Home/Salaries/Salary payments from July 1, 2021

Regulation of wages is one of the main issues in labor relations between employer and employee. From July 1, 2021, legislative changes became valid in the Russian Federation, according to which a new remuneration procedure will apply. All innovations will affect only municipal and budgetary organizations. Federal Law No. 88-FZ dated May 1, 2017 obliges employers to pay employees according to the rules that came into force on July 1, 2021. As part of the new legislative framework, changes also affected funds whose financing does not come from the state budget.

Attention

From July 1, 2021, employers of municipal enterprises do not have the right to pay funds to VISA and Master Card payment systems.

New salary payment rules

Within the framework of the law, from July 1, 2021, Federal Law No. 88 dated May 1, 2017, new wage calculation criteria began to apply:

- All payments to workers are made only to the card of the MIR state payment system. Using cards with any other system will be illegal.

- If an employee does not have the opportunity to receive earned funds on a plastic card, then they can receive money at a bank cash desk.

These changes also apply to all government payments:

- pensions;

- scholarships;

- payment of sick leave;

- maintenance and financial remuneration of persons serving in public positions.

From July 1, 2021, new rules for paying overtime hours have been introduced:

- When going to work on a holiday or on their day off, the employee will receive double pay once. Previously, these hours had to be taken into account and paid twice: as time spent at the workplace in excess of the norm established by law. Moreover, the first 2 hours were paid at one and a half rates, and all subsequent hours at double rates.

- If on a weekday an employee worked 2 hours above normal, then this time is paid at double the rate.

- When going to work on a day off, the employee is paid at a double rate based on the number of hours worked.

- In case of a part-time working week or a shortened working day, the employer does not have the right to establish irregular working hours.

What determines the level of wages?

When calculating average earnings, several components must be taken into account:

- the region of the country or individual city in question;

- industry of employment;

- type of settlement (city, village, town, capital, large center).

This concerns the general employment procedure. But even directly at the workplace, there are certain requirements for determining the level of remuneration, depending on such factors:

- the chosen profession for which the salary is initially set;

- length of service, experience and length of service that add bonuses to the salary;

- special achievements that establish additional bonuses.

Moreover, the presence of official employment does not guarantee that this is the only income of an individual citizen, forming his average monthly income.

Normative base

Payments to employees who work in the budgetary, municipal sector and extra-budgetary funds are regulated by the Labor Code of the Russian Federation and Federal legislation:

- Federal Law No. 272 of 2021. This regulates the liability of organizations to an employee in case of non-compliance with payment deadlines. The employer's responsibilities are described, according to which he must specify the dates for the transfer of funds.

- Federal Law No. 125 of 2021. Amendments have been made to the Labor Code of the Russian Federation that regulate the accrual of wages to employees in accordance with Federal Law No. 125.

- Article 5.27 of the Code of Administrative Offenses of the Russian Federation, part 6, regulates the obligations of the employer in case of non-compliance and incorrect execution of wage laws.

- Labor Code of the Russian Federation Art. 136. The terms and dates for the accrual of funds to workers in an institution that is funded by the state are directly indicated here.

- Federal Law dated May 1, 2017 No. 88-FZ.

What has changed with the innovations on July 1, 2021?

| How was the PO issued earlier? | Changes from July 1, 2021 for organizations financed from the state budget and extra-budgetary funds |

| Employees had the right to use cards with other payment systems, such as Visa and Master Card. |

|

| The employer had to pay double the rate for weekend work and count the same hours as overtime. | With a shortened week or day, additional irregular working hours cannot be established. Remuneration for work on a day off is doubled once. |

The money has already gone...

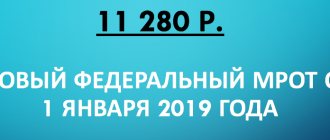

In 2021, the Government of the Russian Federation has already allocated 80 billion from the state treasury to increase salaries. According to analysts, the crisis caused by economic sanctions has been overcome to a certain extent, which made it possible to increase the minimum wage in 2021 and bring the minimum wage closer to the subsistence level.

Minimum wage is the minimum wage in the Russian Federation. From January 1, it is 9.5 thousand rubles, which is 85% of the subsistence level. Since 2015 in the Russian Federation, these main indicators of the standard of living of Russians - the minimum wage and the subsistence minimum - began to converge, so in 2021 the minimum wage increased by 21%. In addition to increasing the minimum wage, from the first month of 2018 the salaries of those Russians whose incomes are less than 9,489 rubles will increase. Thus, more than 4 million workers are expected to increase wages in 2021, of which 1.6 million are public sector employees.

