Payer classification

In accordance with Art. 19 of the Tax Code, taxpayers are individuals and legal entities who are responsible for making mandatory payments to the budget. Legal entities, in turn, are divided into foreign and Russian, and individuals - into those with and without the status of individual entrepreneurs.

Enterprises operating in specific areas are classified into a relatively separate category of entities. For example, we are talking about the gambling business, mining, etc. In these areas, separate types of taxes are established: on the gambling business, mineral extraction tax, etc.

Some experts identify persons who have the right to use tax benefits as a separate category of payers.

There is another category of subjects. It includes the largest taxpayers. The list of these individuals is quite impressive.

Further in the article we will look at the criteria by which taxpayers are classified as the largest, and what are the reporting features of such persons.

Subjects' rights

They are reflected in Art. 21 NK. According to the norm, taxpayers have the right to:

- Receive information from the Federal Tax Service Inspectorate at your place of registration about current fees and taxes, reporting forms, and advice on their preparation. These services are provided to subjects free of charge.

- Receive explanations from the Ministry of Finance of the Russian Federation, tax structures of municipalities and constituent entities of the Russian Federation on issues of application of tax legislation.

- Apply tax benefits enshrined in legislation if there are appropriate grounds. This right is exercised in the manner established by the Tax Code and federal regulations.

- Receive installments, deferments, and tax credits.

- Participate in tax legal relations personally or through your representative.

- Be present when regulatory authorities perform on-site inspections.

- Provide the Federal Tax Service with clarifications and explanations on the facts of calculation/payment of taxes, reports of inspections carried out.

- Require that employees of regulatory structures comply with the provisions of tax legislation.

- Receive copies of audit reports, decisions of tax authorities, tax notices, requirements for tax calculations.

- Do not comply with illegal demands of controlling structures.

- Challenge acts of tax authorities, decisions, actions/inactions of employees of the Federal Tax Service.

- Demand compensation for losses resulting from illegal actions of controlling structures.

- Participate in the consideration of inspection materials, as well as other acts issued by the Federal Tax Service.

These rights apply to all taxpayers, including the largest ones. At the same time, the activities of the latter are under particularly close attention of regulatory structures.

Largest taxpayers: determination criteria

The criteria by which a subject is classified into the category under consideration are established by the Federal Tax Service. These criteria are periodically adjusted depending on the developing economic situation in the country. The current legislation establishes a list of persons, a list of the largest taxpayers, which provides for the delimitation of their control in accordance with the subject of taxation at the appropriate levels (regional, federal).

To classify a payer as the largest, the following are taken into account:

- Indicators of financial and economic activity (FED). The value is determined on the basis of information from the accounting and tax reporting of the enterprise.

- Signs of interdependence with other participants in tax legal relations, indicators indicating the level of influence of the company on the activities of the interdependent structure and the results of its work.

- The economic entity has a special permit (license) to conduct a certain type of activity.

- Results of continuous monitoring of the analyzed enterprise.

"Federal" changes

The order of the Federal Tax Service of the Russian Federation preserved a special category of taxpayers (organizations of the military-industrial complex) with criteria for financial and economic activity that differ from the generally established ones. However, to recognize strategic enterprises as the largest taxpayers, the enterprise must meet all established criteria. As noted in the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated July 27, 2012 No. Ф03-3038/2012. “... when resolving the issue of classifying an organization as a major taxpayer, the tax authority must proceed from an assessment of the totality of circumstances characterizing the activities of a particular taxpayer and influencing the possible classification of an organization as a major taxpayer.” That is, if the taxpayer did not have export supplies while meeting other criteria, then the enterprise of the military-industrial complex cannot be assigned the status of the largest taxpayer.

LEGAL SERVICES

Let us recall that earlier (clause 4 of the Order of the Federal Tax Service of the Russian Federation as amended on June 27, 2012 No. ММВ-7-2 / [email protected] ) taxpayers in the financial sector (credit and insurance companies) subject to accounting were allocated into a separate group as the largest taxpayers depending on the following financial and economic indicators:

- the total amount of federal taxes and fees accrued according to tax reporting data is over 300 million rubles;

- the volume of net assets at the end of the year is at least 25 million rubles;

- the amount of insurance premiums for the reporting period is at least 2 billion rubles.

