Who should report to Rosstat

Statistical reporting is provided for any business entity, regardless of the type of their activity. Large organizations are required to report regularly; they often submit several reporting forms at once. Representatives of small and medium-sized businesses, as well as micro-enterprises, submit statistical reports when they participate in continuous statistical observations once every 5 years, and in the period between this they can be included in the Rosstat sample based on various criteria - type of activity, revenue volume, number, etc. (Resolution of the Government of the Russian Federation dated February 16, 2008 No.).

Reports within the framework of sample studies can be submitted quarterly or monthly, and for micro-enterprises only annual statistical reporting is acceptable (Clause 3, Article 5 of Law No. 209-FZ dated July 24, 2007).

How to find out which forms of statistical reporting you need to report on

Having formed the sample, the territorial bodies of Rosstat are obliged to notify the individual entrepreneurs and organizations included in it of the need to submit the relevant reports, as well as provide forms for completion. If there was no such notification, individual entrepreneurs and companies can independently find out what forms they will use to report in 2018.

How can I find out from the statistics agency which reports (by TIN, OGRN or OKPO) need to be submitted in 2021? The easiest and fastest way is to go to the Rosstat website, on the page ]]>statreg.gks.ru]]> indicate your status (legal entity, individual entrepreneur, branch, etc.) and enter one of the listed details in the special fields. As a result, the system will generate a list of statistical reporting forms that a person must submit, indicating their name, frequency and submission deadline. If the list of statistical reporting forms for 2021 is empty, you do not need to report to Rosstat in this period. Information on the site is updated monthly.

Also, a company or individual entrepreneur can contact the territorial body of Rosstat with an official written request for a list of reports, but this will take much more time (clause 2 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Statistical reporting forms and deadlines for their submission

Statistical forms can be grouped depending on the type of business entity: for example, statistical reporting of individual entrepreneurs, micro-enterprises, medium and small firms, large organizations; there are also forms on which all of the listed entities can report.

Some 2021 statistical reporting may only be intended for certain sectors of activity: agriculture, retail trade, construction, etc. You can also highlight statistical reports presented by the number and composition of personnel, volume of revenue, products produced, etc.

Each statistical form has its own deadlines for submission, violation of which can result in significant fines (Article 13.19 of the Code of Administrative Offenses of the Russian Federation): 10 – 20 thousand rubles. for officials, and 20-70 thousand rubles. For the company. Responsibility for repeated violation of deadlines for submitting statistical reports will increase to 30-50 thousand rubles. for responsible officials, and up to 100-150 thousand rubles. for the organization. The same penalties apply when submitting false statistical data.

If there are no indicators for filling out reporting, Rosstat must be notified about this in a letter, and it should be written every time the next reporting date occurs (clause 1 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Along with statistical reports, legal entities are required to submit a copy of their annual accounting reports to Rosstat. Accounting “statistical” reports (including those in simplified forms) are submitted no later than 3 months after the end of the reporting year (for 2017, the deadline is 04/02/2018). For violating the deadline, officials can be fined 300-500 rubles, and the company 3-5 thousand rubles. (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Statistical reporting forms for 2021 have been approved

The Resolution of the State Committee on Statistics ( reg. No. dated December 19, 2017) approved the forms of state statistical reporting for 2018.

The total number of reporting forms approved for 2021 is 103. Each form indicates the subject of reporting, as well as the procedure and timing for its submission. Compared to 2021, 2 reporting forms and 1 application have been reduced, incl. by combining with other forms, and 1 new form and 3 annexes were introduced (see table below).

| Excluded reporting forms and applications | |||

| № | Name | Frequency of presentation and subjects | Result of cancellation |

| 1. | Form 1-bozor. Report on the sale of agricultural products and livestock at markets. | Annual. Administration of dekhkan and livestock markets. | Converted to sample observation questionnaire |

| 2. | Form 4-eko-M. Report on current costs of nature protection, fees for environmental pollution. | Annual. Organizations that have stationary sources of air pollution and generate toxic waste (except for micro-firms and small enterprises). | Combined with annual reports using the following forms: 2-eko. Report on protected natural areas for 2017; 3-eko. Land reclamation report for 2021. |

| 3. | Application to form 2-xizmat. Report on services provided by legal entities with territorially separate divisions. | Annual. Commercial organizations, except for small enterprises, micro-firms and agricultural organizations, non-profit organizations that have territorially separate divisions that provide services to legal entities and individuals (according to the list established by the State Statistics Committee). | Attached to the annual report in form 2-xizmat. Report on production (rendered) services by type of economic activity for 2021. |

