What is the penalty for violating the payment limit?

Violation of the payment limit can result in a fine for entrepreneurs and companies (Article 15.1 of the Code of Administrative Offenses of the Russian Federation):

- for individual entrepreneurs - from 4,000 to 5,000 rubles;

- for LLC - from 40,000 to 50,000 rubles.

The tax inspectorate can impose a fine only within months from the date of calculation in excess of the limit (Part 1 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation). Both parties can be fined: the one who pays and the one who accepts the payment.

For example, your individual entrepreneur wants to supply equipment for your office. You cannot accept more than 100,000 rubles from him. for one operation due to restrictions in the law, otherwise both you and him will be fined.

The restrictions in the new rules still apply to settlements between organizations and organizations, organizations and individual entrepreneurs, individual entrepreneurs and individual entrepreneurs within the framework of one agreement - they are limited to the amount of 100,000 rubles. or equivalent in currency at the official rate of the Bank of Russia. This applies to settlements not only under current contracts, but also under expired ones, under which the counterparty will have to repay the debt.

The calculation cannot be exceeded even by 1 ruble. For 100,001 rubles. the manager and the payer will be fined.

To avoid a fine, the contract can be divided into several - each within 100,000 rubles.

Settlements with individuals and self-employed people without individual entrepreneur status and withdrawal of money for personal purposes are not limited.

Entrepreneurs can use cash that they:

- received through the sale of goods;

- received for performing work or providing services;

- received as insurance premiums;

- received a loan under a loan agreement from a microfinance organization, a pawnshop, a credit agricultural cooperative and a consumer cooperative;

- received as share contributions from consumer cooperatives;

- returned as the amount of debt under agreements with credit institutions.

Control your business remotely: check how much money is in the cash register and in the current account, see when cashiers open and close shifts.

To learn more

Cash payments between legal entities and individual entrepreneurs are carried out using money received at the cash desk from a bank account.

Which type of payment is more profitable?

Of course, the electronic payment system is the most beneficial and convenient, no matter how you look at it. It makes it possible to make purchases very quickly and simplifies the entire payment process. Moreover, costs are reduced. Let's give a simple example when buyers and sellers are in different regions. There is no way to do this without using cashless payments. However, despite all the visible benefits, it can only be implemented if one has a certain level of technology, culture, and education. Historically, cash came first. There were no non-cash payments before, and there could not have been. The level of development of society and technology simply did not allow this.

Today, cash payments are typical only for more backward countries. Expert research suggests that in the future, non-cash payment systems will replace cash payments.

What can individual entrepreneurs and organizations spend cash on?

They can spend it for several purposes:

- salary fund and social benefits for employees;

- payment of insurance amounts to individuals who paid insurance premiums in cash;

- payment of cash for personal needs of individual entrepreneurs not related to business activities;

- payment for goods, works and services (except for shares and other securities);

- issuing cash to employees on account;

- refund for goods, works, services previously paid in cash for which the buyer wants to issue a refund;

- issuing cash for transactions as a bank payment agent.

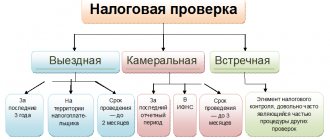

Limits for cash payments

When making cash payments between companies and entrepreneurs, a limit of one hundred thousand rubles must be observed. The number of payments and their frequency do not matter.

However, there are exceptions, and the limit may not be observed:

- When making payments to citizens;

- When making payments to employees, such as scholarships, salaries and others;

- When issuing cash to an employee on account.

In cases where the organization’s activities involve cash transactions in amounts exceeding one hundred thousand, or more than one hundred thousand rubles, it is best to use non-cash payments. It is worth considering several situations that are associated with compliance with the limit:

- Add. agreement to the contract. If you use such a trick, you can get a fine. Additional agreements do not provide the right to exceed the limit.

- Long term contracts. With such contracts, the limit is the same (one hundred thousand rubles) throughout the entire period of its validity.

- Conclusion of several similar contracts. In this case, you can also receive a fine if inspection authorities notice attempts to circumvent the limit.

- Lack of written contract. In such a situation, the limit is calculated for each shipment of products, and it also amounts to one hundred thousand rubles.

Rules for microfinance organizations, pawnshops and credit cooperatives

They can direct cash from the treasury to make loans and repay the loans received with interest.