Now this category of taxpayers has been expanded and restrictions regarding financial and economic indicators have been lifted. In addition, to classify taxpayers as the largest taxpayers at the federal level, another criterion was added for financial sector organizations - the presence of a license to carry out a specific type of activity:

| List of organizations engaged in financial activities | License name |

| Credit organisation. | To carry out banking operations |

| Insurance organization. | For insurance, reinsurance, mutual insurance, intermediary activities as a broker |

| Reinsurance organization. | |

| Mutual Insurance Society. | |

| Insurance broker. | |

| Professional participant in the securities market. | To carry out activities as a professional participant in the securities market and maintain the register |

| Non-state pension fund. | To carry out activities related to pension provision and pension insurance |

Assignment of status

An enterprise can be classified as a major taxpayer (CT) based on the results of its work, considered for any 3 years before the start of the reporting period. Information for the current year is not taken into account.

It should be noted that the status of the largest taxpayer assigned to an enterprise is retained for 2 years after its activities ceased to meet the established criteria. In addition, the status can be maintained for 3 years. This is possible in the event of a reorganization of the largest taxpayer. The corresponding status is retained by companies formed as a result of this procedure. The three-year period includes the year of reorganization.

The largest taxpayers in Russia

Article current as of: December 2021

In tax legislation, the concept of “largest taxpayer” is often encountered. What does it mean, what criteria does it meet, what is it regulated by?

Not only commercial organizations, but also non-profit ones can be recognized as the largest taxpayers. Indicators for the last three years may be taken into account .

The assessment is made in accordance with the volume of income received and profit indicators, which are reflected in the reporting data.

FED indicators for the federal and regional levels are not the same, and accordingly, the restrictions on them are different.

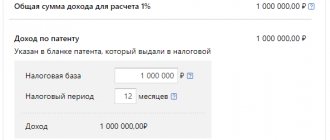

Specific indicatorFederal levelRegional level

| The total amount of taxes that were assessed | From 1 billion rubles | 2-20 billion rubles |

| Total amount of income that was received | From 20 billion rubles | — |

| Enterprise assets | From 20 billion rubles | From 100 million to 20 billion rubles |

| Average number of employees | — | From 50 people |

If an organization is engaged in the provision of services in the field of transport and communications, the indicator is set at 300 million rubles . In regions where an organization applies for this status, the evaluation criteria are equivalent to the total value of the federal tax accrual (75 million - 1 billion rubles).

several aspects should be taken into account :

- To identify a subject of economic activity at the federal level, one of the conditions must be taken into account.

- To classify a taxpayer within a region, all conditions listed in the table must be met.

Types of organizations

Enterprises that are taxpayers may have federal and regional significance.

List of the largest taxpayers

The largest taxpayer is. It is followed by GAZPROM and LUKOIL . Along with oil production, Sberbank of Russia .

Special situations

In practice there are several special situations that need to be taken into account:

- The classification of non-profit organizations as non-profit organizations is permissible if the total income from sales and receipts received outside of sales is at least 20 million rubles.

- During the reorganization of the largest taxpayer, its successor may retain this status for three years.

- If bankruptcy has been initiated, the status ends.

- Banks that were transferred to the Federal Tax Service as the largest taxpayers, in the event of license revocation, retain their status until a court decision.

Tax monitoring

Tax monitoring is usually understood as a method of extended interaction, in which an enterprise provides the Federal Tax Service with access to accounting and tax information, while receiving the right to request a reasoned opinion regarding tax consequences. This regime helps speed up the process of resolving disputes and allows you to prevent additional taxes in the future, as well as receiving penalties and fines.

The procedure is carried out in relation to organizations that submitted a request and complied with the norms of paragraph 2 of Art. 105.27 Tax Code of the Russian Federation, paragraph 3 of Art. 105.26 Tax Code of the Russian Federation. You also need to provide an application and comply with the following conditions :

- Provide documents to the tax authority. In particular, we are talking about regulations for information interaction, accounting policies, and internal documentation.

- Comply with the conditions conducive to filing an application with the tax authority. Their detailed list is given in paragraph 3 of Art. 105.26 Tax Code of the Russian Federation.

- Ensure compliance of the submitted regulations with the standards.

