Purchase of inventory

In accounting and tax accounting, materials are valued at actual cost. This provision must be reflected in the accounting policies. The actual cost of inventories purchased for a fee is the amount of the organization's actual costs for the acquisition, excluding value added tax and other reimbursed taxes.

Examples of costs that can be included in the cost:

- Purchase price excluding VAT and excise taxes;

- Cost of non-returnable containers and packaging;

- Import duties and fees;

- Costs for transportation of raw materials and materials;

- Commission paid to the intermediary;

- Other expenses directly related to the purchase of raw materials and materials.

Example:

The company entered into an agreement for the delivery of materials with the manufacturer. The cost of materials under the contract is 118,000 rubles, including VAT of 18,000 rubles. The deal was concluded through an intermediary commission agent. The commission agent's remuneration is 10% of the transaction amount. The cost of packaging materials is 1000 rubles. It is necessary to calculate the cost of acquisition.

The cost of purchasing materials can be calculated as follows:

- Let's determine the cost of materials without VAT:

118,000 rubles – 118,000 rubles *18/118 = 100,000 rubles. - To determine the amount of the commission agent's remuneration, it is 10% of the transaction value.

That is, 118,000 * 10% = 11,800 rubles. - To determine the cost of purchasing materials, you need

100,000 rubles + 11,800 rubles + 1,000 rubles = 112,800 rubles.

Documentation of receipt of materials:

- Power of attorney to receive materials if they are received not by the director, but by a financially responsible person. The power of attorney must be notarized.

- Sales receipts;

- Invoices;

- Certificate of acceptance of goods in the form TORG-1. This act is not used every time and is used exclusively by large companies when this is stipulated by the terms of the contract. To draw up this act, it is necessary to assemble a special commission.

Example:

Now in front of you is the M-2 power of attorney form (see Figure 1).

Figure 1. Power of attorney M-2 to receive inventory items

In this form you must fill in the following fields:

- Date of issue;

- Validity;

- The organization issuing this power of attorney;

- Account number of this organization;

- Who issued this power of attorney;

- To whom this power of attorney was issued;

- Passport series and number, date of issue;

- A list of material assets that the bearer can receive under this power of attorney.

Sales receipt

The sales receipt lists the material assets that were purchased using this receipt. It must also have a stamp, the signature of the seller, the amount of VAT, the price, the amount of material assets purchased and the units in which they are measured.

Act in the form TORG-1

This is a two-page act, which is filled out by a commission that checks the quantity, quality and all the necessary parameters of material assets. However, there is a disagreement between tax specialists and accountants. Tax officials believe that TORG-1 must be filled out when accepting material assets. Since this invoice is a supporting document for the acceptance of goods.

Question: where is the notarization of a power of attorney provided?

When a power of attorney is issued, it must be certified by the seal of the organization.

The second page of the act lists the members and chairman of the commission. Most often, the chairman of the commission is the director. Signatures and seals must be present here.

Invoice

The invoice must contain:

- Number;

- date;

- Seller and recipient;

- Payment document number;

- Addresses, INN, checkpoint;

- A list of what the invoice was issued for.

When constructing accounting records, the economic activities of a construction enterprise must be organized on the basis of two control systems. The first is an organizational system created to achieve the objectives of operational accounting. The second is a system of organizational procedures that controls the first system; it is built on general principles and consists of the following elements: general rules and instructions, reporting, well-thought-out accounting policies, accounting systems and accounting procedures, budget control. This entire harmonious system is aimed at creating the preconditions that the company’s goals: its economic activities and the general leadership (management) of the organization will achieve the established planned results. The performance monitoring system is an action aimed at achieving the objectives of a legal entity, which are the result of monitoring the activities of the company as a whole and also of individual structures and departments (branches and (or) separate divisions).

According to the tasks facing accounting, the organization of internal control provides sufficient confidence that, according to accounting records, it is always possible to control assets according to accounting data, namely:

- Verify the availability of enterprise assets by periodically (scheduled) checking these assets with accounting records - inventory;

- Monitor the effectiveness of use and eliminate the misappropriation of material assets.

The objects of internal control during construction are the organization’s activity cycles:

- supply cycles;

- cycles of construction and installation works (production);

- cycles for recording work results, including write-offs of inventory items.