Minimum wage

In order to ensure that the requirements for salary increases are met in full, the legislation provides for fines for careless or too greedy employers - up to 50,000 rubles if the salary of the company's employees is less than the minimum wage established from January 1, 2021. By the way, the amount of the types of social payments for different categories of civil and social payments also depends on the size of the minimum wage: such as maternity benefits, sick leave, care for a child up to one and a half years old, and others. Unfortunately, even after increasing the level of the minimum wage, its value remains lower than in some African countries.

Terms and criteria for transfers of earned funds under the Labor Code from July 1, 2021

From October 3, 2021, the rules and procedure for transferring earned funds have changed. In July 2021, there were no innovations in this area. Therefore, the payment terms and criteria will remain the same.

IMPORTANT

As part of changes in legislation in 2021, payment of earned funds and advance payments to municipal, state institutions and extra-budgetary funds must be issued once every 15 calendar days.

Organizations must pay the remaining share of the salary in full no later than 15 calendar days from the end of the month for which funds are accrued. Consequently, the employer has no right to transfer the advance portion on the 20th of the current month, and the remaining share of the salary on the 15th of the next month. Because between the 20th and 15th there will be approximately 25 calendar days, and this is contrary to the new legislation. If the specified deadlines are not met, the organization will be fined.

Thus, when transferring salary to an employee, the employer must comply with two key criteria:

- The temporary break between the advance payment and the rest of the payment is no more than 15 days.

- Full payment of earned funds is carried out no later than fifteen days from the end of the month for which wages are transferred.

Please note:

It is possible to set the dates for issuing the PO in the following way: 20th and 5th, 23rd and 7th, 25th and 10th. It is important for managers to take into account that each month has a different number of days: from 28 to 31. Here, any organization is obliged to independently calculate the time frame from the advance to the full transfer of earned funds.

Changes in personal income tax

There really aren't many significant changes. Some of them may be familiar to those who constantly monitor new amendments to laws.

1) The first change concerns successor companies of reorganized firms . If until 2021 the question of who should provide personal income tax certificates to a reorganized company was unresolved, then the new paragraph 5 in Article 230 of the Tax Code of the Russian Federation removes all contradictions, although not in favor of the legal successors. The new legislation obliges to make a report for the previous company if it did not have time to do this. The report is made in form 3-NDFL for the year and 6-NDFL for the last year and quarter. (See Article 230, paragraph 5 of the Tax Code of the Russian Federation)

New codes for income in 2021 . Compensation for unused vacation - code 2013. Code 2014 - this is severance pay, estimated payments after dismissal, compensation to chief accountants, managers and deputies in excess of three months and six months of earnings. Various fines imposed by court decision for dissatisfaction with consumer rights are now indicated by code 2301. Write-off of bad debts (also by court decision) - 2611. Interest on bonds of Russian companies - 3021. (See Decree of the Government of the Russian Federation dated October 24, 2017 No. ММВ- 7-11/ [email protected] )

3) A pleasant change for shareholders . In the event of bankruptcy of a development company, this company must pay compensation to shareholders from a special fund. Previously, these payments were subject to personal income tax. From 2021, these payments do not fall under the tax heading. (See Article 217, paragraph 1.1 of the Tax Code of the Russian Federation)

4) Changes in the taxation of benefits received from loan agreements. This benefit arises when the interest under the contract is below 2/3 of the key rate formed on the day the interest is calculated. If before 2021 income tax was paid on this benefit in any case, then this year only two cases fall under the tax item. The first is if the agreement is concluded between a superior person and a person dependent on him (for example, between an employee and an employer). The second is if the benefit was the result of a counter-obligation (payment of labor is, in fact, an interest-free loan to a contractor who is an individual). These changes are reflected in Article 212, clause 1.1 of the Tax Code of the Russian Federation.

