Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 08/09/2017

Reading time: 7 min

0

301

The inspectorate requires explanations for the VAT return in cases where, after a desk audit, data has been discovered in the reporting that needs to be further examined.

The tax service's software automatically generates claims if inconsistencies are found in the declarations of the seller and the buyer. Attached to the requirement are tables from the letter of the Federal Tax Service of Russia dated July 16, 2013 No. AS-4-2/12705, which reflect incorrect information in each column according to a possible error code.

- Possible error code 1

- Possible error code 2

- Possible error code 3

- Possible error code 4 [a, b]

- What should the taxpayer do? Receipts

- Error checking

- Explanations or subtle declaration

- Changes in tax calculations

Possible error code 1

Your supplier's reporting does not contain any similar invoice data. This may cause deductions to be taken away. Since the supplier did not reflect an identical invoice, he did not pay the tax. In this case, it is not necessary to submit adjustment reports. It is enough to contact the supplier for clarification. He could simply have made a mistake in the details, which is why the program did not detect the document. If he forgot to report on this implementation, then he should submit a clarification. If the reality of the transaction is documented, the withdrawal of deductions will be unlawful on the part of the tax authority.

Code 000000001 means that errors were made in the declaration or calculation and require clarification, not explanation.

How to correct an error when filling out a declaration

Let's start with the fact that the return of a report with code number “4” indicates that the fields of the declaration were filled in incorrectly or incorrectly. You can find out exactly where the mistake was made by looking at the numbers in brackets. For example, the system sent a declaration for clarification with a similar designation: 4 (20, 21). This means that in columns 20 and 21 the specified data was calculated incorrectly.

Solving the problem is quite easy. In the invoice, you must cross out the incorrect information and then add the correct information. Next, you need to indicate the current date of change in the document, sign and seal the company.

Please note that only the organization that issued the invoice has the right to make changes to the declaration.

There are also situations when all the data is filled out correctly. Then you need to review each item again for any inconsistencies. If no errors are found, we recommend calling the tax inspector and asking in detail about the violations found. It is possible that the data indicated in the invoice is underestimated, or, conversely, overestimated, in comparison with the information reflected in the sales book. First of all, the tax office requests invoice data from the buyer, and if he confirms their accuracy, then they pass it on to the seller. If you cannot obtain real data, then you need to wait for verification. Before the inspector arrives, check the availability of invoices, delivery notes, delivery notes, as well as certificates of work performed.

Possible error code 2

The information inside the declaration contradicts each other. For example, in section 3 and in sections 8 and 9. This also means that the inspectors carried out a detailed reconciliation of the control ratios. This can be done independently before submitting the reports, which will be quite advisable in order to avoid discrepancies and problems with the tax authorities. Error code 2 is possible if the organization erroneously submitted section 2, intended for tax agents, but the program did not detect transactions under code 06 in section 9. This means that the accountant made a mistake.

In this case, an updated declaration is not submitted, since the tax payable is not underestimated, but explanations are provided.

Sometimes errors can occur due to differences in the rules for filling out the form. For example, in section 3 it is necessary to reflect the amounts of deductions and charges in full rubles, and in sections 8 and 9 - in kopecks. There is no need to prepare adjusting statements for such discrepancies; it is enough just to explain that the discrepancies arose due to rounding.

Possible error code 3

There is a discrepancy in sections 10 and 11, intended to be filled out by intermediaries with information from the invoice journal.

Inconsistencies arise if, after selling products on its own behalf, the intermediary company issued an invoice to the buyer, and when checked by the tax service, the program detected inconsistencies. However, errors in the journal cannot affect the basis for calculating tax, so the company can exercise the right not to submit updated reporting. But, due to such errors, inspectors sometimes refuse deductions for the buyer, so explanations along with a table with the correct information still need to be provided in order for the inspector to enter this into his database.

Possible error code 4 [a, b]

Inconsistencies between the details in the invoices of the buyer and supplier. In square brackets, the inspector will reflect the numbers of the columns where incorrect details are entered. It is important to understand that these are columns of invoices or purchase books, namely columns in the tax program table. For example, the Federal Tax Service sent a request with a table for section 8, error code - 4 [19]. This means that the parties to the transaction do not have the same VAT amounts and, possibly, deductions are inflated.

If you do not find an error, please provide an explanation and attach a copy of the invoice. Errors in the TIN/KPP, invoice number or date also mean that there is no need to clarify. Fill out only the table from letter No. AS-4-2/12705 with the correct data so that the tax authorities correct inaccuracies in their database.

Only an underestimated tax means that in response to the requirements it is necessary to submit an amended declaration, and before that pay additional VAT with penalties.

Error codes

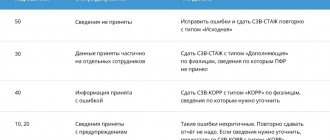

The following possible error codes may be indicated for each operation:

- “1” - if there is no record of the transaction in the counterparty’s tax return, or the counterparty did not submit a VAT return for the same reporting period, or the counterparty submitted reports with zero indicators, or errors made do not allow identifying the invoice record and, accordingly, compare it with the counterparty;

Connect to “Kontur.Focus” and get information about counterparties’ taxes

- “2” - if the transaction data does not correspond to section 8 “Information from the purchase book” (Appendix 1 to section 8 “Information from additional sheets of the purchase book”) and section 9 “Information from the sales book” (Appendix 1 to section 9 “ Information from additional sheets of the sales book"). For example, when deducting the amount of VAT on previously calculated advance invoices;

- “3” - if the transaction data does not correspond between section 10 “Information from the journal of accounting of issued invoices” and section 11 “Information from the journal of accounting of received invoices” (for example, reflection of intermediary transactions);

- “4” - there may be an error in some column. In this case, the number of the column with a possible error is indicated in brackets.

- “5” - in sections 8-12 of the VAT tax return the invoice date is not indicated or the specified invoice date exceeds the reporting period for which the VAT tax return was submitted;

- “6” - in section 8 “Information from the purchase book” (Appendix 1 to section 8 “Information from additional sheets of the purchase book”) of the declaration, a VAT deduction is claimed for tax periods beyond three years;

- “7” - in section 8 “Information from the purchase book” (Appendix 1 to section 8 “Information from additional sheets of the purchase book”) of the declaration, a VAT deduction is claimed based on an invoice drawn up before the date of state registration;

Order an electronic statement and check the counterparty in “Kontur.Focus”

- “8” - in sections 8-12 of the tax return, the transaction type code provided for by order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ;

- “9” - errors were made when canceling entries in section 9 “Information from the sales book” (Appendix 1 to section 9 “Information from additional sheets of the sales book”). Namely, the VAT amount indicated with a negative value exceeds the VAT amount indicated in the invoice entry subject to cancellation, or there is no invoice entry subject to cancellation.

Carry out automatic reconciliation of invoices with counterparties

Requests containing possible error codes "5", "6", "7", "8" and "9" are scheduled to be sent after January 25, 2021.

What should the taxpayer do?

Receipts

First of all, send an electronic receipt to the tax office, which indicates that you have received a request for clarification.

Error checking

The request will indicate all possible error codes for which contradictions and inconsistencies were found. It is necessary to find out exactly which reflected transactions the inspection found inconsistencies in. It is important to reconcile the invoice records with those shown in the statements. Pay attention to the completed details, especially for any inconsistencies identified: date, number, amounts, calculation of the VAT amount at the correct tax rate and the cost of purchases or sales.

Explanations or subtle declaration

Send explanations if previously discovered errors did not change the VAT amount. Also provide explanations if you have not identified any errors and there are no grounds for correction.

Possible response format to the tax office:

“In response to the request from DT.MM.YYYY No. XX, I inform you that I have not identified any grounds for entering other data into the XXX declaration for the reporting period ... the declaration was drawn up correctly.”

If a self-check shows that you made a mistake (for example, a technical error in the digit of a certain code):

“In response to the request from DT.MM.YYYY No. XX, I inform you that when checking the XXX declaration for the reporting period... an error was discovered in the reflection... The updated declaration is attached.”

After re-checking, submit it to the tax inspector at your location, reflecting the new correct tax calculation indicators (if errors were found that underestimated the amount of tax payable to the state budget).

Changes in tax calculations

Elimination of errors in the calculation of the VAT amount in the updated declaration occurs in the direction of its decrease or increase.

If you have submitted clarifications in order to reduce the VAT payable, such reporting will be followed by a desk audit or an on-site audit, if one has not been carried out for a long time. If the audit confirms the fact of a tax reduction, an overpayment will be created on the company’s personal account: return it to your current account, or use it to offset other taxes. You also need to write an application addressed to the head of the Federal Tax Service inspection for a refund or offset.

If you have submitted clarifications for an increase in tax, which means an additional payment, first pay the amount of the underpayment, and then submit the adjustment declaration. This will help you avoid penalties for non-payment of taxes.

The tax office may impose penalties on the amount of non-payment, which must also be paid before submitting the clarification. If the additional payment amount has already been transferred, you can submit the declaration on that day, but it is usually submitted on the next business day.

A private easement is established by agreement of the parties. How to properly purchase a plot of land and avoid problems? Find out about this by reading our article. When should land tax be paid? You will find the answer here.

What to do after receiving a request?

Upon receiving a request, the taxpayer must take the following actions:

1. Submit to the inspection a receipt of receipt of the claim in electronic form through the EDF operator. This must be done within six days from the date the documents were sent by the inspection. If, within the allotted time, the taxpayer does not submit a receipt for acceptance of the demand or notification, inspectors have the right, within 10 days after the expiration of the deadline for transmitting receipts, to make a decision to suspend transactions on the accounts (clause 3 of Art. Tax Code of the Russian Federation).

Receive requests from the Federal Tax Service for free and send the requested documents via the Internet

2. With regard to the entries specified in the request, check the correctness of filling out the declaration, check the information on which discrepancies are established: dates, numbers, amounts, correctness of calculation of the amount of VAT depending on the tax rate and the cost of purchases (sales). If an invoice was accepted for deduction in parts (several times), it is also necessary to check the total amount of VAT accepted for deduction for all entries in such an invoice, including taking into account previous tax periods;

3. Submit to the inspectorate an updated declaration with correct information if an error is identified that leads to an underestimation of the amount of tax payable;

4. If the error in the declaration did not affect the VAT amount, provide an explanation indicating the correct data. In this case, it is also recommended to provide a “clarification”.

5. If, after checking the correctness of filling out the declaration, errors are still not identified, it is necessary to notify the tax authority about this, providing explanations.