The main task of two-stage control is to develop measures to ensure that all employees comply with their job duties . A variety of these accounting activities include the following methods:

- financial accounting (inventory and documentation, correspondence of accounts and accounting entries, reflection in monetary terms of the state of cash and its sources on a certain date);

- management accounting includes measures to assign responsible persons, standardize standards for write-off of materials and other costs;

- audits - an audit of documents, which includes checking the accuracy of document flow, checking arithmetic calculations, monitoring compliance with the rules of accounting of business transactions, inventory of material assets).

All these requirements must be implemented based on the requirements of Articles 5 - 9.19 of the Federal Law of December 6, 2011 No. 402-FZ (as amended on November 28, 2018) “On Accounting,” as well as Chapter II, which is based on the document “ Formation of accounting policies" Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n (as amended on April 28, 2017) "On approval of accounting regulations" (together with the Accounting Regulations "Accounting Policy of the Organization" (PBU 1/2008)", Regulations on accounting “Changes in estimated values” (PBU 21/2008)”) (Registered with the Ministry of Justice of Russia on October 27, 2008 No. 12522).

When performing construction and installation work (hereinafter referred to as construction and installation works), a large number of materials are used. The cost of construction and the results of economic activity of a construction enterprise greatly depend on the volume and cost of materials used. When carrying out work, the manager’s task is to organize competent accounting, on which the tax burden (base) on construction enterprises and the results of its economic activities depend.

An important role in the accounting policy of an enterprise is played by the write-off of inventory items (hereinafter referred to as inventory items) - accounting for those released into production, transferred for use for someone else's needs. At the same time, the write-off of these inventory items in construction has significant features, since the determination of the need for inventory items begins when drawing up design documentation and working documentation prepared on its basis. Design specialists or developer (operator) specialists, at the stage of making technical decisions, select one or another type of materials and equipment - goods and materials, which will be used during the construction process. For these technical solutions, based on the requirements of paragraphs 3.9 and 4.1 of MDS 81-35.2004 “Methods for determining the cost of construction products on the territory of the Russian Federation”, an estimate(s) or consolidated estimate calculation (SER) is drawn up in which the cost of future work is calculated on the basis of estimate standards.

Control of write-off of materials during construction

The General Director, together with the chief accountant, determines the accounting policy for the enterprise. According to the requirements of the legislation of the Russian Federation, specified in Federal Law No. 402 “On Accounting,” the accounting department is assigned responsibilities, in addition to the usual audit, also assigned functions for:

- preventing the write-off of materials in excess of the norm, as well as the unreasonable write-off of inventory and materials as losses;

- preventing the write-off of materials of higher quality than actually used.

These functions make it possible to identify the dishonesty of specialists performing work and save the company’s assets, thereby increasing profits.

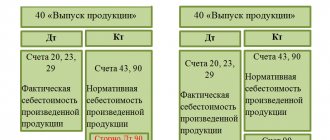

The main issue in writing off materials is assessing their value. In accordance with the requirements of the Accounting Law, materials must be accounted for at their actual cost.

Actual cost is the sum of costs incurred when delivering material to the enterprise, which includes the following costs:

|

The need for building materials is determined by specialists from the production and technical department (PTO). Calculation of the nomenclature and volume of materials that should be used in the construction of any facility is carried out on the basis of the design and working documentation created on its basis based on the relevant regulatory and technical documents, including codes of rules (SP), technological maps, instructions for use factories producing building materials. Based on the project, a selection of materials is carried out and the material and technical supply department makes an application for the purchase of materials based on the construction schedule.

For each facility, by order of the head of the enterprise, a list of responsible employees for writing off inventory items is approved. As a rule, the head of the construction production site or a technical maintenance engineer* is appointed as the senior financially responsible person for filling out the primary documentation for the write-off of inventory items. This person is responsible for verifying the data contained in the material reports. In addition, the same order should establish the responsibility of the manager - the head of the site or the engineer of the production and technical department - for approving the processed documentation. Under their control, this work on writing off inventory items is carried out by financially responsible specialists. The control results are additionally checked by the accountant of the material table; he makes the appropriate entries in accordance with the PBU and the document flow approved at the enterprise.

*A technical equipment engineer can be an estimator.

The document flow for writing off inventory items depends on the availability of calculated and approved consumption rates for inventory items for all types of construction work. Accounting for the write-off of materials in a construction organization pursues the following goals:

- reliability of information about purchased and consumed materials;

- control over the preservation of materials according to warehouse records;

- monitoring compliance with material consumption standards during construction and installation works;

- reliable analysis of the effective use of material resources.