5) I have a new form for 2-NDFL certificates based on the results of 2021. First of all, this is due to the changes mentioned in paragraph 1 - new columns appear: code during reorganization (liquidation) and TIN of the liquidated (reorganized) company. In the second section, you will not need to enter information about the individual’s place of residence. Cancel

the need to put stamps on the register of paper certificates. (See the law on amendments to the order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/ [email protected] )

6) New form of certificate 3-NDFL. The form of the title page has changed (you can see a sample in the appendix to the Order of the Federal Tax Service dated October 25, 2017 No. ММВ-7-11/ [email protected] ). In the second section, paragraph 4 in line 001, the numbers change. We changed the appearance of sheet D1, E1, sheet 3, sheet I. Replaced barcodes (made different digital sequences). Plus, a separate sheet has been added for those who are selling property. From February 19, 2021, 3-NDFL must be filled out using a new form (which is easy to find and download on the Internet). You can read in detail about all the changes in the Order of the Federal Tax Service dated October 25, 2017 No. ММВ-7-11/ [email protected]

7) In connection with paragraph 5 of Article 230 of the Tax Code of the Russian Federation, form 6-NDFL is also being updated . The main changes to the form concern the title page. We inserted columns for reorganization (liquidation) form codes. The code for the place of payment has appeared.

The procedure for issuing wages in 2021 from July 1 for government agencies

Municipal institutions and organizations financed from the state budget, from July 1, 2021, as part of changes in Federal legislation dated May 1, 2017 No. 88-FZ, must pay wages to employees in accordance with the following points:

- Payment is made only to the national payment system - the MIR card. The organization is obliged to enter into appropriate contracts with banks for issuing salary cards to employees. But the employee has the right to independently determine the bank in which the salary account will be located. The employee must notify about the choice of bank no later than 5 days before the date of the next advance or salary. And draw up a corresponding application, which will indicate all bank details.

- The employee has the right to receive funds through the cash register.

How has the procedure for paying wages changed since July 1, 2018 for individual entrepreneurs?

Attention

: If the organization is not financed from the municipal or state budget, or is not an extra-budgetary fund, then the innovations introduced into the legislation from July 1, 2021 will not affect private sector employees.

The terms, dates of issuance of the advance share and full payment of labor are established by the employer. Individual entrepreneurs have the right to transfer wages to a card with any payment system (Visa, Master Card or MIR). The boss independently determines the dates for issuing the advance payment and the full part of the payment.

According to Art. 136 of the Labor Code of the Russian Federation, an employee of the private sector has the right to receive payment on any card, including “MIR”. An individual entrepreneur does not have the right to refuse transfers to the national card of the Russian Federation. Regardless of whether the organization is financed from the state budget or by private individuals. The employee is required to submit an application to change payment details no later than 5 days before the issuance of the salary or its advance part.

Accounting for settlements with personnel for wages

The terms of remuneration (salary, additional payments, allowances) are mandatory terms of the employment contract, therefore changing such conditions unilaterally is unacceptable; it is necessary to draw up an additional agreement to the employment contract (Articles 57, 72 of the Labor Code of the Russian Federation). The procedure for calculating wages (including salary amounts) is established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulations containing labor law standards. The employer's approval of a new procedure for calculating wages means the need to coordinate this procedure with employees (Article 135 of the Labor Code of the Russian Federation). The reason for changing the procedure for calculating wages may be a change in organizational or technological working conditions (changes in equipment and production technology, structural reorganization of production, other reasons) (Article 74 of the Labor Code of the Russian Federation). In our opinion, the introduction of a new procedure for calculating wages can be recognized as changes in working conditions of an organizational nature (Article 74 of the Labor Code of the Russian Federation, paragraph 21 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”, Appeal ruling of the Chelyabinsk Regional Court dated 04/08/2014 in case No. 11-2555/2014). If it is necessary to change the employee’s salary (both upward and downward) associated with the introduction of a new procedure for calculating wages, the employer must take the following actions (Article 74 of the Labor Code of the Russian Federation): - issue an order to introduce a new procedure for calculating wages fees and changes to the staffing table; - send each employee a notice of the change in salary and the reasons that caused it, no later than two months (if the employer is a religious organization - no later than seven calendar days (Article 344 of the Labor Code of the Russian Federation), an individual - no less than two weeks - 14 days (Article 306 of the Labor Code of the Russian Federation)); — make sure that the employee agrees to work in the new conditions, and sign with him an additional agreement to the employment contract on salary changes. If, due to the adoption of a new payroll procedure, the salary is reduced, employees often do not agree with such a change. If the employee does not agree: - the employer is obliged to offer him in writing another job available to him (both a vacant position or work corresponding to the employee’s qualifications, and a vacant lower position or lower paid job), which the employee can perform taking into account his state of health . In this case, the employer is obliged to offer the employee all vacancies available in the given area that meet the specified requirements. The employer is obliged to offer vacancies in other localities if this is provided for by the collective agreement, agreements, or employment contract; - if there is no other suitable job or the employee refused the offered vacancies, after the expiration of the notice period, issue a dismissal order in accordance with clause 7 of part 1 of art. 77 Labor Code of the Russian Federation. Failure to comply with the procedure established by Art. 74 of the Labor Code of the Russian Federation, as well as failure to provide the court with evidence that a change in the terms of the employment contract determined by the parties was a consequence of changes in organizational or technological working conditions and did not worsen the employee’s position compared to the terms of the collective agreement, agreement, may lead to the reinstatement of dismissed workers or recognition of the changes the terms of the employment contract determined by the parties if the employee continues to work illegally (clause 21 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 2, Determination of the Moscow City Court dated April 19, 2016 No. 4g-3056/2016).