| Introduced reporting forms and applications | |||

| 1. | Form 3-qurilish. Report on the status of construction in progress at the end of 2021. | Legal entities and their separate divisions, including construction management bodies (except for small enterprises, micro-firms, farms, non-profit organizations); Project implementation groups with the participation of foreign investment, departments according to the established list. | 1 time every 2 years. No later than February 15th. |

| 2. | Appendix to Form 1-NNT (mahalla). Report on the activities of self-government for 2017. | Citizens' self-government bodies. | Annual. No later than March 2. |

| 3. | Appendix to Form 1-K (savdo). Report on wholesale and retail trade turnover of legal entities with territorially separate divisions. | Organizations engaged in trading activities - wholesale, retail trade (except for small enterprises, micro-firms and agricultural organizations), having territorially separate divisions (according to the list established by the State Statistics Committee). | Menstruation. No later than the 2nd day of the month following the reporting month. |

| 4. | Appendix to Form 1-K (EIZ). A report on the activities of an organization included in a free economic zone, a small industrial zone, a technology park, and a cotton-growing and textile cluster. | Legal entities and their separate divisions included in SEZs, MPZs, technology parks, cotton-growing and textile clusters (including small businesses). | Quarterly. No later than the 2nd day of the month after the reporting period. |

The document is officially published in the National Legislation Database and comes into force on January 1, 2018.

The full text of this document, with comments and links to other acts of legislation related to it can be found in the information retrieval system " ».

Lenara Khikmatova.

Submission of statistical reporting in 2021

Please note that many reporting statistical forms have been developed for almost any economic sector and type of activity. Here we provide tables for statistical reporting relevant in 2021, some of them with deadlines for submission.

| Form | Kind of activity | Subject | Frequency and deadline for submission to Rosstat |

Statistical reporting in 2021, submitted regardless of the type of activity: | |||

| MP (micro) | All types | microenterprises | Annual, February 5 next year |

| PM | All types | small businesses | Quarterly, 29th day after the reporting quarter |

| 1-T | All types | legal entity other than SMP | Annual, January 20 next year |

| 1-T (working conditions) | All types | legal entity other than SMP | Annual, January 19 next year |

| 1-IP | All types except retail trade (excluding motor vehicle trade) | IP | Annual, March 2 next year |

| 1-enterprise | All types, except insurance, banks, government agencies, financial and credit organizations | legal entity other than SMP | Annual, April 1 next year |

| 1-T (working conditions) | All types | legal entity other than SMP | Annual, January 19 next year |

| P-2 | All types | legal entity other than SMP | Quarterly, 20th day after the reporting quarter |

| P-2 (invest) | All types | legal entity other than SMP | Annual, April 1 next year |

| P-3 | All types | Legal entity with a total capital of more than 15 people, except for self-employed enterprises | Monthly, 28th day after the reporting month Quarterly, 30th day after the quarter |

| P-4 | All types | legal entity other than SMP | Monthly, with MSS above 15 people. – 15th of the next month Quarterly, with SSCh 15 people. and less – the 15th day after the reporting quarter |

| P-4 (NZ) | All types | a legal entity with a social capital of more than 15 people, except for self-employed enterprises | Quarterly, 8th day after the reporting quarter |

| P-5 (m) | All types | a legal entity with a social capital of more than 15 people, except for self-employed enterprises | Quarterly, 30th day after the reporting quarter |

| P-6 | All types | legal entity other than SMP | Quarterly, 20th day after the reporting quarter |

| 5-З | All types, except insurance, banks, government agencies, financial and credit organizations | legal entity other than SMP | Quarterly, 30th day after the reporting period (1st quarter, half year, 9 months) |

| All types | legal entity, except SMEs and non-profit organizations | Annual, April 1 next year | |

| 12-F | All types, except insurance, non-state pension funds, banks, government agencies | legal entity other than SMP | Annual, April 1 next year |

| 18-KS | All types | legal entity other than SMP | Annual, February 4 next year |