- Ensure that the internal control system complies with regulations.

Rights and obligations of legal entities - the largest taxpayers

The main responsibility is to notify the tax authorities of changes occurring in the organizational structure. This must be done within one month.

A similar period is provided in situations where a legal entity creates separate divisions within the state.

The news release on the implementation of social projects by large taxpayers is presented below.

Largest taxpayer

Largest taxpayer

(KN) is a legal entity registered in the Russian Federation that meets the criteria specified in the order of the Federal Tax Service of the Russian Federation No. MMV-7-2 / [email protected] dated April 24, 2012.

Loss of status

An enterprise ceases to be considered a major taxpayer if it has been declared bankrupt in court and bankruptcy proceedings have been initiated against it. The corresponding provision is enshrined in the order of the Federal Tax Service dated June 27, 2012. This rule, however, does not apply to credit organizations whose administration is carried out at the level of the Federal Tax Inspectorate for the largest taxpayers. They retain their status until forced liquidation.

FED indicators

During what time period can an organization be classified as a CI? Here, calculations using FED markers will be carried out for any of the three years preceding the reporting year. The status of “Largest Taxpayer” is retained by the organization for 2 years after the year in which it was recognized as a taxpayer.

If the company is reorganized, then the newly created company is called the largest taxpayer for another 3 years. Taking into account the year in which the reorganization took place.

If the debtor legal organization was declared legally bankrupt, then it loses its status as a corporate citizen. But this provision does not apply to credit institutions. If they are administered by the inspectorate for the largest taxpayers at the federal level, then they will be considered corporate property until the date of forced liquidation.

Note that even a non-profit association can be recognized as the largest taxpayer. But only if there is income that meets the criteria for CI.

Indicators of financial and economic activity

For companies whose activities are monitored at the level of the Interregional Inspectorate of the Federal Tax Service for the largest taxpayers, the corresponding status is assigned if one of the following conditions is met:

- The amount of taxes exceeds 1 billion rubles, and for companies operating in the service, transport or communications sectors - 300 million rubles.

- The amount of income received is at least 20 billion rubles.

- The total value of assets is not less than 20 billion rubles.

Additional criteria have been established for individual enterprises. In particular, military-industrial complex organizations under the control of the MI of the Federal Tax Service of Russia for the largest taxpayers receive the appropriate status if:

- Investments of public funds account for more than 50% of all assets.

- The average number of employees is more than 100 people.

- The total value of contracts for the export of strategic products exceeds 27 million rubles.

- The total amount of income from the export of goods is 20% of the total revenue.

Enterprises administered at the interdistrict tax level for the largest taxpayers receive the appropriate status if:

- The amount of income reflected in f. No. 2, ranges from 2 to 20 billion rubles.

- The total amount of contributions to the budget is 75 million rubles. – 1 billion rubles

- The value of the enterprise's assets is 100 million rubles. – 20 billion rubles.

- The average number of employees of the company is more than 50 people.

These taxpayers are considered the largest, regardless of the type of activity performed.

The largest taxpayer is... Concept and main criteria

The largest taxpayers in the Russian Federation are considered to be persons whose affairs are carried out by the Federal Tax Service at the regional, federal, and not at the local level. The largest taxpayers are CN in the abbreviated version.

Depending on the assigned level, they should register for tax purposes with the interdistrict or interregional inspectorate of the Federal Tax Service.

This structure will directly monitor the implementation of tax legislation by the Tax Code.

KN criteria

Let's start by presenting the criteria for the largest taxpayer:

- Certain FED markers. That is, financial and economic activity. To do this, the company's tax and financial statements for the current tax year are reviewed.

- Presence of interdependencies. The largest taxpayer is an organization that directly affects both the activities of interdependent companies and the results of their work.

- Availability of a license. A legal entity must have a certain permit, which opens up the legal opportunity for it to engage in a particular activity.

- Constant monitoring of tax activity.

Cost centers: accounting, organization, grouping

The largest taxpayer is one of the important entities among tax residents. Let us examine in more detail the criteria by which an organization can be classified as a CI.

Ensuring payment of customs duties: methods and calculation of the amount

Conditions for the military industry

Let us separately consider which military-industrial complex can be considered the largest taxpayer in the Russian Federation. There are several criteria at work here; to assign status, it is enough that the organization meets only one of them:

- The amount under export contracts for strategic products exceeds 27 billion rubles.

- The total revenue from these contracts is more than 20% of 27 billion rubles.

- The average number of employees is more than 100 employees.

- State contribution - more than 50%.

These conditions also apply to those organizations and companies that have strategic status.

Interdependence

The tax service for the largest taxpayers also takes into account such an indicator as interdependence. But only in cases where the influence of a tax resident on the tax base is obvious.

It influences in a certain way either the conditions of activity or the results of work.

According to Russian legislative norms, such a taxpayer and his FED will be assessed at the same level as the CN, over whom he has a certain influence.

Availability of a license

It is important to note that there is also a certain category of tax residents, whose FED can be legally conducted only on a federal scale. The amount of taxes paid, the amount of assets, total profitability, number of employees, and the presence of facts of interdependence do not play a determining role here.

We are talking about organizations that have received a license from the state to conduct specific activities:

- A variety of insurance and reinsurance, brokerage services.

- Banking and credit activities.

- Professional work in stock markets.

- Pension insurance, non-state pension funds.

Responsibilities of the CN

The largest taxpayers are required to inform the Federal Tax Service about all changes in their organizational structures. They apply with the relevant documents to the tax office at their location.

So, within 1 month they must notify the Federal Tax Service of the beginning of participation in the affairs of any domestic and foreign companies. The only exceptions here will be LLCs and business entities.

Also, within one month, it is necessary to inform about the creation of separate units on the territory of the Russian Federation. Branches and representative offices are not included in this number.

Within 3 days, those legal entities that are recognized as CN must inform the Federal Tax Service about the closure of separate structures through which activities were carried out in Russia. This norm already applies to branches and representative offices.

If a legal entity, being a corporate citizen, has separate divisions in its structure, then according to the Tax Code of the Russian Federation it is required to register with the Federal Tax Service in all districts, municipalities, regions where these entities are located.

Who is considered a CN in the Russian Federation?

Let's look at the accounting of which specific Russian corporations and enterprises is tax accounting for large taxpayers.

For many years, Gazprom and Rosneft have remained the leaders. At the end of 2021, the gas corporation must transfer 2 trillion rubles in taxes to the Russian budget. This amount also includes contributions from 56 Gazprom subsidiaries. Rosneft has been Russia's main taxpayer for many years. At the end of 2021, this corporation alone will pay 2 trillion rubles in taxes.

Other enterprises in the oil and oil and gas sector remain the leading largest taxpayers. Somehow:

- "Lukoil".

- "Tatneft".

- "Surgutneftegaz".

- "Sibur".

- Novatek, etc.

Following them are the largest corporations specializing in retail trade of a huge range of food products. These are the following retail chains:

- "Magnet".

- "Megapolis".

- X5 Retail Group.

The next fairly large group of the country's main taxpayers are metallurgical companies:

- "Norilsk Nickel".

- MMK.

- NLMK.

- "Severstal".

- UMMC, etc.

The largest domestic taxpayers also include the main telecommunications corporations of the Russian Federation:

- MTS.

- "Megaphone"

- "VimpelCom"

Most of the remaining IPs are in one way or another related to the extraction, processing and/or transportation of various minerals.

Facts about Russian IPs

Here are the defining facts for the largest tax payers in Russia:

- According to Forbes for the past 2021, each of the above companies has a total annual income exceeding 500 billion rubles.

- More than half of Russian IPs have their headquarters in Moscow.

- Only two companies are registered abroad - VimpelCom and Evraz.

- Eight of the largest taxpayers are registered in Russian regions. Tatarstan is in second place after Moscow - there are two KN.

- The leaders in terms of employee numbers are giant commodity corporations. Thus, Rosneft has more than 261,000 employees. As of 2021, Gazprom employed about 500,000 people.

- Among representatives of the largest retail chains, the leaders in terms of the number of employees are Magnit (about 310,000 people as of last year) and X5 Retail Group (the trading corporation employs about 200,000 people).

The largest taxpayers differ from all other tax residents, first of all, in the amount of taxes that they transfer to the state budget. Tax legislation defines clear criteria for CN at the federal and regional levels. In our country, the leading resource corporations in this group are Gazprom and Rosneft.

Source

Source: https://1Ku.ru/finansy/53041-krupnejshij-nalogoplatelshhik-jeto-ponjatie-i-osnovnye-kriterii/

Nuances

Indicators of financial and economic activity for enterprises controlled at the regional level can be established by the Inspectorate Directorates of the Federal Tax Service for the largest taxpayers of the constituent entities of the Russian Federation with their coordination with the Federal Tax Service of the Russian Federation.

It must also be said that organizations using special taxation regimes cannot obtain IP status.

Eligibility criteria for 2021

In order for a legal entity to qualify for this status, it must meet a number of criteria :

- Information on the financial and economic activities of the enterprise for the full reporting period (usually a financial year).

- Signs of mutual dependence of enterprises . Their influence on the final results of the work.

- Availability of permits (licenses) that allow organizing and performing work in certain areas of activity.

If all these criteria are taken into account, the procedure for registering as a UTII payer does not act as an obstacle to being included in the group of large taxpayers, although the law stipulates other provisions.

Availability of permission (license)

Business entities that have received special documents from government bodies to conduct certain types of activities are controlled by the Federal Tax Service for the largest taxpayers. In this case, inconsistency (compliance) with other criteria for classifying an enterprise as a national economy (amount of income, amount of taxes, interdependence or staffing levels) is not taken into account.

Among the types of activities for which the presence of a license provides an economic entity with obtaining the status of a business owner, the following should be included:

- Banking services.

- Pension provision (in this case we are talking about non-state pension funds).

- Pension and other types of insurance, reinsurance.

- Services of brokerage companies.

- Professional participation in the activities of the stock market.

Features of the relationship with the Federal Tax Service

In accordance with the requirements of the Tax Code, if the largest taxpayer has separate divisions, registration is carried out with all Federal Tax Service Inspectors at their location.

In case of a change in the organizational structure, the enterprise is obliged to notify the regulatory authorities. The corresponding notice should be sent to all Federal Tax Service Inspectors where registration was carried out. The largest taxpayer registered on the territory of the Russian Federation, creating separate divisions not in the form of representative offices or branches, or changing information about previously formed divisions, must send a corresponding notification to the regulatory authority within a month.

If an organization liquidates its structures operating on the territory of the Russian Federation, information about this is sent to the inspectorate within three days. This rule applies to all types of divisions, including branches and representative offices.

Information on the largest taxpayers in the Moscow region and other regions enters the unified database of the Federal Tax Service of the Russian Federation.

Tax legislation does not define the concept of the largest taxpayer

Clause 1 of Article 83 of the Tax Code of the Russian Federation only establishes that the financial department has the right to determine the specifics of accounting for the largest taxpayers with the tax authorities.

The taxpayer acquires the status of the largest taxpayer from the moment of registration with the tax authority as the largest taxpayer (Letter of the Ministry of Finance of the Russian Federation dated October 25, 2010 No. 03-02-07/1-493).

TAX CONSULTATION

Tax administration of the largest taxpayers is carried out (Guidelines for tax authorities on issues of accounting for the largest taxpayers, approved by Order of the Ministry of Finance of the Russian Federation and the Federal Tax Service of September 27, 2007 No. MM-3-09 / [email protected] ):

- at the federal level - in interregional inspections of the Federal Tax Service of the Russian Federation for the largest taxpayers;

- at the regional level - in the interdistrict inspections of the Federal Tax Service of the Russian Federation for the largest taxpayers, created in the constituent entities of the Russian Federation.

By order of the Federal Tax Service of the Russian Federation, changes were made to the Criteria for the largest taxpayers at the federal and regional levels.

List of the largest tax payers in Russia

Despite significant fluctuations in oil prices and changes in raw material production volumes, Gazprom remains the main taxpayer in the Russian Federation. The latter will allocate about 2 trillion rubles to the budget by the end of 2021. This amount includes taxes from all 56 subsidiaries and will amount to approximately the same amount.

According to the Interregional Tax Inspectorate for the largest taxpayers, the main “donors” of the federal budget include Lukoil, TAIF-NK, Tatneft, Sibur, Novatek.

Significant funds into the budget come not only from oil and gas sector enterprises. Retail chains Magnit, Megapolis, and X5 Retail Group are also considered the largest taxpayers. The top twenty leaders also include metallurgical enterprises Norilsk Nickel, Severstal, UC Rusal, etc. One cannot fail to mention telecommunications enterprises, VimpelCom.

The total assets of each specified enterprise exceed 500 billion rubles. This data is provided by Forbes magazine for the current year 2021. The head offices of half of these companies are located in Moscow. Some enterprises are registered abroad (for example, VimpelCom).

The leading positions in terms of the average number of personnel are occupied by Gazprom and Rosneft. The first company employs about half a million people, the second has more than 250 thousand people. Among trading enterprises, the leader is Magnit. As of 2021, its staff numbers more than 300 thousand people.

Who is considered a CN in the Russian Federation?

Let's look at the accounting of which specific Russian corporations and enterprises is tax accounting for large taxpayers.

For many years, Gazprom and Rosneft have remained the leaders. At the end of 2021, the gas corporation must transfer 2 trillion rubles in taxes to the Russian budget. This amount also includes contributions from 56 subsidiaries. Rosneft has been Russia's main taxpayer for many years. At the end of 2018, this corporation alone will pay 2 trillion rubles in taxes.

Other enterprises in the oil and oil and gas sector remain the leading largest taxpayers. Somehow:

- "Lukoil".

- "Tatneft".

- "Surgutneftegaz".

- "Sibur".

- Novatek, etc.

Following them are the largest corporations specializing in the retail trade of a huge range of food products. These are the following retail chains:

- "Magnet".

- "Megapolis".

- X5 Retail Group.

The next fairly large group of the country's main taxpayers are metallurgical companies:

- "Norilsk Nickel".

- MMK.

- NLMK.

- "Severstal".

- UMMC, etc.

The largest domestic taxpayers also include the main telecommunications corporations of the Russian Federation:

- MTS.

- "Megaphone"

- VimpelCom.

Most of the remaining IPs are in one way or another related to the extraction, processing and/or transportation of various minerals.

Largest enterprises abroad

As a comparative analysis of companies in the USA and Russia shows, in both countries the leading positions in the list of large taxpayers are occupied by resource giants. In America, the list includes ConocoPhillips, Chevron and ExxonMobil.

Next on the list are enterprises that produce intellectual products. These include Intel, Apple, IBM, Microsoft. A large amount of funds comes to the US budget from banks, insurance companies, manufacturers of medicines, and cosmetic products. It cannot do without a network of fast food outlets. Thus, the world-famous company McDonald's contributes about $2 billion annually to the US budget.

Specifics of the tax burden

For regulatory authorities, the amount of tax deductions is largely a statistical tool and not a guideline for activity. As analysts note, this indicator has not become a key mechanism for ensuring the effective implementation of state fiscal policy. Meanwhile, some experts are confident that the authorities cannot help but see significantly different tax burdens. That is why regulatory authorities use indicators when planning desk audits.

It must be said that enterprises themselves are very sensitive to the disclosure of the size of their tax burden. Most of them refuse official comments. Unofficially, representatives of some economic giants talk about the tax burden being too high, but they do not risk speaking openly about this, since this could significantly damage relations with the Federal Tax Service.

If we talk about the leaders - enterprises of the oil and gas sector, then the general opinion about the load on enterprises was expressed, perhaps, by Igor Sechin, the head of Rosneft. In his interview on the Vesti 24 program, he spoke about the need to reduce taxes. Sechin pointed out that the state doubled the amount of deductions for the oil and gas sector, but prices for raw materials decreased significantly.

However, today there is no one to replace enterprises in the oil and gas sector: the “fashion for entrepreneurship” has long passed, the number of medium and small businesses is steadily decreasing, and the tax base is not increasing. At the same time, it is impossible to reduce social spending today. So the tax burden is placed on the largest payers, primarily on companies in the oil and gas sector.

Meanwhile, according to a number of experts, this consumer attitude of the state towards the largest economic entities brings exclusively short-term benefits. Experts note that the authorities always have the opportunity to receive more tax amounts. Whether the consequences will be negative or positive depends on the level of economic development of the country as a whole and the financial condition of a particular enterprise.