The procedure for transferring wages for legal entities

If a legal entity is financed from the state or municipal budget, then from July 1, 2021, the following procedure for transferring salary to employees is established for the institution:

- The payment period must be clearly stated in the employment and collective agreements, as well as in the regulations on the payment of salary.

- All financial payments must be transferred to a card with the domestic MIR system. An employee has the right to independently choose the bank in which his salary account will be registered. He must notify the employer of his decision 5 days before the advance payment or payday.

If the legal entity is a non-budgetary institution, the payment of funds is carried out in the following order:

- An individual entrepreneur has the right to make transfers to Visa or Master Card. But refusing to choose a bank is illegal. Employees also have the right to receive salaries on the card of the MIR state payment system. The employee must provide management with the details 5 working days before receiving wages.

- The terms, amount of advance payments and wages are specified by the employer.

Examples of accounting entries

Let's look at the accounting entries for wages, examples in the table.

Paying salaries on time

Salaries can be paid from the organization's cash desk, or by non-cash transfer to a card or bank account.

| Debit | Credit | Operation designation |

| 50/1 | 51 | Money was received from the current account to the cash desk for salary payments |

| 70 | 50 | Salaries were paid from the cash register |

| 70 | 51 | Salary paid by transfer to a card or bank account |

Payment deposited

If salaries are paid to employees in cash, there is a deadline for payment specified by law. If, upon completion, there are unpaid amounts left in the cash register, then such salary is subject to deposit, i.e., returned to the current account. It must be issued upon request.

| Debit | Credit | Operation designation |

| 50/1 | 51 | Money was received from the current account to the cash desk for salary payments |

| 70 | 50/1 | Part of the salary was paid to employees |

| 70 | 76/4 | Wages deposited and not paid on time |

| 51 | 50/1 | The money was returned back to the bank account |

| 76/4 | 50/1 | The deposited salary was issued at the request of the employee |

| 76/4 | 68 | Personal income tax withheld |

| 68 | 51 | Personal income tax transferred to the budget |

| 76/4 | 90/1 | Unclaimed wages are written off as other income |

Paying salaries to a bank card (salary project)

The peculiarity of accounting for the payment of wages lies in the way it is processed by the bank. If an enterprise sends a single register, and accordingly, the entire amount under the document is debited from the current account at once, then it is more correct to formalize such a payment through account 76.

Attention! If, according to the register, the bank generates a separate payment slip for each person, then the payment can be directly deposited into account 51. You should also not forget about the commission that the bank charges for such operations.

| Debit | Credit | Operation designation |

| 76 | 51 | Funds were transferred for crediting salaries according to the register |

| 70 | 76 | Employees' salaries have been credited to cards |

| 91/2 | 51 | The bank withheld a commission for crediting funds to employee cards |

Payment of compensation for delay

The law establishes that if an employer delays payment of wages, he is obliged to independently calculate and pay compensation to employees for this event. Such a payment is not subject to taxes, but social contributions must be charged on it.