Submission of statistical reporting in the field of trade: | |||

| PM-bargaining | Wholesale | SMEs, except microenterprises | Monthly, 4th day after the reporting month |

| 1-conjuncture | Retail | legal entity | Quarterly, 15th day of the second month of the reporting quarter |

| 1-conjuncture (wholesale) | Wholesale | legal entity, except micro-enterprises | Quarterly, 10th day of the last month of the reporting quarter |

| 1-removal | Trade | legal entity, except micro-enterprises | Quarterly - on the 5th day after the end of the quarter, annual - on March 1 of the next year |

| 1-TORG | Wholesale and retail trade | legal entity other than SMP | Annual, February 17 next year |

| 1-IP (trade) | Sale of goods to the public, repair of household products | IP | Annual, October 18 of the reporting year |

| 2-RC | Trade in certain goods | Individual entrepreneur and legal entity | Annual, March 30 next year |

| 3-TORG (PM) | Retail | SMEs, except microenterprises | Quarterly, 15th day after the reporting period |

Statistical reporting of organizations providing services: | |||

| 1-IP (services) | Paid services to the population | IP | Annual, March 2 next year, |

| 1-services | Paid services to the population | legal entity, legal entities (except for law offices) | Annual, March 1 next year |

| 1-YES (services) | Services | legal entity, except for microenterprises and non-profit organizations | Quarterly, 15th day of the second month of the reporting quarter |

| 1-manufacturer prices | Manufacturing and services | Individual entrepreneurs and legal entities, except micro-enterprises | Monthly - 22nd of the reporting month, annual - March 11th of the next year |

What reports should be submitted to statistics for those involved in agriculture: | |||

| P-1 (СХ) | Agricultural activities | legal entity, except SMP and peasant farms | Monthly, 3rd day after the reporting month |

| 1-farmer | Sowing crops | SMP, peasant farm, individual entrepreneur | Annual, June 11 of the reporting year |

| 2-farmer | Sowing crops and perennial plantings | SMP, peasant farm, individual entrepreneur | Twice a year on October 2 and November 2, or once a year on November 21 of the reporting year |

| 3-farmer | Availability of farm animals | SMP (monthly), individual entrepreneurs and microenterprises (once a year) | 2nd day after the reporting month, or January 6th after the reporting year |

| 1-purchase prices | Agricultural production | legal entity other than peasant farms | Annual, March 2 next year |

| 2-purchase prices (grain) | Purchase of domestic grain for main production | legal entity | Menstruation, 15th of next month |

| 1-СХ-prices | Agricultural activities | legal entity, except peasant farms and microenterprises | Monthly, 20th of the reporting month |

| 1-СХ (balance) – urgent | Purchase, storage, processing of grain and its processed products | legal entity | Quarterly, 7th day after the reporting quarter |

| 10-MEH (short) | Agricultural activities | legal entity, except peasant farms and microenterprises | Annual, January 20 next year |

| 29-СХ | Agricultural activities in the presence of sown areas, hayfields, or only perennial plantings | legal entity, except SMP and peasant farms | Annual, |

Statistical reporting 2021 - deadlines for the mining industry: | |||

| 1-IP (month) | Extraction and processing; production and distribution of gas, steam, electricity; fishing, logging | Individual entrepreneur with 101 or more employees. | Menstruation, 4th working day of the next month |

| MP (micro) - nature | Individual entrepreneurs and micro-enterprises with up to 15 people. | Annual, January 25 next year | |

| PM-prom | Individual entrepreneurs with employees from 16 to 100 people, small enterprises | Monthly, 4th working day after the reporting month | |

| 1-nature-BM | legal entity other than SMP | Annual, February 10 next year | |

| DAP-PM | Mining, manufacturing, air conditioning, gas, steam, electricity | small businesses | Quarterly, 10th of the last month of the quarter |

| 1-DAP | legal entity other than SMP | Monthly, 10th of the reporting month | |

| IAP | Mining, manufacturing, air conditioning, gas, steam, electricity, water supply, sanitation, waste collection and disposal, pollution removal | legal entity, except micro-enterprises | Annual, October 10 of the reporting year |

List of statistical reporting for the oil and gas industry: | |||

| 1-TEK (oil) | Production of oil, associated gas and gas condensate | legal entity other than SMP | Annual, January 28 next year |

| 1-TEK (drill) | Drilling of the wells | legal entity other than SMP | Annual, January 28 next year |

| 2-TEK (gas) | Availability of gas wells on the balance sheet | legal entity other than SMP | Annual, January 28 next year |

| 6-oil | Oil production and refining | legal entity other than SMP | Quarterly, 30th |

| 1-motor gasoline | Production of motor gasoline and diesel fuel | legal entity other than SMP | Weekly, 1 day after the reporting week, until 12 noon. |