I would like to draw your attention once again to the fact that the statement of material consumption in construction (form M-29) is compiled by a technical and technical equipment engineer according to the design documentation. At the moment, there is an erroneous tendency that the M-29 certificate is issued by estimators on the basis of design estimates. The project estimate does not reflect the actual amount of inventory and materials; the average of material resources is based on the methodology for creating estimate standards, which determine the cost of work. Article 1, paragraphs 30 - 31 of Federal Law No. 190 “Town Planning Code” defines the estimated cost and estimated standards.

| 30) estimated cost of construction, reconstruction, major repairs, demolition of capital construction projects, work to preserve cultural heritage sites (hereinafter referred to as the estimated cost of construction) - the amount of money required for construction, reconstruction, major repairs, demolition of capital construction projects, carrying out work on the preservation of cultural heritage sites; 31) estimated standards - a set of quantitative indicators of materials, products, structures and equipment, labor costs of workers in construction, operating time of machines and mechanisms (hereinafter referred to as construction resources), established for the accepted unit of measurement, and other costs used in determining the estimated cost of construction . |

The average of the estimated cost is indicated by another, already estimated standard, so in the methodology for determining the estimated cost of construction MDS 81-35.2004, in paragraph 2.2 it is indicated:

| 2.2. The estimated norm considers the totality of resources (labor costs of construction workers, operating time of construction machines, requirements for materials, products and structures, etc.) established on the accepted meter for construction, installation or other work. The main function of estimate standards is to determine the standard amount of resources , the minimum necessary and sufficient to perform the corresponding type of work, as the basis for the subsequent transition to cost indicators. Considering that the estimated standards are developed on the basis of the principle of averaging with minimization of the consumption of all necessary resources, it should be taken into account that the standards are not adjusted towards their reduction. |

We especially draw your attention: our estimate methodology does not indicate that, on the basis of estimate standards, it is possible to generate a statement of material consumption in the form M-29. There is no such form in MDS 81-35.2004; this form was put into effect by the Instruction of the Central Statistical Office (CSO) of the USSR on November 24, 1982 No. 613 and has nothing to do with estimate standards.

The report in form No. M-29 serves as the basis for writing off materials as the cost of construction and installation work and comparing the actual consumption of building materials for completed construction and installation work with the consumption determined according to production standards .

Write-off of materials during construction and installation work is carried out on the basis of the following documents:

- certificates of completed work, form KS-2;

- accumulative sheet - a journal for recording the completion of work (according to form No. KS-6a);

- norms for the consumption of materials for a specific type of work. These standards are approved by the head of the organization;

- a report on the actual consumption of materials compared to the standard (performed monthly) according to the statement of material resources at the construction site.

It is best to compile reports on the write-off of materials using the standard M-29 form. Attached to this form are instructions for filling out this document. This form No. M-29 by site managers and financially responsible persons to draw up a monthly report on the use of materials during construction and installation work. This document compares the actual consumption of goods and materials with the costs determined by the approved standards. It is recommended that form No. M-29 be modified for a specific construction enterprise; it should consist of two sections:

- “Standard requirements for materials and volumes of work performed” (filled out by technical and technical engineers) – this can also be an estimator;

- “Comparison of the actual consumption of goods and materials with the consumption determined according to the standards” (filled out by site managers or foremen in accordance with the data in the log book of work performed. These financially responsible persons are appointed by the head of the enterprise).

The procedure for writing off materials during construction is given:

Transfer to the financially responsible person - the work producer - of a material report with the remains of inventory items in his personal warehouse (nomenclature and quantity of materials, their accounting value). Data is generated monthly at the beginning of the reporting month. Material report on form M-19*.

| 1. Formation of the M-29 report by the financially responsible person at the end of the reporting period with the determination of the balance of inventory items on a monthly basis within the time limits established by order of the head of the organization. 2. Submission of the report for verification to the production and technical department within the time limits established by order of the head of the organization. 3. Check by a specialist and approval by the head of the technical and technical department of the M-29 report and the attached material report. This report is approved by the head of the enterprise or chief engineer. 4. Transfer of these documents to the accounting department to the material desk specialist after approval by the manager or chief engineer. 5. Calculation of the cost of receipt of goods and materials, their consumption and balance (according to the documents provided). 6. Entering this data into the consolidated list of materials movement throughout the enterprise and writing it off. |

*Since 2013, the mandatory use of unified forms of primary documentation has been abolished, therefore, each organization decides whether to use this form or not on a voluntary basis.

Moreover, if the decision is positive, then the requirement to use form M-19 must be written down in the company’s accounting policies.

When checking the Form M-29 report, technical equipment engineers may identify inconsistencies. In this case, the site manager (materially responsible person) is obliged to draw up an explanatory note, which indicates the reasons for the excess consumption of materials. The explanatory note must comply with the instructions attached to the M-29 report. According to the data specified in the explanatory note, an act of writing off inventory items drawn up by the commission must be drawn up. The composition of the commission is appointed by the head of the enterprise. If the overexpenditure of goods and materials occurred due to negligence, theft or damage, then the head of the enterprise must contact the competent authorities to obtain the relevant certificates. These certificates are necessary for the legal write-off of materials. If the overexpenditure of inventory and materials is recognized as justified, and it is confirmed by calculations, in this case the manager has the right to allow the accounting department to accept the cost of excessively used materials for write-off. The opposite situation may be observed - savings occurred during the reporting period, then the site manager must also draw up an explanatory note. In this situation, you always need to take into account the principle of warehouse accounting: “if there is a surplus, expect a shortage,” there is a possibility that the wrong materials were used during construction.

All construction costs are provided for in the estimate documentation, which determines its cost and, according to the contract, are not subject to change during construction, then the entire cost overrun falls on the construction contractor, since the cost of the entire construction cannot increase without inclusion in the design documentation. It follows from this that writing off materials in construction implies that the management of the construction company is obliged to take all measures to find the perpetrators and recover damages from them. It is also impossible to exclude the possibility that, for example, materials were stolen by unidentified persons or damage occurred due to a fire or natural disaster. In this case, accounting can write off inventory items, classifying expenses as non-operating .

How to set standards for writing off materials for construction and installation work

Russian accounting legislation does not establish standards by which materials for construction should be written off. Paragraph 92 of the “Methodological guidelines for accounting of industrial plants” (Order of the Ministry of Finance dated December 28, 2001 No. 119 n) states that materials are transferred for construction, literally into production, in accordance with established standards. The quantity and quality of written-off inventory items should not be uncontrolled. Norms for write-off of materials during construction must be approved by the head of the enterprise. For tax accounting, there are requirements of Article 252 of the Tax Code, specified in Part 2 of Federal Law No. 117 of 08/05/2000: justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. Documented expenses mean expenses supported by documents drawn up in accordance with the legislation of the Russian Federation, ...

Each organization develops and sets consumption standards for inventory materials independently ; they are approved by the head of the construction organization. These standards must be developed and consolidated in accordance with the requirements specified in technological maps and other similar internal documents. These documents are not developed by the accounting department, they are developed by those departments that control the construction process (PTO, including, at the direction of the manager, estimators). After their development, these standards are checked (agreed) by the chief engineer and approved by the head of the construction organization.

CONCLUSIONS:

According to current documents, the write-off of materials is carried out by specially appointed people who are professionally involved in accounting - accountants , together with financially responsible persons - the foreman or site manager.

Inventory and materials for construction are written off according to approved standards. As an exception, you can write off materials in excess of the norm. In each such case, it is necessary to identify the reason for the excess write-off. For example, technological losses or correction of defects. When eliminating a defect, the perpetrators are held liable as provided by law.

Transfer of materials in excess of the limit is carried out only with the permission of the manager, indicating the reason for the overexpenditure. The primary accounting document - the invoice - must contain a note about excess write-offs and its reasons. If the reasons are not specified, then the write-off of inventory items will be unlawful. All this will lead to distortion of the cost price, and the data of accounting and tax reporting will also be distorted.

Write-off standards are approved by the head of the enterprise on the basis of standards that can be developed by specialists from the production and technical department (PTO), including estimators. These standards can be adopted according to estimated standards or according to standards adopted in each individual enterprise. To formulate these standards, you can use construction standards, instructions for the use of materials developed by manufacturers - instructions and (or) the advisory document “Collection of standard standards for losses of material resources in construction” (addition to RDS 82-202-96) (approved by the Letter of the State Construction Committee RF dated December 3, 1997 N VB-20-276/12)*.

*(note: This document is not in the register of estimate standards).

If a discrepancy in the consumption of materials is identified, a commission is created; a member of the commission can be a technical equipment engineer and (or) an estimator. Based on the results of the commission’s work, those responsible are held accountable in accordance with the law.

Author: Dmitry Rabotkin, Deputy Director of the Institute of Cost Engineering and Construction Quality Control, Moscow

Write-off of inventories

At this stage, the most important thing is to decide on the method of writing off inventory. PBU offers three options:

- At the cost of each unit;

- At average cost;

- At the cost of the first acquisitions of inventories (FIFO method).

The most popular method of writing off inventory is the FIFO method, since it allows you to account for goods at the most current cost. It is important to remember that the chosen inventory write-off method cannot be changed during the year. It can be changed, but only from the year following the reporting year.

Write-off method at cost of each unit

This method is convenient for those who have a small range of products. This method is used only for certain types of inventories. Namely, for materials that are used in a special order and stocks that cannot be replaced with each other. For example, precious stones, metals and radioactive materials. Since there are quite a few enterprises using these materials, this method is used quite rarely.

Example:

At the beginning of the month, the balance of materials was 300 units at a price of 110 rubles per unit for a total amount of 300 * 110 = 33,000 rubles. There were three arrivals during the month:

- 1st batch: 500 units at a price of 130 rubles per unit for a total amount of 65,000 rubles.

- 2nd batch: 600 units at a price of 170 rubles per unit for a total amount of 102,000 rubles.

- 3rd batch: 200 units at a price of 180 rubles per unit for a total amount of 36,000 rubles.

The total quantity of materials is 1600 units. The total cost of all materials is 236,000 rubles. During the month, 1,200 units of inventory were consumed. Accordingly, 400 units remain.

Write-off at average cost

This method consists in dividing the total cost of materials by their quantity. Including all balances at the beginning of the month and all their receipts.

Example:

At the beginning of the month, the balance of white paint in the organization was 150 kg. The average cost is 60 rubles per 1 kg. There were three paint deliveries during the month:

- 02/02/2013 – 60 kg at a price of 65 rubles per 1 kg;

- 02/15/2013 – 500 kg at a price of 57 rubles per 1 kg;

- 02/27/2013 – 100 kg at a price of 62 rubles per 1 kg.

350 kg of paint were used within a month. Consequently, the average cost will be 58.77 rubles per 1 kg. Based on this, you can calculate at what price to write off 350 kg of paint. It turns out 20,5569.50 rubles. The remainder of the paint in the warehouse will be 460 kg, its cost will be 27,034.2 rubles.

FIFO method

A method in which materials are written off at the cost of the first materials arriving at the warehouse. That is, the prices in the warehouse will always be current market prices. The largest number of accountants use this method.

Example:

The following data is available on the remaining materials in the warehouse:

Remaining: 50 units at a price of 23 rubles.

Received:

- 02/01/2013, 23 units at a price of 23 rubles;

- 02/15/2013, 42 units at a price of 22 rubles;

- 02/17/2013, 30 units at a price of 24 rubles.

In just one month, there were 145 units in stock. 80 units consumed per month.

- It is necessary to determine the cost of the materials used: (50*23)+(23*23)+(7*22)= 1833 rubles.

- The balance is 35 pieces at a price of 22 rubles, 30 pieces at 24 rubles for a total of 1,490 rubles.

Write-off of inventories under the simplified tax system

Material costs can be taken into account at a time at the time of payment or commissioning of the property, subject to payment. This provision is enshrined in Articles 346.17 and 254 of the Tax Code of the Russian Federation. But it is relevant only for those who are on the simplified tax system.

The Tax Code of the Russian Federation contains only general rules

When selling purchased goods, the organization has the right to reduce income from such operations by the cost of purchasing these goods (subclause 3, clause 1, article 268 of the Tax Code of the Russian Federation). It can be determined by one of the following methods for valuing purchased goods:

- at the cost of the first in time of acquisition (FIFO);

- or at average cost;

- or by unit cost.

Let us recall that the tax accounting system is organized by the company independently based on the principle of consistency in the application of tax accounting norms and rules (Article 313 of the Tax Code of the Russian Federation). The procedure for maintaining tax accounting must be established in the accounting policy of the organization.

Therefore, the company has the right to independently choose a method for valuing purchased goods when selling them, including the method for valuing purchased goods at average cost. The main thing is that such a procedure is provided for by the accounting policy.

Sales of reserves

Since inventory is not the main activity, 91 accounts are used. Accordingly, the following entries are made: debit 62, credit 91.1. Here you need supporting documents such as a sales contract and a delivery note in the TORG-12 form. Next, the cost of materials is written off to account 91, posting 91.2, credit 10. An accompanying certificate and calculation is required here.

Question:

And if they have not yet been put into operation, but have been spent, can they be written off?

It is a prerequisite that the materials be put into operation. If you use the cash method, you must make payment first.

Next, you need to charge VAT for tax purposes on payment and shipment. There will be two different entries - 91.2, credit 76 for payment and 91.2, credit 68 for shipment. This depends on which revenue recognition method is used. The supporting document will be an invoice. Next, money is received - debit 51, credit 62. The last entry is the calculation of VAT. Debit 76, credit 68. The supporting document is the invoice.

"Input" VAT

As a general rule, the amount of input VAT is deductible if:

- purchased goods are subject to VAT;

- there is an invoice;

- goods have been registered.

Once all these conditions are met, VAT can be deducted. If payment is made in cash, a sales receipt is required. VAT can be deducted only if the organization operates on the general taxation system. This rule does not apply to those who work under the simplified tax system. Since their type of activity is not subject to VAT. You can switch to the simplified tax system no later than December 31 of the year preceding the reporting year.

Features of write-off at average cost

To account for inventory at average cost, you must perform a number of specific actions:

- Reflect the adopted accounting method in the accounting policy. In this case, the following mandatory criteria must be met:

- this method will be applied to all types and/or groups of stocks defined by the policy;

- the principle of consistency of application will be observed (the selected method will be used over a long period).

- Organize inventory accounting in such a way that the following parameters are met:

- operational analytics made it possible to clearly identify types and groups of inventory items;

- the procedure for capitalization and actual release into production made it possible to accurately determine the amount of accepted or written off inventories in established units of measurement;

- the accounting accounts promptly reflected the cost of each batch of inventory.

- Establish and consolidate in internal regulations a methodology for calculating the average cost. The letter of the Ministry of Finance “On accounting for inventories” dated March 10, 2004 No. 16-00-14/59 established 2 main methods (based on the content of the Guidelines):

- weighted assessment - when the cost calculation is made for a specified period (usually a month); Moreover, during the period, the write-off of raw materials and materials for production occurs only in quantitative terms;

- rolling estimate - when the average cost is determined for each batch of inventory released into production; in this case, accounting is carried out in two dimensions at once - quantitative and cost based on the average cost.

Victoria LLC sells its own baked goods. For 2016, the company's accounting policy for raw materials and supplies is written off into production at average cost. LLC has established to calculate the average cost once a month using the weighted valuation method.

As of May 31, 2016, the LLC has the following data for the Bulk Products group:

Formula for calculating the average cost of materials and goods

Calculation of the average cost of goods or materials for a month involves dividing the total cost of a group (type) of inventory by their quantity, which is the sum of, respectively, the cost and the amount of balance at the beginning of the month and the inventory received during a given month (clause 18 of PBU 5/01).

In this case, the average cost can be calculated in two versions (clause 78 of Order of the Ministry of Finance dated December 28, 2001 No. 119n):

- weighted average score;

- rolling estimate.

A weighted assessment involves finding the average cost for the month based on the quantity and cost of materials at the beginning of the month and all receipts for the month.

And with a moving average, calculations are made for each moment of disposal of inventories. Accordingly, the moving average value is calculated based on the quantity and cost of inventories at the beginning of the month and the receipt of inventories until the moment of release.

Let us give an example of calculating the weighted average estimate of inventory disposal using conventional digital data.

Based on the balance of inventories as of 03/01/2018 and receipts from three batches for March, the average cost per unit of inventories is 55.9 rubles/piece. (RUB 18,831.3 / 337 pcs.).

Accordingly, the cost of disposal is 216 units. Inventory for March 2021 is 12,074.4 rubles. (216 pcs. * 55.9 rub./pc.). Therefore, the cost of the balance is 121 units. Inventory as of March 31, 2018 is RUB 6,756.9. (RUB 18,831.3 – RUB 12,074.4).

Average cost method

It is used more often than the previous one, and involves monthly calculation of the cost of goods using the arithmetic average. In this case, it does not matter from which specific delivery this or that product “left”. This method of writing off inventory items is suitable for companies selling products for which piece accounting is not important. This could be, for example, stationery, clothing, shoes, toys, cosmetics and any other consumer goods. The average cost method is especially beneficial for those goods for which the price is constantly changing, both up and down.

This method is the easiest to account for. The average cost of goods is calculated using the following formula:

[average cost of inventory items] = ([cost of inventory items at the beginning of the month] + [cost of inventory items received during the month]) / ([number of inventory items at the beginning of the month] + [number of inventory items received during the month])

And the cost of inventory written off per month is calculated as follows:

[cost of written-off inventory items] = [average cost of inventory items] X [number of inventory items sold per month]

Example of calculation using the average cost method

At the beginning of the month, the Stationery store had 370 ballpoint pens left at a purchase price of 10 rubles. Within a month, another 1000 pens were delivered in two batches - 500 for 9 rubles 50 kopecks and 500 for 9 rubles. We calculate the average cost.

Cost of inventory items at the beginning of the month: 370 X 10 = 3700 (rub.) Cost of the 1st new supply of inventory items: 500 X 9.5 = 4750 (rub.) Cost of the 2nd new supply of inventory items: 500 X 9 = 4500 (rub.) Average cost of goods and materials: (3700 + 4750 + 4500) : (370 + 1000) = 9.45 (rub.)

This average cost will be used to calculate the written-off goods and calculate the profit. For example, if pens are sold for 15 rubles, and 1,100 pens were sold in a month, the profit specifically for these pens will be calculated as follows:

1100 X 15 – 1100 X 9.45 = 6105 (rub.)

The advantages of the average cost calculation method are the stability of the price of materials sold and simplicity. However, from a tax accounting point of view, it is not optimal in the case where, for example, you purchase the same pens from the same supplier, and he gradually reduces your prices. Let's consider the following option.

At the cost of each unit

item 3)

7Including:— for production 1600016.55264800 — for sale 100016.5516550 — to service industries and farms 500016.5582750 Total 220003641008Balance as of February 1900016,54148900B. WRITING OFF MATERIAL USING THE FIFO METHOD9Used in Januaryincluding: - at the price of the balance at the beginning of the month100055000 - at the price of the first batch60001060000 - at the price of the second batch40001248000 - at the price of the third batch1100020220000Total written off2200015.14333000Including: - for production (including rounding)1600015.14242160- for sale 100015,1415140—to servicers production and farms 500015.1475700 Total (including rounding) 2200015.1433300010Balance as of February 1900020180000Notes.

1) Point 9 of the calculation shows the sequence of writing off material using the FIFO method: first, the balance at the beginning of the month is written off, then receipts in the reporting month: first the first batch, then the second, etc., until the total quantity to be written off in a given month is reached (in the example 22000 kg). From the receipts of the third batch of 20,000 kg, only 11,000 kg were taken - as much as is needed to ultimately produce 22,000 kg.

2) Materials released in a given month (for production, sales, service industries and farms, and for other purposes) are written off in amounts determined based on the average price, which is determined by dividing the total amount written off in a given month by the amount of material written off.

In our example, the average price for January was:

- according to the average cost method - 513000 / 31000 = 16.55 (clause 5);

- according to the FIFO method - 333000 : 22000 kg = 15 - 14 (clause 9, total);

Actual amounts written off have small differences compared to estimated amounts due to rounding of the average monthly price.

3) The balance of material at the beginning of the next month using the FIFO method is determined (clause 10):

- gr. 3 - from the source data (item 4);

- gr. 5 = item 1 + item 2 (total) - item 9 (total);

- gr. 4 = gr. 5 / gr. 3 (on the same point).

4) The cost of materials issued (written off) using the FIFO method can be determined in a simplified, calculated way, when the cost of the material is first established, carried over to the next month, and the remaining amount is written off in the reporting month. In our example it looks like this:

| Item no. | Contents of operation | FIFO | ||

| Qty | Price | Sum | ||

| 1 | Remaining material as of February 1 | 9000 | 20 | 180000 |

| Total | 9000 | 180000 | ||

| 2 | Materials received in January with the addition of the balance as of January 1 | 31000 | 513000 | |

| Materials subject to write-off in January (clause 2 - clause 1) | 22000 | 333000 | ||