| Debit | Credit | Operation designation |

| 91/2 | 73 | Compensation has been calculated |

| 70 | 50, 51 | Salaries were paid in cash or by bank transfer |

| 73 | 50, 51 | Compensation was issued in cash or non-cash |

Refund of salary

The return of excess wages issued can be made on the voluntary initiative of the employee himself personally to the cash desk or to an account, or it can be withheld by the organization from the salary of subsequent periods based on a written application.

| Debit | Credit | Operation designation |

| Voluntary return | ||

| 20, 23, 25, 26 | 70 | Salary accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 50, 51 | Issued in cash or non-cash |

| 26 | 70 | REVERSE - salary amount adjusted |

| 70 | 68 | REVERSE - personal income tax has been adjusted |

| 73 | 70 | Overpaid wages highlighted |

| 50, 51 | 73 | Excess salary is returned to the cash desk or account |

| Employer retention | ||

| 20, 23, 25, 26 | 70 | Salary accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 73 | Excess amounts withheld from wages |

| 70 | 50, 51 | The balance of the salary was issued in cash or by bank transfer |

You might be interested in:

Account 90 in accounting: what is it used for, characteristics, examples of postings

Salary deductions

All deductions can be divided into mandatory and voluntary. Mandatory tax includes personal income tax, deductions on writs of execution and similar documents. Voluntary deductions are those that are made with the consent of the employee on the basis of an application submitted by him.

| Debit | Credit | Operation designation |

| 70 | 68 | Personal income tax withheld |

| 70 | 76 | Withholding of alimony was made |

| 70 | 73/1 | Employee loan payment withheld |

| 70 | 76 | Voluntary health insurance premium withheld |

Payment of financial assistance

Financial assistance is a payment to an employee at the expense of the organization’s profits. If its amount is less than 4,000 rubles, then personal income tax is not withheld from such payment.

| Debit | Credit | Operation designation |

| 84 | 73 | Calculation of financial assistance to an employee |

| 84 | 76 | Accrual of assistance to a person who is not an employee (relative, etc.) |

| 73, 76 | 68 | Personal income tax has been withheld (if the assistance is more than 4,000 rubles) |

| 73, 76 | 50/1 | Financial assistance was issued from the cash register |

| 73, 76 | 51 | Financial assistance was transferred from the current account |

| 84 | 69 | Contributions for financial assistance have been accrued |

Sick leave

The generation of sick leave payments depends on whether the region is participating in the direct payment project. In this case, the organization accrues and shows in accounting only that part of the sick leave that comes from its funds.

| Debit | Credit | Operation designation |

| 20, 23, 25, 26 | 70 | Sick leave accrued for 3 days at the expense of the organization |

| 69 | 70 | Sick leave accrued at the expense of social insurance (for regions not participating in direct payments) |

| 70 | 68 | Personal income tax withheld from sick leave |

| 70 | 50, 51 | Sick leave issued in cash or transferred through a bank |

Vacation pay

According to the Labor Code, each employee has the right to a period of annual leave if he has worked a certain amount of time. The reflection of such a period in accounting depends on whether the company creates a vacation reserve. In addition, if the vacation period falls within two months, payment for the next month is charged to deferred expenses.

| Debit | Credit | Operation designation |

| Using reserve | ||

| 20 | 96 | A vacation reserve has been created |

| 96 | 70 | Vacation accrued to employee |

| 96 | 69 | Contributions to social funds for vacation have been accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 50/1, 51 | Vacation pay has been paid |

| Without using reserve | ||

| 20, 23, 25, 26 | 70 | The current month's vacation has been accrued |

| 97 | 70 | Vacation accrual has been made for the next month. |

| 20, 23, 25, 26 | 69 | Contributions to social funds for vacation have been accrued |

| 97 | 69 | Contributions to social funds have been accrued for vacations that fall in the next month |

| 70 | 68 | Personal income tax withheld |

| 70 | 50/1, 51 | Vacation pay has been paid |

Payment of wages in kind

The law allows part of the employee’s salary to be paid in kind. However, this amount cannot exceed 20% of the total salary accrual. As a payment for earnings, property can be issued that can be used by the employee or be of benefit.

| Debit | Credit | Operation designation |

| 70 | 90/1 | The employee was given a salary in kind |

| 90/2 | 43, 41 | The cost of goods issued as wages has been written off |

| 70 | 91/1 | Other property was issued as salary (materials, fixed assets, etc.) |

| 91/2 | 01, 08, 10 | The value of property issued as salary has been written off |

| 02 | 01 | Depreciation on fixed assets transferred as salary payment was written off |

Important! It is prohibited to issue alcoholic beverages, narcotic or toxic substances, weapons and ammunition, or promissory notes as payment.