Construction statistics - reports in 2021: | |||

| DAS | Construction | legal entity, except micro-enterprises | Quarterly, 10th day of the second month of the reporting quarter |

| 9-KS | Construction | legal entity, except micro-enterprises | Monthly, 25th of the reporting month |

| 12-construction | Construction | legal entity other than SMP | Annual, January 15 of the current year |

Statistical reporting of transport enterprises: | |||

| 65-ETR | Operation and maintenance of urban electric transport | legal entity | Annual, January 25 next year |

| 65-autotrans | Transportation of passengers by buses and passenger taxis | legal entity, except micro-enterprises | Annual, February 10 next year |

| 1-TR (motor transport) | Transportation of goods by road; non-public roads on the balance sheet | legal entity, except micro-enterprises | Annual, January 25 next year |

| 11-GA | Air transportation | legal entities and their separate divisions | Quarterly, 15th day after the reporting quarter |

| 12-GA | Monthly, 7th day after the reporting quarter | ||

| 14-GA | Monthly, 15th day after the reporting quarter | ||

| 32-GA and 33-GA | Quarterly, 7th day after the reporting quarter | ||

| 1-TARIFF (auto), 1-TARIFF (ha), 1-TARIFF(more), 1-TARIFF (yellow), 1-TARIFF (pipe), 1-TARIFF (internal water) | Transportation of goods by road, air, sea, railway, pipeline, water transport | legal entity | Monthly, 23rd of the reporting month |

Reporting to statistics in 2021

Reporting for small and medium-sized businesses

03/18/2018Russian tax portal

Depending on what type of monitoring is carried out, the company will already determine the types of reports to Rosstat.

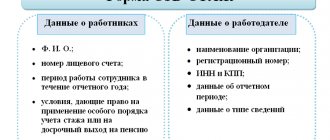

Who is generally required to submit reports to Rosstat? To decide on a set of reporting, you need to divide all enterprises into small and medium-sized businesses, and large businesses.

Reporting forms that must be submitted by organizations that are not small and medium-sized businesses:

1. Form P-1 (it is submitted monthly by the 4th day),

2. Form 1-Enterprise (it is submitted annually before April 1),

3. Form P-4 (it is submitted quarterly or monthly by the 15th),

4. Form P-5 (m) (this form is submitted once a quarter until the 30th day after the end of the reporting period),

5. Form P-2 (the annual form is submitted by February 8 for 2021, and then the form is submitted quarterly by the 20th).

This is a standard set of reporting forms, but there are also specific forms that depend on the type of activity of the company.

Reporting for small and medium businesses

The following forms can be listed: PM (submitted once a quarter), MP (micro) - in kind (it is annual), 1-IP, etc. But the list of forms depends on whether continuous or selective observation is carried out.

Continuous observation - remember, in 2021 all companies and individual entrepreneurs submitted a report on the results of 2015 to Rosstat. These were MP-SP forms for companies and 1-IP form for individual entrepreneurs. Rosstat conducts such continuous monitoring once every five years. The next continuous observation awaits us in 2021, to be more precise, at the end of 2021. We will submit the report in 2021.

In any case, Rosstat will notify everyone that they must submit one or another mandatory form.

Selective surveillance is when Rosstat informs a certain company that it has come under surveillance. A Rosstat employee can notify the enterprise about this by phone or in writing and tell you what forms need to be prepared and in what time frame.

If you do not know what type of reporting should be submitted, you can find out at your Rosstat office. You can ask by phone, or write a letter asking for the required list of reporting forms. Such actions will help avoid fines.

Mandatory reporting forms

At the end of the year, each enterprise is required to submit accounting (financial) statements to Rosstat. One copy goes to the tax authority and the second to Rosstat.

And other types of reporting are already prescribed by Rosstat. For example, a trading company may report monthly using the PM-torg form. As I have already noted, the list of required reporting forms must be updated annually.

What fines are faced by companies that do not submit reports?

If the company does not submit the report on time, then on the basis of Art. 13.19 of the Code of Administrative Offenses of the Russian Federation a fine will be imposed:

— from 20,000 to 70,000 rubles for a legal entity,

— from 10,000 to 20,000 rubles for the head of an enterprise.

If violations are recorded again, then the fine will be increased:

— from 100,000 to 150,000 rubles for a legal entity,

— from 30,000 to 50,000 rubles for the head of an enterprise.

Post: