kazakhstan | 398 |

| Russia | 643 |

| Türkiye | 792 |

| Ukraine | 804 |

We recommend additional reading: 327 deduction code in personal income tax certificate 2 and personal income tax declaration 3

Most often, residents of Ukraine, Belarus and other adjacent countries find employment in Russia. The OKSM has all countries with full names, abbreviations alpha-1 and alpha-2.

Information about each employee is necessary to accumulate information about citizens working in Russia, generate statistical data, tax control and reduce the chances of subjects evading fiscal payments (the more information is required, the more difficult it is to hide something).

All information received by the inspectorate is entered into the AIS-Tax database and will be taken into account when making decisions related to taxation. For example, if, according to the form submitted by the employer, the employee’s income was 100,000 rubles. for a year, and then this employee submitted a forged certificate to obtain a tax deduction and indicated an income of 200,000 rubles, then the forgery will be detected.

Also, thanks to the code, the Federal Tax Service can check whether a citizen of another state has residence in Russia, because the rates for residents and non-residents are different (Article 224 of the Tax Code of the Russian Federation).

Please note that not all Russians are residents, and foreigners are non-residents. Resident status is established by Article 207 of the Tax Code of the Russian Federation: it is acquired by persons who stay in the Russian Federation for more than 183 days in 12 consecutive months (not mandatory in one calendar year). Travel for treatment and study for 6 months is acceptable.

Rates:

- resident – 13%;

- non-resident – 30%.

In the cases specified in Article 224 of the Tax Code of the Russian Federation, a non-resident is subject to a lower tariff (highly qualified specialist, etc.). Also, some income of both residents and non-residents is sometimes subject to increased (35%) or reduced (15%, 9%) rates.

Attention! If errors or contradictions are identified in the documentation, the Federal Tax Service has the right to request clarification. For example, if in one form you indicated Russian citizenship for an employee, and in another - foreign citizenship, then questions may be asked of you.

Filling rules

Issuing a personal income tax certificate 2 is a common matter, but sometimes it is not at all easy. An inexperienced accountant may have problems.

Feature selection

The first thing a specialist faces is identifying the sign. There are two types of signs:

- Filling out occurs for any employee receiving wage payments from the enterprise and deductions from them. This also includes funds protected from personal income tax withholding. A certificate with this indication must be submitted to the tax office no later than April 1.

- All other situations when it is impossible to deduct taxes from certain material assets. For example, if you need to pay for a gift for a person who is not an employee of the company. Temporary dates: until the first of March. In addition, you must indicate the amount of income that is not subject to taxation and the possible amount of tax.

Usually in the second case you have to make two certificates with different characteristics at once. The first is all income in aggregate, the second is the amounts protected from withholding.

Code of the country

The second task is to indicate a reliable country code. Today there is an OKSM classifier of country codes. It was approved on December 14, 2001 by Gosstandart under number 529-ST. Information from it can be found for free on many legal Internet resources, but it is important to remember that the database is constantly updated and subject to adjustments. Therefore, it is necessary to monitor the relevance of the information that comes across on sites and weed out outdated versions. For example:

- Russian citizenship code for personal income tax certificate 2 is 643.

- Belarus - 112.

- Uzbekistan - 860.

- Kazakhstan - 400.

- Armenia - 051.

- Ukraine - 804, etc.

The original classifier is located directly on the official website of Gosstandart. You can also find its changes there, but they are all located separately, which creates a number of inconveniences when searching for the necessary information.

Example document

The standard certificate form has several parts to fill out. The first part includes:

- Full legal name of the organization that was involved in issuing this certificate.

- 1st or 2nd sign indicating the possibility of collecting tax deductions.

- Document data: number, date of completion, what time frame was taken as the basis for the calculation.

- Territorial code of the tax service with which the enterprise is registered.

- The serial number of the adjustments made. If there were none, you must enter the number 0.

- Landline telephone number of the work organization. Required with area code.

- Payment details of the enterprise: taxpayer identification number (TIN), All-Russian Classifier of Municipal Territories (OKTMO) and reason for registration code (KPP). For individual entrepreneurs, it is permissible to put a dash.

- Personal data of the employee for whom the certificate is issued: last name, first name and patronymic, tax identification number, residential address.

- Official taxpayer status. Usually for a Russian resident there is only one.

- State code from classifier 529-ST. This can be either the Russian Federation or any other country from which the employee arrived.

- Code of the employee’s personal identification document, as well as its number and series. Russian passport code is 21.

The second part is further divided into three more sections. Here they describe monthly material income, tax and other deductions, the amount of actual tax and that already paid.

The third part displays income in coded form.

For example, salary code is 2000, vacation payments are 2012, other one-time amounts are 2720. All this is subject to personal income tax. The fourth is coded deductions. For example, code 126 is a deduction for a minor child.

The fifth part is the total amount of personal income tax. To calculate, you need to add up the income for the entire previous year and subtract deductions. From the amount received, calculate 13 percent (if the rate is for the first taxpayer status).

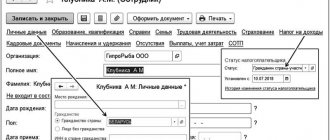

Russian citizenship code for reference 2 personal income tax

In certificate 2, personal income tax, the country code is 643 for Russians always. As a rule, information about each employee is entered into 1C and automatically transferred to any personalized document. So, when submitting personal income tax certificates 2 to the tax accountant, by pressing several commands, he will generate reports for all personnel, and if the organization has a qualified signature, he will immediately send an archive with files to the Federal Tax Service via a telecommunication channel.

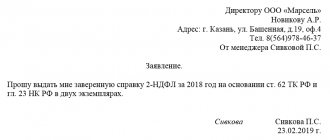

Starting from 2021, another personal income tax form 2 is issued for employees, but you also need to indicate the state code in it. Accountants are accustomed to preparing personal income tax forms at the end of the year, but an employee has the right to request it for any period. For example, now you can apply for a certificate for January 2021, and the accounting department does not have the right to refuse the employee.

If the accountant does not want to generate a report in the 1C program, ask to fill out the form manually - have him indicate the country code 643 and other information, focusing on general classifiers and Federal Tax Service reference books.

Important! The employer is obliged to provide the employee with a personal income tax certificate 2 on the day of applying for it or within 3 days after the application.

You can get the certificate yourself - online.

We recommend additional reading: What does tax deduction code 126, 127, 128 mean in personal income tax certificate 2

Often an income form is required by the bank and based on it the client fills out the bank's form. If it contains the column “country code” or “citizenship”, then feel free to write “643”, since this number is the same throughout the Russian territory.

Filling out 2 personal income tax for a Russian citizen

The form consists of several sections.

Help 2NDFL, part 1

In this upper part there are 2 sections and the following details must be entered here:

- the name of the tax agent, that is, the organization that issues the certificate

- a sign indicating the possibility or impossibility of paying tax

- certificate number, as well as for what period and on what date it is drawn up

- territorial tax code where the company is registered

- correction number (zero means that no corrections have yet been made to the document)

- company telephone number with area code

- organization details: TIN, OKTMO and KPP (for individual entrepreneurs, a dash)

- TIN of the citizen for whom the form is being filled out

- Full name and date of birth of the employee

- taxpayer status (one for a Russian resident)

- RF code or country code where the employee came from

- code of the document used (twenty-one means passport) and its series, number

- the address where the employee lives

The second part of the certificate consists of three sections, which indicate monthly income, deductions and the amount of calculated tax and paid tax.

Help 2NDFL, part 2

Section three lists the coded types of income received. So in this example, the salary is displayed using the code 2000, vacation using the code 2012, and in the twelfth month 2720 the gift received. As for code 501, this is a standard maximum deduction of four thousand from the gift received. Everything above is subject to personal income tax.

The fourth section reflects deductions. So, deduction with code 126 is deductions for a child under eighteen years of age.

The fifth section for calculating personal income tax. Adding up all income for each month (including gifts), we get 282,000 rubles. Accordingly, according to deductions, it comes out to 23,000 + 4000 = 27,000 rubles. The total base from which the tax is calculated is 282,000 – 27,000 = 255,000 rubles. And the calculated tax is 255,000 * 13% = 33,150 rubles.

But in this example, the employee Vinnik quit her job on December 1 and, accordingly, the accountant in December does not have a basis for receiving tax on the value of the gift exceeding four thousand. After all, the deduction is given only in the amount of four thousand, and the gift costs 12,000, so the difference is 12,000 - 4,000 = 8,000 rubles. tax must be paid. But since Vinnik no longer works, this is impossible and the accountant writes in a special field the amount that could not be withheld, that is, 8,000 * 13% = 1,040 rubles. And in those fields where the withheld and transferred tax is indicated, the amount of the calculated tax is written, reduced by this tax, which cannot be collected.

Since a tax has been formed that is impossible to pay, you should additionally draw up 2 personal income taxes indicating sign 2. Where, in general, all the same data is entered, but only the cost of this gift is indicated in the income and the unpaid tax is calculated only on it.

Document for a foreigner

If a citizen of another country works for an organization and requires a 2nd personal income tax certificate, the procedure remains the same. However there is a slight difference:

- The amount of the tax rate directly depends on the length of residence and work in the Russian Federation. For 183 days or more of continuous stay, the rate will be the usual - 13 percent. In addition, in the certificate the taxpayer status will be standard - 1. If the stay is shorter than the established framework, then the rate increases to 30, and the status - 2. There may be other statuses. For example, visitors from the Eurasian Economic Community countries. Their rate is 13% anyway.

- It is necessary to indicate permanent citizenship according to OKSM, regardless of Russian temporary documents.

- It is not necessary to fill out the column with a Russian or foreign TIN.

- You can indicate your place of residence both in Russia and in your home country, but always with a code.

- The identity document of a foreign citizen is entered under code 10.

- In the fifth section, a column with fixed income is added. This is if the employee works on the basis of a patent. In addition, it is permissible to apply to the NFS to reduce personal income tax by an amount equal to fixed payments. After receiving official permission, indicate its number and date of receipt.

If you take into account all the above factors, then registering 2nd personal income tax should not cause much difficulty. The main thing is to correctly understand country codes and other encodings. These can be found in government legal documents.

What is the personal income tax rate if the employee does not have citizenship?

The legislation establishes a uniform procedure for determining the tax status of personal income tax payers. If during the 12 months preceding the date of payment of income, the employee was in Russia for 183 calendar days or more, he is recognized as a tax resident. If during the 12 months preceding the date of payment of income, the employee was in Russia for less than 183 calendar days, he is not recognized as a tax resident. This follows from the provisions of paragraph 2 of Article 207 of the Tax Code of the Russian Federation. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated May 5, 2021 No. 03-04-06-01/115.*

The status of the income recipient is determined by the number of calendar days that the person was actually in Russia over the next 12 consecutive months. A person is considered a tax resident if he has been in Russia for 183 days or more.* An exception to this rule is made for citizens living in the Republic of Crimea and the city of Sevastopol. During 2021, they are recognized as tax residents of Russia if, as of March 18, 2021, they had permanent residence in Crimea or Sevastopol and remained in these regions after their annexation to Russia. Regardless of how long they were in Russia before this date. This procedure is provided for in paragraph 17 of the Regulations, approved by Resolution of the State Council of the Republic of Crimea dated April 11, 2021 No. 2021-6/14, and Article 14 of the Law of Sevastopol dated April 18, 2021 No. 2-ZS.

We recommend reading: Disability or old age pension in 2021, which is better?

Country code in 2 personal income tax Ukraine

The first is all income in aggregate, the second is the amounts protected from withholding. The second task is to indicate a reliable country code. Today there is an OKSM classifier of country codes. It was approved on December 14, 2001 by Gosstandart under number 529-ST.

Information from it can be found for free on many legal Internet resources, but it is important to remember that the database is constantly updated and subject to adjustments.

Therefore, it is necessary to monitor the relevance of the information that comes across on sites and weed out outdated versions.

For example:

- Armenia - 051.

- Belarus - 112.

- Uzbekistan - 860.

- Kazakhstan - 400.

- Ukraine - 804, etc.

- Russian citizenship code for personal income tax certificate 2 is 643.

The original classifier is located directly on the official website of Gosstandart. You can also find its changes there, but they are all located separately,

Citizenship codes: what are they and where to find them

This will not be considered an error. It is important that the certificate data corresponds to the data of the foreign passport and other documents.

Taxpayer identification number (TIN) is a digital code that organizes the accounting of taxpayers in the Russian Federation. 2-NDFL includes the code and address of the Russian Federation, as well as the code and address of the country of residence. Table of codes of states, a large percentage of whose citizens work in Russia. No. State Code in numbers Code lettersAlpha2Alpha31.Russia643RURUS2.Abkhazia895ABABH3.

Republic of Azerbaijan031AZAZE4.Armenia051AMARM5.Belarus112BYBLR6.Georgia268GEGEO7.Ukraine804UAUKR8.Kazakhstan398KZKAZ9.Kyrgyzstan417KGKGZ10.Moldova498MDMDA11.Tajikistan762TJTJK12.Turkmenistan795 TMTKM13.Uzbekistan860UZUZB That is, in relation to the Russian Federation, everyone should write “643” in the column dedicated to encoding, and below, in the column “Country code of residence”, — code of country of citizenship.

If this is Belarus, indicate “112”, citizens of Ukraine

Russia country code for filling out personal income tax certificate 2

d.

- Residence address in the Russian Federation

In this block, you should indicate the full coordinates of the person’s residence at which the migrant is registered in Russia.

Now we move on to the main part of the document.

In this block it is necessary to enter the country code of the state of which the migrant is a citizen, taking into account the all-Russian classifier of countries of the world.

A striking example is the hiring of a citizen of the Republic of Azerbaijan. You must enter 031.

In this line you should indicate the migrant’s residential address in the country from which he came. The legislation allows entries to be made in any order (Latin letters are allowed).

Country code for 2 personal income tax

Formula for the structure of a digital code in OKSM: XXX.

List of countries according to the Classifier Country name Code Short Full 2 letters. 3-letter numbers

ABKHAZIA Republic of Abkhazia AB ABH 895 AUSTRALIA AU AUS 036 AUSTRIA Austrian Republic AT AUT 040 AZERBAIJAN Republic of Azerbaijan AZ AZE 031 ALBANIA Republic of Albania AL ALB 008 ALGERIA Algerian People's Democratic Republic DZ DZA 012 AMERICAN SAMOA AS ASM 016 AN GUILIA AI AIA 660 ANGOLA Republic of Angola

World country codes 2017

(Kingdom of Spain)724ESESPITALY (Italian Republic)380ITITAYEMEN (Yemen Republic)887YEYEMCABO VERDE (Republic of Cape Verde)132CVCPVKAZAKHSTAN (Republic of Kazakhstan)398KZKAZCAMBODIA (Kingdom of Cambodia)116KHKHMCAMEROON (Republic of Cameroon)120CMC MRCANADA124CACANQATAR (State of Qatar)634QAQATKENYA (Republic of Kenya)404KEKENCYPRUS ( Republic of Cyprus196CYCYPKYRGYZSTAN (Kyrgyz Republic)417KGKGZKIRIBATI (Republic of Kiribati)296KIKIRCHINA (People's Republic of China)156CNCHNCOCONUT (KEELING) ISLANDS166CCCCKCOLOMBIA (Republic of Colombia)170COCOLCOMOROS (Union of Comoros)17 4KMCOMCONGO (Republic of the Congo)178CGCOGCONGO, DEMOCRATIC REPUBLIC180CDCODKOREA (Democratic People's Republic of Korea)408KPPRKKOREA ( Republic of Korea)410KRKORCOSTA RICA (Republic of Costa Rica)188CRCRICOTE D'IVOIRE (Republic of Côte d'Ivoire)384CICIVCUBA (Republic of Cuba)192CUCUBKUWAIT (State of Kuwait)414KWKWTCURACAO531CWCUWLAOSIAN