How is the advance paid?

There is no clear definition of the concept of “advance” in the legislation of the Russian Federation. On October 3, 2021, new criteria came into law, within the framework of which an employee has the right to receive earned money at least once every six months. There will be no changes in 2021. The rules affect municipal and state institutions, as well as funds not financed from the state budget.

Payments of the advance share in 2021 are made in the following order:

- The advance payment is issued strictly until the 30th day of the current month. The employing organization has the right to transfer earned funds to employees more than 2 times in one month. Every 10 days or every seven days.

- The dates of advance payments are clearly stated by the employer in regulatory documents, collective agreements, and regulations on the payment of wages. Payment periods cannot be set. For example, “...from the 25th to the 27th” or “...from the 3rd to the 7th.”

Additional information

Employers should note that salary payment deadlines set for the 15th and 30th are not a safe option due to the need to pay personal income tax.

Not the minimum wage alone

Indeed, there is a wage increase for public sector employees in 2021, but this increase, unfortunately, will not help significantly improve the living standards of Russians at least to the pre-crisis level of 2014. Prices for essential goods, as well as for utilities, are rising at an accelerated pace. It is also important that the increase in wages in the Russian Federation will be achieved mainly due to an increase in income tax by 4% - from 18 to 22%.

As before, consistently high salaries in the Russian Federation are, of course, not among public sector employees, but among top managers and IT specialists. Employers from Moscow and St. Petersburg are especially generous, offering wages of 50 thousand rubles and more for irregular working hours. Salaries of 100 thousand and above appear in 1.3% of all vacancies announced in Russia in January 2021.

What should an employee do if he doesn’t yet have a MIR card?

If an employee has not issued a card before July 1, 2021, and money from the budget has been deposited into the account, then the bank will define it as funds of “unexplained purpose.” The bank is obliged to notify the client about the presence of money in his account, and also offer two ways of developing events:

- Open an account and link a MIR plastic card to it.

- Open a simple account without a card, and then receive funds from it in cash.

Attention

If the client does not open a new account and does not appear at the bank within ten working days, the money will be returned to the payer.

Insurance premiums

Increased income limits for calculating insurance premiums

In 2021, the base for calculating insurance contributions to the Social Insurance Fund (in case of temporary disability and in connection with maternity) will be 815,000 rubles, and the base for calculating contributions to the Pension Fund at the “regular” rate is 1,021,000 rubles. This is provided for by Decree of the Government of the Russian Federation dated November 15, 2017 No. 1378.

Let us remind you that for income exceeding the maximum base value, contributions to the Social Insurance Fund are not charged, and contributions to the Pension Fund are paid at a rate of 10%, not 22%. As for “medical” contributions to the Federal Compulsory Compulsory Medical Insurance Fund, a maximum base value is not established for them; therefore, these contributions are paid from all taxable payments. Those who have the right to apply reduced tariffs accrue pension contributions until in 2018 the amount of payments to an employee exceeds the maximum base value - 1,021,000 rubles.

Insurance premium rates have been retained until 2021

The tariffs for pension, medical and insurance contributions for temporary disability and in connection with maternity will not change in 2021 (Federal Law No. 361-FZ of November 27, 2017). So, if an organization does not have the right to use reduced tariffs, then in 2017 it must charge contributions at the basic tariffs. They are listed in the table:

| Type of contributions | Base in 2021 | Rate within the base | Rate over base |

| Pension | RUB 1,021,000 | 22% | 10% |

| For social insurance in case of temporary disability and maternity | 815,000 rub. | 2,9 % (1,8 %) | |

| Medical | Not installed | 5,1 % | |

The general contribution rate in 2021 is still 30% (Articles 425, 426 of the Tax Code of the Russian Federation):

- 22% – for pension insurance;

- 5.1% – for health insurance;

- 2.9% - for social insurance. In this case, the amount of contributions to be paid depends on whether the income exceeded the established limit or not.

The 30% rate will be valid until 2021 inclusive (Articles 425, 426 of the Tax Code of the Russian Federation). The extension of the tariff is provided for by Federal Law No. 361-FZ dated November 27, 2017.