- For MFOs and pawnshops, the issuance and repayment of loans, payment of interest, fines, penalties and penalties on loans attracted by MFOs and pawnshops are limited to 50,000 per agreement and 1 million rubles. per day for a separate office of the organization.

- For credit cooperatives, the issuance and repayment of loans under agreements for the transfer of personal savings, payment of interest, penalties, penalties and fines, payment of share savings by a consumer cooperative cannot exceed 100,000 rubles. under one contract and 2 million rubles. per day in one department.

Adjusting calculations

Bank transfer is regulated by the Civil Code, as well as several provisions that were adopted by the Central Bank. Payment without the use of cash must strictly comply with all requirements specified in regulations.

By studying the regulations on the rules for making money transfers, you can find out how to use this payment method and what are the requirements for payment documents.

Watch the video about cashless payments:

In some cases there are no restrictions

There are no restrictions for:

- cash payments between individuals;

- banking operations;

- customs duties and taxes.

Ordinary entrepreneurs and organizations cannot issue and repay loans using cash. First, they must deposit money into a current account and withdraw it again.

Cash that is returned to the cash desk as the balance of an advance that has not been spent cannot be used for settlements. First, they need to be returned to the bank and deposited into a current account (Letter of the Bank of Russia dated July 9, 2020 No. 29-1-1-OE/10561).

What regulates the procedure for organizing cash and non-cash payments?

Cash and non-cash payments in the Russian Federation are regulated by the following regulations:

- Ch. 46 Civil Code of the Russian Federation;

- Law “On the Central Bank of the Russian Federation (Bank of Russia)” dated July 10, 2002 No. 86-FZ;

- Law “On the use of cash register equipment...” dated May 22, 2003 No. 54-FZ (hereinafter referred to as Law No. 54-FZ);

- Instruction of the Bank of Russia “On making cash payments” dated October 7, 2013 No. 3073-U (hereinafter referred to as Instruction No. 3073-U);

- Regulations of the Bank of Russia “On the procedure for conducting cash transactions...” dated January 28, 2018 No. 630-P;

- Directive of the Bank of Russia “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” dated March 11, 2014 No. 3210-U;

- Directive of the Central Bank of the Russian Federation “On the maximum amount of cash payments and spending of cash...” dated 10/07/2013 No. 3073-U (hereinafter referred to as instruction No. 3073-U).

Settlements under a letter of credit

1. Settlements under a letter of credit (from the French accreditif, Latin ad credere - authority) is a form of payment in which the bank, on behalf of the client (payer) to open a letter of credit, undertakes to make payments in favor of the recipient of the funds upon presentation of the documents provided for by the terms of the letter of credit (Clause 1 of Article 867 of the Civil Code).

In addition to the transfer of funds, the execution of a letter of credit may consist of payment, acceptance or discounting of a bill of exchange. The corresponding actions can be carried out either by the payer's bank (issuing bank, from the Latin emitto - to issue), or by another bank (executing bank).

Opening a letter of credit consists of allocating (separating) funds from which payments will be made, which provides the recipient with payment guarantees.

At the same time, the letter of credit form of payment also provides protection to the payer, since payment to the recipient of funds is made only after submitting to the bank documents confirming execution under the main contract (for example, supply of goods, performance of work, etc.).

In these conditions, a letter of credit is extremely in demand when making payments in conditions of a high risk of non-payment, the absence of established business relations between counterparties, as well as when the costs associated with debt collection are significant. Therefore, the letter of credit form of payment is widely used in foreign trade transactions.

The list of documents, the provision of which by the recipient is necessary to make a payment in his favor, is established by the payer when opening a letter of credit. At the same time, the bank, based on external signs, checks the documents for their compliance with the terms of the letter of credit, but does not investigate the issue of the actual execution of the agreement by the recipient of the funds.

2. A revocable letter of credit (Article 868 of the Civil Code) can be changed or canceled (cancelled) without prior notification to the recipient of funds and without creating any obligations of the issuing bank (payer bank) to it. In accordance with current legislation, a letter of credit is assumed to be revocable, unless otherwise indicated in its text (clause 3 of Article 868 of the Civil Code).

Changing or canceling an irrevocable letter of credit (Article 869 of the Civil Code) without the consent of the recipient of funds is impossible.

A confirmed letter of credit is an irrevocable letter of credit, under which the executing bank, along with the issuing bank, assumes the obligation to make payment, regardless of the receipt of funds from the latter. A confirmed irrevocable letter of credit cannot be canceled without the consent of not only the recipient of the funds, but also the executing bank (clause 2 of Article 869 of the Civil Code). A confirmed letter of credit gives the recipient of funds additional guarantees of payment.

Covered (deposited) letter of credit - a letter of credit, the terms of which provide for the transfer of the amount of the letter of credit (covering) to the executing bank at the expense of the payer or at the expense of the loan provided to him by the issuing bank (if there are no funds in the account in the required amount). A covered letter of credit can be used in the absence of a correspondent relationship between the issuing bank and the nominated bank.

In case of an uncovered (guaranteed) letter of credit, the executing bank has the right to write off the amount of the letter of credit from the correspondent account of the issuing bank, which then reimburses them at the expense of the payer.

From an economic point of view, an uncovered letter of credit is a form of short-term lending.

3. Payment under a letter of credit is made when the recipient of funds submits to the bank documents confirming the fulfillment of the terms of the letter of credit, during its validity period (as well as within the period for submitting documents provided by the letter of credit).

If documents do not comply with the terms of the letter of credit (for example, when submitting an uncertified copy of a document, whereas according to the terms of the letter of credit it must be certified; submitting documents in a smaller number of copies, etc.), the executing bank has the right to refuse to accept them and not make payment, immediately notifying about this by the recipient of funds and the issuing bank (clause 1 of Article 871 of the Civil Code).

In this case, the issuing bank conveys the specified information to the payer, who can give an order for payment, despite the incorrect execution of documents, if the obligation under the main agreement was fulfilled by the recipient of the funds.

The recipient of funds has the right to re-submit the documents provided for by the terms of the letter of credit before its expiration.

The costs of making a payment, which are borne by the executing bank, must be compensated to it by the issuing bank, and to the latter, in turn, by the payer (clause 2 of Article 870 of the Civil Code).

If the executing bank makes a payment in violation of the terms of the letter of credit, the issuing bank may refuse to reimburse the amounts paid (under an uncovered letter of credit) or demand the return of coverage under a covered letter of credit. In this case, an incorrect payment may be recovered by the executing bank from the recipient of funds as unjust enrichment (Articles 1102, 1107 of the Civil Code)1.

A letter of credit can be closed upon expiration of its term, upon cancellation of a revocable letter of credit, as well as upon refusal of the recipient of funds to use the letter of credit (Article 873 of the Civil Code).

4. As a general rule, the issuing bank is responsible for violation of the letter of credit to the payer, and the executing bank is responsible to the issuing bank (clause 1 of Article 872 of the Civil Code). In this case, the payer is responsible to the recipient of funds for failure to fulfill the main obligation; the fact that banks and even the recipient of funds violates the terms of the letter of credit does not relieve the payer from the obligation to make payment under the main agreement.

At the same time, if the executing bank unreasonably refuses to pay funds under a covered or confirmed letter of credit, liability to the recipient of the funds may be assigned to the executing bank.

If the executing bank makes an incorrect payment of funds under a covered or confirmed letter of credit, liability to the payer may be assigned to the executing bank.

Settlements by payment orders

1. Settlements by payment orders are a form of settlement in which the bank, on behalf of the client (payer), undertakes to transfer a certain amount of money from his account to the account of the recipient of funds (clause 1 of Article 863 of the Civil Code).

Payment orders are the most popular form of non-cash payments in commercial transactions: according to data posted on the official website of the Bank of Russia, 97% of the volume (in rubles) of all payments processed through credit institutions in the first half of 2021 were payment payments instructions.

2. The payment order is executed at the expense of the client’s funds available in his account (clause 1 of Article 863 of the Civil Code). In the absence of funds sufficient to execute a payment order, the order is placed in a card index and executed after funds are received in the account in the required amount.

An agreement between the bank and the client (payer) may provide for the execution of a payment order at the bank’s expense (crediting the client’s account).

Payment orders received by the bank are executed in the order provided for in Art. 855 of the Civil Code (clause 3 of Article 864 of the Civil Code).

As an exception, the law provides for the possibility of making a transfer also by a person who does not have a bank account (clause 2 of Article 863 of the Civil Code).

Payment orders are executed within the time limits established by law (or in accordance with it), unless a shorter period is provided for in the bank account agreement or is not determined by business customs applied in banking practice. In accordance with current legislation, the transfer of funds must be made no later than the next business day from the moment the payment document is received by the bank (see Article 31

Law on Banks and Banking Activity). Before execution, the payment order can be canceled (revoked) by the client.

If there are no correspondent relations between the executing bank (payer’s bank) and the recipient’s bank, the payer’s bank has the right to involve other banks in the execution of the payment order (clause 2 of Article 865 of the Civil Code).

In accordance with Art. 316 of the Civil Code, which consolidated the approach that existed in judicial practice, the obligation to execute a payment order is considered fulfilled from the moment funds are credited to the correspondent account of the recipient's bank, opened with the payer's bank or the cash settlement center of the Bank of Russia.

The bank has the responsibility to inform the client about the execution of the payment order.

3. For non-execution and improper (for example, untimely) execution of a payment order, the bank is liable to the client (clause 1 of Article 866 of the Civil Code). The executing bank must compensate the payer for losses (Article 15, 393 of the Civil Code) caused both by its actions and by the actions of intermediary banks if they were involved in executing the payment order. At the same time, the law provides for the possibility of imposing liability directly on the intermediary bank that is guilty of failure to fulfill the order (clause 2 of Article 866 of the Civil Code).

In addition, the bank may be charged a penalty established by the bank account agreement or (if there is no corresponding condition in the agreement between the bank and the payer) interest for unlawful withholding of someone else’s funds (Article 395 of the Civil Code).

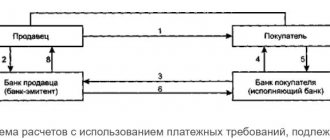

Payments for collection

1. Payments for collection (from Italian incasso - receipt) are a form of payment in which the bank, on behalf of the client, undertakes to take actions to receive payment and (or) acceptance of payment from the payer (clause 1 of Article 874 of the Civil Code).

Just as with settlements under a letter of credit, the issuing bank can attract an executing bank to execute the order (clause 2 of Article 874 of the Civil Code).

When making collection payments, the payment order is given to the bank not by the payer, but by the recipient of the funds. Collection operations are carried out on his behalf and at his expense.

Collection settlements are widely used in international trade. In this case, banks assume the function of transferring documents of title from the supplier to the buyer against payment of the agreed amount. After payment, the bank provides the buyer with documents allowing the latter to receive the delivered goods. Thus, a sufficient balance of interests is achieved between the parties to the purchase and sale agreement, while the buyer does not have a long-term diversion of funds, as with a letter of credit.

In Russia, collection payments are not widespread enough; their use is mainly limited to payments of a public nature (for example, collection of arrears and penalties for taxes and fees).

2. Payments for collection are carried out on the basis of payment requirements of the recipient of funds and collection orders.

The right of the recipient of funds to submit payment claims to the payer's bank account must be provided for in an agreement between the payer and the executing bank. To write off funds in favor of the recipient, in addition to his order, in this case the consent (acceptance) of the payer is required. In this case, acceptance can be given both before and after the request is received by the bank - the so-called pre-given acceptance (Article 6 of the Law on the National Payment System).

A collection order is drawn up if the recipient of funds has the right to submit orders to the payer’s account, as provided for by law (for example, when collecting under enforcement documents presented to the bank by collectors in accordance with Article 70 of the Law on Enforcement Proceedings, when collecting leasing payments on the basis of clause 1 Article 13 of the Leasing Law) or an agreement between the payer and his bank. Write-off of funds under collection orders is carried out without the payer's order (in an indisputable manner).

3. The issuing bank, having previously checked the correctness of the received settlement documents, ensures that they are sent to the executing bank.

The executing bank also checks the correctness of execution and completeness of settlement documents and is obliged to immediately notify the issuing bank of the absence of any document or of the discrepancy of the submitted documents by external features with the collection order (payment request). If the deficiencies are not eliminated, the executing bank has the right to return the submitted documents without execution (clause 1 of Article 875 of the Civil Code).

If the verification of the payment documents is positive, the executing bank debits the funds from the payer's account.

If there are insufficient funds in the account, settlement documents are placed in a card index, of which the executing bank notifies the issuing bank.

Payment requests and collection orders are executed in the order provided for in Art. 855 GK.

In the case where the payment depends on the payer's acceptance, the debit is made after its receipt. Refusal to pay must be motivated by the payer. The executing bank immediately informs the issuing bank (and that, in turn, the recipient) of the reasons for the refusal.

When settling for collection, the order of the recipient of funds is considered executed at the moment the funds arrive in his account.

4. In case of non-execution or improper execution of the order, the issuing bank bears responsibility to the client, which at the same time can be assigned to the executing bank that violated the rules for making settlements (clause 3 of Article 874 of the Civil Code).

Basic principles of calculations

There are a number of principles by which non-cash payments should be structured. Among them are:

full legality- sufficiency of funds

- urgency of payment

- notifying the account holder before debiting funds

- performance of all operations exclusively according to the terms of the contract

All non-cash transactions must be carried out only in accordance with current legal requirements.

In order for operations to be carried out according to plans, there must be enough money in the account. This principle must be adhered to when building a cashless payment system.

Urgency of payment means the execution of transfers within the agreed time frame. The agreement with the bank specifies certain nuances and payment deadlines.

By adhering to the basic principles of cashless payments, the organization will be able to create an effective way to pay and receive funds when interacting with other individuals.

The most protected form

To protect the payer from fraud or the provision of poor-quality services, payment using a letter of credit may be used. This method is considered time-consuming, but at the same time quite secure. The bank transfers funds only after receiving confirmation of the fulfillment of the agreed obligations between the payer and the recipient.

It is worth noting that to pay using the letter of credit method, you need to create a separate account, even if you already have a current account with the same bank.

Working with the cash register: advances, power outages, correction checks

Individual entrepreneurs provide tutoring services on the simplified tax system. Often clients pay an advance, and at the end of the month I summarize the results for each client. I am interested in how to calculate the advance payment at the time of service delivery. Do you need to make additional checks?

- The advance payment is made in two checks. Issue the first check with the payment sign “Advance” when the client makes an advance payment. Issue the second check after the final payment of the entire amount. In the check with the final payment, you need to take into account the amount of the previously paid advance. How this happens in Kontur.Market. Please note, Art. 4 of Law No. 192-FZ, until July 1, 2021, it is permitted not to use cash register systems when returning or offsetting an advance payment.

We suffer from frequent power outages; the cash register, the cashless payment terminal, and the Internet are turned off. How to close a shift in such a situation? Can it close automatically?

- Close your shift manually as soon as power returns. Devices that allow equipment to operate for up to several hours even when the electricity is turned off will help you - these are uninterruptible power supplies (UPS, or UPS). The lack of Internet in this case is not a problem - the cash register accumulates sales data and transmits it automatically to the OFD as soon as the connection to the Internet is restored.

In what cases is a correction check generated? What happens if you don't use it?

- The Federal Tax Service clarified that a correction check needs to be generated only if the online cash register is not used (Letter of the Federal Tax Service dated 08/06/2018 No. ED-4-20/15240), this may exempt you from a fine. See the article for details.

Firms on the simplified taxation system and VAT receive receipts from individuals for maintenance services and rental of non-residential premises into their current account. Individuals pay via online banking. Do I need to punch checks? If necessary, is it possible to do this not on the day of payment?

- Law No. 54-FZ has a clause that regulates the time of check generation: “a cash receipt (strict reporting form) must be generated no later than the business day following the day of payment” (clause 5.3, Article 1.2 of Law No. 54-FZ ). Thus, you can generate a check on the next business day after payment. As for issuing a check to the buyer: if you have his contacts, send an electronic check at the time it is generated, and if there are no contacts, issue a paper check upon first contact with the client. A wide range of cash desks are suitable for this. The choice of cash register is influenced by your assortment (the number of items in the product range) and the intensity of sales (the number of receipts per day).

When making a courier delivery, is it necessary to give a cash receipt or will an electronic receipt be sufficient?

- CCP is applied at the time of settlement. If the courier accepts the payment, then he must generate the check. This can be either a paper check or an electronic check, but the buyer must ask for one before settlement. If the buyer paid for the goods on the website, then the receipt must be generated within 24 hours after payment and sent electronically.

1) Is it technically possible to send a receipt by email to the buyer a few days after the purchase?

2) Management Company (LLC on the simplified tax system), how to issue a check for utility expenses if the certificates of completion of work and the invoice are issued half a month later than the billing month?

- By law, the check must be generated no later than the business day following the day of payment, but no later than the moment the goods are transferred.

Is it possible to process several payments with one check from individuals who came to a legal entity’s account in one day?

- No, each individual must have their own check.

The organization's account received payment for office rental from an individual for a legal entity that rents an office. Should our organization, upon receiving payment, issue a cash receipt to an individual? Is this considered an electronic payment? Is cash applied?

- If from the statement you understand that the payment was made by an individual, then you need to generate a check; if you understand that this is a legal entity, then a check is not needed.

A legal entity provides legal services under the simplified tax system; there are rare sales to individuals. At what point should I switch to an online cash register and if there are zero sales, do I need to open and close shifts daily?

- The service sector will switch to online cash registers from July 1, 2021. There is no need to open a shift at the cash register every day; do it on the day of payment through the cash register.

The organization connected to the online cash register, but the integration was not configured; as a result, checks were not generated and were not sent to the OFD. This was discovered two months later. What to do in such a situation?

- If the check has not even been generated, the situation looks like a non-use of the cash register system. In such cases, a correction check is generated; see how to create it in the article.

Are there ready-made programs that transmit data to the cash register in the necessary sections: advance payment, offset of advance payment, issuance of a loan, repayment of a loan, receipt of a loan, receipt/return of electronic means of payment, receipt/return of non-cash means of payment?

- The availability of these capabilities depends on the POS software and item source you use. For example, the cash register module of Kontur.Market supports advance payments, receipts and returns in cash and non-cash (payment by card).

We add goods to the cash register manually through the device itself (we do not use software). If the price of an item changes during the day, will there be any problems with checks issued on that day for that item before the price change?

- No, you can change the price as many times as you like during the shift. The OFD will receive information about each receipt with the exact price at which you sold the goods at that point in time.

Which cash register supports synchronization with 1C?

- Depends on what kind of synchronization you need. We recommend that you clarify this issue with the manufacturer of the cash register or 1C. Between Kontur.Market and 1C there is integration for transferring items from 1C to Market, and the Market cash module sends sales data to 1C: Enterprise in the form of a ready-made report on retail sales.

Is it necessary to use special programs for a cash register? We manage the receipt and consumption of goods in other programs in a format convenient for us, and this results in double work (individual entrepreneur, canteen).

- Cash registers have their own software. It can be integrated with an accounting program, then there will be no need to do double work on transferring items. To understand whether Kontur.Market will help you, you need to know what accounting program you use. We recommend contacting the manager of the SKB Kontur branch in your city.

Entrepreneur cash payments

If an individual is an individual entrepreneur, he is subject to restrictions on commercial settlements in cash with organizations and other individual entrepreneurs.

A businessman has the right to give himself amounts from the cash register that are not limited by the limit, and he can spend them on his personal needs. Payment in cash for each of the transactions concluded by the entrepreneur (except for transactions with individuals - not individual entrepreneurs) should not exceed the established limit of 100,000 rubles.

Example

Individual entrepreneur T.T. Petrov, taking 300,000 rubles from the cash register, entered into a supply agreement for 160,000 rubles. Exceed 100,000 rubles. When paying in cash, it is not possible in this case either. An individual entrepreneur can pay 100,000 rubles in cash, and the remaining 60,000 rubles. should be transferred to the seller by bank transfer.

If an individual entrepreneur pays in cash for his personal expenses not related to commercial activities, this restriction does not apply.

As a rule, business entities practice breaking down such contracts, characterizing different conditions in each or dividing the assortment. It should be taken into account that the court may consider several contracts concluded with one supplier to be a single transaction if they are signed on the same day and paid at a time in an amount of over 100,000 rubles. (resolution of the Federal Antimonopoly Service on case No. A72-3587/2008 dated December 13, 2008).

Cash payments between a legal entity and an individual require the use of a cash register that transmits information to the Federal Tax Service. This requirement applies to all companies and individual entrepreneurs, except those exempt from the mandatory use of cash registers or those that have been deferred until 07/01/2019.