Citizenship (country code) in 2-NDFL

Since it is with these countries that there is an agreement on free movement, movement of capital and labor. Here are the numerical values for them by citizenship, country code for reference 2-NDFL:

- Armenia – “051”,

- Kazakhstan – “398”,

- Kyrgyzstan – “417”.

- Belarus – “112”,

Since quite a lot of people with Ukrainian citizenship come to Russia to work, many employers may need the country code for the 2-NDFL certificate: Ukraine - “804”.

For citizens of Tajikistan the code “762” is indicated, and for citizens of Uzbekistan – “860”. As for the “far” abroad, a considerable proportion of such workers are citizens of China, whose code is “156”. If necessary, the necessary numeric codes can be found in OKSM yourself.

Categories:

Source: https://konsalt74.ru/kod-strany-v-2-ndfl-ukraina-67731/

Structure

Structurally, the classifier consists of three blocks:

- digital identification,

- names,

- letter identification.

The digital identification block contains a three-digit digital code of the country of the world, constructed using the ordinal coding method.

The names block includes a short name and the full official name of the country of the world. The absence of the full name of a country in the classifier position means that it coincides with the short name.

The block of alphabetic identification of countries of the world contains two-digit (alpha-2) and three-digit (alpha-3) alphabetic codes, the signs of which are letters of the Latin alphabet. The basic principle that was used to create letter codes is the principle of visual association of codes with the names of countries in the world in English, French or other languages.

- Two-character alphabetic codes are recommended for international exchanges and allow a visual association to be created with the common name of a country in the world without any reference to its geographic location or status.

- Three-digit letter codes are used in special cases determined by the competent organizations.

The digital code has the advantage over the letter code in that it is not affected by changes in the names of countries around the world, which may entail changes in the alpha 2 and alpha 3 codes. Formula for the structure of a digital code in OKSM: XXX. In the classifier, countries of the world are arranged in ascending order of their digital codes. An example of recording OKSM positions:

032 Argentina AR ARG Argentine Republic,

Where:

032 - digital country code; THREE DIGIT with leading zeros. Argentina is the short name of the country; Argentine Republic is the full official name of the country; AR - letter code alpha-2; ARG is the alpha-3 alphabetic code.

Criticism of the classifier

In the Rosstandart classifier of world countries, the Russian spelling of the names of a number of countries and territories differs from the names used on geographical maps and in dictionaries of geographical names published by Rosreestr (and the former Federal Service of Geodesy and Cartography). Meanwhile, according to Decree of the Government of Russia dated June 1, 2009 N 457, Rosreestr is the authorized federal executive body in the field of geographical names.

The citywide classifier of St. Petersburg “Countries and Territories” (https://classif.spb.ru/classificators/view/cnt.php?st=), harmonized with OKSM, presents all applications, the history of changes in the names of states, and the names of countries in the genitive case and in English for ease of use when filling out documents in the citizenship column. In addition, the classifier contains a geographic region code that corresponds to the digital code in the section “Composition of macrogeographic (continental) regions and their constituent geographic regions” of the document “Standard codes of countries or regions for use in statistics.”

The code is constructed using the ordinal coding method using a variable number of characters, not exceeding 3 characters. The object code is used to identify macrogeographical and geographic regions; the decoding of the codes of geographic regions is presented in the citywide classifier of St. Petersburg “Macrogeographical Regions”, registration number 043 https://classif.spb.ru/classificators/view/view_classif.php?id=43&st =A

> Interesting facts

Used by the State Statistics Committee of the LPR and the State Customs Committee of the LPR